It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

Silicon Valley Bank collapsed Friday morning after a stunning 48 hours in which its capital crisis set off fears of a meltdown across the banking

industry. Silicon Valley Bank, one of the tech sector’s favorite lenders, has shut down after members attempt to withdraw their funds. California

Department of Financial Protection and Innovation announced Friday that it was taking over and closing the distressed bank to protect deposits, naming

the Federal Deposit Insurance Corporation as its receiver. The Federal Deposit Insurance Corporation says it has seized control of Silicon Valley

Bank, confirming the lender was shut down by California regulators amid a run on the bank. The FDIC in turn formed a separate entity where all insured

SVB deposits would be transferred.

When will more banks follow?

www.wsj.com...

www.nbcnews.com...

www.cnn.com...

www.foxbusiness.com...#&_intcmp=fnhpbt4,hp1bt

When will more banks follow?

www.wsj.com...

www.nbcnews.com...

www.cnn.com...

www.foxbusiness.com...#&_intcmp=fnhpbt4,hp1bt

edit on

v382023Fridaypm31America/ChicagoFri, 10 Mar 2023 12:38:36 -06001 by Violater1 because: kofui

a reply to: Violater1

I have been expecting another domino to fall.

Four Biggest U.S. Banks Lose $52 Billion in Market Value

I have been expecting another domino to fall.

Four Biggest U.S. Banks Lose $52 Billion in Market Value

The four biggest U.S. banks lost $52 billion of market value Thursday, part of a broad rout across financial stocks. Bank investors were spooked by SVB Financial Group's decision to sell a large chunk of its securities portfolio at a $1.8 billion loss as it deals with an outflow of deposits, which more than halved the technology-focused bank's stock.[/ex

www.wsj.com...

a reply to: NightSkyeB4Dawn

Housing is setting up to crash again too, and this time the big speculators are holding lots of empty inventory.

Housing is setting up to crash again too, and this time the big speculators are holding lots of empty inventory.

originally posted by: ketsuko

a reply to: NightSkyeB4Dawn

Housing is setting up to crash again too, and this time the big speculators are holding lots of empty inventory.

Give the houses to the homeless, leave the bankers to fend for themselves deserted in the wilderness, and establish a new currency. This fractional inflationary one is garbagola.

originally posted by: NightSkyeB4Dawn

I have been expecting another domino to fall.

Four Biggest U.S. Banks Lose $52 Billion in Market Value.

The four largest US banks have over $11trillion in assets, $52billion is only .005% of that.

edit on 10-3-2023 by AugustusMasonicus because: Help me....I'm clotting up at altitude!

originally posted by: ketsuko

a reply to: NightSkyeB4Dawn

Housing is setting up to crash again too, and this time the big speculators are holding lots of empty inventory.

I think you are dead on in your assertion.

a reply to: Violater1

Could it cause contagion among other banks? Quite possible!

I sold my Citizens Financial Group (CFG) stock for a 28% loss today #oof but made back more than that on my Nividia short, QID & SDS long profits.

Could it cause contagion among other banks? Quite possible!

I sold my Citizens Financial Group (CFG) stock for a 28% loss today #oof but made back more than that on my Nividia short, QID & SDS long profits.

edit on 10-3-2023 by FamCore because: (no reason given)

originally posted by: AugustusMasonicus

originally posted by: NightSkyeB4Dawn

I have been expecting another domino to fall.

Four Biggest U.S. Banks Lose $52 Billion in Market Value.

The four largest US banks have over $11trillion in assets, $52billion is only .005% of that.

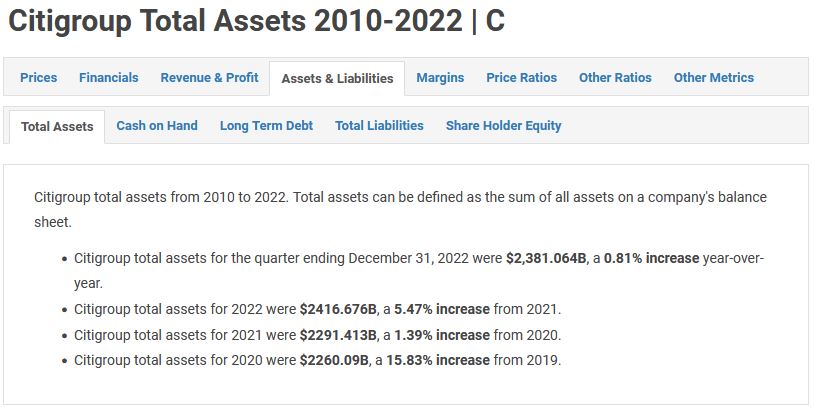

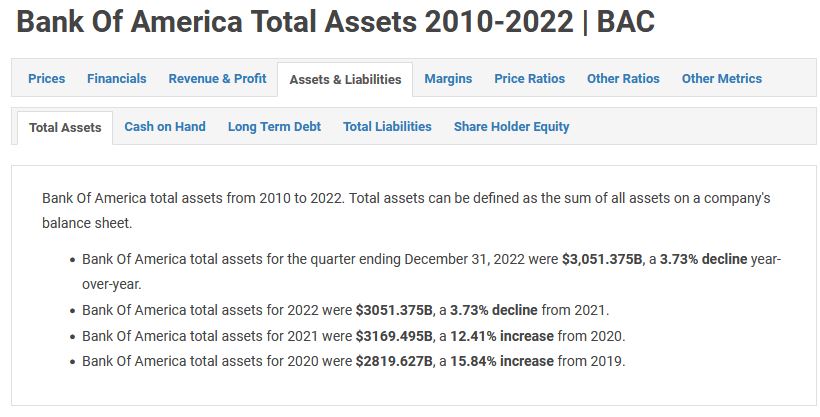

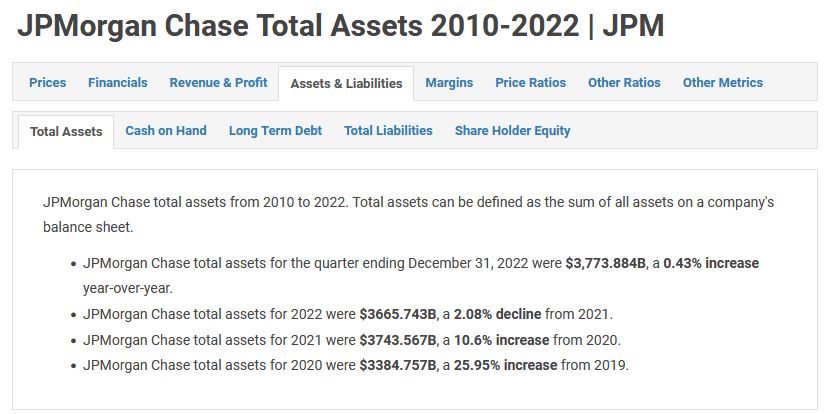

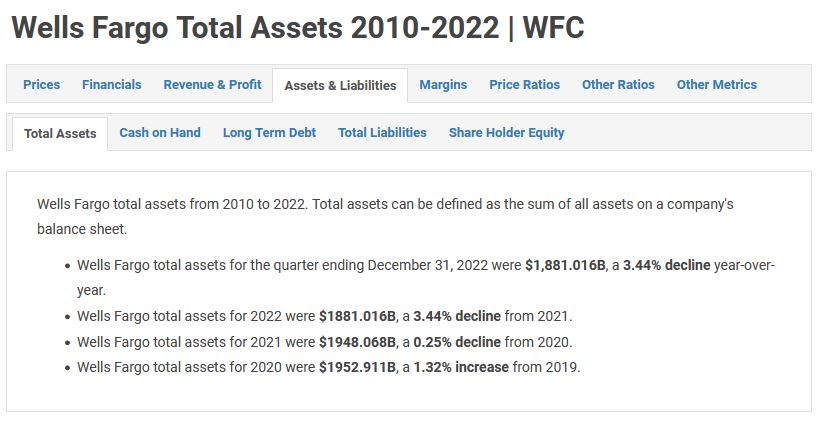

I thought your figure was high, so i looked at

www.macrotrends.net...

www.macrotrends.net...

www.macrotrends.net...

www.macrotrends.net...

As you can read, their total assets are only about 8,945.148 Billion.

Can you please provide a link to your 11 Trillion.

Also, noted above, that 2 of the big banks have been loosing over 3% a year.

JP Morgan, Well Fargo, Bank of America potentially exposed to Samuel Bankman-Fried’s FTX exchange.

www.fxstreet.com... 0001

edit on v572023Fridaypm31America/ChicagoFri, 10 Mar 2023 13:57:33 -06001 by Violater1 because: fezy math

originally posted by: Violater1

Can you please provide a link to your 11 Trillion.

Yeah, your own sources. Try adding correctly:

Citi $2.4416

BoA: $3.051

JPM: $3.665

WF: $1.881

Total $11.013

And if you opt for the 22 Q4 figures it's another $70billion meaning that rounding error is worth more than this entire bank in the Original Post.

edit on 10-3-2023 by AugustusMasonicus because: DEY. TERK. YER. ELERKJERN. AGERN!!!!!

originally posted by: AugustusMasonicus

originally posted by: Violater1

Can you please provide a link to your 11 Trillion.

Yeah, your own sources. Try adding correctly:

Citi $2.4416

BoA: $3.051

JPM: $3.665

WF: $1.881

Total $11.013

And if you opt for the 22 Q4 figures it's another $70billion meaning that rounding error is worth more than this entire bank in the Original Post.

Your still wrong.

I erroneously left out Wells Fargo. Regardless, I'm using the quarter ending in December of 2022. The numbers shown by Macrotrends are in BILLIONS, not Trillions.

originally posted by: Violater1

I erroneously left out Wells Fargo. Regardless, I'm using the quarter ending in December of 2022. The numbers shown by Macrotrends are in BILLIONS, not Trillions.

LOL. FFS.

Citi's 2.416 billion is $2,416,000,000,000.

And like I already said, it's even higher using the 22 Q4 numbers. Winning!

edit on 10-3-2023 by AugustusMasonicus because: DEY. TERK. YER. ELERKJERN. AGERN!!!!!

originally posted by: v1rtu0s0

www.thegatewaypundit.com...

Thank you for your contribution.

This wasn’t the first time Cramer led investors off a cliff.

Jim Cramer fanatically encouraged investors to keep their money with Bear Stearns right after two of its highly leveraged hedge funds collapsed and it needed to be bailed out during the 2008 liquidity crisis.

“Bear Stearns is fine! Do not take your money out!” Cramer shouted on his “Mad Money” show on March 11, 2008. “Bear Stearns is not in trouble!”

Five or six days later Bear Stearns was bailed out for $2 per share.

edit on v322023Fridaypm31America/ChicagoFri, 10 Mar 2023 15:32:41 -06001

by Violater1 because: u8t76

new topics

-

Only two Navy destroyers currently operational as fleet size hits record low

Military Projects: 8 hours ago

top topics

-

George Stephanopoulos and ABC agree to pay $15 million to settle Trump defamation suit

Mainstream News: 13 hours ago, 17 flags -

Only two Navy destroyers currently operational as fleet size hits record low

Military Projects: 8 hours ago, 7 flags

active topics

-

One out of every 20 Canadians Dies by Euthanasia

Medical Issues & Conspiracies • 25 • : fos613 -

Only two Navy destroyers currently operational as fleet size hits record low

Military Projects • 2 • : Bluntone22 -

They Know

Aliens and UFOs • 89 • : fos613 -

Pelosi injured in Luxembourg

Other Current Events • 37 • : fos613 -

More Bad News for Labour and Rachel Reeves Stole Christmas from Working Families

Regional Politics • 3 • : Bilbous72 -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 3695 • : RelSciHistItSufi -

Encouraging News Media to be MAGA-PAF Should Be a Top Priority for Trump Admin 2025-2029.

Education and Media • 90 • : Coelacanth55 -

Nov 2024 - Former President Barack Hussein Obama Has Lost His Aura.

US Political Madness • 16 • : Coelacanth55 -

Mood Music Part VI

Music • 3735 • : BrucellaOrchitis -

A Bunch of Maybe Drones Just Flew Across Hillsborough County

Aircraft Projects • 83 • : charlyv