It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

Krazysh0t

reply to post by peck420

Well it was a solution to a problem that I tried to come up with. Too many threads highlight problems in our country yet fail to provide a solution. I thought maybe this would be a good try. Well, if DtI ratio is a poor solution, then I am out of them... I'll try to keep thinking of one and update my OP if I think of one or one is posted by another member.

Don't stop!

You are on the right path with the Debt/GDP being utter BS. From an economics perspective, it is used because it is quick and easy...that's it.

The only area you mis-stepped on was how to derive a maximum debt level.

There is no right or wrong in that area, so it will generate immense confusion...I can find you economists that say it is fine, too low, too high, etc.

For me, I believe that debt and fiscal policy need to be tied to the same metric for any sense of sanity to come out of this. My personal choice, population. As your population grows, your ability to increase your economy, and your ability to handle larger debt grows in step. Let's your economic wave flatten, similar to fiat, without giving up an actual dollar backing, like, well, liked a gold backed dollar.

Granted, that would be putting all fiscal policy control in the hands of the citizens, so I doubt it would fly in political circles.

reply to post by peck420

Nice I like that. I also feel like I am on the right track by looking at government revenue, so maybe some sort of cross with population levels and government revenue. Hmmm... I'll have to ponder this for a while.

Nice I like that. I also feel like I am on the right track by looking at government revenue, so maybe some sort of cross with population levels and government revenue. Hmmm... I'll have to ponder this for a while.

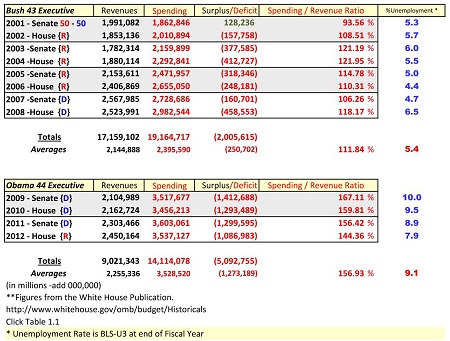

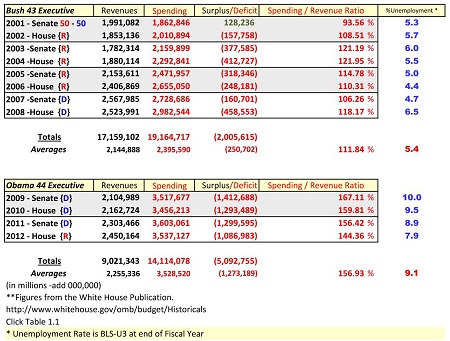

This chart has the real numbers from the White House database.

whitehouse.gov

scroll down and click Table 1.1 .... it will open an excel spreadsheet.

whitehouse.gov

scroll down and click Table 1.1 .... it will open an excel spreadsheet.

Krazysh0t

reply to post by Krazysh0t

To put the 471% number in my OP in perspective, if you were to make $60,000 a year, you'd need to have $282,600 in debt. That's a combination of a decent house, a nice car, and a sizable chunk of credit card debt.

That's not even accurate, though. The $17 Trillion "official" debt would be only related to rollover debt or primarily credit-card type debt. The house & car debts are better compared to the US unfunded liabilities. usdebtclock.org...

Yes, that's an additional $126 Trillion dollars.

NOW run either calculation debt/income or GDP/income ratio and the scene becomes much more harsh.

(Yes, this is very pertinent and inconvenient to the deniers right now. We've got economists who argue that failure to pay out Social Security, Medicare, or Rx benefits in deferrence to prioritizing bond and treasury payments would amount to a default. For that to be true, then we MUST consider those unfunded liabilities as being debts. That means the US' true debt figure is almost $143 Trillion and, for all intents and purposes, that government is already $126 T over the so-called "Debt Ceiling."

Krazysh0t

reply to post by crimvelvet

Well that is worrying since traditionally countries under our financial system tend to wage war against their rivals and if BRICS can now rival the IMF, that may be a precursor to world war.

Yes very worrying since Clinton gave the USA military advantage away to China.

You can see some glimpses of what is going on if you look. Remember Reid and Obama completely shut down talks and negotiations. That is not typical politics until you add in the IMF. Now that the IMF is holding their meetings (early) we have the Republicans offering a bit of a hand to the Democrats.

Then consider the saber rattling over Syria and Russia calling the bluff of the USA.

Don't forget the news is controlled by the bankers so how this is handled in the news is also a clue. (Will the Republicans come out looking OK?) So far the implementation of Obamacare, which is a really big flop, has been glossed over.

I think what you will see is an agreement to make some cuts, a small debt ceiling raise in return for not touching Obamacare. Obamacare will then be found to be a really big flop especially among low income types who though they were going to get free healthcare. This is the Democratic base and the Republicans will move into control.

Remember 50% of the population has an IQ under 100. +/- 1 sigma, 68.3% of the population, is between an IQ of 85 and 115. This is your lower class working population including foreman and such and they are going to have to navigate the implementation of Obamacare???

Like I said. MORE Popcorn.

reply to post by Krazysh0t

I think what you are trying to look at is 'Projected Revenue' based on future projected earnings.

This is where things get into a real sticky wicket because of an aging population with few children.

I will send you over to an Economist who is very good at explaining these things. Demographic Bomb and US Debt Explosion

He has done the work you are trying to do.

I also feel like I am on the right track by looking at government revenue, so maybe some sort of cross with population levels and government revenue. Hmmm...

I think what you are trying to look at is 'Projected Revenue' based on future projected earnings.

This is where things get into a real sticky wicket because of an aging population with few children.

I will send you over to an Economist who is very good at explaining these things. Demographic Bomb and US Debt Explosion

He has done the work you are trying to do.

reply to post by Krazysh0t

And that Demographic Bomb and US Debt Explosion is all so the reason for illegal immigrant Amnesty. The government KNOWS we have an aging population with the Baby Boomers retiring and expecting SS.

And that Demographic Bomb and US Debt Explosion is all so the reason for illegal immigrant Amnesty. The government KNOWS we have an aging population with the Baby Boomers retiring and expecting SS.

...Realize those are from BEFORE the rampant exponential growth of debt we’ve seen under Obama. Between the exponential rise, and the inevitable bump in interest rates to come, those bars are too small. Even with that, the graph points out that in about 2035 ALL of government revenues are consumed by Medical, Social Security, and interest payments. Entitlements and mandatory interest charges. About 22 years. IMHO, it’s going to be much sooner. As soon as interest rates start to rise, I think we’ve got about 5 years. Call it 2025 at best.

Realize, too, that there is nothing The Fed can do to “fix” this. If they buy all the bonds, keeping rates from exploding, the currency will enter a hyperinflation. If they do NOT buy the bonds, rates explode (due to the high level of debts being financed) and the deficit blows out very fast. As evidenced by Greece, the Rest Of World will not be stepping up to loan a lot of money to a Government Entitlement Economy, even with high interest rates.

The Democrats propose to raise tax RATES, to get the revenue line to rise above 18%. Yet we know that can not happen. We are already past the peak of the Laffer Curve, so any increase in rates will result in less revenue, not more....

reply to post by crimvelvet

RE: The Laffer Curve

We've crossed the point of optimal taxation on the Laffer Curve, not the point of maximum revenue. Now, while it is certainly true that crossing the point of optimal taxation is a really crappy, short sighted, wrong thing to do by the government, we all know that those in power care about things far less tangible than fairness and doing what is smart. We've got one side that wants to punish success as brutally as possible who are seeking that maximum tax point and we've got another side that is unwilling to make the unpopular move of eviscerating large expenditure sinks such as the military and corporate tax breaks to move the overall debt down to where the optimal tax point is creating a surplus of revenue.

In practice we're stuck between a whiney, ungrateful brat and a scared, capitulating child.

RE: The Laffer Curve

We've crossed the point of optimal taxation on the Laffer Curve, not the point of maximum revenue. Now, while it is certainly true that crossing the point of optimal taxation is a really crappy, short sighted, wrong thing to do by the government, we all know that those in power care about things far less tangible than fairness and doing what is smart. We've got one side that wants to punish success as brutally as possible who are seeking that maximum tax point and we've got another side that is unwilling to make the unpopular move of eviscerating large expenditure sinks such as the military and corporate tax breaks to move the overall debt down to where the optimal tax point is creating a surplus of revenue.

In practice we're stuck between a whiney, ungrateful brat and a scared, capitulating child.

reply to post by burdman30ott6

The USA is still in a world of hurt as long as the international corporations move manufacturing overseas but sell to Americans buying on credit cards or SS checks.

You also have the problem that the high paying American jobs esp. from high tech have evaporated. You are not going to maximize revenue if your workers are burger flippers instead of high paid computer programmers.

Lots of different stuff going on and not much of it good.

we seem to be rather far along the Tyler curve too.

We've crossed the point of optimal taxation on the Laffer Curve, not the point of maximum revenue.

The USA is still in a world of hurt as long as the international corporations move manufacturing overseas but sell to Americans buying on credit cards or SS checks.

You also have the problem that the high paying American jobs esp. from high tech have evaporated. You are not going to maximize revenue if your workers are burger flippers instead of high paid computer programmers.

Lots of different stuff going on and not much of it good.

we seem to be rather far along the Tyler curve too.

Alexander Tytler Cycle:

The average age of the world's greatest civilizations from the beginning of history has been about 200 years. During those 200 years, these nations always progressed through the following sequence:

From bondage to spiritual faith;

From spiritual faith to great courage;

From courage to liberty;

From liberty to abundance;

From abundance to selfishness;

From selfishness to complacency;

From complacency to apathy;

From apathy to dependence;

From dependence back into bondage.

reply to post by crimvelvet

Had not heard of the Tyler curve. Thanks for that shiver up the spine, man.

We're clearly well past this region:

And frighteningly so, there are aspects indicating we could be anywhere from top to bottom, even, in this region:

What scares the hell out of me is the speed I've seen those last 4 or 5 transitions manifest themselves in. It seems like just 20 years ago we were enjoying selfishness and transitioned to complacency immediately following the Cold War. A scant 10 years ago that became apathy when we watched the foundation for the devestation of our rights being laid and did next to nothing to stop it. The last 5 years have turned the majority of the nation completely dependent on the government teats and handouts.

What a goddamned debacle.

Had not heard of the Tyler curve. Thanks for that shiver up the spine, man.

We're clearly well past this region:

From bondage to spiritual faith;

From spiritual faith to great courage;

From courage to liberty;

From liberty to abundance;

From abundance to selfishness;

From selfishness to complacency;

And frighteningly so, there are aspects indicating we could be anywhere from top to bottom, even, in this region:

From complacency to apathy;

From apathy to dependence;

From dependence back into bondage.

What scares the hell out of me is the speed I've seen those last 4 or 5 transitions manifest themselves in. It seems like just 20 years ago we were enjoying selfishness and transitioned to complacency immediately following the Cold War. A scant 10 years ago that became apathy when we watched the foundation for the devestation of our rights being laid and did next to nothing to stop it. The last 5 years have turned the majority of the nation completely dependent on the government teats and handouts.

What a goddamned debacle.

reply to post by burdman30ott6

Yes that one is a real wake up call. But with knowledge we do not have to repeat the past. Time to spread the word.

I too have noticed the acceleration too and it was done on purpose.

From the Director-general of the World Trade Organization:

Google Lamy "Global Governance" and Also read www.opednews.com...

Had not heard of the Tyler curve. Thanks for that shiver up the spine,

Yes that one is a real wake up call. But with knowledge we do not have to repeat the past. Time to spread the word.

I too have noticed the acceleration too and it was done on purpose.

From the Director-general of the World Trade Organization:

The reality is that, so far, we have largely failed to articulate a clear and compelling vision of why a new global order matters — and where the world should be headed. Half a century ago, those who designed the post-war system — the United Nations, the Bretton Woods system, the General Agreement on Tariffs and Trade (GATT) — were deeply influenced by the shared lessons of history.

All had lived through the chaos of the 1930s — when turning inwards led to economic depression, nationalism and war. All, including the defeated powers, agreed that the road to peace lay with building a new international order — and an approach to international relations that questioned the Westphalian, sacrosanct principle of sovereignty... www.theglobalist.com...

Google Lamy "Global Governance" and Also read www.opednews.com...

burdman30ott6

RE: The Laffer Curve

Throw the Laffer Curve out. It has never held truth for the US. Hauser has proved this with empirical data.

For the record, even Arthur Laffer has never claimed the Laffer Curve as accurate for the US. The curve was born when he drew it out to simplify a very complicated equation to illustrate his point to politicians.

edit on 10-10-2013 by peck420 because: (no reason given)

Yeah the debt to GDP is a pretty worthless number.

First, GDP is the market value of finished goods and services.

One of the main reasons is that the U.S. debt represents the total number of outstanding Tbills etc. that exist for any time period. The GDP(even if you were to use that number) is for a period, not from beginning of time. If you were to have any ratio it would need to be based on the number of debts that will be maturing within the same measured time period.

Also I like this one article, I will post the link...but...

"The government “borrows” by creating T-securities out of thin air, backed only by full faith and credit, then exchanging these T- securities for dollars it previously had created from thin air, which it destroys."

It's all scammy nonsense just like everything in this country. Actually the whole financial system is and has been since the creation of federal reserve.

So basically the two have nothing to do with one another.

mythfighter.com...

First, GDP is the market value of finished goods and services.

One of the main reasons is that the U.S. debt represents the total number of outstanding Tbills etc. that exist for any time period. The GDP(even if you were to use that number) is for a period, not from beginning of time. If you were to have any ratio it would need to be based on the number of debts that will be maturing within the same measured time period.

Also I like this one article, I will post the link...but...

"The government “borrows” by creating T-securities out of thin air, backed only by full faith and credit, then exchanging these T- securities for dollars it previously had created from thin air, which it destroys."

It's all scammy nonsense just like everything in this country. Actually the whole financial system is and has been since the creation of federal reserve.

So basically the two have nothing to do with one another.

mythfighter.com...

edit on 10-10-2013 by OrphanApology because: d

reply to post by Krazysh0t

I don't know where that site is getting those revenue numbers but they are just wrong.

Look at Page 2 of this PDF - this is right from the treasury department and breaks down the revenues and debt issued each month.

The revenue for the first 11 months of the fiscal year is 2.472 trillion so revenues for the year are going to be around 2.7 trillion. Expenditures will likely be about 3.55 trillion so we will run a deficit of about 850 billion this year.

So it is actually 16.9 / 2.7 = 625%

But this is way underselling how bad this problem really is. Every year entitlement expenses are rising and nothing is likely to stop this growth, especially with obamacare now going into effect.

I don't know where that site is getting those revenue numbers but they are just wrong.

Look at Page 2 of this PDF - this is right from the treasury department and breaks down the revenues and debt issued each month.

The revenue for the first 11 months of the fiscal year is 2.472 trillion so revenues for the year are going to be around 2.7 trillion. Expenditures will likely be about 3.55 trillion so we will run a deficit of about 850 billion this year.

So it is actually 16.9 / 2.7 = 625%

But this is way underselling how bad this problem really is. Every year entitlement expenses are rising and nothing is likely to stop this growth, especially with obamacare now going into effect.

After contemplation, it does not seem to matter if the true ratio is 471% or 625% (or 2000% for that matter).

From a macroscopic view, one must ask the question "Is this economic system sustainable?", and inevitably the answer is an emphatic and resounding "NO!"

Once this question is answered, we have begun our descent down the rabbit hole. Surely those in the hidden positions of influence over this economic system know that it is an unsustainable runaway freight train of disaster.

Therein lies the reality that an agenda is at work, and financial collapse is a foreseen and welcomed piece of that agenda. We see it as diabolical. They see it as destiny, the mission of the ordained elite.

From a macroscopic view, one must ask the question "Is this economic system sustainable?", and inevitably the answer is an emphatic and resounding "NO!"

Once this question is answered, we have begun our descent down the rabbit hole. Surely those in the hidden positions of influence over this economic system know that it is an unsustainable runaway freight train of disaster.

Therein lies the reality that an agenda is at work, and financial collapse is a foreseen and welcomed piece of that agenda. We see it as diabolical. They see it as destiny, the mission of the ordained elite.

new topics

-

Avatar Crucifix in my baked potato! Before surgery + more. Palestinian nurse, Christian patient.

General Chit Chat: 1 hours ago -

Senator Karim Bianchi, from Chile, telling was abducted 2012.

Aliens and UFOs: 2 hours ago -

Gaza Genocide Real or Propaganda

Middle East Issues: 3 hours ago -

Akkabadori: history of tolerant euthanasia

History: 8 hours ago -

Don Trump-Quixote

Political Issues: 9 hours ago -

Paranoia that will tear apart Russia and China

World War Three: 11 hours ago

top topics

-

Egypt to join South Africa genocide case at ICJ

Middle East Issues: 16 hours ago, 9 flags -

Gaza Genocide Real or Propaganda

Middle East Issues: 3 hours ago, 6 flags -

SecretKnowledge sez howaryiz all, im back.

Introductions: 13 hours ago, 5 flags -

Don Trump-Quixote

Political Issues: 9 hours ago, 5 flags -

Akkabadori: history of tolerant euthanasia

History: 8 hours ago, 5 flags -

Paranoia that will tear apart Russia and China

World War Three: 11 hours ago, 3 flags -

Senator Karim Bianchi, from Chile, telling was abducted 2012.

Aliens and UFOs: 2 hours ago, 3 flags -

Avatar Crucifix in my baked potato! Before surgery + more. Palestinian nurse, Christian patient.

General Chit Chat: 1 hours ago, 2 flags

active topics

-

Candidate TRUMP Now Has Crazy Judge JUAN MERCHAN After Him - The Stormy Daniels Hush-Money Case.

Political Conspiracies • 1519 • : network dude -

The biggest problem with the Hush money trial

US Political Madness • 183 • : network dude -

Christianity superior to other faiths for very specific reasons. Awaken to true FREEDOM..!!

Conspiracies in Religions • 36 • : jofafot -

Gaza Genocide Real or Propaganda

Middle East Issues • 38 • : Lazy88 -

Don Trump-Quixote

Political Issues • 19 • : FlyersFan -

A new Why Files How CRISPR and AI Destroy the World

Science & Technology • 26 • : FlyInTheOintment -

Egypt to join South Africa genocide case at ICJ

Middle East Issues • 33 • : YourFaceAgain -

SecretKnowledge sez howaryiz all, im back.

Introductions • 4 • : SecretKnowledge2 -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 965 • : Thoughtful3 -

NASA Black Hole Visualization - Go Beyond the Brink

Space Exploration • 15 • : andy06shake