It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

Originally posted by newcovenant

Clinton handed Bush a 3 trillion dollar surplus which he quickly burned through waging 2 wars, offering a tax cut to the rich and a prescription drug benefits program for seniors that helped big pharma sell drugs to old folks that didn't really want them.

What is this tax cut to the rich you speak of? Didn't the Bush's tax cuts help ALL tax paying Americans? Didn't Bush's child tax credit help only the middle class and poor? I surely enjoyed them and I wasn't rich in anyway lol...

Tax Credit

The original Child Tax Credit was only refundable for families with three or more qualifying children. Families with one or two children could use the credit to lower their taxes, but would not get a refund check if their credit was greater than their tax liability. In 2001, the law was changed to allow smaller families to get a limited refund of the Child Tax Credit.

Please stop with the far left talking points and actually type something from your own head for once.

Anyway as you nicely pointed out by re-copying my post the numbers don't lie and Democrats are far and away better for the country no matter how much kicking screaming and lying the Republicans do.

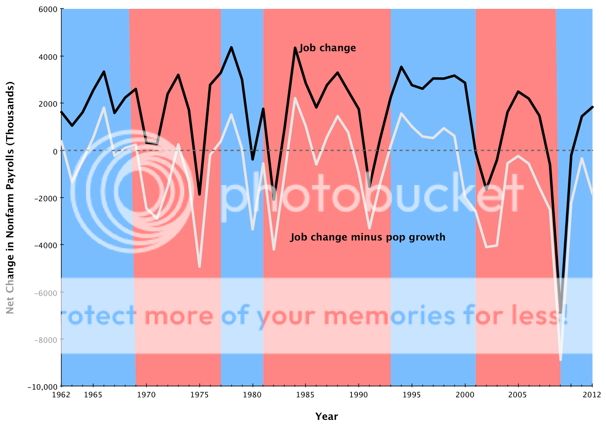

Lets look at job growth too that you hang on to as some shield.

If we go with the common analogy that the first year of a new President is actually still the work of the previous president we see a different pattern.

In the chart below Blue is democrat and red is republican.

1969 to 1970 the republicans were handed a sharp decline that went to a steep incline in 1971... one for the republicans

1977 to 1978 the democrats were handed a steep incline and then in 1979 we saw a steep decline...two for the republicans

1981 to 1982 the republicans were handed a steep decline and in 1983 we saw a steep incline...three for the republicans

1993 to 1994 the democrats were handed a steep incline that started to decline in 1995...four for the republicans

2001 to 2002 the republicans were handed a steep decline and in 2003 we see a steep incline...five for the republicans

2009 to 2010 we see a steep incline and in 2011 it tapers off and is showing a decline....I guess we will see on this one who gets the point...

You can stick to your numbers but I'll bet in 2016 we will see the same pattern as ALL the previous democratic presidents after Obama wins again...

So to answer

I'm going to kindly disagree with you...

Democrats are far and away better for the country

edit on 2-10-2012 by Xtrozero because: (no reason given)

reply to post by azamber

May I break in for a moment?

Someone may have been giving you false information. About 19% of our budget goes for Defense. 20% for Social Security, another 20% for Medicare, Medicaid, and other health programs, 13% went for low income people needing help, 1% for foreign aid.

Not all of Defense spending is for war, either. A lot of it stays in the US running bases, paying soldier's salaries, doing research and development work, heck, even Air Force One gets thrown in there.

I don't think wars are as big an item as you seem to think.

May I break in for a moment?

Someone may have been giving you false information. About 19% of our budget goes for Defense. 20% for Social Security, another 20% for Medicare, Medicaid, and other health programs, 13% went for low income people needing help, 1% for foreign aid.

Not all of Defense spending is for war, either. A lot of it stays in the US running bases, paying soldier's salaries, doing research and development work, heck, even Air Force One gets thrown in there.

I don't think wars are as big an item as you seem to think.

Too bad that small minds think alike. Too many people think and wonder what will happen in real life!. What I want to know is why so many

people are worried when they should feel secure.? What do YOU really think will happen? What have you done? If you are prepared then you won't be

afraid.

reply to post by charles1952

I appreciate that you got me off my butt to fact check, and we are both wrong, and right, to an extent. Had some fun on this site, and here's some of what I found.

Military Defense- $716.3 billion

Foreign Military Aid- $12.5 billion

Foreign Economic Aid- $43.8 billion

Welfare-Families and Children- $113.5 billion (of which, 85.1 billion is for the SNAP, "food stamp" program)

Welfare-Housing- $59.6 billion (it appears only 19.2 billion is for rental assistance)

Welfare- Social Exclusion n.e.c (whatever this means) $161.6 billion (of which only 16.5 bil is for actual TANF "cash assistance" welfare. Most of the 161.5 bil is tax credits for families with children, totalling $91.2 bil)

Health-Medicaid-$255.3 billion

Health-Children's Health Ins. Fund-$9.8 billion

Point is, people spend far less on actual welfare to needy families than they think, and far more on military defense and foreign intervention.

I appreciate that you got me off my butt to fact check, and we are both wrong, and right, to an extent. Had some fun on this site, and here's some of what I found.

Military Defense- $716.3 billion

Foreign Military Aid- $12.5 billion

Foreign Economic Aid- $43.8 billion

Welfare-Families and Children- $113.5 billion (of which, 85.1 billion is for the SNAP, "food stamp" program)

Welfare-Housing- $59.6 billion (it appears only 19.2 billion is for rental assistance)

Welfare- Social Exclusion n.e.c (whatever this means) $161.6 billion (of which only 16.5 bil is for actual TANF "cash assistance" welfare. Most of the 161.5 bil is tax credits for families with children, totalling $91.2 bil)

Health-Medicaid-$255.3 billion

Health-Children's Health Ins. Fund-$9.8 billion

Point is, people spend far less on actual welfare to needy families than they think, and far more on military defense and foreign intervention.

Too many people here are attempting to deny ignorance while at the same time, accepting ignorance by not doing anything. It's a shame really, when

people can take care of themselves yet choose not to.....

The government and it's policies suck.....in EVERY country. Please name one that isn't ripping off the taxpayors. But we can take care of ourselves. Even at the hand that feeds us. Stock up on food and water. You have shelter. The people of the 1st world countries are greedy. They want a lot yet don't want to work for it. Entitlement is LAZY.

So much for self sustaining, at least in the 1st world countries.

The government and it's policies suck.....in EVERY country. Please name one that isn't ripping off the taxpayors. But we can take care of ourselves. Even at the hand that feeds us. Stock up on food and water. You have shelter. The people of the 1st world countries are greedy. They want a lot yet don't want to work for it. Entitlement is LAZY.

So much for self sustaining, at least in the 1st world countries.

edit on 2-10-2012 by Gridrebel because: (no reason given)

reply to post by azamber

Dear azamber,

I am now totally confused. When I looked at that site I saw health care at $846.1 billion. I don't know what to think any more, I think I'll just lay down and wait for the spinning to stop.

With respect,

Charles1952

Dear azamber,

I am now totally confused. When I looked at that site I saw health care at $846.1 billion. I don't know what to think any more, I think I'll just lay down and wait for the spinning to stop.

With respect,

Charles1952

Originally posted by Hefficide

reply to post by burdman30ott6

"Paying for the little guy", as you put it, strikes me. I don't know how to define "the little guy".

Easy answer... I used "little guy" because I didn't feel like being blunt and crass. Little guy = the have nots.

There is a frustration always encountered in these type of arguments. I know I feel frustration at the opposite view from my own and I'm sure you feel it towards me. The root of this frustration is emotional response versus logical response. The emotional response is pretty much what you're putting out there. It's very much about the individuals who are the make-up of the "have nots" and focuses on their struggle. You naturally tend to point out "Look, look at their suffering. We have to do something about their suffering and misfortune." I gravitate towards a more logical (albeit on the selfish side of logic) stance of "OK, I'm looking at their suffering, but how does it make sense that we should redistribute the hard earnings of others to pay for the remediation fo suffering they had nothing to do with?"

Your position on this issue makes zero personal sense to me. If somebody who has money to spare decides to personally assist anyone in need, I think that is fantastic. Charity is an awesome way for someone to decide themselves to make a difference! That said, forced charity or wealth redistribution is asinine. It is merely punishing someone for being successfull while simultaneously rewarding others for being less than successfull. I do not have a heart of stone, but neither do I believe the government has any right to lay claim to any portion of any individual's paycheck to be cast across the masses.

Rates assessed to fund public infrastructure should be usage and benefit based. Start utilizing more of the Public Private Partnership model for infrstructure projects and maintenance. In these models, the user pays for the facility based on how much they use it. This makes sense and, when you get right down to the root of things, is the way it was meant to be in the first place... as evidenced by the initial gas tax laws which formed the Federal Highway Trust Fund. Folks who didn't drive paid a lot less into the fund because they didn't purchase gasoline.

Our education system is a disgrace and, as such, changes should be made before the government can pass any kind of sniff test over fleecing more tax dollars to fund the abomination. Year after year of half assed, failing students being shuffled out the same doors from the same teachers. Tax funded positions should NEVER be unionized and ALWAYS be performance based. ALWAYS. It is criminal to mandate money be taken from every working citizen to go into the pockets of failing educators whose jobs are iron clad protected thanks to union seniority.

Our unemployment system is a joke. This should be handled as a trust fund in which people have an account allowing them to draw out money to the point in which they surpass what they paid into the system to begin with. After that point, sorry... not my problem. Get a job, and if you cannot find a job which pays what your previous one did, get two jobs. If one absolutely cannot find a job, allow them to draw their unemployment under the iron clad stipulation that the money drawn be treated as a loan which must be paid back. Apply the same laws we use for student loans and tax debt... Pay it, or get garnished.

Our medical system is equally a crock, moreso with Obamacare in effect (hey, there's another example of unlawfully restricting a man's rights over his own earnings, but that's a different topic entirely). The argument of people dying in the streets is cute, considering that simply does not happen. Instead, we've got a system where have not can walk into a hospital, recieve care, then pass the cost of that care off to all the haves via elevated hospital rates. Why was Obamacare devised, then? Easy... some of the haves got smart enough to develop health insurance companies which they pay into each month, and which limit their personal exposure to paying for the have nots. We cannot allow that to stand, because the insurance companies weren't posting their robust profits anymore. Thus, a new law/tax gets enacted to ensure that the majority of the payment for the have nots' care comes directly from the pockets of the haves.

The United States has privatized corporate profits and socialized corporate losses, and the Federal individual income structure is the mechanism by which they do it.

reply to post by charles1952

I went to Pie Chart, and underneath the chart of all gov't expenses, there was a complete breakdown. Each section has numerous subsections, and some of those expand further. What you saw for Healthcare was just the total, but it expands to six subsections, which expand into many more. Interesting site to see where the money goes!

I went to Pie Chart, and underneath the chart of all gov't expenses, there was a complete breakdown. Each section has numerous subsections, and some of those expand further. What you saw for Healthcare was just the total, but it expands to six subsections, which expand into many more. Interesting site to see where the money goes!

reply to post by burdman30ott6

Just a correction before I get lost in thought and the process of replying. You said this:

As a person who has entered an emergency room as an "indigent" I am sorry to tell you that you have been sold a bill of goods. The myth that the poor get reasonable medical care in ERs is just not true. The law only states that a hospital must stabilize a patient. So, if I show up at an ER with a blood pressure that is so high I could die at any given moment, they only need give me one pill, or injection, to lower my blood pressure, temporarily. Once that's happened? Back to the street. No diagnosis, No treatment of the underlying problem.

Oh, and for that? They send an outrageous bill - just as high as they would send any able to pay patient. In my case it was not blood pressure, so thankfully I did not die 8 hours after leaving the ER. But I did get ( and paid ) a bill for about $700.00 total - and the only care I got was a single dose of anxiety medication which costs about a quarter per pill at Wal Mart.

Beyond that, you seem to perceive me as the emotional one... the weepy bleeding heart. I can accept that. But, understand, that I see you as the emotional one. The angry, frightened one who is scared to death of losing control and security. You've already circled your wagons. And now any noise in the brush merits shooting at.

My social values are not born simply of empathy. They are also born of logic. Even though I complain about this society ( as we all do ), I can take my garbage to the curb, or take an evening walk... and I probably won't get mugged, shot, attacked or killed. It is possible, but not probable.

I enjoy this. And this ability exists due to many factors - one of which is that we have systems in place to help the desperately unfortunate. In other words, if I am killed during tomorrow nights walk it will most likely be a drug addict - and not a good man who snapped because he could not stand to watch his children starve for another moment and devolved into an act of desperation - killing me for what's in my pocket.

You'll respond by saying that I have given into cowardice - or that I am living a life based upon acceptance of extortion. And a number of people will happily agree with you and star it. But many will not understand that these compromises I speak of are the very reason that they can sit in their living rooms starring your idealistic posts. Without making these sorts of social compromises they would all ( including you and I ) be too busy either sleeping or pulling "watch" duty - ready to kill anyone who got too close to our property.

You might tell me that this country was not founded upon such social compacts. I counter with the Mayflower Compact

~To be continued:

Just a correction before I get lost in thought and the process of replying. You said this:

The argument of people dying in the streets is cute, considering that simply does not happen. Instead, we've got a system where have not can walk into a hospital, recieve care, then pass the cost of that care off to all the haves via elevated hospital rates.

As a person who has entered an emergency room as an "indigent" I am sorry to tell you that you have been sold a bill of goods. The myth that the poor get reasonable medical care in ERs is just not true. The law only states that a hospital must stabilize a patient. So, if I show up at an ER with a blood pressure that is so high I could die at any given moment, they only need give me one pill, or injection, to lower my blood pressure, temporarily. Once that's happened? Back to the street. No diagnosis, No treatment of the underlying problem.

Oh, and for that? They send an outrageous bill - just as high as they would send any able to pay patient. In my case it was not blood pressure, so thankfully I did not die 8 hours after leaving the ER. But I did get ( and paid ) a bill for about $700.00 total - and the only care I got was a single dose of anxiety medication which costs about a quarter per pill at Wal Mart.

Beyond that, you seem to perceive me as the emotional one... the weepy bleeding heart. I can accept that. But, understand, that I see you as the emotional one. The angry, frightened one who is scared to death of losing control and security. You've already circled your wagons. And now any noise in the brush merits shooting at.

My social values are not born simply of empathy. They are also born of logic. Even though I complain about this society ( as we all do ), I can take my garbage to the curb, or take an evening walk... and I probably won't get mugged, shot, attacked or killed. It is possible, but not probable.

I enjoy this. And this ability exists due to many factors - one of which is that we have systems in place to help the desperately unfortunate. In other words, if I am killed during tomorrow nights walk it will most likely be a drug addict - and not a good man who snapped because he could not stand to watch his children starve for another moment and devolved into an act of desperation - killing me for what's in my pocket.

You'll respond by saying that I have given into cowardice - or that I am living a life based upon acceptance of extortion. And a number of people will happily agree with you and star it. But many will not understand that these compromises I speak of are the very reason that they can sit in their living rooms starring your idealistic posts. Without making these sorts of social compromises they would all ( including you and I ) be too busy either sleeping or pulling "watch" duty - ready to kill anyone who got too close to our property.

You might tell me that this country was not founded upon such social compacts. I counter with the Mayflower Compact

In the name of God, Amen. We, whose names are underwritten, the loyal subjects of our dread Sovereign Lord King James, by the Grace of God, of Great Britain, France, and Ireland, King, defender of the Faith, etc.

Having undertaken, for the Glory of God, and advancements of the Christian faith and honor of our King and Country, a voyage to plant the first colony in the Northern parts of Virginia, do by these presents, solemnly and mutually, in the presence of God, and one another, covenant and combine ourselves together into a civil body politic; for our better ordering, and preservation and furtherance of the ends aforesaid; and by virtue hereof to enact, constitute, and frame, such just and equal laws, ordinances, acts, constitutions, and offices, from time to time, as shall be thought most meet and convenient for the general good of the colony; unto which we promise all due submission and obedience.

In witness whereof we have hereunto subscribed our names at Cape Cod the 11th of November, in the year of the reign of our Sovereign Lord King James, of England, France, and Ireland, the eighteenth, and of Scotland the fifty-fourth, 1620

~To be continued:

And now the Declaration of Independance

Source

We have, as a society, deformed the meanings of both of these words so terribly. Look at the synonyms and I think they provide a better context. Fear has led Americans into mixing and inverting these two words into a convoluted mess.

When the body of work upon which this nation was founded is looked in total, and not cherry picked or read with confirmation bias firmly in place - one can easily see that this nation was based upon the very principles of community and of civic duty. These were people who dared not to fear.

~Heff

That to secure these rights, Governments are instituted among Men, deriving their just powers from the consent of the governed, That whenever any Form of Government becomes destructive of these ends, it is the Right of the People to alter or to abolish it, and to institute new Government, laying its foundation on such principles and organizing its powers in such form, as to them shall seem most likely to effect their Safety and Happiness. Prudence, indeed, will dictate that Governments long established should not be changed for light and transient causes; and accordingly all experience hath shewn, that mankind are more disposed to suffer, while evils are sufferable, than to right themselves by abolishing the forms to which they are accustomed. But when a long train of abuses and usurpations, pursuing invariably the same Object evinces a design to reduce them under absolute Despotism, it is their right, it is their duty, to throw off such Government, and to provide new Guards for their future security.

Source

despotism

Definition

des·pot·ism[ déspə tìzzəm ]

NOUN

1. rule by despot: rule by a despot or tyrant

2. abuse of power: cruel and arbitrary use of power

Thesaurus

NOUN

Synonyms: tyranny, dictatorship, absolutism, autocracy, authoritarianism, repression

NOUN

Antonyms: democracy

democracy

Definition

de·moc·ra·cy[ di mókrəssee ]

de·moc·ra·cies Plural

NOUN

1. free and equal representation of people: the free and equal right of every person to participate in a system of government, often practiced by electing representatives of the people by the majority of the people

2. democratic nation: a country with a government that has been elected freely and equally by all its citizens

3. democratic system of government: a system of government based on the principle of majority decision-making

4. control of organization by members: the control of an organization by its members, who have a free and equal right to participate in decision-making processes

[ Late 16th century. Directly or via French < medieval Latin democratia < Greek dēmokratia "rule of the people" < dēmos "people" + kratos "rule" ]

Thesaurus

NOUN

Synonyms: social equality, equality, egalitarianism, classlessness, consensus, fairness

Synonyms: democratic system, democratic state, democratic organization, representative form of government, republic, parliamentary government

NOUN

Antonyms: inequality, dictatorship

We have, as a society, deformed the meanings of both of these words so terribly. Look at the synonyms and I think they provide a better context. Fear has led Americans into mixing and inverting these two words into a convoluted mess.

When the body of work upon which this nation was founded is looked in total, and not cherry picked or read with confirmation bias firmly in place - one can easily see that this nation was based upon the very principles of community and of civic duty. These were people who dared not to fear.

~Heff

reply to post by xuenchen

Yes, you can thank the Republicans.

They are holding American's tax breaks hostage to protect their rich friends.

Nice attempt at spin though.

Yes, you can thank the Republicans.

They are holding American's tax breaks hostage to protect their rich friends.

Nice attempt at spin though.

Originally posted by HostileApostle

reply to post by xuenchen

Yes, you can thank the Republicans.

They are holding American's tax breaks hostage to protect their rich friends.

Nice attempt at spin though.

How so exactly ?

Details and sources are welcome at this point.

reply to post by charles1952

I don't know where I got 3 trillion.

90 million is still a lot.

Thanks for pointing it out.

I should be at least in the ballpark with these numbers. lol

I don't know where I got 3 trillion.

90 million is still a lot.

Thanks for pointing it out.

I should be at least in the ballpark with these numbers. lol

reply to post by Xtrozero

Are you people not happy unless you are telling someone else what to do and how to think?

Why don't I do what I want and you do the same for a change? I am not asking you to agree with me. I don't give a crap what you do. You want to sell your snake oil to stupid people you can continue. I will not tell you how to think or what to do and appreciate the same respect. This isn't a right wing-Nazi Country yet though I see you are working on it.

Please stop with the far left talking points and actually type something from your own head for once.

Are you people not happy unless you are telling someone else what to do and how to think?

Why don't I do what I want and you do the same for a change? I am not asking you to agree with me. I don't give a crap what you do. You want to sell your snake oil to stupid people you can continue. I will not tell you how to think or what to do and appreciate the same respect. This isn't a right wing-Nazi Country yet though I see you are working on it.

Originally posted by xuenchen

Originally posted by HostileApostle

reply to post by xuenchen

Yes, you can thank the Republicans.

They are holding American's tax breaks hostage to protect their rich friends.

Nice attempt at spin though.

How so exactly ?

Details and sources are welcome at this point.

Don't joke. They are certainly wasted here.

reply to post by xuenchen

If Obama wins, we'll all see an increase in taxes and cost of goods. Taxes, because of the end of the Bush tax cuts. Cost of goods, because of all the businesses that'll raise thier prices due to their taxes being raised.

If Obama loses, look for a scorched earth policy. Taxes will go up, and costs will increase. Obama will still be president at the time of taxmageddon.

So next time you see a leftist, say thank you to them for having less money. It's their fault.

If Obama wins, we'll all see an increase in taxes and cost of goods. Taxes, because of the end of the Bush tax cuts. Cost of goods, because of all the businesses that'll raise thier prices due to their taxes being raised.

If Obama loses, look for a scorched earth policy. Taxes will go up, and costs will increase. Obama will still be president at the time of taxmageddon.

So next time you see a leftist, say thank you to them for having less money. It's their fault.

edit on 2-10-2012 by beezzer because: (no reason given)

reply to post by beezzer

Let's play a little game called Economics 101.

Taxes play no role in the price of goods or services. If Company A can sell widget X for $5 because that maximizes their profit, it doesn't matter if they are taxed at 1% or 50%, their maximizing profit is still at $5.

If they use your logic and increase their price to $8 because they say they are now taxed more, then their sales are going to drop because the consumer doesn't care about how much they are taxed at. All they care about is if they are willing to pay $8 for widget X. If consumers are willing to pay $8 per widget, then Company A would already be charging $8 to maximize their profits. Since they weren't and instead charging $5, then raising their prices means that they are going to sell less widgets.

Profit is profit, you maximize it always, it doesn't matter if taxes are low or high. Taxes only come into play after you have maximized your profits, you don't take them into consideration before hand.

So, if any company does decide to raise prices because of taxes, they are morons and deserve to go out of business.

Let's play a little game called Economics 101.

Taxes play no role in the price of goods or services. If Company A can sell widget X for $5 because that maximizes their profit, it doesn't matter if they are taxed at 1% or 50%, their maximizing profit is still at $5.

If they use your logic and increase their price to $8 because they say they are now taxed more, then their sales are going to drop because the consumer doesn't care about how much they are taxed at. All they care about is if they are willing to pay $8 for widget X. If consumers are willing to pay $8 per widget, then Company A would already be charging $8 to maximize their profits. Since they weren't and instead charging $5, then raising their prices means that they are going to sell less widgets.

Profit is profit, you maximize it always, it doesn't matter if taxes are low or high. Taxes only come into play after you have maximized your profits, you don't take them into consideration before hand.

So, if any company does decide to raise prices because of taxes, they are morons and deserve to go out of business.

reply to post by HostileApostle

That was an interesting response, but it confuses me. But, then again, I'm easily confused.

Normally, I don't accept economic advice from a creature that keeps his gold in carrot shaped ingots, (24 carrot gold) but I've got to go with him this time.

That was an interesting response, but it confuses me. But, then again, I'm easily confused.

You don't see taxes as both fixed and variable costs in, say, a manufacturing plant? And you don't think costs play a role in setting the price and determining profit? Profit is, roughly, what you have left after you take costs away from revenue. Costs are crucial in determining profits, and heavily influence prices.

Taxes play no role in the price of goods or services.

But if they change the tax rate, that changes the cost. If the cost increases but the sales price remains the same, profit goes down. It can go down to a negative number, in which case, they eventually close down. Say the costs, including taxes are 90% of revenue and they make 10% on every piece sold. What happens if taxes go from 1% to 50%? They lose half their profit. Of course, it does depend on where the tax is levied. If it's based on sales (as in gasoline or cigarettes), you can be knocked into a loss, if it's based on profit, you can be knocked to a smaller, but not negative profit.

If Company A can sell widget X for $5 because that maximizes their profit, it doesn't matter if they are taxed at 1% or 50%, their maximizing profit is still at $5.

But taxes aren't applied to one company, they're applied to all. If the gas tax goes from 40 cents a gallon to $1.40 a gallon, evrybody has to pay more, they all raise their prices by a dollar, and the consumer has no reason to try to find another gas station.

If they use your logic and increase their price to $8 because they say they are now taxed more, then their sales are going to drop because the consumer doesn't care about how much they are taxed at.

Only if the market price remains at $5. If everybody else increases to $8 dollars, there will probably be an industry-wide reduction in sales, but Comapny A would keep the same market share.

All they care about is if they are willing to pay $8 for widget X. If consumers are willing to pay $8 per widget, then Company A would already be charging $8 to maximize their profits. Since they weren't and instead charging $5, then raising their prices means that they are going to sell less widgets.

You have to take them into consideration. You consider making and selling a plywood airplane, then, when you figure in tax, you see that your net ROI will be 1%, and at that, there's a risk of failure. You see that you're better off putting your money in CDs than this new product. No ethical accountant would neglect giving you an ROI analysis for every major decision.

Taxes only come into play after you have maximized your profits, you don't take them into consideration before hand.

Normally, I don't accept economic advice from a creature that keeps his gold in carrot shaped ingots, (24 carrot gold) but I've got to go with him this time.

reply to post by charles1952

Taxes are not costs, period.

It's as simple as that. Taxes are only applied to profits, costs are applied to revenue. In a supply and demand system, you can't offset higher taxes by raising prices. In order to raise your prices, your demand needs to go up or the supply needs to go down. Taxes do no change the demand from the consumer, and there is no reason they change the supply.

Besides, we really aren't talking huge numbers here. Saying something is going to increase from $5 to $8 is just over reaction and/or fear mongering. Let's look at an example.

Before the hypothetical scary tax increase. I had a revenue of $500,000 selling 100,000 units at $5 a piece. Let's say my costs were $250,000. That leaves me a profit of $250,000. At our current tax rate of 35% for the upper bracket, that means I pay $87,500 in taxes, leaving me $162,500 in net profit.

Now, let's look at the scary tax increase. Let's say I don't increase my prices and I sell the same amount of units. Costs are the same, so I still have a gross profit of $250,000. Now the scary tax increase rate goes to 39.6%. So now I pay $99,000 in taxes, leaving me $151,000. Yes, we are talking about a difference of 11k...when netting 150k, crying about 10k makes you look a little like a greedy bastard.

But back to your logic that we have to increase prices to get that lost profit back. To make the same net profit with the new tax rate, you will have to make a gross profit of $269,039.73. Let's just say your costs will stay the same. So in order to accomplish this you either need to sell 3,808 more units, or raise your price to $5.19 and hope that your sales don't go down.

But this is where economics comes in. If you could raise your price to $5.19 and still sell 100,000 units, why weren't you doing it before? Nothing changed besides the tax rate that you pay, you didn't make your goods or service any better, the demand didn't go up, your supply didn't go down, so what exactly would drive that price increase?

The answer is nothing, so if you did increase the price you are more than likely going to sell less units for a lower gross profit. If not, then you should have been charging more anyway. So having a lower gross profit, and a higher tax rate, you are going to lose twice.

This is why anyone who raises price in response to a tax increase is a moron and deserves to go out of business.

p.s. - Gasoline is a special case because it doesn't operate under supply/demand, it hasn't for a long time.

Taxes are not costs, period.

It's as simple as that. Taxes are only applied to profits, costs are applied to revenue. In a supply and demand system, you can't offset higher taxes by raising prices. In order to raise your prices, your demand needs to go up or the supply needs to go down. Taxes do no change the demand from the consumer, and there is no reason they change the supply.

Besides, we really aren't talking huge numbers here. Saying something is going to increase from $5 to $8 is just over reaction and/or fear mongering. Let's look at an example.

Before the hypothetical scary tax increase. I had a revenue of $500,000 selling 100,000 units at $5 a piece. Let's say my costs were $250,000. That leaves me a profit of $250,000. At our current tax rate of 35% for the upper bracket, that means I pay $87,500 in taxes, leaving me $162,500 in net profit.

Now, let's look at the scary tax increase. Let's say I don't increase my prices and I sell the same amount of units. Costs are the same, so I still have a gross profit of $250,000. Now the scary tax increase rate goes to 39.6%. So now I pay $99,000 in taxes, leaving me $151,000. Yes, we are talking about a difference of 11k...when netting 150k, crying about 10k makes you look a little like a greedy bastard.

But back to your logic that we have to increase prices to get that lost profit back. To make the same net profit with the new tax rate, you will have to make a gross profit of $269,039.73. Let's just say your costs will stay the same. So in order to accomplish this you either need to sell 3,808 more units, or raise your price to $5.19 and hope that your sales don't go down.

But this is where economics comes in. If you could raise your price to $5.19 and still sell 100,000 units, why weren't you doing it before? Nothing changed besides the tax rate that you pay, you didn't make your goods or service any better, the demand didn't go up, your supply didn't go down, so what exactly would drive that price increase?

The answer is nothing, so if you did increase the price you are more than likely going to sell less units for a lower gross profit. If not, then you should have been charging more anyway. So having a lower gross profit, and a higher tax rate, you are going to lose twice.

This is why anyone who raises price in response to a tax increase is a moron and deserves to go out of business.

p.s. - Gasoline is a special case because it doesn't operate under supply/demand, it hasn't for a long time.

edit on 3-10-2012 by

HostileApostle because: (no reason given)

edit on 3-10-2012 by HostileApostle because: (no reason given)

reply to post by HostileApostle

Gasoline is a commodity traded on international markets.

The supply/demand factors influence the trading "bids and asks".

Wholesalers set prices on what they pay for gasoline.

Retailers set prices based on what they pay for gasoline plus operating expenses.

"Taxes" on profits are eventually part of the operating expenses Yes?

Gasoline is a special case because it doesn't operate under supply/demand, it hasn't for a long time.

Gasoline is a commodity traded on international markets.

The supply/demand factors influence the trading "bids and asks".

Wholesalers set prices on what they pay for gasoline.

Retailers set prices based on what they pay for gasoline plus operating expenses.

"Taxes" on profits are eventually part of the operating expenses Yes?

new topics

-

Any one suspicious of fever promotions events, major investor Goldman Sachs card only.

The Gray Area: 1 hours ago -

God's Righteousness is Greater than Our Wrath

Religion, Faith, And Theology: 5 hours ago -

Electrical tricks for saving money

Education and Media: 8 hours ago -

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News: 10 hours ago -

Sunak spinning the sickness figures

Other Current Events: 10 hours ago -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues: 10 hours ago

top topics

-

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News: 10 hours ago, 9 flags -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest: 14 hours ago, 8 flags -

Electrical tricks for saving money

Education and Media: 8 hours ago, 4 flags -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues: 10 hours ago, 3 flags -

Sunak spinning the sickness figures

Other Current Events: 10 hours ago, 3 flags -

Late Night with the Devil - a really good unusual modern horror film.

Movies: 12 hours ago, 2 flags -

The Good News According to Jesus - Episode 1

Religion, Faith, And Theology: 15 hours ago, 1 flags -

Any one suspicious of fever promotions events, major investor Goldman Sachs card only.

The Gray Area: 1 hours ago, 1 flags -

God's Righteousness is Greater than Our Wrath

Religion, Faith, And Theology: 5 hours ago, 0 flags

active topics

-

God's Righteousness is Greater than Our Wrath

Religion, Faith, And Theology • 8 • : randomuser2034 -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 661 • : Justoneman -

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs • 59 • : andy06shake -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three • 36 • : TheMisguidedAngel -

British TV Presenter Refuses To Use Guest's Preferred Pronouns

Education and Media • 146 • : Consvoli -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues • 19 • : Consvoli -

Terrifying Encounters With The Black Eyed Kids

Paranormal Studies • 76 • : Consvoli -

Samuel Aun Woer

Religion, Faith, And Theology • 27 • : helebi20 -

Any one suspicious of fever promotions events, major investor Goldman Sachs card only.

The Gray Area • 2 • : Cavemannick -

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News • 42 • : 38181