It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

5

share:

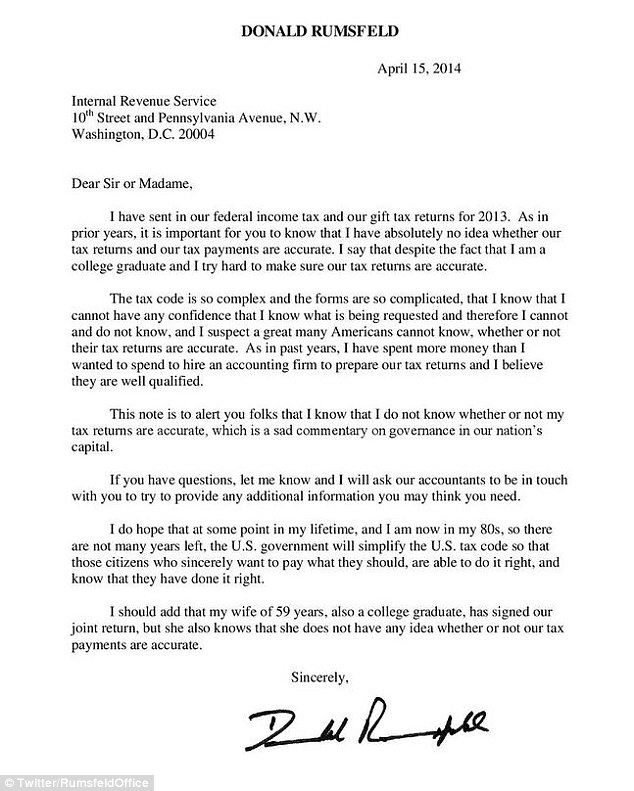

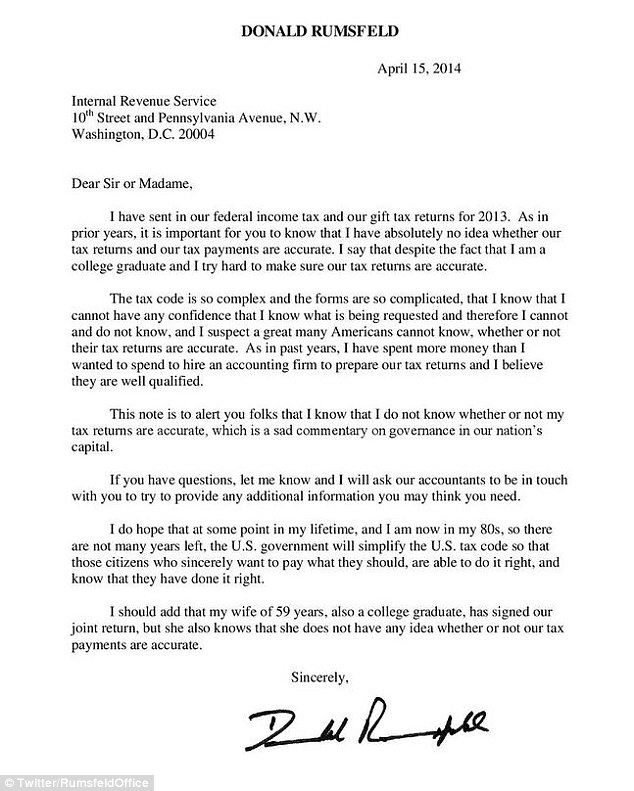

There is no forum for taxes and all the political forums don't fit this, as most of us, regardless of ideology pay taxes. But he did hit the nail on

the head with this one.

www.dailymail.co.uk...

I used to always get money back. Nowadays, I seem to always be paying in, even after making my deduction adjustments the year prior. Frankly, it's frustrating. I have enough on my plate. Why can't we set up a system that allows us to pay our taxes on a weekly/monthly basis depending on how you are paid and just be able to focus on other things? Like fixing the FRICKING TAX LAWS!

www.dailymail.co.uk...

I used to always get money back. Nowadays, I seem to always be paying in, even after making my deduction adjustments the year prior. Frankly, it's frustrating. I have enough on my plate. Why can't we set up a system that allows us to pay our taxes on a weekly/monthly basis depending on how you are paid and just be able to focus on other things? Like fixing the FRICKING TAX LAWS!

reply to post by TDawgRex

I got on this topic with friends in the D.C. area not to long ago. Their confusion is this. To their knowledge. The District of Colombia does not have a representative. And the the old thing goes "No Taxation without representation". They know they should pay taxes. Taxes are taken from their paychecks. And they file like the rest of us every year. But there appears to be no set rate.

Since I don't live in the area. I never bothered to follow up on this.

Is there anyone here that lives in D.C. that can confirm this?

I got on this topic with friends in the D.C. area not to long ago. Their confusion is this. To their knowledge. The District of Colombia does not have a representative. And the the old thing goes "No Taxation without representation". They know they should pay taxes. Taxes are taken from their paychecks. And they file like the rest of us every year. But there appears to be no set rate.

Since I don't live in the area. I never bothered to follow up on this.

Is there anyone here that lives in D.C. that can confirm this?

edit on 16-4-2014 by Bigburgh because: (no reason given)

edit on

16-4-2014 by Bigburgh because: (no reason given)

reply to post by TDawgRex

Plausible deniability. Something Donny knows well.

It's a hidden benefit of the tax code. Don't underestimate its value.

Plausible deniability. Something Donny knows well.

It's a hidden benefit of the tax code. Don't underestimate its value.

reply to post by TDawgRex

becareful what you ask for.;.. "Fixing" doesn't have the same meaning to TPTB as the rest of us

Like fixing the FRICKING TAX LAWS

becareful what you ask for.;.. "Fixing" doesn't have the same meaning to TPTB as the rest of us

edit on 16-4-2014 by Blowback because: (no reason given)

Like I believe Donnie does his own taxes. Poor old Donnie is it getting hard to remember if you can deduct the sale of chemical weapons to dictators

or if the last payoff was illegal or not? It's people like him and the warmonging dirt bags he ran with that should be the target of the IRS not the

honest hard working Americans that can barely get by. I am not a college graduate and have no problem doing my taxes in fact nobody I know has a

problem with their taxes.

reply to post by buster2010

He does say "His accountants". Hell, I use an accountant, but I truthfully am not comfortable with the final product. I've been audited the past three years and always owe more which I pay. (And yes, I have changed accountants).

I'm just saying that the Tax Code should not be as arduous as it is for the individual.

Wealthy people and Big Business can afford a Platoon of tax accountants to find loopholes. The rest of us can't.

He does say "His accountants". Hell, I use an accountant, but I truthfully am not comfortable with the final product. I've been audited the past three years and always owe more which I pay. (And yes, I have changed accountants).

I'm just saying that the Tax Code should not be as arduous as it is for the individual.

Wealthy people and Big Business can afford a Platoon of tax accountants to find loopholes. The rest of us can't.

reply to post by TDawgRex

TDawg, while it's always laudable to look for common ground with our fellow humans, even warmongering multi-trillion dollar "misplacer's" like Donald here I feel he was saying something else in his letter.

While polite and all Rumsfeld was letting the IRS know:

Simple US tax methodology for rich people. IRS doesn't know the Rumsfeld's are getting those new Google bodies to upload their brains so they can live forever.

TDawg, while it's always laudable to look for common ground with our fellow humans, even warmongering multi-trillion dollar "misplacer's" like Donald here I feel he was saying something else in his letter.

While polite and all Rumsfeld was letting the IRS know:

- 1) There could be problems with his taxes.

2) He's really old (and cranky) and has little time left so don't try to corner him.

3) His wife is old too so don't try using her as a hostage.

Simple US tax methodology for rich people. IRS doesn't know the Rumsfeld's are getting those new Google bodies to upload their brains so they can live forever.

edit on 739am3939am112014 by Bassago because: (no reason given)

IF that's really from Rummy, then I agree with him too.

It doesn't matter if he did or didn't do his own taxes. He's signing them. He's responsible.

H&R Block does ours. They supposedly aren't complicated but we still don't know how to do them.

And we don't know if H&R Block is doing it correctly. We just have to hope they are.

If the average person in this country can't do their taxes .. then something is wrong.

It doesn't matter if he did or didn't do his own taxes. He's signing them. He's responsible.

H&R Block does ours. They supposedly aren't complicated but we still don't know how to do them.

And we don't know if H&R Block is doing it correctly. We just have to hope they are.

If the average person in this country can't do their taxes .. then something is wrong.

Bassago

While polite and all Rumsfeld was letting the IRS know:

1) There could be problems with his taxes.

2) He's really old (and cranky) and has little time left so don't try to corner him.

3) His wife is old too so don't try using her as a hostage.

Simple US tax methodology for rich people. IRS doesn't know the Rumsfeld's are getting those new Google bodies to upload their brains so they can live forever.

edit on 739am3939am112014 by Bassago because: (no reason given)

That's funny.

I wonder if I can use that tactic without going to prison?

I want my Google body as well!

I have no other income...just pension and supplemental handouts....HST/GST refunds and the like....

It still took me at least an hour just to read and interpret the yes no questions......(and I am still in a quandary as to the meaning of a few of em....but answered anyways....)

The entire process is ridiculous at best.....

Then it took several attempts to on line file......finally, after endless frustration....I don't owe them anything....

Youd think they could have figured that out all by themselves.....????? idiots!

It still took me at least an hour just to read and interpret the yes no questions......(and I am still in a quandary as to the meaning of a few of em....but answered anyways....)

The entire process is ridiculous at best.....

Then it took several attempts to on line file......finally, after endless frustration....I don't owe them anything....

Youd think they could have figured that out all by themselves.....????? idiots!

edit on 16-4-2014 by stirling because: (no reason

given)

reply to post by TDawgRex

He's right and the subject of the tax code's messiness has been a subject of discussion for several years now. What is to be done about it is a huge argument apparently that doesn't get a lot of press. One of my professors actually testified before Congress on the subject of the mess that the tax code is and he talked about it in class. He was a big proponent for what is called VAT or value added tax. Basically, instead of a complex marginal tax code based on income or a basic sales tax, VAT would basically increase on goods that required more steps along the supply chain. Basically VAT wouldn't be on food or other necessities but would instead be levied against gross consumption and resource use along that supply chain. It's complicated but not once you figure out how it works.

en.wikipedia.org...

In other words, the tax would increase for luxury goods but for more basic goods, it'd be less. The difference between eating at home and eating at a restaurant. The more you consume, the more VAT you'll eventually pay. I'm probably not doing it justice, lol. It's an interesting idea and, like I said, it's one of the ideas that have been brought up in the rewriting of our tax code. Tax accountants across the country know it's a freaking mess.

He's right and the subject of the tax code's messiness has been a subject of discussion for several years now. What is to be done about it is a huge argument apparently that doesn't get a lot of press. One of my professors actually testified before Congress on the subject of the mess that the tax code is and he talked about it in class. He was a big proponent for what is called VAT or value added tax. Basically, instead of a complex marginal tax code based on income or a basic sales tax, VAT would basically increase on goods that required more steps along the supply chain. Basically VAT wouldn't be on food or other necessities but would instead be levied against gross consumption and resource use along that supply chain. It's complicated but not once you figure out how it works.

en.wikipedia.org...

In other words, the tax would increase for luxury goods but for more basic goods, it'd be less. The difference between eating at home and eating at a restaurant. The more you consume, the more VAT you'll eventually pay. I'm probably not doing it justice, lol. It's an interesting idea and, like I said, it's one of the ideas that have been brought up in the rewriting of our tax code. Tax accountants across the country know it's a freaking mess.

reply to post by WhiteAlice

VAT, Flat Tax or Fair Tax.

Any one of them has to be better what we have now.

But I don't think they'll like it as it only pays for what is needed. Not all the pork barrel projects they have going on.

VAT, Flat Tax or Fair Tax.

Any one of them has to be better what we have now.

But I don't think they'll like it as it only pays for what is needed. Not all the pork barrel projects they have going on.

reply to post by TDawgRex

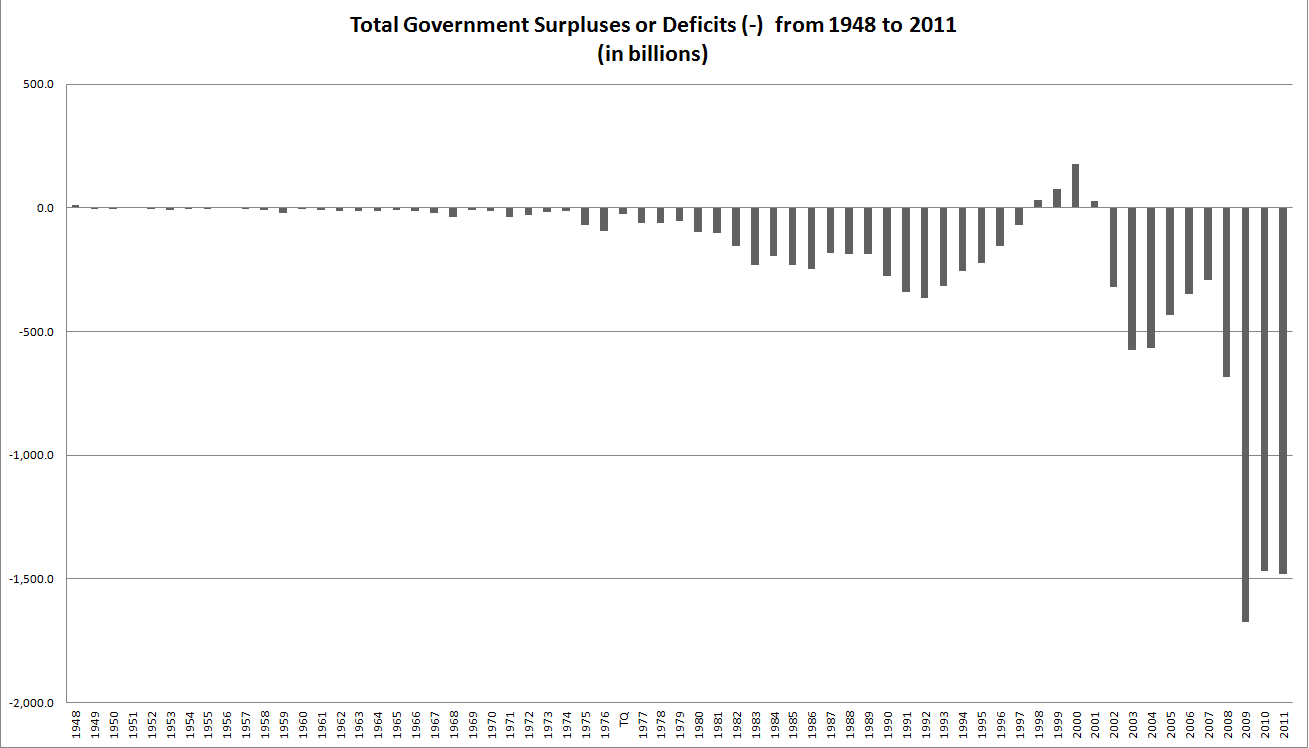

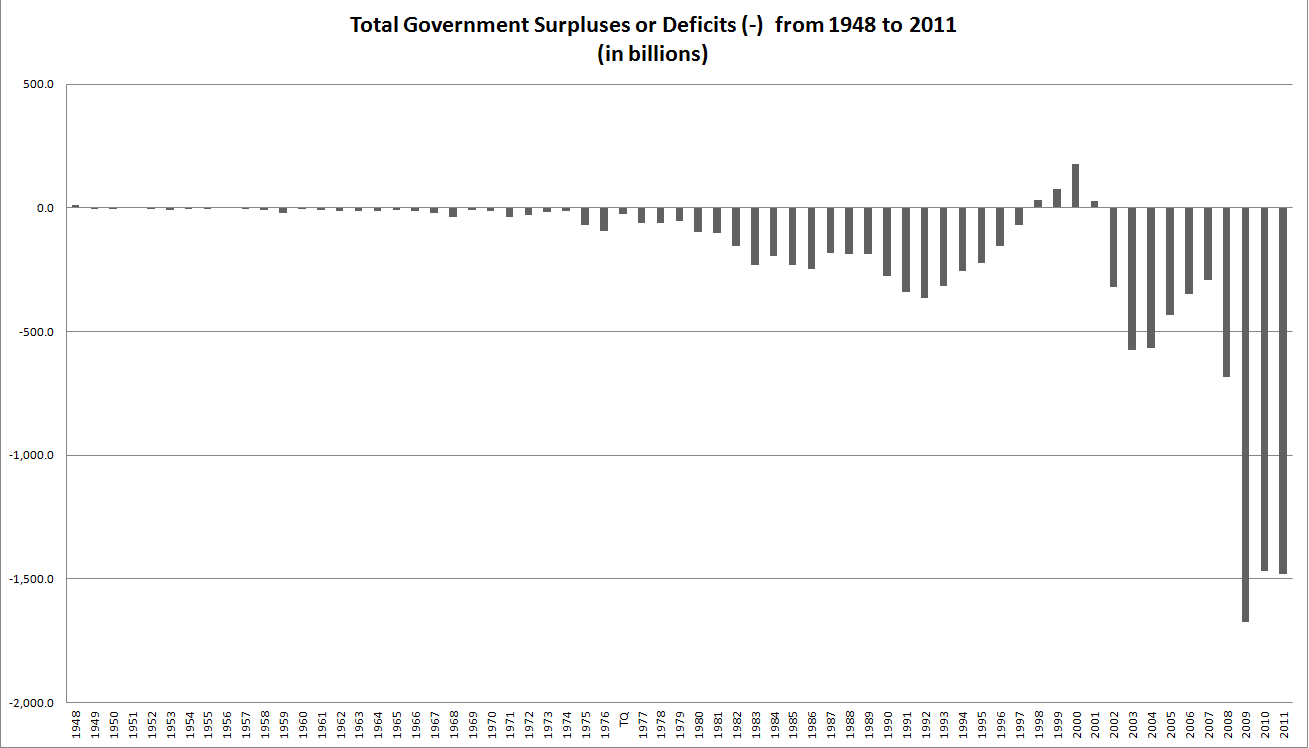

Actually, considering that we've been running at a deficit for most of the past 30 years (with the exception of being the surpluses of the Clinton era), our tax revenues have not covered our government spending in the slightest. Here's a graph I made of the federal surplus/deficit in terms of budget based on information provided by the OMB.

Now, when I originally made that graph, I had it all the way back to the dawn of the US but that was pointless because all the way up til the 70's, the balance hovered around 0. I have taken governmental accounting and that is actually exactly where the government should be hovering at all times. It should not be acquiring debt or holding onto revenues (in the case of Clinton, though, it was to reduce total deficit from prior years). It's pretty gross. Part of the reason why this is occurring is that tax revenues are actually declining.

Although the top marginal tax rate for corporations is at 35%, what is actually paid (called effective tax) by many of the large corporations is generally 6-9% because they use things like "check the box", offshore tax shelters, corporate tax credits, and much, much more. In fact, some companies, like Bank of America, were able to obtain a huge tax refunds after earning billions in profits due to the way that losses from prior years can be used to offset future tax and other quirks. So all of that shenanigans that went in 2008? Well those became a "net operating loss" or NOL that could be used to reduce future taxation. Was really a win-win in some ways. NOLs are actually one of the areas that California tried to defend itself against by prohibiting the use of them for 2 years. They can really impact tax revenues both at the state and federal levels.

Sen. Bernie Sanders actually wrote up an overview of how much these kind of things affect tax revenues: www.sanders.senate.gov...

A few years ago, I independently compiled the difference between what some of the largest companies in the world should've paid and what they actually paid and it was in the billions for just 8 companies. It's really quite shocking. I was motivated to do this after my tax prof informed the class that GE had paid $0 in taxes the prior year after reporting billions in revenue. In the tax field, GE's tax accountants are called "the greatest tax firm in the world".

Actually, considering that we've been running at a deficit for most of the past 30 years (with the exception of being the surpluses of the Clinton era), our tax revenues have not covered our government spending in the slightest. Here's a graph I made of the federal surplus/deficit in terms of budget based on information provided by the OMB.

Now, when I originally made that graph, I had it all the way back to the dawn of the US but that was pointless because all the way up til the 70's, the balance hovered around 0. I have taken governmental accounting and that is actually exactly where the government should be hovering at all times. It should not be acquiring debt or holding onto revenues (in the case of Clinton, though, it was to reduce total deficit from prior years). It's pretty gross. Part of the reason why this is occurring is that tax revenues are actually declining.

Although the top marginal tax rate for corporations is at 35%, what is actually paid (called effective tax) by many of the large corporations is generally 6-9% because they use things like "check the box", offshore tax shelters, corporate tax credits, and much, much more. In fact, some companies, like Bank of America, were able to obtain a huge tax refunds after earning billions in profits due to the way that losses from prior years can be used to offset future tax and other quirks. So all of that shenanigans that went in 2008? Well those became a "net operating loss" or NOL that could be used to reduce future taxation. Was really a win-win in some ways. NOLs are actually one of the areas that California tried to defend itself against by prohibiting the use of them for 2 years. They can really impact tax revenues both at the state and federal levels.

Sen. Bernie Sanders actually wrote up an overview of how much these kind of things affect tax revenues: www.sanders.senate.gov...

A few years ago, I independently compiled the difference between what some of the largest companies in the world should've paid and what they actually paid and it was in the billions for just 8 companies. It's really quite shocking. I was motivated to do this after my tax prof informed the class that GE had paid $0 in taxes the prior year after reporting billions in revenue. In the tax field, GE's tax accountants are called "the greatest tax firm in the world".

reply to post by WhiteAlice

I actually like Sanders, though he is a Socialist, he does say so in a forthright manner. Taxes are out of control right now. And it's not only Apr 15th. It's year round.

They're talking about a mileage tax now. That alone would cripple the transportation industry.

All I can say is, "When will it STOP!"

I actually like Sanders, though he is a Socialist, he does say so in a forthright manner. Taxes are out of control right now. And it's not only Apr 15th. It's year round.

They're talking about a mileage tax now. That alone would cripple the transportation industry.

All I can say is, "When will it STOP!"

reply to post by TDawgRex

Yeah, Sanders doesn't mince his words. I respect him for his honesty.

There's already gas taxes that have been present on the per gallon price for a very long time. Those fall under an excise tax and the proceeds are slated for transportation related costs (ie roads and whatnot) at both the state and federal levels. The federal excise tax on gas is 18.4 cents per gallon for unleaded and 24.4 cents per gallon for diesel. Those get bumped even more depending on the state one lives in and their own excise taxes. The average excise tax per gallon across the US is currently around 50 cents of every gallon. So people have already been paying for a transportation tax really since 1932 on the federal level. Theoretically, it is a kind of mileage tax as those with a vehicle with better mileage is going to paying less in excise taxes than a vehicle with poor gas mileage. It's interesting that they are looking at changing it to mileage traveled though as that probably means that, as cars in general have had very improved gas mileage, it makes sense that they'd be receiving fewer revenues due to that as well.

The excise taxes on gas tend to be slated for the purpose of maintaining road infrastructure. I don't think that a penny goes outside of that purpose but am not 100% certain and am too lazy to verify it 100% lol.

Yeah, Sanders doesn't mince his words. I respect him for his honesty.

There's already gas taxes that have been present on the per gallon price for a very long time. Those fall under an excise tax and the proceeds are slated for transportation related costs (ie roads and whatnot) at both the state and federal levels. The federal excise tax on gas is 18.4 cents per gallon for unleaded and 24.4 cents per gallon for diesel. Those get bumped even more depending on the state one lives in and their own excise taxes. The average excise tax per gallon across the US is currently around 50 cents of every gallon. So people have already been paying for a transportation tax really since 1932 on the federal level. Theoretically, it is a kind of mileage tax as those with a vehicle with better mileage is going to paying less in excise taxes than a vehicle with poor gas mileage. It's interesting that they are looking at changing it to mileage traveled though as that probably means that, as cars in general have had very improved gas mileage, it makes sense that they'd be receiving fewer revenues due to that as well.

The excise taxes on gas tend to be slated for the purpose of maintaining road infrastructure. I don't think that a penny goes outside of that purpose but am not 100% certain and am too lazy to verify it 100% lol.

Fair or Flat Tax, a VAT offers too many opportunities to hike the rate at every stage of the chain like our current system has and they'd be off and

running with their same tax code crony games with the consumers caught in the middle.

But you know why they would never do it unless forced - Make it one rate for all time and tie it to the budget like that, and they lose the power to use the rates to reward and punish.

But you know why they would never do it unless forced - Make it one rate for all time and tie it to the budget like that, and they lose the power to use the rates to reward and punish.

ketsuko

Fair or Flat Tax, a VAT offers too many opportunities to hike the rate at every stage of the chain like our current system has and they'd be off and running with their same tax code crony games with the consumers caught in the middle.

But you know why they would never do it unless forced - Make it one rate for all time and tie it to the budget like that, and they lose the power to use the rates to reward and punish.

Isn't that a flat tax?

new topics

-

BIDEN Admin Begins Planning For January 2025 Transition to a New President - Today is 4.26.2024.

2024 Elections: 14 minutes ago -

Big Storms

Fragile Earth: 1 hours ago -

Where should Trump hold his next rally

2024 Elections: 4 hours ago -

Shocking Number of Voters are Open to Committing Election Fraud

US Political Madness: 5 hours ago -

Gov Kristi Noem Shot and Killed "Less Than Worthless Dog" and a 'Smelly Goat

2024 Elections: 5 hours ago -

Falkville Robot-Man

Aliens and UFOs: 6 hours ago -

James O’Keefe: I have evidence that exposes the CIA, and it’s on camera.

Whistle Blowers and Leaked Documents: 6 hours ago -

Australian PM says the quiet part out loud - "free speech is a threat to democratic dicourse"...?!

New World Order: 7 hours ago -

Ireland VS Globalists

Social Issues and Civil Unrest: 8 hours ago -

Biden "Happy To Debate Trump"

2024 Elections: 8 hours ago

top topics

-

James O’Keefe: I have evidence that exposes the CIA, and it’s on camera.

Whistle Blowers and Leaked Documents: 6 hours ago, 13 flags -

Blast from the past: ATS Review Podcast, 2006: With All Three Amigos

Member PODcasts: 10 hours ago, 13 flags -

Australian PM says the quiet part out loud - "free speech is a threat to democratic dicourse"...?!

New World Order: 7 hours ago, 12 flags -

Biden "Happy To Debate Trump"

2024 Elections: 8 hours ago, 12 flags -

Mike Pinder The Moody Blues R.I.P.

Music: 11 hours ago, 8 flags -

What is the white pill?

Philosophy and Metaphysics: 10 hours ago, 6 flags -

Shocking Number of Voters are Open to Committing Election Fraud

US Political Madness: 5 hours ago, 6 flags -

RAAF airbase in Roswell, New Mexico is on fire

Aliens and UFOs: 8 hours ago, 5 flags -

Ireland VS Globalists

Social Issues and Civil Unrest: 8 hours ago, 5 flags -

Where should Trump hold his next rally

2024 Elections: 4 hours ago, 4 flags

active topics

-

Gov Kristi Noem Shot and Killed "Less Than Worthless Dog" and a 'Smelly Goat

2024 Elections • 39 • : Zanti Misfit -

So this is what Hamas considers 'freedom fighting' ...

War On Terrorism • 268 • : TheWoker -

BIDEN Admin Begins Planning For January 2025 Transition to a New President - Today is 4.26.2024.

2024 Elections • 2 • : NoCorruptionAllowed -

Falkville Robot-Man

Aliens and UFOs • 7 • : KKLOCO -

Big Storms

Fragile Earth • 9 • : nerbot -

"We're All Hamas" Heard at Columbia University Protests

Social Issues and Civil Unrest • 294 • : TheWoker -

Where should Trump hold his next rally

2024 Elections • 15 • : Zanti Misfit -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues • 89 • : AlongCameaSpider -

Post A Funny (T&C Friendly) Pic Part IV: The LOL awakens!

General Chit Chat • 7138 • : baddmove -

Ireland VS Globalists

Social Issues and Civil Unrest • 8 • : nugget1

5