It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

8

share:

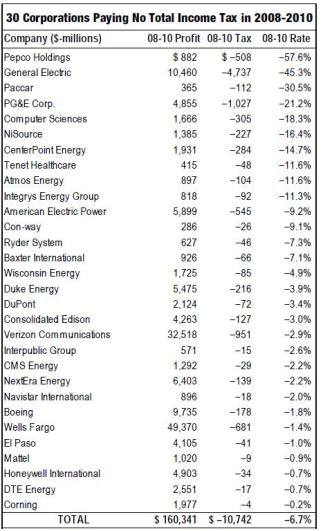

Here is a great example of how our tax code has been hijacked by corporations who rake in billions and don't pay a dime but just defer taxes in to

the future while getting refunds! The joke is on all of us as our small businesses; individuals and others have to fill the hole left after giant

corporations profit while America burns to the ground (financially speaking).

www.ctj.org...

The game is fixed from the top to the bottom and it is all legal!

www.ctj.org...

Earlier today, the U.S. House of Representatives’ Ways and Means Committee held a hearing on “tax reform and the U.S. manufacturing sector.” With no apparent irony, the Committee invited Susan Ford, a senior official from champion corporate tax-avoider Corning, Inc., to testify on how Congress ought to make the U.S. tax code more friendly for manufacturing.

Ford raised eyebrows with her claim that in 2011, Corning paid a U.S. tax rate of 36 percent and a foreign tax rate of 17 percent.

It’s unclear how Ms. Ford comes up with a 36 percent rate, but clearly one thing she’s doing is counting Corning’s “deferred” U.S. taxes (taxes not yet paid) as well as “current” taxes (U.S. taxes actually paid in 2011). Of course, those “deferred” taxes may eventually be paid. If and when they are paid, they will be included in Corning’s “current” taxes in the year(s) they are paid.

But current taxes are what Corning actually pays each year, and Corning has amassed an impressive record of paying nothing, or less than nothing, in current U.S. taxes. CTJ and ITEP’s November 2011 corporate tax avoidance report found that between 2008 and 2010, Corning didn’t pay a dime in federal corporate income taxes, actually receiving a $4 million refund to add to its $1.9 billion in U.S. profits during this period. And a more recent CTJ report found that in 2011, Corning earned almost $1 billion in U.S. pretax income, and once again didn’t pay a dime in federal income tax. These data paint a dramatically different picture from the “36 percent” claim made by Corning before Congress today.

The game is fixed from the top to the bottom and it is all legal!

But mention how the illegals scam the IRS and you'll have people with pitch forks and torches level of anger.

When the real evil is these huge corporations paying zero while sending jobs out of the US.

When the real evil is these huge corporations paying zero while sending jobs out of the US.

Lets call it what it is. They paid the mafia bosses protection money. Sorry this post isn't longer but.......That's all I got to say about that.

Let’s remember that Corning also spent $2.8 million on lobbying during the 2008-10 period they spent enjoying a tax-free ride from the federal government. There are companies across the country paying their fair share in taxes and still making enough to grow their business and please their shareholders. Those are the kinds of companies Congress should be hearing from.

edit on 21-7-2012 by GD21D because: (no reason

given)

new topics

-

Putin, Russia and the Great Architects of the Universe

ATS Skunk Works: 1 hours ago -

A Warning to America: 25 Ways the US is Being Destroyed

New World Order: 5 hours ago -

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies: 11 hours ago

top topics

-

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies: 11 hours ago, 28 flags -

A Warning to America: 25 Ways the US is Being Destroyed

New World Order: 5 hours ago, 10 flags -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues: 17 hours ago, 8 flags -

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs: 16 hours ago, 7 flags -

2024 Pigeon Forge Rod Run - On the Strip (Video made for you)

Automotive Discussion: 17 hours ago, 4 flags -

Is AI Better Than the Hollywood Elite?

Movies: 13 hours ago, 3 flags -

Maestro Benedetto

Literature: 12 hours ago, 1 flags -

Putin, Russia and the Great Architects of the Universe

ATS Skunk Works: 1 hours ago, 1 flags

8