It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

JP Morgan Chase CEO Denounces Bitcoin as "Terrible" and Predicts its Downfall-or is it the dollar?

page: 16

share:

Link - RT

What this tells me is that it's time to invest in Bitcoins.

How come? This is the CEO of JP Morgan Chase, and he doesn't understand how Bitcoins work - he doesn't understand that they have more value than the dollars he holds so dear - the value comes from something called electricity and computational power.

In the Electronic Age, does it not make sense that electricity would be a decent choice for something to back a currency? Has anyone ever played Risk 2200 and used their energy credits in order to purchase things?

What does the dollar have backing it? Nothing but a failed economy, trillions in debt and endless popping bubbles.

When the CEO of JP Morgan chase says "the cryptocurrency does not have much staying power because the hurdles it faces are insurmountable," I am interested in what those obstacles he is talking about are, because that would give me a clue as to how the world is going to change in the next few years.

Whatever "obstacles" are in the way of the Bitcoin are probably going to collapse, in my opinion, for the same reasons that the Bitcoin is going to survive.

What really gives away the Bitcoin as the winner in this situation is the CEO of JP Morgan Chase being wrong about certain statements he thinks are factual.

That is incorrect. In fact, the method in which the Bitcoin is made makes it more valuable than the U.S. Dollar by far if we take how many times it can be replicated without any backing of a real resource as the function determining its value (which is zero times for the Bitcoin and infinite for the dollar).

First of all, and?

Second of all,

When the CEO of JP Morgan Chase speaks, he is really admitting that he doesn't know what he is talking about. And - the winner in this battle is going to be the side with the least amount of inaccurate information - which is not his side. He may have more informed things to say, as he was chosen as the CEO of JP Morgan Chase, but certainly not in this article (which could be biased) -

In the meantime, if he is one of the most informed bankers on the issue, there you go. Things are moving too fast for the leadership to keep up. Which still supports my original argument.

But his remarks remind me of how successful Netflix was by taking advantage of people's natural need to stream content in an organized fashion, at their leisure, of their choice - and how cable comapanies have been left in the dust.

Who wants to pay $40 a month for a service that doesn't include any control over content and has advertisements, when someone could pay $10 a month for Netflix?

Seeing how wrong he is about things, in fact, leads us to this.

So, what the CEO is saying, the CEO of a BANK that relies on the FREE MARKET, that the only way to stop the Bitcoin is through government intervention. His own words make his own position extremely weak.

But the bigger question is, what government is willing to put its weight behind shutting down a currency that is clearly a stable alternative to the dollar?

That would almost be a suicidal move - for it would be transparent, and made during a diplomatic stand-off of sorts between nations who are already fed up with the U.S. enough to back the Bitcoin as the global currency over the Dollar, if the option was made available - is there really a better argument to be made for the dollar to be the global reserve currency?

The head of the largest bank in the US said Thursday that bitcoin is a “terrible store of value,” in part because international governments, bankers, and other officials are unsure whether they can trust the digital currency.

Jamie Dimon, the CEO of JP Morgan Chase - which has $2.509 trillion in total assets - told CNBC that the cryptocurrency does not have much staying power because the hurdles it faces are insurmountable.

“It’s a terrible store of value. It could be replicated over and over,” he said. “It doesn’t have the standing of a government.”

Bitcoin proponents say that the currency’s ability to exist without any centralization is what makes it so appealing. It is a peer-to-peer payment system that is formulated when computers compete with each other to “mine,” or solve cryptographic problems, and are assigned bitcoins as a reward.

What this tells me is that it's time to invest in Bitcoins.

How come? This is the CEO of JP Morgan Chase, and he doesn't understand how Bitcoins work - he doesn't understand that they have more value than the dollars he holds so dear - the value comes from something called electricity and computational power.

In the Electronic Age, does it not make sense that electricity would be a decent choice for something to back a currency? Has anyone ever played Risk 2200 and used their energy credits in order to purchase things?

What does the dollar have backing it? Nothing but a failed economy, trillions in debt and endless popping bubbles.

When the CEO of JP Morgan chase says "the cryptocurrency does not have much staying power because the hurdles it faces are insurmountable," I am interested in what those obstacles he is talking about are, because that would give me a clue as to how the world is going to change in the next few years.

Whatever "obstacles" are in the way of the Bitcoin are probably going to collapse, in my opinion, for the same reasons that the Bitcoin is going to survive.

What really gives away the Bitcoin as the winner in this situation is the CEO of JP Morgan Chase being wrong about certain statements he thinks are factual.

It's a terrible store of value, it can be replicated over and over."

That is incorrect. In fact, the method in which the Bitcoin is made makes it more valuable than the U.S. Dollar by far if we take how many times it can be replicated without any backing of a real resource as the function determining its value (which is zero times for the Bitcoin and infinite for the dollar).

“It doesn’t have the standing of a government.”

First of all, and?

Second of all,

The use of bitcoin became so prevalent in 2013 that its value surged from $13 to over $1,000 by the end of the year, when it was the subject of Senate hearings that were largely neutral and at times positive towards the digital currency.

When the CEO of JP Morgan Chase speaks, he is really admitting that he doesn't know what he is talking about. And - the winner in this battle is going to be the side with the least amount of inaccurate information - which is not his side. He may have more informed things to say, as he was chosen as the CEO of JP Morgan Chase, but certainly not in this article (which could be biased) -

In the meantime, if he is one of the most informed bankers on the issue, there you go. Things are moving too fast for the leadership to keep up. Which still supports my original argument.

But his remarks remind me of how successful Netflix was by taking advantage of people's natural need to stream content in an organized fashion, at their leisure, of their choice - and how cable comapanies have been left in the dust.

Who wants to pay $40 a month for a service that doesn't include any control over content and has advertisements, when someone could pay $10 a month for Netflix?

Seeing how wrong he is about things, in fact, leads us to this.

Dimon speculated that bitcoin will soon become popular enough that the government will intervene, which could spell out the cryptocurrency’s demise.

“They will eventually be made as a payment system to follow the same standards as the other payment systems and that will probably be the end of them,” he said.

So, what the CEO is saying, the CEO of a BANK that relies on the FREE MARKET, that the only way to stop the Bitcoin is through government intervention. His own words make his own position extremely weak.

But the bigger question is, what government is willing to put its weight behind shutting down a currency that is clearly a stable alternative to the dollar?

That would almost be a suicidal move - for it would be transparent, and made during a diplomatic stand-off of sorts between nations who are already fed up with the U.S. enough to back the Bitcoin as the global currency over the Dollar, if the option was made available - is there really a better argument to be made for the dollar to be the global reserve currency?

edit on 24amFri, 24 Jan 2014 07:12:49 -0600kbamkAmerica/Chicago by

darkbake because: (no reason given)

reply to post by darkbake

It is a possibility, I suppose, that a currency with more value than the dollar because it has a resource backing it will be shut down by world governments because it is too useful for people to use - but that flies in the face of what history has shown us has happened in the past ten years regarding file-sharing evolving into Netflix.

It would also set an interesting precedent - governments and corporations not acting in the best interest of the people, but in self-defense of themselves. How long would that last? See - the government and corporations only exist because they provide services to the people, who then in turn pay them with either votes / legitimacy or cash.

Back to Netflix flourishing - the traditional Cable companies are struggling, and no amount of cursing and yelling about how things should be working according to them makes any difference when faced with the reality of how things do work. And who can complain - that's how the free market is supposed to function.

In fact, if the CEO was correct in his assertions, I would be just as surprised as if he was incorrect - because that would mark a major shift in how the Information Age functions a mere 10 - 20 years after it started getting into full swing.

-----

The reason I posted this article in the first place is because I feel like there is something of substance going on at the moment that is not being discussed or reported on. This was the closest I could get to it.

It is a possibility, I suppose, that a currency with more value than the dollar because it has a resource backing it will be shut down by world governments because it is too useful for people to use - but that flies in the face of what history has shown us has happened in the past ten years regarding file-sharing evolving into Netflix.

It would also set an interesting precedent - governments and corporations not acting in the best interest of the people, but in self-defense of themselves. How long would that last? See - the government and corporations only exist because they provide services to the people, who then in turn pay them with either votes / legitimacy or cash.

Back to Netflix flourishing - the traditional Cable companies are struggling, and no amount of cursing and yelling about how things should be working according to them makes any difference when faced with the reality of how things do work. And who can complain - that's how the free market is supposed to function.

In fact, if the CEO was correct in his assertions, I would be just as surprised as if he was incorrect - because that would mark a major shift in how the Information Age functions a mere 10 - 20 years after it started getting into full swing.

-----

The reason I posted this article in the first place is because I feel like there is something of substance going on at the moment that is not being discussed or reported on. This was the closest I could get to it.

edit on 24amFri, 24 Jan 2014 06:59:39 -0600kbamkAmerica/Chicago by darkbake

because: (no reason given)

edit on 24amFri, 24 Jan 2014 07:00:38 -0600kbamkAmerica/Chicago by darkbake because: (no reason

given)

Great thread! I myself have been aware of bitcoins for about 5 or 6 years now.....and once almost invested heavily in them. This was when they were

worth about $100 a piece. They are worth roughly $900 a piece now.....a shame I didn't invest. People say that it is a bad investment, because the

prices go up and down so much.....remind you of anything? Fortunately, I do NOT think bitcoins have reached their stable price...and I think it will

keep rising. Once it DOES , however, assuming that it will continue on, the highs and lows will fluctuate less, and it will be less volatile.

Anyway, I do NOT think bitcoins have ANY CHANCE IN HELL of going anywhere.....which ONE exception - the world government's force its shut down (if they can). They already DO see it as threat, especially the big banks, mainly because it is electricity which generates it, and just like Tesla's original design for electrical plants that couldn't be metered, the banks do not want something they are not in complete control of.

Anyway, I do NOT think bitcoins have ANY CHANCE IN HELL of going anywhere.....which ONE exception - the world government's force its shut down (if they can). They already DO see it as threat, especially the big banks, mainly because it is electricity which generates it, and just like Tesla's original design for electrical plants that couldn't be metered, the banks do not want something they are not in complete control of.

reply to post by darkbake

Well, you seem to have as a good understanding as the Bankster on the "value" of bitcoins. The value comes from the same source as the dollar, the trusts that users have on it, in that point the bankster gets it right, trust can be maintained by force hence the power of having a state linked to it (that will defend it tooth and nail). Bitcoin on the other hand depends simply on a broader but at the same time weaker (non enforcible) trust base (no one will invade a nation or go to war about it). It is all about trust you can redeem the bitcoin electricity or computing power needed to create it if it crashes below the cost of production. So the value is simply the trust in the continued perception of the currency viability and it is system dependent (that is why the petrodollar and be the reserve currency is important) ...

How come? This is the CEO of JP Morgan Chase, and he doesn't understand how Bitcoins work - he doesn't understand that they have more value than the dollars he holds so dear - the value comes from something called electricity and computational power.

Well, you seem to have as a good understanding as the Bankster on the "value" of bitcoins. The value comes from the same source as the dollar, the trusts that users have on it, in that point the bankster gets it right, trust can be maintained by force hence the power of having a state linked to it (that will defend it tooth and nail). Bitcoin on the other hand depends simply on a broader but at the same time weaker (non enforcible) trust base (no one will invade a nation or go to war about it). It is all about trust you can redeem the bitcoin electricity or computing power needed to create it if it crashes below the cost of production. So the value is simply the trust in the continued perception of the currency viability and it is system dependent (that is why the petrodollar and be the reserve currency is important) ...

Funny that this comes on the heels of Google actually taking a look at backing bitcoin...I think JP sees possible loss of power to something a bit

more "here and now" without the "good ole boy" system.

Source

Source

To his surprise, Gundotra wrote him back. He also forwarded Malik’s query to another Google staffer and started a series of email exchanges that led to one Googler telling Malik that the company is indeed pondering how it can make use of the world’s first form of decentralized digital cash.

“We are working in the payments team to figure out how to incorporate bitcoin into our plans,” wrote Google Senior VP of Ads and Commerce Sridhar Ramaswamy at one point in the email exchange that Malik forwarded to me. He promised to get back in touch “when we are a little more sure.”

questions about bitcoin from an old computer guy.....

1...does the (person, persons, organization, country, cartel, banker, crook) that originally wrote the "code" for bitcoin, have a backdoor where he can go in and control it?

2...it is said that bitcoin will max out at a quantity of 21 million total...really?...guaranteed by who?...and how would anyone know for sure?

3...if all buy/sell transactions are handled by an computer algorithm, why can days go by, before credited into actual currency in users accounts?

4...if fraud is discovered, or, bitcoin loses value quickly, how do you get your money back, and from who?...an algorithm?

1...does the (person, persons, organization, country, cartel, banker, crook) that originally wrote the "code" for bitcoin, have a backdoor where he can go in and control it?

2...it is said that bitcoin will max out at a quantity of 21 million total...really?...guaranteed by who?...and how would anyone know for sure?

3...if all buy/sell transactions are handled by an computer algorithm, why can days go by, before credited into actual currency in users accounts?

4...if fraud is discovered, or, bitcoin loses value quickly, how do you get your money back, and from who?...an algorithm?

reply to post by Panic2k11

I see what you are saying about not being able to redeem the Bitcoins for the energy that was used to make them in the first place, that was a good call (the dollar still can't be redeemed for gold, either).

But at the same time, the Bitcoin supply is limited, and what is made takes work to produce. This makes it a bit different to the U.S. dollar, but more similar than I had first said.

Source

I looked into Bitcoin mining once, and this source is talking about the fact that the Bitcoins are made to get harder and harder to mine over time. Also, the block reward is halved every once in a while.

Therefore, there will be a limited supply of Bitcoins introduced into the market by 2140. The U.S. Dollar, however, has no such limit - it can be printed at will. This was more of what I was getting at - in addition, even though the Bitcoin cannot be redeemed for the electricity (good point btw) it still had to be earned with electricity. In fact, some mining rigs, once outdated, produce less of a return in Bitcoins than their power bill.

I see what you are saying about not being able to redeem the Bitcoins for the energy that was used to make them in the first place, that was a good call (the dollar still can't be redeemed for gold, either).

But at the same time, the Bitcoin supply is limited, and what is made takes work to produce. This makes it a bit different to the U.S. dollar, but more similar than I had first said.

Source

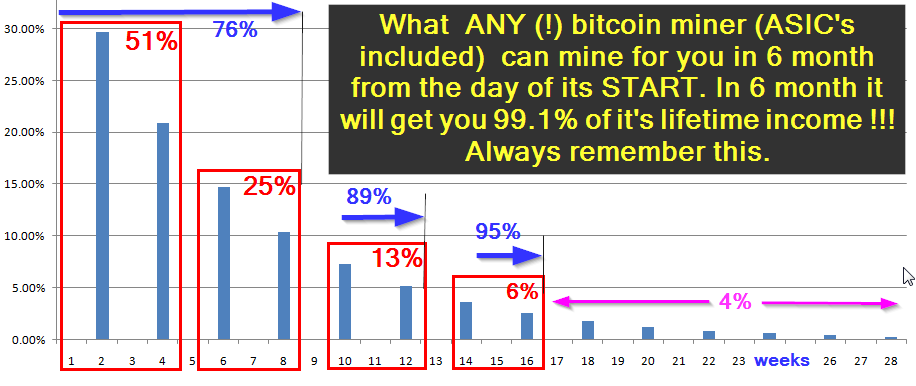

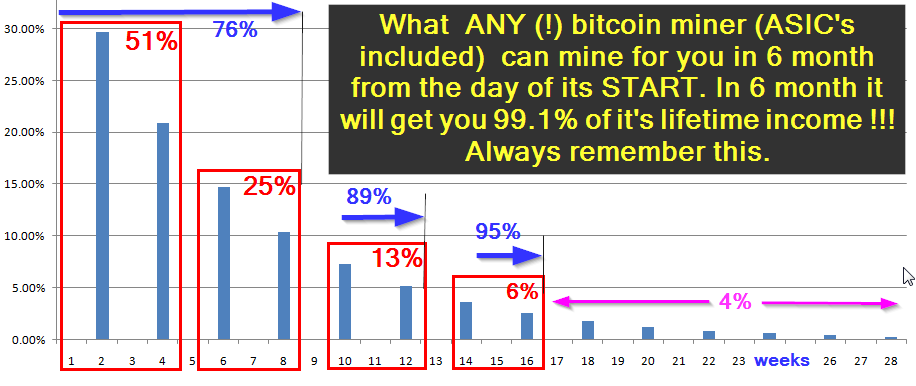

CPU mining is DEAD. GPU mining is DEAD. Even FPGA mining is DEAD !

ASIC's ? Yes them still can be profitable. But..... ONLY if you can get your ASIC cheap. Here are the maximum prices you can pay for ASIC, and still have some hopes to get ROI in 3-4 month:

40+ GHs for 1BTC - if you get your machine TODAY

75+ GH/BTC - if ASIC delivered within 1 month

160+ GH/BTC - if ASIC delivered within 2 month

Why ROI in 3-4 month?

Because if it takes longer, most likelly you will never get your money back Never forget this:

i.imgur.com...

I looked into Bitcoin mining once, and this source is talking about the fact that the Bitcoins are made to get harder and harder to mine over time. Also, the block reward is halved every once in a while.

Currently, doing the work of payment processing is rewarded with newly created bitcoins, 25 per block. The block reward will be halved to 12.5 bitcoins in 2017 and again approximately every four years thereafter. By 2140 there will be approximately 21 million bitcoins in existence and transaction processing will be solely incentivized by transaction fees.[27] Today, transactions that pay a fee may be processed more quickly

Therefore, there will be a limited supply of Bitcoins introduced into the market by 2140. The U.S. Dollar, however, has no such limit - it can be printed at will. This was more of what I was getting at - in addition, even though the Bitcoin cannot be redeemed for the electricity (good point btw) it still had to be earned with electricity. In fact, some mining rigs, once outdated, produce less of a return in Bitcoins than their power bill.

edit on 24amFri, 24 Jan 2014 08:26:16 -0600kbamkAmerica/Chicago by darkbake because: (no reason given)

reply to post by jimmyx

One question a friend and I had was about the fact that the Bitcoins are generated through hashing algorithms - which my friend, who is a hacker, noted was hacking.

Does anyone know if the Bitcoin algorithms are actually being hashed in order to break into secure systems or something like that? Like double-dipping? Paying people to use computing power to hack?

I haven't done any hacking, so I'm not privy to details in this. But it seems like if all of that computer power was being used to hash it might as well be hashing something useful, and someone who was smart enough to make the Bitcoin protocol would be smart enough to know this, right?

The founder of Bitcoin was a pseudonym, Satoshi Nakamoto, which may be a group of people, who are also in possession of around 1 million Bitcoins, or 1.1 billion U.S. Dollars.

Right now, Gavin Andresen is running the show.

One question a friend and I had was about the fact that the Bitcoins are generated through hashing algorithms - which my friend, who is a hacker, noted was hacking.

Does anyone know if the Bitcoin algorithms are actually being hashed in order to break into secure systems or something like that? Like double-dipping? Paying people to use computing power to hack?

I haven't done any hacking, so I'm not privy to details in this. But it seems like if all of that computer power was being used to hash it might as well be hashing something useful, and someone who was smart enough to make the Bitcoin protocol would be smart enough to know this, right?

The founder of Bitcoin was a pseudonym, Satoshi Nakamoto, which may be a group of people, who are also in possession of around 1 million Bitcoins, or 1.1 billion U.S. Dollars.

Right now, Gavin Andresen is running the show.

In April 2011, Forbes quoted Andresen as saying, "Bitcoin is designed to bring us back to a decentralized currency of the people," and "this is like better gold than gold."[5]

edit on 24amFri, 24 Jan 2014 08:36:36 -0600kbamkAmerica/Chicago by darkbake because: (no reason

given)

reply to post by darkbake

This is why JPM hates Bitcoin.

They can't completely control it. They are trying though.

JPM trying and failing to patent their own electronic currency

JPM is arguably the biggest criminal enterprise in the history of Humanity

This is why JPM hates Bitcoin.

They can't completely control it. They are trying though.

JPM trying and failing to patent their own electronic currency

JPM is arguably the biggest criminal enterprise in the history of Humanity

All I want to know is how do I cash out?

I need a new car.

I need a new car.

edit on 24-1-2014 by SLAYER69 because: (no reason given)

reply to post by darkbake

Do you honestly think the USD or bitcoin will even be around in 2140? It doesn't make much sense.

As for the miners, the source is not entirely correct. People bank off having the newest tech first. If you can get a first batch for the miners using the newest tech, you're going to at least double your investment in the first few months.

Do you honestly think the USD or bitcoin will even be around in 2140? It doesn't make much sense.

As for the miners, the source is not entirely correct. People bank off having the newest tech first. If you can get a first batch for the miners using the newest tech, you're going to at least double your investment in the first few months.

jimmyx

questions about bitcoin from an old computer guy.....

1...does the (person, persons, organization, country, cartel, banker, crook) that originally wrote the "code" for bitcoin, have a backdoor where he can go in and control it?

2...it is said that bitcoin will max out at a quantity of 21 million total...really?...guaranteed by who?...and how would anyone know for sure?

3...if all buy/sell transactions are handled by an computer algorithm, why can days go by, before credited into actual currency in users accounts?

4...if fraud is discovered, or, bitcoin loses value quickly, how do you get your money back, and from who?...an algorithm?

1. No, probably not. The very nature of the public ledger system would make the use of such a backdoor transparent and probably pretty easy to detect. Most bitcoin client/mining software is open sourced too. Keep in mind you should trust the people you buy your bitcoin from and store your wallet with, they may be able to lose them or steal them.

2. The algorithm to determine bitcoins has a finite limit (as mentioned by OP)

3. Days? I thought it was minutes. When you trade a bitcoin a public ledger being run by miners is updated usually within a few minutes to an hour. Other currecny software such as LTC is faster too. To actually buy a bitcoin you have to have someone sell it to you for USD. The speed this can happen depends on the market you are using.

4. In some cases, if it is the market you are usings fault and soley their fault they may refund you. Otherwise, if you were to take a bitcoin, put it in the recycle bin and empty, its gone. It is like burning away paper money (I mean literally with fire). If it loses value, well that sucks!

Here is my question:

What happens to the security, safety, and integrity of bitcoin when quantum computing is introduced?

It seems like the whole reasons people use this currency is its security and decentralized nature. Since encryption relies entirely on factorizing primes, and quantum computers can handle this task easily, what is to say there isnt the NSA or some corporation (like google) with a quantum computer tracking EVERY btc trade. All of these hashing algorithms are nothing against this technology, we could mine all the bitcoin left to exist in a week! With quantum computers involved this all falls apart. As we get closer and closer to personal quantum computers this currency will be useless...

Also what happens when the internet shuts off?? We trade thumbdrives with btc on them It wont be around forever. Lets just stick to trading bushels of hay for goats people. Stupid paper and math currencies.

reply to post by darkbake

Bitcoins have no limit is supply (there is an upper bound, that is still to be reached) but they can be infinity fractioned (removing the limit in supply). Mining itself does not add value to bitcoins (in fact it decreases it as it spreads their value to cover the new mined coins), mining bitcoins is only a function of the security method a hurdle that secures the system.

The limit at the core is the same it is a systemic limit, the dollar has an unfixed upper limit of production also (note that the dollar itself can also be fractioned but paper money tends to continuously decrease in value as a result of the credit system it relies on). The limit in the dollar is the just harder to define as it is based on the capacity of the system to absorb new bills (especially if the real value of it decreases faster than expected and there is a decrease in ways to convert it into other stuff, that is the problem with the quantitative easing that Japan is at cusp of the wave, next the US and then the UK).

As an European I'm glad that Germany is preventing the Eurozone to engage in the same behavior (even if for the wrong reasons) and I think that Eurobonds should have been used to spread the burden.

But at the same time, the Bitcoin supply is limited, and what is made takes work to produce.

Bitcoins have no limit is supply (there is an upper bound, that is still to be reached) but they can be infinity fractioned (removing the limit in supply). Mining itself does not add value to bitcoins (in fact it decreases it as it spreads their value to cover the new mined coins), mining bitcoins is only a function of the security method a hurdle that secures the system.

The U.S. Dollar, however, has no such limit - it can be printed at will.

The limit at the core is the same it is a systemic limit, the dollar has an unfixed upper limit of production also (note that the dollar itself can also be fractioned but paper money tends to continuously decrease in value as a result of the credit system it relies on). The limit in the dollar is the just harder to define as it is based on the capacity of the system to absorb new bills (especially if the real value of it decreases faster than expected and there is a decrease in ways to convert it into other stuff, that is the problem with the quantitative easing that Japan is at cusp of the wave, next the US and then the UK).

As an European I'm glad that Germany is preventing the Eurozone to engage in the same behavior (even if for the wrong reasons) and I think that Eurobonds should have been used to spread the burden.

reply to post by Panic2k11

I'd posit that mining does add value in a sense, because it brings bit-coin from a pure abstraction into the physical. When you mine, you use physical resources and electricity. That makes it easier for some investors to understand the concept and latch onto it as a legitimate new currency. You're right about the infinite fractioning, but I honestly think it'll be replaced by a more advanced cryptocurrency by the time they're all mined out.

I'd posit that mining does add value in a sense, because it brings bit-coin from a pure abstraction into the physical. When you mine, you use physical resources and electricity. That makes it easier for some investors to understand the concept and latch onto it as a legitimate new currency. You're right about the infinite fractioning, but I honestly think it'll be replaced by a more advanced cryptocurrency by the time they're all mined out.

reply to post by darkbake

Sounds like the moneychangers are pooping in their pants since this time there is no one single person to kill (Kennedy, Garfield, Lincoln...all the way back to Jesus and probably a few before him as well)

The banksters may 'finally' after 2000 years may have to stop feeding off of others.

Sounds like the moneychangers are pooping in their pants since this time there is no one single person to kill (Kennedy, Garfield, Lincoln...all the way back to Jesus and probably a few before him as well)

The banksters may 'finally' after 2000 years may have to stop feeding off of others.

Jamie Dimon makes my blood boil. I knew when I clicked on your thread that you'd be talking about him....

but the picture at the very first......

darkbake! I think I might vomit!!

InverseLookingGlass said:

The man is a demon. He needs to be gone.

but the picture at the very first......

darkbake! I think I might vomit!!

InverseLookingGlass said:

JPM is arguably the biggest criminal enterprise in the history of Humanity

The man is a demon. He needs to be gone.

The first time I heard of Bit coin was on the deep web. Due to the association with crime I was put off from buying any, That was when they were cheap

($30 ish a piece). I wish I would have now.

new topics

-

The functionality of boldening and italics is clunky and no post char limit warning?

ATS Freshman's Forum: 42 minutes ago -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News: 1 hours ago -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest: 1 hours ago -

Weinstein's conviction overturned

Mainstream News: 2 hours ago -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics: 4 hours ago -

Krystalnacht on today's most elite Universities?

Social Issues and Civil Unrest: 4 hours ago -

Chris Christie Wishes Death Upon Trump and Ramaswamy

Politicians & People: 4 hours ago -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media: 7 hours ago -

Any one suspicious of fever promotions events, major investor Goldman Sachs card only.

The Gray Area: 9 hours ago

top topics

-

Krystalnacht on today's most elite Universities?

Social Issues and Civil Unrest: 4 hours ago, 8 flags -

Weinstein's conviction overturned

Mainstream News: 2 hours ago, 6 flags -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics: 4 hours ago, 5 flags -

Electrical tricks for saving money

Education and Media: 16 hours ago, 5 flags -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media: 7 hours ago, 5 flags -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News: 1 hours ago, 3 flags -

Chris Christie Wishes Death Upon Trump and Ramaswamy

Politicians & People: 4 hours ago, 2 flags -

Any one suspicious of fever promotions events, major investor Goldman Sachs card only.

The Gray Area: 9 hours ago, 2 flags -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest: 1 hours ago, 2 flags -

God's Righteousness is Greater than Our Wrath

Religion, Faith, And Theology: 13 hours ago, 1 flags

active topics

-

Chris Christie Wishes Death Upon Trump and Ramaswamy

Politicians & People • 16 • : nugget1 -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics • 54 • : network dude -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media • 162 • : Vermilion -

The functionality of boldening and italics is clunky and no post char limit warning?

ATS Freshman's Forum • 5 • : CarlLaFong -

Weinstein's conviction overturned

Mainstream News • 19 • : Vermilion -

Candidate TRUMP Now Has Crazy Judge JUAN MERCHAN After Him - The Stormy Daniels Hush-Money Case.

Political Conspiracies • 762 • : Oldcarpy2 -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 675 • : Thoughtful3 -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News • 3 • : network dude -

Any one suspicious of fever promotions events, major investor Goldman Sachs card only.

The Gray Area • 9 • : xuenchen -

President BIDEN Vows to Make Americans Pay More Federal Taxes in 2025 - Political Suicide.

2024 Elections • 145 • : ImagoDei

6