It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

It's another setup to create a problem and then miraculously provide a magic solution 🐇

Why even work anymore or work hard, it seems more and more pointless now.

All has been for nothing !!

All has been for nothing !!

The scary part is these 2 banks' situations aren't the only ones. Possibly a run on these banks too

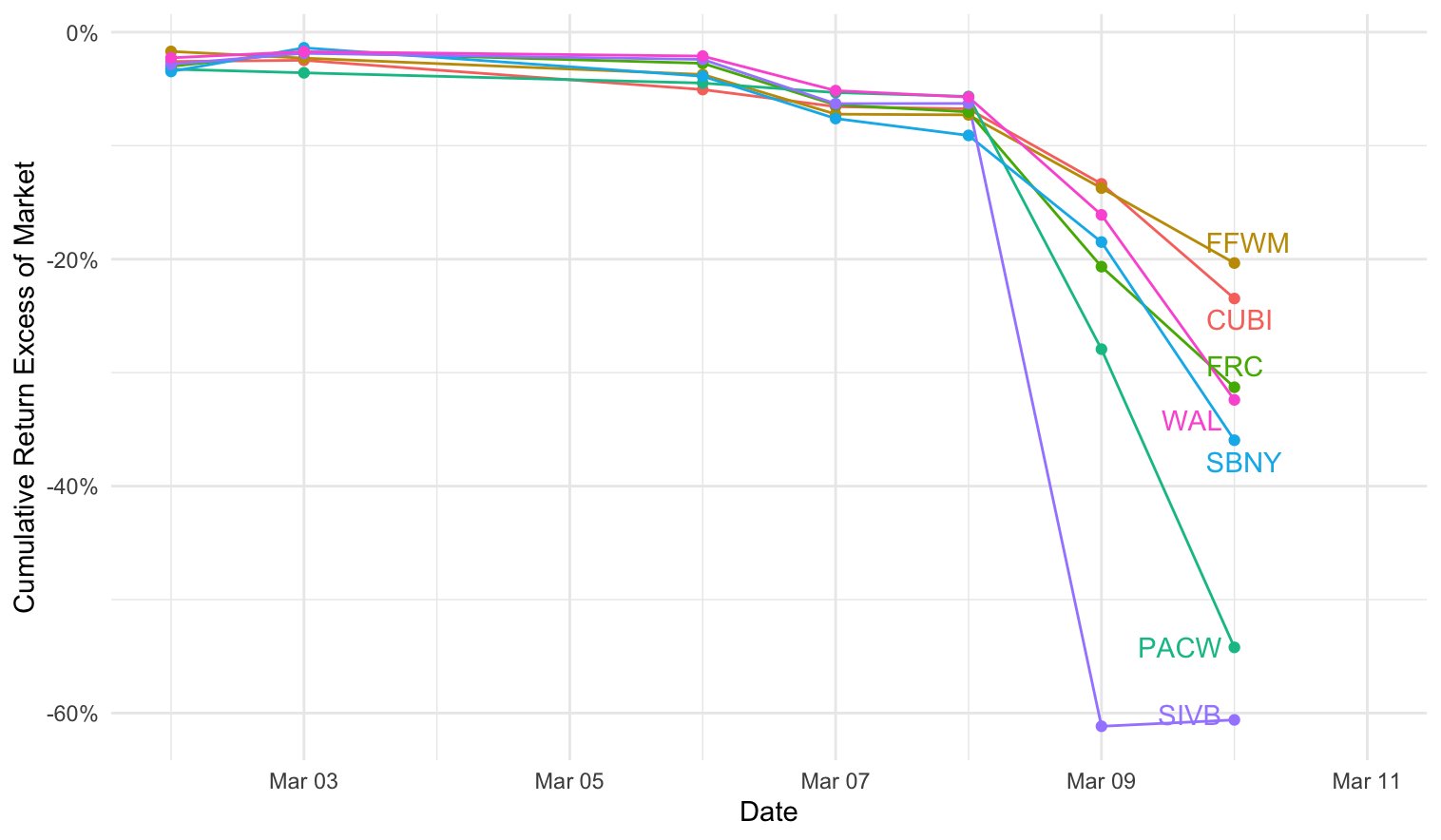

SVB Financial Group (SIVB) (-60%)

PacWest Bancorp (PACW) (-54%)

Signature Bank (SBNY) (-36%)

Western Alliance Bancorp (WAL) (-32.4%)

First Republic Bank (FRC) (-31.3%)

Customers Bancorp Inc (CUBI) (-23.5%)

First Foundation Inc (FFWM) (-20.3%)

twitter.com...

twitter.com...

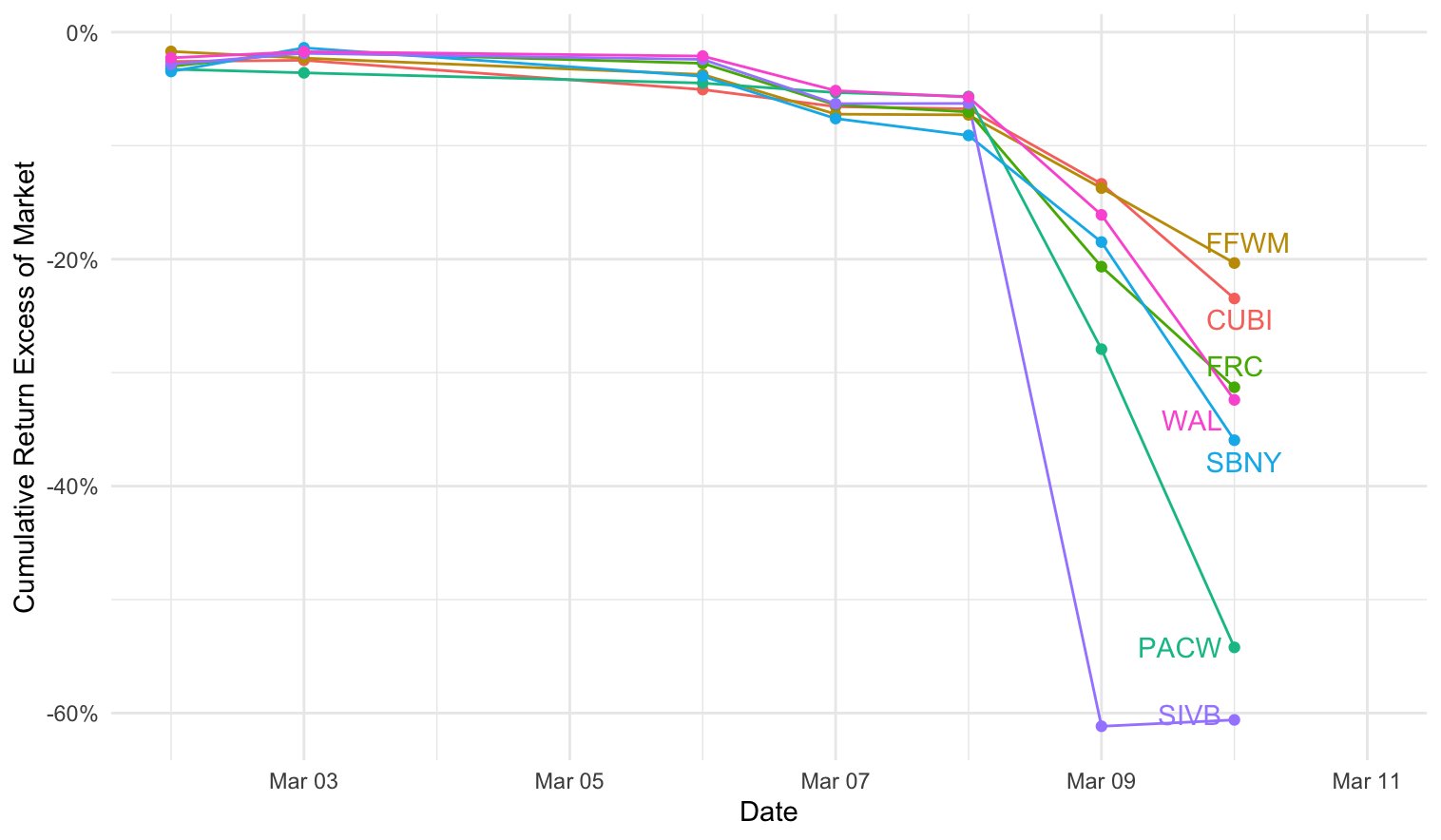

SVB Financial Group (SIVB) (-60%)

PacWest Bancorp (PACW) (-54%)

Signature Bank (SBNY) (-36%)

Western Alliance Bancorp (WAL) (-32.4%)

First Republic Bank (FRC) (-31.3%)

Customers Bancorp Inc (CUBI) (-23.5%)

First Foundation Inc (FFWM) (-20.3%)

twitter.com...

twitter.com...

edit on 12-3-2023 by putnam6 because: (no reason given)

originally posted by: burntheships

How many other banks are on the verge of failure?

Back in 2008, some of them were deemed "too big to fail" and were bailed out, while others just failed. The whole thing seemed unfair to those paying attention and one reaction to this was decentralized Bitcoin being created.

I'm most concerned about the honesty of institutions that manage assets in the trillions, and what happens if that honesty turns out to be lacking.

originally posted by: IndieA

Maybe it's time to support your local credit union.

Local credit unions are not safe either. They usually operate in the car loan area. My local credit union kept my house loan and the lady told me this as very unusual as they normally sell them off.

When people can't make their car payments, these credit unions will take that liability and sell for pennies on the dollar. Lucky for me, I see this happening and I'll scoop up some nice cars in Q4 at 50% off.

You get what you vote for .

I say let them Fail survival of the Fittest who ever makes it out the other-side will be stronger and more stable.

Things will get bad Really bad but it is what it is there is no going back there is no really pointing the finger because it's everyone's fault .

The Poor will remain poor as they always have , The Middle Class will suffer and shrink and The Rich will move their money over Seas and China will buy more of the United States

I say Again you get what you voted for , So here it is What people voted for.

I say let them Fail survival of the Fittest who ever makes it out the other-side will be stronger and more stable.

Things will get bad Really bad but it is what it is there is no going back there is no really pointing the finger because it's everyone's fault .

The Poor will remain poor as they always have , The Middle Class will suffer and shrink and The Rich will move their money over Seas and China will buy more of the United States

I say Again you get what you voted for , So here it is What people voted for.

a reply to: JAGStorm

Understandably, SVB is huge in California lore,

Venture capital for many start ups, wineries,

big names like Pay Pal. The get woke crowd.

I’m less familiar with Signature Bank.

Initially My first thought was the tech crunch,

but now I’m looking back on Black Rock’s

Huge loss in 2022...I think it is systemic.

ETA: Signature was a lender to crypto investors.

Understandably, SVB is huge in California lore,

Venture capital for many start ups, wineries,

big names like Pay Pal. The get woke crowd.

I’m less familiar with Signature Bank.

Initially My first thought was the tech crunch,

but now I’m looking back on Black Rock’s

Huge loss in 2022...I think it is systemic.

ETA: Signature was a lender to crypto investors.

edit on 12-3-2023 by burntheships because: (no reason given)

originally posted by: litterbaux

originally posted by: IndieA

Maybe it's time to support your local credit union.

Local credit unions are not safe either. They usually operate in the car loan area. My local credit union kept my house loan and the lady told me this as very unusual as they normally sell them off.

When people can't make their car payments, these credit unions will take that liability and sell for pennies on the dollar. Lucky for me, I see this happening and I'll scoop up some nice cars in Q4 at 50% off.

Now this is what I'm looking for.

Hope so you do that?

My second mortgage is through a local credit union, if I stopped paying how could someone buy it out for less than I owe?

I've got a brother who hasn't paid his mortgage in two years, I've got half a mind to buy his place but I'm not sure how to get into that game.

a reply to: burntheships

They are going to print money to cover it. Talk about stupid and irresponsible.

They are going to print money to cover it. Talk about stupid and irresponsible.

a reply to: infolurker

It seems the crypto meltdown is seeping into

the institutional banking sectors. We will never know

since FTX was deep with many institutions.

It seems the crypto meltdown is seeping into

the institutional banking sectors. We will never know

since FTX was deep with many institutions.

edit on 12-3-2023 by burntheships because: (no reason given)

a reply to: lordcomac

What they'll do is bundle the mortgages or car loans into a special service vehicles and sell them. The movie "The big short" covers this and I'll be honest, I thought the regulators had this figured out.

But they didn't. I honestly can't believe this is going to happen again.

So what do you do? Most people say "pay off your debts!" Yeah, if you had the ability to do that you would have done it already. Most people are riddled with CC debt (ATH) with interest rates 20-30% (ATH).

The play right now is to just wait. Keep your cash readily available. You're going to get some deals of your lifetime in cars and real estate. It's going to be Q4 of this year or even later into 2024.

What they'll do is bundle the mortgages or car loans into a special service vehicles and sell them. The movie "The big short" covers this and I'll be honest, I thought the regulators had this figured out.

But they didn't. I honestly can't believe this is going to happen again.

So what do you do? Most people say "pay off your debts!" Yeah, if you had the ability to do that you would have done it already. Most people are riddled with CC debt (ATH) with interest rates 20-30% (ATH).

The play right now is to just wait. Keep your cash readily available. You're going to get some deals of your lifetime in cars and real estate. It's going to be Q4 of this year or even later into 2024.

a reply to: IndieA

At this point I do not expect honesty from

any financial institution. The best I hope for is a bank

that is in bucket 2 or 3 of the Basel3 agreement.

Aka known as a tier 1 bank.

This is scary as The Feds have not clarified if the

small banks will be rescued if needed.

At this point I do not expect honesty from

any financial institution. The best I hope for is a bank

that is in bucket 2 or 3 of the Basel3 agreement.

Aka known as a tier 1 bank.

This is scary as The Feds have not clarified if the

small banks will be rescued if needed.

a reply to: burntheships

I wish you, and everyone on ATS, the best of luck.

FTX was the canary in the coal mine, now you see two banks fail in a couple days.

The house of cards is falling, have a couple months of food/water/cash on hand until CBDC comes.

I wish you, and everyone on ATS, the best of luck.

FTX was the canary in the coal mine, now you see two banks fail in a couple days.

The house of cards is falling, have a couple months of food/water/cash on hand until CBDC comes.

new topics

-

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News: 1 hours ago -

Sunak spinning the sickness figures

Other Current Events: 1 hours ago -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues: 2 hours ago -

Late Night with the Devil - a really good unusual modern horror film.

Movies: 3 hours ago -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest: 5 hours ago -

The Good News According to Jesus - Episode 1

Religion, Faith, And Theology: 7 hours ago -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three: 9 hours ago

top topics

-

Florida man's trip overseas ends in shock over $143,000 T-Mobile phone bill

Social Issues and Civil Unrest: 12 hours ago, 8 flags -

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs: 16 hours ago, 7 flags -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest: 5 hours ago, 7 flags -

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News: 1 hours ago, 5 flags -

Former Labour minister Frank Field dies aged 81

People: 14 hours ago, 4 flags -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three: 9 hours ago, 3 flags -

Bobiverse

Fantasy & Science Fiction: 12 hours ago, 3 flags -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues: 2 hours ago, 3 flags -

Sunak spinning the sickness figures

Other Current Events: 1 hours ago, 3 flags -

Late Night with the Devil - a really good unusual modern horror film.

Movies: 3 hours ago, 2 flags

active topics

-

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues • 9 • : DBCowboy -

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs • 40 • : Irishhaf -

President BIDEN Vows to Make Americans Pay More Federal Taxes in 2025 - Political Suicide.

2024 Elections • 124 • : Justoneman -

Ditching physical money

History • 20 • : GENERAL EYES -

Sunak spinning the sickness figures

Other Current Events • 3 • : NoCorruptionAllowed -

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News • 13 • : DAVID64 -

The Reality of the Laser

Military Projects • 42 • : Zaphod58 -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three • 27 • : RickyD -

Mood Music Part VI

Music • 3100 • : TheDiscoKing -

Breaking Baltimore, ship brings down bridge, mass casualties

Other Current Events • 484 • : ThatSmellsStrange