It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

a reply to: BeefNoMeat

Only short term T-Bills have a higher interest rate, meaning that the market for the purchasing of short term T-Bills is saturated, and further incentive is needed for their purchase.

Long Term T-Bills have a low interest rate, meaning that there is a high demand for them, and no further incentive is needed.

It follows that long term, there is no real need for alarm as to the state of the bond market, however there is some short term worry.

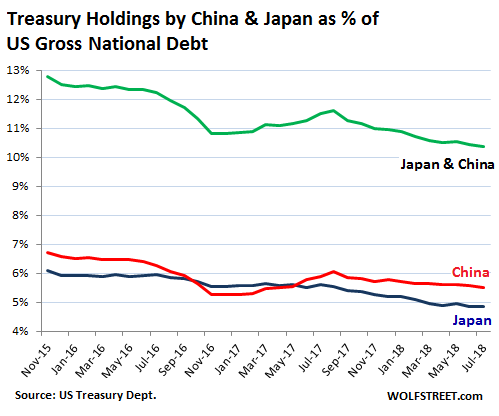

wolfstreet.com...

and

ticdata.treasury.gov...

From this data it can be assumed that US entities and citizens purchased about $1.66 Trillion in bond in the last year alone, becoming the largest holder at about 33%.

Only short term T-Bills have a higher interest rate, meaning that the market for the purchasing of short term T-Bills is saturated, and further incentive is needed for their purchase.

Long Term T-Bills have a low interest rate, meaning that there is a high demand for them, and no further incentive is needed.

It follows that long term, there is no real need for alarm as to the state of the bond market, however there is some short term worry.

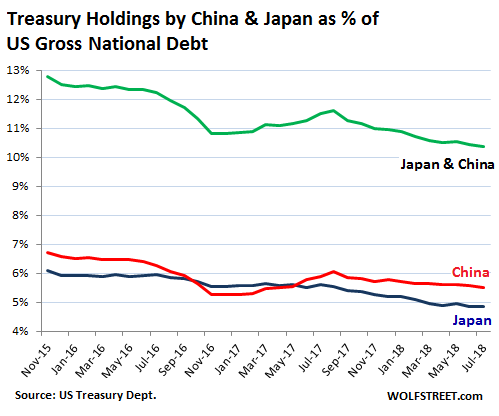

wolfstreet.com...

and

ticdata.treasury.gov...

From this data it can be assumed that US entities and citizens purchased about $1.66 Trillion in bond in the last year alone, becoming the largest holder at about 33%.

edit on 8-1-2019 by dubiousatworst because: fixed info

a reply to: toysforadults

Apple, and Samsung, have released new phones every year for a decade. 5 years ago, new phones were getting better and better. There were new exciting features every year, to justify the upgrade. I have the Galaxy 8, and will not upgrade anytime soon. There are no longer new features on the new phones, that my Galaxy 8, can not do. So why upgrade? The market is saturated.

Anyone, who has Galaxy 7, or iPhone 7, or newer, have 0 reason, to spend $1000 for a phone, that is far less than a massive upgrade, like there was years ago. Maybe in 3 years, I will upgrade.

Apple, and Samsung, have released new phones every year for a decade. 5 years ago, new phones were getting better and better. There were new exciting features every year, to justify the upgrade. I have the Galaxy 8, and will not upgrade anytime soon. There are no longer new features on the new phones, that my Galaxy 8, can not do. So why upgrade? The market is saturated.

Anyone, who has Galaxy 7, or iPhone 7, or newer, have 0 reason, to spend $1000 for a phone, that is far less than a massive upgrade, like there was years ago. Maybe in 3 years, I will upgrade.

samsung started making junk but keep charging the same if they dont stop making junk there sales will go down alot more

a reply to: toysforadults

it is bad news for day traders and stock markets, yes. The rest of the economy? not really.

it is bad news for day traders and stock markets, yes. The rest of the economy? not really.

originally posted by: toysforadults

An inverted yield curve is bad news

Quoted for truth.

@dubiousatworst: appreciate the info graphic. The rest of your reply w.r.t. incentives and bond market ‘saturation’, well, you keep doing you. Maybe you can sprinkle in a, “it stands to reason” into your dubious, at best, investment vernacular — “it follows” is saturated.

a reply to: BeefNoMeat

See that is exactly what I am talking about. You are misunderstanding the entirety of what I was posting about. I'm NOT giving or even talking about investing, im looking at the economic picture as a whole. People latch onto how stock markets are doing or an index fund is doing and assume it is actually a good marker for the way the entire market is doing. Which is exactly what my first post was about. This is NOT about your 401k or managing "investments" (which they are not actually, but that is semantics), but about economic health.

See that is exactly what I am talking about. You are misunderstanding the entirety of what I was posting about. I'm NOT giving or even talking about investing, im looking at the economic picture as a whole. People latch onto how stock markets are doing or an index fund is doing and assume it is actually a good marker for the way the entire market is doing. Which is exactly what my first post was about. This is NOT about your 401k or managing "investments" (which they are not actually, but that is semantics), but about economic health.

a reply to: dubiousatworst

the health of the economy isn't that great that's the entire point

the massive amounts of debt from government and consumer's is the main indicator you are ignoring

it's all bad and someone has to pay it all back

the health of the economy isn't that great that's the entire point

the massive amounts of debt from government and consumer's is the main indicator you are ignoring

it's all bad and someone has to pay it all back

a reply to: toysforadults

Industrial production is up, year over year in almost every category.

www.federalreserve.gov...

unemployment is down and better than prior to the default swaps disaster

www.bls.gov...#

wages and consumer spending are up

www.bea.gov...

home construction is down (this is a negative) but only for larger permits

www.census.gov...

shipments and orders are up in every category in manufacturing, except for computers

www.census.gov...

retail and sales are up

www.census.gov...

imports are slowing, while exports are hastening. While growth is continuing, albeit at a slightly slower pace.

www.instituteforsupplymanagement.org...

So that looks to me like it is pretty good outside of computers doing poorly.

Industrial production is up, year over year in almost every category.

www.federalreserve.gov...

unemployment is down and better than prior to the default swaps disaster

www.bls.gov...#

wages and consumer spending are up

www.bea.gov...

home construction is down (this is a negative) but only for larger permits

www.census.gov...

shipments and orders are up in every category in manufacturing, except for computers

www.census.gov...

retail and sales are up

www.census.gov...

imports are slowing, while exports are hastening. While growth is continuing, albeit at a slightly slower pace.

www.instituteforsupplymanagement.org...

So that looks to me like it is pretty good outside of computers doing poorly.

a reply to: dubiousatworst

now, put in a little extra effort and correlate the data to the rise in corporate and consumer debt. also, show the ratio of inflation to wage growth over a period of time

now, put in a little extra effort and correlate the data to the rise in corporate and consumer debt. also, show the ratio of inflation to wage growth over a period of time

a reply to: toysforadults

This is a good (albeit long) article on the debt, and debt serviceability. If a global shock were to come due to corporate debt, it will come from China, not the US.

www.pimco.com...

The ratio of inflation to wage growth has been horrible since the late 60s/ early 70s due to a couple issues including an overabundance of cheap labor. Wage growth has been around 2-3% as of the last 2 quarters which slightly outstrips inflation rates (1.9%) by ~1%, where as in the past, right before the Great Recession we were seeing 4-5% wage growth and interest rates that matched.

www.thebalance.com...

www.frbatlanta.org...

This is a good (albeit long) article on the debt, and debt serviceability. If a global shock were to come due to corporate debt, it will come from China, not the US.

www.pimco.com...

The ratio of inflation to wage growth has been horrible since the late 60s/ early 70s due to a couple issues including an overabundance of cheap labor. Wage growth has been around 2-3% as of the last 2 quarters which slightly outstrips inflation rates (1.9%) by ~1%, where as in the past, right before the Great Recession we were seeing 4-5% wage growth and interest rates that matched.

www.thebalance.com...

www.frbatlanta.org...

new topics

-

BIDEN Admin Begins Planning For January 2025 Transition to a New President - Today is 4.26.2024.

2024 Elections: 1 hours ago -

Big Storms

Fragile Earth: 2 hours ago -

Where should Trump hold his next rally

2024 Elections: 5 hours ago -

Shocking Number of Voters are Open to Committing Election Fraud

US Political Madness: 6 hours ago -

Gov Kristi Noem Shot and Killed "Less Than Worthless Dog" and a 'Smelly Goat

2024 Elections: 6 hours ago -

Falkville Robot-Man

Aliens and UFOs: 7 hours ago -

James O’Keefe: I have evidence that exposes the CIA, and it’s on camera.

Whistle Blowers and Leaked Documents: 7 hours ago -

Australian PM says the quiet part out loud - "free speech is a threat to democratic dicourse"...?!

New World Order: 8 hours ago -

Ireland VS Globalists

Social Issues and Civil Unrest: 9 hours ago -

Biden "Happy To Debate Trump"

2024 Elections: 9 hours ago

top topics

-

James O’Keefe: I have evidence that exposes the CIA, and it’s on camera.

Whistle Blowers and Leaked Documents: 7 hours ago, 14 flags -

Australian PM says the quiet part out loud - "free speech is a threat to democratic dicourse"...?!

New World Order: 8 hours ago, 13 flags -

Blast from the past: ATS Review Podcast, 2006: With All Three Amigos

Member PODcasts: 11 hours ago, 13 flags -

Biden "Happy To Debate Trump"

2024 Elections: 9 hours ago, 12 flags -

Mike Pinder The Moody Blues R.I.P.

Music: 12 hours ago, 8 flags -

What is the white pill?

Philosophy and Metaphysics: 11 hours ago, 6 flags -

Shocking Number of Voters are Open to Committing Election Fraud

US Political Madness: 6 hours ago, 6 flags -

RAAF airbase in Roswell, New Mexico is on fire

Aliens and UFOs: 9 hours ago, 5 flags -

Ireland VS Globalists

Social Issues and Civil Unrest: 9 hours ago, 5 flags -

Where should Trump hold his next rally

2024 Elections: 5 hours ago, 5 flags

active topics

-

Where should Trump hold his next rally

2024 Elections • 19 • : theatreboy -

Gov Kristi Noem Shot and Killed "Less Than Worthless Dog" and a 'Smelly Goat

2024 Elections • 41 • : 5thHead -

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies • 38 • : SchrodingersRat -

Big Storms

Fragile Earth • 11 • : GENERAL EYES -

BIDEN Admin Begins Planning For January 2025 Transition to a New President - Today is 4.26.2024.

2024 Elections • 7 • : WannabeeAuCourant -

Joe Biden and Donald Trump are both traitors

2024 Elections • 65 • : MrMez -

Mood Music Part VI

Music • 3112 • : underpass61 -

James O’Keefe: I have evidence that exposes the CIA, and it’s on camera.

Whistle Blowers and Leaked Documents • 12 • : pianopraze -

Australian PM says the quiet part out loud - "free speech is a threat to democratic dicourse"...?!

New World Order • 6 • : Scratchpost -

"We're All Hamas" Heard at Columbia University Protests

Social Issues and Civil Unrest • 297 • : TheWoker