It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

2

share:

Fortunately, this "new tax" won't apply to me. It's still just another sign that the administration knows that they will be struggling to pay for

everything. No real changes. Just more taxes.

Nothing to see here folks.... Just another Obamacare surprise!!!!

Deficit Neutral? or smoke and mirrors??

cnsnews.com...

"NEW TAXES" are set to roll in for 2013 Its called "Taxmageddon"

Companies rarely absorb any higher costs....

blog.heritage.org...

A provision of President Obama’s health care law imposes a second Medicare tax on investment income for Americans classified as wealthy, effectively raising taxes on investment income and taxing investors twice.

The provision, a little-known part of ObamaCare, levies a 3.8 percent Medicare tax on investment income for couples making more than $250,000 or individuals making more than $200,000 a year. The tax is scheduled to go into effect on January 1, 2013.

Currently, the government levies a 2.9 percent Medicare payroll tax on all wages, with half (1.45%) paid by the individual and half by the employer.

Beginning in 2013, couples making more than $250,000 (or individuals making $200,000) will have to pay an additional 3.8 percent Medicare tax on any investment income (unearned income) they might have.

In other words, beginning in 2013, wealthy Americans who have investment income will be taxed twice to pay for Medicare – once on their regular salary and again on their investment income.

Nothing to see here folks.... Just another Obamacare surprise!!!!

The new tax was part of Democrats’ attempt to make Obamacare appear deficit-neutral, and it will add $318 billion to federal coffers between 2013 and 2022, according to a July CBO analysis.

The tax applies to traditional investment income derived from dividends, real estate investments, interest, or profits from trading financial products such as stocks and bonds.

Deficit Neutral? or smoke and mirrors??

cnsnews.com...

"NEW TAXES" are set to roll in for 2013 Its called "Taxmageddon"

Unless President Obama and Congress take action soon, Taxmageddon will hit on January 1, 2013. Taxmageddon is a $494 billion tax increase for 2013 alone. It is made up of several expiring tax policies and the implementation of new Obamacare tax increases that all kick in at the start of next year.

Taxmageddon includes a rise in the capital gains tax from 15 percent to 20 percent, in addition to the 3.8 percent from Obamacare, which brings the capital gains tax rate to 23.8 percent, a 59 percent increase as of New Year’s Day.

In addition, beginning in 2013, Obamacare imposes a 2.3 percent excise tax on the sale of commonly used medical equipment. This tax has the potential to significantly affect employment and medical innovation. Device manufacturers will either pass on the tax as higher costs to consumers or absorb it themselves. If they pay the costs themselves, they will likely have to recoup this cost by decreasing labor costs.

Companies rarely absorb any higher costs....

blog.heritage.org...

these taxes on the rich, are just a way to get back some of the massive amount of loophole dollars, that the wealthy got away with over the last few

decades.

a certified public accountant that our family has known for thirty years, has said that if the government eliminates dividend, and estate taxes, within 3 generations, the top1 percent will own 99% of this country. of course, i was leery of what he said, but he actually led me through the calculations, and in a short time, it became apparent he knew what he was talking about.

a certified public accountant that our family has known for thirty years, has said that if the government eliminates dividend, and estate taxes, within 3 generations, the top1 percent will own 99% of this country. of course, i was leery of what he said, but he actually led me through the calculations, and in a short time, it became apparent he knew what he was talking about.

reply to post by jibeho

How many times can people say this is a "new discovery"????

www.abovetopsecret.com...

www.abovetopsecret.com...

And nothing is taxed twice...the money you have made on an investment has not had taxes paid on it yet.

How many times can people say this is a "new discovery"????

www.abovetopsecret.com...

www.abovetopsecret.com...

And nothing is taxed twice...the money you have made on an investment has not had taxes paid on it yet.

Wouldn't your title be more correct if it said medicare double taxation if you make over 200K a year? Oh the GOP will be screaming CLASS WARFARE at

the top of their lungs. I look forward to Mittens and Ryan trying to make it sound like everyone's taxes will be going up.

We balance it okay up here north of your border, but really dont want to start an argument here about the differences between Canada and US.

My point is, with some work it is possible to make everyone happy.

Then again, some people just dont really care about helping their fellow citizen.

Disclaimer: I am not insinuating this about the OP at all, just a general opinion.

My point is, with some work it is possible to make everyone happy.

Then again, some people just dont really care about helping their fellow citizen.

Disclaimer: I am not insinuating this about the OP at all, just a general opinion.

reply to post by OutKast Searcher

The wealthy always cry that their money was taxed when they earned it before investing it. And what kind of work did the majority of these people do to earn that money? Wait for mommy and daddy to die.

And nothing is taxed twice...the money you have made on an investment has not had taxes paid on it yet.

The wealthy always cry that their money was taxed when they earned it before investing it. And what kind of work did the majority of these people do to earn that money? Wait for mommy and daddy to die.

edit on 20-8-2012 by buster2010 because: (no reason given)

reply to post by buster2010

But the tax is on Capital GAINS...it is the profit they make off the money invested...not the invested money itself. It is new money...and it should be taxed just like any other income.

I just don't get how they get "double taxation" out of it.

But the tax is on Capital GAINS...it is the profit they make off the money invested...not the invested money itself. It is new money...and it should be taxed just like any other income.

I just don't get how they get "double taxation" out of it.

Obamacare robbed medicare. Seriously dug into it.

Will there even be any medicare left to 'double tax'??

Obamacare Robs 716$ Billion from Medicare

Will there even be any medicare left to 'double tax'??

Obamacare Robs 716$ Billion from Medicare

reply to post by jibeho

1st...all businesses look for ways to cut labor costs all the time...taxes have nothing to do with "cutting" labor costs...that's a fallacy always thrown out there by businesses themselves.

2nd...if all businesses have to pay the taxes, all businesses are on an equal footing.

3rd...business owners and executives make dumbass decisions that affects their sales and profits. most of the time, labor has very liitle to do with it.

1st...all businesses look for ways to cut labor costs all the time...taxes have nothing to do with "cutting" labor costs...that's a fallacy always thrown out there by businesses themselves.

2nd...if all businesses have to pay the taxes, all businesses are on an equal footing.

3rd...business owners and executives make dumbass decisions that affects their sales and profits. most of the time, labor has very liitle to do with it.

Originally posted by FlyersFan

Obamacare robbed medicare. Seriously dug into it.

Will there even be any medicare left to 'double tax'??

Obamacare Robs 716$ Billion from Medicare

oh yes...keep using the word "rob"...republicans think people are so stupid that they won't notice they are being manipulated. "seriously dug into it"??? rrriiiggghhttt!!!..... Obama only "robbed" insurance companies of some of their massive profits taken from taxpayers.

edit on 20-8-2012

by jimmyx because: context

reply to post by OutKast Searcher

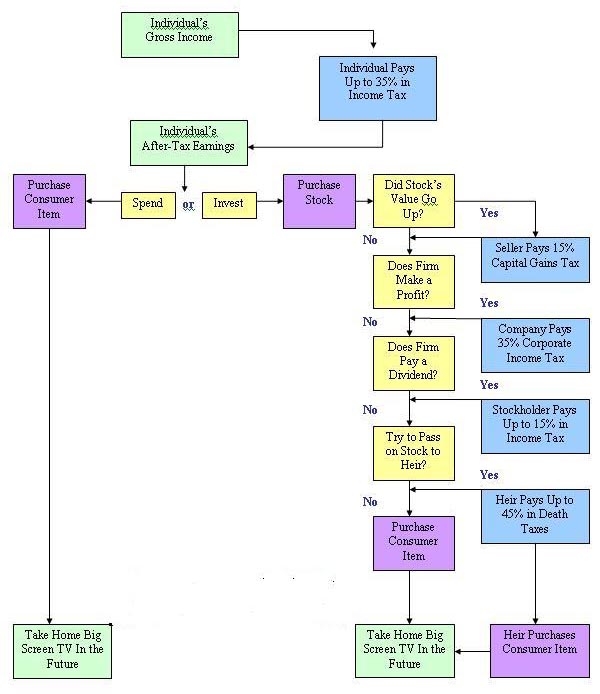

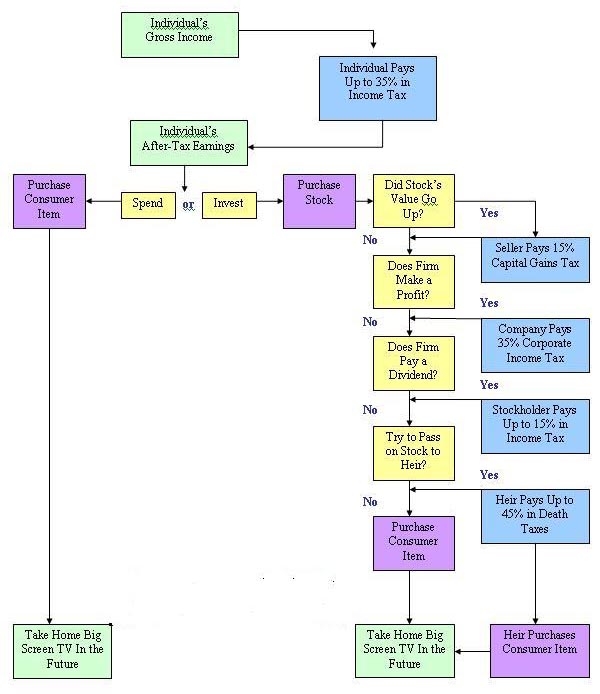

Maybe this will explain the taxation "flow" and how the same dollar can get hit up to 4 times. Make that five with this new tax.

Maybe this will explain the taxation "flow" and how the same dollar can get hit up to 4 times. Make that five with this new tax.

We earn income.

We then pay tax on that income.

We then either consume our after-tax income, or we save and invest it.

If we consume our after-tax income, the government largely leaves us alone.

If we save and invest our after-tax income, a single dollar of income can be taxed as many as four different times.

reply to post by jibeho

The problem with your diagram is that it shows no medicare tax being paid by all those other taxes. If it's all just included as 'one big 15% tax' then another 3% isn't going to hurt anything. God forbid millionaires can't manage to make themselves more obscenely wealthy at the expense of the rest of us.

Keep on defending the rich, you might get there one day.

The problem with your diagram is that it shows no medicare tax being paid by all those other taxes. If it's all just included as 'one big 15% tax' then another 3% isn't going to hurt anything. God forbid millionaires can't manage to make themselves more obscenely wealthy at the expense of the rest of us.

Keep on defending the rich, you might get there one day.

reply to post by jibeho

Whoever said that one dollar should ever be taxed one time???

I earn a dollar...it's taxed....I buy something...it's taxed....the company uses that dollar to pay it's worker...it's taxed....repeat....

The idea that a dollar should ever be taxed on time is illogical.

Whoever said that one dollar should ever be taxed one time???

I earn a dollar...it's taxed....I buy something...it's taxed....the company uses that dollar to pay it's worker...it's taxed....repeat....

The idea that a dollar should ever be taxed on time is illogical.

reply to post by links234

That's because its currently deducted from earned income (after tax earnings on the chart). They want to spread the branches to include investment income as well. The question was raised regarding double taxation. Hence the chart.

No need to defend the rich from me. Just opposed to this ridiculous tax and spend mentality. Everyone needs to have some skin in the game. They just can't keep looking to bleed the rich to pay for everyone else. Doesn't work that way . Just ask the French.

That's because its currently deducted from earned income (after tax earnings on the chart). They want to spread the branches to include investment income as well. The question was raised regarding double taxation. Hence the chart.

No need to defend the rich from me. Just opposed to this ridiculous tax and spend mentality. Everyone needs to have some skin in the game. They just can't keep looking to bleed the rich to pay for everyone else. Doesn't work that way . Just ask the French.

edit on 20-8-2012 by jibeho

because: (no reason given)

reply to post by jibeho

Therein lies your problem of what's going on. If you're making >$200,000 in investments it's highly unlikely you're 'earning' any other income, especially any to really offset the amount you may have already contributed to the medicare tax.

It's like the Warren Buffett argument, he 'earns' $100,000 a year from his CEO job, but he makes multiple millions of dollars on top of that. So yeah, $3,800 (3.8% of 100,000) is fair but $3,800 of millions upon millions is not.

All of that aside, the smartest way to invest is to use the money you get back from investments to invest further. Perhaps if you're just starting off you want to take your earned income and invest it, but there comes a point (if you're a smart investor) where that's no longer needed to get the same or greater returns.

Therein lies your problem of what's going on. If you're making >$200,000 in investments it's highly unlikely you're 'earning' any other income, especially any to really offset the amount you may have already contributed to the medicare tax.

It's like the Warren Buffett argument, he 'earns' $100,000 a year from his CEO job, but he makes multiple millions of dollars on top of that. So yeah, $3,800 (3.8% of 100,000) is fair but $3,800 of millions upon millions is not.

All of that aside, the smartest way to invest is to use the money you get back from investments to invest further. Perhaps if you're just starting off you want to take your earned income and invest it, but there comes a point (if you're a smart investor) where that's no longer needed to get the same or greater returns.

new topics

-

Where should Trump hold his next rally

2024 Elections: 49 minutes ago -

Shocking Number of Voters are Open to Committing Election Fraud

US Political Madness: 1 hours ago -

Gov Kristi Noem Shot and Killed "Less Than Worthless Dog" and a 'Smelly Goat

2024 Elections: 2 hours ago -

Falkville Robot-Man

Aliens and UFOs: 2 hours ago -

James O’Keefe: I have evidence that exposes the CIA, and it’s on camera.

Whistle Blowers and Leaked Documents: 3 hours ago -

Australian PM says the quiet part out loud - "free speech is a threat to democratic dicourse"...?!

New World Order: 4 hours ago -

Ireland VS Globalists

Social Issues and Civil Unrest: 4 hours ago -

Biden "Happy To Debate Trump"

2024 Elections: 5 hours ago -

RAAF airbase in Roswell, New Mexico is on fire

Aliens and UFOs: 5 hours ago -

What is the white pill?

Philosophy and Metaphysics: 6 hours ago

top topics

-

A Warning to America: 25 Ways the US is Being Destroyed

New World Order: 14 hours ago, 21 flags -

Blast from the past: ATS Review Podcast, 2006: With All Three Amigos

Member PODcasts: 7 hours ago, 11 flags -

Mike Pinder The Moody Blues R.I.P.

Music: 7 hours ago, 8 flags -

Biden "Happy To Debate Trump"

2024 Elections: 5 hours ago, 8 flags -

James O’Keefe: I have evidence that exposes the CIA, and it’s on camera.

Whistle Blowers and Leaked Documents: 3 hours ago, 7 flags -

Australian PM says the quiet part out loud - "free speech is a threat to democratic dicourse"...?!

New World Order: 4 hours ago, 7 flags -

What is the white pill?

Philosophy and Metaphysics: 6 hours ago, 5 flags -

Ireland VS Globalists

Social Issues and Civil Unrest: 4 hours ago, 4 flags -

RAAF airbase in Roswell, New Mexico is on fire

Aliens and UFOs: 5 hours ago, 4 flags -

Putin, Russia and the Great Architects of the Universe

ATS Skunk Works: 10 hours ago, 3 flags

active topics

-

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs • 77 • : yuppa -

Biden "Happy To Debate Trump"

2024 Elections • 39 • : underpass61 -

Where should Trump hold his next rally

2024 Elections • 6 • : WeMustCare -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media • 306 • : Xtrozero -

Russia Ukraine Update Thread - part 3

World War Three • 5737 • : Arbitrageur -

Gov Kristi Noem Shot and Killed "Less Than Worthless Dog" and a 'Smelly Goat

2024 Elections • 26 • : CarlLaFong -

James O’Keefe: I have evidence that exposes the CIA, and it’s on camera.

Whistle Blowers and Leaked Documents • 8 • : Athetos -

Weinstein's conviction overturned

Mainstream News • 29 • : Xtrozero -

Shocking Number of Voters are Open to Committing Election Fraud

US Political Madness • 2 • : xuenchen -

Candidate TRUMP Now Has Crazy Judge JUAN MERCHAN After Him - The Stormy Daniels Hush-Money Case.

Political Conspiracies • 810 • : Annee

2