It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

This story is from mid 2017, it is an opinion column in The Guardian.

Trump's way of making the case it seems, he did something similar when backing out of the climate 'accord' rather than a good rubust reason to do so.

The ASCE have made their take on the cost,

Trump's working plan is way out,

It's been faulted in a big way because this is only an attraction to big developers in new works and who only see to cream profits, it won't help the vast majority of infrastructure repairs and maintenance, which are needed more than anything, and developers will not be interested, while it will not help rural communities and and towns either.

It would though, help fill the pockets of those developers and the investors.

The opinion say,

Makes sense to me, everyone pay their taxes...including the big boys, everyone gets their reward.

Read on,

www.theguardian.com...

Trump's way of making the case it seems, he did something similar when backing out of the climate 'accord' rather than a good rubust reason to do so.

At a roundtable discussion with state transportation officials on Friday, Donald Trump said America’s ageing roads, bridges, railways, and water systems were being “scoffed at and laughed” at. He pledged that they “will once again be the envy of the world”. This seems to be a core theme for Trump: America’s greatness depends on others envying us rather than scoffing and laughing at us.

The ASCE have made their take on the cost,

The American Society of Civil Engineers, giving America’s overall infrastructure a grade of D-plus, says we would need to spend $3.6tn by 2020 to bring it up to par.

Trump's working plan is way out,

His “$1tn infrastructure plan”, unveiled last week, doesn’t amount to $1tn of new federal investment in infrastructure. It would commit $200bn of federal dollars over ten years, combined with about $800bn of assorted tax breaks to get developers to build things instead of the federal government doing it.

It's been faulted in a big way because this is only an attraction to big developers in new works and who only see to cream profits, it won't help the vast majority of infrastructure repairs and maintenance, which are needed more than anything, and developers will not be interested, while it will not help rural communities and and towns either.

It would though, help fill the pockets of those developers and the investors.

The opinion say,

Sorry, Donald. The only way we get this is if big corporations and the wealthy pay their fair share of taxes to support it.

Makes sense to me, everyone pay their taxes...including the big boys, everyone gets their reward.

Read on,

www.theguardian.com...

It would commit $200bn of federal dollars over ten years, combined with about $800bn of assorted tax breaks to get developers to build things instead of the federal government doing it.

Explain to me how that's a giveaway?

The tax break doesn't give anything.

It lets people who work for their money keep more of it.

edit on 13-2-2018 by neo96 because: (no reason given)

Damn it jobs and profits again, we can't have any of that. Free stuff we need more FREE STUFF !

Anyway lets fix stuff instead of free stuff for foreigners!

Anyway lets fix stuff instead of free stuff for foreigners!

a reply to: mikell

"The Rich" always benefit the most when the government spends $$$ on projects or programs. Even increasing Welfare programs creates nice profits for those who are in charge of doling out the bread crumbs.

Works like this in Capitalist, Socialist, and Communist societies.

"The Rich" always benefit the most when the government spends $$$ on projects or programs. Even increasing Welfare programs creates nice profits for those who are in charge of doling out the bread crumbs.

Works like this in Capitalist, Socialist, and Communist societies.

This is more a conservative plan. Not taking tax dollars from people and getting things done. The business will need to hire workers, the new

workers will pay taxes, buy goods and services.

Lol, so when did the government not taking peoples money and things getting done, became a bad thing?

Lol, so when did the government not taking peoples money and things getting done, became a bad thing?

a reply to: Oldtimer2

From 2015:

“Sanders, the ranking member of the Senate Budget Committee, had argued his plan was “deficit neutral.” Hundreds of billions in new spending would have been offset by closing a number of corporate tax breaks that allow some major companies to escape paying taxes or stash profits overseas. But Republicans objected and said a large tax increase on business was not the right economic plan. They want to create a new “deficit neutral reserve fund” to supplement federal infrastructure spending.

”

www.thefiscaltimes.com...

From 2015:

“Sanders, the ranking member of the Senate Budget Committee, had argued his plan was “deficit neutral.” Hundreds of billions in new spending would have been offset by closing a number of corporate tax breaks that allow some major companies to escape paying taxes or stash profits overseas. But Republicans objected and said a large tax increase on business was not the right economic plan. They want to create a new “deficit neutral reserve fund” to supplement federal infrastructure spending.

”

www.thefiscaltimes.com...

originally posted by: SocratesJohnson

This is more a conservative plan. Not taking tax dollars from people and getting things done. The business will need to hire workers, the new workers will pay taxes, buy goods and services.

Why give the business tax breaks to the extent of 82 cents for each dollar...Oh! I get it, you only read the headline!

originally posted by: neo96

It would commit $200bn of federal dollars over ten years, combined with about $800bn of assorted tax breaks to get developers to build things instead of the federal government doing it.

Explain to me how that's a giveaway?

The tax break doesn't give anything.

It lets people who work for their money keep more of it.

Doh!

this should suprise me, but not anymore. Liberals want an infrastructure bill. Trump agrees. Puts together a first draft, and asks for ideas on

funding. The left #s on Trumps "stupid plan".

If the assholes on the left would pull their heads out of their backsides long enough to smell something other than their own #, they might realize that not EVERYTHING Trump does is some sinister plot to make his cronies rich. But when all you are smart enough to hold is a hammer, you get all excited that EVERYTHING looks like a nail.

Quit being stupid.

If the assholes on the left would pull their heads out of their backsides long enough to smell something other than their own #, they might realize that not EVERYTHING Trump does is some sinister plot to make his cronies rich. But when all you are smart enough to hold is a hammer, you get all excited that EVERYTHING looks like a nail.

Quit being stupid.

a reply to: smurfy

"Sorry, Donald. The only way we get this is if big corporations and the wealthy pay their fair share of taxes to support it."

They a;ready pay the majority of taxes.

Pew

And up until Trump, the US corporate tax rates was one of the highest on Earth.

Sorry, but your opinion piece and your OP is a scam.

"Sorry, Donald. The only way we get this is if big corporations and the wealthy pay their fair share of taxes to support it."

They a;ready pay the majority of taxes.

A Pew Research Center analysis of IRS data from 2015, the most recent available, shows that taxpayers with incomes of $200,000 or more paid well over half (58.8%) of federal income taxes, though they accounted for only 4.5% of all returns filed (6.8% of all taxable returns).

By contrast, taxpayers with incomes below $30,000 filed nearly 44% of all returns but paid just 1.4% of all federal income tax – in fact, two-thirds of the nearly 66 million returns filed by people in that lowest income tier owed no tax at all. (The IRS tax data used here are estimates based on a stratified probability sample of all returns.)

Pew

And up until Trump, the US corporate tax rates was one of the highest on Earth.

Sorry, but your opinion piece and your OP is a scam.

originally posted by: MOMof3

a reply to: Oldtimer2

From 2015:

“Sanders, the ranking member of the Senate Budget Committee, had argued his plan was “deficit neutral.” Hundreds of billions in new spending would have been offset by closing a number of corporate tax breaks that allow some major companies to escape paying taxes or stash profits overseas. But Republicans objected and said a large tax increase on business was not the right economic plan. They want to create a new “deficit neutral reserve fund” to supplement federal infrastructure spending.

”

www.thefiscaltimes.com...

Yes, that was very short-sightedness on the part of the GOP members, Yet Bernie's plan was still only a six year period, and very sensible, everybody would pay, contractors would do the work...and his idea was to fix the infrastructure in danger, not to line pockets with big money from tolls from fancy new structures in certain places.

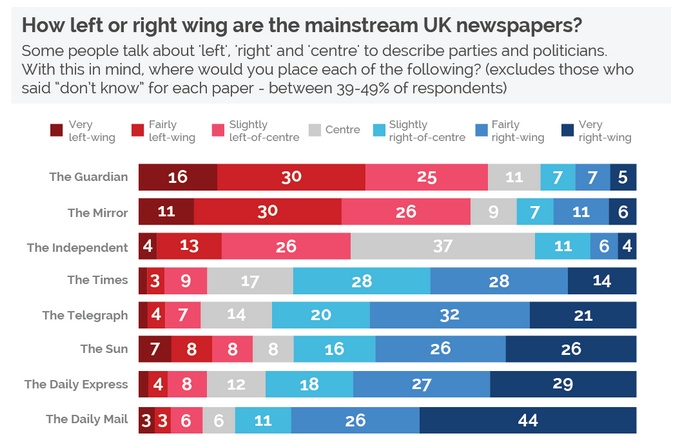

...it is an opinion column in The Guardian...

Enough said...

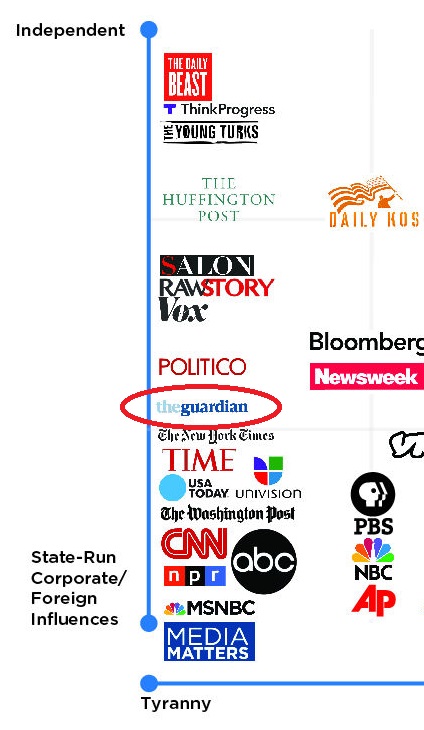

Another 'Scam Alert': the MSM is anything BUT a credible source of truth.

NOT drinking the KoolAid...

Fake News And Propaganda - Is The Guardian In Bed With The Deep State?

This was state ideology masquerading as robust reporting; in Britain’s ‘flagship’ newspaper of liberal journalism, no less...

The Guardian, MI5 And State Propaganda

This suggests that respected liberal media like the New York Times and Guardian are key battlegrounds in the relentless elite efforts to control public opinion. When the Guardian Media Group is owned by The Scott Trust Limited, a 'profit-seeking enterprise'?

When the paper is thus owned and run by an elite group of individuals with links to banking, insurance, advertising, multinational consumer goods, telecommunications, information technology, venture investment, corporate media, marketing services and other sectors of the establishment?

A Liberal Pillar Of The Establishment – ‘New Look’ Guardian, Old-Style Orthodoxy

The mainstream media appears to serve multiple functions. First, to distribute information that the controlling cabal wants you to believe is real news. Secondly, to assist in the cover-up of information that has leaked out through other sources. In other words, Damage Control. Thirdly, as a weapon to assassinate the characters of those who expose the practices of the Establishment. Also, to act as a firewall to prevent information detrimental to the elite's control from reaching the public. Finally, to continue to reinforce mainstream accounts of current and historical events. The mainstream news essentially serves as a primary tool for social conditioning or mind-control.

"It is through the press and the media that the lie is penetrating through to the masses," declared Professor Marrs. The media is used as a weapon. So when you watch, read, or listen to mainstream news, ask yourself, "what will the CFR like me to believe today?"

Centralized Control of History, Media, and Academia

edit on 2.13.2018 by Murgatroid because: Felt like it...

a reply to: network dude

LIES! We all know that Trump is an evil douche-bag with not a single good bone in his body! And everything he does, IS in fact rooted with sinister intentions!

*pulls out pitchfork*

they might realize that not EVERYTHING Trump does is some sinister plot to make his cronies rich

LIES! We all know that Trump is an evil douche-bag with not a single good bone in his body! And everything he does, IS in fact rooted with sinister intentions!

*pulls out pitchfork*

originally posted by: LesMisanthrope

a reply to: smurfy

"Sorry, Donald. The only way we get this is if big corporations and the wealthy pay their fair share of taxes to support it."

They a;ready pay the majority of taxes.

A Pew Research Center analysis of IRS data from 2015, the most recent available, shows that taxpayers with incomes of $200,000 or more paid well over half (58.8%) of federal income taxes, though they accounted for only 4.5% of all returns filed (6.8% of all taxable returns).

By contrast, taxpayers with incomes below $30,000 filed nearly 44% of all returns but paid just 1.4% of all federal income tax – in fact, two-thirds of the nearly 66 million returns filed by people in that lowest income tier owed no tax at all. (The IRS tax data used here are estimates based on a stratified probability sample of all returns.)

Pew

And up until Trump, the US corporate tax rates was one of the highest on Earth.

Sorry, but your opinion piece and your OP is a scam.

I believe you are correct about the corporate tax rate, but that does not mean the corporations actually pay for it.

That is where tax incidence comes in to play. In the end, it is the consumers that pay those tax burdens.

a reply to: introvert

Clearly there are credits and provisions they take advantage of. Otherwise there would be no sense in doing corporate business in the US.

I believe you are correct about the corporate tax rate, but that does not mean the corporations actually pay for it.

Clearly there are credits and provisions they take advantage of. Otherwise there would be no sense in doing corporate business in the US.

new topics

-

Only two Navy destroyers currently operational as fleet size hits record low

Military Projects: 9 hours ago

top topics

-

George Stephanopoulos and ABC agree to pay $15 million to settle Trump defamation suit

Mainstream News: 15 hours ago, 17 flags -

Only two Navy destroyers currently operational as fleet size hits record low

Military Projects: 9 hours ago, 8 flags

active topics

-

George Stephanopoulos and ABC agree to pay $15 million to settle Trump defamation suit

Mainstream News • 12 • : TzarChasm -

Encouraging News Media to be MAGA-PAF Should Be a Top Priority for Trump Admin 2025-2029.

Education and Media • 91 • : TzarChasm -

More Bad News for Labour and Rachel Reeves Stole Christmas from Working Families

Regional Politics • 4 • : gortex -

One out of every 20 Canadians Dies by Euthanasia

Medical Issues & Conspiracies • 25 • : fos613 -

Only two Navy destroyers currently operational as fleet size hits record low

Military Projects • 2 • : Bluntone22 -

They Know

Aliens and UFOs • 89 • : fos613 -

Pelosi injured in Luxembourg

Other Current Events • 37 • : fos613 -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 3695 • : RelSciHistItSufi -

Nov 2024 - Former President Barack Hussein Obama Has Lost His Aura.

US Political Madness • 16 • : Coelacanth55 -

Mood Music Part VI

Music • 3735 • : BrucellaOrchitis