It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

3

share:

Think America has debt? China did its own stimulus in 2009. IT gave away billions of dollars for crazy projects. Think America has bridges to nowhere?

China has whole cities that are empty. It was all done to keep China's growth rates high. Now China has billions in loans coming due, all from money

given from its banks. What will China do? Will it drag down the local economy? Could China call in its loans to the US and crash our economy?

thediplomat.com...

thediplomat.com...

They could start collecting all the securities they have on American debt

It would not surprise me if China had mass debt. Modern economics relies substantionally on forecasting and as well all know forecasts can be wayyyyy off.

It would not surprise me if China had mass debt. Modern economics relies substantionally on forecasting and as well all know forecasts can be wayyyyy off.

edit on 7-9-2012 by MDDoxs because: (no reason given)

reply to post by travis911

'Quantative Easing' will not help. Operation Twist is just a silly joke.

The mother.

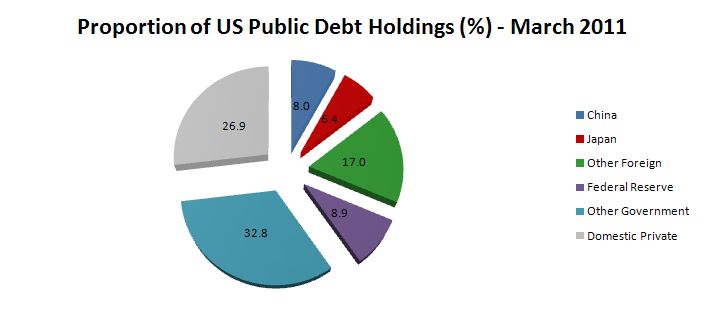

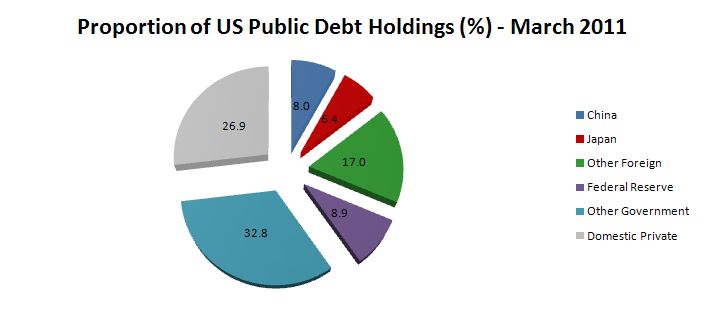

“It is true that China is the largest foreign owner of our debt,” said Josh Gordon, policy director of the Concord Coalition, a Virginia-based nonprofit that advocates getting the nation’s debt under control. “But the vast majority of our debt is held by us.” Read more: www.foxnews.com...

'Quantative Easing' will not help. Operation Twist is just a silly joke.

The mother.

The Treasury Department reported Tuesday that the national debt had topped $16 trillion, adding fuel to Republicans' criticisms of President Obama's deficit spending just as the Democrats are kicking off their national convention. Read more: www.foxnews.com...

edit on 7-9-2012 by

freemarketsocialist because: (no reason given)

A thought, and the 'Wild Card'. We have, as well as most parts of the world, been subject to weather not conducive to crop growth. For several years

running we have had drought and failed crops. So it went for us in the US. China has not been spared, in fact their projects to channel water to the

north of their country have been in full swing. Russia has had the same fouling weather in the form of too much water. Loans.... collecting loans,

making loans to cover old loans, forgiveness of loans, it doesn't matter what the whorlwind of finance is up to, people have to eat. They also need

water for all the obvious reasons, the key element. So this 'Debt Bomb' is really secondary. Nations need to be co-ordinating the food needs of the

world. But that's unlikely largely.

I think the priorities at this point are apparent, and finance will just have to wait it's turn. Mother nature, God, the Devil, the jet stream, El Nino, whatever the belief of the cause, money will be of little use with nothing harvested for the year. It won't matter as many many crops fall to drought. Oil producing countries....... well they had better build hothouses and grow their own.

I think the priorities at this point are apparent, and finance will just have to wait it's turn. Mother nature, God, the Devil, the jet stream, El Nino, whatever the belief of the cause, money will be of little use with nothing harvested for the year. It won't matter as many many crops fall to drought. Oil producing countries....... well they had better build hothouses and grow their own.

The Chinese model is actually far superior to our own. Because…

Whenever Western governments borrow money, to then spend, in order to stimulate their economy, the spent money is generally gone forever. In the U.S it tends to go on things like weapons, well a military plane only costs more money to run. In the UK it’s often on things like welfare, and the NHS. The NHS does at least save money being spent on private insurance but the money spent is still gone.

However…

Whenever government borrows money (the UK is currently able to borrow up to ten years, for less than 1% interest rates) www.bloomberg.com...

To lend to business then…

Either all, or most of the money comes back AND infrastructure still gets built AND it goes on to make more money for the economy than an e.g. U.S military tank, or expensive to run NHS hospital.

Even if China only gets repaid 80% of the money they have leant, they are still in a much better position than the e.g. U.S that has borrowed in excess of 14 trillion, and will never get any of that money back (because it wasn’t even the intention when they disposed of it, in the dustbin of government spending). In Britain & the U.S the only way we can (realistically) tolerate our huge debts is to…

A. Continue to repay our interest repayments

B. Whilst reassuring debtors this will always be the case –even if it’s through quantitative easing (used to be called “printing money”).

As long as that’s the case, the value of currency debts, will continue to hold true in the currencies we base them in (i.e. our own).

As it happens…

Both the U.S and Britain have made it damn clear that (no matter what happens to the economy) the printing presses (will as a last ditch resort) always be switched on enough, to ensure our debts are always repaid to investors. This situation prevents panic and investors self-fulfilling fear prophecies (of only being so scarred, they’ll only lend money at interest rates, a country cannot realistically sustain).

The problem in the Eurozone is that (because individual countries don’t control the amount of Euro’s they can print-issue) the only way they can meet their debts is to…

A. Seek the help of other countries: The problem is this makes their debt the problem of everybody, and responsible countries that save money like the Germans hate it! They are therefore reluctant to lend, and so when they have, it has only been to prevent crisis at the last minute –after lenders have got freaked out. Therefore the money they lend never goes as far, as had they leant a few months earlier. But from the German politicians point of view, they can only bring other parties around into supporting them in lending, when economic Armageddon is minutes walk from knocking on everyone, in the Eurozones, front door!

B. Or troubled nations, can cut the money they spend on their own public, and use it to help meet interest repayments. Stupidly (yet again, politically logically) this is usually a condition the Germans put on handing any emergency loan money, over (because it can bring to the bare minimum the amounts Germany has to lend in emergency loans). But economically it’s stupid, because it’s economically suicidal because: Every time an indebted Eurozone, troubled nation has: Raised taxes, cut total government spending, economic growth has gone from bad to worse! Consequently their debt (even if temporarily made sustainable by emergency German, economic loans) because unsustainable again (so yet more German money is needed –money that would have better been handed over in the first place, to allow growth to actually happen). AND if a country like Greece does default on its debts, and therefore does leave the Eurozone, the indebted German government AND their private banks will lose billions which then means they have fully caught the original, indebted countries, economic disease. When one considers the easily bankrupting amount leant by German, French, and British banks (usually under massive government pressure, as it’s a form of helping their own government) it’s possible that Greece doing (what would probably be in their own, selfish economic interests) could start an economic chain reaction, of one bank not receiving repayment, causing the banks-investors that own it’s debts, to do the same on theirs, and so on. It does not take much unrepaid money to start such an economic chain reaction. The difference between a country-bank investors believe can 100% repay their debts is lending costs of less than 1% (like Britain’s-US) and one that can only 99% repay it’s debts, is interest rates in excess of 10%, and then 20% and so on (as the 10% interest rates, makes the existing debts less sustainable).

So…

The whole thing is a house of cards, waiting to fall. Whether it will, depends on

1. Will countries like Germany lend money at rates AND conditions, that do not economically destroy the country they are supposedly trying to save?

2. Will (the more) secure countries like Britain-U.S adopt the China model? Western economists hate China’s model, because all our prominent economic institutions are “sponsored”-bribed, by the major financial institutions –likewise so too are our political ones (in the UK over half of the ruling Conservatives donations comes from the banking sector). They hate China’s model because (if you are a bank) the last thing you want, is the government lending money to business (that need-could grow with it) WHEN the reason government is lending, is because it’s doing it at cheaper rates than the banks-institutions behind them offer. Basically they don’t want to lose Market Share against the one thing they cannot compete against is government. It would however be in the national interests for our governments to do exactly this, but if you’re a bank, it’s your own interests, then everyone else’s that’s most important!

Granted: It’s not exactly good news for China, it’s economy, or the amount of Chinese bad debt China (may) end having to shoulder if Chinese state & privately run banks only receive back e.g. 80% of the money they leant (rather than 107% plus percent they were expecting.)

But at least (under the worst case scenario of 80%) only 20%-27% of money is lost forever, rather than the 99%-100% that’s gone every time Britain-US increase their governments spending.

The Chinese have it sorted, we’re just too corrupt (politically, and institutionally) to properly embrace, what’s quite self-evidently in our own, national interests.

The main problem facing China is simply that economic problems in the West –world generally, have hit their exports, and can trigger some deflation. But they’ll come through. And a decline for them, is annual growth less than 10%, for us it’s growth less than 0% (and yet both countries have inflation to worry about!)

Whenever Western governments borrow money, to then spend, in order to stimulate their economy, the spent money is generally gone forever. In the U.S it tends to go on things like weapons, well a military plane only costs more money to run. In the UK it’s often on things like welfare, and the NHS. The NHS does at least save money being spent on private insurance but the money spent is still gone.

However…

Whenever government borrows money (the UK is currently able to borrow up to ten years, for less than 1% interest rates) www.bloomberg.com...

To lend to business then…

Either all, or most of the money comes back AND infrastructure still gets built AND it goes on to make more money for the economy than an e.g. U.S military tank, or expensive to run NHS hospital.

Even if China only gets repaid 80% of the money they have leant, they are still in a much better position than the e.g. U.S that has borrowed in excess of 14 trillion, and will never get any of that money back (because it wasn’t even the intention when they disposed of it, in the dustbin of government spending). In Britain & the U.S the only way we can (realistically) tolerate our huge debts is to…

A. Continue to repay our interest repayments

B. Whilst reassuring debtors this will always be the case –even if it’s through quantitative easing (used to be called “printing money”).

As long as that’s the case, the value of currency debts, will continue to hold true in the currencies we base them in (i.e. our own).

As it happens…

Both the U.S and Britain have made it damn clear that (no matter what happens to the economy) the printing presses (will as a last ditch resort) always be switched on enough, to ensure our debts are always repaid to investors. This situation prevents panic and investors self-fulfilling fear prophecies (of only being so scarred, they’ll only lend money at interest rates, a country cannot realistically sustain).

The problem in the Eurozone is that (because individual countries don’t control the amount of Euro’s they can print-issue) the only way they can meet their debts is to…

A. Seek the help of other countries: The problem is this makes their debt the problem of everybody, and responsible countries that save money like the Germans hate it! They are therefore reluctant to lend, and so when they have, it has only been to prevent crisis at the last minute –after lenders have got freaked out. Therefore the money they lend never goes as far, as had they leant a few months earlier. But from the German politicians point of view, they can only bring other parties around into supporting them in lending, when economic Armageddon is minutes walk from knocking on everyone, in the Eurozones, front door!

B. Or troubled nations, can cut the money they spend on their own public, and use it to help meet interest repayments. Stupidly (yet again, politically logically) this is usually a condition the Germans put on handing any emergency loan money, over (because it can bring to the bare minimum the amounts Germany has to lend in emergency loans). But economically it’s stupid, because it’s economically suicidal because: Every time an indebted Eurozone, troubled nation has: Raised taxes, cut total government spending, economic growth has gone from bad to worse! Consequently their debt (even if temporarily made sustainable by emergency German, economic loans) because unsustainable again (so yet more German money is needed –money that would have better been handed over in the first place, to allow growth to actually happen). AND if a country like Greece does default on its debts, and therefore does leave the Eurozone, the indebted German government AND their private banks will lose billions which then means they have fully caught the original, indebted countries, economic disease. When one considers the easily bankrupting amount leant by German, French, and British banks (usually under massive government pressure, as it’s a form of helping their own government) it’s possible that Greece doing (what would probably be in their own, selfish economic interests) could start an economic chain reaction, of one bank not receiving repayment, causing the banks-investors that own it’s debts, to do the same on theirs, and so on. It does not take much unrepaid money to start such an economic chain reaction. The difference between a country-bank investors believe can 100% repay their debts is lending costs of less than 1% (like Britain’s-US) and one that can only 99% repay it’s debts, is interest rates in excess of 10%, and then 20% and so on (as the 10% interest rates, makes the existing debts less sustainable).

So…

The whole thing is a house of cards, waiting to fall. Whether it will, depends on

1. Will countries like Germany lend money at rates AND conditions, that do not economically destroy the country they are supposedly trying to save?

2. Will (the more) secure countries like Britain-U.S adopt the China model? Western economists hate China’s model, because all our prominent economic institutions are “sponsored”-bribed, by the major financial institutions –likewise so too are our political ones (in the UK over half of the ruling Conservatives donations comes from the banking sector). They hate China’s model because (if you are a bank) the last thing you want, is the government lending money to business (that need-could grow with it) WHEN the reason government is lending, is because it’s doing it at cheaper rates than the banks-institutions behind them offer. Basically they don’t want to lose Market Share against the one thing they cannot compete against is government. It would however be in the national interests for our governments to do exactly this, but if you’re a bank, it’s your own interests, then everyone else’s that’s most important!

Granted: It’s not exactly good news for China, it’s economy, or the amount of Chinese bad debt China (may) end having to shoulder if Chinese state & privately run banks only receive back e.g. 80% of the money they leant (rather than 107% plus percent they were expecting.)

But at least (under the worst case scenario of 80%) only 20%-27% of money is lost forever, rather than the 99%-100% that’s gone every time Britain-US increase their governments spending.

The Chinese have it sorted, we’re just too corrupt (politically, and institutionally) to properly embrace, what’s quite self-evidently in our own, national interests.

The main problem facing China is simply that economic problems in the West –world generally, have hit their exports, and can trigger some deflation. But they’ll come through. And a decline for them, is annual growth less than 10%, for us it’s growth less than 0% (and yet both countries have inflation to worry about!)

Truth to tell, i could care less......it means nothing anymore.....

The world, its money and its banks, can go suck lemons....

Lifes too short, and theres a great sunrise every morning, and a pretty nice one every night.....

These money problems are all creations of mankinds self inflated ego driven imagination.....well have to come back down to reality sooner or later...just be ready for it.....................

peace

The world, its money and its banks, can go suck lemons....

Lifes too short, and theres a great sunrise every morning, and a pretty nice one every night.....

These money problems are all creations of mankinds self inflated ego driven imagination.....well have to come back down to reality sooner or later...just be ready for it.....................

peace

new topics

-

Don’t Obstruct the Leftist Implosion

US Political Madness: 17 minutes ago -

NASA Black Hole Visualization - Go Beyond the Brink

Space Exploration: 54 minutes ago -

Russia police launch major manhunt after troops massacred by comrade in occupied Ukraine

Other Current Events: 3 hours ago -

Chinese scientists create new mutant Ebola strain with horror eye symptoms

Breaking Alternative News: 4 hours ago -

Maclemore - Hind's Hall (Pro-Palestine protest song)

Music: 4 hours ago -

Social Security projected to cut benefits in 2035 barring a fix

Global Meltdown: 6 hours ago -

Trump supporters training in the HILLS!!!!

US Political Madness: 7 hours ago -

Is the move to greenwashing solar and wind power set up for money laundering.

The Gray Area: 7 hours ago -

LIVE: Putin inauguration ceremony

Regional Politics: 9 hours ago -

Black kids in the Bronx don't know what the word 'computer' is

People: 10 hours ago

top topics

-

Trump supporters training in the HILLS!!!!

US Political Madness: 7 hours ago, 15 flags -

Black kids in the Bronx don't know what the word 'computer' is

People: 10 hours ago, 8 flags -

This is what it is all about

US Political Madness: 13 hours ago, 7 flags -

Chinese scientists create new mutant Ebola strain with horror eye symptoms

Breaking Alternative News: 4 hours ago, 7 flags -

Russia police launch major manhunt after troops massacred by comrade in occupied Ukraine

Other Current Events: 3 hours ago, 5 flags -

Social Security projected to cut benefits in 2035 barring a fix

Global Meltdown: 6 hours ago, 5 flags -

LIVE: Putin inauguration ceremony

Regional Politics: 9 hours ago, 3 flags -

NASA Black Hole Visualization - Go Beyond the Brink

Space Exploration: 54 minutes ago, 3 flags -

Is the move to greenwashing solar and wind power set up for money laundering.

The Gray Area: 7 hours ago, 2 flags -

Aliens and Las Vegas

Aliens and UFOs: 13 hours ago, 1 flags

3