It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

Originally posted by sirhumperdink

i really dont see how this is incentive to invest please explain "flyersfan"

It's very simple. Economics 101. Both REAL democrats (not today's socialists, but the JFK democrats of yesteryear) and republicans know that if you give tax breaks to companies or to individuals when they invest, then they will create jobs and wealth that flows through the economy. Their 'reward' is a 15% tax on investment income rather than the higher income tax that is paid on wages.

....man i feel dirty just responding

So ... go take a shower with lots of soap and come back and read and learn.

Originally posted by dn4cer2000

Yeah, they also hold 90% of the wealth. So yeah, they should pay 90% of taxes.

BINGO! thank you .. you just proved my earlier post.

This guy wants exactly what I just said ...

Someone makes $150 so tax them $100 and leave them $50.

Someone makes $75 so tax them $25 and leave them $50.

SLAVERY TO THE STATE. No one will bother trying to earn money that will only be taken away.

I suggest you go read Atlas Shrugged ...

Another cruel reality is that the hyper rich like to hide their money from the tax man, which increases the disparity and the tax burden.

Read that last paragraph again:

Corporate taxes paid for more than a quarter of federal outlays in the 1950s and a fifth in the 1960s. They began to decline during the Nixon administration, yet even by the second half of the 1990s, corporate taxes still covered 11 percent of the cost of federal programs. But in fiscal years 2002 and 2003, corporate taxes paid for a mere 6% of federal expenses.

Ostensibly, the U.S. federal tax code requires corporations to pay 35% of their profits in income taxes.

But of the 275 Fortune 500 companies that made a profit each year from 2001 to 2003 and for which adequate information to draw conclusions is publicly available, only a small proportion paid federal income taxes anywhere near that statutory 35 percent tax rate. The vast majority paid considerably less.

In fact, in 2002 and 2003, the average effective tax rate for all of these 275 companies was less than half the statutory 35% rate. Over the 2001-2003 period, effective tax rates ranged from a low of -59.6% for Pepco Holdings to a high of 34.5 percent for CVS.

Over the three-year period, the average effective rate for all 275 companies dropped by a fifth, from 21.4% in 2001 to 17.2% in 2002-2003.

The statistics are startling:

- Eighty-two of the 275 companies, almost a third of the total, paid zero or less in federal income taxes in at least one year from 2001 to 2003. In the years they paid no income tax, these companies earned $102 billion in pretax U.S. profits. But instead of paying $35.6 billion in income taxes as the statutory 35 percent corporate tax rate seems to require, these companies generated so many excess tax breaks that they received outright tax rebate checks from the U.S. Treasury, totaling $12.6 billion. These companies' "negative tax rates" meant that they made more after taxes than before taxes in those no-tax years.

- Twenty-eight corporations enjoyed negative federal income tax rates over the entire 2001-2003 period. These companies, whose pretax U.S. profits totaled $44.9 billion over the three years, included, among others: Pepco Holdings (-59.6 percent tax rate), Prudential Financial (-46.2 percent), ITT Industries (-22.3 percent), Boeing (-18.8 percent), Unisys (-16.0 percent), Fluor (-9.2 percent) and CSX (-7.5 percent), the company previously headed by current Secretary of the Treasury John Snow.

- In 2003 alone, 46 companies paid zero or less in federal income taxes. These 46 companies told their shareholders they earned U.S. pretax profits in 2003 of $42.6 billion, yet they received tax rebates totaling $5.4 billion. Almost as many companies, 42, paid no tax in 2002, reporting $43.5 billion in pretax profits, yet receiving $4.9 billion in tax rebates. From 2001 to 2003, the number of no-tax companies jumped from 33 to 46, an increase of 40 percent.

- In 2001, the Treasury paid corporations $40 billion in tax refunds, a third more than the 1998-2000 average.

- Then in 2002 and 2003, after the law was changed to expand tax subsidies and make it easier for corporations to carry back excess tax breaks to earlier years, corporate tax refunds skyrocketed to an average of $63 billion a year - more than double the 1998-2000 average.

Corporations are now paying the lowest levels of taxes in the post-World War II era. In fiscal 2002 and 2003, federal corporate incomes taxes dropped to their lowest sustained level as a share of the economy since World War II. Only a single year during the early Reagan administration was lower.

In 1986, President Ronald Reagan fully abandoned his earlier policy of showering tax breaks on corporations. The Tax Reform Act of 1986 closed tens of billions of dollars in corporate loopholes, so that by 1988, the overall effective corporate tax rate for large corporations was up to 26.5 percent. That improvement occurred even though the statutory corporate tax rate was cut from 46 percent to 34 percent as part of the 1986 reforms. In the 1990s, however, many corporations began to find ways around the 1986 reforms, abetted by tax-shelter schemes devised by major accounting firms.

Effective corporate tax rates then plummeted, thanks to Bush administration-backed tax breaks passed in 2002 and 2003, continued corporate offshore tax-sheltering, and the refusal of the Congress and White House to crack down on even the most abusive inherited corporate tax-sheltering activities.

Corporate taxes paid for more than a quarter of federal outlays in the 1950s and a fifth in the 1960s. They began to decline during the Nixon administration, yet even by the second half of the 1990s, corporate taxes still covered 11% of the cost of federal programs. But in fiscal years 2002 and 2003, corporate taxes paid for a mere 6 percent of federal expenses.

Read that last paragraph again:

Corporate taxes paid for more than a quarter of federal outlays in the 1950s and a fifth in the 1960s. They began to decline during the Nixon administration, yet even by the second half of the 1990s, corporate taxes still covered 11 percent of the cost of federal programs. But in fiscal years 2002 and 2003, corporate taxes paid for a mere 6% of federal expenses.

reply to post by FlyersFan

You realise that doesn't actually prove your point? Yes?

In your 150 argument that person would be making something like 0.0000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000 00000000000000000001% of the total income in America and would pay 0.0000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000 00000000000000000001% of the taxes.

That person's effective tax rate would be 0%.

In fact, "statistics from the Internal Revenue Service show that the 400 wealthiest taxpayers pay tax rates of less than 20 percent"

You realise that doesn't actually prove your point? Yes?

In your 150 argument that person would be making something like 0.0000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000 00000000000000000001% of the total income in America and would pay 0.0000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000 00000000000000000001% of the taxes.

That person's effective tax rate would be 0%.

In fact, "statistics from the Internal Revenue Service show that the 400 wealthiest taxpayers pay tax rates of less than 20 percent"

edit on 22-2-2012 by captainnotsoobvious because: (no reason given)

reply to post by FlyersFan

you have failed to describe how this low tax rate is an incentive

you say its an incentive....and what that incentive is supposed to do

but you have not said how this is an incentive

how is this 15% rate going to draw more investors than a 25% rate?

lol at the post below me

seriously i applaud your ability to enrage people

you have failed to describe how this low tax rate is an incentive

you say its an incentive....and what that incentive is supposed to do

but you have not said how this is an incentive

how is this 15% rate going to draw more investors than a 25% rate?

edit on 22-2-2012 by sirhumperdink because: (no reason given)

lol at the post below me

seriously i applaud your ability to enrage people

edit on 22-2-2012 by sirhumperdink because: (no reason given)

edit on

22-2-2012 by sirhumperdink because: (no reason given)

Originally posted by Jiggyfly

Actually, mods, please delete my account. The type of discussion you generate as mods is nothing more than typical echo chamber crap.

Originally posted by Maponos

Bit of a troll OP

Why are you a forum moderator?

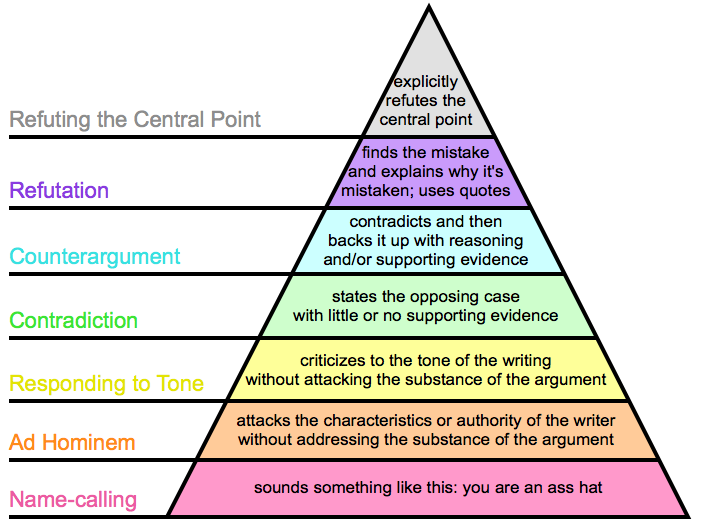

Since more than half of the posts in this thread are personal attacks that have no bearing on the topic whatsoever, I`d like to make you acquainted with this scale that measures whether a poster is on the side of civility, honesty and facts (top of the pyramid) or falsehood and incivility.

While most of our national enemies are rich, most of the rich are not our enemies. Obama wants to further divide (and concur) us for a number of

reasons that have been discussed here hundreds of times. The "rich" paying a higher percentage of income is already in place...and that is more

than fair. Don't fall further into the "they" and "them" mentality. "They" and "them" are the government and TPTB, not each other. Just

watch as gas prices rise so we are "forced" to switch to supporting "green" power that won't work...and isn't really "green" after all.

Its all a game people...and we are the pawns. Make each move you make count, and together...we can still win the game. Start picking off each other, and we are destine to loose.

Its all a game people...and we are the pawns. Make each move you make count, and together...we can still win the game. Start picking off each other, and we are destine to loose.

Originally posted by FlyersFan

Originally posted by OutKast Searcher

Except this example you gave will never happen with the US tax system. So it is dishonest to use examples like this to argue against the system because the example doesn't accurately portray the system.

No. There is nothing 'dishonest' about it. The point is .. this is EXACTLY what people who scream 'MAKE THEM PAY MORE' are trying to do. They want the whole thing flattened out. You say it would 'never happen'. But yes, if the people here got their way that is exactly what would happen.

What exactly are people here screaming for?

I would like to see the top tax brackets increased a little bit and the rest of the brackets decreased a little bit.

In a graduated tax bracket system like we have...your example still will never be able to happen. I have seen no one say they want to tax the "rich" to the point to where they have a net income less than someone who grossed less than they did.

So yes, I do believe it is a dishonest example.

Originally posted by sirhumperdink

how is this 15% rate going to draw more investors than a 25% rate

Are you serious? A 15% tax rate means they pay less of their money out than a 25% tax rate.

THEY KEEP MORE OF THEIR MONEY. It can't be more simple than that.

MONEY is the incentive.

reply to post by FlyersFan

so you would not invest in a company that would make you profits if you had to pay 25% rather than 15%?

please respond

so you would not invest in a company that would make you profits if you had to pay 25% rather than 15%?

please respond

edit on 22-2-2012 by sirhumperdink because: (no reason given)

reply to post by FlyersFan

You are describing "trickle down economics"...but the thing is...it never worked.

Any company that bases their hiring practices on taxes is not a very smart business man. You base hiring soley on profit...like all business decisions should be made. If hiring one more person will increase your profit...you hire someone.

Any increase in profit will give you a net gain after taxes because of the way our tax system is set up.

If you disagree...please give me a real world example where making extra money creates a situation that you net less money after taxes than you would if you didn't make that extra money. You have still not given an example or an explanation how this would happen under our system.

It's very simple. Economics 101. Both REAL democrats (not today's socialists, but the JFK democrats of yesteryear) and republicans know that if you give tax breaks to companies or to individuals when they invest, then they will create jobs and wealth that flows through the economy. Their 'reward' is a 15% tax on investment income rather than the higher income tax that is paid on wages.

You are describing "trickle down economics"...but the thing is...it never worked.

Any company that bases their hiring practices on taxes is not a very smart business man. You base hiring soley on profit...like all business decisions should be made. If hiring one more person will increase your profit...you hire someone.

Any increase in profit will give you a net gain after taxes because of the way our tax system is set up.

If you disagree...please give me a real world example where making extra money creates a situation that you net less money after taxes than you would if you didn't make that extra money. You have still not given an example or an explanation how this would happen under our system.

Originally posted by sirhumperdink

so you would not invest in a company that would make you profits if you had to pay 25% rather than 15%?

Are you really asking that? Do you understand the purpose of investing? It's to MAKE MONEY.

Paying out less money means you make more money. OF COURSE people are more likely to invest

their money if they only lose %15 rather than %25. Seriously .. don't you see that?

The very wealthy, the corporations, should be rewarded with tax breaks every time they bring one of their businesses HOME. If Nike comes home from

Indonesia, give them a tax break. It they leave the manufacturing there, they should have to pay a HUGE penalty.

Same with Apple. Same with all of them. Punitive action for dirty deeds. The suckers are rich ENOUGH.

Same with Apple. Same with all of them. Punitive action for dirty deeds. The suckers are rich ENOUGH.

edit on 2/22/2012 by BellaSabre

because: (no reason given)

reply to post by OutKast Searcher

Exactly, people that own businesses tend to use extra revenue to find ways to make more money (shipping jobs overseas, automating production, etc., etc.). Very few people go, "ahh yes, 10% saved on taxes I'll use that to hire an extra employee or six". It's a myth. One created by and perpetuated by people that want to pay less in taxes. Regardless of the evidence.

Exactly, people that own businesses tend to use extra revenue to find ways to make more money (shipping jobs overseas, automating production, etc., etc.). Very few people go, "ahh yes, 10% saved on taxes I'll use that to hire an extra employee or six". It's a myth. One created by and perpetuated by people that want to pay less in taxes. Regardless of the evidence.

reply to post by FlyersFan

no i dont

please explain why someone would willingly chose to not invest in a company because theyre only going to make $75 instead of $85

please

no i dont

please explain why someone would willingly chose to not invest in a company because theyre only going to make $75 instead of $85

please

reply to post by FlyersFan

Invest, but not in staff.

The fact is you'd refute this with facts if you had any, but trickle down is a long disproven myth.

Invest, but not in staff.

The fact is you'd refute this with facts if you had any, but trickle down is a long disproven myth.

I'll say this again:

Corporate taxes paid for more than a quarter of federal outlays in the 1950s and a fifth in the 1960s.

They began to decline during the Nixon administration, yet even by the second half of the 1990s, corporate taxes still covered 11 percent of the cost of federal programs.

But in fiscal years 2002 and 2003, corporate taxes paid for a mere 6% of federal expenses.

Corporate taxes paid for more than a quarter of federal outlays in the 1950s and a fifth in the 1960s.

They began to decline during the Nixon administration, yet even by the second half of the 1990s, corporate taxes still covered 11 percent of the cost of federal programs.

But in fiscal years 2002 and 2003, corporate taxes paid for a mere 6% of federal expenses.

Originally posted by FlyersFan

Originally posted by sirhumperdink

so you would not invest in a company that would make you profits if you had to pay 25% rather than 15%?

Are you really asking that? Do you understand the purpose of investing? It's to MAKE MONEY.

Paying out less money means you make more money. OF COURSE people are more likely to invest

their money if they only lose %15 rather than %25. Seriously .. don't you see that?

No...I don't see it.

If I invest in a company that is going to make me a profit of 100,000...I'm going to invest in that company no matter if I have to pay 15k in taxes or 25k in taxes.

Would you really just decide NOT to make 75k just because you had to pay 25k in taxes??? But you would say, if I could make 85k and only pay 15k in taxes...you would be all for it?

That doesn't make sense...which is why this whole "people won't try to make more money because they are taxed" argument isn't logical at all.

Originally posted by Skyfloating

I found a chart sourced from the IRS that shows how the top 10% of income earners paid 71% of federal income tax. This is pretty interesting because it would mean that all those calls that the rich should pay more taxes or that they dont pay enough taxes are wrong. The 10%ers seem to be paying plenty of taxes.

Thoughts?

I spent several years as a "7%er", and felt like I was paying an ungodly amount of taxes - however, I always thought about it this way...My first approximately $40k in annual income is money I "need" (for mortgage, vehicle expenses, food, utilities, insurance, double taxations like property tax, etc.) Everything beyond that is "extra" (not that there's ever really "extra")

I realize that where I live, the sales tax rate is around 9%. The average person spends around 100% of their income after their mortgage/rent on things which have sales tax attached to them. The guy making $30k a year pays the same for his morning apple as the guy making $200k a year, effectively paying a higher percentage of his income in sales tax.

Just throwing out random, unresearched numbers to get my "plan" across, it would look something like this:

Income: $0-40,000 = 0 tax

All Income from dollar 40,001 to $999,999 = 15%

All Income from dollar 1,000,000 to $9,999,999 = 25%

All income from dollar 1B+ = 35%

With the general idea to make it so that more people could "get by" comfortably with reasonably-paying jobs without forcing businesses to pay more, reducing everyone's tax rates overall, and implementing structure to close loopholes and ensure those rates are actually paid.

I'm sure my percentages or cutoffs are not correct, but exempting up to a basic "American Standard of Living" from income tax should be the starting point, while encouraging working toward higher incomes without too much of a "Law of Diminishing Returns" should be the rest of the equation.

The "bottom 90%" (aka most of America) may not pay the majority of the federal income tax, but they -by far- pay the highest percentage of their income in excise taxes, sales taxes, property taxes, etc.

Dr. Ron Paul would do away w/ the illegal income tax ( i don't have an income - rather - a symbiotic relationship w/ the co. i work for).

see :

devvy.com...

for the best info on the non ratified 16th and 17th amendments which launched the illegal irs in 1914 just after the unfed was given to the elites.

read:

'the Creature of Jekyll Island' - Griffin

'End the Fed' - Dr. Ron Paul

the so-called income tax is a way of placing all U.S. 'citizens' in debt and using the debt returns for their own enslaving agenda.

the unfed owners believe in debt (taxes) and death (the war machine).

the "rich" paying "taxes" really means nothing to the continued well being of the constitution and the U.S.

just the perpetuation of the illusion that most folks accept as reality visavis the thug organization known as the irs.

see:

livefreenow.org...

and

www.thelawthatneverwas.com...

see :

devvy.com...

for the best info on the non ratified 16th and 17th amendments which launched the illegal irs in 1914 just after the unfed was given to the elites.

read:

'the Creature of Jekyll Island' - Griffin

'End the Fed' - Dr. Ron Paul

the so-called income tax is a way of placing all U.S. 'citizens' in debt and using the debt returns for their own enslaving agenda.

the unfed owners believe in debt (taxes) and death (the war machine).

the "rich" paying "taxes" really means nothing to the continued well being of the constitution and the U.S.

just the perpetuation of the illusion that most folks accept as reality visavis the thug organization known as the irs.

see:

livefreenow.org...

and

www.thelawthatneverwas.com...

edit on 22-2-2012 by jibajaba because: (no reason given)

new topics

-

A Warning to America: 25 Ways the US is Being Destroyed

New World Order: 2 hours ago -

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies: 8 hours ago -

Maestro Benedetto

Literature: 10 hours ago -

Is AI Better Than the Hollywood Elite?

Movies: 10 hours ago

top topics

-

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies: 8 hours ago, 28 flags -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues: 15 hours ago, 8 flags -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest: 17 hours ago, 7 flags -

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs: 13 hours ago, 6 flags -

A Warning to America: 25 Ways the US is Being Destroyed

New World Order: 2 hours ago, 6 flags -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News: 16 hours ago, 5 flags -

2024 Pigeon Forge Rod Run - On the Strip (Video made for you)

Automotive Discussion: 14 hours ago, 4 flags -

Is AI Better Than the Hollywood Elite?

Movies: 10 hours ago, 3 flags -

The functionality of boldening and italics is clunky and no post char limit warning?

ATS Freshman's Forum: 16 hours ago, 1 flags -

Maestro Benedetto

Literature: 10 hours ago, 1 flags

active topics

-

A Warning to America: 25 Ways the US is Being Destroyed

New World Order • 2 • : Disgusted123 -

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies • 19 • : ADVISOR -

When an Angel gets his or her wings

Religion, Faith, And Theology • 22 • : AcrobaticDreams1 -

King Charles 111 Diagnosed with Cancer

Mainstream News • 321 • : FlyersFan -

Is there a hole at the North Pole?

ATS Skunk Works • 41 • : burritocat -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest • 16 • : FlyersFan -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues • 33 • : FlyersFan -

Weinstein's conviction overturned

Mainstream News • 24 • : burritocat -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 690 • : burritocat -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media • 266 • : SchrodingersRat