It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

Disclaimer: I had to alter the article title because it was too long for ATS. I tried to keep the spirit of the title the same though.

The tax cuts were supposed to be ‘rocket fuel’ for the economy. Since they passed, the markets are down.

Remember those tax cuts that were supposed to usher in 4% of yearly economic growth? Yeah, so that hasn't happened. In FACT, the markets are showing negative growth right now.

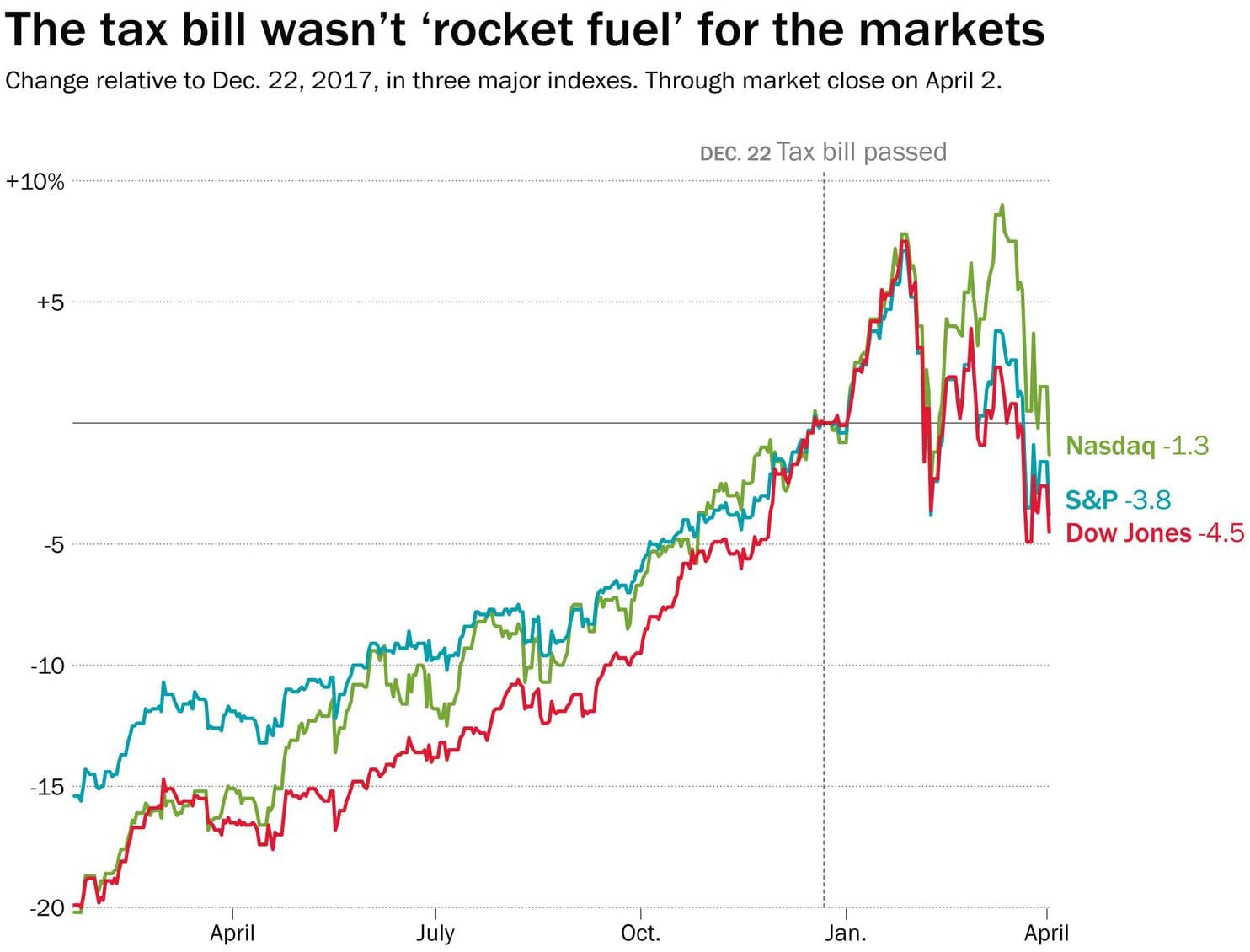

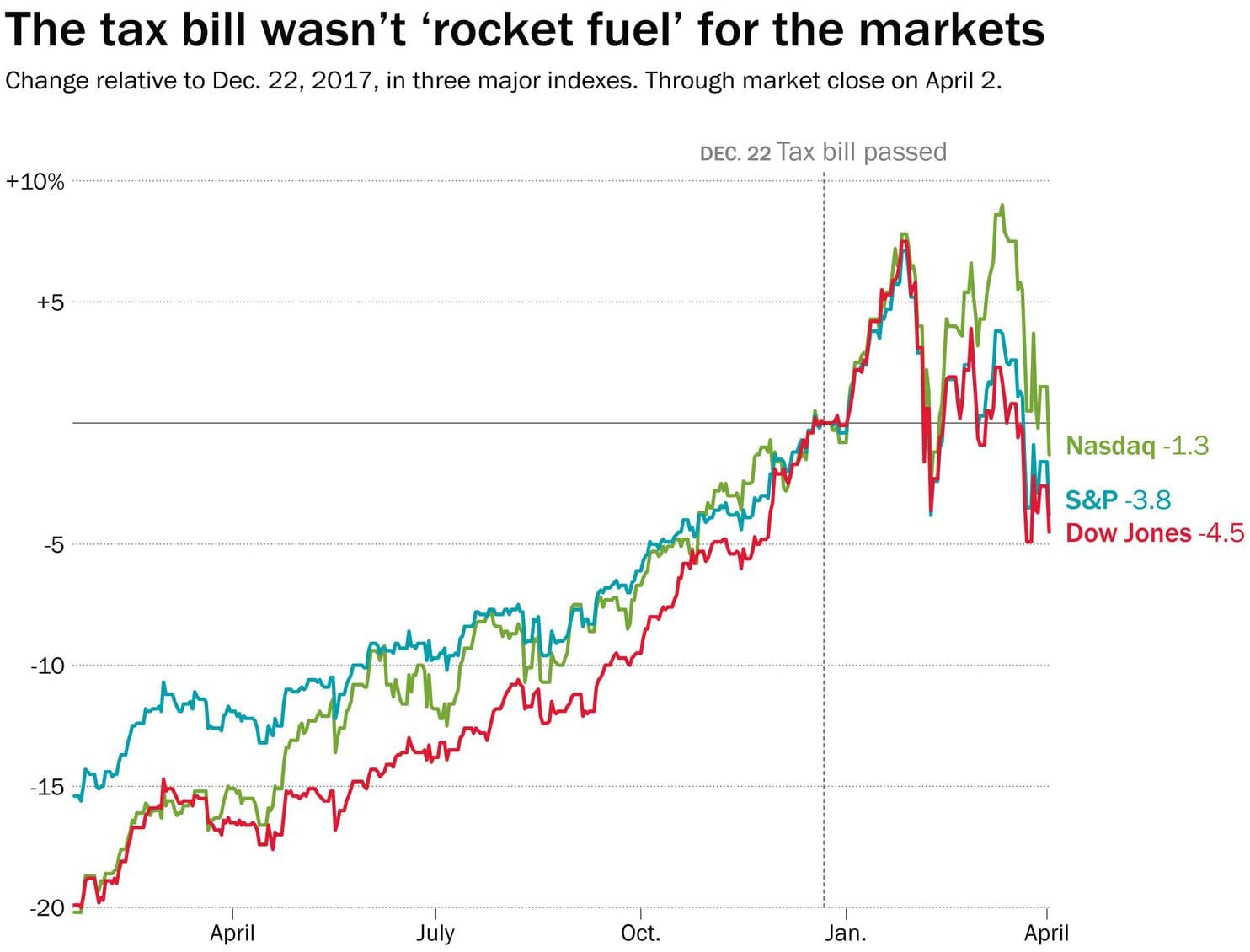

Here's one of the many economic graphs posted in this article

As you can see there is steady growth all the way up to Trump's tax cuts. Then a month later, a bunch of volatility. It's not like we didn't call this back when Trump and Republican Congressmen were ramrodding this bill through Congress before anyone could read it. When your economy is at near full employment, squeezing any more juice out of it is a just wasted effort. Of course this is yet ANOTHER example of supply side economics being a huge disaster for the country. Fortunately we haven't hit a recession yet, but I wouldn't be surprised if one is around the corner in a few years. I said it then and I'm going to repeat it now: Fixing something that isn't broken is STUPID!

Now we all have to deal with the consequences of conservatives voting themselves more (debt financed; can't forget that this bill adds over a trillion dollars to the national debt too) money instead of sticking to their principles about fiscal responsibility.

PS: This isn't the Democrats' fault.

The tax cuts were supposed to be ‘rocket fuel’ for the economy. Since they passed, the markets are down.

Remember those tax cuts that were supposed to usher in 4% of yearly economic growth? Yeah, so that hasn't happened. In FACT, the markets are showing negative growth right now.

“We must cut our taxes, reduce economic burdens and restore America’s competitive edge,” Trump said during a November speech in Missouri. “We’re going to do that, too, and it’s already happening. Look what’s happening with our markets. People get it.”

At that point, the Dow Jones was up 21 percent over the course of his presidency, and it would continue spiking upward for the next few weeks. But Trump promised more.

“These massive tax cuts will be rocket fuel,” he said, “rocket fuel for the American economy.”

Trump’s favorite measure for the health of the economy over the course of 2017 was those same markets, which seemed as though they were never again going to go down. Until they did — about 40 days after that rocket-fuel bill was signed into law. In early February, the markets sank, kicking off what has been a prolonged stretch of volatility.

Between Trump’s inauguration and the signing of the tax cut bill, the Dow, S&P and Nasdaq had increased by 19.9 percent, 15.4 percent and 20.2 percent, respectively. After, through the market’s close on Monday, they had fallen by 1.9 percent, 2.2 percent and 2.7 percent.

They went back up Tuesday but were still down since Dec. 22. Between Sept. 11 and Dec. 22, the Dow, the S&P and Nasdaq rose 11 percent, 7 percent and 8 percent, respectively. During the same number of market days after the bill was signed, they were all down.

At close of market on Monday, each measure was off its 52-week high by at least 9 percent. Before the bill’s signing, none of those indexes had been down more than 3.7 percent off its 52-week high.

Here's one of the many economic graphs posted in this article

As you can see there is steady growth all the way up to Trump's tax cuts. Then a month later, a bunch of volatility. It's not like we didn't call this back when Trump and Republican Congressmen were ramrodding this bill through Congress before anyone could read it. When your economy is at near full employment, squeezing any more juice out of it is a just wasted effort. Of course this is yet ANOTHER example of supply side economics being a huge disaster for the country. Fortunately we haven't hit a recession yet, but I wouldn't be surprised if one is around the corner in a few years. I said it then and I'm going to repeat it now: Fixing something that isn't broken is STUPID!

Now we all have to deal with the consequences of conservatives voting themselves more (debt financed; can't forget that this bill adds over a trillion dollars to the national debt too) money instead of sticking to their principles about fiscal responsibility.

PS: This isn't the Democrats' fault.

a reply to: Krazysh0t

I, on the other hand, and both surprised and pleased how little the market has dropped.

Considering that a market correction was due no matter whether there was a tax cut or not, no matter a trade war with China or not, the market seems to me very stable.

Connecting the market dropping to tax cuts is laughable.

I, on the other hand, and both surprised and pleased how little the market has dropped.

Considering that a market correction was due no matter whether there was a tax cut or not, no matter a trade war with China or not, the market seems to me very stable.

Connecting the market dropping to tax cuts is laughable.

edit on 4-4-2018 by nwtrucker because: (no reason given)

I would say it's way to early to judge the effectiveness of the tax cuts.

Market was to high to begin with, to many years of the fed pumping money directly into the market coupled with artificially suppressed interest rates

screwed any middle class person that put money away.

I am much happier to see soft corrections than a continued fake rise in the numbers followed by a sudden big correction.

I am much happier to see soft corrections than a continued fake rise in the numbers followed by a sudden big correction.

I am not surprised. Tax cuts are actually a disincentive to work harder. If you can work less and still make the same amount of money that is what you

are going to do. Of course some people just want more and more money, even if they don't need it, but most people are content if they have enough to

remain secure.

Ah, I see this is Jeff Bezos' retaliation in the Trump/Amazon feud.

Lemme know when there's legitimate news.

ETA: and "Rocket fuel". Nice indirect reference to Blue Origin.

Lemme know when there's legitimate news.

ETA: and "Rocket fuel". Nice indirect reference to Blue Origin.

edit on 4-4-2018 by Wardaddy454 because: (no reason given)

originally posted by: nwtrucker

a reply to: Krazysh0t

I, on the other hand, and both surprised and pleased how little the market has dropped.

This is nice, but we aren't that far removed from the tax cuts passing yet. It took 7 years for Bush' tax cuts to break our economy. And while we were riding high that entire time, the reckoning DID come and it hurt IMMENSELY.

Considering that a market correction was due no matter whether there was a tax cut or not, no matter a trade war with China or not, the market seems to me very stable.

Connecting the market dropping to tax cuts is laughable.

Actually it is more likely due to Trump's ongoing shenanigans and desire to start trade wars, but the point of the thread is to show that Trump's promises for the economy aren't materializing.

originally posted by: Bluntone22

I would say it's way to early to judge the effectiveness of the tax cuts.

So where is the promised 4% growth? You do know that in order to see such high growth the volatility we are experiencing now goes a long way to making it impossible right?

originally posted by: Wardaddy454

Ah, I see this is Jeff Bezos' retaliation in the Trump/Amazon feud.

Lemme know when there's legitimate news.

ETA: and "Rocket fuel". Nice indirect reference to Blue Origin.

Are you seriously calling real stock graphs and charts propaganda? Does that sand scratch your ears with your head shoved in it all the time?

originally posted by: shooterbrody

a reply to: Krazysh0t

PS: This isn't the Democrats' fault.

We know that.

It will be rubbed in their faces starting around the summer time.

Will they be honest and run on raising taxes for the midterms k?

I for one hope they do.

I hope they do too. I've been saying we needed to raise taxes not lower them since we started discussing this stupid tax cut last year.

originally posted by: Krazysh0t

originally posted by: nwtrucker

a reply to: Krazysh0t

I, on the other hand, and both surprised and pleased how little the market has dropped.

This is nice, but we aren't that far removed from the tax cuts passing yet. It took 7 years for Bush' tax cuts to break our economy. And while we were riding high that entire time, the reckoning DID come and it hurt IMMENSELY.

Considering that a market correction was due no matter whether there was a tax cut or not, no matter a trade war with China or not, the market seems to me very stable.

Connecting the market dropping to tax cuts is laughable.

Actually it is more likely due to Trump's ongoing shenanigans and desire to start trade wars, but the point of the thread is to show that Trump's promises for the economy aren't materializing.

Oh, the Bush tax cuts broke the economy.

So we're just gonna ignore Fanny Mae and Freddie mac, that Barney Frank ignored the signs, and Republicans asking for more regulations on them?

originally posted by: Krazysh0t

originally posted by: nwtrucker

a reply to: Krazysh0t

I, on the other hand, and both surprised and pleased how little the market has dropped.

This is nice, but we aren't that far removed from the tax cuts passing yet. It took 7 years for Bush' tax cuts to break our economy. And while we were riding high that entire time, the reckoning DID come and it hurt IMMENSELY.

Considering that a market correction was due no matter whether there was a tax cut or not, no matter a trade war with China or not, the market seems to me very stable.

Connecting the market dropping to tax cuts is laughable.

Actually it is more likely due to Trump's ongoing shenanigans and desire to start trade wars, but the point of the thread is to show that Trump's promises for the economy aren't materializing.

Even more laughable.

originally posted by: Krazysh0t

originally posted by: Bluntone22

I would say it's way to early to judge the effectiveness of the tax cuts.

So where is the promised 4% growth? You do know that in order to see such high growth the volatility we are experiencing now goes a long way to making it impossible right?

It has been 3 months.

originally posted by: Krazysh0t

originally posted by: Wardaddy454

Ah, I see this is Jeff Bezos' retaliation in the Trump/Amazon feud.

Lemme know when there's legitimate news.

ETA: and "Rocket fuel". Nice indirect reference to Blue Origin.

Are you seriously calling real stock graphs and charts propaganda? Does that sand scratch your ears with your head shoved in it all the time?

I'll let you know, as soon as you get done sniffing the air coming from certain derrières.

originally posted by: Bluntone22

originally posted by: Krazysh0t

originally posted by: Bluntone22

I would say it's way to early to judge the effectiveness of the tax cuts.

So where is the promised 4% growth? You do know that in order to see such high growth the volatility we are experiencing now goes a long way to making it impossible right?

It has been 3 months.

And only the first phase.

originally posted by: Bluntone22

originally posted by: Krazysh0t

originally posted by: Bluntone22

I would say it's way to early to judge the effectiveness of the tax cuts.

So where is the promised 4% growth? You do know that in order to see such high growth the volatility we are experiencing now goes a long way to making it impossible right?

It has been 3 months.

Do you even have conceptual idea of what a 4% growth graph will look like? You know that slope you see pre-tax cuts in the graph I posted? It would be MUCH MUCH steeper and set backs like recently would go against that promise. Keep in mind that in order for these "taxes to pay for themselves" we need to have that 4% growth (actually I'm pretty sure that is only to MERELY see the $1 trillion in debt added, but things are dicey there). The fact is that you just can't admit that the tax cuts were a bad idea.

edit on 4-4-2018 by Krazysh0t because: (no reason given)

originally posted by: Edumakated

a reply to: Krazysh0t

Ummm... you do realize markets react to more than just one variable, right?

So tell me. What's causing the volatility if not for Trump?

new topics

-

Where should Trump hold his next rally

Politicians & People: 23 minutes ago -

Shocking Number of Voters are Open to Committing Election Fraud

US Political Madness: 1 hours ago -

Gov Kristi Noem Shot and Killed "Less Than Worthless Dog" and a 'Smelly Goat

2024 Elections: 1 hours ago -

Falkville Robot-Man

Aliens and UFOs: 2 hours ago -

James O’Keefe: I have evidence that exposes the CIA, and it’s on camera.

Whistle Blowers and Leaked Documents: 2 hours ago -

Australian PM says the quiet part out loud - "free speech is a threat to democratic dicourse"...?!

New World Order: 3 hours ago -

Ireland VS Globalists

Social Issues and Civil Unrest: 4 hours ago -

Biden "Happy To Debate Trump"

2024 Elections: 4 hours ago -

RAAF airbase in Roswell, New Mexico is on fire

Aliens and UFOs: 4 hours ago -

What is the white pill?

Philosophy and Metaphysics: 6 hours ago

top topics

-

A Warning to America: 25 Ways the US is Being Destroyed

New World Order: 14 hours ago, 21 flags -

Blast from the past: ATS Review Podcast, 2006: With All Three Amigos

Member PODcasts: 6 hours ago, 11 flags -

Mike Pinder The Moody Blues R.I.P.

Music: 7 hours ago, 8 flags -

Biden "Happy To Debate Trump"

2024 Elections: 4 hours ago, 8 flags -

Australian PM says the quiet part out loud - "free speech is a threat to democratic dicourse"...?!

New World Order: 3 hours ago, 7 flags -

James O’Keefe: I have evidence that exposes the CIA, and it’s on camera.

Whistle Blowers and Leaked Documents: 2 hours ago, 6 flags -

What is the white pill?

Philosophy and Metaphysics: 6 hours ago, 5 flags -

Ireland VS Globalists

Social Issues and Civil Unrest: 4 hours ago, 4 flags -

RAAF airbase in Roswell, New Mexico is on fire

Aliens and UFOs: 4 hours ago, 4 flags -

Putin, Russia and the Great Architects of the Universe

ATS Skunk Works: 10 hours ago, 3 flags

active topics

-

Shocking Number of Voters are Open to Committing Election Fraud

US Political Madness • 2 • : xuenchen -

Candidate TRUMP Now Has Crazy Judge JUAN MERCHAN After Him - The Stormy Daniels Hush-Money Case.

Political Conspiracies • 810 • : Annee -

Where should Trump hold his next rally

Politicians & People • 3 • : theatreboy -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media • 301 • : burritocat -

Do you ever just get "bored" of everything?

Rant • 22 • : JonnyC555 -

Biden "Happy To Debate Trump"

2024 Elections • 36 • : DontTreadOnMe -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 701 • : Thoughtful3 -

This is our Story

General Entertainment • 2 • : ByeByeAmericanPie -

Mike Pinder The Moody Blues R.I.P.

Music • 2 • : DontTreadOnMe -

The functionality of boldening and italics is clunky and no post char limit warning?

ATS Freshman's Forum • 14 • : Encia22