It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

Corporation That Paid Nothing In Taxes For Four Years Tells Congress It Pays Too Much In Taxes

page: 1share:

Corporation That Paid Nothing In Taxes For Four Years Tells Congress It Pays Too Much In Taxes

www.alternet.org

(visit the link for the full news article)

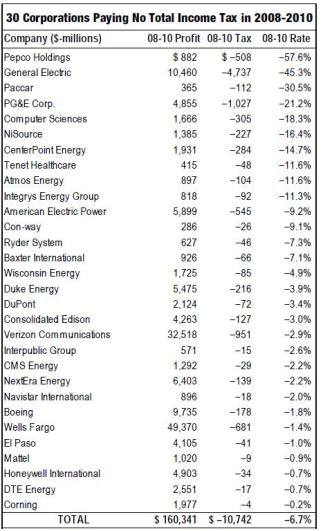

Over a four years period from 2008 to 2011, Corning Inc. was one of 26 companies that managed to avoid paying any American income taxes, even though it earned nearly $3 billion during that time. In fact, according to Citizens For Tax Justice, the company received a $4 million refund from 2008 to 2010. That didn’t stop Susan Ford, a senior executive at the company, from telling the House Ways and Means Committee this week that America’s high corporate tax rate was putting her company at a disadvantage:

Soo......not only did Corning not pay taxes...they got a REFUND - they paid "negative" taxes - the taxpayer paid them!!

And this is somehow too high a tax rate for corporate america??

Dunno that you need an NWO as a conspiracy when greed like this exists!

www.alternet.org

(visit the link for the full news article)

Ford told the committee that Corning paid an effective tax rate of 36 percent in 2011, but as CTJ notes, she is counting taxes on profits earned overseas that haven’t yet been paid and won’t be unless the company decides to bring the money back to the United States. Corning’s actual tax rate in 2011, according to CTJ’s analysis, was actually negative 0.2 percent.

And this is somehow too high a tax rate for corporate america??

Dunno that you need an NWO as a conspiracy when greed like this exists!

www.alternet.org

(visit the link for the full news article)

edit on 24-7-2012 by Aloysius the Gaul because: (no reason given)

If true this is messed up beyond belief. It is no wonder our economy is so screwed up.

How can it be -.2? What kind of math is that? Why can't my taxes be -.2? I would even settle for $0. To be honest though I understand being taxed to a point. We need money generated for things to pay state workers, I really do not have a problem with that. But these big corps really piss me off with this stuff.

Is this really true? How can they get away without paying taxes?

Raist

Ford told the committee that Corning paid an effective tax rate of 36 percent in 2011, but as CTJ notes, she is counting taxes on profits earned overseas that haven’t yet been paid and won’t be unless the company decides to bring the money back to the United States. Corning’s actual tax rate in 2011, according to CTJ’s analysis, was actually negative 0.2 percent.

How can it be -.2? What kind of math is that? Why can't my taxes be -.2? I would even settle for $0. To be honest though I understand being taxed to a point. We need money generated for things to pay state workers, I really do not have a problem with that. But these big corps really piss me off with this stuff.

Is this really true? How can they get away without paying taxes?

Raist

It didn't just pay nothing in taxes - it got a refund as well. After earning $3B, Corning still received a $4M refund making it's effective tax rate

a negative 0.2 percent.

Originally posted by Raist

Is this really true? How can they get away without paying taxes?

Raist

By using the tax-code to it's advantage. Tax-codes are crafted by 'consultants' from the "financial" industry, who then proceed to work for the companies they 'blessed' with tax relief... (or their kids get a job with them, or their husbands or wives, cousins or siblings...etc)... then their are internships, scholarships, grant monies, and the ubiquitous consulting/lobbying jobs.... it's all part of the scam. Our taxes = THEIR money!!

Taxes never HAD to be a morass of unintelligible overlapping provisos and stipulations.... but then.. we never NEEDED the Fed or IRS to take the tax process over for the government either... go figure.

edit on 24-7-2012 by Maxmars because: (no reason given)

edit on 24-7-2012 by Maxmars because: (no reason given)

reply to post by RealSpoke

Notice how many esteemed member of the Energy Cartel are in there??? Poor oppressed corporations.

Notice how many esteemed member of the Energy Cartel are in there??? Poor oppressed corporations.

And people discount the Occupy movement..

Sure it was disorganized and comprised primarily of unemployed people...

However the message is sound...

The uber rich complain about paying negative taxes.. Mortgage companies refuse payment for the explicit purpose of foreclosing on people (even if you can pay your mortgage) which is actually on of the many horrible things the "Banksters" do to people, environmental catastrophe (BP) where no one is really held accountable by any means..

The super rich can get away with everything and anything and the peons just sit there and let them do it...

On a side note, I couldn't help but notice the all wonderful PG&E was on that list.. Let's not forget what they do to people (note a specific court case where they were seeping cancer causing chemicals into the water supply, after people started getting sick tried to cover it up.)

Sure it was disorganized and comprised primarily of unemployed people...

However the message is sound...

The uber rich complain about paying negative taxes.. Mortgage companies refuse payment for the explicit purpose of foreclosing on people (even if you can pay your mortgage) which is actually on of the many horrible things the "Banksters" do to people, environmental catastrophe (BP) where no one is really held accountable by any means..

The super rich can get away with everything and anything and the peons just sit there and let them do it...

On a side note, I couldn't help but notice the all wonderful PG&E was on that list.. Let's not forget what they do to people (note a specific court case where they were seeping cancer causing chemicals into the water supply, after people started getting sick tried to cover it up.)

edit on

24-7-2012 by DaMod because: (no reason given)

See that is how trickle economics, they don't pay any taxes & our taxes end up being given to them refunds on said unpaid taxes--thusly trickling

down to them.

Ain't it a grand scheme?

Nearly as good as banking!

Derek

Ain't it a grand scheme?

Nearly as good as banking!

Derek

reply to post by RealSpoke

So General Electric made $10 billion and then we the tax payers paid them another $5 billion?

Why? Because they were nice enough to sell us $10 billion worth of energy?

How does this make sense to anyone?

So General Electric made $10 billion and then we the tax payers paid them another $5 billion?

Why? Because they were nice enough to sell us $10 billion worth of energy?

How does this make sense to anyone?

So in this reality the little guy is paying companies that make billions in profit already?? Ughhh..

I want to know how much Apple has paid in taxes since it has just been announced that they have 110 billion dollars cash on hand and they have a cap of 571 billion dollars.

Money is an addiction, just like drugs. Some people just want more and more..

I want to know how much Apple has paid in taxes since it has just been announced that they have 110 billion dollars cash on hand and they have a cap of 571 billion dollars.

Money is an addiction, just like drugs. Some people just want more and more..

Don't worry!l

Mitt Romney will lower corporate tax rates by 10%!!

Mitt Romney will lower corporate tax rates by 10%!!

In some cases, IRS agent Peter Coons was specifically told not to pursue cases against wealthy and politically connected families. "While influential taxpayers were getting a break, myself and many division managers were being pressured to establish quotas and collect more revenues from the average person," Coons told the San Jose Mercury News. Wealthy corporations get special treatment, too. By 2002, the portion of federal revenue coming from corporate taxes had fallen to below 10 percent--down from approximately 33 percent during the Eisenhower administration. Overall, in 2002, the IRS assessed just 22 negligence penalties against 2.5 million U.S. corporations, a decline of more than 99 percent from 1993, when nearly 2,400 penalties--a pitifully low number itself--were imposed. Meanwhile, corporations have been using legal tax shelters and creative "massaging" of tax laws to get away with tens of billions. Take "inversion." In an inversion, a U.S.-based corporation creates an offshore subsidiary for about $27,000 (the cost of a mail drop, usually in Bermuda)--and then transforms the subsidiary into the corporate parent. Presto--the U.S. company becomes the subsidiary of the new, offshore company, which escapes paying U.S. taxes by charging its "subsidiary" for everything from management services to use of the corporate logo. What would have been taxable profits are transformed into tax deductions.

This article is a good review of the book Perfectly Legal on the tax scams

Originally posted by Maxmars

reply to post by RealSpoke

Notice how many esteemed member of the Energy Cartel are in there??? Poor oppressed corporations.

yeah, these are the same companies that are saying climate change is a hoax and the scientist are getting rich while they will go out of business if they have to stop polluting so much

Originally posted by Ghost375

Don't worry!l

Mitt Romney will lower corporate tax rates by 10%!!

-10.2%??

Corporations should be taxed. They exist by charter and are legal creations that begin with regulation and demand constant regulation. Individuals

are not legal creations, do not exist by charter and in fact preexist government. The question should not be why aren't corporations paying more in

taxes, the real question should be why are individuals who have an unalienable right to earn a living paying taxes "on" the income they earn?

Is a ditch digger subject to the applicable revenue laws and liable for this so called "income tax"? Is a janitor subject to the applicable revenue laws and liable for this so called "income tax"? Is an architect subject to the applicable revenue laws and liable for this so called "income tax"? Is a doctor subject to the applicable revenue laws and liable for this so called "income tax"? Is a cook, waiter, busboy, dishwasher subject to the applicable revenue laws and liable for this so called "income tax"? Are contractors, day laborers, electricians and plumbers subject to the applicable revenue laws and liable for this so called "income tax"?

To the best of my knowledge, all the professions or jobs I just listed have not been made liable for any "income tax" but countless of those professionals and employees pay the damn tax anyway. What if most Americans are not even liable for the tax, not subject to the applicable revenue laws, but corporations most assuredly are? What if, instead of getting really angry because of the overwhelming sense of helplessness one feels when discovering that the taxes - they don't likely owe to begin with - they pay are being used to subsidize multinational corporations these people simply refused to pay the taxes they most likely don't owe to begin with?

Do you think if more than 250 million people stopped paying taxes they don't owe that Congress would keep giving the absurd tax breaks they give corporations? Do you think that the loss of revenue caused by more than 250 million people refusing to pay the taxes they don't owe would encourage the federal government to simply adjust and live within their means, or do you think they would look to those corporations to replace that lost income?

Wouldn't it be nice if people exercised the inherent political power they hold in this country and asserted their rights and starved the very beast that is biting the hand that feeds it?

Is a ditch digger subject to the applicable revenue laws and liable for this so called "income tax"? Is a janitor subject to the applicable revenue laws and liable for this so called "income tax"? Is an architect subject to the applicable revenue laws and liable for this so called "income tax"? Is a doctor subject to the applicable revenue laws and liable for this so called "income tax"? Is a cook, waiter, busboy, dishwasher subject to the applicable revenue laws and liable for this so called "income tax"? Are contractors, day laborers, electricians and plumbers subject to the applicable revenue laws and liable for this so called "income tax"?

To the best of my knowledge, all the professions or jobs I just listed have not been made liable for any "income tax" but countless of those professionals and employees pay the damn tax anyway. What if most Americans are not even liable for the tax, not subject to the applicable revenue laws, but corporations most assuredly are? What if, instead of getting really angry because of the overwhelming sense of helplessness one feels when discovering that the taxes - they don't likely owe to begin with - they pay are being used to subsidize multinational corporations these people simply refused to pay the taxes they most likely don't owe to begin with?

Do you think if more than 250 million people stopped paying taxes they don't owe that Congress would keep giving the absurd tax breaks they give corporations? Do you think that the loss of revenue caused by more than 250 million people refusing to pay the taxes they don't owe would encourage the federal government to simply adjust and live within their means, or do you think they would look to those corporations to replace that lost income?

Wouldn't it be nice if people exercised the inherent political power they hold in this country and asserted their rights and starved the very beast that is biting the hand that feeds it?

Wait...so a multinational corporation has to pay taxes on all of their profits all to the US?

Not, say, to the country they made the profits in?

I got news for you, these corporations funnel their profits outside of the US because the US has too high of a corporate tax rate.

Lower your tax rate to a point where these companies want to funnel the money through the US, and you make money. Jack up the tax rate, they move their money to a more favourable location...well, they keep funneling it through other countries.

Not, say, to the country they made the profits in?

I got news for you, these corporations funnel their profits outside of the US because the US has too high of a corporate tax rate.

Lower your tax rate to a point where these companies want to funnel the money through the US, and you make money. Jack up the tax rate, they move their money to a more favourable location...well, they keep funneling it through other countries.

Why should corporations pay ANY taxes AT ALL? Employees of corporations, from the CEO to the janitor, pay taxes on their incomes. Shareholders, should

they ever get a dividend, pay taxes on that. If by any chance their shares become worth more because of the success of the corporation, and they sell

their shares, they pay taxes on their gains. Plus corporations are subject to inumerable governmental regulations on how they do business that costs

them dearly. The US has one of the HIGHEST corporate taxes in the world. The government is there with its hand out every step of the way.

This idea, which is pervasive, that somehow people avoiding taxes are evil is crazy. There's another thread here about the rich hiding $14 trillion from the texman. GOOD FOR THEM! The government doesn't deserve this money. The government confiscates it. And who says the government is benign in all this? The so-called "civil service" enjoys higher salaries than their civilian counterparts. They have better benefits, better pensions, greater job security, and they have shown no particluar restraint in spending taxpayer confiscated money on themselves. The GSA spent a quarter billion on parties. The Secret Service spent per diem on prostitutes. OUR tax money is being wasted every day.

It's not a crime to avoid taxes. It ought to be encouraged.

This idea, which is pervasive, that somehow people avoiding taxes are evil is crazy. There's another thread here about the rich hiding $14 trillion from the texman. GOOD FOR THEM! The government doesn't deserve this money. The government confiscates it. And who says the government is benign in all this? The so-called "civil service" enjoys higher salaries than their civilian counterparts. They have better benefits, better pensions, greater job security, and they have shown no particluar restraint in spending taxpayer confiscated money on themselves. The GSA spent a quarter billion on parties. The Secret Service spent per diem on prostitutes. OUR tax money is being wasted every day.

It's not a crime to avoid taxes. It ought to be encouraged.

edit on 7/24/2012 by schuyler because: (no reason given)

reply to post by schuyler

Because corporations exist by the good graces of the state, and because Congress has the complete and plenary power of taxation. I am not clear on what precisely you are advocating here. On the one hand you applaud the fact that the few are refusing to acquiesce to taxation, but on the other hand you seem to be A-Okay that janitors are not doing the same thing but instead paying taxes on their hard earned labor of which the labor to survive. The janitor does not exist by the good graces of the state, corporations do. That's why they should be taxed and the unincoroporated individual who is simply earning a living to survive...well, you show me in the tax code where they've even been made liable for any tax at all.

Why should corporations pay ANY taxes AT ALL?

Because corporations exist by the good graces of the state, and because Congress has the complete and plenary power of taxation. I am not clear on what precisely you are advocating here. On the one hand you applaud the fact that the few are refusing to acquiesce to taxation, but on the other hand you seem to be A-Okay that janitors are not doing the same thing but instead paying taxes on their hard earned labor of which the labor to survive. The janitor does not exist by the good graces of the state, corporations do. That's why they should be taxed and the unincoroporated individual who is simply earning a living to survive...well, you show me in the tax code where they've even been made liable for any tax at all.

new topics

-

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies: 2 hours ago -

Maestro Benedetto

Literature: 4 hours ago -

Is AI Better Than the Hollywood Elite?

Movies: 4 hours ago -

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs: 8 hours ago -

2024 Pigeon Forge Rod Run - On the Strip (Video made for you)

Automotive Discussion: 8 hours ago -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues: 9 hours ago -

The functionality of boldening and italics is clunky and no post char limit warning?

ATS Freshman's Forum: 10 hours ago -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News: 11 hours ago -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest: 11 hours ago

top topics

-

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies: 2 hours ago, 23 flags -

Krystalnacht on today's most elite Universities?

Social Issues and Civil Unrest: 14 hours ago, 9 flags -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media: 16 hours ago, 8 flags -

Weinstein's conviction overturned

Mainstream News: 12 hours ago, 8 flags -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics: 14 hours ago, 8 flags -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest: 11 hours ago, 7 flags -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues: 9 hours ago, 7 flags -

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs: 8 hours ago, 6 flags -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News: 11 hours ago, 5 flags -

2024 Pigeon Forge Rod Run - On the Strip (Video made for you)

Automotive Discussion: 8 hours ago, 4 flags

active topics

-

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 687 • : Justoneman -

Reason of the Existence

The Gray Area • 21 • : BingoMcGoof -

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies • 10 • : nugget1 -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics • 85 • : Sookiechacha -

Chris Christie Wishes Death Upon Trump and Ramaswamy

Politicians & People • 24 • : nugget1 -

New whistleblower Jason Sands speaks on Twitter Spaces last night.

Aliens and UFOs • 63 • : pianopraze -

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs • 74 • : Justoneman -

Starburst galaxy M82 - Webb Vs Hubble

Space Exploration • 6 • : Arbitrageur -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media • 264 • : stelth2 -

VirginOfGrand says hello

Introductions • 9 • : TheMichiganSwampBuck