It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

a reply to: Gryphon66

Therefore it should resonate that they have the lowest taxes of all the states and provide amazing benefits to all of their citizens....yet...they have enormous taxes, those who reside there struggle to provide the basics to their families, in many cities housing is out of reach for most.

Homelessness is rampant among the most vulnerable populations, trash piles up in every neighborhood because they dont enforce the most basic of environmental laws to protect the tax paying population, human waste in public spaces is such a hazard that municipalities face lawsuits due to workers health suffering due to the untenable working conditions at public buildings.

The subsidized public utilities regulated by the taxes raised by the economic powerhouse is unable to operate and provide basic services because they failed to upgrade equipment which would prevent the devastating fires further endangering the public. Yet, by god...recent state legislations passed include mandatory "lactation" space to be provided by employers.

They have also passed recent Bill's to discourage use of sugary drinks, provide free healthcare to non citizens, nevermind citizens, they be damned without healthcare while contributing to noncitizens, other local non binding resolutions include "population control measures". Exactly what they mean remains an unknown which should frighten everyone.

YES...looks like they are doing just fine, the world's 5th largest economy cant provide housing, cant provide electricity, clean water is only important for any lactating pregnant frogs with Latin names no one ever saw before, they are pretty good at sucking up 3 billion in federal funds for bullets trains that have enough track to go for 2 miles. Seems they can do better...but maybe I just expect too much

Therefore it should resonate that they have the lowest taxes of all the states and provide amazing benefits to all of their citizens....yet...they have enormous taxes, those who reside there struggle to provide the basics to their families, in many cities housing is out of reach for most.

Homelessness is rampant among the most vulnerable populations, trash piles up in every neighborhood because they dont enforce the most basic of environmental laws to protect the tax paying population, human waste in public spaces is such a hazard that municipalities face lawsuits due to workers health suffering due to the untenable working conditions at public buildings.

The subsidized public utilities regulated by the taxes raised by the economic powerhouse is unable to operate and provide basic services because they failed to upgrade equipment which would prevent the devastating fires further endangering the public. Yet, by god...recent state legislations passed include mandatory "lactation" space to be provided by employers.

They have also passed recent Bill's to discourage use of sugary drinks, provide free healthcare to non citizens, nevermind citizens, they be damned without healthcare while contributing to noncitizens, other local non binding resolutions include "population control measures". Exactly what they mean remains an unknown which should frighten everyone.

YES...looks like they are doing just fine, the world's 5th largest economy cant provide housing, cant provide electricity, clean water is only important for any lactating pregnant frogs with Latin names no one ever saw before, they are pretty good at sucking up 3 billion in federal funds for bullets trains that have enough track to go for 2 miles. Seems they can do better...but maybe I just expect too much

originally posted by: Edumakated

It talks about New Jersey, CT, CA, and how billionaires are leaving for Florida largely because of lower taxes.

Not just the 1%.

A majority of my clients (I am a barber in my own shop), have moved down here, first as snowbirds (down here in winter, and north for summer), then sold their houses up north because of high taxes, and then moved down here permanently. Cutting property tax down by 90% alone, they have a great pension, or retirement from up north, with far less taxes now, and have plenty of extra. Then as home prices get more median country wide, the home prices down here don't seem too bad. They are moving from houses in NY that costs $400K, then spending $350k down here (cause they don't have to be right on the water), and getting way more home for the money. These are all people with incomes up around and above 6 figures just from their pensions, retirements, and SSI/SSD.

edit on 29-10-2019 by KnoxMSP because: (no reason given)

originally posted by: Vroomfondel

a reply to: dfnj2015

Socialism is supposed to make the people equal. If socialism made the state rich but the people are suffering either you are doing it wrong or it doesn't work.

No, its working as intended.

Francois Hollande raised taxes to 70% for the rich, and they started leaving, which resulted in lowering the taxes. I guess that's been memory holed?

originally posted by: Blaine91555

a reply to: pexx421

If you truly are the owner of investment properties, on which you owe no mortgage, you must be very wealthy yourself?

I've seen the real numbers and yes my landlord is losing money on all his properties. He only gains spendable income when he decides to sell and yes, then he will make money. He has five houses, which is his retirement. You ever hear the term land poor?

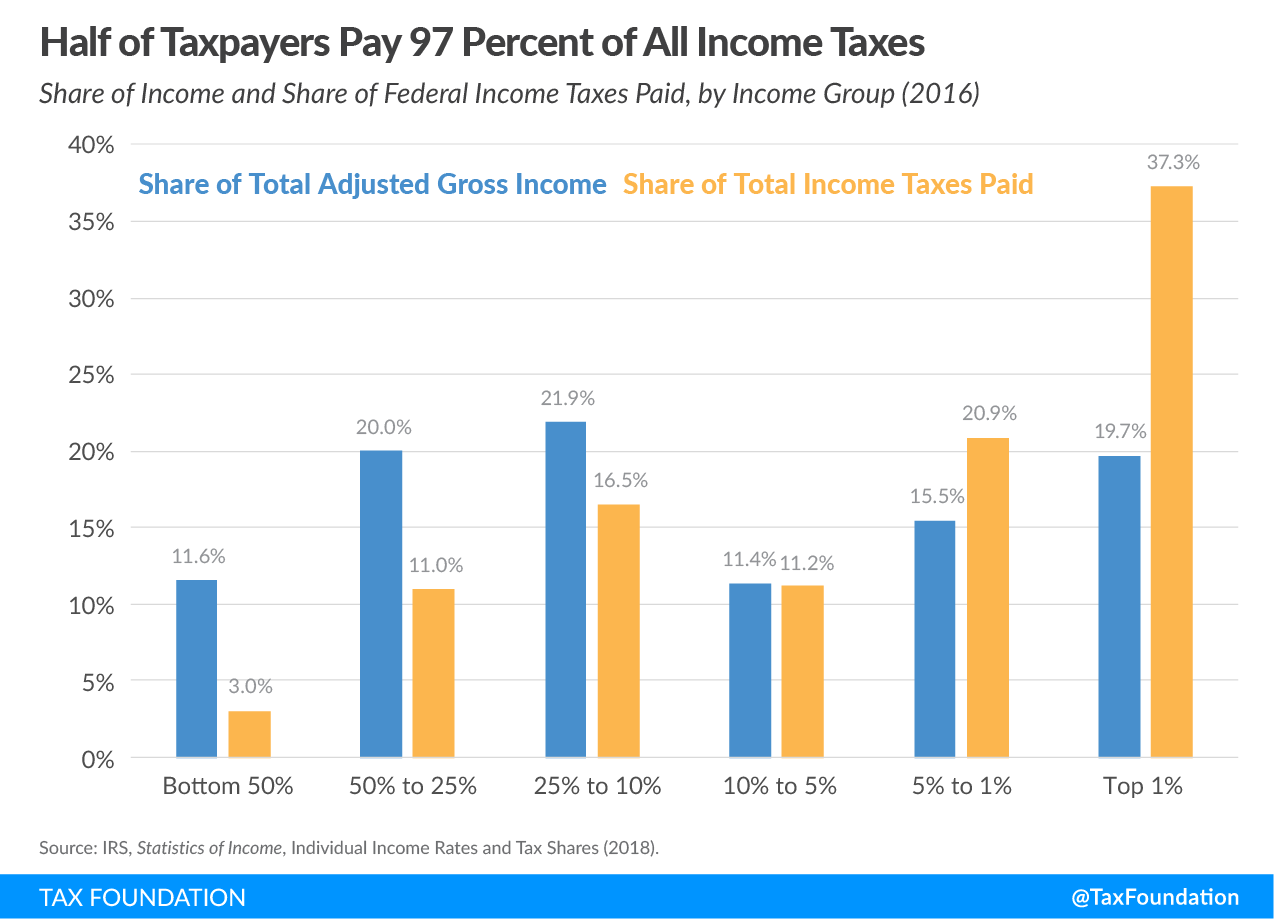

This is just federal and not state, but it paints the real picture.

Hey, that’s cool, 50% pay 97% of taxes. I get it. But that 50% owns everything. It actually gets even worse, as in your chart you show the top 1% pays 37% of the total taxes, while making 19% of the “income”. But where it gets even more radical is the wealth distribution. Not income, wealth. Where that top 1% actually holds something like 95% of all the wealth of the nation. Really a fraction of 1%. And that’s where it’s really at, because the majority of their accumulated money each year is not their income (19%) but rather their profit from their wealth, which dwarfs their “income”. And the wealth is where the real disparity between the haves and have nots comes from, and this is the area where legislation is written in board rooms, where execs decide on where we go to war, or what democracies we overthrow. Where oligarchy, price fixing, etc are conceived and enacted. And these are the people you want us to lament for being taxed? Nah. I’ll save my pity for the guy I see on the corner selling apples to people at the red light. I know he ain’t robbing me, and hell, the cops might shoot him tomorrow mistaking his apples for a gun when they go to confront him about not having a license to be poor, right after they shoot his dog.

a reply to: pexx421

The top 5% pay almost 60% of the taxes and that's not enough for you? What is enough? 75%? 90%?

Wow, that's some extreme hyperbole.

If that apple vendor works hard, buys an orchard and retires rich, what then? Take it away from him to give it to others?

The only way you could have the money to support a truly progressive agenda is to tax the middle class and tax them hard. It's simple reality that if you taxed the top 5% at a rate of 100% it would not even begin to cover the costs.

Property taxes, gas taxes and the like hit the working poor hard, so why do those who support progressive taxation also support high taxes that impact the poor? Taxes like that are in fact Poor Taxes, put in place to take from the poor and give to the state.

The top 5% pay almost 60% of the taxes and that's not enough for you? What is enough? 75%? 90%?

I’ll save my pity for the guy I see on the corner selling apples to people at the red light. I know he ain’t robbing me, and hell, the cops might shoot him tomorrow mistaking his apples for a gun when they go to confront him about not having a license to be poor, right after they shoot his dog.

Wow, that's some extreme hyperbole.

If that apple vendor works hard, buys an orchard and retires rich, what then? Take it away from him to give it to others?

The only way you could have the money to support a truly progressive agenda is to tax the middle class and tax them hard. It's simple reality that if you taxed the top 5% at a rate of 100% it would not even begin to cover the costs.

Property taxes, gas taxes and the like hit the working poor hard, so why do those who support progressive taxation also support high taxes that impact the poor? Taxes like that are in fact Poor Taxes, put in place to take from the poor and give to the state.

originally posted by: pexx421

originally posted by: Blaine91555

a reply to: pexx421

If you truly are the owner of investment properties, on which you owe no mortgage, you must be very wealthy yourself?

I've seen the real numbers and yes my landlord is losing money on all his properties. He only gains spendable income when he decides to sell and yes, then he will make money. He has five houses, which is his retirement. You ever hear the term land poor?

This is just federal and not state, but it paints the real picture.

Hey, that’s cool, 50% pay 97% of taxes. I get it. But that 50% owns everything. It actually gets even worse, as in your chart you show the top 1% pays 37% of the total taxes, while making 19% of the “income”. But where it gets even more radical is the wealth distribution. Not income, wealth. Where that top 1% actually holds something like 95% of all the wealth of the nation. Really a fraction of 1%. And that’s where it’s really at, because the majority of their accumulated money each year is not their income (19%) but rather their profit from their wealth, which dwarfs their “income”. And the wealth is where the real disparity between the haves and have nots comes from, and this is the area where legislation is written in board rooms, where execs decide on where we go to war, or what democracies we overthrow. Where oligarchy, price fixing, etc are conceived and enacted. And these are the people you want us to lament for being taxed? Nah. I’ll save my pity for the guy I see on the corner selling apples to people at the red light. I know he ain’t robbing me, and hell, the cops might shoot him tomorrow mistaking his apples for a gun when they go to confront him about not having a license to be poor, right after they shoot his dog.

Try using paragraphs... While I think your posts are generally full of nonsense, it becomes harder to engage when you respond with a wall of text.

originally posted by: dfnj2015

a reply to: JAGStorm

Socialism is why blue states are the richest states.

NO !

As if raising taxes makes you richer - can you balance your chequebook ?

Decades of accumulated wealth under capitalism is the reason they are rich.

As Venezuela and other states show, socialism leads to poverty

But keep right on denying reality

originally posted by: M5xaz

originally posted by: dfnj2015

a reply to: JAGStorm

Socialism is why blue states are the richest states.

NO !

As if raising taxes makes you richer - can you balance your chequebook ?

Decades of accumulated wealth under capitalism is the reason they are rich.

As Venezuela and other states show, socialism leads to poverty

But keep right on denying reality

That’s fine. If we ignore facts. Know the difference between Venezuela and Sweden? 20 years of us led attempted coups, assassination attempts, embargo’s, sanctions, and other assorted economic warfare. But I suppose in your eyes the only variable that matters is social programs.

a reply to: pexx421

Sweden is not a socialist country.

www.heritage.org...

Sweden is not a socialist country.

They prefer to cite Norway, Sweden, and Denmark as examples of socialist success. There are, however, several key problems with that. First, these countries are not technically socialist. By the YDSA’s definition, socialism entails a centrally planned economy with nationalized means of production. Although these countries have high income taxes and provide generous social programs, they remain prosperous because of their free-market economies.

www.heritage.org...

originally posted by: Blaine91555

a reply to: pexx421

The top 5% pay almost 60% of the taxes and that's not enough for you? What is enough? 75%? 90%?

I’ll save my pity for the guy I see on the corner selling apples to people at the red light. I know he ain’t robbing me, and hell, the cops might shoot him tomorrow mistaking his apples for a gun when they go to confront him about not having a license to be poor, right after they shoot his dog.

Wow, that's some extreme hyperbole.

If that apple vendor works hard, buys an orchard and retires rich, what then? Take it away from him to give it to others?

The only way you could have the money to support a truly progressive agenda is to tax the middle class and tax them hard. It's simple reality that if you taxed the top 5% at a rate of 100% it would not even begin to cover the costs.

Property taxes, gas taxes and the like hit the working poor hard, so why do those who support progressive taxation also support high taxes that impact the poor? Taxes like that are in fact Poor Taxes, put in place to take from the poor and give to the state.

That’s not hyperbole, fool. It was a semi humorous portrayal of current unrelated social issues people in the us face today. As for “how much is enough?!!” How about this. Stack up all their income, and all their wealth. Do it for all the different class strata. Then make each bracket pay the percentage off the taxes that they have in wealth and income. For those with negative wealth and income, they’ll get money back from the govt (that’s probably the whole lower 60% of Americans who make $15 an hour or less, or are unemployed). I expect the percentage that top 1% pays will go quite a bit higher.

a reply to: DJMSN

You are overstating your case in my opinion when you're not outright exaggerating beyond all rationality.

The housing market is expensive because of DEMAND for housing in CA not the failure of government.

PG&E is a private CORPORATION that has benefited from government subsidies yet, has not reinvested profits or even maintained its infrastructure ... arguably a mini-study in the absolute failure of the theories behind the so-called Laffer Curve.

And so on ...

Those are not universal problems across the entire state of CA.

These are the regurgitated talking points of the right-extremist corporate media.

You are overstating your case in my opinion when you're not outright exaggerating beyond all rationality.

The housing market is expensive because of DEMAND for housing in CA not the failure of government.

PG&E is a private CORPORATION that has benefited from government subsidies yet, has not reinvested profits or even maintained its infrastructure ... arguably a mini-study in the absolute failure of the theories behind the so-called Laffer Curve.

And so on ...

Those are not universal problems across the entire state of CA.

These are the regurgitated talking points of the right-extremist corporate media.

originally posted by: pexx421

originally posted by: Blaine91555

a reply to: pexx421

The top 5% pay almost 60% of the taxes and that's not enough for you? What is enough? 75%? 90%?

I’ll save my pity for the guy I see on the corner selling apples to people at the red light. I know he ain’t robbing me, and hell, the cops might shoot him tomorrow mistaking his apples for a gun when they go to confront him about not having a license to be poor, right after they shoot his dog.

Wow, that's some extreme hyperbole.

If that apple vendor works hard, buys an orchard and retires rich, what then? Take it away from him to give it to others?

The only way you could have the money to support a truly progressive agenda is to tax the middle class and tax them hard. It's simple reality that if you taxed the top 5% at a rate of 100% it would not even begin to cover the costs.

Property taxes, gas taxes and the like hit the working poor hard, so why do those who support progressive taxation also support high taxes that impact the poor? Taxes like that are in fact Poor Taxes, put in place to take from the poor and give to the state.

That’s not hyperbole, fool. It was a semi humorous portrayal of current unrelated social issues people in the us face today. As for “how much is enough?!!” How about this. Stack up all their income, and all their wealth. Do it for all the different class strata. Then make each bracket pay the percentage off the taxes that they have in wealth and income. For those with negative wealth and income, they’ll get money back from the govt (that’s probably the whole lower 60% of Americans who make $15 an hour or less, or are unemployed). I expect the percentage that top 1% pays will go quite a bit higher.

"Fool" - resorting to name calling does not impress me in the slightest.

What you say is already the case. The bottom 45% I think it is pay in nothing, but get back something. Anytime anyone gets any kind of check or service from the government, most of the money came from the top 5% as it is now.

Robin Hood stole from the rich to give to the poor. Our government takes from the rich to give to the state, which then wastes half of it before it gets to the poor.

I'll give you this, all people who bring the same skills to the table and work should earn the same. We get out of this world what we put in to it.

I think the real problem here is that what you seem to truly want is to take it away from those who can and give it to those who won't. I mean why should they work and learn skills so they can earn more, when they can just have it taken from those who earned it and handed to them by the state.

Again, even if you take 100% from the top 5% it would not pay for what is being promised and you would have to hit the working middle class hard and raise their taxes. You know, the dirty little secret that politicians dance around when asked, how are going to pay for that?

originally posted by: Blaine91555

originally posted by: pexx421

originally posted by: Blaine91555

a reply to: pexx421

The top 5% pay almost 60% of the taxes and that's not enough for you? What is enough? 75%? 90%?

I’ll save my pity for the guy I see on the corner selling apples to people at the red light. I know he ain’t robbing me, and hell, the cops might shoot him tomorrow mistaking his apples for a gun when they go to confront him about not having a license to be poor, right after they shoot his dog.

Wow, that's some extreme hyperbole.

If that apple vendor works hard, buys an orchard and retires rich, what then? Take it away from him to give it to others?

The only way you could have the money to support a truly progressive agenda is to tax the middle class and tax them hard. It's simple reality that if you taxed the top 5% at a rate of 100% it would not even begin to cover the costs.

Property taxes, gas taxes and the like hit the working poor hard, so why do those who support progressive taxation also support high taxes that impact the poor? Taxes like that are in fact Poor Taxes, put in place to take from the poor and give to the state.

That’s not hyperbole, fool. It was a semi humorous portrayal of current unrelated social issues people in the us face today. As for “how much is enough?!!” How about this. Stack up all their income, and all their wealth. Do it for all the different class strata. Then make each bracket pay the percentage off the taxes that they have in wealth and income. For those with negative wealth and income, they’ll get money back from the govt (that’s probably the whole lower 60% of Americans who make $15 an hour or less, or are unemployed). I expect the percentage that top 1% pays will go quite a bit higher.

"Fool" - resorting to name calling does not impress me in the slightest.

What you say is already the case. The bottom 45% I think it is pay in nothing, but get back something. Anytime anyone gets any kind of check or service from the government, most of the money came from the top 5% as it is now.

Robin Hood stole from the rich to give to the poor. Our government takes from the rich to give to the state, which then wastes half of it before it gets to the poor.

I'll give you this, all people who bring the same skills to the table and work should earn the same. We get out of this world what we put in to it.

I think the real problem here is that what you seem to truly want is to take it away from those who can and give it to those who won't. I mean why should they work and learn skills so they can earn more, when they can just have it taken from those who earned it and handed to them by the state.

Again, even if you take 100% from the top 5% it would not pay for what is being promised and you would have to hit the working middle class hard and raise their taxes. You know, the dirty little secret that politicians dance around when asked, how are going to pay for that?

?? Ok, first off, in my head it sounded like mr t.

That aside, how do I advocate taking from those who earn it and giving to those who don’t? Unearned income is by definition unearned. If you are a banker, you aren’t making money, except in the fact you are actually creating money out of thin air. Point being, the banks job is to EXTRACT money from people that earn it. Just like our monopolies, oligopolies, predatory capitalists future shares speculators, sweat shop owners, rentiers etc. In fact, the vast majority of our economy is specifically designed to extract money from those who actually earn it, ie: the laborers. I am all for the laborers getting their money tax free. Because they earned it. I’m all for govt stepping in and penalizing companies for exploitative wage fixing and price fixing. Because that’s theft from the workers. Now how about I make a bunch of assumptions and aspersions in your direction?

Oh, and let me add. If that’s how it’s set up now, where are the 50billions that bezos should have paid in taxes?? How much did he pay again? And

Exxon? Etc etc.

originally posted by: M5xaz

Decades of accumulated wealth under capitalism is the reason they are rich.

Also because once somebody gets rich they can pass most of it on to the next generation when they die, so it stays locked into families and doesn't go to the state. Which is a good thing?

a reply to: Blaine91555

Sure. I guess we will have to. As nothing I said resembles Cuba in any conceivable way. So apparently you just hear whatever you want to, and make associations from that made up discussion to attempt to disparage your opponents argument, or you are intentionally obtuse and disengenuous. In what way does Cuba tax wealth and unearned income, and not labor??

At any rate, the reality is that here, in the US, capital picks the winners, not the people, not the govt. capital decides elections, decides on war, bailouts, rights, guilt or innocence, and so on. I’m sure it’s a horror to you, but I expect the people, or even the govt would be no worse at picking winners or losers than capital is.

But, you’re right Blaine. Much as we may disagree, and I feel for your delusions and lack of facts, it is all good and I hope you and yours have a great day! 👍

Sure. I guess we will have to. As nothing I said resembles Cuba in any conceivable way. So apparently you just hear whatever you want to, and make associations from that made up discussion to attempt to disparage your opponents argument, or you are intentionally obtuse and disengenuous. In what way does Cuba tax wealth and unearned income, and not labor??

At any rate, the reality is that here, in the US, capital picks the winners, not the people, not the govt. capital decides elections, decides on war, bailouts, rights, guilt or innocence, and so on. I’m sure it’s a horror to you, but I expect the people, or even the govt would be no worse at picking winners or losers than capital is.

But, you’re right Blaine. Much as we may disagree, and I feel for your delusions and lack of facts, it is all good and I hope you and yours have a great day! 👍

originally posted by: DJMSN

a reply to: Gryphon66

Therefore it should resonate that they have the lowest taxes of all the states and provide amazing benefits to all of their citizens....yet...they have enormous taxes, those who reside there struggle to provide the basics to their families, in many cities housing is out of reach for most.

Homelessness is rampant among the most vulnerable populations, trash piles up in every neighborhood because they dont enforce the most basic of environmental laws to protect the tax paying population, human waste in public spaces is such a hazard that municipalities face lawsuits due to workers health suffering due to the untenable working conditions at public buildings.

The subsidized public utilities regulated by the taxes raised by the economic powerhouse is unable to operate and provide basic services because they failed to upgrade equipment which would prevent the devastating fires further endangering the public. Yet, by god...recent state legislations passed include mandatory "lactation" space to be provided by employers.

They have also passed recent Bill's to discourage use of sugary drinks, provide free healthcare to non citizens, nevermind citizens, they be damned without healthcare while contributing to noncitizens, other local non binding resolutions include "population control measures". Exactly what they mean remains an unknown which should frighten everyone.

YES...looks like they are doing just fine, the world's 5th largest economy cant provide housing, cant provide electricity, clean water is only important for any lactating pregnant frogs with Latin names no one ever saw before, they are pretty good at sucking up 3 billion in federal funds for bullets trains that have enough track to go for 2 miles. Seems they can do better...but maybe I just expect too much

Seriously? You’re going to decry pg&e, a publicly traded private corporation, who spent all their money on corporate stock buybacks and bonuses to execs Rather than upgrading and maintaining their infrastructure, as an example of the perils of liberalism and socialism? It’s capitalism at its best! It’s truest nature! Lowest work/quality for highest profit! What doublethink!

new topics

-

Electrical tricks for saving money

Education and Media: 3 hours ago -

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News: 4 hours ago -

Sunak spinning the sickness figures

Other Current Events: 5 hours ago -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues: 5 hours ago -

Late Night with the Devil - a really good unusual modern horror film.

Movies: 7 hours ago -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest: 8 hours ago -

The Good News According to Jesus - Episode 1

Religion, Faith, And Theology: 10 hours ago

top topics

-

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest: 8 hours ago, 8 flags -

Florida man's trip overseas ends in shock over $143,000 T-Mobile phone bill

Social Issues and Civil Unrest: 15 hours ago, 8 flags -

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News: 4 hours ago, 8 flags -

Former Labour minister Frank Field dies aged 81

People: 17 hours ago, 4 flags -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three: 12 hours ago, 3 flags -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues: 5 hours ago, 3 flags -

Sunak spinning the sickness figures

Other Current Events: 5 hours ago, 3 flags -

Bobiverse

Fantasy & Science Fiction: 15 hours ago, 3 flags -

Electrical tricks for saving money

Education and Media: 3 hours ago, 3 flags -

Late Night with the Devil - a really good unusual modern horror film.

Movies: 7 hours ago, 2 flags

active topics

-

President BIDEN Vows to Make Americans Pay More Federal Taxes in 2025 - Political Suicide.

2024 Elections • 136 • : ImagoDei -

Electrical tricks for saving money

Education and Media • 3 • : Mike72 -

TLDR post about ATS and why I love it and hope we all stay together somewhere

General Chit Chat • 10 • : theshadowknows -

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News • 31 • : WeMustCare -

Why to avoid TikTok

Education and Media • 20 • : 5thHead -

How ageing is" immune deficiency"

Medical Issues & Conspiracies • 32 • : annonentity -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 657 • : daskakik -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three • 30 • : DaRAGE -

Spectrophilia - Women Who Have Had Affairs With Ghosts Say Spooks Are Better Lovers Than Real Men

Paranormal Studies • 32 • : burritocat -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest • 18 • : Xtrozero