It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

Now this is an eye opener and a sobering assessment. In searching for this story, I found Peter Schiff has been a featured guest on ATS Live, among

other references from past years here. It sounds like he's a man respected for his opinion and background.

If he's right about this prediction, as he's apparently called the past few economic crashes/recessions? We're in very bad trouble.

It's partially the bell I've been ringing myself with regard to this nations unbelievable attitude toward printing money like Monopoly can be "Played" forever with our people sitting as the bankers and the inevitable rising interest rates that will bring this house crashing down.

I hope the full extent of his predictions are incorrect though. This is worse than even I figured it would be.

We cannot spend our way out of debt. (absurd and ignorant notion on the face of it.) We cannot tax our way out of it. (People are damn near broken by the taxes now and Obamacare is going to hit much harder and very soon). The only thing we can do is cut. Cut at *ALL* levels. Not just the gaming with sequester to cut with maximum pain for some while others keep the bonus money flowing as if nothing is wrong. That is where games come in and games are what got us here. He goes on...

If this man knows his stuff.....and he appears to know his stuff....then we're in for a calamity and not too far into the future. We have all the makings for one big crap pie. All we need is rising interest rates, which is largely what the Fed is spending money like it's free to prevent.

The game can't play forever.

Our resources, even by printing funny money in fantasy spreadsheets, are coming to a break point. There isn't much play left to run on this and I hope people here, at least, pay heed to these warning signs.

Much of the nation is blinded by outright cooked books and creative numbers. I hope folks at ATS, with our skeptical minds, know better and use that critical thinking to recall the past several years, back to 2006/2007, to know what chain of events led us here to see what it's leading us to.

Hunker down, by the sound of it.

If he's right about this prediction, as he's apparently called the past few economic crashes/recessions? We're in very bad trouble.

It's partially the bell I've been ringing myself with regard to this nations unbelievable attitude toward printing money like Monopoly can be "Played" forever with our people sitting as the bankers and the inevitable rising interest rates that will bring this house crashing down.

I hope the full extent of his predictions are incorrect though. This is worse than even I figured it would be.

"I think we are heading for a worse economic crisis than we had in 2007," Schiff said. "You're going to have a collapse in the dollar...a huge spike in interest rates... and our whole economy, which is built on the foundation of cheap money, is going to topple when you pull the rug out from under it."

Schiff says that, despite "phony" signs of an economic recovery, the cancer destroying America stems from a lethal concoction of our $16 trillion federal debt and the Fed's never ending money printing.

We cannot spend our way out of debt. (absurd and ignorant notion on the face of it.) We cannot tax our way out of it. (People are damn near broken by the taxes now and Obamacare is going to hit much harder and very soon). The only thing we can do is cut. Cut at *ALL* levels. Not just the gaming with sequester to cut with maximum pain for some while others keep the bonus money flowing as if nothing is wrong. That is where games come in and games are what got us here. He goes on...

"I think we are heading for a worse economic crisis than we had in 2007," Schiff said. "You're going to have a collapse in the dollar...a huge spike in interest rates... and our whole economy, which is built on the foundation of cheap money, is going to topple when you pull the rug out from under it."

Schiff says that, despite "phony" signs of an economic recovery, the cancer destroying America stems from a lethal concoction of our $16 trillion federal debt and the Fed's never ending money printing.

If this man knows his stuff.....and he appears to know his stuff....then we're in for a calamity and not too far into the future. We have all the makings for one big crap pie. All we need is rising interest rates, which is largely what the Fed is spending money like it's free to prevent.

(Source: Money Morning)

"The Fed knows that the U.S. economy is not recovering," he noted. "It simply is being kept from collapse by artificially low interest rates and quantitative easing. As that support goes, the economy will implode."

The game can't play forever.

Our resources, even by printing funny money in fantasy spreadsheets, are coming to a break point. There isn't much play left to run on this and I hope people here, at least, pay heed to these warning signs.

Much of the nation is blinded by outright cooked books and creative numbers. I hope folks at ATS, with our skeptical minds, know better and use that critical thinking to recall the past several years, back to 2006/2007, to know what chain of events led us here to see what it's leading us to.

Hunker down, by the sound of it.

edit on 11-6-2013 by Wrabbit2000 because: (no reason given)

reply to post by Wrabbit2000

Nice article wrab. I'm not even over there in the usa. But down here in Oz, I'm sweating on clearing my 35K (yes 35000) credit card debt. (hit it hard to get our last house to "substantial progress" so as to not lose my owner builder's permit). I'm on a pension so there's no real way to bring in exra dollars. Why have I mentioned all of that?

Well, I see the writing on the wall. If you guys go down, we go down. so I feel for all of you. Let's hope somehow work your way out of your huge predicament

Nice article wrab. I'm not even over there in the usa. But down here in Oz, I'm sweating on clearing my 35K (yes 35000) credit card debt. (hit it hard to get our last house to "substantial progress" so as to not lose my owner builder's permit). I'm on a pension so there's no real way to bring in exra dollars. Why have I mentioned all of that?

Well, I see the writing on the wall. If you guys go down, we go down. so I feel for all of you. Let's hope somehow work your way out of your huge predicament

reply to post by Wrabbit2000

Please, how do we hunker down, how does one come through this without relying on the government for help.

That is the end game of all this. We will be so desperate that we will beg for some help.

Is owning property the answer, or will the government grab that up too.

How about guns, can we really make a difference by force, the government is taking guns too.

How about voting, ha ha ha. We know they have control over that.

How about technology, can we discover or invent something that will drive the market again.

Thanks for the info Wrabbit. Never mind my rant, Just frustrated.

Please, how do we hunker down, how does one come through this without relying on the government for help.

That is the end game of all this. We will be so desperate that we will beg for some help.

Is owning property the answer, or will the government grab that up too.

How about guns, can we really make a difference by force, the government is taking guns too.

How about voting, ha ha ha. We know they have control over that.

How about technology, can we discover or invent something that will drive the market again.

Thanks for the info Wrabbit. Never mind my rant, Just frustrated.

reply to post by Observationalist

It doesn't seem like technology can be the answer. We currently have the technology to feed, clothe, and shelter every person on the planet, there's just no money in it.

It doesn't seem like technology can be the answer. We currently have the technology to feed, clothe, and shelter every person on the planet, there's just no money in it.

reply to post by Wrabbit2000

Yes wrabbit, printing money and making it appear out of thin air, with nothing to back it up, can be a powder keg. I have been hearing this talk (about the bottom falling out) for quite some time now. I have a feeling it is going that way, and by postponing the inevitable, it is only going to make the crash all the worst, and the sting from it will be mighty.

Yes wrabbit, printing money and making it appear out of thin air, with nothing to back it up, can be a powder keg. I have been hearing this talk (about the bottom falling out) for quite some time now. I have a feeling it is going that way, and by postponing the inevitable, it is only going to make the crash all the worst, and the sting from it will be mighty.

reply to post by Observationalist

Hey, I'm with ya. I'm frustrated too. I see the train wreck coming and have no better idea how to ride this one out than you do.

Silver? Okay... Sounds good... except, will you take silver coins in barter? I sure won't. I don't have the means to test metals and be sure it IS silver. Gold? Same problem. Same reason for a big no on immediate needs during a crisis. It may work fine afterward when economies come back up, but that won't feed and clothe us during the crash years.

Personally, I've diversified as much as I can in physical skills and equipment. Reloading ammunition, for instance, as hunting may become a rather pressing issue in this area of the U.S.. If you can't buy dinner, it's shoot some or starve. Growing works...for those with land and for the amount which can be grown. We aren't a 3 or more harvest region. It won't wash for the whole year's supply. So that is one solution ...Although a little late to get started if one hasn't already.

Also, information brokering.

If things are on the skids and falling apart, computers won't BE a thing had by all with high speed internet access and MOST people figure they don't need to know things like how to make a bar of soap. How to fix up a batch of shampoo or detergent. Few people, outside those already mechanically inclined, can tell you how to fix the basic, necessary systems to get a vehicle to fire up after sitting in neglect. Fewer still can say with life and death certainty, just how to filter water from all variety of sources and contamination (which CAN be filtered, that is...and a point itself) to make it potable. Hell, many don't know the difference between Potable water and potty water. It sounds funny, but it's tragic to realize it's true.

We have time now, in a fully working society where all which may be scarce is currently plentiful. Think outside the box and build skills to barter and work in trade with....not just supplies to immediately live day to day. Be the man who teaches others how to fish ..and takes needed supplies in trade for the service. Not the man who needs taught. That is my whole approach in a nutshell.

If nothing happens? Nothing lost... All these skills and abilities are useful in or out of disaster, so it's all good, either way.

Hey, I'm with ya. I'm frustrated too. I see the train wreck coming and have no better idea how to ride this one out than you do.

Silver? Okay... Sounds good... except, will you take silver coins in barter? I sure won't. I don't have the means to test metals and be sure it IS silver. Gold? Same problem. Same reason for a big no on immediate needs during a crisis. It may work fine afterward when economies come back up, but that won't feed and clothe us during the crash years.

Personally, I've diversified as much as I can in physical skills and equipment. Reloading ammunition, for instance, as hunting may become a rather pressing issue in this area of the U.S.. If you can't buy dinner, it's shoot some or starve. Growing works...for those with land and for the amount which can be grown. We aren't a 3 or more harvest region. It won't wash for the whole year's supply. So that is one solution ...Although a little late to get started if one hasn't already.

Also, information brokering.

If things are on the skids and falling apart, computers won't BE a thing had by all with high speed internet access and MOST people figure they don't need to know things like how to make a bar of soap. How to fix up a batch of shampoo or detergent. Few people, outside those already mechanically inclined, can tell you how to fix the basic, necessary systems to get a vehicle to fire up after sitting in neglect. Fewer still can say with life and death certainty, just how to filter water from all variety of sources and contamination (which CAN be filtered, that is...and a point itself) to make it potable. Hell, many don't know the difference between Potable water and potty water. It sounds funny, but it's tragic to realize it's true.

We have time now, in a fully working society where all which may be scarce is currently plentiful. Think outside the box and build skills to barter and work in trade with....not just supplies to immediately live day to day. Be the man who teaches others how to fish ..and takes needed supplies in trade for the service. Not the man who needs taught. That is my whole approach in a nutshell.

If nothing happens? Nothing lost... All these skills and abilities are useful in or out of disaster, so it's all good, either way.

reply to post by Wrabbit2000

Conjecture at the top. This plan is far to intricate for cursory analysis, even though Schiff has a great record. Max Keiser also says imminent collapse, but no such fall has occurred.

Conjecture at the top. This plan is far to intricate for cursory analysis, even though Schiff has a great record. Max Keiser also says imminent collapse, but no such fall has occurred.

reply to post by Wrabbit2000

If the Dollar did collapse how long would it take to implement a new currency?

If the Dollar did collapse how long would it take to implement a new currency?

Originally posted by aboveandbelow

reply to post by Wrabbit2000

Conjecture at the top. This plan is far to intricate for cursory analysis, even though Schiff has a great record. Max Keiser also says imminent collapse, but no such fall has occurred.

Aboveandbelow - unfortunately "the writing on the wall" is clear for all to see. This is not conjecture anymore. In fact we've seen this movie already - the Wymar Republic - and it ain't pretty. Scary part of it is it's global effect. What happens here (US) will have a drastic effect on the rest of the world. So OP is correct.

The FED is printing "funny money" like crazy with nothing to back it up. Economy is not expanding but shrinking and more and more people are dependent of gov't subsidies. Then we get taxed more.

And like the OP said - once the interest goes up - then what's next?

Unless of course one refuses to see the eminent then all things will chug along like a well oiled machine.

reply to post by Wrabbit2000

Awesome Wrabbit, that lightened my day. I like the idea of gathering skills and information. Your right, we gotta think outside the box here, but when the hammer is falling as fast as it is, its hard to notice anythinge else.

Thanks

Edit:

For me personaly the hammer is falling fast. That's where the frustration comes in.

Awesome Wrabbit, that lightened my day. I like the idea of gathering skills and information. Your right, we gotta think outside the box here, but when the hammer is falling as fast as it is, its hard to notice anythinge else.

Thanks

Edit:

For me personaly the hammer is falling fast. That's where the frustration comes in.

edit on 11-6-2013 by Observationalist because: (no reason

given)

edit on 11-6-2013 by Observationalist because: (no reason given)

reply to post by EA006

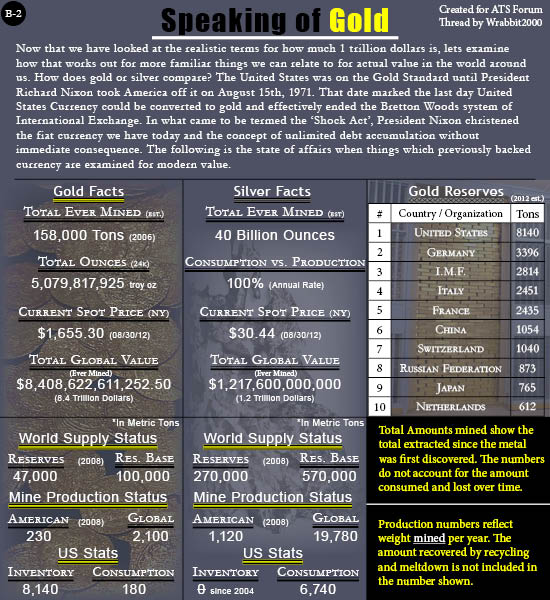

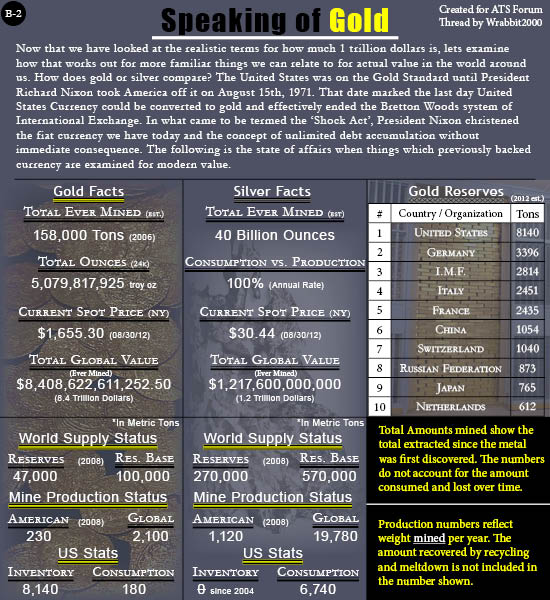

That's a scary question. I made up this graphics chart last year for my budget thread:

Going by that? The short answer is..... Who knows?? The last crashes were isolated to nations, for the most part. Singular at a time. The outside world helped in large part, so the bounce at the bottom wasn't fatal. As another post said, when the U.S. goes down, so does much of the world economy by the sheer interconnected design of modern economics. It's nothing US-focused as much as just the "Global Village" we've all become for total inter dependency. There ARE a couple nations which are in better shape. MUCH better shape...but they won't have much interest in helping the Western nations, I imagine.

(Source)

That's a bit dated with last year and most of the numbers have changed quite a bit. Most for the worse, I'm afraid. It gives a basic idea of world layout for the debt scene though.

Russia is near debt free because they already had their crash and a HARD crash it was. Also, largely, by runaway debt as became apparent in the year or two before they tanked.

That's a scary question. I made up this graphics chart last year for my budget thread:

Going by that? The short answer is..... Who knows?? The last crashes were isolated to nations, for the most part. Singular at a time. The outside world helped in large part, so the bounce at the bottom wasn't fatal. As another post said, when the U.S. goes down, so does much of the world economy by the sheer interconnected design of modern economics. It's nothing US-focused as much as just the "Global Village" we've all become for total inter dependency. There ARE a couple nations which are in better shape. MUCH better shape...but they won't have much interest in helping the Western nations, I imagine.

(Source)

That's a bit dated with last year and most of the numbers have changed quite a bit. Most for the worse, I'm afraid. It gives a basic idea of world layout for the debt scene though.

Russia is near debt free because they already had their crash and a HARD crash it was. Also, largely, by runaway debt as became apparent in the year or two before they tanked.

I'm in the UK and if the USA goes down we and I suppose Europe also will go down as well. We are already seeing all the signs of social upheaval and

our Government seems to have no idea what the hell to do.

It reminds me of an old joke my Grandmother told me and I feel its actually the response all of our countries need to put to the Bankers.

Esta asks Ebenezer, "Why are you so worried do you have a problem?"

Ebenezer, "I owe Jacob a lot of money and I can see him in the street coming this way".

Esta goes over to the window, raises it and hanging out of the window yells, "Jacob, you know the money Ebenezer owes you, well he can't pay it back." She then slams the window shut.

Ebenezer stares at his wife with his mouth open, "Why did you do that Woman?"

She smiles sweetly at him and says "Well now he has the problem also."

In reality the bankers are going to have to write a huge amount of country's debts off and rebalance the finances of the world. Our current financial systems are failing. They have allowed a situation with their practices and money printing that has simply gone beyond the point of possibly rebalancing the credit side of the sheets.

The bankers, especially from the Central Banks, which I believe are all privately owned, need to pay the price for their greed and criminality.

It reminds me of an old joke my Grandmother told me and I feel its actually the response all of our countries need to put to the Bankers.

Esta asks Ebenezer, "Why are you so worried do you have a problem?"

Ebenezer, "I owe Jacob a lot of money and I can see him in the street coming this way".

Esta goes over to the window, raises it and hanging out of the window yells, "Jacob, you know the money Ebenezer owes you, well he can't pay it back." She then slams the window shut.

Ebenezer stares at his wife with his mouth open, "Why did you do that Woman?"

She smiles sweetly at him and says "Well now he has the problem also."

In reality the bankers are going to have to write a huge amount of country's debts off and rebalance the finances of the world. Our current financial systems are failing. They have allowed a situation with their practices and money printing that has simply gone beyond the point of possibly rebalancing the credit side of the sheets.

The bankers, especially from the Central Banks, which I believe are all privately owned, need to pay the price for their greed and criminality.

Originally posted by Wrabbit2000

reply to post by EA006

That's a scary question. I made up this graphics chart last year for my budget thread:

Going by that? The short answer is..... Who knows?? The last crashes were isolated to nations, for the most part. Singular at a time. The outside world helped in large part, so the bounce at the bottom wasn't fatal. As another post said, when the U.S. goes down, so does much of the world economy by the sheer interconnected design of modern economics. It's nothing US-focused as much as just the "Global Village" we've all become for total inter dependency. There ARE a couple nations which are in better shape. MUCH better shape...but they won't have much interest in helping the Western nations, I imagine.

(Source)

That's a bit dated with last year and most of the numbers have changed quite a bit. Most for the worse, I'm afraid. It gives a basic idea of world layout for the debt scene though.

Russia is near debt free because they already had their crash and a HARD crash it was. Also, largely, by runaway debt as became apparent in the year or two before they tanked.

Nice chart Wrabbit2000. Interesting thing is there's no more safe place to "park" your $$. Nothing is stable. Heck even the 'Austerity' implemented by the Greeks is now being realized as a failure.

Comment is free IMF and Greece: Institutional Monstrous Failure As this weekend's game of blame tennis between the European commission and the Fund illustrates, the troika is as dysfunctional in 2013 as it was in 2010

In a chapter of their new book, The Body Economic, academics David Stuckler and Sanjay Basu calculate the toll austerity has taken on the health of ordinary Greeks. Their assessment is sobering: an HIV epidemic; medics unable to afford gloves, gowns and wipes, and spiralling suicides. Last week the IMF admitted it had been too sanguine about the devastation austerity would wreak on Greece – and that some of the measures forced on Athens in return for its emergency loans had been wrong. Put bluntly, the social crisis catalogued by Stuckler and Basu needn't have been so devastating, and fewer Greeks need have died.

....

www.guardian.co.uk...

So two choices on the table - both with the same dire consequence:

Spend less - economy goes down

Spend more - economy goes down

So what to do?

Stock up on stuff? But then whatcha gonna do WHEN Uncle Sam came knocking at the door demanding to surrender your "stuff" - in the name of the security of the country?

So like I've saying on other post - the problems facing mankind is NOW beyond its control!

If fact if you're really serious about things, these inevitable economic nightmare we're about to experience is nothing when you add to the equation - infrastructure and law enforcement collapse.

Let me ask you this - how large is the prison population in the US? Quite large?

Now what would happen if the guards/wardens of these facilities don't get paid anymore or their wages are reduced drastically. Do you think they still show up to work? Would you?

What do you think will happen to the prisoners? If no one can guard them anymore?

Think it's not gonna happen? Think again, it's already happening - little by little.

"The US has been spending billions and trillions on wars, and is not providing adequate finances for their infrastructures and social programs, including support for prisons," said international lawyer Edward Corrigan in an interview with Press TV's US Desk. Corrigan also pointed to the economy's impact on the prison system and emphasized that as many US states are on the verge of going bankrupt, they are considering to switch to the profit-making private prisons, which “has made the situation much worse." “The US has the highest number of prisoners per capita in the world. There's this crisis in California right now, where they're talking about releasing thousands of prisoners because of this problem of over-crowdedness,” Corrigan added. Although there have been tax-cuts, the US prison system still does not have sufficient money to fund their programs, he added. This comes as the US State of California spends nearly USD 50,000 annually per inmate, while lawmakers suggest the circulation of even more tax-payers' money into the prison system in order to improve its failing health standards. - See more at: www.presstv.com...

www.presstv.com...

Mind your the report above was from 2011 - how is it now?

reply to post by Wrabbit2000

If 150,000 tons of Gold have been mined maybe that could be used to back a new currency?

If 150,000 tons of Gold have been mined maybe that could be used to back a new currency?

reply to post by EA006

That's all the gold ever mined on Earth, by every nation ever known to exist, since recorded history began. Estimated totals, of course. From that number you have to deduct gold sitting at the bottom of the ocean by shipwreck in the various crusades, conquests and misadventures of the past. Gold sitting in finished goods like electronics, jewelry and bullion bars as well as what is simple lost to time and the ages. A few tons, for example, are still said to be in the Peruvian mountains. Somewhere.... Remnants of a lost empire that hid it rather than have it siezed. If it was ever found, no one popped up with the immense wealth it would have represented, even in past times.

So the number where that's concerned is for the best, in the most unrealistically rosey scenario where it still only came to 8.4 trillion US dollars in value at current market prices. That, to compare to over 16 trillion in just US debt. That doesn't count Japan or other nation's debt which, in some cases, is also more than all that gold combined if taken in isolation.

Unless everything in the world is revalued to a totally new currency, it cannot work. I'm not even sure how it could with a gold base, on a new currency. There are only so many ounces, for example and just to slap an equivilant price of $0.50 on every consumer good on the planet currently in a store or warehouse (From rubber doggy doo in Hong Kong to the latest Mercedes Benz) I'm not entirely sure the existing gold stocks would be up to the math involved.

It's a bad bad spot we find ourselves in when we start to question alternatives to shift over to. Ummm.. Find Asteroids with new mineral wealth? See if Antarctica is as rich in minerals as it's immense size may suggest? (and...be sure to send me down with some guns to shoot the prospectors, too.... That isn't how I want to see that place destroyed. )

That's all the gold ever mined on Earth, by every nation ever known to exist, since recorded history began. Estimated totals, of course. From that number you have to deduct gold sitting at the bottom of the ocean by shipwreck in the various crusades, conquests and misadventures of the past. Gold sitting in finished goods like electronics, jewelry and bullion bars as well as what is simple lost to time and the ages. A few tons, for example, are still said to be in the Peruvian mountains. Somewhere.... Remnants of a lost empire that hid it rather than have it siezed. If it was ever found, no one popped up with the immense wealth it would have represented, even in past times.

So the number where that's concerned is for the best, in the most unrealistically rosey scenario where it still only came to 8.4 trillion US dollars in value at current market prices. That, to compare to over 16 trillion in just US debt. That doesn't count Japan or other nation's debt which, in some cases, is also more than all that gold combined if taken in isolation.

Unless everything in the world is revalued to a totally new currency, it cannot work. I'm not even sure how it could with a gold base, on a new currency. There are only so many ounces, for example and just to slap an equivilant price of $0.50 on every consumer good on the planet currently in a store or warehouse (From rubber doggy doo in Hong Kong to the latest Mercedes Benz) I'm not entirely sure the existing gold stocks would be up to the math involved.

It's a bad bad spot we find ourselves in when we start to question alternatives to shift over to. Ummm.. Find Asteroids with new mineral wealth? See if Antarctica is as rich in minerals as it's immense size may suggest? (and...be sure to send me down with some guns to shoot the prospectors, too.... That isn't how I want to see that place destroyed. )

The thing to do is work to get off any dependence of government NOW!

NOWNOWNOW!!!

So when the US of A collapses, you aren't caught short.

An analogy. . . . building your own lifeboat will keep you afloat much better than staying on the Titanic.

SnF Brother Rabbit!

NOWNOWNOW!!!

So when the US of A collapses, you aren't caught short.

An analogy. . . . building your own lifeboat will keep you afloat much better than staying on the Titanic.

SnF Brother Rabbit!

Originally posted by Observationalist

reply to post by Wrabbit2000

Awesome Wrabbit, that lightened my day. I like the idea of gathering skills and information. Your right, we gotta think outside the box here, but when the hammer is falling as fast as it is, its hard to notice anythinge else.

Thanks

Edit:

For me personaly the hammer is falling fast. That's where the frustration comes in.edit on 11-6-2013 by Observationalist because: (no reason given)edit on 11-6-2013 by Observationalist because: (no reason given)

An old wise gentleman's words rings true nowadays or any day:

That is:

"Keep your life simple. Get rid of anything that has no real value to life."

Originally posted by EA006

reply to post by Wrabbit2000

If the Dollar did collapse how long would it take to implement a new currency?

Unfortunately - EA006, imho there's no other currency that is able replace the $$. Too little too late since the global economy is already deeply imbedded/indebted on the $$.

The way I see it is this. Either there have been very, very clever people running the whole show, like a well orchestrated chess game, the so called

Illuminati...Or...there have been incredibly inept, greedy, psychopaths running the show. At the moment I honestly cant tell if its A or B..

As far as I can see the world economy collapsed in 2007..since then it's been running on BS and vapors. TPTB have been kicking the can down the road with quantitative easing aka printing money from thin air.

On one hand it looks like TPTB have been at their wits end trying to paper over the cracks until it all implodes...which seemed inevitable since 2007...and nothing has changed, if anything the cracks have grown into grand canyons. I hear on the news all the time that things are supposedly improving in Europe..yet how can that be when the debts were in the 100's of billions, that kind of money doesn't just reappear over a few years...it would take decades, a century maybe even, to balance things out, in fact lets face it, that kind of debt never gets paid back EVER. And supposedly most of it is owned by China.

The Chinese cant be that stupid either. The Chinese government have been buying up chunks of Africa and south America ...and funny enough I hear Chinese citizens (the new millionaires) are buying up property all over the place, in Europe definatley. Apparently they see it as a great bargain currently. This is helping to artificially prop up the housing market and actually I can see an new property bubble occurring in some places, as where I live the houses have never hit their true values, still at least 4 times over priced. But if the local economy is dead, then all you will have is rich Chinese and nothing else...I mean rich people, even quite a lot of them can't support an economy with their saving alone, well not for very long anyhow...a few years maybe.

Also if Asia is getting more prosperous, then where is the cheap labor we relied on going to come from? Its basically all over for us in the west...One way or another China is taking advantage currently, and who can blame them they wont be getting all the cash back so they can repossess everything by default by the looks of it.

As far as I can see the world economy collapsed in 2007..since then it's been running on BS and vapors. TPTB have been kicking the can down the road with quantitative easing aka printing money from thin air.

On one hand it looks like TPTB have been at their wits end trying to paper over the cracks until it all implodes...which seemed inevitable since 2007...and nothing has changed, if anything the cracks have grown into grand canyons. I hear on the news all the time that things are supposedly improving in Europe..yet how can that be when the debts were in the 100's of billions, that kind of money doesn't just reappear over a few years...it would take decades, a century maybe even, to balance things out, in fact lets face it, that kind of debt never gets paid back EVER. And supposedly most of it is owned by China.

The Chinese cant be that stupid either. The Chinese government have been buying up chunks of Africa and south America ...and funny enough I hear Chinese citizens (the new millionaires) are buying up property all over the place, in Europe definatley. Apparently they see it as a great bargain currently. This is helping to artificially prop up the housing market and actually I can see an new property bubble occurring in some places, as where I live the houses have never hit their true values, still at least 4 times over priced. But if the local economy is dead, then all you will have is rich Chinese and nothing else...I mean rich people, even quite a lot of them can't support an economy with their saving alone, well not for very long anyhow...a few years maybe.

Also if Asia is getting more prosperous, then where is the cheap labor we relied on going to come from? Its basically all over for us in the west...One way or another China is taking advantage currently, and who can blame them they wont be getting all the cash back so they can repossess everything by default by the looks of it.

edit on 11-6-2013 by TheBlackHat because: (no reason given)

edit on 11-6-2013 by TheBlackHat because: (no reason

given)

new topics

-

12 jurors selected in Trump criminal trial

US Political Madness: 2 hours ago -

Iran launches Retalliation Strike 4.18.24

World War Three: 2 hours ago -

Israeli Missile Strikes in Iran, Explosions in Syria + Iraq

World War Three: 3 hours ago -

George Knapp AMA on DI

Area 51 and other Facilities: 8 hours ago -

Not Aliens but a Nazi Occult Inspired and then Science Rendered Design.

Aliens and UFOs: 8 hours ago -

Louisiana Lawmakers Seek to Limit Public Access to Government Records

Political Issues: 11 hours ago

top topics

-

BREAKING: O’Keefe Media Uncovers who is really running the White House

US Political Madness: 15 hours ago, 25 flags -

George Knapp AMA on DI

Area 51 and other Facilities: 8 hours ago, 23 flags -

Biden--My Uncle Was Eaten By Cannibals

US Political Madness: 16 hours ago, 18 flags -

Israeli Missile Strikes in Iran, Explosions in Syria + Iraq

World War Three: 3 hours ago, 12 flags -

"We're All Hamas" Heard at Columbia University Protests

Social Issues and Civil Unrest: 16 hours ago, 7 flags -

Louisiana Lawmakers Seek to Limit Public Access to Government Records

Political Issues: 11 hours ago, 7 flags -

So I saw about 30 UFOs in formation last night.

Aliens and UFOs: 14 hours ago, 5 flags -

Not Aliens but a Nazi Occult Inspired and then Science Rendered Design.

Aliens and UFOs: 8 hours ago, 4 flags -

Iran launches Retalliation Strike 4.18.24

World War Three: 2 hours ago, 4 flags -

The Tories may be wiped out after the Election - Serves them Right

Regional Politics: 12 hours ago, 3 flags

active topics

-

Israeli Missile Strikes in Iran, Explosions in Syria + Iraq

World War Three • 49 • : VictorVonDoom -

Iran launches Retalliation Strike 4.18.24

World War Three • 11 • : YourFaceAgain -

MULTIPLE SKYMASTER MESSAGES GOING OUT

World War Three • 45 • : Irishhaf -

George Knapp AMA on DI

Area 51 and other Facilities • 22 • : SchrodingersRat -

BREAKING: O’Keefe Media Uncovers who is really running the White House

US Political Madness • 15 • : BingoMcGoof -

Running Through Idiot Protestors Who Block The Road

Rant • 109 • : Astyanax -

12 jurors selected in Trump criminal trial

US Political Madness • 20 • : Lumenari -

Pfizer is 'deeply sorry'

Diseases and Pandemics • 23 • : VoiceofReality -

It has begun... Iran begins attack on Israel, launches tons of drones towards the country

World War Three • 887 • : 5thHead -

The Tories may be wiped out after the Election - Serves them Right

Regional Politics • 20 • : ScarletDarkness