It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

7

share:

Here is a report that I put together earlier, in regards to all of the Myths surrounding the Tax Plan Championed by Obama/Biden, which they summarize

through the slogans: "We Will Raise The Taxes of ONLY The Wealthiest 5% of America", and "95% of America will not see a Dime's Worth of Tax

Increase".

Here is the Truth:

The "Marginal Tax Rate" consists of Federal Taxes which are imposed upon EVERY SINGLE Individually Earned Dollar above a set limit. Here is what a Harvard Economics Professor has to say about it:

"Senator Obama would raise the top individual tax rate back to 39.6 percent, impose an additional 2 to 4 percent tax on earnings for some over the existing Social Security wage cap, and bring back the phase-out of the personal exemption and certain itemized deductions for higher-income taxpayers. When added up, the top effective marginal tax rate rises...from 37.9 percent to roughly 48 to 50 percent. "High" is in the eye of the beholder, but these are tax rates not seen since before the Tax Reform Act of 1986."

This Tax Rate DOES NOT include the Income Taxes which are Paid through the State, Various Taxes which are enacted through Localities, and so forth. Here is what two Scholars at the American Enterprise Institute have to say about this issue as well:

"While both candidates will reduce their tax plans to clever sound bites, voters should consider how those plans would affect incentives to earn income. Unfortunately, Senator Obama’s proposed "tax cuts for the middle class" are actually marginal rate hikes in disguise."

ON the other hand, Senator McCain plans on eliminating Tax Rates across the entire Spectrum of Income Earners. He simply plans on Decreasing these Taxes in a greater amount from those that already pay higher percentages, and Decreasing Taxes in lesser amounts from those that already pay lower percentages. The lowest income bracket of American Citizens already pays BELOW 2% of ALL Income Taxes in America.

Here is an article written by a Wall Street Journal Economics Specialist, which addresses the REALITY of the current American Tax System:

"The latest data show that a big portion of the federal income tax burden is shouldered by a small group of the very richest Americans. The wealthiest 1 percent of the population earn 19 per¬cent of the income but pay 37 percent of the income tax. The top 10 percent pay 68 percent of the tab. Meanwhile, the bottom 50 percent—those below the median income level—now earn 13 percent of the income but pay just 3 percent of the taxes."

The REALITY of the American Tax system can be complicated, and that is one of the many reasons why so many American Citizens never fully grasp the reality behind Political Rhetoric and Campaign Slogans. Hopefully the aforementioned allows for a greater deal of insight and clarification into the Facts behind the Current American Tax System. The Smokescreen has parted, and the Truth remains.

Here is the Truth:

The "Marginal Tax Rate" consists of Federal Taxes which are imposed upon EVERY SINGLE Individually Earned Dollar above a set limit. Here is what a Harvard Economics Professor has to say about it:

"Senator Obama would raise the top individual tax rate back to 39.6 percent, impose an additional 2 to 4 percent tax on earnings for some over the existing Social Security wage cap, and bring back the phase-out of the personal exemption and certain itemized deductions for higher-income taxpayers. When added up, the top effective marginal tax rate rises...from 37.9 percent to roughly 48 to 50 percent. "High" is in the eye of the beholder, but these are tax rates not seen since before the Tax Reform Act of 1986."

-Greg Mankiw

This Tax Rate DOES NOT include the Income Taxes which are Paid through the State, Various Taxes which are enacted through Localities, and so forth. Here is what two Scholars at the American Enterprise Institute have to say about this issue as well:

"While both candidates will reduce their tax plans to clever sound bites, voters should consider how those plans would affect incentives to earn income. Unfortunately, Senator Obama’s proposed "tax cuts for the middle class" are actually marginal rate hikes in disguise."

ON the other hand, Senator McCain plans on eliminating Tax Rates across the entire Spectrum of Income Earners. He simply plans on Decreasing these Taxes in a greater amount from those that already pay higher percentages, and Decreasing Taxes in lesser amounts from those that already pay lower percentages. The lowest income bracket of American Citizens already pays BELOW 2% of ALL Income Taxes in America.

Here is an article written by a Wall Street Journal Economics Specialist, which addresses the REALITY of the current American Tax System:

"The latest data show that a big portion of the federal income tax burden is shouldered by a small group of the very richest Americans. The wealthiest 1 percent of the population earn 19 per¬cent of the income but pay 37 percent of the income tax. The top 10 percent pay 68 percent of the tab. Meanwhile, the bottom 50 percent—those below the median income level—now earn 13 percent of the income but pay just 3 percent of the taxes."

The REALITY of the American Tax system can be complicated, and that is one of the many reasons why so many American Citizens never fully grasp the reality behind Political Rhetoric and Campaign Slogans. Hopefully the aforementioned allows for a greater deal of insight and clarification into the Facts behind the Current American Tax System. The Smokescreen has parted, and the Truth remains.

The fact that none of the leftists are replying to this thread means that they can't argue with the facts or they're too ignorant to understand the

data. Just another example of how Obama's tax plan won't work.

I've said it a hundred times and I'll say it again - when you tax the job-creating class you're risking taking away jobs from the rest of America. And yes I know the left usually responds with "well they outsource anyway so what difference does it make". The difference is corporations outsource the work that is often repetitive and can be easily handled by offshore workers. When they save money that way, they open doors to other areas of expansion. That may mean Americans need to educate themselves to become competitive in the job market, but since when is an education ever a bad thing. Gone are the days when a high school GED or diploma would cut it. This is the age of the global economy.

I applaud your work on this post! It's worth a star and a flag.

I've said it a hundred times and I'll say it again - when you tax the job-creating class you're risking taking away jobs from the rest of America. And yes I know the left usually responds with "well they outsource anyway so what difference does it make". The difference is corporations outsource the work that is often repetitive and can be easily handled by offshore workers. When they save money that way, they open doors to other areas of expansion. That may mean Americans need to educate themselves to become competitive in the job market, but since when is an education ever a bad thing. Gone are the days when a high school GED or diploma would cut it. This is the age of the global economy.

I applaud your work on this post! It's worth a star and a flag.

Another Star and Flag for you my friend. Excellent work!

It's a shame the debates don't offer enough time to get into this when Obama and Biden through out there 95% number. Of course as you said, the reality is that this information is hard to grasp for many.

I agree with you too sos37, where is the usual crowd defending Obama's policy here?

Interesting.

It's a shame the debates don't offer enough time to get into this when Obama and Biden through out there 95% number. Of course as you said, the reality is that this information is hard to grasp for many.

I agree with you too sos37, where is the usual crowd defending Obama's policy here?

Interesting.

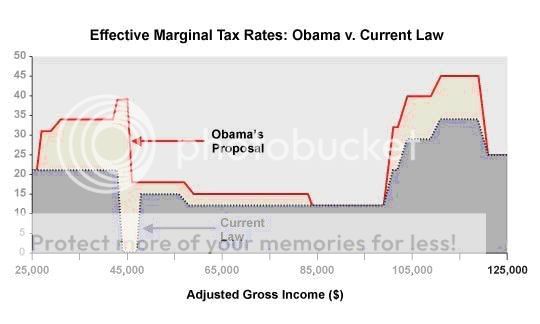

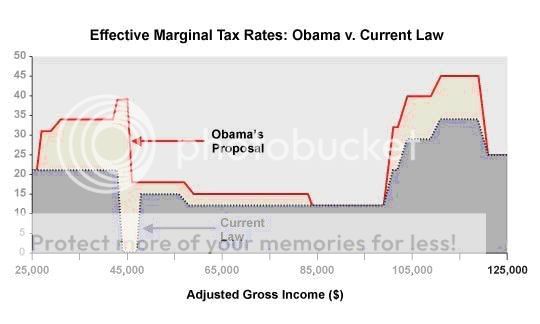

Well, I think the Washignton Post graph is trustowrothy:

And judged by that, the OP is off mark.

Is it a part of that:

www.factcheck.org...

[edit on 7-10-2008 by buddhasystem]

And judged by that, the OP is off mark.

Is it a part of that:

www.factcheck.org...

[edit on 7-10-2008 by buddhasystem]

Originally posted by buddhasystem

Well, I think the Washignton Post graph is trustowrothy:

No, it's pointless really. The great tax cuts that show up under Obama's plan affect those that make under $66,000 a year. If you have a family with 2 kids, and make $66,000 you're barely paying any taxes to begin with. The changes in the tax rate would be undetectable to those in this bracket. Undetectable until unemployment increased due to job cuts caused by higher taxes.

Where's the concern for jobs being pushed overseas? It will happen folks. If you increase taxes on business then you're simply increasing their incentive to go elsewhere for location and labor. How does this help our economy? How can we talk about helping the economy one hand and then elect someone who will punish the job producing class on the other?

The whole Obama approach is unethical if you ask me. So your neighbor has 4 cars and you only have one. Does that mean that the government should take 2 of his cars away from him? Tax him, not me. Is that it?

Unfortunately, that's exactly it dbates.

There have been many of us pointing out for a while now that this would happen. If you increase taxes that much on the top earners, they will make up the difference by cutting jobs, moving them overseas to cheaper markets, whatever. And you're right. It will happen.

People get so caught up in this class envy pushed by Obama and Biden, that they forget to take a look at the bigger picture. The top wage earners in this country are not our enemies. They are the ones supplying our jobs. Raising their taxes is a terrible idea. Terrible.

There have been many of us pointing out for a while now that this would happen. If you increase taxes that much on the top earners, they will make up the difference by cutting jobs, moving them overseas to cheaper markets, whatever. And you're right. It will happen.

People get so caught up in this class envy pushed by Obama and Biden, that they forget to take a look at the bigger picture. The top wage earners in this country are not our enemies. They are the ones supplying our jobs. Raising their taxes is a terrible idea. Terrible.

Originally posted by dbates

Where's the concern for jobs being pushed overseas? It will happen folks.

Jobs are already going overseas, under the watch of our beloved deregulators, and much faster than you can say "McCain supports illegal immigration".

If you increase taxes on business then you're simply increasing their incentive to go elsewhere for location and labor.

Last time I checked, most of the stuff we use is already made in China and when I called Dell support my call landed in India. Tax or no tax.

[edit on 7-10-2008 by buddhasystem]

Originally posted by dbates

The great tax cuts that show up under Obama's plan affect those that make under $66,000 a year. If you have a family with 2 kids, and make $66,000 you're barely paying any taxes to begin with. The changes in the tax rate would be undetectable to those in this bracket.

And that would make the OP quite false, right?

Originally posted by buddhasystem

Ah, I noticed you edited out your "they deserve to pay a little" remark.

Interesting. Especially considering the quoted from above:

The wealthiest 1 percent of the population earn 19 per¬cent of the income but pay 37 percent of the income tax. The top 10 percent pay 68 percent of the tab. Meanwhile, the bottom 50 percent—those below the median income level—now earn 13 percent of the income but pay just 3 percent of the taxes."

Looks they already are "paying a little" doesn't it?

reply to post by buddhasystem

How easy we blame illegal immigration? If lazy Americans would get educated and quit relying on handouts they would get good jobs. The manufacturing days are about over. We are becoming a service industry and education is the key for high paying jobs. Funny how no one complains about the legal froeign doctors and nurses coming in to our country cause we can't educate enough Americans to occupy those high paying jobs.

Most individuals don't pay taxes cause they don't earn that much. How is that a tax cut for them if they owe no taxes. The op post has merits. Good job op.

One question about dell. Do you continue to buy Dell stuff? If so quit complaining. This means you support them outsourcing jobs. If you and others would quit buying from them they will bring those jobs back.

How easy we blame illegal immigration? If lazy Americans would get educated and quit relying on handouts they would get good jobs. The manufacturing days are about over. We are becoming a service industry and education is the key for high paying jobs. Funny how no one complains about the legal froeign doctors and nurses coming in to our country cause we can't educate enough Americans to occupy those high paying jobs.

Most individuals don't pay taxes cause they don't earn that much. How is that a tax cut for them if they owe no taxes. The op post has merits. Good job op.

One question about dell. Do you continue to buy Dell stuff? If so quit complaining. This means you support them outsourcing jobs. If you and others would quit buying from them they will bring those jobs back.

Originally posted by buddhasystem

Originally posted by dbates

The great tax cuts that show up under Obama's plan affect those that make under $66,000 a year. If you have a family with 2 kids, and make $66,000 you're barely paying any taxes to begin with. The changes in the tax rate would be undetectable to those in this bracket.

And that would make the OP quite false, right?

How so? Because under Obama's plan, the family making $66,000 now has to worry about whether their jobs are going away.

Originally posted by buddhasystem

Originally posted by dbates

Where's the concern for jobs being pushed overseas? It will happen folks.

Jobs are already going overseas, under the watch of our beloved deregulators, and much faster than you can say "McCain supports illegal immigration".

The trend of offshoring to India is actually slowing down, which is to be expected as their middle class continues to emerge and become more dominant. The cost gains from offshoring decrease as the middle class demands more and more money.

But nothing, not even added taxes to U.S. companies who offshore jobs, are going to stop the trend because there are other countries to be exploited like Africa and the Phillipines.

In fact, installing a tax on companies to offshore will probably do one of two things, if not both:

1) Companies will eliminate MORE U.S. based jobs and hire more offshore workers to make up the loss

2) Some companies heavily vested in offshoring may relocate their headquarters off U.S. soil overseas and be immune to U.S. tax altogether. This has already happened with Haliburton as they moved from Houston to Dubai, and it's happened in the U.K. with Smiths and WPP, the world's second largest ad firm.

Is this what we want in our current economic situation? More uncertainty, more offshoring, fewer American jobs and more reasons for companies to leave the U.S.? The Obama tax cuts make all of those options more appealing to the job-creating class.

If you increase taxes on business then you're simply increasing their incentive to go elsewhere for location and labor.

Last time I checked, most of the stuff we use is already made in China and when I called Dell support my call landed in India. Tax or no tax.

[edit on 7-10-2008 by buddhasystem]

At one point Dell actually moved their Enterprise support back to the U.S. due to poor customer service and a high number of complaints, so they do listen to the customer. But for consumer-level support, yes, they will stay with the offshore jobs because it's cheaper than American labor.

Again, the best way for U.S. folks to fight this trend is to educate themselves with college degrees and find other, highly skilled work still available in the U.S.

Raising taxes on the rich and on corporations will just cause product prices to rise due to the raised taxes being embedded into prices.

Corporations don't really pay taxes, they just pass it along in their prices, lower wages, or job cuts. In fact the entire business process is riddled with all kinds of tax burdens. The people in government know this truth but they also know that the American people are too stupid enough to know that corporations are actually another tax collector of a hidden tax imposed on American citizens through the increased price in goods. Well I shouldn't say stupid, more like distracted and ignorant.

And since the rich are usually the ones that employ people and produce goods, Obama's tax plan will actually HURT lower income more due to an increased inflation in goods sold.

Corporations don't really pay taxes, they just pass it along in their prices, lower wages, or job cuts. In fact the entire business process is riddled with all kinds of tax burdens. The people in government know this truth but they also know that the American people are too stupid enough to know that corporations are actually another tax collector of a hidden tax imposed on American citizens through the increased price in goods. Well I shouldn't say stupid, more like distracted and ignorant.

And since the rich are usually the ones that employ people and produce goods, Obama's tax plan will actually HURT lower income more due to an increased inflation in goods sold.

Originally posted by wutone

Corporations don't really pay taxes, they just pass it along in their prices, lower wages, or job cuts.

Thank you! That's the heart of the matter right there isn't it? We're fools if we believe that taxes on the rich don't effect the poor. Just look at the price of cigarettes. Everyone knows that a new $.50 tax per pack means that the counter price will go up $.50. No one expects the mega-corporation to eat up the new tax. The consumer pays the tax.

Somehow, some here seem to be under the mistaken ideology that increasing taxes on McDonalds and The Gap will somehow create more revenue without increasing the price of hamburgers and clothes. Again, are we all fools? Apparently some of us are.

Originally posted by sos37

Originally posted by buddhasystem

Originally posted by dbates

The great tax cuts that show up under Obama's plan affect those that make under $66,000 a year. If you have a family with 2 kids, and make $66,000 you're barely paying any taxes to begin with. The changes in the tax rate would be undetectable to those in this bracket.

And that would make the OP quite false, right?

How so? Because under Obama's plan, the family making $66,000 now has to worry about whether their jobs are going away.

Well, come on now, look at the graph and whatever supporting materials were posted in the OP. The user "dbates" then posts information (which I believe is true) which plainly contradicts all of that. This was the extent of my particular statement, so please don't drag "worry about jobs" in this, quite concrete, argument.

According to dbates, the OP is wrong on the facts.

new topics

-

Thousands Of Young Ukrainian Men Trying To Flee The Country To Avoid Conscription And The War

Other Current Events: 2 hours ago -

12 jurors selected in Trump criminal trial

US Political Madness: 4 hours ago -

Iran launches Retalliation Strike 4.18.24

World War Three: 5 hours ago -

Israeli Missile Strikes in Iran, Explosions in Syria + Iraq

World War Three: 5 hours ago -

George Knapp AMA on DI

Area 51 and other Facilities: 11 hours ago -

Not Aliens but a Nazi Occult Inspired and then Science Rendered Design.

Aliens and UFOs: 11 hours ago

top topics

-

George Knapp AMA on DI

Area 51 and other Facilities: 11 hours ago, 25 flags -

Israeli Missile Strikes in Iran, Explosions in Syria + Iraq

World War Three: 5 hours ago, 14 flags -

Louisiana Lawmakers Seek to Limit Public Access to Government Records

Political Issues: 13 hours ago, 7 flags -

So I saw about 30 UFOs in formation last night.

Aliens and UFOs: 16 hours ago, 6 flags -

Iran launches Retalliation Strike 4.18.24

World War Three: 5 hours ago, 6 flags -

Do we live in a simulation similar to The Matrix 1999?

ATS Skunk Works: 17 hours ago, 5 flags -

Not Aliens but a Nazi Occult Inspired and then Science Rendered Design.

Aliens and UFOs: 11 hours ago, 5 flags -

12 jurors selected in Trump criminal trial

US Political Madness: 4 hours ago, 4 flags -

The Tories may be wiped out after the Election - Serves them Right

Regional Politics: 14 hours ago, 3 flags -

Thousands Of Young Ukrainian Men Trying To Flee The Country To Avoid Conscription And The War

Other Current Events: 2 hours ago, 2 flags

active topics

-

Scarface does Tiny Desk Concert

Music • 7 • : sitrose -

The Acronym Game .. Pt.3

General Chit Chat • 7727 • : F2d5thCavv2 -

Russia Ukraine Update Thread - part 3

World War Three • 5697 • : F2d5thCavv2 -

Do we live in a simulation similar to The Matrix 1999?

ATS Skunk Works • 22 • : SchrodingersRat -

Iran launches Retalliation Strike 4.18.24

World War Three • 15 • : semperfortis -

President BIDEN Warned IRAN Not to Attack ISRAEL - Iran Responded with a Military Attack on Israel.

World War Three • 43 • : WeMustCare -

Israeli Missile Strikes in Iran, Explosions in Syria + Iraq

World War Three • 52 • : WeMustCare -

Mandela Effect - It Happened to Me!

The Gray Area • 107 • : inflaymes69 -

Terrifying Encounters With The Black Eyed Kids

Paranormal Studies • 45 • : daskakik -

Not Aliens but a Nazi Occult Inspired and then Science Rendered Design.

Aliens and UFOs • 12 • : BeyondKnowledge3

7