It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

2

share:

BBC

Well here it is folks, apparently the EU deal of which we can all bet on.

Now banks have agreed to take a 50% loss on Greek debt?

So this must be crisis averted and all is well in the world, for now.

Commentary from ZeroHedge:

That was my first query, how did they get the banks to agree to a 50% haircut? Something extraordinary on offer, or some kind of coercion?

What do you ATS folks think of this development?

The European Union has reached a "three-pronged" agreement it says is vital to resolving the Greek debt crisis.

As part of the deal, banks have agreed to take a 50% loss on Greek debt.

That has removed a major obstacle in European efforts to stabilise the problem.

The announcement helped lift the euro as investors were more optimistic about the outlook for the region's growth and single currency.

"The result will relieve the whole world that was expecting a decision that was strong from the eurozone," French President Nicolas Sarkozy said at a press conference in Brussels.

Well here it is folks, apparently the EU deal of which we can all bet on.

Now banks have agreed to take a 50% loss on Greek debt?

So this must be crisis averted and all is well in the world, for now.

Commentary from ZeroHedge:

If true, this means that Portugal, Ireland, Spain and Italy will promptly commence sabotaging their economies (just like Greece) simply to get the same debt Blue Light special as Greece. It also means that, at least according to Barclays, we have a CDS credit event, although we are certain that Europe would never announce this deal unless ISDA (complete determinations committee list here) was onboard, and corrupt as always. In addition, Greece was unable to generate a 90% acceptance for a 21% haircut tender offer. And we are somehow supposed to believe they can do it with 50%? Lastly, as a reminder, on September 14, Moody's put SocGen, BNP and Credit Agricole on downgrade review. This will be the trigger.

That was my first query, how did they get the banks to agree to a 50% haircut? Something extraordinary on offer, or some kind of coercion?

What do you ATS folks think of this development?

reply to post by surrealist

I tthink this deal will just continue the collapse of the Euro. Gold will probably rebound even higher as well.

China is getting antsy as well with their offers of help just sitting on the table. They don't want to see a return of a strong Dollar or Euro.

I tthink this deal will just continue the collapse of the Euro. Gold will probably rebound even higher as well.

China is getting antsy as well with their offers of help just sitting on the table. They don't want to see a return of a strong Dollar or Euro.

Is this outcome to be well received by other Eurozone countries laden with debt such as Spain, Portugal, Ireland and Italy? I guess that is what ZH

was getting at in the commentary.

Kinda like we are both with the same bank, but because I overspent and could not afford to make my repayments on the debt, the bank takes a 50% haircut on my debt while you get nuthin.

Kinda like we are both with the same bank, but because I overspent and could not afford to make my repayments on the debt, the bank takes a 50% haircut on my debt while you get nuthin.

Originally posted by surrealist

BBC

... how did they get the banks to agree to a 50% haircut? Something extraordinary on offer ...

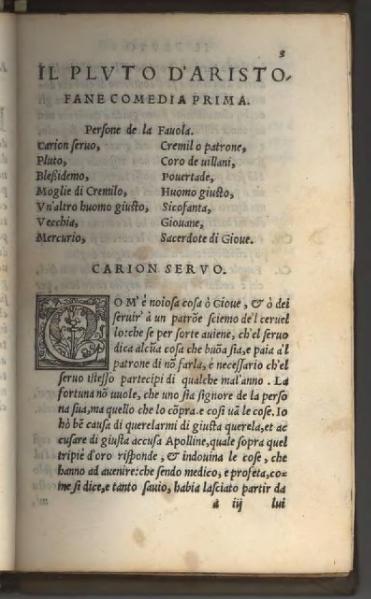

Perhaps they sold the isle of Lesbos, the Parthenon and an original copy of Aristophanes comedic play 'Plutus'

Commedia di Aristofane. IL PLVTO D'ARISTO

translated by Bartolomio & Pietro Rositini, 1545

edit on 26-10-2011 by InformationAccount because: (no reason given)

Serves them right. Investing risk capital means risk losing capital positions. higher profits for riskpremiums and saveguarding those risks by

governments is just immoral, but this is what happens. Btw if you want high profits for 0 actual risk, invest in greece now. All new credits are

currently backed up.

reply to post by surrealist

From my understanding, the larger creditor agencies agreed to the 50% write down. Of course, now comes the hard part of convincing the actual investors.

From my understanding, the larger creditor agencies agreed to the 50% write down. Of course, now comes the hard part of convincing the actual investors.

There is so much optimistic hype out there with this groundbreaking deal that I reserve some grave concern with what the reaction will be should this

somehow go belly up.

Deal or no deal, the only thing this really does is provide temporary relief in that Greece is out of the fiscal frying pan . . . for now.

The ring of debt encircling the globe is still there and they system that gave rise to this enormous debt is still in place like a big old deer tic sucking the blood out of the host. The 'management team' that brought us to this point is still in place. The mid-management level, too, remains unchanged.

It is something similar to opening the torso of a cancer victim and yanking out one of ten tumors and hoping that will cure the patient.

The cancer continues to spread and the host succumbs.

I ask you all, how is this elimination of debt any different from that? How does it eliminate the problem? How does it fix the system?

Maybe I'm daft, but I don't see where all this optimism comes from in light of the above.

Somebody . . .ANYBODY . . . please help me to understand this.

The ring of debt encircling the globe is still there and they system that gave rise to this enormous debt is still in place like a big old deer tic sucking the blood out of the host. The 'management team' that brought us to this point is still in place. The mid-management level, too, remains unchanged.

It is something similar to opening the torso of a cancer victim and yanking out one of ten tumors and hoping that will cure the patient.

The cancer continues to spread and the host succumbs.

I ask you all, how is this elimination of debt any different from that? How does it eliminate the problem? How does it fix the system?

Maybe I'm daft, but I don't see where all this optimism comes from in light of the above.

Somebody . . .ANYBODY . . . please help me to understand this.

i posted this on the UP to the Minute Market thread:

"hold on for the roller coaster ride... the CAC, FTSE, DAX...& the DOW Futures are all up significantly... with the DOW Jones above 12,000 ... hooray?

well, the reason is because the EU has technically 'forgiven' some of the debt/swaps that investors bet on...

the wording concerning some of the sovereign debt default swaps is such that these CDS will not have to be paid... so there are no winners only losers that spent money betting Greece, et al would go belly up in default

i touched on this subject in some thread weeks ago, but for the life of me i cannot find the post in my listings of posts in my Profile..

the thing is... despite the early enthusiasm... when the results of non-payments of CDS are fully realized... the whole casino of credit swaps as an instrument to protect ones positions are null & void and unreliable---and Markets detest uncertainty

either the EU and the USA negate all those swaps & bets and end the casino betting binge or go

-All In-

and back the paper/bonds/bets with taxpayer monies as the USA Fed did 3 years ago.

i suspect the EU Markets will lead the way down if the CDS paper is rendered non-payable based on technical jargon "

i'm glad someone else caught the 'hidden-in-plain-sight' sea-change event that is taking place...

i suspect the OWS will demand claw-backs for all the TARPS & Swaps paid by the Fed @ 100 cents on the dollar back in the bank bail-out days..

debt forgiveness indeed, the markets & lost profits by the investment banks on negated CDS will require a pound of flesh from someone =somehow =somewhere

"hold on for the roller coaster ride... the CAC, FTSE, DAX...& the DOW Futures are all up significantly... with the DOW Jones above 12,000 ... hooray?

well, the reason is because the EU has technically 'forgiven' some of the debt/swaps that investors bet on...

the wording concerning some of the sovereign debt default swaps is such that these CDS will not have to be paid... so there are no winners only losers that spent money betting Greece, et al would go belly up in default

i touched on this subject in some thread weeks ago, but for the life of me i cannot find the post in my listings of posts in my Profile..

the thing is... despite the early enthusiasm... when the results of non-payments of CDS are fully realized... the whole casino of credit swaps as an instrument to protect ones positions are null & void and unreliable---and Markets detest uncertainty

either the EU and the USA negate all those swaps & bets and end the casino betting binge or go

-All In-

and back the paper/bonds/bets with taxpayer monies as the USA Fed did 3 years ago.

i suspect the EU Markets will lead the way down if the CDS paper is rendered non-payable based on technical jargon "

i'm glad someone else caught the 'hidden-in-plain-sight' sea-change event that is taking place...

i suspect the OWS will demand claw-backs for all the TARPS & Swaps paid by the Fed @ 100 cents on the dollar back in the bank bail-out days..

debt forgiveness indeed, the markets & lost profits by the investment banks on negated CDS will require a pound of flesh from someone =somehow =somewhere

edit on 27-10-2011 by St Udio because: (no reason given)

This whole deal seems fishy to me.

Last time they wrote up a deal like this banks refused a much lower haircut and a bailout package of a 145 billion euros was then shoved down the throats of the people.

The first bailout was about 20% smaller than that and no haircut was even talked about.

Someone is making a lot of money here, and it isn't the people, and in this case, it probably won't be the banks.

Last time they wrote up a deal like this banks refused a much lower haircut and a bailout package of a 145 billion euros was then shoved down the throats of the people.

The first bailout was about 20% smaller than that and no haircut was even talked about.

Someone is making a lot of money here, and it isn't the people, and in this case, it probably won't be the banks.

Originally posted by Agent_USA_Supporter

This deal wont save greece.

Finally, something we agree on.

Sadly the debt in the EU zone can not be erased with another Trillion bailout and a 50% forgiveness of the Greek debt, why not? because since 2008 the

IMF have funded so far 17 trillion dollars to keep the EU zone euro from collapsing, guess what? it has not fixed a darn thing, as more bailouts are

needed.

So, this latest attempt to keep the EU afloat is going to fail once again, because you can not hide the trillions of dollars that were created with the derivative crap and more is been crated by the minute.

So expect another crisis coming soon and more bailouts needed.

The economist that believe that debt can be erased with more debt is a moron and should be fired

So, this latest attempt to keep the EU afloat is going to fail once again, because you can not hide the trillions of dollars that were created with the derivative crap and more is been crated by the minute.

So expect another crisis coming soon and more bailouts needed.

The economist that believe that debt can be erased with more debt is a moron and should be fired

Originally posted by surrealist

Is this outcome to be well received by other Eurozone countries laden with debt such as Spain, Portugal, Ireland and Italy? I guess that is what ZH was getting at in the commentary.

Kinda like we are both with the same bank, but because I overspent and could not afford to make my repayments on the debt, the bank takes a 50% haircut on my debt while you get nuthin.

While Ireland won’t seek debt discounts, the government might pursue other relief given to Greece, including cheaper interest payments on aid and longer to repay it, according to a person familiar with the matter who declined to be identified as no final decision has been taken.

Irish See Opportunity

As for the new Trillion pot, they don't plan on putting more money in, just leveraging it

if greece cant sort out its own economy AGAIN, shouldnt they just call it a day and go into liquidation. sell off all its assets and land, and just

call it quits..........

probably a stupid idea, but im tired of hearing about it to be honest

probably a stupid idea, but im tired of hearing about it to be honest

new topics

-

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three: 1 hours ago -

Bobiverse

Fantasy & Science Fiction: 3 hours ago -

Florida man's trip overseas ends in shock over $143,000 T-Mobile phone bill

Social Issues and Civil Unrest: 4 hours ago -

Former Labour minister Frank Field dies aged 81

People: 6 hours ago -

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs: 7 hours ago -

This is our Story

General Entertainment: 10 hours ago

top topics

-

President BIDEN Vows to Make Americans Pay More Federal Taxes in 2025 - Political Suicide.

2024 Elections: 12 hours ago, 16 flags -

One Flame Throwing Robot Dog for Christmas Please!

Weaponry: 17 hours ago, 6 flags -

Florida man's trip overseas ends in shock over $143,000 T-Mobile phone bill

Social Issues and Civil Unrest: 4 hours ago, 6 flags -

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs: 7 hours ago, 5 flags -

Don't take advantage of people just because it seems easy it will backfire

Rant: 17 hours ago, 4 flags -

Ditching physical money

History: 17 hours ago, 4 flags -

Former Labour minister Frank Field dies aged 81

People: 6 hours ago, 4 flags -

Bobiverse

Fantasy & Science Fiction: 3 hours ago, 3 flags -

This is our Story

General Entertainment: 10 hours ago, 3 flags -

Ode to Artemis

General Chit Chat: 13 hours ago, 3 flags

active topics

-

One Flame Throwing Robot Dog for Christmas Please!

Weaponry • 10 • : ATruGod -

Breaking Baltimore, ship brings down bridge, mass casualties

Other Current Events • 477 • : ArMaP -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 644 • : cherokeetroy -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three • 8 • : Astyanax -

New whistleblower Jason Sands speaks on Twitter Spaces last night.

Aliens and UFOs • 51 • : Ophiuchus1 -

The Reality of the Laser

Military Projects • 40 • : Zaphod58 -

President BIDEN Vows to Make Americans Pay More Federal Taxes in 2025 - Political Suicide.

2024 Elections • 67 • : UnderAether -

Windows tracking links to WEF and more:

New World Order • 21 • : milaganenogan -

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs • 29 • : SchrodingersRat -

"We're All Hamas" Heard at Columbia University Protests

Social Issues and Civil Unrest • 274 • : YourFaceAgain

2