It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

6

share:

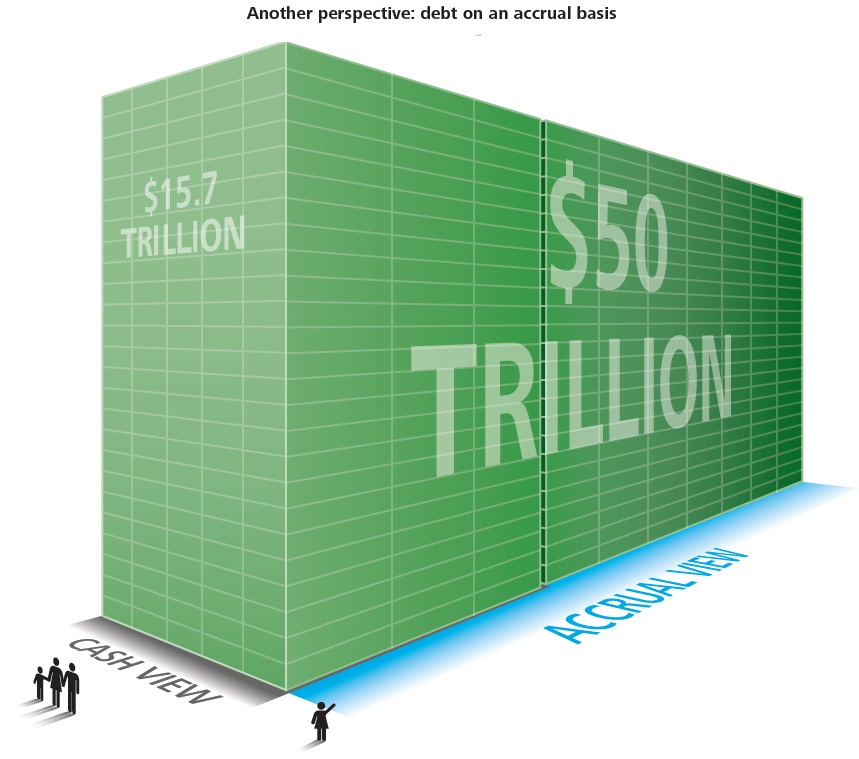

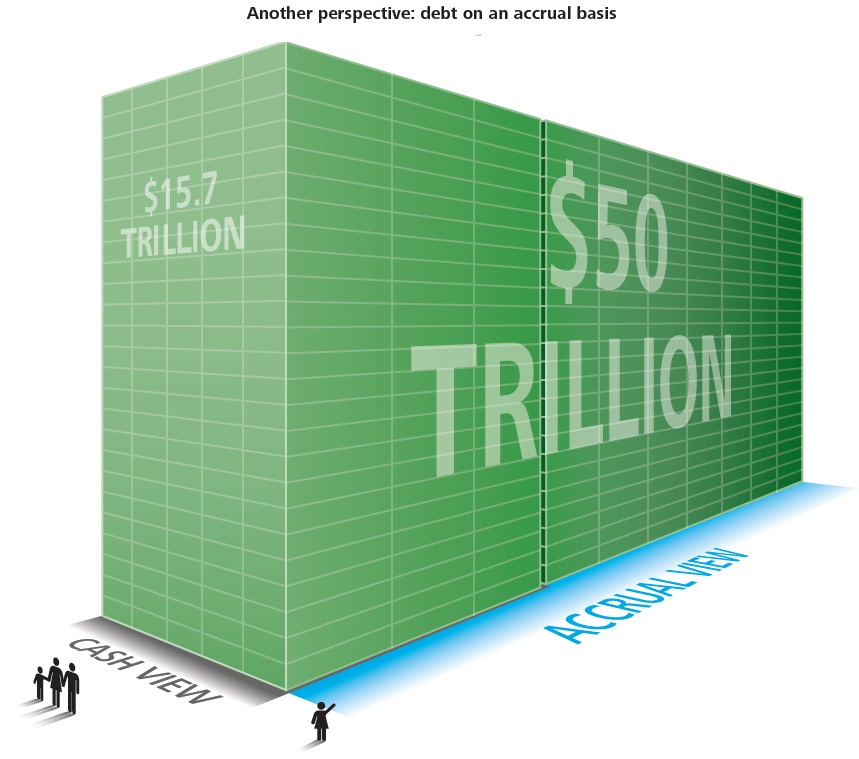

Now that all eyes are on the national debt and not just the annual deficit, it is time to consider all options.

We can see how hysterical our elected officials become when their special interests are threatened. Their personal income is not even in danger here, it is their power that they fear losing.

Repudiating the National Debt (June, 1992)

We can see how hysterical our elected officials become when their special interests are threatened. Their personal income is not even in danger here, it is their power that they fear losing.

Repudiating the National Debt (June, 1992)

In the spring of 1981, conservative Republicans in the House of Representatives cried. They cried because, in the first flush of the Reagan Revolution that was supposed to bring drastic cuts in taxes and government spending, as well as a balanced budget, they were being asked by the White House and their own leadership to vote for an increase in the statutory limit on the federal public debt, which was then scraping the legal ceiling of $1 trillion. They cried because all of their lives they had voted against an increase in public debt, and now they were being asked, by their own party and their own movement, to violate their lifelong principles. The White House and its leadership assured them that this breach in principle would be their last: that it was necessary for one last increase in the debt limit to give President Reagan a chance to bring about a balanced budget and to begin to reduce the debt. Many of these Republicans tearfully announced that they were taking this fateful step because they deeply trusted their president, who would not let them down.

Famous last words. In a sense, the Reagan handlers were right: there were no more tears, no more complaints, because the principles themselves were quickly forgotten, swept into the dustbin of history. Deficits and the public debt have piled up mountainously since then, and few people care, least of all conservative Republicans. Every few years, the legal limit is raised automatically. By the end of the Reagan reign the federal debt was $2.6 trillion; now it is $3.5 trillion and rising rapidly. And this is the rosy side of the picture, because if you add in “off-budget” loan guarantees and contingencies, the grand total federal debt is $20 trillion.

Since Reagan, however, intellectual-political life has gone topsy-turvy. Conservatives and allegedly “free-market” economists have turned handsprings trying to find new reasons why “deficits don’t matter,” why we should all relax and enjoy the process. Perhaps the most absurd argument of Reaganomists was that we should not worry about growing public debt because it is being matched on the federal balance sheet by an expansion of public “assets.” Here was a new twist on free-market macroeconomics: things are going well because the value of government assets is rising! In that case, why not have the government nationalize all assets outright? Reaganomists, indeed, came up with every conceivable argument for the public debt except the phrase of Abba Lerner, and I am convinced that they did not recycle that phrase because it would be difficult to sustain with a straight face at a time when foreign ownership of the national debt is skyrocketing. Even apart from foreign ownership, it is far more difficult to sustain the Lerner thesis than before; in the late 1930s, when Lerner enunciated his thesis, total federal interest payments on the public debt were $1 billion; now they have zoomed to $200 billion, the third-largest item in the federal budget, after the military and Social Security: the “we” are looking ever shabbier compared to the “ourselves.”

In a free-market economy that respects property rights, the volume of private debt is self-policed by the necessity to repay the creditor, since no Papa Government is letting you off the hook. In addition, the interest rate a debtor must pay depends not only on the general rate of time preference but on the degree of risk he as a debtor poses to the creditor. A good credit risk will be a “prime borrower,” who will pay relatively low interest; on the other hand, an improvident person or a transient who has been bankrupt before, will have to pay a much higher interest rate, commensurate with the degree of risk on the loan.

Most people, unfortunately, apply the same analysis to public debt as they do to private. If sanctity of contracts should rule in the world of private debt, shouldn’t they be equally as sacrosanct in public debt? Shouldn’t public debt be governed by the same principles as private? The answer is no, even though such an answer may shock the sensibilities of most people. The reason is that the two forms of debt-transaction are totally different. If I borrow money from a mortgage bank, I have made a contract to transfer my money to a creditor at a future date; in a deep sense, he is the true owner of the money at that point, and if I don’t pay I am robbing him of his just property. But when government borrows money, it does not pledge its own money; its own resources are not liable. Government commits not its own life, fortune, and sacred honor to repay the debt, but ours. This is a horse, and a transaction, of a very different color.

Although largely forgotten by historians and by the public, repudiation of public debt is a solid part of the American tradition. The first wave of repudiation of state debt came during the 1840s, after the panics of 1837 and 1839. Those panics were the consequence of a massive inflationary boom fueled by the Whig-run Second Bank of the United States. Riding the wave of inflationary credit, numerous state governments, largely those run by the Whigs, floated an enormous amount of debt, most of which went into wasteful public works (euphemistically called “internal improvements”), and into the creation of inflationary banks. Outstanding public debt by state governments rose from $26 million to $170 million during the decade of the 1830s. Most of these securities were financed by British and Dutch investors.

Apart from the moral, or sanctity-of-contract argument against repudiation that we have already discussed, the standard economic argument is that such repudiation is disastrous, because who, in his right mind, would lend again to a repudiating government? But the effective counterargument has rarely been considered: why should more private capital be poured down government rat holes? It is precisely the drying up of future public credit that constitutes one of the main arguments for repudiation, for it means beneficially drying up a major channel for the wasteful destruction of the savings of the public. What we want is abundant savings and investment in private enterprises, and a lean, austere, low-budget, minimal government. The people and the economy can only wax fat and prosperous when their government is starved and puny.

Canceling federal agency-held bonds, then, reduces the federal debt by 40 percent. I would advocate going on to repudiate the entire debt outright, and let the chips fall where they may. The glorious result would be an immediate drop of $200 billion in federal expenditures, with at least the fighting chance of an equivalent cut in taxes.

In order to go this route, however, we first have to rid ourselves of the fallacious mindset that conflates public and private, and that treats government debt as if it were a productive contract between two legitimate property owners.

edit on 9-10-2013 by greencmp because: (no reason given)

reply to post by greencmp

So is this kind of like Donald Trump's rule of financial survival?

Going to have to reread this again, I admit to not quite getting the full ramifications on this one. Can you give a brief summary of it's main point(s?) Sorry, still having my first coffee of the day.

So is this kind of like Donald Trump's rule of financial survival?

"If you owe the bank 50 thousand dollars you've got a problem,

If you owe the bank 50 million dollars they've got a problem."

Going to have to reread this again, I admit to not quite getting the full ramifications on this one. Can you give a brief summary of it's main point(s?) Sorry, still having my first coffee of the day.

edit on 743am2020am112013 by Bassago because: (no reason given)

Bassago

reply to post by greencmp

So is this kind of like Donald Trump's rule of financial survival?

"If you owe the bank 50 thousand dollars you've got a problem,

If you owe the bank 50 million dollars they've got a problem."

Going to have to reread this again, I admit to not quite getting the full ramifications on this one. Can you give a brief summary of it's main point(s?) Sorry, still having my first coffee of the day.

edit on 743am2020am112013 by Bassago because: (no reason given)

This is a biggie for sure!

The basic point is that we cannot afford the public debt that we now hold. Truthfully, we haven't been able to afford it for some time now. At some point we will be forced to default, we have as good a chance to address the problem now as we may ever have.

greencmp

Bassago

reply to post by greencmp

So is this kind of like Donald Trump's rule of financial survival?

"If you owe the bank 50 thousand dollars you've got a problem,

If you owe the bank 50 million dollars they've got a problem."

Going to have to reread this again, I admit to not quite getting the full ramifications on this one. Can you give a brief summary of it's main point(s?) Sorry, still having my first coffee of the day.

edit on 743am2020am112013 by Bassago because: (no reason given)

This is a biggie for sure!

The basic point is that we cannot afford the public debt that we now hold. Truthfully, we haven't been able to afford it for some time now. At some point we will be forced to default, we have as good a chance to address the problem now as we may ever have.

Agreed, painful decisions will only get worse if we wait. Considering the amount of our debt held by foreign nations if we do default they're going to get hammered. I think the hundreds of trillions tied up in the derivatives market are also going to get crushed causing global chaos.

That said this would become a "Last man standing" scenario that we could probably weather. It boggles the mind to think of the billions or trillions of dollars tied up in local investment accounts that would be totally destroyed.

reply to post by greencmp

"I was not around when they decided I was an idiot"

-Don Juan Matus

If they can't show your signature, it is not your debt...

"I was not around when they decided I was an idiot"

-Don Juan Matus

reply to post by greencmp

There is one massive hole in this argument (a hole which should NOT be there and, in all probability, was intentionally placed there precisely to prevent future repudiation). In previous times of debt repudiation in the USA the US dollar was backed by gold. That no longer being the case, the entirety of the dollar's value is rooted in blind trust and confidence. The government doesn't need to be thin and hungry, it needs to be starved... to death, then buried and a lean, austere replacement found. In other words, it is wholely impossible to repudiate this debt without accepting the fact that both the current dollar and the current government must die for it to benefit WE THE PEOPLE.

There is one massive hole in this argument (a hole which should NOT be there and, in all probability, was intentionally placed there precisely to prevent future repudiation). In previous times of debt repudiation in the USA the US dollar was backed by gold. That no longer being the case, the entirety of the dollar's value is rooted in blind trust and confidence. The government doesn't need to be thin and hungry, it needs to be starved... to death, then buried and a lean, austere replacement found. In other words, it is wholely impossible to repudiate this debt without accepting the fact that both the current dollar and the current government must die for it to benefit WE THE PEOPLE.

burdman30ott6

reply to post by greencmp

There is one massive hole in this argument (a hole which should NOT be there and, in all probability, was intentionally placed there precisely to prevent future repudiation). In previous times of debt repudiation in the USA the US dollar was backed by gold. That no longer being the case, the entirety of the dollar's value is rooted in blind trust and confidence. The government doesn't need to be thin and hungry, it needs to be starved... to death, then buried and a lean, austere replacement found. In other words, it is wholely impossible to repudiate this debt without accepting the fact that both the current dollar and the current government must die for it to benefit WE THE PEOPLE.

I see no other alternative, we must have a stable backed currency going forward and the dollar cannot be it (at least this dollar). I have thought about this a lot and gold is still the only option though, I would be interested in hearing any thoughts on the subject if only to point out the flaws in any alternative.

Restoring the republic will require the elimination of most official offices, powers and legislation that have accumulated over the last century.

edit on 9-10-2013 by greencmp because: (no reason given)

It's primarily interest being paid to the Federal Reserve that constitutes the public debt. Since they create "money" based on thin air we should

repay the debt in kind.

We intentionally suckered in foreigners to buy our debt making it much more difficult to repudiate the debt, otherwise the only people who would be out would be those who own the Federal Reserve.

We intentionally suckered in foreigners to buy our debt making it much more difficult to repudiate the debt, otherwise the only people who would be out would be those who own the Federal Reserve.

Asktheanimals

It's primarily interest being paid to the Federal Reserve that constitutes the public debt. Since they create "money" based on thin air we should repay the debt in kind.

We intentionally suckered in foreigners to buy our debt making it much more difficult to repudiate the debt, otherwise the only people who would be out would be those who own the Federal Reserve.

I know where you are coming from, I too have had sympathies for that mechanism. The problem is that the debt continues to increase and the interest rate will not stay low. The actual debt held by foreign governments is small (1 to 2 trillion or less in total).

Furthermore, if the debt is paid at all it will be paid with tax dollars drawn directly out of the economy, not simply printed up. The monopoly money aspect occurs during the issuance phase of "quantitative easing".

new topics

-

Biden "Happy To Debate Trump"

Mainstream News: 21 minutes ago -

RAAF airbase in Roswell, New Mexico is on fire

Aliens and UFOs: 30 minutes ago -

What is the white pill?

Philosophy and Metaphysics: 2 hours ago -

Mike Pinder The Moody Blues R.I.P.

Music: 2 hours ago -

Putin, Russia and the Great Architects of the Universe

ATS Skunk Works: 5 hours ago -

A Warning to America: 25 Ways the US is Being Destroyed

New World Order: 10 hours ago

top topics

-

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies: 16 hours ago, 34 flags -

A Warning to America: 25 Ways the US is Being Destroyed

New World Order: 10 hours ago, 18 flags -

Mike Pinder The Moody Blues R.I.P.

Music: 2 hours ago, 7 flags -

What is the white pill?

Philosophy and Metaphysics: 2 hours ago, 5 flags -

Is AI Better Than the Hollywood Elite?

Movies: 17 hours ago, 4 flags -

RAAF airbase in Roswell, New Mexico is on fire

Aliens and UFOs: 30 minutes ago, 3 flags -

Biden "Happy To Debate Trump"

Mainstream News: 21 minutes ago, 3 flags -

Putin, Russia and the Great Architects of the Universe

ATS Skunk Works: 5 hours ago, 2 flags -

Maestro Benedetto

Literature: 17 hours ago, 1 flags

active topics

-

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News • 26 • : Threadbarer -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media • 277 • : Threadbarer -

New whistleblower Jason Sands speaks on Twitter Spaces last night.

Aliens and UFOs • 72 • : pianopraze -

Biden "Happy To Debate Trump"

Mainstream News • 5 • : malte86 -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues • 78 • : gortex -

What is the white pill?

Philosophy and Metaphysics • 14 • : kwaka -

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs • 16 • : introufo2 -

Post A Funny (T&C Friendly) Pic Part IV: The LOL awakens!

General Chit Chat • 7136 • : underpass61 -

A Warning to America: 25 Ways the US is Being Destroyed

New World Order • 26 • : theatreboy -

ChatGPT Beatles songs about covid and masks

Science & Technology • 25 • : ArMaP

6