It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

When rates are low, stocks will grow

when rates are high, stocks will die

when rates are high, stocks will die

a reply to: intrptr

I am glad that my husband and I pay off our highest interest credit cards and got the lowest interest on the ones we still have.

Things are going to be very interesting after 10 years of low interest rates, after all the regular consumer has not gotten any better, actually most of them has taken cuts after the 2008 housing bubble crash, so we are not prosperous at all.

I am glad that my husband and I pay off our highest interest credit cards and got the lowest interest on the ones we still have.

Things are going to be very interesting after 10 years of low interest rates, after all the regular consumer has not gotten any better, actually most of them has taken cuts after the 2008 housing bubble crash, so we are not prosperous at all.

originally posted by: FamCore

a reply to: mikegrouchy

Can someone PLEASE spell out for me what this means to regular Joe Schmoe?

Does it mean companies have to pay more, so we also have to pay more?

I don't quite get it :/

All that extra funny money that has been printed to try to prop up the economy? This will help sponge it out, but contracting the money supply means that extra money has to be pulled out through extra interest payments on everything.

Anything you finance in the future or anything you have with a variable interest rate, you can expect to see that rate increase now. Those bigger payments will pull that extra cash out, but those of us with the least ability to bear that extra cost will hurt for it the most because it will make everything more expensive.

If the Fed isn't careful, they can cause massive inflation doing this.

a reply to: ketsuko

That is the smart way to keep credit In the positive side, you know how to play the game, my husband and I do it too, but most Americans can not survive without their credit cards for everything, I even started to use more cash this days too.

That is the smart way to keep credit In the positive side, you know how to play the game, my husband and I do it too, but most Americans can not survive without their credit cards for everything, I even started to use more cash this days too.

edit on 16-12-2015 by marg6043 because: (no reason given)

a reply to: mikegrouchy

Haven't looked yet, but I'm guessing oil and gold will continue their slide. Both make me happy as I sold (out of necessity) most of my metals near their highs, and I drive an internal combustion powered vehicle. Planning to start purchasing gold again as it gets near the $850 and down from there I've been patiently awaiting for the past few years.

Haven't looked yet, but I'm guessing oil and gold will continue their slide. Both make me happy as I sold (out of necessity) most of my metals near their highs, and I drive an internal combustion powered vehicle. Planning to start purchasing gold again as it gets near the $850 and down from there I've been patiently awaiting for the past few years.

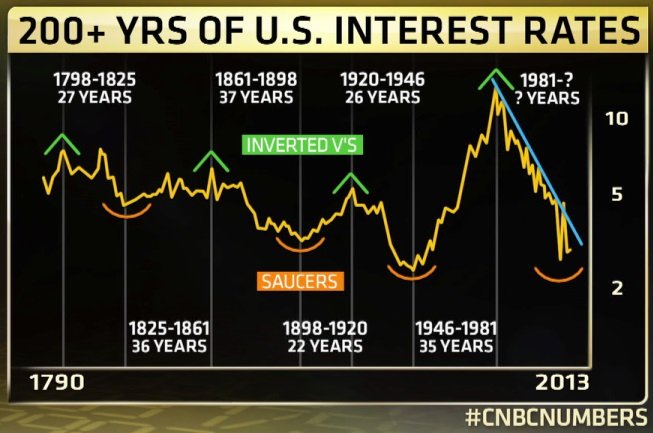

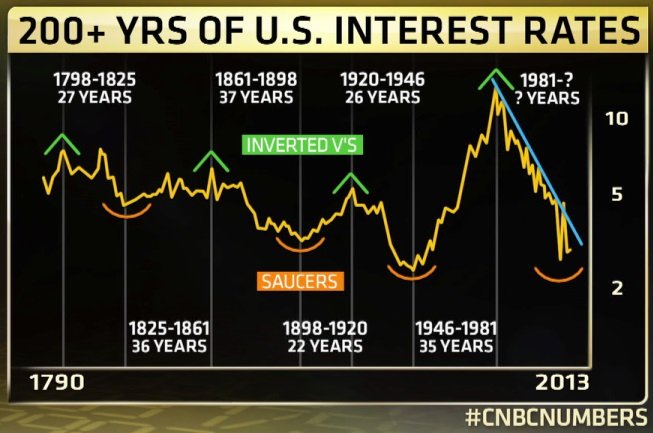

Historically for the last 200 years interest rates have been slightly above 5%. What we have now is a complete aberration. It's not at all normal. And

it hurts a certain group of people. These are not 1%ers or banks, they are older people on a fixed income who have a life savings, the proverbial

"nest egg" that they were going to depend upon for retirement. But with interest rates less than 1% they have had to eat into their capital because

they can't depend on interest for their income. These folks did not invest in stocks because they didn't trust the markets. they just saved every day

of their lives, before there were such things as "401K's" and "IRA's" which are a mixed bag anyway. And with interest rates as they have been their

money is just being eaten away. Yes, I know inflation and interest rates go hand-in-hand, but that is a great big topic best handled elsewhere. I'm

more interested in renewal rates, which have been absolute crap since I retired 10 years ago.

I know people here on ATS are fond of lamenting how poor they are and how rich the banks are, and they don't really care about this group of people until they get there themselves. This minuscule uptick is nothing more than symbolic. It won't do jack for those people.

I know people here on ATS are fond of lamenting how poor they are and how rich the banks are, and they don't really care about this group of people until they get there themselves. This minuscule uptick is nothing more than symbolic. It won't do jack for those people.

a reply to: schuyler

Well that is the bright side - If you start putting your money into things that are supposed to have an interest rate based rate of return, you might soon see some reason to start saving again.

But we have a ways to go before we get there and plenty of pain in between.

Well that is the bright side - If you start putting your money into things that are supposed to have an interest rate based rate of return, you might soon see some reason to start saving again.

But we have a ways to go before we get there and plenty of pain in between.

originally posted by: marg6043

a reply to: ketsuko

Bingo!!!!!!!!!, wait when it starts to hit the consumers, I expect people to hold more to what they have, rather than going on shopping sprees.

No. Low interest rates encourage inflation. Higher rates discourage inflation. If you're seeing inflation growing, then they aren't raising the rate fast enough.

As currency unification nears, US dollar climbs to 9.84 pesos

- Buenos Aires Herald

www.buenosairesherald.com...

- Buenos Aires Herald

www.buenosairesherald.com...

a reply to: dogstar23

Yes you are right, but while is supposed to help with inflation, it doesn't help the consumer that have to deal with increases in prices of goods.

But as usual the term inflation vs. prices of goods and services rise, is been told that is not really understood by those that controls the interest target rates or they are lying, because you can get inflation even when interest rates are low.

People tend to panic when interest rates starts to rise, so the power buying decreases.

Yes you are right, but while is supposed to help with inflation, it doesn't help the consumer that have to deal with increases in prices of goods.

But as usual the term inflation vs. prices of goods and services rise, is been told that is not really understood by those that controls the interest target rates or they are lying, because you can get inflation even when interest rates are low.

People tend to panic when interest rates starts to rise, so the power buying decreases.

a reply to: mikegrouchy

The side effects of interest rates hike, the dollar become more attractive to foreign investors boosting its value, darn when was the last time that the dollar was more valuable than the Euro?

The side effects of interest rates hike, the dollar become more attractive to foreign investors boosting its value, darn when was the last time that the dollar was more valuable than the Euro?

new topics

-

news article; "Only two Navy destroyers currently operational as fleet size hits record low"

Military Projects: 31 minutes ago -

George Stephanopoulos and ABC agree to pay $15 million to settle Trump defamation suit

Mainstream News: 5 hours ago

top topics

-

The Mystery Drones and Government Lies

Political Conspiracies: 16 hours ago, 14 flags -

George Stephanopoulos and ABC agree to pay $15 million to settle Trump defamation suit

Mainstream News: 5 hours ago, 14 flags -

Light from Space Might Be Travelling Instantaneously

Space Exploration: 13 hours ago, 9 flags -

The MSM has the United Healthcare assassin all wrong.

General Conspiracies: 14 hours ago, 8 flags -

2025 Bingo Card

The Gray Area: 14 hours ago, 7 flags -

More Bad News for Labour and Rachel Reeves Stole Christmas from Working Families

Regional Politics: 12 hours ago, 7 flags -

news article; "Only two Navy destroyers currently operational as fleet size hits record low"

Military Projects: 31 minutes ago, 3 flags

active topics

-

Drones everywhere in New Jersey

Aliens and UFOs • 162 • : Guyfriday -

President-Elect DONALD TRUMP's 2nd-Term Administration Takes Shape.

Political Ideology • 330 • : WeMustCare -

Light from Space Might Be Travelling Instantaneously

Space Exploration • 24 • : norhoc4 -

Will all hell break out? Jersey drones - blue beam

Aliens and UFOs • 68 • : Skinnerbot -

Pelosi injured in Luxembourg

Other Current Events • 36 • : nugget1 -

news article; "Only two Navy destroyers currently operational as fleet size hits record low"

Military Projects • 0 • : Coelacanth55 -

The MSM has the United Healthcare assassin all wrong.

General Conspiracies • 12 • : StoutBroux -

The Mystery Drones and Government Lies

Political Conspiracies • 69 • : DaydreamerX -

George Stephanopoulos and ABC agree to pay $15 million to settle Trump defamation suit

Mainstream News • 9 • : WeMustCare -

One out of every 20 Canadians Dies by Euthanasia

Medical Issues & Conspiracies • 22 • : BernnieJGato