It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

A lot of folks on ATS have been following the current outbreak of SARSCoV-2, the "novel coronavirus" since January speculating on just how damaging

this pandemic could be to the global economy.

I'm from the US so I am also looking at this from the perspective of "what will happen with the West".

It's painfully obvious that governments locking down citizens, banning public gatherings of more than 10 individuals, and not allowing patrons to go to bars, restaurants, barbershops, etc. will result in a massive economic slowdown, the likes of which we haven't seen in probably a half a century or more.

To me, this will be much bigger than the 2008 financial crisis that caused 30 million people to become unemployed and doubled the national debt of the us (as an aside, here is one of my favorite threads I made back in 2017 about the '08 financial crisis: Diving Head First into the 2008 Financial Crisis: An In-Depth Analysis of What Happened).

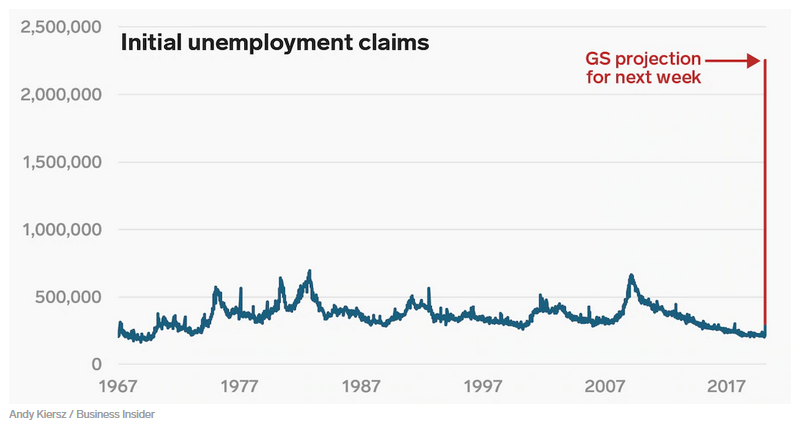

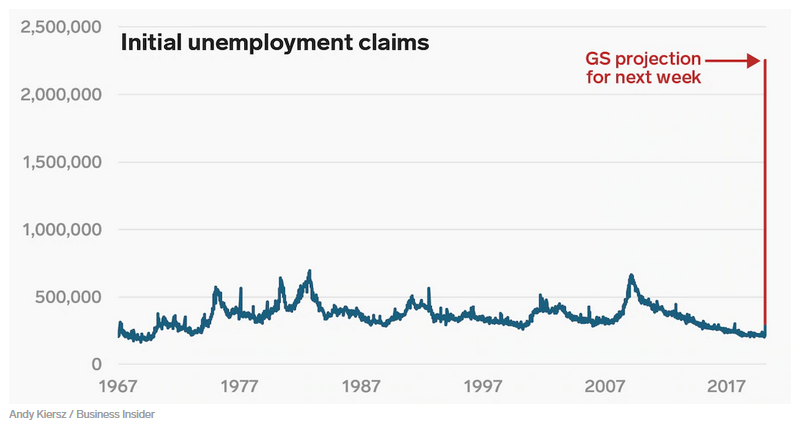

Goldman Sachs predicts the pandemic will result in 2.25 million US jobless claims next week (and we are just at the early stages of this event). Look at the chart in this article about Goldman Sachs prediction - that's nuts!

Side note: I began authoring this 2 weeks ago so that's why this still says "next week".

Source: A jarring new chart shows America needs to immediately brace itself for historic unemployment

So far here is the US government and Federal Reserve’s financial response to the virus (yes, I know the Federal Reserve is not part of the federal government, but their policy directly affects our economy for obvious reasons):

Emergency rate cut to the Federal Funds interest rate by 100 basis points (1%) to 0-0.25% by the Federal Reserve

www.bankrate.com...

Federal Reserve Bank of New York announces up to $1.5 trillion of capital injections to calm Treasury-bill liquidity issues and try to boost economic activity

markets.businessinsider.com...

The deadline for filing your federal tax return has been pushed out by 90 days from April 15th to July 15th

www.irs.gov...

Federal Reserve backstopping municipal bond debt market

Fed Backstops Corner of Municipal Debt Markets Amid Calls for Support

Federal Reserve to initiate stimulus program consisting of $3,000 for families and total of $4 trillion in liquidity overall

Virus aid bill includes $3,000 for families, $4 trillion liquidity for Fed: Mnuchin

Now the Fed says “unlimited stimulus” for the markets:

www.marketwatch.com... -2020-03-22?link=MW_latest_news

Our government working to try to finalize a deal where each US family could be eligible for up to $3,000, or individuals who would be eligible for up to $1,200 (also extending unemployment benefits)

(yes the bill has passed at this point now, again written in future tense but now we are there):

abc7news.com...

Fed to buy exchange-traded funds (ETFs)

www.msn.com..." target="_blank" class="postlink" rel="nofollow">

www.msn.com...

Treasury to deploy program for loans for small businesses, to be up and running by Friday of this week:

Mnuchin Says Small Business Loans Up and Running This Week

This just in:

Coronavirus job losses could total 47 million, unemployment rate may hit 32%, Fed estimates

I'm sure there are plenty of other stimulus packages/programs I have not included in this list - this thing has been moving so quickly.

As a supplement to this discussion, here is a thread I made back in August discussing how insurance companies are mandated to purchase Treasuries and other securities, and how monetary policy such as Zero Interest Rate Policy or ZIRP (which we are now at with the Fed Funds Rate at 0% - 0.25%) or Negative Interest Rate Policy or NIRP would cause some of these giant insurance companies to implode - maybe this is even more relevant than it was 9 months ago: US Monetary Policy Dangers – ZIRP or NIRP Will Mean Bailouts or Implosion

One of the craziest things about this whole ordeal is that the stimulus bill went through and politicians are once again bringing our country further into debt and borrowing from the future rather than cutting budgets or forgoing their salary - then they act like they are doing us all a favor even though they are pandering to private interest groups and their idiot voter bases.

Anyway, mini-rant over, thread OP over, let's get into the discussion. Depression or a Reset, or both? What are we thinking ATS and how can one prepare?

I'm from the US so I am also looking at this from the perspective of "what will happen with the West".

It's painfully obvious that governments locking down citizens, banning public gatherings of more than 10 individuals, and not allowing patrons to go to bars, restaurants, barbershops, etc. will result in a massive economic slowdown, the likes of which we haven't seen in probably a half a century or more.

To me, this will be much bigger than the 2008 financial crisis that caused 30 million people to become unemployed and doubled the national debt of the us (as an aside, here is one of my favorite threads I made back in 2017 about the '08 financial crisis: Diving Head First into the 2008 Financial Crisis: An In-Depth Analysis of What Happened).

Goldman Sachs predicts the pandemic will result in 2.25 million US jobless claims next week (and we are just at the early stages of this event). Look at the chart in this article about Goldman Sachs prediction - that's nuts!

Side note: I began authoring this 2 weeks ago so that's why this still says "next week".

Source: A jarring new chart shows America needs to immediately brace itself for historic unemployment

So far here is the US government and Federal Reserve’s financial response to the virus (yes, I know the Federal Reserve is not part of the federal government, but their policy directly affects our economy for obvious reasons):

Emergency rate cut to the Federal Funds interest rate by 100 basis points (1%) to 0-0.25% by the Federal Reserve

www.bankrate.com...

Federal Reserve Bank of New York announces up to $1.5 trillion of capital injections to calm Treasury-bill liquidity issues and try to boost economic activity

markets.businessinsider.com...

The deadline for filing your federal tax return has been pushed out by 90 days from April 15th to July 15th

www.irs.gov...

Federal Reserve backstopping municipal bond debt market

Fed Backstops Corner of Municipal Debt Markets Amid Calls for Support

The Federal Reserve tiptoed into the market for municipal debt on Friday, a small move that economists, lawmakers and state treasurers say should be expanded as the coronavirus places huge financial pressure on local governments.

The Fed will now let banks tap cheap loans by pledging short-term, highly rated municipal debt as collateral. That gives banks an incentive to buy local debt from money market mutual funds, creating demand for securities that had become hard to trade amid broader financial turmoil.

Federal Reserve to initiate stimulus program consisting of $3,000 for families and total of $4 trillion in liquidity overall

Virus aid bill includes $3,000 for families, $4 trillion liquidity for Fed: Mnuchin

Now the Fed says “unlimited stimulus” for the markets:

www.marketwatch.com... -2020-03-22?link=MW_latest_news

Our government working to try to finalize a deal where each US family could be eligible for up to $3,000, or individuals who would be eligible for up to $1,200 (also extending unemployment benefits)

(yes the bill has passed at this point now, again written in future tense but now we are there):

abc7news.com...

There is also a one-time rebate check of about $1,200 per person, or $3,000 for a family of four, as well as the extended unemployment benefits.

Fed to buy exchange-traded funds (ETFs)

the Fed said it would buy exchange-traded funds that track the corporate bond market, a first for the U.S. central bank.

www.msn.com..." target="_blank" class="postlink" rel="nofollow">

www.msn.com...

Treasury to deploy program for loans for small businesses, to be up and running by Friday of this week:

Mnuchin Says Small Business Loans Up and Running This Week

This just in:

Coronavirus job losses could total 47 million, unemployment rate may hit 32%, Fed estimates

I'm sure there are plenty of other stimulus packages/programs I have not included in this list - this thing has been moving so quickly.

As a supplement to this discussion, here is a thread I made back in August discussing how insurance companies are mandated to purchase Treasuries and other securities, and how monetary policy such as Zero Interest Rate Policy or ZIRP (which we are now at with the Fed Funds Rate at 0% - 0.25%) or Negative Interest Rate Policy or NIRP would cause some of these giant insurance companies to implode - maybe this is even more relevant than it was 9 months ago: US Monetary Policy Dangers – ZIRP or NIRP Will Mean Bailouts or Implosion

One of the craziest things about this whole ordeal is that the stimulus bill went through and politicians are once again bringing our country further into debt and borrowing from the future rather than cutting budgets or forgoing their salary - then they act like they are doing us all a favor even though they are pandering to private interest groups and their idiot voter bases.

Anyway, mini-rant over, thread OP over, let's get into the discussion. Depression or a Reset, or both? What are we thinking ATS and how can one prepare?

edit on 30-3-2020 by FamCore because: (no reason given)

reset, thanks for asking

and I don't have to inspect and register that Toyota....cool...aww it's nothing Toyotas always pass no problem bub

and I don't have to inspect and register that Toyota....cool...aww it's nothing Toyotas always pass no problem bub

a reply to: bananashooter

What are the mechanics of a debt jubilee? Would there have to be a new currency afterward (global or still separate currencies for each nation)?

What happens to people's equity? How would the entities that issued the debt be made whole again (or at least salvaged so they do not implode)?

I know you won't have defined answers for all of these questions but it's the type of thing I want to discuss here in this thread, because these potential outcomes are important to reflect on so individuals can best prepare.

Thanks for the comment bananashooter, let's keep this thing going

What are the mechanics of a debt jubilee? Would there have to be a new currency afterward (global or still separate currencies for each nation)?

What happens to people's equity? How would the entities that issued the debt be made whole again (or at least salvaged so they do not implode)?

I know you won't have defined answers for all of these questions but it's the type of thing I want to discuss here in this thread, because these potential outcomes are important to reflect on so individuals can best prepare.

Thanks for the comment bananashooter, let's keep this thing going

a reply to: FamCore

I think you are 100% correct.

I think this virus is a man made bioweapon released by the same people who killed Abraham Lincoln, sunk the titanic, started ww1 and 2, killed JFK, did 9.11, MKUltra'd most of the mass shooters, and now released the bioweapon as ,hopefully, their final move to make a world controlled by their private central banks.

I think this will be the end of our world as we know it.

I think we will see riots, and possibly even a revolution and new world wide monetary system in the end.

I think you are 100% correct.

I think this virus is a man made bioweapon released by the same people who killed Abraham Lincoln, sunk the titanic, started ww1 and 2, killed JFK, did 9.11, MKUltra'd most of the mass shooters, and now released the bioweapon as ,hopefully, their final move to make a world controlled by their private central banks.

I think this will be the end of our world as we know it.

I think we will see riots, and possibly even a revolution and new world wide monetary system in the end.

Id say the mechanics of it would be a new currency and a new agreement with every country tuning against China and no one paying their debt back, I

think everyone’s equity added to reach a even number for everyone, anyone owning a ridiculous amount of equity would be redistributed, then the

world would starve China out and cut food imports.

I think the only way to beat China is with a siege warfare tactic, starve them out. Even though I say equity redistributed I only mean once, otherwise it’s socialism and not jubilee. a reply to: FamCore

I think the only way to beat China is with a siege warfare tactic, starve them out. Even though I say equity redistributed I only mean once, otherwise it’s socialism and not jubilee. a reply to: FamCore

Reset already happened when the President declared a National Emergency and nationalized every industry, and then gave the FED the greenlight to

purchase assets.

www.abovetopsecret.com...

www.abovetopsecret.com...

The economic impact of "the virus19" could be 10x bigger than the 1929 crash !!!

😈 🥶

😈 🥶

a reply to: FamCore

I think we're seeing a dead cat bounce in the market. The past week has made it seem like there's going to be a quick recovery, but there is a lot to why it could have risen the past 5 trading days.

It's probably going to start it's drawn out decent down for some time IMO. Once the earnings reports come out soon, and we start seeing the ramifications of economic mistakes (not the virus itself, human error).

Worse of all, almost all of this spending doesn't even address what they blame for the cause of our woes. I think that shows that the virus isn't truly the cause of our economic problems... But they don't want to address the real problems, so we'll blame it on the virus and throw money at the broken system.

I don't know how I'd describe what rises from the ashes. I think we're coming to an age where the new markets are like the new wars. Hard to compare to the past, less conventional, and more like asymmetrical.

I do think tax payers, workers, and consumers will be the ones who ultimately get screwed. Government will pick the winners with the bailouts, there will be deals for consolidation and takeovers. Less options for consumers and job seekers, and more concentration of power.

But that just my pessimistic speculation. I'll be more optimistic when my country shows a glimmer of competence or balls for that matter.

I think we're seeing a dead cat bounce in the market. The past week has made it seem like there's going to be a quick recovery, but there is a lot to why it could have risen the past 5 trading days.

It's probably going to start it's drawn out decent down for some time IMO. Once the earnings reports come out soon, and we start seeing the ramifications of economic mistakes (not the virus itself, human error).

Worse of all, almost all of this spending doesn't even address what they blame for the cause of our woes. I think that shows that the virus isn't truly the cause of our economic problems... But they don't want to address the real problems, so we'll blame it on the virus and throw money at the broken system.

I don't know how I'd describe what rises from the ashes. I think we're coming to an age where the new markets are like the new wars. Hard to compare to the past, less conventional, and more like asymmetrical.

I do think tax payers, workers, and consumers will be the ones who ultimately get screwed. Government will pick the winners with the bailouts, there will be deals for consolidation and takeovers. Less options for consumers and job seekers, and more concentration of power.

But that just my pessimistic speculation. I'll be more optimistic when my country shows a glimmer of competence or balls for that matter.

a reply to: FamCore

The Chinese Communist Government are Killing You All Softly with a Lying Song...........

tv.infowars.com...

The Chinese Communist Government are Killing You All Softly with a Lying Song...........

tv.infowars.com...

a reply to: bananashooter

I think the way of beating China is by being better. Something that should be easy for the developed world.

The problem is we have all gotten lazy and forgotten our core principals. We have something that is far from a free market now. We're trying to compete with them by sabotaging the very pillars our system used to be based on.

If the developed world got back to being self reliant as nations with healthy free markets and democracies, beating them would just inherently be baked in.

I think the way of beating China is by being better. Something that should be easy for the developed world.

The problem is we have all gotten lazy and forgotten our core principals. We have something that is far from a free market now. We're trying to compete with them by sabotaging the very pillars our system used to be based on.

If the developed world got back to being self reliant as nations with healthy free markets and democracies, beating them would just inherently be baked in.

a reply to: CriticalStinker

I agree with this premise you’ve proposed as well... also don’t forget increased surveillance, less ability to freely travel and some sort of major overhaul of healthcare policy as a result of all this (which will help private interest groups of course, thank you weak-hearted bureaucrats and lobbyists)

I agree with this premise you’ve proposed as well... also don’t forget increased surveillance, less ability to freely travel and some sort of major overhaul of healthcare policy as a result of all this (which will help private interest groups of course, thank you weak-hearted bureaucrats and lobbyists)

a reply to: FamCore

For what it's worth, I'm not all doom and gloom. I haven't changed my day to day life one bit because of the virus... But I have completely re positioned my finances.

I'm already planning on how I'll invest on the upswing, I've increased 401k contributions to average down my share prices and buy low throughout the dip (which I don't think we've seen the bottom). And I'll be very aggressive on the upswing.

I think we do come back from this, and I plan to profit on that. But I don't think we come out stronger, hell, I don't think we even learn any more lessons. We'll simply kick the can down the road, and in 10-20 years, we'll see another black swan event we'll blame on anything except the underlying problems that made us so vulnerable in the first place.

I've been talking a lot about personal responsibility recently, so I'll be the change I talk about and make sure I have my affairs in order throughout my life. I refuse to be at the mercy of some safety net, or the government if I can help it.

Edit: I hope the last part isn't taken the wrong way. I'm not an elitist. I'm someone who started with very humble beginnings, but eventually I had to face my anxiety. The only way I've found to cope with that is to address anything that stresses me head on, and do everything in my power to make sure I have thought out my future. Of course things can happen out of my control, but I'd be more OK with that than letting something slip through the cracks.

For what it's worth, I'm not all doom and gloom. I haven't changed my day to day life one bit because of the virus... But I have completely re positioned my finances.

I'm already planning on how I'll invest on the upswing, I've increased 401k contributions to average down my share prices and buy low throughout the dip (which I don't think we've seen the bottom). And I'll be very aggressive on the upswing.

I think we do come back from this, and I plan to profit on that. But I don't think we come out stronger, hell, I don't think we even learn any more lessons. We'll simply kick the can down the road, and in 10-20 years, we'll see another black swan event we'll blame on anything except the underlying problems that made us so vulnerable in the first place.

I've been talking a lot about personal responsibility recently, so I'll be the change I talk about and make sure I have my affairs in order throughout my life. I refuse to be at the mercy of some safety net, or the government if I can help it.

Edit: I hope the last part isn't taken the wrong way. I'm not an elitist. I'm someone who started with very humble beginnings, but eventually I had to face my anxiety. The only way I've found to cope with that is to address anything that stresses me head on, and do everything in my power to make sure I have thought out my future. Of course things can happen out of my control, but I'd be more OK with that than letting something slip through the cracks.

edit on 30-3-2020 by CriticalStinker because: (no reason given)

a reply to: FamCore

If you consider that you work for a boss that pays you in tokens that you can only cash at the Company store, that's what digital currency is. He owns the house you rent , so you give him some tokens , he owns the Store so he gets all the tokens back that he paid you. He owns all the factories that put the goods on the shelf of the store. So he doesn't really pay you anything that he doesn't get back. It looks like money, even smells like money, but any free choice with freedom is gone.

If you consider that you work for a boss that pays you in tokens that you can only cash at the Company store, that's what digital currency is. He owns the house you rent , so you give him some tokens , he owns the Store so he gets all the tokens back that he paid you. He owns all the factories that put the goods on the shelf of the store. So he doesn't really pay you anything that he doesn't get back. It looks like money, even smells like money, but any free choice with freedom is gone.

Coronavirus Pandemic to Ultimately Result in Depression or a Reset

I would say a depressive reset.

That has been "the plan" for decades.

edit on 3/30/20 by Gothmog because: (no reason given)

I've said this from the beginning, while people were looking for aliens or asteroids or who-knows-what.

Whether the virus was released on purpose, or whether the reaction was cooked up on the fly and based on already contrived plans, the whole thing has been since the beginning, quite clearly to me, a controlled black swan event.

Whether the virus was released on purpose, or whether the reaction was cooked up on the fly and based on already contrived plans, the whole thing has been since the beginning, quite clearly to me, a controlled black swan event.

new topics

-

Are you ready for the return of Jesus Christ? Have you been cleansed by His blood?

Religion, Faith, And Theology: 45 minutes ago -

Chronological time line of open source information

History: 2 hours ago -

A man of the people

Diseases and Pandemics: 3 hours ago -

Ramblings on DNA, blood, and Spirit.

Philosophy and Metaphysics: 3 hours ago -

4 plans of US elites to defeat Russia

New World Order: 5 hours ago -

Thousands Of Young Ukrainian Men Trying To Flee The Country To Avoid Conscription And The War

Other Current Events: 8 hours ago -

12 jurors selected in Trump criminal trial

US Political Madness: 11 hours ago -

Iran launches Retalliation Strike 4.18.24

World War Three: 11 hours ago

top topics

-

George Knapp AMA on DI

Area 51 and other Facilities: 17 hours ago, 26 flags -

Israeli Missile Strikes in Iran, Explosions in Syria + Iraq

World War Three: 12 hours ago, 17 flags -

Thousands Of Young Ukrainian Men Trying To Flee The Country To Avoid Conscription And The War

Other Current Events: 8 hours ago, 6 flags -

Iran launches Retalliation Strike 4.18.24

World War Three: 11 hours ago, 6 flags -

Not Aliens but a Nazi Occult Inspired and then Science Rendered Design.

Aliens and UFOs: 17 hours ago, 5 flags -

12 jurors selected in Trump criminal trial

US Political Madness: 11 hours ago, 4 flags -

4 plans of US elites to defeat Russia

New World Order: 5 hours ago, 2 flags -

A man of the people

Diseases and Pandemics: 3 hours ago, 2 flags -

Chronological time line of open source information

History: 2 hours ago, 2 flags -

Ramblings on DNA, blood, and Spirit.

Philosophy and Metaphysics: 3 hours ago, 1 flags

active topics

-

12 jurors selected in Trump criminal trial

US Political Madness • 31 • : ImagoDei -

Thousands Of Young Ukrainian Men Trying To Flee The Country To Avoid Conscription And The War

Other Current Events • 8 • : FlyersFan -

European court rules human rights violated by climate inaction

Fragile Earth • 61 • : iaylyan -

Post A Funny (T&C Friendly) Pic Part IV: The LOL awakens!

General Chit Chat • 7124 • : underpass61 -

Are you ready for the return of Jesus Christ? Have you been cleansed by His blood?

Religion, Faith, And Theology • 5 • : Hakaiju -

4 plans of US elites to defeat Russia

New World Order • 25 • : FlyersFan -

BREAKING: O’Keefe Media Uncovers who is really running the White House

US Political Madness • 16 • : Hakaiju -

Fossils in Greece Suggest Human Ancestors Evolved in Europe, Not Africa

Origins and Creationism • 65 • : Xtrozero -

The Tories may be wiped out after the Election - Serves them Right

Regional Politics • 24 • : crayzeed -

A man of the people

Diseases and Pandemics • 7 • : TheMichiganSwampBuck