It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

a reply to: AugustusMasonicus

There's a historical rationale behind that "mooch" status. Reconstruction was a slow rolling train wreck, still in effect but designed to maintain northern marketplace advantages 150 years later.

There's a historical rationale behind that "mooch" status. Reconstruction was a slow rolling train wreck, still in effect but designed to maintain northern marketplace advantages 150 years later.

a reply to: burdman30ott6

There are plenty of mooching northern states too, it's not a south only predilection, nor is it a red state/blue state one either.

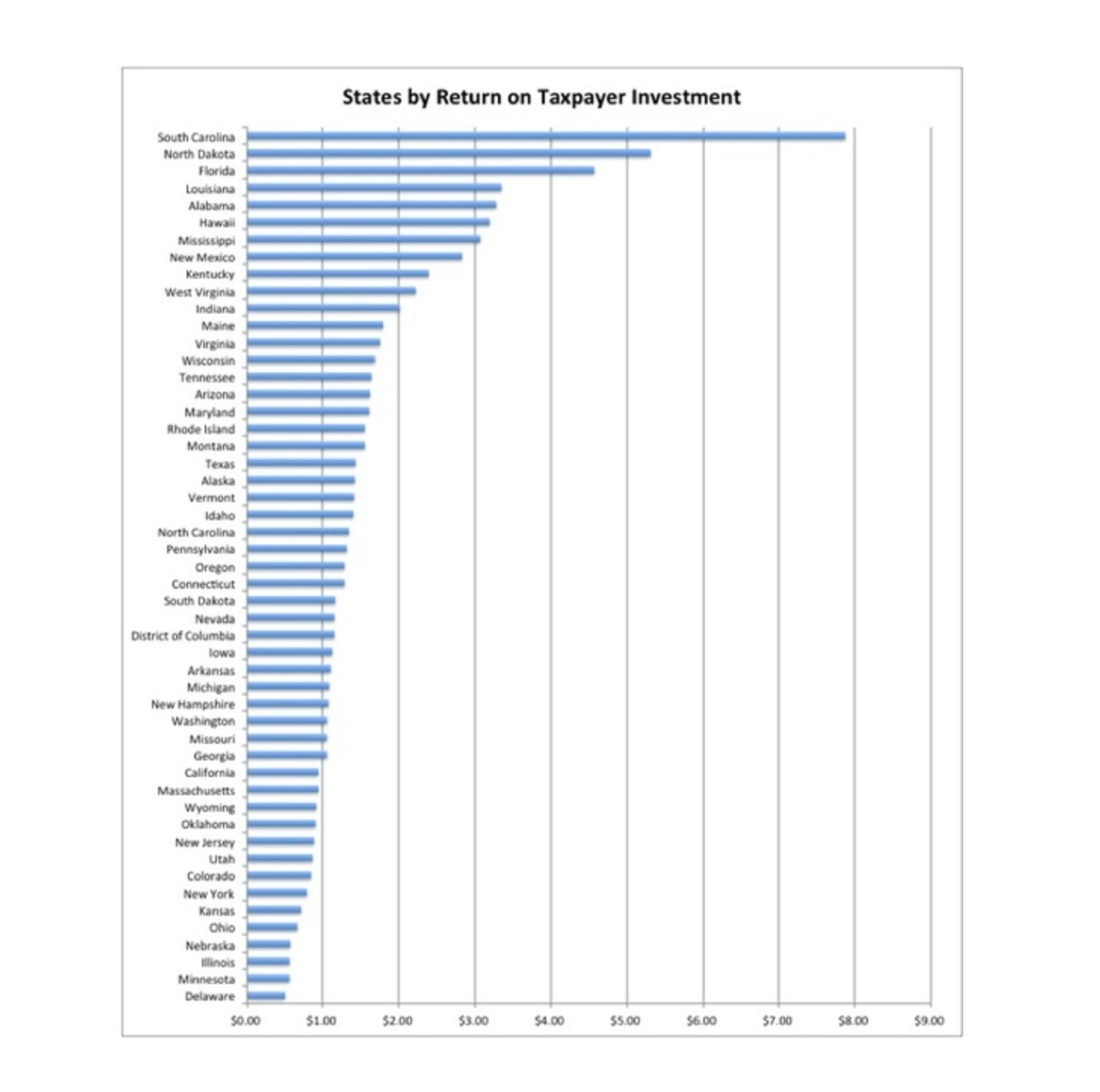

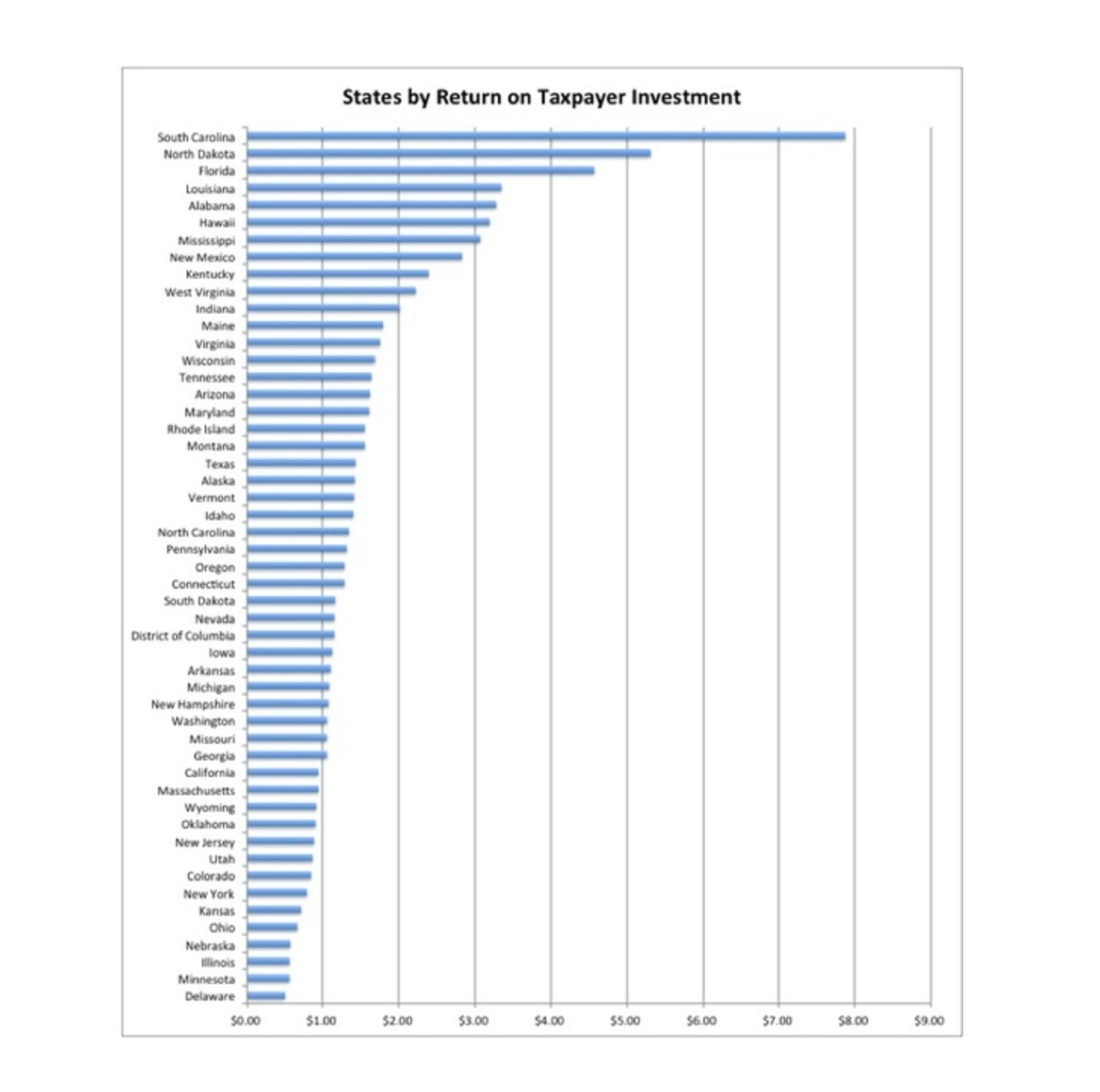

Here's data I used for another thread:

There are plenty of mooching northern states too, it's not a south only predilection, nor is it a red state/blue state one either.

Here's data I used for another thread:

a reply to: Edumakated

Exactly . The flat tax with NO deductions is the fairest way to go. The deductions are just loopholes.

If everyone including the politicians and the .0001% had to pay the same or near same income to tax percentage without deductions or loopholes rampant govt wasteful spending would decrease along with taxes .

If Bezos paid 10% in his yearly income with no deductions he would quickly want to drop the tax to 1% and decrease govt and it's spending.

Exactly . The flat tax with NO deductions is the fairest way to go. The deductions are just loopholes.

If everyone including the politicians and the .0001% had to pay the same or near same income to tax percentage without deductions or loopholes rampant govt wasteful spending would decrease along with taxes .

If Bezos paid 10% in his yearly income with no deductions he would quickly want to drop the tax to 1% and decrease govt and it's spending.

edit

on 051130America/ChicagoMon, 11 Nov 2019 19:05:38 -0600000000p3042 by interupt42 because: (no reason given)

a reply to: Edumakated

If your making 50 million a year that doesnt hurt at all. I have ZERO sympathy for the ultra wealthy whining about taxes.

If your making 50 million a year that doesnt hurt at all. I have ZERO sympathy for the ultra wealthy whining about taxes.

originally posted by: Edumakated

a reply to: interupt42

Honestly, I think the average person really is just bad at connecting dots.

I live in an uber liberal town and people are always complaining about property taxes. Yet, these same people can't seem to realize they vote for this sh*t. There isn't a teachers union demand or some other liberal boondoggle these folks won't support.

The problem is they always think someone else is paying for it....

It was amazing to me to have seen all the people walking around with butthurt expressions last January - March after they calculated how the SALT changes were going to affect them in our liberal new york metro town.

Prior to tax time most of these same people told me on more than one occasion that they believed that the "rich should be made to pay their fair share" ... not being overly idealical myself I'd always nod politely while thinking that these people would be upset if they actually got what they were asking for.

They certainly didn't like it when I politely pointed out to them how they were the "rich being made to pay their fair share" once those SALT changes took affect.

a reply to: AugustusMasonicus

If you do let me know and we'll get beers.

network dude is close by, we can make it a party.

And if we do move it will be to Nashville, North or South Carolina so I can get my mooch on for once.

If you do let me know and we'll get beers.

network dude is close by, we can make it a party.

originally posted by: CriticalStinker

If you do let me know and we'll get beers.

network dude is close by, we can make it a party.

My mooching will extend to this as well.

Tennessee has been on my considering list for awhile now.

I always said that Herman Cain’s Nine-Nine-Nine plan was a horrible typo that should have been none-none-none to wake some people up. You see, the Constitution and that Amendment was very clear that Congress has the power to lay and collect taxes. There is not jack said about having the ability to create legislation to enforce it. So the IRS and all the employers placed into indentured servitude as tax collectors...absolutely unconstitutional and therefore illegal.

That said, other than making out tax bills for all their voters (good luck with re-election), Congress has only the choice of taking whatever new tax scheme and running with it 100%. That is how you do a flat rate sale tax. Say 30% with 10% to the state that collects it and 20% to the Federal with xx% of that redistributed back to the states as federal funding (roads, food stamps, healthcare, etc.)

Fair, balanced, everyone wins. There can even be a program that pays low income thresholds a certain amount to offset the sales tax. Say $500/month or so.

I always said that Herman Cain’s Nine-Nine-Nine plan was a horrible typo that should have been none-none-none to wake some people up. You see, the Constitution and that Amendment was very clear that Congress has the power to lay and collect taxes. There is not jack said about having the ability to create legislation to enforce it. So the IRS and all the employers placed into indentured servitude as tax collectors...absolutely unconstitutional and therefore illegal.

That said, other than making out tax bills for all their voters (good luck with re-election), Congress has only the choice of taking whatever new tax scheme and running with it 100%. That is how you do a flat rate sale tax. Say 30% with 10% to the state that collects it and 20% to the Federal with xx% of that redistributed back to the states as federal funding (roads, food stamps, healthcare, etc.)

Fair, balanced, everyone wins. There can even be a program that pays low income thresholds a certain amount to offset the sales tax. Say $500/month or so.

a reply to: AugustusMasonicus

Oh sure move to SC where if you actually need disability you cant get it for the jerks who get it and drive escalades and get 5 k in foodstamps a month. lol.

Oh sure move to SC where if you actually need disability you cant get it for the jerks who get it and drive escalades and get 5 k in foodstamps a month. lol.

originally posted by: AugustusMasonicus

originally posted by: CriticalStinker

If you do let me know and we'll get beers.

network dude is close by, we can make it a party.

My mooching will extend to this as well.

I'll be a net contributor to the beer fund.

originally posted by: AugustusMasonicus

a reply to: Edumakated

Just a minor point of contention, where I live, in New Jersey, we were a net contributor to the Treasury prior to the SALT tax rules passing meaning we put more into the Treasury then we took out. Now it's even higher.

Yes , and South New Jersey Still wants to Become the 51'st State and Finally End this Madness !

originally posted by: CriticalStinker

originally posted by: AugustusMasonicus

originally posted by: CriticalStinker

If you do let me know and we'll get beers.

network dude is close by, we can make it a party.

My mooching will extend to this as well.

I'll be a net contributor to the beer fund.

Does that extend to majority consumer.

originally posted by: VictorVonDoom

a reply to: dfnj2015

The real reason we won't get a flat tax has nothing to do with fairness.

The current system of progressive taxes, deductions, and penalties gives the government powerful tools for behavior modification and social engineering. Desirable actions are rewarded with tax deductions, undesirable behavior is punished with higher taxes. Sin taxes and Obamacare are two examples.

Not to mention all the people who make a living navigating the tax code.

I was just thinking how you could use the system to invest the money in your home by way of a home business and write it off on your taxes.

Yea, I could get creative with a business that writes off home repairs and improvements, new furniture and appliances, a company vehicle, basically whatever I wanted to invest in on my own, then right off the expenses. If I keep the books right, I'll never make enough to get taxed more then I write off.

Then after thinking more deeply about the idea I realized that every tax advantage was actually a way for the government to manipulate how my money got spent. In the process of using the tax codes to my supposed advantage, I'll be like a trained monkey jumping though hoops to keep my money that the government still has control over. Either give the government a tax tribute for them to use as they please or they make you use your money the way they want you to use it.

originally posted by: yuppa

Oh sure move to SC where if you actually need disability you cant get it for the jerks who get it and drive escalades and get 5 k in foodstamps a month. lol.

Yup, South Carolina, the Welfare Queen of the Republic at nearly $8 taken for every $1 put in, is high on the list. I want to see what it's like to live the mooch life like a baller.

originally posted by: Ahabstar

I always said that Herman Cain’s Nine-Nine-Nine plan was a horrible typo that should have been none-none-none to wake some people up.

I would have went with Nein-Nein-Nein to really get attention and hit both angles at the same time.

originally posted by: AugustusMasonicus

a reply to: yuppa

I'm not, I'm Mediterranean, so I'm gonna be living off the backs of the working stiffs from other states. Give me my moochie bucks South Carolina, I earned them when I lived in New Jersey.

i wish you luck then.

a reply to: Edumakated

I get the logic that the rich wil move if taxes are too high but i have zero sympathy for the ultra rich. They all too often hide their money and use loopholes to get around corporate taxes.

I get the logic that the rich wil move if taxes are too high but i have zero sympathy for the ultra rich. They all too often hide their money and use loopholes to get around corporate taxes.

new topics

-

A Warning to America: 25 Ways the US is Being Destroyed

New World Order: 3 hours ago -

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies: 9 hours ago -

Maestro Benedetto

Literature: 10 hours ago -

Is AI Better Than the Hollywood Elite?

Movies: 10 hours ago

top topics

-

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies: 9 hours ago, 28 flags -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues: 15 hours ago, 8 flags -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest: 17 hours ago, 7 flags -

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs: 14 hours ago, 6 flags -

A Warning to America: 25 Ways the US is Being Destroyed

New World Order: 3 hours ago, 6 flags -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News: 17 hours ago, 5 flags -

2024 Pigeon Forge Rod Run - On the Strip (Video made for you)

Automotive Discussion: 15 hours ago, 4 flags -

Is AI Better Than the Hollywood Elite?

Movies: 10 hours ago, 3 flags -

The functionality of boldening and italics is clunky and no post char limit warning?

ATS Freshman's Forum: 16 hours ago, 1 flags -

Maestro Benedetto

Literature: 10 hours ago, 1 flags

active topics

-

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 691 • : Imbackbaby -

Alternate Electors vs Fake Electors - What is the Difference.

2024 Elections • 116 • : Threadbarer -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues • 34 • : AllisVibration -

Victoria government has cancelled the commmonwealth games, no money.

Regional Politics • 3 • : nazaretalazareta -

A Warning to America: 25 Ways the US is Being Destroyed

New World Order • 2 • : Disgusted123 -

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies • 19 • : ADVISOR -

When an Angel gets his or her wings

Religion, Faith, And Theology • 22 • : AcrobaticDreams1 -

King Charles 111 Diagnosed with Cancer

Mainstream News • 321 • : FlyersFan -

Is there a hole at the North Pole?

ATS Skunk Works • 41 • : burritocat -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest • 16 • : FlyersFan