It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

3

share:

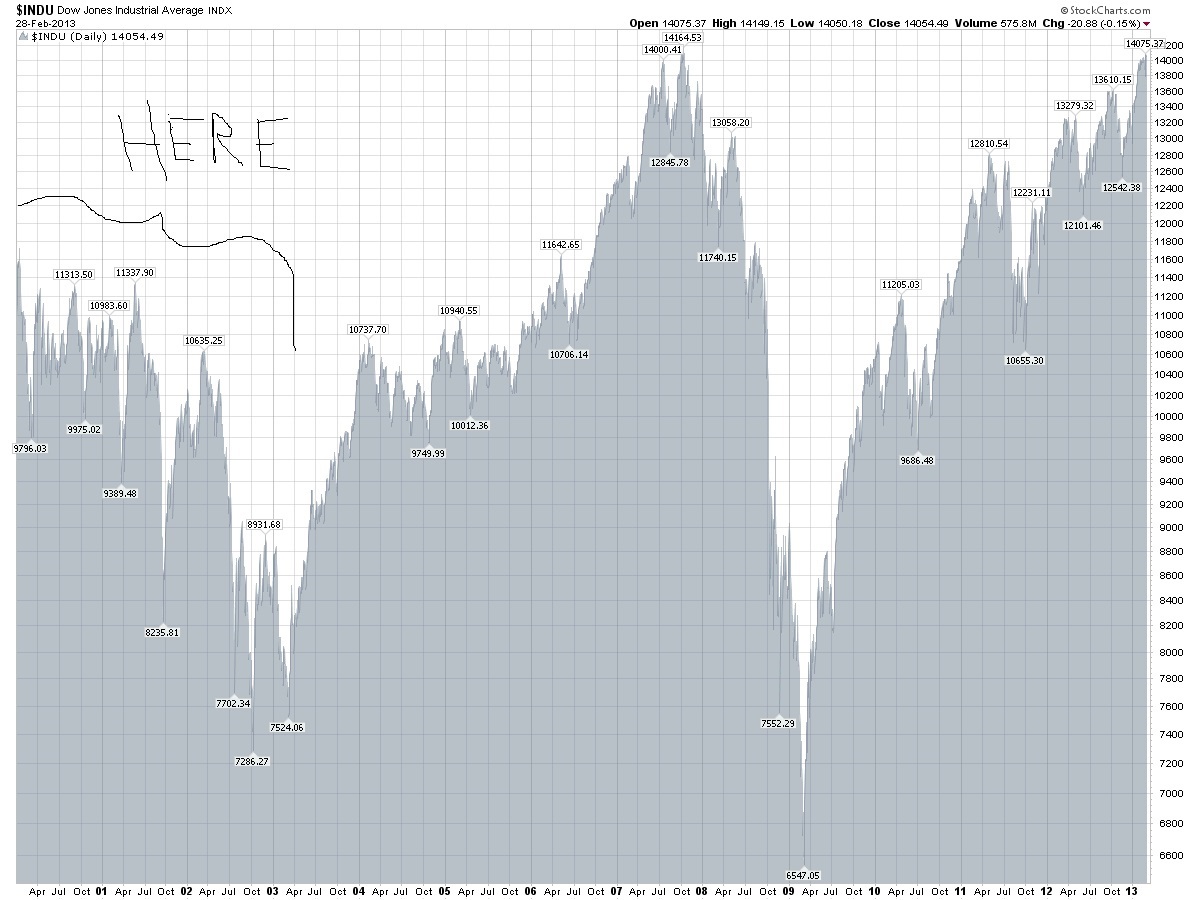

MSM is touting the stock market increase of late to be indicative of a recovery. I'm no MBA, but my memory is not so short that I don't remember

how leading up to New Year's Day of 2000, things looked peachy and the market was booming. A few days later, anybody whose retirement fund was

stock-market based, especially NASDAQ and other high risk stocks, was back to net negative investment.

I've never thought the current stock market was a viable indicator of the economic health of the country. Am I just being ignorant?

I've never thought the current stock market was a viable indicator of the economic health of the country. Am I just being ignorant?

well hmmm

Soros sells off a buttload of junk retail stock and buys gold

and just so happens to sell a buttload of ammunition to the DHS..

what do you think is coming?

Soros sells off a buttload of junk retail stock and buys gold

and just so happens to sell a buttload of ammunition to the DHS..

what do you think is coming?

The elephant in the room everyone is ignoring.

How can the derivatives market be larger than the entire world's financial wealth?

Derivitives

This alone would make most with some common sense ask what the real deal is.

How can the derivatives market be larger than the entire world's financial wealth?

Derivitives

This alone would make most with some common sense ask what the real deal is.

edit on 14-3-2013 by IntelRetard because: (no reason

given)

The Federal Reserve is buying $85 Billion dollars a month in Toxic Bonds from the banks.

If that was not happening - where would that stock market be?

$85 BILLION

If that was not happening - where would that stock market be?

$85 BILLION

I think the stock market has become a huge scam. Not many of the companies have any assets worth even nearly what their outstanding stock is. That

wouldn't be a problem if their product was actually a necessity to the people but that is rarely the case. There is going to be a major correction

soon and nobody is going to do good. After that people will loose faith in the stock market and there will be a worldwide tumble of economies. Why

did they think a global network could not tumble and crash. Almost everyone is in the same boat now and it is the titanic.

reply to post by lynxpilot

Guyw dont forget about quantitive easing........because using your credit card to pay for your other credit cards, that your using to buy stock in your company because it is failing and needs the capital is well...............what is the word for the stupidest thing you have ever heard of?

Guyw dont forget about quantitive easing........because using your credit card to pay for your other credit cards, that your using to buy stock in your company because it is failing and needs the capital is well...............what is the word for the stupidest thing you have ever heard of?

I know we have swings up and down, and traditionally they haven't meant the end of the world, but I'm perplexed as to why a fed chairman, president,

and minions would try to pass this charade off as something to be optimistic about. For the last 2 or 3 months, they're trying to say housing is

bouncing back, and CNN or somebody had some blather a day or two ago about jobs, pay, and unemployment all being on the move to better.

I have absolutely no trust in the stock market. I know a lot of folks (Soros and others) have made fortunes from it, but they're also at the wheel of where the real economy goes, as drivers, so they have legal insider info.

Somebody was predicting that the market would be in the 16K range within the next year or so, and I don't doubt that it may actually do that, but I suspect that anybody that rides that wave up is going to hit the beach hard.

I have absolutely no trust in the stock market. I know a lot of folks (Soros and others) have made fortunes from it, but they're also at the wheel of where the real economy goes, as drivers, so they have legal insider info.

Somebody was predicting that the market would be in the 16K range within the next year or so, and I don't doubt that it may actually do that, but I suspect that anybody that rides that wave up is going to hit the beach hard.

Originally posted by lynxpilot

MSM is touting the stock market increase of late to be indicative of a recovery. I'm no MBA, but my memory is not so short that I don't remember how leading up to New Year's Day of 2000, things looked peachy and the market was booming. A few days later, anybody whose retirement fund was stock-market based, especially NASDAQ and other high risk stocks, was back to net negative investment.

I've never thought the current stock market was a viable indicator of the economic health of the country. Am I just being ignorant?

Actually it was 2007 when the market took a dump . . . not 2000. Things were just fine and rosey for the first 7 years of the 2000's. And by 2010, not only was it back, but had gained 12% on top of that. (27% down to 39% up the next two years). So . . . your memory is a little "fuzzy" on that.

The problem was all the doom and gloomers pulled all their money out (what was left) because of fears that they would lose more. If they would have just relaxed and left it alone . . . Their retirement accts would be booming right now . . . Whether you want to blame the panicky nature of man or relying on emotion to manage their money . . . people messed up by doing that. No actual financial advisors were telling people to pull all their money out . .. except those trying to sell doom books or precious metals.

That said, the market shows investor confidence in the companies that are traded. The Dow and S&P show a index of the largest traded companies over a range of industries. It is a good indicator of what the largest scale investors are doing, but doesn't directly equate to the health of the economy.

Problem in this country is everyone (general public) thinks they know what they are talking about when it comes to the movements and levels, yet they usually don't know the first thing about personal finance. If they did they wouldn't be poor and bitching all the time . . .

For direction of the economy, look at what are considered "leading economic indicators" . . . these allow predictions on the economy because they change before the actual economy goes in that direction.

Economic Indicators

However, stock market can turn on a whim . . . and our debt is a serious problem. A lot of people are also predicting some sort of equity bubble, but prices are constantly going through corrections (said to be built in). So if the leading indicators move in a direction, the market will adjust before it hits the wallet of the public.

edit on 3/14/13 by solomons path because: (no reason given)

Originally posted by lynxpilot

I know we have swings up and down, and traditionally they haven't meant the end of the world, but I'm perplexed as to why a fed chairman, president, and minions would try to pass this charade off as something to be optimistic about. For the last 2 or 3 months, they're trying to say housing is bouncing back, and CNN or somebody had some blather a day or two ago about jobs, pay, and unemployment all being on the move to better.

I have absolutely no trust in the stock market. I know a lot of folks (Soros and others) have made fortunes from it, but they're also at the wheel of where the real economy goes, as drivers, so they have legal insider info.

Somebody was predicting that the market would be in the 16K range within the next year or so, and I don't doubt that it may actually do that, but I suspect that anybody that rides that wave up is going to hit the beach hard.

Housing starts, job creation, etc . . . are indicators used in prediction. It's not about being an insider . . . it's actually all common sense. When the market is down . . . buy. When it is up . . . sell/move to other areas of investment (like hiring, etc).

The problem is the general public acts in the exact opposite manner . . . based on fear or a false perception of creating wealth. When people see things going down, their emotional tie to their money makes them want to save whats left and get out. When they hear things are good, they invest and when the next down turn comes all they can think about is how much they lost and then they sell . . . losing money. That's why you get an advisor to take the emotion out of it.

Originally posted by solomons path

Actually it was 2007 when the market took a dump . . . not 2000. Things were just fine and rosey for the first 7 years of the 2000's. And by 2010, not only was it back, but had gained 12% on top of that. (27% down to 39% up the next two years). So . . . your memory is a little "fuzzy" on that.

The problem was all the doom and gloomers pulled all their money out (what was left) because of fears that they would lose more. If they would have just relaxed and left it alone . . . Their retirement accts would be booming right now . . . Whether you want to blame the panicky nature of man or relying on emotion to manage their money . . . people messed up by doing that. No actual financial advisors were telling people to pull all their money out . .. except those trying to sell doom books or precious metals.

That said, the market shows investor confidence in the companies that are traded. The Dow and S&P show a index of the largest traded companies over a range of industries. It is a good indicator of what the largest scale investors are doing, but doesn't directly equate to the health of the economy.

Problem in this country is everyone (general public) thinks they know what they are talking about when it comes to the movements and levels, yet they usually don't know the first thing about personal finance. If they did they wouldn't be poor and bitching all the time . . .

For direction of the economy, look at what are considered "leading economic indicators" . . . these allow predictions on the economy because they change before the actual economy goes in that direction.

Economic Indicators

However, stock market can turn on a whim . . . and our debt is a serious problem. A lot of people are also predicting some sort of equity bubble, but prices are constantly going through corrections (said to be built in). So if the leading indicators move in a direction, the market will adjust before it hits the wallet of the public.edit on 3/14/13 by solomons path because: (no reason given)

actually, it did take a dump in 2000 and was exacerbated by events of 9/11/2001.

new topics

-

James O’Keefe: I have evidence that exposes the CIA, and it’s on camera.

Whistle Blowers and Leaked Documents: 2 minutes ago -

Australian PM says the quiet part out loud - "free speech is a threat to democratic dicourse"...?!

New World Order: 47 minutes ago -

Ireland VS Globalists

Social Issues and Civil Unrest: 1 hours ago -

Biden "Happy To Debate Trump"

Mainstream News: 1 hours ago -

RAAF airbase in Roswell, New Mexico is on fire

Aliens and UFOs: 1 hours ago -

What is the white pill?

Philosophy and Metaphysics: 3 hours ago -

Mike Pinder The Moody Blues R.I.P.

Music: 4 hours ago -

Putin, Russia and the Great Architects of the Universe

ATS Skunk Works: 7 hours ago -

A Warning to America: 25 Ways the US is Being Destroyed

New World Order: 11 hours ago

top topics

-

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies: 17 hours ago, 35 flags -

A Warning to America: 25 Ways the US is Being Destroyed

New World Order: 11 hours ago, 20 flags -

Mike Pinder The Moody Blues R.I.P.

Music: 4 hours ago, 7 flags -

What is the white pill?

Philosophy and Metaphysics: 3 hours ago, 5 flags -

Biden "Happy To Debate Trump"

Mainstream News: 1 hours ago, 5 flags -

Australian PM says the quiet part out loud - "free speech is a threat to democratic dicourse"...?!

New World Order: 47 minutes ago, 4 flags -

RAAF airbase in Roswell, New Mexico is on fire

Aliens and UFOs: 1 hours ago, 4 flags -

Putin, Russia and the Great Architects of the Universe

ATS Skunk Works: 7 hours ago, 3 flags -

Ireland VS Globalists

Social Issues and Civil Unrest: 1 hours ago, 2 flags -

James O’Keefe: I have evidence that exposes the CIA, and it’s on camera.

Whistle Blowers and Leaked Documents: 2 minutes ago, 0 flags

active topics

-

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 696 • : daskakik -

Biden "Happy To Debate Trump"

Mainstream News • 29 • : theatreboy -

James O’Keefe: I have evidence that exposes the CIA, and it’s on camera.

Whistle Blowers and Leaked Documents • 0 • : pianopraze -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media • 284 • : cherokeetroy -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics • 96 • : xuenchen -

Ireland VS Globalists

Social Issues and Civil Unrest • 6 • : TimBurr -

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies • 32 • : network dude -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest • 20 • : Oldcarpy2 -

Australian PM says the quiet part out loud - "free speech is a threat to democratic dicourse"...?!

New World Order • 2 • : ColeYounger2 -

Starburst galaxy M82 - Webb Vs Hubble

Space Exploration • 10 • : LSU2018

3