It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

Originally posted by FlyersFan

Justin Bieber ... I really don't get the attraction the little girls have to him.

And I'm kinda surprised that anyone old enough to get a credit card

would still be interested in him.

Isn't he the 'idol' for the 10-12 year olds?

Don't the girls older than that go for the guys who are more .. um .. 'guyish'??

Seriously .. doesn't he draw the younger crowd??

Hes promoting PRE PAID cards not credit cards.

reply to post by Infi8nity

But you are actually getting a service for the fee you pay.

Oh yes, you can't "lose" a wad of prepaid card if you leave it in your pocket when you go surfing but you can a wad of cash. Stolen card? Not such a problem. Stolen cash...

No. No need to. Doesn't really matter though. It really doesn't seem like a bad idea to me (and not because Justin says so).

Your really sticking up for credit card company's?

Pretty much so. But then you have to write things down and that's haarrrrrdddd.

How is a prepaid card teaching them budgeting? You can learn the same exact lessons by keeping paper bills.

To a greedy mega corporation's, what?

Its almost the exact same thing, only difference is your giving money to a greedy mega corporation's.

But you are actually getting a service for the fee you pay.

No reason to.

Why have a middle man if their is no reason to?

It helps teach them that when you spend all the money you have you don't have any more to spend. It also provides them with a record of exactly where they spend their money. Cash, on the other hand, just sort of disappears. A little here, a little there, whoops, nothing left. I wonder how that happened?

This is not teaching them budgeting, if any thing its teaching them to spend their money on frivolous crap to make them self's fell more "grown up". Children do not need pre paid cards, (unless they want to make a perches on the net)

Oh yes, you can't "lose" a wad of prepaid card if you leave it in your pocket when you go surfing but you can a wad of cash. Stolen card? Not such a problem. Stolen cash...

Yeah, I know. It's a profit thing. Shameful.

These company's are targeting children because they are the only group thats not in their system.

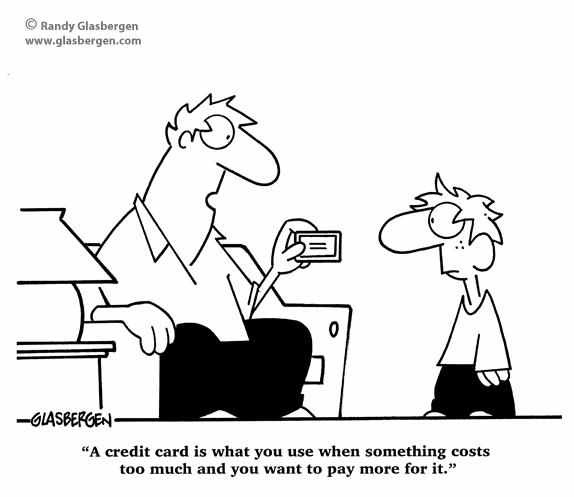

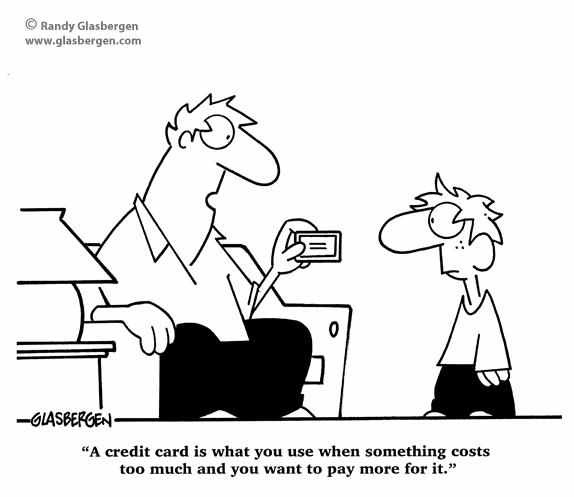

Credit cards = the new chains of slavery for mankind. People should learn how to live within their means but when you live in a greed is good society

this is next to impossible.

Originally posted by Phage

reply to post by buster2010

It isn't a credit card.

Even though it is prepaid it is still a credit card. Because it uses the same system as if it were credit card the only difference is is the limit of your credit is the balance on the card and you are still charged fees for using it.

I think the argument against pushing credit cards/debit cards and seriously blurring the lines between those distinctly different things is a valid

one.

At the college I attend, the College ID card IS a debit card. MasterCard branded. I was required to get this pre-paid card the first semester I was there when I hadn't even heard of FAFSA yet and was 100% cash pay. It wasn't useful for much, since I chose not to use it. However, by simply enrolling and getting the school ID, it opened an account for me in the bank they've co-branded with that I could "charge" with whatever I wanted to set up to add on the prepaid card. The account and card wasn't optional. Just my decision whether to make use of it.

Once I started in earnest with full time + credit hours on FAFSA, it's the mechanism ..and ONLY option that I understand, to get my refund disbursements. They drop onto the School ID card like magic (if I didn't know so much better after life experience with CC's) for a few thousand at a drop. The school even allows the School ID/Debit Card to be used in the Student Store for a $200 credit against student loan expenses in advance of load disbursement. Handy....and isn't it a dandy thing, they had game consoles there for right about that price too. I saw one sell while I was in there getting basic school stuff. He paid the bulk with the advance and the remainder for tax with another card.

What was even more telling was my math class here a few days ago. I don't mind admitting I'm in remedial math. English may be my strong point but Algebra is an exotic animal someone needs to make extinct. The thing was, the instructor had asked for a show of hands on how many had balanced a check book or even knew how to ....and only about 4 out of 25 raised their hands.

The conditioning all this is carrying is just a negative overall thing, IMO.

At the college I attend, the College ID card IS a debit card. MasterCard branded. I was required to get this pre-paid card the first semester I was there when I hadn't even heard of FAFSA yet and was 100% cash pay. It wasn't useful for much, since I chose not to use it. However, by simply enrolling and getting the school ID, it opened an account for me in the bank they've co-branded with that I could "charge" with whatever I wanted to set up to add on the prepaid card. The account and card wasn't optional. Just my decision whether to make use of it.

Once I started in earnest with full time + credit hours on FAFSA, it's the mechanism ..and ONLY option that I understand, to get my refund disbursements. They drop onto the School ID card like magic (if I didn't know so much better after life experience with CC's) for a few thousand at a drop. The school even allows the School ID/Debit Card to be used in the Student Store for a $200 credit against student loan expenses in advance of load disbursement. Handy....and isn't it a dandy thing, they had game consoles there for right about that price too. I saw one sell while I was in there getting basic school stuff. He paid the bulk with the advance and the remainder for tax with another card.

What was even more telling was my math class here a few days ago. I don't mind admitting I'm in remedial math. English may be my strong point but Algebra is an exotic animal someone needs to make extinct. The thing was, the instructor had asked for a show of hands on how many had balanced a check book or even knew how to ....and only about 4 out of 25 raised their hands.

The conditioning all this is carrying is just a negative overall thing, IMO.

reply to post by buster2010

No. It is not at all the same.

A credit card can carry a credit balance which can continue to increase up to the credit limit while at the same time accruing interest. A prepaid card carries a debit balance. Once that balance is depleted that's it, no more fun. There is no interest accrued on a prepaid card.

If you pay your credit card late, you are charged a fee. If you don't refill your prepaid card you are not charged a fee.

If you pay your credit card late, your credit rating is affected. If you don't refill your prepaid card your credit rating is not affected.

Because it uses the same system as if it were credit card the only difference is is the limit of your credit is the balance on the card and you are still charged fees for using it.

No. It is not at all the same.

A credit card can carry a credit balance which can continue to increase up to the credit limit while at the same time accruing interest. A prepaid card carries a debit balance. Once that balance is depleted that's it, no more fun. There is no interest accrued on a prepaid card.

If you pay your credit card late, you are charged a fee. If you don't refill your prepaid card you are not charged a fee.

If you pay your credit card late, your credit rating is affected. If you don't refill your prepaid card your credit rating is not affected.

edit on 3/2/2013 by Phage because: (no reason given)

I think this was bound to happen sooner or later. Is the logic that Since our grandkids' grandkids will be paying off our debt they should learn to

start managing credit/debt early? As a parent My kids won't even have a cell phone until they get their drivers license, a prepaid credit card isn't

even a consideration.

Posted Via ATS Mobile: m.abovetopsecret.com

Originally posted by Phage

Um. It's a prepaid card.

Do you think learning how to budget is a bad thing?

You have to pay for the card and then you get used to the idea of no pain swiping it at any fast food restaurant/store/whatever.......

It is like training troops for war, first you get them in a barrack and then you drive the points home again and again till they get used to it.

Regards, Iwinder

reply to post by Iwinder

Until it's empty. How is that different from pulling a $5 bill out of your pocket...until your pocket is empty?

no pain swiping it at any fast food restaurant/store/whatever.......

edit on 3/2/2013 by Phage because: (no reason given)

I hate to do the old I walked to school barefoot in a snowstorm thing but fare warning I am about to do that.

In order to get my first credit card I had to borrow $400.00 from my bank with my father co-signing the loan.

Then I had to pay off the loan obviously to get credit.

Now this was back in 1976 and that loan cost me $37.00 in interest.

I was making $1.45 per hour part time at a hotel and $15.00 per week cutting lawns.

It took me two years and then some to pay it off just so I could charge more money and pay more interest.

Now they give them away?

I never got into trouble with the card money wise, but to this day we only have one credit card and use it quite often but we do pay it off in full each month and for that we get a lot of free gas.

My first credit card limit was $100.00 now I can charge up to $23000.00 with extensions if we need them which we don't.

No wonder people are in trouble money wise in this day and age.

Interesting topic and S&F to the OP

Regards, Iwinder

In order to get my first credit card I had to borrow $400.00 from my bank with my father co-signing the loan.

Then I had to pay off the loan obviously to get credit.

Now this was back in 1976 and that loan cost me $37.00 in interest.

I was making $1.45 per hour part time at a hotel and $15.00 per week cutting lawns.

It took me two years and then some to pay it off just so I could charge more money and pay more interest.

Now they give them away?

I never got into trouble with the card money wise, but to this day we only have one credit card and use it quite often but we do pay it off in full each month and for that we get a lot of free gas.

My first credit card limit was $100.00 now I can charge up to $23000.00 with extensions if we need them which we don't.

No wonder people are in trouble money wise in this day and age.

Interesting topic and S&F to the OP

Regards, Iwinder

Originally posted by Phage

reply to post by Iwinder

Until it's empty. How is that different from pulling a $5 bill out of your pocket...until your pocket is empty?

no pain swiping it at any fast food restaurant/store/whatever.......

edit on 3/2/2013 by Phage because: (no reason given)

It is like training troops for war, first you get them in a barrack and then you drive the points home again and again till they get used to it.

This is how as in my above statement.

Regards, Iwinder

reply to post by Iwinder

No, it's not like that.

It's like taking money out of your wallet and paying for something except:

1) You get a statement which tells you where you have spent your money.

2) If you lose the card or if it is stolen, you get your money back.

This is not a credit card.

No, it's not like that.

It's like taking money out of your wallet and paying for something except:

1) You get a statement which tells you where you have spent your money.

2) If you lose the card or if it is stolen, you get your money back.

This is not a credit card.

Originally posted by Phage

reply to post by Iwinder

It isn't a credit card.

I am and we all are aware that it is not a credit card, but it is a training tool just swipe and enjoy.

Regards, Iwinder

Originally posted by Iwinder

Originally posted by Phage

reply to post by Iwinder

It isn't a credit card.

I am and we all are aware that it is not a credit card, but it is a training tool just swipe and enjoy.

Regards, Iwinder

Right, can't pull that five spot out of your pocket and enjoy now, can you?

What happens when you swipe and it comes up empty? No lesson learned?

edit on 3/2/2013 by Phage because: (no reason given)

Originally posted by Phage

Originally posted by Iwinder

Originally posted by Phage

reply to post by Iwinder

It isn't a credit card.

I am and we all are aware that it is not a credit card, but it is a training tool just swipe and enjoy.

Regards, Iwinder

Right, can't pull that five spot out of your pocket and enjoy now, can you?

What happens when you swipe and it comes up empty? No lesson learned?edit on 3/2/2013 by Phage because: (no reason given)

You see its the joy of pulling out a piece of plastic and getting your gratification right there and then.

You don't actually see the money..

It is much easier on the brain to swipe plastic compared to actually taking out the $15.00 you busted your ass for cutting grass in hot weather....

Regards, Iwinder

reply to post by Iwinder

Maybe. Taking $15 out of my pocket never slowed me down as a kid but thinking about what was (or wasn't) going to be in my pocket next week did. I don't see the difference if you know the card isn't a money tree or if you're using cash.

It is much easier on the brain to swipe plastic compared to actually taking out the $15.00 you busted your ass for cutting grass in hot weather....

Reply to post by Phage

I'm not against learning to budget, its something I wish my parents had done. But they can get by with cash while it still has value. Things they would want to order online or requires a credit card I'll be the gate keeper of until mid high school.

Posted Via ATS Mobile: m.abovetopsecret.com

I'm not against learning to budget, its something I wish my parents had done. But they can get by with cash while it still has value. Things they would want to order online or requires a credit card I'll be the gate keeper of until mid high school.

new topics

-

Maestro Benedetto

Literature: 1 hours ago -

Is AI Better Than the Hollywood Elite?

Movies: 1 hours ago -

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs: 4 hours ago -

2024 Pigeon Forge Rod Run - On the Strip (Video made for you)

Automotive Discussion: 5 hours ago -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues: 6 hours ago -

The functionality of boldening and italics is clunky and no post char limit warning?

ATS Freshman's Forum: 7 hours ago -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News: 7 hours ago -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest: 7 hours ago -

Weinstein's conviction overturned

Mainstream News: 9 hours ago -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics: 10 hours ago

top topics

-

Krystalnacht on today's most elite Universities?

Social Issues and Civil Unrest: 10 hours ago, 9 flags -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics: 10 hours ago, 8 flags -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media: 13 hours ago, 7 flags -

Weinstein's conviction overturned

Mainstream News: 9 hours ago, 7 flags -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues: 6 hours ago, 7 flags -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest: 7 hours ago, 6 flags -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News: 7 hours ago, 5 flags -

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs: 4 hours ago, 4 flags -

2024 Pigeon Forge Rod Run - On the Strip (Video made for you)

Automotive Discussion: 5 hours ago, 2 flags -

Any one suspicious of fever promotions events, major investor Goldman Sachs card only.

The Gray Area: 15 hours ago, 2 flags

active topics

-

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media • 230 • : Xtrozero -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues • 94 • : Scratchpost -

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News • 62 • : ByeByeAmericanPie -

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs • 72 • : yuppa -

My Poor Avocado Plant.

General Chit Chat • 77 • : JonnyC555 -

New whistleblower Jason Sands speaks on Twitter Spaces last night.

Aliens and UFOs • 61 • : Ophiuchus1 -

Is AI Better Than the Hollywood Elite?

Movies • 2 • : 5thHead -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues • 25 • : CarlLaFong -

Mood Music Part VI

Music • 3102 • : Hellmutt -

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs • 9 • : Ophiuchus1