It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

Interesting tibit here

S.KOREA TO HOLD EMERGENCY MEETING ON JAN. 26 TO DISCUSS MARKETS

Bloomberg has the details: South Korea Vice Finance Minister Choo Kyung Ho will host an emergency meeting tomorrow at 11 a.m. with counterparts from Bank of Korea and financial regulators to discuss market instabilities in emerging economies including Argentina, ministry says in text message.

So what happens if there is a, gasp, 5% drop from all time S&P500 highs - Janet Yellen shows up on every TV channel and tells broke viewers now is the time to buy stocks and pay for them in 4 easy installments using their favorite EBT card. What about a 10% correction: the army gets mobilized? And should the unthinkable happen and the centrally-planned "market" crash by 20% then nothing short of DefCon 1 and a 24/7 curfew would be acceptable.

We joke, but this is what happens in a time when the "confidence" of the entire world is defined by the daily move straight line higher in the S&P, and the tiniest derivation from this path results in sheer panic.

[/quote

www.zerohedge.com...

reply to post by Hellas

they say times like these are the perfect golden opportunities to buy common stock...any expert recommendations?

they say times like these are the perfect golden opportunities to buy common stock...any expert recommendations?

edit on

25-1-2014 by reject because: (no reason given)

Im not really sure what all this means honestly, maybe someone can explain, even before I joined ATS many moons ago, I have heard of a Financial

collapse in the USA.

What does Jan 31, 2014 default in China (Bonds) ?

and far as I know a -300 drop against a 16,0000 now lower Stock Market !

To really be a true melt down it would have to drop by Thousands quick

What does Jan 31, 2014 default in China (Bonds) ?

and far as I know a -300 drop against a 16,0000 now lower Stock Market !

To really be a true melt down it would have to drop by Thousands quick

Wake me up when it falls below 4K. That's where the fun is going to start.

Is everybody's powder dry? MuaHahahah!! I love doom porn!

Is everybody's powder dry? MuaHahahah!! I love doom porn!

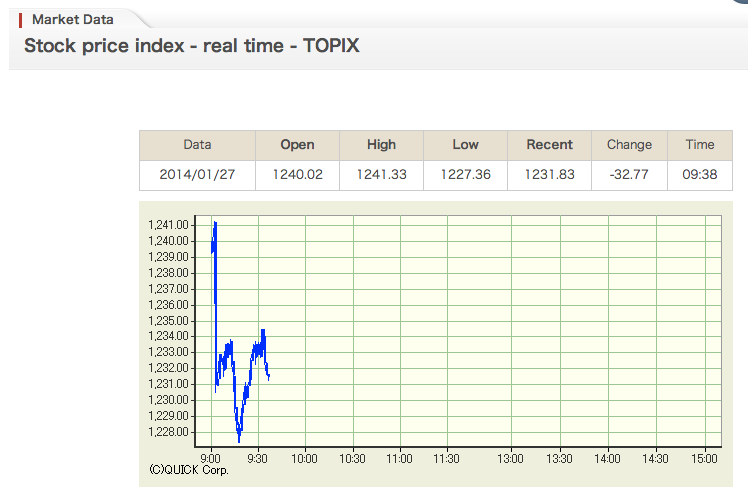

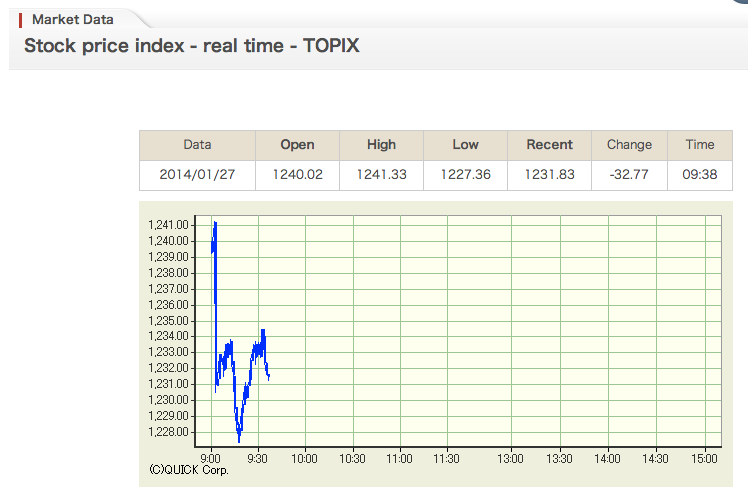

Japan, South Korea shares tumble on emerging market fears

CNBC

Tokyo Stock Exchange

Nikkei

CNBC Nikkei Real time

Asian equity markets kicked off the week with sharp losses after a sell-off in emerging-market currencies last week spooked investors.

Markets in Australia were closed to observe 'Australia Day.'

On Friday, emerging-market currencies took a beating amid growing worries about political upheaval, slowing growth and U.S. monetary policy. Turkey's lira hit a new record low against the dollar, and Argentina's peso was down almost 20 percent on the week against the dollar. That saw the Dow Jones Industrial Average post triple-digit declines for a second session on Friday.

"The EM currency selloff is causing a contagion effect where Asian markets are opening lower. The question is whether the selloff in the EM countries, Turkey, Ukraine and Argentina will have a sweeping effect on the others such as EM Asian countries. There are groups within the EM space that has current account surplus and demand for their goods which will weather this storm better," wrote Kelly Teoh, market strategist at IG in a note.

CNBC

Tokyo Stock Exchange

Nikkei

CNBC Nikkei Real time

edit on 26-1-2014 by Hellas because: (no reason given)

reply to post by Hellas

Thank's for the update. Being in Australia, I thought I'd be able to get the opening jump on this, this morning. Have been watching intensely for finacial reports of Friday. It is complete silence here and I do mean silence, even from our finacial guru's. Which just gives more insight to our case here. I had forgoten about the natural market close for the Australia Day holliday. How conveniant and well timed. Tomorrow my fellow Aussies won't know what hit them and it won't be good as they are going to be a day behind of the fall out and will be defenseless of the coming 24 hrs. Tents will be the new real estate boom.

Thank's for the update. Being in Australia, I thought I'd be able to get the opening jump on this, this morning. Have been watching intensely for finacial reports of Friday. It is complete silence here and I do mean silence, even from our finacial guru's. Which just gives more insight to our case here. I had forgoten about the natural market close for the Australia Day holliday. How conveniant and well timed. Tomorrow my fellow Aussies won't know what hit them and it won't be good as they are going to be a day behind of the fall out and will be defenseless of the coming 24 hrs. Tents will be the new real estate boom.

edit on 26-1-2014 by 13th Zodiac because: (no reason given)

www.abovetopsecret.com... Well this, is a interesting addition to the mix. So what was behind or what was the agenda of

the China/CNN rumor last week. Now seems to carry weight. Someone is manipulating things behind the scenes.

reply to post by 19KTankCommander

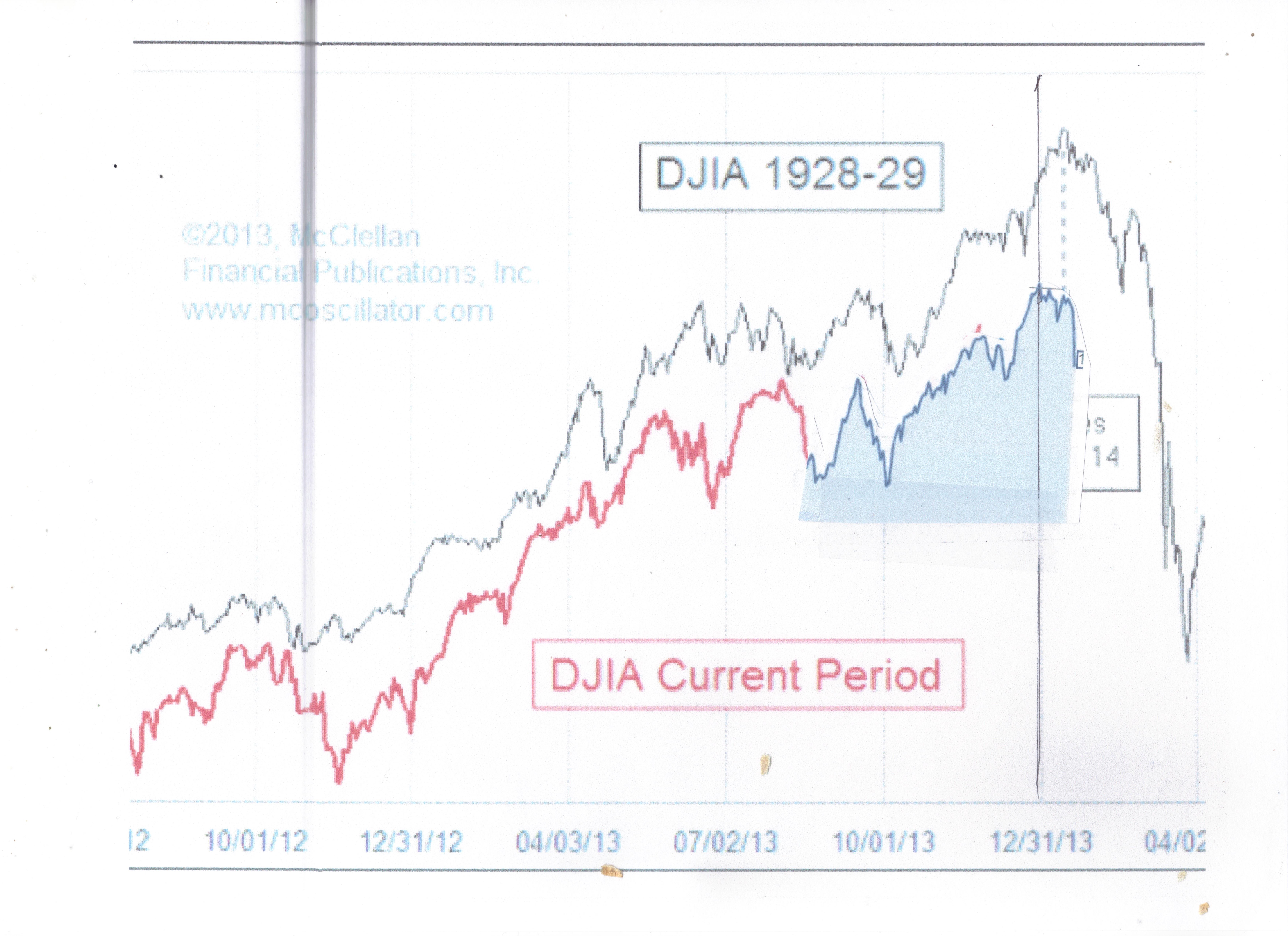

That is too close to identical.

That is creepy beyond words, and it simply reeks of behind the scenes manipulation, someone appears to literally mimicking the stock market crash, almost exactly. The question is, in todays market, will it have the same effect, vs what it was back then?

I have heard a lot of people argue that it won't. Me, and many others, fear it will. Whoever is doing this, I think they are hedging their bets it will.

Paging Mr. Soros. Paging Mr. Soros. Please pick up the red phone.

That is too close to identical.

That is creepy beyond words, and it simply reeks of behind the scenes manipulation, someone appears to literally mimicking the stock market crash, almost exactly. The question is, in todays market, will it have the same effect, vs what it was back then?

I have heard a lot of people argue that it won't. Me, and many others, fear it will. Whoever is doing this, I think they are hedging their bets it will.

Paging Mr. Soros. Paging Mr. Soros. Please pick up the red phone.

edit on 26-1-2014 by Libertygal because: (no reason given)

13th Zodiac

www.abovetopsecret.com... Well this, is a interesting addition to the mix. So what was behind or what was the agenda of the China/CNN rumor last week. Now seems to carry weight. Someone is manipulating things behind the scenes.

Wow, I hadn't even read your post yet, and having just read about China, then seeing the post right above this that I replied to, we have come to the same conclusion.

Question is, really, who?

Is it Soros? The "Illuminati"?

I don't have an answer, but, all signs are pointing to an obvious market manipulation, and China knows.

Heck, we know, but we are walking headlong into it, like a naked child into a blizzard.

Lord help us.

edit on 26-1-2014 by Libertygal because: (no reason given)

Alright,

Looks like the Forbes column beat writer Mr Chang mistook Citibank Chinese offices for all of China banking. Citibank is a US bank and it is curtailing withdraws due to it's currency shortage.

Still, we are all hyper sensitive to the Currency market as there are at least 2 countries that are facing serious and possible immediate currency revaluation.

Bought some more gold and silver to hedge my risk...

Good luck to all

Sirric

Looks like the Forbes column beat writer Mr Chang mistook Citibank Chinese offices for all of China banking. Citibank is a US bank and it is curtailing withdraws due to it's currency shortage.

Still, we are all hyper sensitive to the Currency market as there are at least 2 countries that are facing serious and possible immediate currency revaluation.

Bought some more gold and silver to hedge my risk...

Good luck to all

Sirric

reply to post by reject

IF the market crashes then gold will be god. That's all I have to say. The crash will come when QE3 is tappered.

IF the market crashes then gold will be god. That's all I have to say. The crash will come when QE3 is tappered.

amfirst1

reply to post by reject

IF the market crashes then gold will be god. That's all I have to say. The crash will come when QE3 is tappered.

Until you want a loaf of bread. Lol .

I'll swap you this 1 ton nugget of gold for that loaf of bread.

No thanks you keep it, I can eat gold.

reply to post by 13th Zodiac

Toilet paper. You don't realize the real value of soothing toilet paper.

Toilet paper. You don't realize the real value of soothing toilet paper.

19KTankCommander

reply to post by Libertygal

I finally got that scanner to work, sorry about the quality of pic running low on ink as well, so here is the updated chart, I guess one has to think history will be repeating itself, since we had almost a 500 point loss in two days.

Anyone want to look for themselves go to McCellan.com and Dow charts, put the same start date listed on chart and you can match them up. Its to eerie to see them and make one think. I will continue to watch this.

Damn that's creepy. Good find...

reply to post by MessageforAll

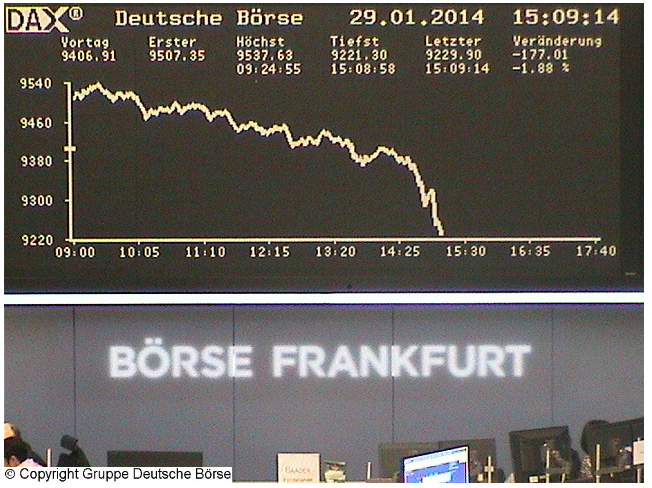

Well that depends on your Trades. But an overall -2% in one trading day can't be very good. We'll see how this goes today. Still 4.5 hours to go.

Wall Streets opens in a couple of minutes

Well that depends on your Trades. But an overall -2% in one trading day can't be very good. We'll see how this goes today. Still 4.5 hours to go.

Wall Streets opens in a couple of minutes

edit on 29-1-2014 by Hellas because: (no reason given)

reply to post by Hellas

I see, Hellas you seem kinda informed when it comes to stock, could you explain in laymen terms whats happening now?

Referring to this :

www.zerohedge.com...

www.zerohedge.com...

I'm sure you read ZH, I try to read, however I rarely understand anything lol. Still over time I might. Something has happened in Turkey and apparently is spreading to South Africa.

I see, Hellas you seem kinda informed when it comes to stock, could you explain in laymen terms whats happening now?

Referring to this :

www.zerohedge.com...

www.zerohedge.com...

I'm sure you read ZH, I try to read, however I rarely understand anything lol. Still over time I might. Something has happened in Turkey and apparently is spreading to South Africa.

reply to post by MessageforAll

Just for the heck of it, I took a look at the markets, worldwide. Over the last 5 days, US indices have fallen around an average of 3.5-3.6%. European, 4.8-4.9%. Asia, 2.8-2.9%, except for Shanghai, which is up. I don't really know that it spells doom, just interesting.

Just for the heck of it, I took a look at the markets, worldwide. Over the last 5 days, US indices have fallen around an average of 3.5-3.6%. European, 4.8-4.9%. Asia, 2.8-2.9%, except for Shanghai, which is up. I don't really know that it spells doom, just interesting.

reply to post by MessageforAll

My take on this is since we are connected by the central bank system, every slip on let's say currencies has a butterfly effect on other currencies. (See for example the whole turmoil Turkey had last month with corruption etc.) So everything is planned and created.

Now you could spin this web in any form or shape to create every possible conspiracy theory as to how "they" control things. I personally just trade for fun and do not have inside knowledge when it comes to the global picture. Like I said this is just my take on this.

My take on this is since we are connected by the central bank system, every slip on let's say currencies has a butterfly effect on other currencies. (See for example the whole turmoil Turkey had last month with corruption etc.) So everything is planned and created.

Now you could spin this web in any form or shape to create every possible conspiracy theory as to how "they" control things. I personally just trade for fun and do not have inside knowledge when it comes to the global picture. Like I said this is just my take on this.

new topics

-

Weinstein's conviction overturned

Mainstream News: 49 minutes ago -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics: 2 hours ago -

Krystalnacht on today's most elite Universities?

Social Issues and Civil Unrest: 2 hours ago -

Chris Christie Wishes Death Upon Trump and Ramaswamy

Politicians & People: 2 hours ago -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media: 5 hours ago -

Any one suspicious of fever promotions events, major investor Goldman Sachs card only.

The Gray Area: 7 hours ago -

God's Righteousness is Greater than Our Wrath

Religion, Faith, And Theology: 11 hours ago

top topics

-

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News: 16 hours ago, 11 flags -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues: 16 hours ago, 6 flags -

Krystalnacht on today's most elite Universities?

Social Issues and Civil Unrest: 2 hours ago, 6 flags -

Sunak spinning the sickness figures

Other Current Events: 16 hours ago, 5 flags -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics: 2 hours ago, 5 flags -

Weinstein's conviction overturned

Mainstream News: 49 minutes ago, 4 flags -

Electrical tricks for saving money

Education and Media: 14 hours ago, 4 flags -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media: 5 hours ago, 2 flags -

Any one suspicious of fever promotions events, major investor Goldman Sachs card only.

The Gray Area: 7 hours ago, 2 flags -

Chris Christie Wishes Death Upon Trump and Ramaswamy

Politicians & People: 2 hours ago, 1 flags

active topics

-

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics • 23 • : Boomer1947 -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media • 102 • : Threadbarer -

Weinstein's conviction overturned

Mainstream News • 10 • : xuenchen -

Chris Christie Wishes Death Upon Trump and Ramaswamy

Politicians & People • 8 • : network dude -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues • 79 • : Consvoli -

Remember These Attacks When President Trump 2.0 Retribution-Justice Commences.

2024 Elections • 57 • : TzarChasm -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 670 • : cherokeetroy -

British TV Presenter Refuses To Use Guest's Preferred Pronouns

Education and Media • 159 • : 5thHead -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three • 40 • : Myhandle -

President BIDEN Vows to Make Americans Pay More Federal Taxes in 2025 - Political Suicide.

2024 Elections • 144 • : underpass61