It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

8

share:

Directly from the mouth of their representatives after coming up with a new Cashless

Challenge program. This program is designed to bribe small businesses mostly in food service to start accepting digital/electronic payments for

their small purchases. Speed, convenience, efficiency is cited as the benefits. Of course they leave out the fact that the real benefit is the

billions in additional new transaction fees they are chasing.

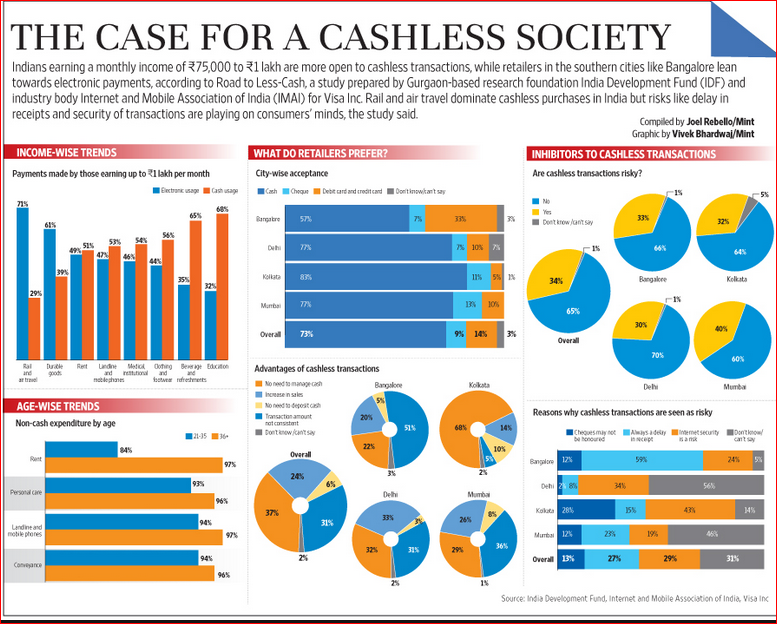

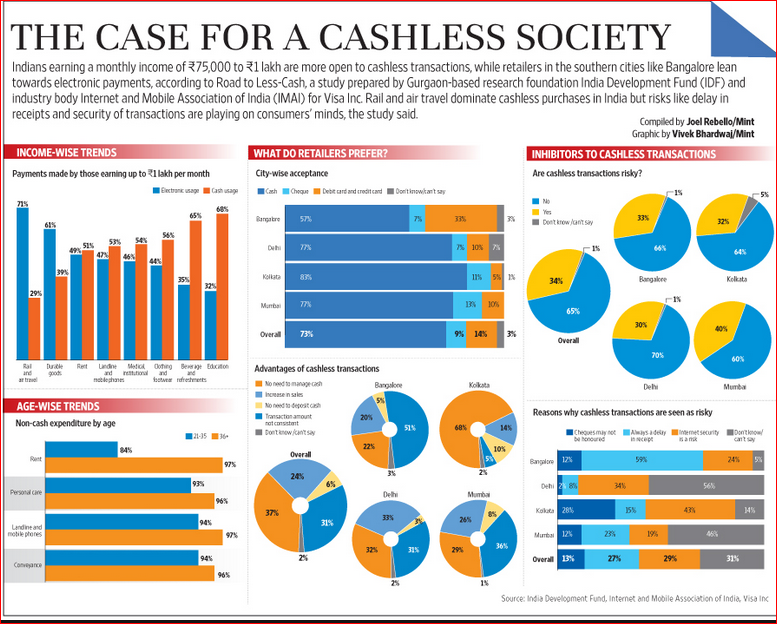

They are also making a case for India to go cashless.

So there we have it, no more beating around the bush. It will not be long before they come for our physical bullion next.

In a related matter, Delaware has adopted block chain technology for stock trades and record keeping as well.

It seems to me we are experiencing in real time a dynamic shift of finance similar to adoption of Brenton Woods or the Gold Confiscation Act. It makes sense, the average split appears to 35-45 years between fundamental dynamic shifts in the way the global economy works since the beginning of the 20th century. We are now seeing it happen again, but this time the move is to cashless, and IMO the consequences will be biblical.

“We are declaring war on cash,” Visa spokesman Andy Gerlt proudly proclaimed after the program was announced.

They are also making a case for India to go cashless.

There is nowhere to hide. The cashless society is coming, and with it, your freedom to spend where and when you see fit. Your ability to get fair prices from open trade borders will be closed. And when you convert your paper to Gold, that will be attacked next.

And those people using Bitcoin to transfer wealth out of countries to retain their economic freedom we say this; What are you going to transfer your wealth into? Are you going to leave it in Bitcoins? Then enjoy 100% volatility.

Risk cannot be created or destroyed, it can only be exchanged for different risk. The wall is being built alright. It is being built around your economic freedom. Then the cries of BUY AMERICAN will sound out, as you will not be able to buy anywhere else. And American corporations will own your spending habits. Do you think supermarkets want to make less money when they ask for your "Club Card"?

So there we have it, no more beating around the bush. It will not be long before they come for our physical bullion next.

In a related matter, Delaware has adopted block chain technology for stock trades and record keeping as well.

With the near unanimous passing of a bill that will explicitly recognize the right to trade stocks using a blockchain, Delaware is making a strong case for it being the blockchain-friendliest state.

The Delaware Senate Bill 69, which won a majority vote in the Senate with 20 to 0 in favor of the bill and 40 to 1 in the House of Representatives in favor of the bill, will be expected to be signed into law by end of July, with an effective date of 1st August. The bill includes a series of amendments to the Delaware General Corporation Law, specifically to Sections 219, 224, and 232, that legally recognize any number of records being stored on networks of electronic databases – e.g., blockchain – for the creation and maintenance of corporate records, including the corporation’s stock ledger.

Once effective, the bill will allow private companies incorporated in Delaware to start issuing and tracking shares of stock on a distributed ledger. As of now, only private-company stocks are within reach of the bill. However, the state of Delaware is still in talks with the Securities and Exchange Commission about also bringing the publicly traded stock to a distributed ledger. Nevertheless, by allowing potential large-scale issuance of stock on blockchain, the bill paves the way for new opportunities and could catalyze violent disruptions of traditional models of finance.

It seems to me we are experiencing in real time a dynamic shift of finance similar to adoption of Brenton Woods or the Gold Confiscation Act. It makes sense, the average split appears to 35-45 years between fundamental dynamic shifts in the way the global economy works since the beginning of the 20th century. We are now seeing it happen again, but this time the move is to cashless, and IMO the consequences will be biblical.

edit on 7-26-2017

by worldstarcountry because: typo in subject line

a reply to: worldstarcountry

I would think that a majority of people would not let this slide, at least not anytime soon. The logistics of out right getting rid of cash seems very hard to accomplish. Then again, I guess nothing would surprise me these days.

I would think that a majority of people would not let this slide, at least not anytime soon. The logistics of out right getting rid of cash seems very hard to accomplish. Then again, I guess nothing would surprise me these days.

a reply to: iTruthSeeker

slow boiling in a pot has already gotten us to open declarations of war on cash in 2017. The continued devaluation of the USD this year is a direct result of people moving their wealth into blockchain technology digital currencies. The digi currency market explosion of this year is directly causing the devaluation of our dollar.

I think blockchain tech and digital currency is exactly the plan to destroy cash. It is taking time for the governments to legislate it, but as we can see from the OP, THEY ARE getting to it.

It is the people who will demand the instruments of their own slavery. We are entering the next chapter of a Brave New World. We can prolongue the inevitable for a couple generations, but it takes educating our children about the plans and why they must stay with physical assets that are not tracked to keep their freedom.

As it stands, today screens mostly filled with garbage and propaganda disguised with humor is what is educating our youth.

slow boiling in a pot has already gotten us to open declarations of war on cash in 2017. The continued devaluation of the USD this year is a direct result of people moving their wealth into blockchain technology digital currencies. The digi currency market explosion of this year is directly causing the devaluation of our dollar.

I think blockchain tech and digital currency is exactly the plan to destroy cash. It is taking time for the governments to legislate it, but as we can see from the OP, THEY ARE getting to it.

It is the people who will demand the instruments of their own slavery. We are entering the next chapter of a Brave New World. We can prolongue the inevitable for a couple generations, but it takes educating our children about the plans and why they must stay with physical assets that are not tracked to keep their freedom.

As it stands, today screens mostly filled with garbage and propaganda disguised with humor is what is educating our youth.

a reply to: worldstarcountry

Consumers will adopt to being cashless. Heck, I am almost cashless now as it is just easier to use my debit / credit cards at most businesses. I know of a few businesses that don't even take cash. We have a hamburger chain here in Chicago that no longer takes cash (their reason was cash was harder to manage - theft, making change, etc). The savings and operational efficiency far outweigh the few customers they'd lose.

There is a benefit....

however, there is also a down side and it is always being monitored and government and banks having the ability to just literally shut you off. This is something that has concerned me for awhile and I don't really know what the answer is for someone who isn't in the position to be totally off grid. All of your money for the most parts is 0s and 1s on a computer screen. Combine that with restrictions on accessing your cash all at once, it seems ripe for abuse and collapse.

Government could decide they want a "bail in" and just dip into your money electronically. A hacker could just take all your money.

Really bothersome...

Consumers will adopt to being cashless. Heck, I am almost cashless now as it is just easier to use my debit / credit cards at most businesses. I know of a few businesses that don't even take cash. We have a hamburger chain here in Chicago that no longer takes cash (their reason was cash was harder to manage - theft, making change, etc). The savings and operational efficiency far outweigh the few customers they'd lose.

There is a benefit....

however, there is also a down side and it is always being monitored and government and banks having the ability to just literally shut you off. This is something that has concerned me for awhile and I don't really know what the answer is for someone who isn't in the position to be totally off grid. All of your money for the most parts is 0s and 1s on a computer screen. Combine that with restrictions on accessing your cash all at once, it seems ripe for abuse and collapse.

Government could decide they want a "bail in" and just dip into your money electronically. A hacker could just take all your money.

Really bothersome...

a reply to: worldstarcountry

they are gonna have to make it free to use for small businesses if they want to get it every where. small company i worked for a few years back did away with the set up they had cause it cost them each time they ran a transaction over the credit card machine. they ended up setting it up over the computer system found a free way to do it but they would only take a cc if they had to.

they are gonna have to make it free to use for small businesses if they want to get it every where. small company i worked for a few years back did away with the set up they had cause it cost them each time they ran a transaction over the credit card machine. they ended up setting it up over the computer system found a free way to do it but they would only take a cc if they had to.

a reply to: Edumakated

i always pay in cash, and it is always faster than the person ahead of me that ran a cc/debit/link card/write a check.

i always pay in cash, and it is always faster than the person ahead of me that ran a cc/debit/link card/write a check.

originally posted by: luke1212

a reply to: Edumakated

i always pay in cash, and it is always faster than the person ahead of me that ran a cc/debit/link card/write a check.

Impossible... debit / credit fixes this...

We are so far off from a cashless society it's not even going to be in our lifetime. The day when every person on the planet who is a consumer holds

a digital phone in their hand will be the time when a cashless option merits consideration.

We are so far off from that day it's not even worth considering right now.

We are so far off from that day it's not even worth considering right now.

why not just have a microchip implanted on top of our hands and we can just use a scanner for every transaction!

a reply to: worldstarcountry

Cashless society is coming. It wont be that hard. Simply make it possible for small businesses with very low fees. I am talking fractions of 1%. And then outlaw cash, deem it not legal tender. The holdouts will have no option if they want to continue buying gas. They also must make it simple for the older folks. Like convert for them and send the resulting card containing the money. If anybody is capable of paying in cash or writing a check they are capable of swiping.

And about the bitcoin snippet - when it comes it wont be bitcoin, itll be regulated and wont experience such rapid swings. It will be a cryptocurrency though.

And again on bitcoin, hell yes us btc holders enjoy that volatility. 100% swinging volatility means huge YUGE profits for traders. If one put their life savings into bitcoin this time last year they would now have 4x as much savings worth in fiat with only 15% capital gains in taxes (US). Hell if they played the swings they would have 10x more at minimum.

Plus you can buy literally anything in bitcoin itself already. Especially in Europe.

Cashless society is coming. It wont be that hard. Simply make it possible for small businesses with very low fees. I am talking fractions of 1%. And then outlaw cash, deem it not legal tender. The holdouts will have no option if they want to continue buying gas. They also must make it simple for the older folks. Like convert for them and send the resulting card containing the money. If anybody is capable of paying in cash or writing a check they are capable of swiping.

And about the bitcoin snippet - when it comes it wont be bitcoin, itll be regulated and wont experience such rapid swings. It will be a cryptocurrency though.

And again on bitcoin, hell yes us btc holders enjoy that volatility. 100% swinging volatility means huge YUGE profits for traders. If one put their life savings into bitcoin this time last year they would now have 4x as much savings worth in fiat with only 15% capital gains in taxes (US). Hell if they played the swings they would have 10x more at minimum.

Plus you can buy literally anything in bitcoin itself already. Especially in Europe.

edit on 26-7-2017 by lightedhype because: (no reason

given)

edit on 26-7-2017 by lightedhype because: (no reason given)

Next thing you know gary goes to buy another round and his head wouldn't go through.

They turned his chip off, man!

Gary's outside screaming at the sky- turn it back on! turn it on!

Yeah- what could possibly go wrong with putting huge for profit corporations in charge of every single transaction?

It worked out so well with the medical industry.

edit:

Thinking it's time I buy those silver ounce bars I've been wanting...

edit on 26-7-2017 by lordcomac because: (no reason given)

One overlooked and interesting aspect here is the forever need of drug money and resulting laundering. I am referencing government need for dryg money

not dealers. It can be argued that drug money is the only thing that kept the economy afloat back in 2008.

With a cashless society, tptb would still need a way to bring in and launder drug money. That is probably a factor holding it off more than anything. But imo, it could be solved simply by leaving other cryptocurrencies allowed out in the wild and keeping them unregulated. This would allow there to be a national crypto the new 'fiat' and other cryptocurrencies to be used for under the table deals and transactions. Hell that could be a preexisting centralised variant of bicoin like say ripple. It would allow for the flow of this money to actually be trackable like never before with cash but would still allow tptb power with it as they could just blame transactions on that blockchain on the criminal enterprise. Bitcoin is already thought of in that regard by most because of Silk Road and the like.

With a cashless society, tptb would still need a way to bring in and launder drug money. That is probably a factor holding it off more than anything. But imo, it could be solved simply by leaving other cryptocurrencies allowed out in the wild and keeping them unregulated. This would allow there to be a national crypto the new 'fiat' and other cryptocurrencies to be used for under the table deals and transactions. Hell that could be a preexisting centralised variant of bicoin like say ripple. It would allow for the flow of this money to actually be trackable like never before with cash but would still allow tptb power with it as they could just blame transactions on that blockchain on the criminal enterprise. Bitcoin is already thought of in that regard by most because of Silk Road and the like.

edit on 26-7-2017 by lightedhype because: (no reason given)

The fear of the gov cuting ur funds with cashless is funny ... tell me how they cant do that now ... can u take ur paycheck and spend it without some

bank ... i think not ... can the gov take everything u own with no reason ... yes ... can the gov take ur pay or earnings and dock them to any amount

they wish ... also yes so being cashless would not really change this ... we where there the day we took a check insted of cash from our jobs

a reply to: lightedhype

Of all phone owners worldwide the vast majority do not hold phones capable of sending / receiving crypto currency like BTC which uses the blockchain. Cryptos require specific smart phone technology. For instance in some 3rd world countries Digicel has developed a regional only form of crypto which operates on analog phones. But it's only specific to that region and not multiple cryptos. Analog networks are disappearing in favor of digital networks. However, it costs hundreds of millions to update entire networks across large distances.

Digital phones are still pretty expensive. The computing power required to maintain security on a digital phone requires more advance internal components not typically found in low end digital phones.

There are a lot of pieces of the puzzle that have to fit together first before a cashless system can be fully implemented.

Of all phone owners worldwide the vast majority do not hold phones capable of sending / receiving crypto currency like BTC which uses the blockchain. Cryptos require specific smart phone technology. For instance in some 3rd world countries Digicel has developed a regional only form of crypto which operates on analog phones. But it's only specific to that region and not multiple cryptos. Analog networks are disappearing in favor of digital networks. However, it costs hundreds of millions to update entire networks across large distances.

Digital phones are still pretty expensive. The computing power required to maintain security on a digital phone requires more advance internal components not typically found in low end digital phones.

There are a lot of pieces of the puzzle that have to fit together first before a cashless system can be fully implemented.

Will true quantum computing (not D-wave) beat the blockchain puzzles?

Have you ever seen some of these people with credit and debit cards? I'd actually be willing to wager that on average, cash is a faster medium than

cards. Plus it isn't trackable. I have 50% of my money in the bank, 50% in cash, I pay with cash whenever possible.

a reply to: Outlier13

China is snapping up infrastructure projects and deals left and right in the undeveloped and developed world, including telecom. The most rudimentary smart phones from seven years ago were able an still can handle block chain tech crypto transactions.

As you can see, that was three years ago. The detractions you attempt to use no longer apply since you first made these assumptions. Time has passed, and progress has occurred in the proliferation of personal tracking devices know as smart phones.

The block chain technology is being played now in an effort to kill off the USD. Average prices for crypto-currency continue to trend upward is a direct result of the same reasoning some have for parking into bullion. The world's citizen's are losing faith in the USD and holding their money as alternate currency or assets from Federal Reserve notes. I welcome the end of he FED, but replacing with crypto is not my thing. At lest with bullion, I can stay in a collective of humans are are trying to remain sovereign with their spending without every detail analyzed and scrutinized by super computers for personality profiles.

Don't get flagged for the wrong type of behavior traits, or the AI will automate a kill campaign starting with drone accounts on social media, and ending with friends and family talking in an interview on the news or Dr. Phil about how you were such a good person and never expected they could do such things that caused agents of the state to kill you on site without a trial . And everybody would believe it.

a reply to: markovian

They cannot do it now because the legislation allowing for it has not been fully implemented. However. changing your definition as a depositor and instead as a shareholder has essentially confiscated the money you deposit into a bank as no longer technically guaranteed. This only happened in the last five years.

Its already happening, most of us just have not connected all the dots yet.

China is snapping up infrastructure projects and deals left and right in the undeveloped and developed world, including telecom. The most rudimentary smart phones from seven years ago were able an still can handle block chain tech crypto transactions.

More people around the world have cell phones than ever had land-lines

February 25, 2014

There are almost as many cell-phone subscriptions (6.8 billion) as there are people on this earth (seven billion)—and it took a little more than 20 years for that to happen. In 2013, there were some 96 cell-phone service subscriptions for every 100 people in the world. Shouting is the likely the next-most widespread communications technique:

Those figures are the latest from the United Nations’ telecommunications agency, which keeps track of the rise and fall of various kinds of communications technology. Of course, 100 subscriptions doesn’t mean that everyone has a cell phone, just most people. In wealthier countries, penetration rates exceed 100% because of individuals with multiple subscriptions, making up for the disparity in developing economies. Still, penetration rates are impressive even in poor countries, with an average of 89.4 subscriptions per 100 inhabitants.

As you can see, that was three years ago. The detractions you attempt to use no longer apply since you first made these assumptions. Time has passed, and progress has occurred in the proliferation of personal tracking devices know as smart phones.

The block chain technology is being played now in an effort to kill off the USD. Average prices for crypto-currency continue to trend upward is a direct result of the same reasoning some have for parking into bullion. The world's citizen's are losing faith in the USD and holding their money as alternate currency or assets from Federal Reserve notes. I welcome the end of he FED, but replacing with crypto is not my thing. At lest with bullion, I can stay in a collective of humans are are trying to remain sovereign with their spending without every detail analyzed and scrutinized by super computers for personality profiles.

Don't get flagged for the wrong type of behavior traits, or the AI will automate a kill campaign starting with drone accounts on social media, and ending with friends and family talking in an interview on the news or Dr. Phil about how you were such a good person and never expected they could do such things that caused agents of the state to kill you on site without a trial . And everybody would believe it.

a reply to: markovian

They cannot do it now because the legislation allowing for it has not been fully implemented. However. changing your definition as a depositor and instead as a shareholder has essentially confiscated the money you deposit into a bank as no longer technically guaranteed. This only happened in the last five years.

Its already happening, most of us just have not connected all the dots yet.

edit on 7-27-2017 by worldstarcountry because: (no reason

given)

new topics

-

Ireland VS Globalists

Social Issues and Civil Unrest: 26 minutes ago -

Biden "Happy To Debate Trump"

Mainstream News: 57 minutes ago -

RAAF airbase in Roswell, New Mexico is on fire

Aliens and UFOs: 1 hours ago -

What is the white pill?

Philosophy and Metaphysics: 2 hours ago -

Mike Pinder The Moody Blues R.I.P.

Music: 3 hours ago -

Putin, Russia and the Great Architects of the Universe

ATS Skunk Works: 6 hours ago -

A Warning to America: 25 Ways the US is Being Destroyed

New World Order: 10 hours ago

top topics

-

President BIDEN's FBI Raided Donald Trump's Florida Home for OBAMA-NORTH KOREA Documents.

Political Conspiracies: 16 hours ago, 35 flags -

A Warning to America: 25 Ways the US is Being Destroyed

New World Order: 10 hours ago, 18 flags -

Mike Pinder The Moody Blues R.I.P.

Music: 3 hours ago, 7 flags -

What is the white pill?

Philosophy and Metaphysics: 2 hours ago, 5 flags -

Biden "Happy To Debate Trump"

Mainstream News: 57 minutes ago, 5 flags -

RAAF airbase in Roswell, New Mexico is on fire

Aliens and UFOs: 1 hours ago, 4 flags -

Putin, Russia and the Great Architects of the Universe

ATS Skunk Works: 6 hours ago, 2 flags -

Ireland VS Globalists

Social Issues and Civil Unrest: 26 minutes ago, 2 flags

active topics

-

Candidate TRUMP Now Has Crazy Judge JUAN MERCHAN After Him - The Stormy Daniels Hush-Money Case.

Political Conspiracies • 793 • : matafuchs -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media • 279 • : cherokeetroy -

Putin, Russia and the Great Architects of the Universe

ATS Skunk Works • 21 • : Oldcarpy2 -

Is AI Better Than the Hollywood Elite?

Movies • 22 • : 5thHead -

Biden "Happy To Debate Trump"

Mainstream News • 14 • : Hakaiju -

King Charles 111 Diagnosed with Cancer

Mainstream News • 324 • : Oldcarpy2 -

Ireland VS Globalists

Social Issues and Civil Unrest • 2 • : TimBurr -

President Biden is Angry at A.G. Merrick Garland for Not Being Loyal to the Biden Family.

Above Politics • 20 • : WeMustCare -

RAAF airbase in Roswell, New Mexico is on fire

Aliens and UFOs • 4 • : gortex -

New whistleblower Jason Sands speaks on Twitter Spaces last night.

Aliens and UFOs • 75 • : baablacksheep1

8