It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

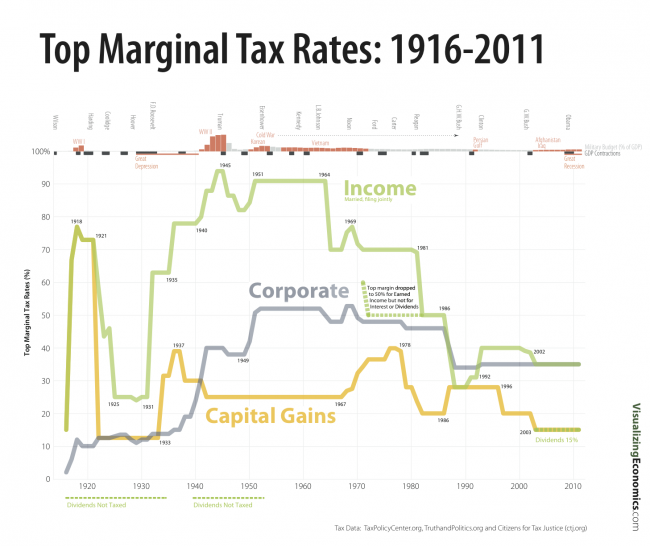

I looked up the 60s, when America was on the way to the moon muscle cars were being dreamed up that sold for 5000 Dollars back then and go for 80.000

Euros in Sweden now (in good condition) and the economy was growing like crazy and employment was good. So I assumed tax rates would be really really

low because the job creators were so busy and the middleclass was rocking.

Well turns out back in the day America had some of the highest taxation. The income tax went as high as 91% for the top bracket, that would give even the most socialist countries in Europe a stomach age. Capital gain tax went up to 35%. Now we are being told, high tax baaad, low tax good. However taxes have been low and things have not been so great. Now we are being told we just did not lower them enough.

So how do taxes really impact an economy? Do high taxes for the rich flush fresh capital back into the system without the inflation of the printing press?

Well turns out back in the day America had some of the highest taxation. The income tax went as high as 91% for the top bracket, that would give even the most socialist countries in Europe a stomach age. Capital gain tax went up to 35%. Now we are being told, high tax baaad, low tax good. However taxes have been low and things have not been so great. Now we are being told we just did not lower them enough.

So how do taxes really impact an economy? Do high taxes for the rich flush fresh capital back into the system without the inflation of the printing press?

reply to post by Merinda

High taxes weren't really the cause. It was really cause Europe got freaking decimated by a huge war and the U.S. had no competition for a long time.

High taxes weren't really the cause. It was really cause Europe got freaking decimated by a huge war and the U.S. had no competition for a long time.

Taxation isnt some master prosperity switch that is either on or off.

All this noise over taxes and it's just a small factor among many factors.

Tax me 100% and you wont guarantee prosperity tax me 0% and the same is true.

Politicians use taxes as an oversimplification to manipulate the stupid voters.

All this noise over taxes and it's just a small factor among many factors.

Tax me 100% and you wont guarantee prosperity tax me 0% and the same is true.

Politicians use taxes as an oversimplification to manipulate the stupid voters.

you can confiscate the top 50% of taxes payers yearly salary and still be in deficit. It’s a mute point to raise taxes. We need to lower spending.

how does rasing taxes boost the economy? its a silly notion. If it did so then why is obama fighting to keep middle class wage the same? He should

raise them, it will boost the economy right?

If a corporation has a choice between pocketing it's profits and paying a high tax rate...or hiring more workers and expanding (expense) which they

pay zero tax rate on, yes higher corproate tax rates can translate to lower unemployment and more money in the pockets of the middle class, purchasing

power...increased demand etc.

Originally posted by Merinda

So I assumed tax rates would be really really low because the job creators were so busy and the middleclass was rocking.

Well turns out back in the day America had some of the highest taxation. The income tax went as high as 91% for the top bracket,

Look into the differences between statutory and effective tax rates as it relates to each decade of the last half century in the US. The effective tax rates have been rising across the board while statutory rates have declined. Those "91%-ers" in the 60s likely paid a lower effective rate once all their deductions, exemptions, and loopholes were massaged into the picture than the upper bracket income earners pay today. We have fewer deductions, fewer exemptions, and fewer loopholes (unless you are a corporate entity, at least) than existed even in the early 90s.

This is all a shell game, a fine line between how badly the government can bone the people while spoon feeding them horsecrap before they realize their in pain and eating offal. Just like this fiscal cliff crap... anyone who really believes the Democrats want to raise taxes on the rich and, ultimately, themselves since most of those in DC are amongst the top 2%, is completely brainwashed. Nobody in DC has any intention of screwing themselves and their financial handlers... but it sure looks good on paper.

reply to post by Merinda

Back in the day our taxes also didn't fund a tunnel for turtles to cross a road without getting run over or literally kill off farmers in California because the Smelt fish was more important to their livelihood.

I'm all for taxes if it supports things like say...infrastructure and defense.

But the pork has got to go, along with all the subsidies.

The entitlement programs should be policed more vigorously as well.

Maybe it’s time to bring back the Civilian Conservation Corps? That is one program that did work. You are able bodied? Well, we have a bridge that needs repaired. Ya want a check...then get to work.

Back in the day our taxes also didn't fund a tunnel for turtles to cross a road without getting run over or literally kill off farmers in California because the Smelt fish was more important to their livelihood.

I'm all for taxes if it supports things like say...infrastructure and defense.

But the pork has got to go, along with all the subsidies.

The entitlement programs should be policed more vigorously as well.

Maybe it’s time to bring back the Civilian Conservation Corps? That is one program that did work. You are able bodied? Well, we have a bridge that needs repaired. Ya want a check...then get to work.

Higher taxs rates means more money that the government has to blow, then turn around and cry "we need to raise taxes agian".

Government is broken,social programs are broken, everything government does to fix "something wrong" creates more problems than it fixes.

Then figure in inflation,population growth, and economic competition of other countries,.

Tax the rich is not going to solve a damn thing except create more people "in need".

Too many people just don't want to get it,.

Government is broken,social programs are broken, everything government does to fix "something wrong" creates more problems than it fixes.

Then figure in inflation,population growth, and economic competition of other countries,.

Tax the rich is not going to solve a damn thing except create more people "in need".

Too many people just don't want to get it,.

Raising dividend tax rates could cause companies to seek growth rather than value to shareholders. Unfortunately they may

loot the

coffers a month before tax rates go up pushing growth off in the near-term. This is a great reminder that corporations are no longer interested

in the long term competitiveness of the company but in short term profits and shareholder payouts.

Raising individual rates at the high end may also encourage flatter organizational structures as it could make the big money executive positions less lucrative. That is, of course, if they also raised the capital gains tax which I believe makes up a lion's share of executive pay.

However, unless they seriously pursue loopholes and tax havens, I fear it's all for naught. The prospect of capital flight do to increased taxes is also, in my opinion, a very real problem. The people who have acquired power are not apt to give it up willingly and the required government intervention to prevent it may be outside of political reality.

Raising individual rates at the high end may also encourage flatter organizational structures as it could make the big money executive positions less lucrative. That is, of course, if they also raised the capital gains tax which I believe makes up a lion's share of executive pay.

However, unless they seriously pursue loopholes and tax havens, I fear it's all for naught. The prospect of capital flight do to increased taxes is also, in my opinion, a very real problem. The people who have acquired power are not apt to give it up willingly and the required government intervention to prevent it may be outside of political reality.

Maybe.

Poor people get a lot of their tax money back at the end of the year.

If you take more money out of the hands of the richer people with higher taxes and use it to pay for programs. This creates jobs and gives money to the poorer people. These poorer people buy things with their money. Businesses have to hire more people to meet this increased demand. This puts more money in the hands of poor people who buy things; the cycle continues.

The richer people have less money to save which puts more money back into the system.

So why not? It might not directly result in America's financial problems being solved by taking in more money, but it might start a chain reaction that does.

Poor people get a lot of their tax money back at the end of the year.

If you take more money out of the hands of the richer people with higher taxes and use it to pay for programs. This creates jobs and gives money to the poorer people. These poorer people buy things with their money. Businesses have to hire more people to meet this increased demand. This puts more money in the hands of poor people who buy things; the cycle continues.

The richer people have less money to save which puts more money back into the system.

So why not? It might not directly result in America's financial problems being solved by taking in more money, but it might start a chain reaction that does.

reply to post by Indigo5

Sure seems like the advertised tax rate is meaningless doesn't it?

Oh, that's because it is.

Fiscal problems will continue until they throw Laffer's Curve out in respect to US taxation.

Sure seems like the advertised tax rate is meaningless doesn't it?

Oh, that's because it is.

Fiscal problems will continue until they throw Laffer's Curve out in respect to US taxation.

edit on 30-11-2012 by peck420 because: (no reason

given)

Originally posted by Merinda

I looked up the 60s, when America was on the way to the moon muscle cars were being dreamed up that sold for 5000 Dollars back then and go for 80.000 Euros in Sweden now (in good condition) and the economy was growing like crazy and employment was good. So I assumed tax rates would be really really low because the job creators were so busy and the middleclass was rocking.

Well turns out back in the day America had some of the highest taxation. The income tax went as high as 91% for the top bracket, that would give even the most socialist countries in Europe a stomach age. Capital gain tax went up to 35%. Now we are being told, high tax baaad, low tax good. However taxes have been low and things have not been so great. Now we are being told we just did not lower them enough.

So how do taxes really impact an economy? Do high taxes for the rich flush fresh capital back into the system without the inflation of the printing press?

I knew that for years. Seems like those government jobs stabalized the economy so it could grow. This BS about raising taxes being really bad for the economy is a big lie. It had a neutral effect. Trouble is that now all the raised taxes would have to go to pay the debt that we acquired by cutting taxes. Everyones taxes have to go up and the rich need to be paying taxes. Companies that employ people don't need to be taxed, when the money is taken out by the owner it needs to be taxed. Corporate execs are making moocho bucks and are paying a lot less than their share. Corporations are causing this mess, for the reductions of taxes of the execs to be realized they will destroy the economy of the country. What can I put in my pocket is their concern, they will bankrupt a corporation to get personal gain and benefits.

I am not saying all corporations are like that by any means, but many big corporations are. I had to add this part because not doing it would make it a lie.

edit on 30-11-2012 by rickymouse because: (no reason given)

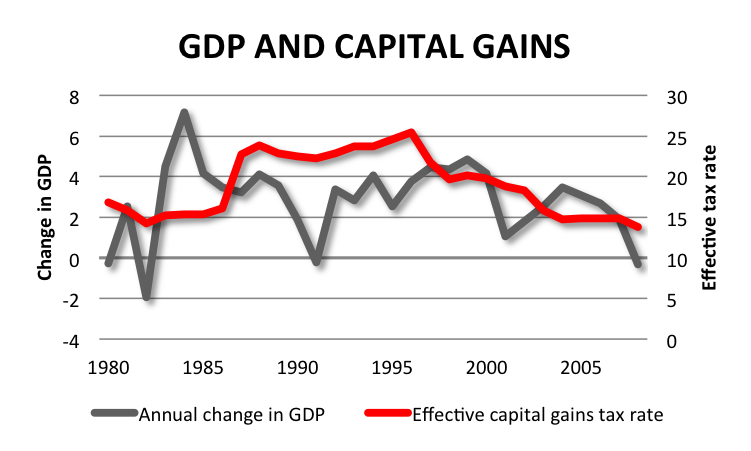

This has been thoroughly and repeatedly researched over 100 years to the point that it is not an idealogical or political debate.

Raising corporate tax rates has ZERO impact on GDP growth.

If fact there is a .3 correlation shown between increasing corporate tax rates (both actual and effective tax rates) and GDP growth.

Capital flight to more tax friendly nations is short-term. Places like Ireland will drop tax rates to draw in foriegn capital when thier economy is struggling, but can't maintain those levels and recover. Thus talk of an EU bailout for Ireland, which further stresses the rest of the EU and forces them to consider more robust revenue sources.

So bottom line...capital flight? Short term. Does raising rates hurt the economy? Not at all. Does raising the rates help an economy? Yes...slightly at a .30 correlation. We would need to keep the rates steady for a longer term at a higher rate to feel the full benefit.

Right now capital gains is sow low that it encourages speculative, short term, hit and run investment, rather than long term...and corporate rates are so low that encourages corporations to sit on/reserve profits, rather than re-invest in expanding.

BTW - The reason that government revenues don't significantly increase short-term when you raise corporate rates is just that. Corportions end up paying roughly the same amount in taxes because they take some of those profits that would be taxed as profits and expand and re-invest...new equipment, research, hiring....those funds go into the pocket of the consumer/middle class which has more money to spend...and thus demand increases...call it re-distribution if you like...call it a step toward a more healthy income distribution, but either way what you get is money flowing more often and in a slightly more equal way, healthier economy and growth.

Raising corporate tax rates has ZERO impact on GDP growth.

If fact there is a .3 correlation shown between increasing corporate tax rates (both actual and effective tax rates) and GDP growth.

Capital flight to more tax friendly nations is short-term. Places like Ireland will drop tax rates to draw in foriegn capital when thier economy is struggling, but can't maintain those levels and recover. Thus talk of an EU bailout for Ireland, which further stresses the rest of the EU and forces them to consider more robust revenue sources.

So bottom line...capital flight? Short term. Does raising rates hurt the economy? Not at all. Does raising the rates help an economy? Yes...slightly at a .30 correlation. We would need to keep the rates steady for a longer term at a higher rate to feel the full benefit.

Right now capital gains is sow low that it encourages speculative, short term, hit and run investment, rather than long term...and corporate rates are so low that encourages corporations to sit on/reserve profits, rather than re-invest in expanding.

BTW - The reason that government revenues don't significantly increase short-term when you raise corporate rates is just that. Corportions end up paying roughly the same amount in taxes because they take some of those profits that would be taxed as profits and expand and re-invest...new equipment, research, hiring....those funds go into the pocket of the consumer/middle class which has more money to spend...and thus demand increases...call it re-distribution if you like...call it a step toward a more healthy income distribution, but either way what you get is money flowing more often and in a slightly more equal way, healthier economy and growth.

Originally posted by peck420

reply to post by Indigo5

Sure seems like the advertised tax rate is meaningless doesn't it?

Oh, that's because it is.

Fiscal problems will continue until they throw Laffer's Curve out in respect to US taxation.edit on 30-11-2012 by peck420 because: (no reason given)

See my post above. Increasing corporate rates isn't a direct boost to gov revenues.

Corps can either...keep profits or invest.

Increased corp tax rates incentivize corporations to re-invest (hiring and expansion) rather than reserve that money to be taxed as profit.

That hiring and expansion moves the money to the consumer, not the gov. What you get is an increasing long-term trend line in GDP as the economy picks up. Long-term less dependance on safety nets, welfare, unemployment etc. and the gov saves on expenses not revenue.

edit on 30-11-2012 by

Indigo5 because: (no reason given)

You can tax pretty heavily during the boom times but it is fools errand to keep the rates the same during the bust.

Taxation should ALWAYS lag behind private and corporate prosperity. You're never going to convince any correct thinking individual that taking more money from them makes them richer. You're also never going to convince any correct thinking individual that taxing the company they work for will make their job more stable or make it easier for them to get a raise in salary.

Taxation should ALWAYS lag behind private and corporate prosperity. You're never going to convince any correct thinking individual that taking more money from them makes them richer. You're also never going to convince any correct thinking individual that taxing the company they work for will make their job more stable or make it easier for them to get a raise in salary.

reply to post by Indigo5

Could you link to the statistics? I don't disagree with any of your conclusions, but I would like to see the numbers laid bare.

Perhaps, but how long is short-term? Given the number of nations to which capital can migrate, can our economy stay strong long enough to benefit from the re-balancing? As is often repeated, the market can stay irrational longer than you can stay solvent. Though perhaps I overestimate the number of places for capital to fly to given the instability of many countries.

This has been thoroughly and repeatedly researched over 100 years to the point that it is not an idealogical or political debate.

If fact there is a .3 correlation shown between increasing corporate tax rates (both actual and effective tax rates) and GDP growth.

Could you link to the statistics? I don't disagree with any of your conclusions, but I would like to see the numbers laid bare.

Capital flight to more tax friendly nations is short-term. Places like Ireland will drop tax rates to draw in foriegn capital when thier economy is struggling, but can't maintain those levels and recover.

Perhaps, but how long is short-term? Given the number of nations to which capital can migrate, can our economy stay strong long enough to benefit from the re-balancing? As is often repeated, the market can stay irrational longer than you can stay solvent. Though perhaps I overestimate the number of places for capital to fly to given the instability of many countries.

Originally posted by Indigo5

See my post above. Increasing corporate rates isn't a direct boost to gov revenues.

Corps can either...keep profits or invest.

Increased corp tax rates incentivize corporations to re-invest (hiring and expansion) rather than reserve that money to be taxed as profit.

That hiring and expansion moves the money to the consumer, not the gov. What you get is an increasing long-term trend line in GDP as the economy picks up. Long-term less dependance on safety nets, welfare, unemployment etc. and the gov saves on expenses not revenue.edit on 30-11-2012 by Indigo5 because: (no reason given)

Correlation does not mean causation.

You represent data the same way most US economists do, like the US is in an isolated bubble. It is not. I would bet my life that if world market averages were used to show disparities between global market changes and tax induced changes, we would find that the higher tax rates influence slower GDP growth and lower tax rates influence faster GDP growth.

Tax rates, even though they are not representative of tax receipts, influence confidence.

Lower tax rates increase confidence, higher tax rates reduce confidence.

Higher confidence brings better growth and stability.

Set all personal income tax rates to a 5 bracket, progressive system (15%,17.5%, 20%, 22.5%, and 25%). All personal income taxes would include capital gains, etc, and follow the same progressive rate, determined by your overall earnings.

Set corporate tax rates to whatever makes you look more desirable than your regional competition (currently would have to be in around 25-26%).

Remove all loopholes.

Call it a day.

I think that the is a definite limit where tax becomes confiscatory.

To me, if you make over $1,000,000 dollars per year, regardless of the source, your tax rate on the income over $1,000,000 income should be 50%.

I think that estates under $10,000,000 should not be taxed. That way many family farms and/or businesses could be passed down to the next generation.

I think that everyone should pay a minimum tax of %10. So even if you're getting welfare, you should be taxed %10 on your income. That way you might appreciate your government more.

No one should get back more tax then they have paid into the government regardless of various earned income tax credits etc.

Also , if you're business and you make a profit of over $1,000,000 per year, the business should have an alternative minimum tax of 10%. That way you can't have business giants like GE filing a 56,000 page tax return and not paying any tax.

If you are an overseas corporation doing business in the US, you should have to pay a minimum tax of %25 on your gross business.

If your a US business doing business overseas, you should have to bring your cash back to the US (for accounting purposes) once per year and pay tax on the money you've made.

To me, if you make over $1,000,000 dollars per year, regardless of the source, your tax rate on the income over $1,000,000 income should be 50%.

I think that estates under $10,000,000 should not be taxed. That way many family farms and/or businesses could be passed down to the next generation.

I think that everyone should pay a minimum tax of %10. So even if you're getting welfare, you should be taxed %10 on your income. That way you might appreciate your government more.

No one should get back more tax then they have paid into the government regardless of various earned income tax credits etc.

Also , if you're business and you make a profit of over $1,000,000 per year, the business should have an alternative minimum tax of 10%. That way you can't have business giants like GE filing a 56,000 page tax return and not paying any tax.

If you are an overseas corporation doing business in the US, you should have to pay a minimum tax of %25 on your gross business.

If your a US business doing business overseas, you should have to bring your cash back to the US (for accounting purposes) once per year and pay tax on the money you've made.

Originally posted by hezro

reply to post by Indigo5

This has been thoroughly and repeatedly researched over 100 years to the point that it is not an idealogical or political debate.

If fact there is a .3 correlation shown between increasing corporate tax rates (both actual and effective tax rates) and GDP growth.

Could you link to the statistics? I don't disagree with any of your conclusions, but I would like to see the numbers laid bare.

I'll start here since it is an analysis demonstrated by someone that is Anti-Spending...and wants lower tax rates...but still acknowledges the historical fact and math.

Furthermore, it does not appear lower corporate tax rates result in higher GDP.

Real GDP has trended down slightly since 1947, while corporate tax rates have declined significantly.

Obviously, there is more to the slowdown in the GDP growth trend than corporate taxes, but even when looking at year-over-year change in the tax rate there does not appear to be a boost to GDP.

The correlation between the year-over-year change in corporate tax rate and GDP is a weak, but surprisingly positive, .35. Since 1947, an increase in corporate tax rates has been positively correlated to GDP

seekingalpha.com...

The last bit discusses the positive correlation +/+ between corporate tax rates and gdp....weak (short term)..but positive to GDP... (.35) ...Decrease corporate tax rates = 0 effect on GDP...increasing corporate tax rates = +.35 correlation increase in GDP. He notes "suprisingly"...but when you think of corporate behavior it makes sense...they don't suffer the higher tax bill, they lower profits through re-investing, hiring, expansion etc. which directs money to the economy.

I can provide other sources, but thought starting with someone who first declares ...

I believe government spending is too high and taxes as well. This philosophical framework aside, I had to ask myself are corporations the best entities to target for tax cuts.

He has a conservative philosophy and yet acknowledges mathmetical and historical truth.

Originally posted by hezro

Capital flight to more tax friendly nations is short-term. Places like Ireland will drop tax rates to draw in foriegn capital when thier economy is struggling, but can't maintain those levels and recover.

Perhaps, but how long is short-term? Given the number of nations to which capital can migrate, can our economy stay strong long enough to benefit from the re-balancing? As is often repeated, the market can stay irrational longer than you can stay solvent. Though perhaps I overestimate the number of places for capital to fly to given the instability of many countries.

It costs money to repeatedly move money, that is one barrier to playing hop-scoth around the globe with corporate treasuries. It quickly becomes a losing proposition. Ireland was a refuge for many corporate treasuries...Including Google and Cisco...AND Ireland just got an 89 Billion dollar bailout from the EU with more to come. Think they are going to have to reconsider thier revenues? Then Google and Cisco need to go where? Other EU countries are facing increasing costs either from thier own economies or from bailing out Greece, Ireland et al.

Short term, refuge...long term, the running and jumping from refuge to refuge costs too much. They will settle back home with a predictable and fair rate.

new topics

-

That which the "news" never talks about; Truth about election fraud

Mainstream News: 59 minutes ago -

Biden doesnt want the votes of "Death to America" chanters

US Political Madness: 1 hours ago -

Horizon Post office scandal

Regional Politics: 1 hours ago -

Joe Biden and Donald Trump are both traitors

US Political Madness: 3 hours ago -

I'm new here. Avid conspiracy fan.

Introductions: 4 hours ago -

Denmark's Notre-Dame moment - 17th Century Borsen goes up in Flames

Mainstream News: 5 hours ago

top topics

-

Suspected Iranian agent working for Pentagon while U.S. coordinated defense of Israel

US Political Madness: 13 hours ago, 16 flags -

The Baloney aka BS Detection Kit

Social Issues and Civil Unrest: 13 hours ago, 7 flags -

That which the "news" never talks about; Truth about election fraud

Mainstream News: 59 minutes ago, 6 flags -

Denmark's Notre-Dame moment - 17th Century Borsen goes up in Flames

Mainstream News: 5 hours ago, 4 flags -

How does my computer know

Education and Media: 16 hours ago, 3 flags -

I'm new here. Avid conspiracy fan.

Introductions: 4 hours ago, 3 flags -

Joe Biden and Donald Trump are both traitors

US Political Madness: 3 hours ago, 2 flags -

Horizon Post office scandal

Regional Politics: 1 hours ago, 1 flags -

Biden doesnt want the votes of "Death to America" chanters

US Political Madness: 1 hours ago, 1 flags

active topics

-

It has begun... Iran begins attack on Israel, launches tons of drones towards the country

World War Three • 754 • : Vermilion -

Biden doesnt want the votes of "Death to America" chanters

US Political Madness • 3 • : Coelacanth55 -

That which the "news" never talks about; Truth about election fraud

Mainstream News • 4 • : Justoneman -

Candidate TRUMP Now Has Crazy Judge JUAN MERCHAN After Him - The Stormy Daniels Hush-Money Case.

Political Conspiracies • 242 • : Annee -

US and Israel Reportedly Conclude Most Hostages Still Held in Gaza Are Dead

War On Terrorism • 151 • : NorthOS -

SHORT STORY WRITERS CONTEST -- April 2024 -- TIME -- TIME2024

Short Stories • 19 • : JJproductions -

I'm new here. Avid conspiracy fan.

Introductions • 11 • : 19Bones79 -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 494 • : cherokeetroy -

Abortions in first 12 weeks should be legalised in Germany, commission says

Medical Issues & Conspiracies • 18 • : Consvoli -

Joe Biden and Donald Trump are both traitors

US Political Madness • 34 • : andy06shake