It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

5

share:

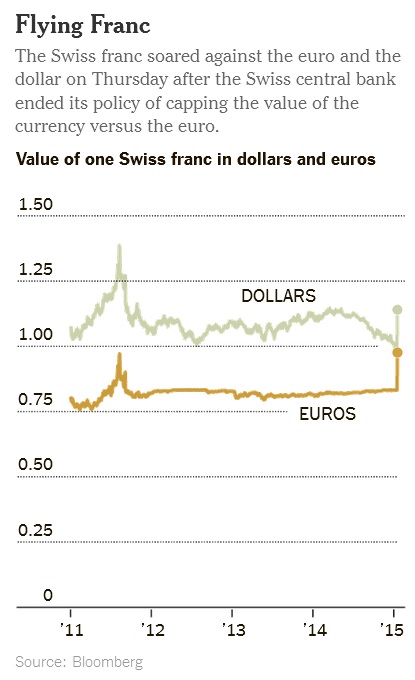

The Swiss central bank stunned global markets on Thursday by abandoning a crucial part of its three-year effort to hold down the value of its national currency against the ever-weakening euro.

The country had been trying to cap the value of its currency, the franc, as nervous investors fled the market tumult and sought the relative safety of Switzerland. But in the face of a steep decline in the euro, the plan proved too risky and too costly to continue.

The abrupt move sent the value of the Swiss franc soaring, as the country’s stocks broadly plummeted. Exporters, in particular, got slammed, over fears that the rising currency would weigh on profit.

Surprise Move by Swiss Central Bank Underscores Global Uncertainty

“We can only guess at what was in their minds,” Carl Weinberg, chief global economist at High Frequency Economics, said of the Swiss central bank’s move. “Maybe they are afraid that the euro is coming on some hard times, and they didn’t want to be tied to a sinking ship.”

The Swiss made all they could to keep the euro lower than 1.20 francs since 2011, meaning they buy you all the Euros you wanted to sell, a month ago they said they would still maintain the policy, but as Euro keep falling and Swiss fear European central bank will start printing money soon they ditch their effort and removed the cap of 1.20, fearing they will be flooded by euros, that, if the European union fails, would be worthless. so to protect themselves of an euro collapse they risk deflation.

Having a very strong currency means their exports are prohibit to other countries, and as the franc raised 15% vs Euro and $, their bonds and companies stock collapsed today (Nestle is down 6%, Swatch 16%).

If Switzerland is ready to give themselves a blow to ditch the euro, it seems to me they see an imminent collapse of the euro zone, after all they made their move 3 days before Greece elections.

Time to get some gold?

edit on 15-1-2015 by Indigent because: (no reason given)

edit on 15-1-2015 by Indigent because: (no

reason given)

I bought a ton of swiss francs last week, simply cause I think there notes look cool lol. HAPPY DAYS. Couple of nights out on the piss paid for

anyway lol. Crazy money wizzards.

The Euro was a real no goer from the start, so to blame the Swiss for this is a bit rich really. Are they not merely protecting their own interests?

How can you have a single currency when there are countries whose economies are strong due to manufacturing and exporting, whilst other countries economies are solely reliant on Tourism.

Sure, it's great for the tourists, no trips to the cambio de change to worry about, but the standard of living for the citizens living in the countries reliant on tourism have been sacrificed.

How can you have a single currency when there are countries whose economies are strong due to manufacturing and exporting, whilst other countries economies are solely reliant on Tourism.

Sure, it's great for the tourists, no trips to the cambio de change to worry about, but the standard of living for the citizens living in the countries reliant on tourism have been sacrificed.

edit on 15/1/15 by Cobaltic1978 because: (no reason given)

The timing of this Swiss move just before the Greek election is telling. I believe they wanted to cut off the flow of Euro before the Greek decision

as they could have been swamped with Euro in hours if Greece moves to the far right.

I've seen predictions of the Euro reaching parity with the US $....so there is still room to fall it seems.

I've seen predictions of the Euro reaching parity with the US $....so there is still room to fall it seems.

Man....the euro going back to where it came from is cool.....then it will go back up so no worries......play the pound yen....instead.....

This Swiss Franc correction is truly unprecedented.

Abrupt move of 30% in 10 minutes just showing how leveraged is all Forex Ponzi trades.

Funny reading for all Forex speculators www.excelmarkets.com...

Also answering all those "trash Euro" comments. It is not so important if Euro will trade on parity with US dollar or even below dollar.

The big question what will happen if China decides to do something similar to what Swiss Central Bank have done now.

What will be Yuan/Dollar/Euro rates if China decides to unpeg Yuan ? Swiss economy is relatively small and besides being historically "safe haven" is not that important tbh.

Abrupt move of 30% in 10 minutes just showing how leveraged is all Forex Ponzi trades.

Funny reading for all Forex speculators www.excelmarkets.com...

As Directors and Shareholders we would like to offer our sincerest apologies for this devastating turn of events, and to thank you for being such a supportive group.

edit on 16-1-2015 by kitzik because: (no reason given)

Also answering all those "trash Euro" comments. It is not so important if Euro will trade on parity with US dollar or even below dollar.

The big question what will happen if China decides to do something similar to what Swiss Central Bank have done now.

What will be Yuan/Dollar/Euro rates if China decides to unpeg Yuan ? Swiss economy is relatively small and besides being historically "safe haven" is not that important tbh.

edit on 16-1-2015 by kitzik because: (no reason given)

the Swiss were protecting themselves & their Franc from the Peg to the Euro

they avoided losing billions more... when a southern nation removes itself from the EU, and when the Northern Euro gets born in competition to the defunct €...

I like how the Swiss did not first inform the IMF nor the BIS of their gambit to de-peg from the €uro

CYA is running free

they avoided losing billions more... when a southern nation removes itself from the EU, and when the Northern Euro gets born in competition to the defunct €...

I like how the Swiss did not first inform the IMF nor the BIS of their gambit to de-peg from the €uro

CYA is running free

a reply to: St Udio

There would be NEWS that Swiss Central Bank informed IMF and those news would make similar impact on Forex markets like the news we had

If this info would be leaked semi officially this would made more inside traders aware of upcoming decision. IMHO, Switzerland did informed IMF, those are almost the same banker elites that running all fiat currencies Ponzi shows.

What was interesting is to see how overstretched are small speculators playing on high margins and quickly going in red. It is also interesting to note how detached are Central Banks moves from normal common sense raising negative interest rates from -0.25% to -0.75%

I like how the Swiss did not first inform the IMF nor the BIS of their gambit to de-peg from the €uro

There would be NEWS that Swiss Central Bank informed IMF and those news would make similar impact on Forex markets like the news we had

If this info would be leaked semi officially this would made more inside traders aware of upcoming decision. IMHO, Switzerland did informed IMF, those are almost the same banker elites that running all fiat currencies Ponzi shows.

What was interesting is to see how overstretched are small speculators playing on high margins and quickly going in red. It is also interesting to note how detached are Central Banks moves from normal common sense raising negative interest rates from -0.25% to -0.75%

edit on 16-1-2015

by kitzik because: (no reason given)

new topics

-

Where should Trump hold his next rally

2024 Elections: 2 hours ago -

Shocking Number of Voters are Open to Committing Election Fraud

US Political Madness: 2 hours ago -

Gov Kristi Noem Shot and Killed "Less Than Worthless Dog" and a 'Smelly Goat

2024 Elections: 3 hours ago -

Falkville Robot-Man

Aliens and UFOs: 3 hours ago -

James O’Keefe: I have evidence that exposes the CIA, and it’s on camera.

Whistle Blowers and Leaked Documents: 4 hours ago -

Australian PM says the quiet part out loud - "free speech is a threat to democratic dicourse"...?!

New World Order: 5 hours ago -

Ireland VS Globalists

Social Issues and Civil Unrest: 5 hours ago -

Biden "Happy To Debate Trump"

2024 Elections: 6 hours ago -

RAAF airbase in Roswell, New Mexico is on fire

Aliens and UFOs: 6 hours ago -

What is the white pill?

Philosophy and Metaphysics: 7 hours ago

top topics

-

A Warning to America: 25 Ways the US is Being Destroyed

New World Order: 16 hours ago, 21 flags -

James O’Keefe: I have evidence that exposes the CIA, and it’s on camera.

Whistle Blowers and Leaked Documents: 4 hours ago, 12 flags -

Blast from the past: ATS Review Podcast, 2006: With All Three Amigos

Member PODcasts: 8 hours ago, 12 flags -

Australian PM says the quiet part out loud - "free speech is a threat to democratic dicourse"...?!

New World Order: 5 hours ago, 10 flags -

Biden "Happy To Debate Trump"

2024 Elections: 6 hours ago, 10 flags -

Mike Pinder The Moody Blues R.I.P.

Music: 8 hours ago, 8 flags -

Ireland VS Globalists

Social Issues and Civil Unrest: 5 hours ago, 5 flags -

RAAF airbase in Roswell, New Mexico is on fire

Aliens and UFOs: 6 hours ago, 5 flags -

What is the white pill?

Philosophy and Metaphysics: 7 hours ago, 5 flags -

Putin, Russia and the Great Architects of the Universe

ATS Skunk Works: 11 hours ago, 4 flags

active topics

-

Candidate TRUMP Now Has Crazy Judge JUAN MERCHAN After Him - The Stormy Daniels Hush-Money Case.

Political Conspiracies • 815 • : Annee -

Where should Trump hold his next rally

2024 Elections • 10 • : EmmanuelGoldstein -

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies • 35 • : Threadbarer -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media • 309 • : cherokeetroy -

Remember These Attacks When President Trump 2.0 Retribution-Justice Commences.

2024 Elections • 58 • : WeMustCare -

2024 Pigeon Forge Rod Run - On the Strip (Video made for you)

Automotive Discussion • 8 • : WhitewaterSquirrel -

Gov Kristi Noem Shot and Killed "Less Than Worthless Dog" and a 'Smelly Goat

2024 Elections • 28 • : cherokeetroy -

Shocking Number of Voters are Open to Committing Election Fraud

US Political Madness • 5 • : AwakeNotWoke -

The Acronym Game .. Pt.3

General Chit Chat • 7756 • : bally001 -

RAAF airbase in Roswell, New Mexico is on fire

Aliens and UFOs • 8 • : Skinnerbot

5