It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

Mitt Romney’s plan to overhaul the tax code would produce cuts for the richest 5 percent of Americans — and bigger bills for everybody else, according to an independent analysis set for release Wednesday.

The study was conducted by researchers at the nonpartisan Tax Policy Center, a joint project of the Brookings Institution and the Urban Institute, who seem to bend over backward to be fair to the Republican presidential candidate. To cover the cost of his plan — which would reduce tax rates by 20 percent, repeal the estate tax and eliminate taxes on investment income for middle-class taxpayers — the researchers assume that Romney would go after breaks for the richest taxpayers first.

They even look at what would happen if Republicans’ dreams for tax reform came true and the proposal generated significant revenue through economic growth. The wealthy keeps getting wealthier while the poor keeps getting poorer. Welcome to the plantation model economy.

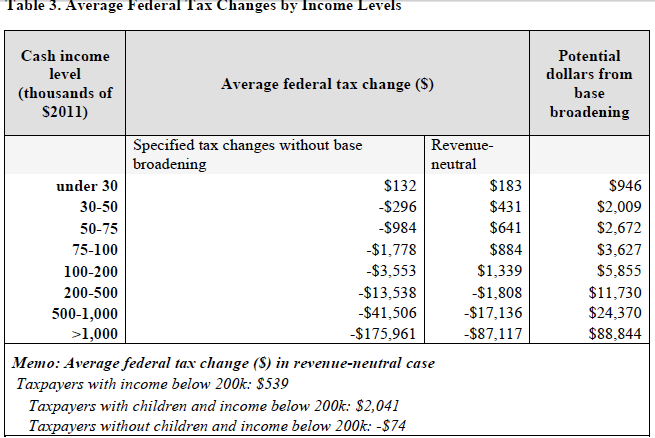

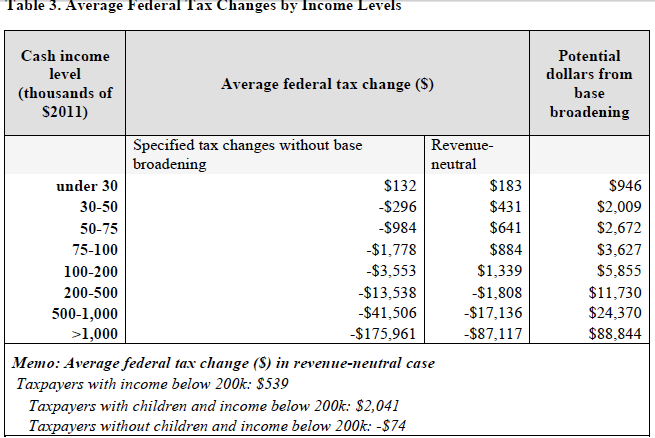

None of it helped Romney. His rate-cutting plan for individuals would reduce tax collections by about $360 billion in 2015, the study says. To avoid increasing deficits — as Romney has pledged — the plan would have to generate an equivalent amount of revenue by slashing tax breaks for mortgage interest, employer-provided health care, education, medical expenses, state and local taxes, and child care — all breaks that benefit the middle class.

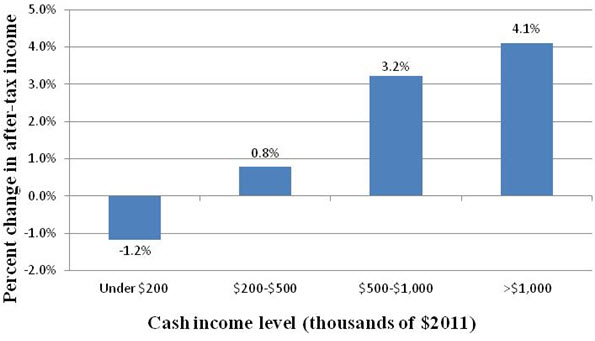

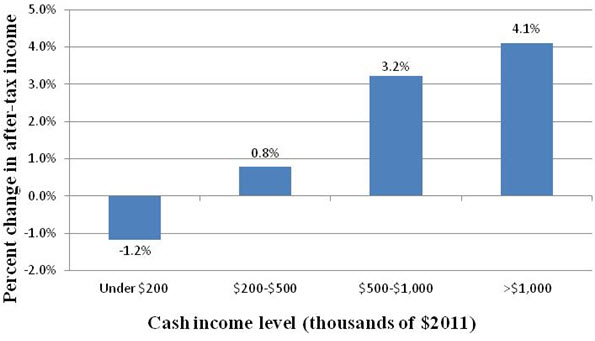

What would that mean for the average tax bill? Millionaires would get an $87,000 tax cut, the study says. But for 95 percent of the population, taxes would go up by about 1.2 percent, an average of $500 a year.

www.washingtonpost.com... y.html

Not very surprising. No one seems to cry when the wealth is redistributed from the poor TO the rich..only the other way around. Haven't conservatives learned by now that nothing trickles down? Even if there were a free market the same principles would be at hand.

The same people that claim Obamas plan is going to hurt the rich say NOTHING if Romneys plan is going to hurt the poor or middle class.

edit

on 2-8-2012 by RealSpoke because: (no reason given)

Surprise Surprise!!!

The Tax etc. was only made for the poor/middle class people ...

The Rich have always got away with paying very little or no tax ... Thanks to the contacts they have or the political people they "donate" towards...

Tax is only for the hard working people ... In my opinion every Tax in the World has a legal loophole for the Very Rich.

This is not news ... Because this is what happens all the bloody time... We get stepped on while the rich get their shoes polished!!!

The Tax etc. was only made for the poor/middle class people ...

The Rich have always got away with paying very little or no tax ... Thanks to the contacts they have or the political people they "donate" towards...

Tax is only for the hard working people ... In my opinion every Tax in the World has a legal loophole for the Very Rich.

This is not news ... Because this is what happens all the bloody time... We get stepped on while the rich get their shoes polished!!!

Thread didn't get much attention, not surprising since it isn't bashing Obama or poor people

I don't hear the Right screaming class warfare over this.

In fact I don't hear the right at all.

Once again they ignore a thread to keep it off the front page

Well, here's a bump.

In fact I don't hear the right at all.

Once again they ignore a thread to keep it off the front page

Well, here's a bump.

Originally posted by RealSpoke

Thread didn't get much attention, not surprising since it isn't bashing Obama or poor people

Or maybe because a different thread from a few hours earlier has the same theme.

www.abovetopsecret.com...

And it seems the actual Romney "Plan" is only superficial with no real details.

All the "forward" analysis is speculation.

This is all it says about individual taxes;

Romney website

Individual Taxes

America’s individual tax code applies relatively high marginal tax rates on a narrow tax base. Those high rates discourage work and entrepreneurship, as well as savings and investment. With 54 percent of private sector workers employed outside of corporations, individual rates also define the incentives for job-creating businesses. Lower marginal tax rates secure for all Americans the economic gains from tax reform.

- Make permanent, across-the-board 20 percent cut in marginal rates

- Maintain current tax rates on interest, dividends, and capital gains

- Eliminate taxes for taxpayers with AGI below $200,000 on interest, dividends, and capital gains

- Eliminate the Death Tax

- Repeal the Alternative Minimum Tax (AMT)

edit on Aug-02-2012 by xuenchen because: (no reason given)

of course the "ats millionaires" are going to ignore such a thread.

what humors me is so many voters who go for the gop are on welfare.

do they have any clue?

what humors me is so many voters who go for the gop are on welfare.

do they have any clue?

Originally posted by elitegamer23

of course the "ats millionaires" are going to ignore such a thread.

what humors me is so many voters who go for the gop are on welfare.

do they have any clue?

I think many if not most people on assistance were recent victims of the economic killings.

Those people had good jobs and a better life a few short years ago.

The "assistance" money is no where near enough to keep them out of hock.

They were expecting the jobs to come back.

They blame Obama .... right or wrong doesn't matter.

They blame Obama.

They won't vote for him again.

There is a big difference between the recent economic prisoners and the chronic "professional" assistance receivers.

edit on Aug-02-2012 by xuenchen because: (no reason given)

Originally posted by xuenchen

Originally posted by elitegamer23

of course the "ats millionaires" are going to ignore such a thread.

what humors me is so many voters who go for the gop are on welfare.

do they have any clue?

I think many if not most people on assistance were recent victims of the economic killings.

Those people had good jobs and a better life a few short years ago.

The "assistance" money is no where near enough to keep them out of hock.

They were expecting the jobs to come back.

They blame Obama .... right or wrong doesn't matter.

They blame Obama.

They won't vote for him again.

There is a big difference between the recent economic prisoners and the chronic "professional" assistance receivers.

edit on Aug-02-2012 by xuenchen because: (no reason given)

you dont believe a republican on welfare is an economic prisoner and a democrat on welfare is a professional assistance receiver do you?

reply to post by elitegamer23

Never said anything about party affiliation.

I am talking about Recent victims.

Those people had jobs a few short years ago.

The assistance does not pay enough.

They want the jobs back, not busted promises and class room economic theories.

you dont believe a republican on welfare is an economic prisoner and a democrat on welfare is a professional assistance receiver do you?

Never said anything about party affiliation.

I am talking about Recent victims.

Those people had jobs a few short years ago.

The assistance does not pay enough.

They want the jobs back, not busted promises and class room economic theories.

A little bit on the Tax Policy Centre.

newsbusters.org...

(bold is mine)

I'm sure we'll next see a "non-partisan" group come out saying Romney swats tiny kittens with a spatula.

One of the favors the media routinely perform for liberal politicians is citing left-of-center think tanks as "non-partisan" entities, who just happen to have evidence proving the awfulness of conservative policies. A classic example occurred on the July 7 CBS Evening News, as reporter Chip Reid cited "the non-partisan Tax Policy Center" as showing how Barack Obama's "tax cuts" are superior to John McCain's.

In fact, the Tax Policy Center is the product of the left-leaning Brookings Institution and the Urban Institute. The Tax Policy Center data cited by CBS followed the liberal approach of portraying tax cuts as a government giveaway, and calculating the raw dollar value of each person's "benefit." Reid reported: "A recent study by the non-partisan Tax Policy Center says Obama's plan would give a cut of more than a thousand dollars to families making between $37,000 and $66,000 a year. Under McCain's plan, they'd get just $319."

newsbusters.org...

(bold is mine)

I'm sure we'll next see a "non-partisan" group come out saying Romney swats tiny kittens with a spatula.

Originally posted by xuenchen

reply to post by elitegamer23

you dont believe a republican on welfare is an economic prisoner and a democrat on welfare is a professional assistance receiver do you?

Never said anything about party affiliation.

I am talking about Recent victims.

Those people had jobs a few short years ago.

The assistance does not pay enough.

They want the jobs back, not busted promises and class room economic theories.

well shouldnt the usa have a major surplus of jobs after 10 years of bush tax cuts? how many trillions did the ' job creators' save?

we should b up to our noses in jobs right now. where the hell are all these jobs. im probably asking the wrong person.

are there any ' job creators' here?

Good, someone needs to give the rich the incentive to start investing and expanding business so some jobs can finally be created. You know, REAL

jobs, not those fake jobs that the Dept of Labor keeps reporting.

Originally posted by OptimusSubprime

Good, someone needs to give the rich the incentive to start investing and expanding business so some jobs can finally be created. You know, REAL jobs, not those fake jobs that the Dept of Labor keeps reporting.

what are you talking about , george w bush gave trillions in tax cuts, gave crap loads of money to the job creators. where are these jobs ? you seem to think more money in the hands of the job creators equals more jobs.

if you are talking about the jobs created at over sea banks where they hide the trillions, then i understand what you are getting at.

btw i paid taxes when i was 12, 14 and have paid taxes every year since i was 16.

i just dont fall for all the political lies and propaganda that many people on both sides seem to believe.

edit on 2-8-2012 by elitegamer23

because: (no reason given)

Originally posted by RealSpoke

Not very surprising. No one seems to cry when the wealth is redistributed from the poor TO the rich..only the other way around. Haven't conservatives learned by now that nothing trickles down? Even if there were a free market the same principles would be at hand.

They know damn well that it doesn't trickle down. That's the whole point. Themselves and their rich buddies keep all the capital. That's the cornerstone of the Republican platform, and those who vote Republican think that one day they'll be a millionaire too

Romney's plan...

At revenue neutral...which means no fantasy assumptions of "expanding" the amount of taxpayers due to all the trickle-down....everybody making less than 200k pays more...the rich get a cut.

At revenue neutral...which means no fantasy assumptions of "expanding" the amount of taxpayers due to all the trickle-down....everybody making less than 200k pays more...the rich get a cut.

edit on 2-8-2012 by Indigo5 because: (no reason given)

edit on 2-8-2012 by Indigo5 because: (no

reason given)

Originally posted by elitegamer23

Originally posted by OptimusSubprime

Good, someone needs to give the rich the incentive to start investing and expanding business so some jobs can finally be created. You know, REAL jobs, not those fake jobs that the Dept of Labor keeps reporting.

what are you talking about , george w bush gave trillions in tax cuts, gave crap loads of money to the job creators. where are these jobs ? you seem to think more money in the hands of the job creators equals more jobs.

if you are talking about the jobs created at over sea banks where they hide the trillions, then i understand what you are getting at.

btw i paid taxes when i was 12, 14 and have paid taxes every year since i was 16.

i just dont fall for all the political lies and propaganda that many people on both sides seem to believe.edit on 2-8-2012 by elitegamer23 because: (no reason given)

Ah, the old "He's bashing Obama, so by default he must be a Bush supporter" approach. Bush is the worst President in history and should be in jail for treason. Reagan however, was on to something... trickle down economics. It works, and it works well. Statistics show that it works. History shows that it works. Calvin Coolidge was also on to something, You have been working for quite a while, as have I, and I have NEVER worked for someone that made 40, 50, 60 K a year. The business owners are the rich, or almost rich, and they drive the economic growth of our economy by investing, expanding business and taking risks. All of those things leads to innovation, job creation, new products and services, etc... all as a result of a rich person. The only way a rich person will do any of that is if the boot of the government is off of their neck.

Romney will raise your taxes if you make under 200k. Why are none of the Obama-bashers screaming about it? 200k is small business owners.

Originally posted by beezzer

Romney swats tiny kittens with a spatula.

What a great bumper sticker.

new topics

-

LIVE: Putin inauguration ceremony

Regional Politics: 1 hours ago -

Black kids in the Bronx don't know what the word 'computer' is

People: 3 hours ago -

Aliens and Las Vegas

Aliens and UFOs: 6 hours ago -

This is what it is all about

US Political Madness: 6 hours ago -

Malls, Music, Monoculture, Decline

Music: 9 hours ago

top topics

-

Breaking--Hamas Accepts New Cease Fire

Middle East Issues: 17 hours ago, 13 flags -

This is what it is all about

US Political Madness: 6 hours ago, 7 flags -

FBI confirms new leads connected to DNA evidence and cellphone data in disturbing killings of elderl

Other Current Events: 17 hours ago, 6 flags -

Black kids in the Bronx don't know what the word 'computer' is

People: 3 hours ago, 4 flags -

Sweet Home Alabama (metal cover by Leo Moracchioli)

Music: 14 hours ago, 4 flags -

Which chapter of the apocalypse is raining fish?

Jokes, Puns, & Pranks: 13 hours ago, 3 flags -

LIVE: Putin inauguration ceremony

Regional Politics: 1 hours ago, 2 flags -

Moyes No Longer Blowing Bubbles

World Sports: 17 hours ago, 2 flags -

Aliens and Las Vegas

Aliens and UFOs: 6 hours ago, 1 flags -

Malls, Music, Monoculture, Decline

Music: 9 hours ago, 1 flags

active topics

-

Really Unexplained

General Chit Chat • 160 • : Beesnestbomber -

Black kids in the Bronx don't know what the word 'computer' is

People • 3 • : DAVID64 -

Medvedev: “No one can hide, a global catastrophe is coming”

World War Three • 217 • : andy06shake -

Time Traveler Caught on Camera?

Paranormal Studies • 34 • : TheMisguidedAngel -

Aliens and Las Vegas

Aliens and UFOs • 5 • : Skinnerbot -

Breaking--Hamas Accepts New Cease Fire

Middle East Issues • 180 • : network dude -

Doctors Predict Epidemic of Prion Brain Diseases From mRna Jab

Health & Wellness • 70 • : chr0naut -

Israeli strikes on southern Gaza city of Rafah kill 22, mostly children, as US advances aid package

Middle East Issues • 161 • : Lazy88 -

The BEAST System of Revelation has been awoken and has assumed control, at least since COVID.

New World Order • 19 • : chr0naut -

LIVE: Putin inauguration ceremony

Regional Politics • 0 • : gortex