It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

The market for low and unskilled work is slowly drying up. That's what happens when MacDonald's has those touchscreen keypads for ordering. Instead

of six employees they now have one. And that's for the lowest level jobs.

People afraid of population control are always going on about how there is still plenty of land, water and food for billions more people to live, and that's completely true. But what about jobs? What are all those people going to do for a living? Particularly when there is a huge number of people who are now continuing to work far past the traditional retirement age because they can't afford to retire? You can't have a growing economy when a big percentage of the workforce is nothing but people delivering pizza and weed to each other.

Demographics bumping up against technology. That's the rub.

People afraid of population control are always going on about how there is still plenty of land, water and food for billions more people to live, and that's completely true. But what about jobs? What are all those people going to do for a living? Particularly when there is a huge number of people who are now continuing to work far past the traditional retirement age because they can't afford to retire? You can't have a growing economy when a big percentage of the workforce is nothing but people delivering pizza and weed to each other.

Demographics bumping up against technology. That's the rub.

originally posted by: JAGStorm

originally posted by: Edumakated

originally posted by: Gryphon66

originally posted by: jjkenobi

Over a trillion in debt.

Rolling blackouts.

Tens of thousands of homeless living in tent shelters.

Yep, checks out.

You seem to have left out that CA is the world's fifth largest economy.

That makes it even worse. All that economic activity and liberals still can't help but run the state into the ground.

Thanks for playing...

Just like I said in the beginning post, it is too simple! If the state is so amazing #1 why would people leave, #2 why would they leave to states without taxes.

I went from a state with NO income tax (FL) to one with it (MI) Many others from down there have done the same for reasons I already mentioned -- better climate, better jobs, better CoL. You'd think with no income tax that FL would be THE place to go, but it's not all it's cracked up to be for a variety of reasons that don't do anything to make no income tax look all that appealing weighed against everything else.

I do have a friend who went from FL to California, suburban LA specifically. She insists her bang for her buck out there is far better than it was in FL. I don't live in CA, but I have to take her word for it if she says so, just like she has to take my word for it when I say the bang for the buck in MI is superior to FL. The same can be said for people leaving CA -- the weather may be of concern (or rather, wildfire risk in a naturally arid state) They may live in high CoL areas and not want the commute from cheaper ones, thus transfer jobs to other states and save drive time and some money. They may not like the taxation, and may have a better run of it somewhere else. Or that somewhere else might end up looking good at the start, but might bite them in the ass & pocketbook later on when CoL levels out for things like food or utilities, so they didn't really save themselves much money & frustration with the move in the end.

You're trying to make the perks of somewhere black and white when they really are not. I cannot for the life of me find anything worth moving to TN or KY over, but for most, cheap CoL is the selling point they hinge their choice on. That cheap CoL seems to come at a cost of dead end work and/or low paying work to put up with when I look at them. Not worth it to me. To others, sure, probably if they think it's a better deal than they have, especially if they think the difference in income tax makes up for it.

edit on 10/29/2019 by Nyiah because: (no reason given)

Second edit: And while we're at it, JinMi can probably back me up on this, he's in the same area. There's been a suspiciously noticeable influx of people from TX lately, too. Texas is another with no state income tax. Many of these people's plates don't show originating from Dallas or Houson or the other lmbasted "lib towns" counties down there, so why would they leave? Because for reasons not considered by us, there's a draw up here even with income tax that is better than staying in TX. It's usually jobs and CoL.

edit on 10/29/2019 by Nyiah because: (no reason given)

I’d be perfectly fine with a flat 35% tax levied only upon capital gains, rent, and other unearned income, while leaving all labor wages and non profits completely exempt from taxation.

35% on rental income. Who is it you suppose pays for that and I'll give you a hint, it ain't the rental property owners. Talk about wanting to stick it to the poor!!! What did the working poor ever do to you?

The owner of the house I'm leasing right now is losing money every month I live here. Property taxes, insurance and keeping the place in good repair costs more than I pay in rent. Why do you think rent is so high? Again it's not because of the property owners.

Capital gains? What do you suppose happens to investors? They stop investing and regular peoples retirement goes up in smoke as the funds fail.

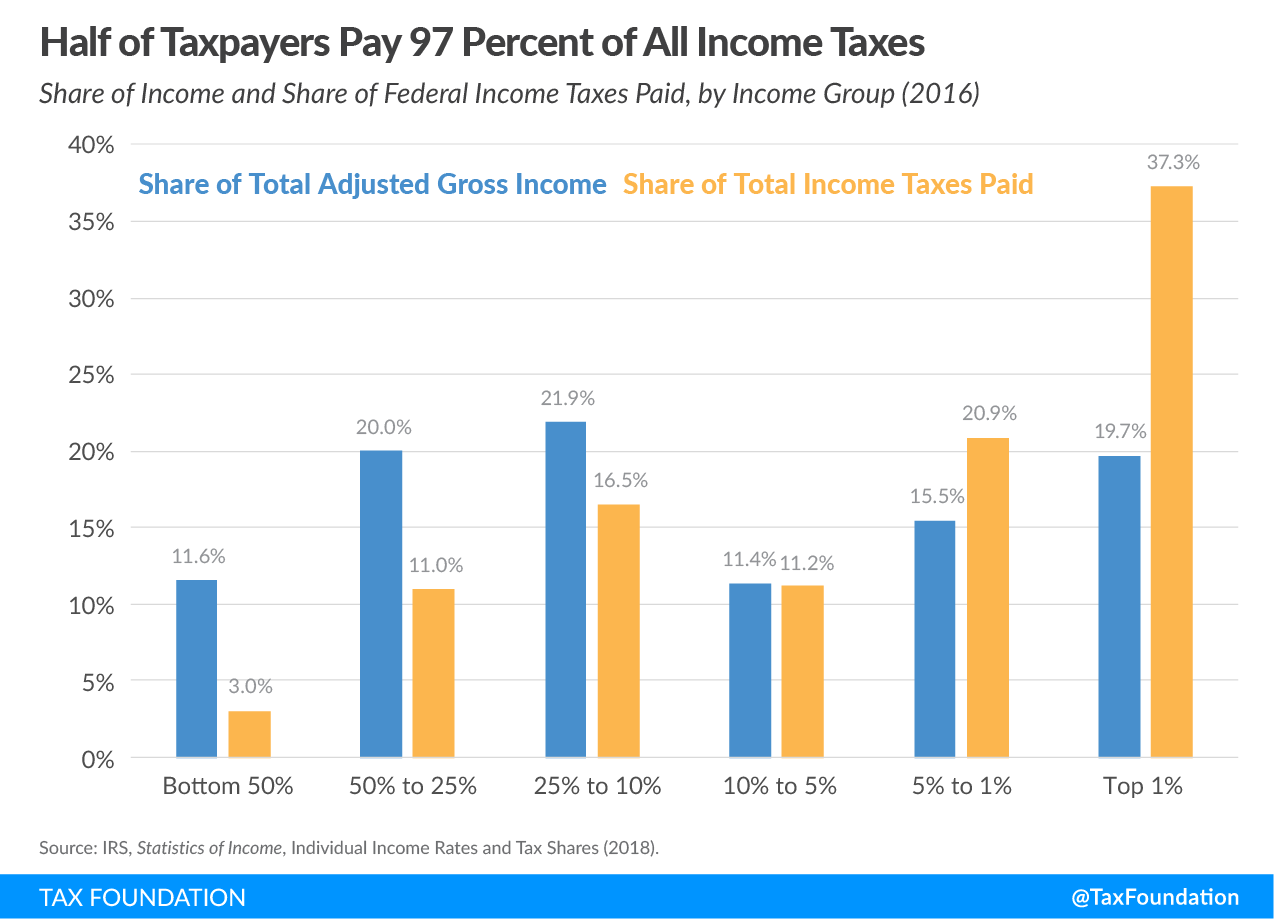

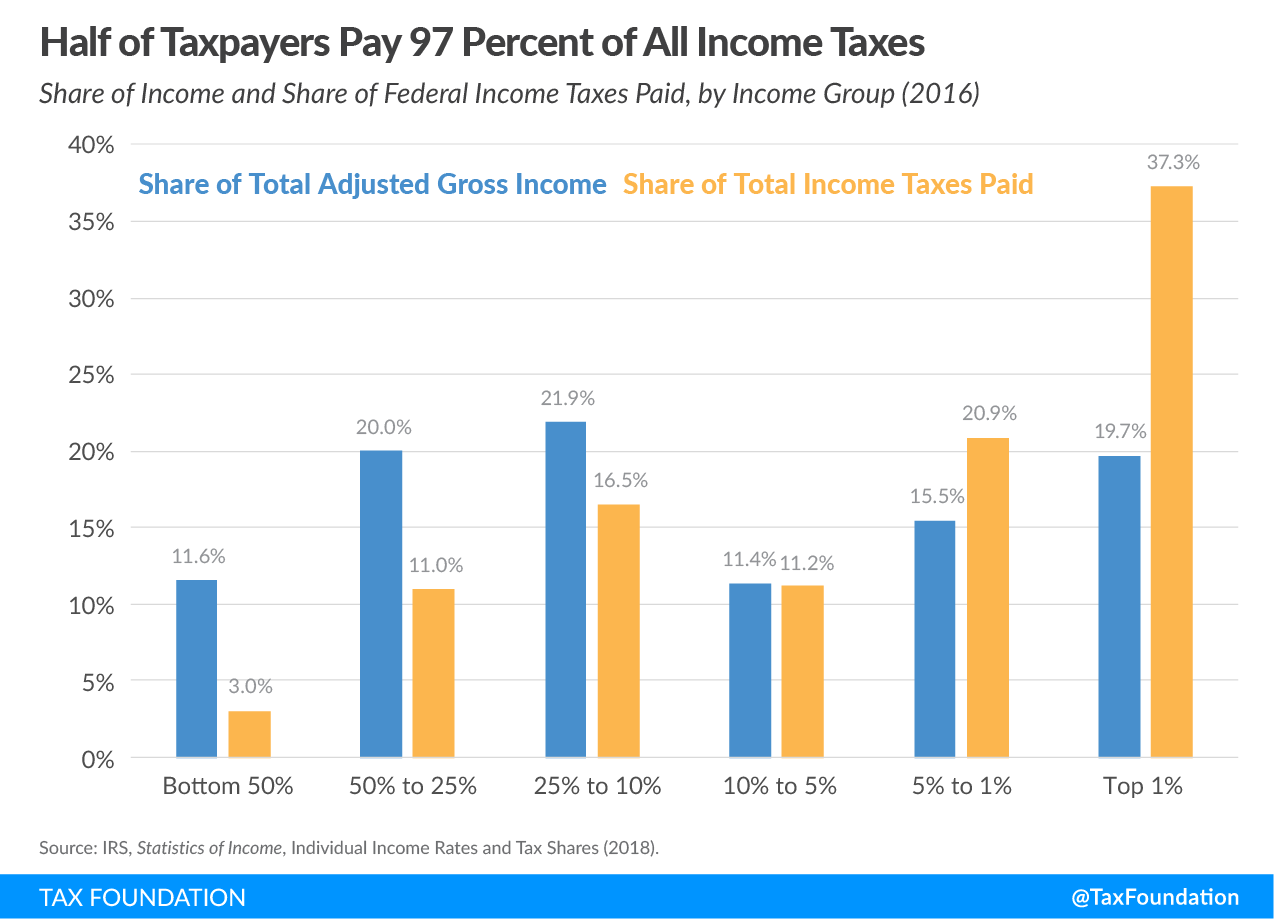

You do know that the rich and nearly rich pay almost all the taxes now, right? How much more progressive can it get than it already is? In this case progressive and regressive are synonymous.

A link to the actual article from the Stanford prof (the other researcher works at Amazon) is here.

The full publication is behind a paywall so only the abstract is available unfortunately.

So, less than 1% (above base-line) left California in 2013 whose income was in the top tax bracket that suffered the increase in 2012.

The rest of the abstract deals with highly technical analysis of the impact of changes in pre-tax income.

Looking for other sources to put this in perspective, consider a 2015 article from the Sacramento Bee: Roughly 5 million people left California in the last decade. See where they went.

So, there was less than a 1% drop in high-end earners the year after the tax increase (2013) and by (2014) overall migration was seen as slowing from there based on the same standard (IRS migration data) as was used by the Stanford study.

How're things going recently?

Revenue Estimates California Budget

Since CA just moved from the 6th largest economy in the world to the 5th in the world and revenues continue to climb, it seems that they're doing okay. Business Insider

The full publication is behind a paywall so only the abstract is available unfortunately.

First, over and above baseline rates of taxpayer departure from California, an additional 0.8% of the California residential tax filing base whose 2012 income would have been in the new top tax bracket moved out from full-year residency of California in 2013, mostly to states with zero income tax.

So, less than 1% (above base-line) left California in 2013 whose income was in the top tax bracket that suffered the increase in 2012.

The rest of the abstract deals with highly technical analysis of the impact of changes in pre-tax income.

Looking for other sources to put this in perspective, consider a 2015 article from the Sacramento Bee: Roughly 5 million people left California in the last decade. See where they went.

Based on tax returns, the IRS migration data is considered the gold standard for measuring population shifts, though it lags two to three years behind the current date. The latest, separate estimates from the state Department of Finance showed net domestic migration losses slowing, but not ending, in 2014

So, there was less than a 1% drop in high-end earners the year after the tax increase (2013) and by (2014) overall migration was seen as slowing from there based on the same standard (IRS migration data) as was used by the Stanford study.

How're things going recently?

Figure REV-01 compares the revenue forecasts, by source, in the 2018 Budget Act and the Governor’s Budget. Revenue, including transfers, is expected to be $137 billion in 2018-19 and $143 billion in 2019-20. The projected increase since the 2018 Budget Act is due largely to an improved outlook for personal income tax. The sales tax forecast has been revised down. The corporation tax is up but the improvement is seen as one-time and not ongoing. Over the three fiscal years, personal income tax is up $7.5 billion, sales tax is down $1.4 billion, and corporation tax is up $1.3 billion

Revenue Estimates California Budget

Since CA just moved from the 6th largest economy in the world to the 5th in the world and revenues continue to climb, it seems that they're doing okay. Business Insider

edit on 29-10-2019 by Gryphon66 because: Format

a reply to: Nyiah

We have to look at the overall picture. We can't go by my friends, or your family, etc.

The overall picture says rich people are leaving California and taking their money with them.

Sometimes the effects of this kind of migration is not felt for years.

Look at Illinois, they are losing more people than anywhere else in the country. Illinois says people are leaving because of the weather, well if that was true they wouldn't be moving to Wisconsin would they? They are moving because they are being taxed to death.

We have to look at the overall picture. We can't go by my friends, or your family, etc.

The overall picture says rich people are leaving California and taking their money with them.

Sometimes the effects of this kind of migration is not felt for years.

Look at Illinois, they are losing more people than anywhere else in the country. Illinois says people are leaving because of the weather, well if that was true they wouldn't be moving to Wisconsin would they? They are moving because they are being taxed to death.

originally posted by: Blaine91555

I’d be perfectly fine with a flat 35% tax levied only upon capital gains, rent, and other unearned income, while leaving all labor wages and non profits completely exempt from taxation.

35% on rental income. Who is it you suppose pays for that and I'll give you a hint, it ain't the rental property owners. Talk about wanting to stick it to the poor!!! What did the working poor ever do to you?

The owner of the house I'm leasing right now is losing money every month I live here. Property taxes, insurance and keeping the place in good repair costs more than I pay in rent. Why do you think rent is so high? Again it's not because of the property owners.

Capital gains? What do you suppose happens to investors? They stop investing and regular peoples retirement goes up in smoke as the funds fail.

You do know that the rich and nearly rich pay almost all the taxes now, right? How much more progressive can it get than it already is? In this case progressive and regressive are synonymous.

Want to hear something screwy? Here in Michigan, as a renter, I can claim a state tax rebate on my rent paid. I think it's maxed at $1200 a year or similar. I think it has to do with the homestead tax up here.

We only found out about that when we goofed on our state taxes and had to amend one year, we went to H & R Block and let them handle it. We didn't take the tax break, as much as the tax prep pushed it, because it seemed stupid and not right.

a reply to: Gryphon66

From your link:

Do people think these small businesses are just going to be OK paying more and more and more. Of course not, they are all going to leave.

From your link:

There are 3.9 million small businesses in California, making up 99.8% of the state's businesses. Those companies employ nearly 50% of the state's workforce.

Do people think these small businesses are just going to be OK paying more and more and more. Of course not, they are all going to leave.

originally posted by: JAGStorm

a reply to: Nyiah

The overall picture says rich people are leaving California and taking their money with them.

Sometimes the effects of this kind of migration is not felt for years.

This is not really a factual summation of what seems to be happening in CA. Less than 1% of the group of high-income tax payers that would have been affected by the tax increase is shown to have left CA in 2013 (the study period.)

a reply to: JAGStorm

WRT California, Gryphon's numbers there seem to hint that you're overstating things. Granted, I gave it all a cursory once-over, but it doesn't look anywhere close to as dire as you advertise.

As for Illinois, that's another state I don't see having much variety going for it economically, not tax-wise. What's the top industry there again? It's agriculture, isn't it? Trying to sell Illinois as a place to stay in, or move to, is akin to trying to say Iowa is more than crop fields. Parts of it might be, but come on.

WRT California, Gryphon's numbers there seem to hint that you're overstating things. Granted, I gave it all a cursory once-over, but it doesn't look anywhere close to as dire as you advertise.

As for Illinois, that's another state I don't see having much variety going for it economically, not tax-wise. What's the top industry there again? It's agriculture, isn't it? Trying to sell Illinois as a place to stay in, or move to, is akin to trying to say Iowa is more than crop fields. Parts of it might be, but come on.

originally posted by: JAGStorm

a reply to: Gryphon66

From your link:

There are 3.9 million small businesses in California, making up 99.8% of the state's businesses. Those companies employ nearly 50% of the state's workforce.

Do people think these small businesses are just going to be OK paying more and more and more. Of course not, they are all going to leave.

That's an opinion sure. There are no facts that back it up. Small businesses were not really targetted by the tax increase your article was based on.

originally posted by: Gryphon66

originally posted by: JAGStorm

a reply to: Gryphon66

From your link:

There are 3.9 million small businesses in California, making up 99.8% of the state's businesses. Those companies employ nearly 50% of the state's workforce.

Do people think these small businesses are just going to be OK paying more and more and more. Of course not, they are all going to leave.

That's an opinion sure. There are no facts that back it up. Small businesses were not really targetted by the tax increase your article was based on.

That's the thing, who do you think is next... small businesses. Most of us can see the writing on the wall.

Again, this article doesn't mean the population will leave California overnight, but it does show trends. Trends can tell you a lot.

Wow. I’ve rented out before. My brother rents places out. You guys are so full of #. “He’s losing money renting the place to me”. Bull#. If

he owns it flat out, then I assure you he’s making money in hand each month from you. If he pays a mortgage then he’s building equity.

As to risk, again no. If you lose your investment then you have lost disposable income. And you can then make another investment when you have more disposable income. If, however, you get fired from a job, then you can no longer use them as a reference. That loss of continuity can risk your whole future in your career field, which was often a major investment in education costs, certifications etc. Just be honest and say that to you guys, rich peoples risks (of their disposable income) count more than poor peoples risks (of their income allocated to necessities).

And, oh! I’m supposed to cry a river for folks being taxed twice? I get taxed at least twice on 100% of my income, as do most Americans. “Oh noes! The wealthy elite may not put money back into their personal, fixed gambling system!!” Boo fking hoo. We don’t need a stock exchange. Let them invest it back into manufacturing materials rather than future profit predictions. The stock market system is a rigged game for fools and suckers. You can have it. And I hope you enjoy the 10% of it that you share with the rest of the working class, buying into companies you will never have a say in, at the whim and mercy of your betters.

Simple minded fools are easily led to vote against their best interests by the people controlling the wealth and mainstream narrative, with all the backing of the analytic social engineers. Sheep all need a good shepherd I suppose.

As to risk, again no. If you lose your investment then you have lost disposable income. And you can then make another investment when you have more disposable income. If, however, you get fired from a job, then you can no longer use them as a reference. That loss of continuity can risk your whole future in your career field, which was often a major investment in education costs, certifications etc. Just be honest and say that to you guys, rich peoples risks (of their disposable income) count more than poor peoples risks (of their income allocated to necessities).

And, oh! I’m supposed to cry a river for folks being taxed twice? I get taxed at least twice on 100% of my income, as do most Americans. “Oh noes! The wealthy elite may not put money back into their personal, fixed gambling system!!” Boo fking hoo. We don’t need a stock exchange. Let them invest it back into manufacturing materials rather than future profit predictions. The stock market system is a rigged game for fools and suckers. You can have it. And I hope you enjoy the 10% of it that you share with the rest of the working class, buying into companies you will never have a say in, at the whim and mercy of your betters.

Simple minded fools are easily led to vote against their best interests by the people controlling the wealth and mainstream narrative, with all the backing of the analytic social engineers. Sheep all need a good shepherd I suppose.

a reply to: Gryphon66

My article shows data that happened after 2012

yours shows from 2004 to 2013. So the progressive tax was only in effect for one year.

My article shows data that happened after 2012

A new paper by Stanford University researchers shows wealthy residents were about 40% more likely to leave after Californians in 2012 passed a progressive income tax hike.

yours shows from 2004 to 2013. So the progressive tax was only in effect for one year.

Roughly 5 million people left California in the last decade. See where they went.

About 5 million Californians left between 2004 and 2013. Roughly 3.9 million people came here from other states during that period, for a net population loss of more than 1 million people.

originally posted by: JAGStorm

originally posted by: Gryphon66

originally posted by: JAGStorm

a reply to: Gryphon66

From your link:

There are 3.9 million small businesses in California, making up 99.8% of the state's businesses. Those companies employ nearly 50% of the state's workforce.

Do people think these small businesses are just going to be OK paying more and more and more. Of course not, they are all going to leave.

That's an opinion sure. There are no facts that back it up. Small businesses were not really targetted by the tax increase your article was based on.

That's the thing, who do you think is next... small businesses. Most of us can see the writing on the wall.

Again, this article doesn't mean the population will leave California overnight, but it does show trends. Trends can tell you a lot.

Fking let em go! Here’s the thing. I, and the vast majority of Americans, make a wage. It’s a pretty level wage, there’s not many ups and downs in it. Next year, my masters may bless me with an increase, like last year, that doesn’t keep up with inflation. But, it does let me keep going. Pays my bills. Provides my fam and I with necessities and some luxuries. Is that good enough for our whole corporate model in the US? Hell no! They have to continually make MORE profit each year than the year before. And to do that, they keep pushing my wages down, reducing the amount of services they provide, provide less benefits. All at the same time that they are increasing prices and profits. They do it AT THE EXPENSE of their workers and customers. That’s the American model.

And you would have me worry about what’s fair to them?! Rather than the working class, whom they’ve disenfranchised of the value of their labor for the last fifty years? Piss off. Y’all are on the wrong side of history, and the wrong side of right. When profits rise by 50% and wages rise by 50%? THEN I’ll have more sympathy for the poor wealthy elite. Until then I’ll just marvel that through fear and disgust people like you all can be convinced to blame the victims and extol vices as virtues.

originally posted by: Gryphon66

originally posted by: JAGStorm

a reply to: Nyiah

The overall picture says rich people are leaving California and taking their money with them.

Sometimes the effects of this kind of migration is not felt for years.

This is not really a factual summation of what seems to be happening in CA. Less than 1% of the group of high-income tax payers that would have been affected by the tax increase is shown to have left CA in 2013 (the study period.)

The problem is that 1% makes a disproportionate amount of tax revenue. And yes, they are leaving.

Here is an article from the NYT. It talks about New Jersey, CT, CA, and how billionaires are leaving for Florida largely because of lower taxes.

The New Jersey resident (unnamed by Mr. Haines) is the hedge-fund billionaire David Tepper. In December, Mr. Tepper declared himself a resident of Florida after living for over 20 years in New Jersey. He later moved the official headquarters of his hedge fund, Appaloosa Management, to Miami.

New Jersey won’t say exactly how much Mr. Tepper paid in taxes. But according to Institutional Investor’s Alpha, he earned more than $6 billion from 2012 to 2015. Tax experts say his move to Florida could cost New Jersey — which has a top tax rate of 8.97 percent — hundreds of millions of dollars in lost payments.

So yeah, you can say only a small number of people left, but the real questions is how much money did they take with them? Jeff Bezos is one guy.... but you don't think Seattle wouldn't suffer if he packed up his toys and moved somewhere else?

Look, CA is a beautiful state. However, progressives are running it into the ground. San Franfeces. Los Anusgeles. Homeless everywhere. Out of control illegal immigration. High cost of living. All this is attributed to leftism.

At some point, people just say enough is enough and no amount of sunshine is going to make up for the social and fiscal mismanagement.

Tech companies are leaving Silicon Valley as it is too expensive. Hollywood is making movies elsewhere.

If taxes (state, local, federal) are eating up half your income, that's not so bad if you're say...Robert Downey, Jr. and making $80,000,000 per year.

However, if you are Bob Downs middle class Jr. and making $80,000 per year, half is not so good. Try raising a family, buying a home, car, insurance, food, utilities, education, etc. etc. etc. on $40 grand a year in CA. That's poverty level.

However, if you are Bob Downs middle class Jr. and making $80,000 per year, half is not so good. Try raising a family, buying a home, car, insurance, food, utilities, education, etc. etc. etc. on $40 grand a year in CA. That's poverty level.

a reply to: pexx421

If you truly are the owner of investment properties, on which you owe no mortgage, you must be very wealthy yourself?

I've seen the real numbers and yes my landlord is losing money on all his properties. He only gains spendable income when he decides to sell and yes, then he will make money. He has five houses, which is his retirement. You ever hear the term land poor?

This is just federal and not state, but it paints the real picture.

If you truly are the owner of investment properties, on which you owe no mortgage, you must be very wealthy yourself?

I've seen the real numbers and yes my landlord is losing money on all his properties. He only gains spendable income when he decides to sell and yes, then he will make money. He has five houses, which is his retirement. You ever hear the term land poor?

This is just federal and not state, but it paints the real picture.

originally posted by: Edumakated

originally posted by: Gryphon66

originally posted by: JAGStorm

a reply to: Nyiah

The overall picture says rich people are leaving California and taking their money with them.

Sometimes the effects of this kind of migration is not felt for years.

This is not really a factual summation of what seems to be happening in CA. Less than 1% of the group of high-income tax payers that would have been affected by the tax increase is shown to have left CA in 2013 (the study period.)

The problem is that 1% makes a disproportionate amount of tax revenue. And yes, they are leaving.

Here is an article from the NYT. It talks about New Jersey, CT, CA, and how billionaires are leaving for Florida largely because of lower taxes.

The New Jersey resident (unnamed by Mr. Haines) is the hedge-fund billionaire David Tepper. In December, Mr. Tepper declared himself a resident of Florida after living for over 20 years in New Jersey. He later moved the official headquarters of his hedge fund, Appaloosa Management, to Miami.

New Jersey won’t say exactly how much Mr. Tepper paid in taxes. But according to Institutional Investor’s Alpha, he earned more than $6 billion from 2012 to 2015. Tax experts say his move to Florida could cost New Jersey — which has a top tax rate of 8.97 percent — hundreds of millions of dollars in lost payments.

So yeah, you can say only a small number of people left, but the real questions is how much money did they take with them? Jeff Bezos is one guy.... but you don't think Seattle wouldn't suffer if he packed up his toys and moved somewhere else?

Look, CA is a beautiful state. However, progressives are running it into the ground. San Franfeces. Los Anusgeles. Homeless everywhere. Out of control illegal immigration. High cost of living. All this is attributed to leftism.

At some point, people just say enough is enough and no amount of sunshine is going to make up for the social and fiscal mismanagement.

Tech companies are leaving Silicon Valley as it is too expensive. Hollywood is making movies elsewhere.

Just because someone with money lives somewhere doesn’t necessarily profit that place. See Louisiana, like I said. Huge corporate profit, #hole state. Exactly why are they leaving anyway? Is it because they’re not making enough money? Are they going broke because of the taxes? Fk no. They just want more. Its bullsht. The us and irs can force them to pay taxes, and to not pass those taxes onto the customers too. They can force the companies and owners to just make “reasonable profit” and if those companies don’t like making moderate profit, then they can surrender their license to make money in the US At all, and someone else would be more than happy to take up the slack. Access to the us market is a privilege, not a right. Just ask China. Or anyone with a business license. We could feasibly set the rules up any way we want, and I’m sure that there are plenty able intelligent people out there who would love to run Walmart, for instance, for a fraction of what the waltons are extracting. Same goes for chase, Citibank, utility companies, etc.

edit on 29-10-2019 by pexx421 because: (no reason given)

new topics

-

Biden--My Uncle Was Eaten By Cannibals

US Political Madness: 1 minutes ago -

"We're All Hamas" Heard at Columbia University Protests

Social Issues and Civil Unrest: 2 minutes ago -

The good, the Bad and the Ugly!

Diseases and Pandemics: 1 hours ago -

Russian intelligence officer: explosions at defense factories in the USA and Wales may be sabotage

Weaponry: 4 hours ago -

African "Newcomers" Tell NYC They Don't Like the Free Food or Shelter They've Been Given

Social Issues and Civil Unrest: 5 hours ago -

Russia Flooding

Other Current Events: 6 hours ago -

MULTIPLE SKYMASTER MESSAGES GOING OUT

World War Three: 7 hours ago -

Two Serious Crimes Committed by President JOE BIDEN that are Easy to Impeach Him For.

US Political Madness: 8 hours ago -

911 emergency lines are DOWN across multiple states

Breaking Alternative News: 8 hours ago -

Former NYT Reporter Attacks Scientists For Misleading Him Over COVID Lab-Leak Theory

Education and Media: 10 hours ago

top topics

-

Go Woke, Go Broke--Forbes Confirms Disney Has Lost Money On Star Wars

Movies: 14 hours ago, 13 flags -

Pro Hamas protesters at Columbia claim hit with chemical spray

World War Three: 10 hours ago, 11 flags -

Elites disapearing

Political Conspiracies: 12 hours ago, 9 flags -

Freddie Mercury

Paranormal Studies: 15 hours ago, 7 flags -

African "Newcomers" Tell NYC They Don't Like the Free Food or Shelter They've Been Given

Social Issues and Civil Unrest: 5 hours ago, 7 flags -

Two Serious Crimes Committed by President JOE BIDEN that are Easy to Impeach Him For.

US Political Madness: 8 hours ago, 5 flags -

911 emergency lines are DOWN across multiple states

Breaking Alternative News: 8 hours ago, 5 flags -

A Personal Cigar UFO/UAP Video footage I have held onto and will release it here and now.

Aliens and UFOs: 13 hours ago, 5 flags -

Former NYT Reporter Attacks Scientists For Misleading Him Over COVID Lab-Leak Theory

Education and Media: 10 hours ago, 4 flags -

Why did Phizer team with nanobot maker

Medical Issues & Conspiracies: 10 hours ago, 4 flags

active topics

-

Russian intelligence officer: explosions at defense factories in the USA and Wales may be sabotage

Weaponry • 82 • : FlyersFan -

Biden--My Uncle Was Eaten By Cannibals

US Political Madness • 0 • : CarlLaFong -

"We're All Hamas" Heard at Columbia University Protests

Social Issues and Civil Unrest • 0 • : FlyersFan -

Abortions in first 12 weeks should be legalised in Germany, commission says

Medical Issues & Conspiracies • 27 • : Vermilion -

Elites disapearing

Political Conspiracies • 23 • : chiefsmom -

Israel ufo shoot down drones?

Aliens and UFOs • 27 • : Brigadier1970 -

Former NYT Reporter Attacks Scientists For Misleading Him Over COVID Lab-Leak Theory

Education and Media • 4 • : Vermilion -

Russia Flooding

Other Current Events • 4 • : Dalamax -

African "Newcomers" Tell NYC They Don't Like the Free Food or Shelter They've Been Given

Social Issues and Civil Unrest • 8 • : FlyersFan -

I Guess Cloud Seeding Works

Fragile Earth • 22 • : Degradation33