It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

Harte, the dairy farm is actually an example of how a family can keep the asset without selling the farm.

The IRS regs have a little provision in them that states that you can pay off your estate tax over 16 years (I think it's 16), provided the business asset is the bulk of the estate. In the case of the dairy farmer who has little else other than milk farms inc, the estate can elect to use the 16 year plan. the interest is a bitch but the taxes will be paid over time if the business is profitable enough.

in the case of the building with tenants, one could probably try the same thing but it might not be viewed as a business in the same manner as the milk farm. We had a client who died and her store was housed in a brownstone that she owned. the only way she could have paid the estate off would have been to sell the property and close the business or take the 16 year payout deal. the business wasn't profitable enough to take out a mortgage for the amount needed to pay the taxes. the executrix was left with the one option since she was inheriting the business and she didn't want to shut it down.

in another case we recently had, the estate had that nice 6 floor building in a very pricey neighborhood. the building had to be sold to pay the taxes because it would have been impossible to get a mortgatge (too many rent controlled tenants) and the beneficiaries ended up screwed because the client had horrific estate planning (lame old will). we tried to get him to change it for years but he was a bit of an eccentric (and a very old family friend) and his opinion was that the more trouble he cause for his executors the better. he got his final wish.

The IRS regs have a little provision in them that states that you can pay off your estate tax over 16 years (I think it's 16), provided the business asset is the bulk of the estate. In the case of the dairy farmer who has little else other than milk farms inc, the estate can elect to use the 16 year plan. the interest is a bitch but the taxes will be paid over time if the business is profitable enough.

in the case of the building with tenants, one could probably try the same thing but it might not be viewed as a business in the same manner as the milk farm. We had a client who died and her store was housed in a brownstone that she owned. the only way she could have paid the estate off would have been to sell the property and close the business or take the 16 year payout deal. the business wasn't profitable enough to take out a mortgage for the amount needed to pay the taxes. the executrix was left with the one option since she was inheriting the business and she didn't want to shut it down.

in another case we recently had, the estate had that nice 6 floor building in a very pricey neighborhood. the building had to be sold to pay the taxes because it would have been impossible to get a mortgatge (too many rent controlled tenants) and the beneficiaries ended up screwed because the client had horrific estate planning (lame old will). we tried to get him to change it for years but he was a bit of an eccentric (and a very old family friend) and his opinion was that the more trouble he cause for his executors the better. he got his final wish.

Nearly all are married-couple families, many with two or more earners. Far from shirking the tax burden, they pay 82.5 percent of total federal income taxes and two-thirds of federal taxes overall.

The bottom quintile pays 1.1 percent of total federal taxes.

I would also like to see these percentages in relation to actual income. The top fifth obviously earn much more than the bottom one. It is silly to say this 82 1/2% and 66% are unfair when they probably hold nearly that ratio of the $.

Originally posted by Crakeur

Harte, the dairy farm is actually an example of how a family can keep the asset without selling the farm.

Not if you realize how hard the dairy framing in Vermont is going right now...

MONTPELIER — Vermont dairy farmers by the end of next week are expected to receive their first checks under an emergency price support program implemented by the state in late June.

Addison Indepentant

The larger point is that the Estate Tax doesn't hurt the rich...but it does hurt many Americans who are not "rich".

-- Boat

boat, somewhere in my post I think I said "provided the farm was profitable enought to make the payments" or something to that effect.

the dairy farm was simply a good example of a situation where one asset made up more than 90% of the total value of the estate. I didn't take the plight of the vermont dairy farmers into consideration because it only made my point more confusing. next time I will revert back to the standby method of using widgets as the company's final product.

the dairy farm was simply a good example of a situation where one asset made up more than 90% of the total value of the estate. I didn't take the plight of the vermont dairy farmers into consideration because it only made my point more confusing. next time I will revert back to the standby method of using widgets as the company's final product.

Boatphone appears to be the only poster on this thread with a solid grasp on economics. I applaud your use of links to real data to backup your

statements Boat.

cheers!

cheers!

would you like links to my resume. I deal with estate tax issues daily. the vt dairy farmer issue was

oh never mind.

oh never mind.

Originally posted by Crakeur

would you like links to my resume. I deal with estate tax issues daily. the vt dairy farmer issue was

oh never mind.

Crakeur,

Since you deal with estate tax issuer by any chance could you get a short exsplanation of how hard it is for a person set up the bulk of there estate to pass hands with out an estate tax?

Someone needs to explain to Democrats that this could benefit the minimum wage earners (16-18 year olds) now and in the future.

1st they benefit by getting a raise now, and if they work hard for 40-50 years they will reap another benefit by not having their hard earned money taxed again at their death!

It's a win-win proposition!

[edit on 3-8-2006 by RRconservative]

1st they benefit by getting a raise now, and if they work hard for 40-50 years they will reap another benefit by not having their hard earned money taxed again at their death!

It's a win-win proposition!

[edit on 3-8-2006 by RRconservative]

Is a shame that we the working class are the most targeted of all the incomes in our nation.

Is a reason why I stay at home and my husband is the only one that brings the income.

It is horrible how much he has to pay for taxes and is incredible that every time his income change its a reg flag to the IRA.

No I am not joking but I feel sometimes that we have been monitored by the IRA and that our rights to privacy are invaded.

I will say no more.

We are not even rich. If we were I would not be complaining.

The poor gets to keep most of their income, the rich gets away from taxes and the ones in the middle are the ones that has to make up for the upper and the bottom.

Shame

[edit on 3-8-2006 by marg6043]

Is a reason why I stay at home and my husband is the only one that brings the income.

It is horrible how much he has to pay for taxes and is incredible that every time his income change its a reg flag to the IRA.

No I am not joking but I feel sometimes that we have been monitored by the IRA and that our rights to privacy are invaded.

I will say no more.

We are not even rich. If we were I would not be complaining.

The poor gets to keep most of their income, the rich gets away from taxes and the ones in the middle are the ones that has to make up for the upper and the bottom.

Shame

[edit on 3-8-2006 by marg6043]

Originally posted by RRconservative

Someone needs to explain to Democrats that this could benefit the minimum wage earners (16-18 year olds) now and in the future.

[edit on 3-8-2006 by RRconservative]

RRconservative,

Sory to half to put things this way, but there is no way the rich who will save money from the repealing of the estate tax will all of a sudden have there heart grow 3 fold and decide to give all the little people that they walk all over a raise.

I might sooner belive they would invest in an ivory back scracher.

If this were a perfect world, say as if looking at things through rose colored glasses, you might see more of that reaching the little people who half to work.

Originally posted by The Big O

They're dead...they don't need the money. I mean, these are the super rich, why am I concerned with how much money they have again?

Giving someone who makes 5.15 a raise is one thing...giving someone who has millions in the bank a raise is something completely different.

-O

REPLY: When was the last time some bum on the street signed your paycheck??

So.... a regular guy has an idea, and risks it all to start a company, and does very well. He and his family work the business for 30 years. He has planned it so his sons can continue the business and live the American dream, and keep their other employees working.

He dies, and the Estate Tax is so high they have to fire everyone, and sell the business just to pay the taxes. It happens all the time.

The poor gets to keep most of their income, the rich gets away from taxes and the ones in the middle are the ones that has to make up for the upper and the bottom.

REPLY: Marg, I hate to do it to you, and I know how you and most people "feel", but the data shows you and many others to be in error. Because of the high taxes for many, the wife works to pay the taxes on what the husband makes, which is how some people are "better off".

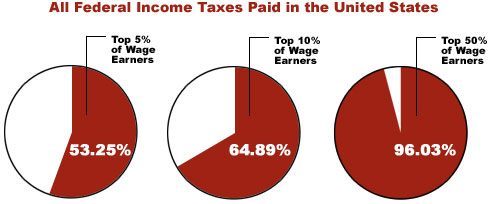

True, the "poor" pay liitle to no taxes. However, the top 50% off earners pay 96.3% of all taxes. And, since the rate cuts, the "rich" are putting more into the economy, and paying more into the government. Here's the numbers, folks:

Less than four dollars out of every $100 paid in income taxes in the United States is paid by someone in the bottom 50% of wage earners.

Are the top half millionaires? Noooo, more like "thousandaires." The top 50% were those individuals or couples filing jointly who earned $26,000 and up in 1999. (The top 1% earned $293,000-plus.)

Americans who want to are continuing to improve their lives - and those who don't want to, aren't. Here are the wage earners in each category and the percentages they pay:

Top 5% pay 53.25% of all income taxes (Down from 2000 figure: 56.47%).

The top 10% pay 64.89% (Down from 2000 figure: 67.33%).

The top 25% pay 82.9% (Down from 2000 figure: 84.01%).

The top 50% pay 96.03% (Down from 2000 figure: 96.09%).

The bottom 50% pay a paltry 3.97% of all income taxes.

The top 1% is paying more than ten times the federal income taxes than the bottom 50%!

And who earns what? The top 1% earns 17.53 (2000: 20.81%) of all income. The top 5% earns 31.99 (2000: 35.30%). The top 10% earns 43.11% (2000: 46.01%); the top 25% earns 65.23% (2000: 67.15%), and the top 50% earns 86.19% (2000: 87.01%) of all the income.

Most of The Rich actually EARN their money.... unless your Teddy "Chappaquidick Fats" Kennedy or Howard "YEEAAAGGGGHHHHHH" Dean.

[edit on 4-8-2006 by zappafan1]

Good job RedGolem - thanks.

BTW - 75% of the world's poor now are female, according to a new UN study.

...So what's the tax on diddly squat?

The idea that rich being richer filters down to the poorer members of society via job creation etc etc is a phallacy. That is what Thatcher said 20

years ago here in Britain as she reduced taxes for the rich. She even commissioned a report to prove it. However, when the report came out it was so

bad that they thought the math had the decimal point in the wrong place due to a typing error!! They changed it and issued the report. Everybody was

now happy cos it proved the theory that untaxing the rich filtered down to the poor. Then they found out the orignal numbers were correct. the report

was re-released on good friday so that it was ignored over a holiday weekend. The phallacy lives on.

Western society especially the US and increasingly the UK is obsessed with greed. There are thousands of people who's ANNUAL income is more than 99% of us would love to win on the lottery and retire with.

Please don't give me the "joe blogs worked hard building a business for 30 years etc etc". There are for more backhanders, fiddling, tax evasion at play than anyone dares admit. Especially governemnt since they use most of those to get there!

I'm all for pay/income differentials but the amount some folks have is obscene.

Western society especially the US and increasingly the UK is obsessed with greed. There are thousands of people who's ANNUAL income is more than 99% of us would love to win on the lottery and retire with.

Please don't give me the "joe blogs worked hard building a business for 30 years etc etc". There are for more backhanders, fiddling, tax evasion at play than anyone dares admit. Especially governemnt since they use most of those to get there!

I'm all for pay/income differentials but the amount some folks have is obscene.

how is it you guys always miss the important parts of stories?

increasing the fed min wage = more money in the youth's pockets to blow on ipods, gasoline, and other taxable goods

i say youth's pockets because older people tend to have better paying jobs that start around 10.75 (living wage) and up from there

i say the best solution to fix the government budget is to put all our politicians on a living wage and give them 2 weeks paid vacation a year and see how they like it.

sorry, no more 3 month recesses, month long presidential retreats, or darth cheney's mysterious disapearances after shooting people

www.cafepress.com... hooting/-/sort_by_score_desc/pg_1/fpt_/c_/opt_/rpp_60/st_?CMP=KNC-G-EF

this "tax cut for the rich" bull crap is stupid

there should never have ever been an estate tax

the sheer concept of it sickens me

even if you have a multi billion dollar estate, you worked for that estate and paid taxes when you made it into a multi billion dollar estate

just because you die does not give anyone the right to take what you made

it was yours in life and you pass it on to your heirs in death

the government has no part in the equation and they should get their greedy hands out of it completely

"but the government needs money"

they they should have a big freaking bakesale to raise funds for their moronic escapades, they could sell lemonaid while they're at it

increasing the Fed. minimum wage.

increasing the fed min wage = more money in the youth's pockets to blow on ipods, gasoline, and other taxable goods

i say youth's pockets because older people tend to have better paying jobs that start around 10.75 (living wage) and up from there

i say the best solution to fix the government budget is to put all our politicians on a living wage and give them 2 weeks paid vacation a year and see how they like it.

sorry, no more 3 month recesses, month long presidential retreats, or darth cheney's mysterious disapearances after shooting people

www.cafepress.com... hooting/-/sort_by_score_desc/pg_1/fpt_/c_/opt_/rpp_60/st_?CMP=KNC-G-EF

this "tax cut for the rich" bull crap is stupid

there should never have ever been an estate tax

the sheer concept of it sickens me

even if you have a multi billion dollar estate, you worked for that estate and paid taxes when you made it into a multi billion dollar estate

just because you die does not give anyone the right to take what you made

it was yours in life and you pass it on to your heirs in death

the government has no part in the equation and they should get their greedy hands out of it completely

"but the government needs money"

they they should have a big freaking bakesale to raise funds for their moronic escapades, they could sell lemonaid while they're at it

$3.5 trillion-----that was the federal deficit for 2005...

www.usatoday.com...

if the government was forced to live by the same rules that most households have to live with, all our taxes would probably double and our government would probably have to shrink to half it's size.

instead of working so hard to cut taxes, they need to do some massive cutting of the spending!!!

what they're doing is rediculous, and insane. can we at least see some matching cuts in spending to offset the cuts in taxes please? across the board cuts to all expenditures, not just the few pet peeves that they seem to like to pick on.

if they can start living with the money that they are getting now, instead of overspending in the trillions of dollars, I might consider a tax cut. otherwise, well, election time is drawing near, and I hope they all lose their danged jobs!

[edit on 4-8-2006 by dawnstar]

www.usatoday.com...

if the government was forced to live by the same rules that most households have to live with, all our taxes would probably double and our government would probably have to shrink to half it's size.

instead of working so hard to cut taxes, they need to do some massive cutting of the spending!!!

what they're doing is rediculous, and insane. can we at least see some matching cuts in spending to offset the cuts in taxes please? across the board cuts to all expenditures, not just the few pet peeves that they seem to like to pick on.

if they can start living with the money that they are getting now, instead of overspending in the trillions of dollars, I might consider a tax cut. otherwise, well, election time is drawing near, and I hope they all lose their danged jobs!

[edit on 4-8-2006 by dawnstar]

Its just plain wrong for the government to take money away from a family due to a death in order to "redistribute" it to others. WRONG! I don't

care how much the family makes. It does not matter whether the family will be affected by it or not. The death tax will not affect my family. We are

not "rich." Both my father and mother are having to continue working into their 70's in order to support themselves.

This is pure liberal socialism. How hard is it to understand that this money belongs to US, the PEOPLE, not the freakin GOVERNMENT to redistribute as it sees fit. This is the reason the US broke away from England in the first place. WAKE UP PEOPLE !

If every congressman refused to attach earmarks and our president had a backbone like Reagan did, we could eliminate the national debt with no problem and our economy would go into sprint mode.

The idea that it is the government's job to TAKE CARE OF US is WRONG. I don't hear my parents complaining. You did not hear people complain during WWII about rationing.

UGGGHHH !

G.Houtchens

armchair coach

amateur historian

This is pure liberal socialism. How hard is it to understand that this money belongs to US, the PEOPLE, not the freakin GOVERNMENT to redistribute as it sees fit. This is the reason the US broke away from England in the first place. WAKE UP PEOPLE !

If every congressman refused to attach earmarks and our president had a backbone like Reagan did, we could eliminate the national debt with no problem and our economy would go into sprint mode.

The idea that it is the government's job to TAKE CARE OF US is WRONG. I don't hear my parents complaining. You did not hear people complain during WWII about rationing.

UGGGHHH !

G.Houtchens

armchair coach

amateur historian

it's wrong for the government to be taken as much money from the people as they are, I don't care where it's coming from or how. but still, the

root of the problem is their spending. and, well, look at it this way, they don't think that we gave them enough, they think they should have

gotten more, a few trillion dollars more...and well, them not getting it didn't stop them from spending it, did it? nope. they spent it anyways, and

some future generation will get to pay the piper.....

that's wrong also.

that's wrong also.

I see no "the rich are getting a huge break" guys can respond to his post...

-- Boat

You have voted zappafan1 for the Way Above Top Secret award. You have two more votes this month.

-- Boat

new topics

-

God's Righteousness is Greater than Our Wrath

Religion, Faith, And Theology: 29 minutes ago -

Electrical tricks for saving money

Education and Media: 3 hours ago -

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News: 4 hours ago -

Sunak spinning the sickness figures

Other Current Events: 5 hours ago -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues: 5 hours ago -

Late Night with the Devil - a really good unusual modern horror film.

Movies: 7 hours ago -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest: 8 hours ago -

The Good News According to Jesus - Episode 1

Religion, Faith, And Theology: 10 hours ago

top topics

-

Florida man's trip overseas ends in shock over $143,000 T-Mobile phone bill

Social Issues and Civil Unrest: 15 hours ago, 8 flags -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest: 8 hours ago, 8 flags -

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News: 4 hours ago, 8 flags -

Bobiverse

Fantasy & Science Fiction: 15 hours ago, 3 flags -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three: 12 hours ago, 3 flags -

Electrical tricks for saving money

Education and Media: 3 hours ago, 3 flags -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues: 5 hours ago, 3 flags -

Sunak spinning the sickness figures

Other Current Events: 5 hours ago, 3 flags -

Late Night with the Devil - a really good unusual modern horror film.

Movies: 7 hours ago, 2 flags -

The Good News According to Jesus - Episode 1

Religion, Faith, And Theology: 10 hours ago, 1 flags

active topics

-

New whistleblower Jason Sands speaks on Twitter Spaces last night.

Aliens and UFOs • 53 • : pianopraze -

Sunak spinning the sickness figures

Other Current Events • 5 • : glen200376 -

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs • 44 • : MikeDeGrasseTyson -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three • 31 • : budzprime69 -

How ageing is" immune deficiency"

Medical Issues & Conspiracies • 33 • : rickymouse -

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News • 32 • : ThatSmellsStrange -

The Reality of the Laser

Military Projects • 46 • : Zaphod58 -

God's Righteousness is Greater than Our Wrath

Religion, Faith, And Theology • 0 • : randomuser2034 -

President BIDEN Vows to Make Americans Pay More Federal Taxes in 2025 - Political Suicide.

2024 Elections • 136 • : ImagoDei -

Electrical tricks for saving money

Education and Media • 3 • : Mike72