It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

CNN

The last one is the one you should be paying attention. SOMEONE knows what's happening and why and they aren't telling anybody. That should have all of you worried.

Those T-bill purchases drew enormous demand, banks requesting nearly four times as much cash from the Fed with .

These aggressive steps from the Fed, along with the strong demand from banks, shows that the overnight lending market is not back to normal. Banks are still clamoring for cash -- and the Fed is rushing to fill the vacuum.

The NY Fed eased the stress by injecting tons of cash, marking its first rescue in the overnight lending market since 2008.

"It is worrisome that these numbers continue to rise, and we don't yet have a very clear explanation," said Colas.

The last one is the one you should be paying attention. SOMEONE knows what's happening and why and they aren't telling anybody. That should have all of you worried.

www.zerohedge.com...

The only possible explanation, is someone really needed to lock in cash for month end (the maturity of the op is on Nov 7) which is when a "No Deal" Brexit may go live, and as a result one or more banks are bracing for the worst. The question, as before, remains why: just what is the source of this unprecedented spike in liquidity needs in a system which already has $1.5 trillion in excess reserves? And while we await the answer, expect stocks to close pleasantly in the green as dealers transform their newly granted liquidity into bets on risk assets.

almost everyone that thought about buying short term bonds/paper isturning their backs and zipping up their wallets... the buying is collapsing

just like the EZ Auto Loans, for say 5 years... those people don't buy Bank or Treasury Paper/bonds..

.but neither are they paying their Loans.... even recent brand new auto loans are in default at about a 400% increase from normal

~I reckon the buyers are buying a new car to live-in then skipping town to a better job market, knowing the banks or Re-Po man won't likely get them any time soon~

most everyone is hand-to-mouth cash flow

ETA: usawatchdog.com...

link has a 44:44 YT with interview of Michael Pento

(There is free information on PentoPort.com. To become a subscriber to Michael Pento’s podcasts, click here. There is a five week free trial option.)

in the OP linked YT... the speaker stated the Banks are in Trouble, more so than in the great recession…

your housing defaults along side the car loan defaulta are sapping the Banks' reserves & they are cash strapped because the masses are defaulting enmasse on bank loans, finance obligations through other outlets ---- so that B anks are sinking to bankruptcy and can't buy Fed default assets nor bonds/paper/et al.... the B lack Swan is the bankers are all gone-fishing

just like the EZ Auto Loans, for say 5 years... those people don't buy Bank or Treasury Paper/bonds..

.but neither are they paying their Loans.... even recent brand new auto loans are in default at about a 400% increase from normal

~I reckon the buyers are buying a new car to live-in then skipping town to a better job market, knowing the banks or Re-Po man won't likely get them any time soon~

most everyone is hand-to-mouth cash flow

edit on th31157222164127142019 by St Udio because: (no reason given)

ETA: usawatchdog.com...

link has a 44:44 YT with interview of Michael Pento

(There is free information on PentoPort.com. To become a subscriber to Michael Pento’s podcasts, click here. There is a five week free trial option.)

edit on th31157222236927262019 by St Udio because: (no reason given)

in the OP linked YT... the speaker stated the Banks are in Trouble, more so than in the great recession…

your housing defaults along side the car loan defaulta are sapping the Banks' reserves & they are cash strapped because the masses are defaulting enmasse on bank loans, finance obligations through other outlets ---- so that B anks are sinking to bankruptcy and can't buy Fed default assets nor bonds/paper/et al.... the B lack Swan is the bankers are all gone-fishing

edit on th31157222313227382019 by St Udio because: (no reason

given)

originally posted by: scraedtosleep

a reply to: toysforadults

Could this be related?

Lot of ceo's resigning.

www.resignation.info...

www.businessinsider.com...

During the first three quarters of 2019, 1,160 CEOs left their positions, according to the staffing firm Challenger, Gray, & Christmas.

This figure exceeds the number of CEOs who departed during the same nine-month span at the height of the 2008 recession (which saw 1,132 CEO departures).

The tech sector has seen the second-highest number of CEO departures, with 154 executives in that industry leaving their positions.

a reply to: toysforadults

They know the whole system is stuffed, and any one with any sense is organizing hard assets while they can. CEO's would be well up with the play.

They know the whole system is stuffed, and any one with any sense is organizing hard assets while they can. CEO's would be well up with the play.

Just read someone commenting that the repo market lock up may be related to either a large foriegn bank ( think Deutsche Bank) failing and/ or

unforeseen systemic issues with negative yielding bonds. The second part makes a lot of sense as to what has happened.

The repo market is a place where banks, insurers, and others get their liquidity needs. A bond with a negative 1 percent coupon with 6 years to maturity is only going to be worth 94% of its face value if you accept it as collateral and then get stuck with it, if your debtor defaults. So you'd be a fool to lend anything like it's face value. There is a lot of this negative yielding sovereign debt on EU bank balance sheets right now.

The repo market should be the most boring function of the financial system. To be locked up this long, and requiring this level of FED action says that the banksters have once again pooped in the pool and will soon be screaming for a bailout because no one saw this crisis coming.

The repo market is a place where banks, insurers, and others get their liquidity needs. A bond with a negative 1 percent coupon with 6 years to maturity is only going to be worth 94% of its face value if you accept it as collateral and then get stuck with it, if your debtor defaults. So you'd be a fool to lend anything like it's face value. There is a lot of this negative yielding sovereign debt on EU bank balance sheets right now.

The repo market should be the most boring function of the financial system. To be locked up this long, and requiring this level of FED action says that the banksters have once again pooped in the pool and will soon be screaming for a bailout because no one saw this crisis coming.

edit on 28-10-2019 by jefwane because: Typo

a reply to: toysforadults

Everything is expressed in US dollars, many countries are buying in because their countries fiat is weaker so its a perceived flight to safety. So America has to hold Euros and issue dollars. The only place for these dollars to hang out is in the stock market because everything else cant cut the mustard. Hence the stock market reaching new highs. This has the effect of keeping the price of Gold and Silver suppressed because it keeps demand down. This allows central banks to buy at suppressed prices.

Every economy on Earth exists because of stable food supply, if the supply shows any sign of instability the effect on the stock market will be the same as oil interruptions. According to the MSM the poor harvest is nothing to worry about, even though the price of a box of Kellogg's has gone up thirty per cent in Australia. This inflation in food prices should suppress the retail sector over the Christmas period, with the penny dropping after Xmas, when a flight to safety should begin. Many asset managers are putting a per cent age of gold into clients portfolios. But if the Central Banks have bought all the cheap precious metals, and demand goes up for what's left in the event of a rush, that would put a strong competitor against the Fiat dollar. Since the American dollar is the only game in town, and has to chase Gold/Silver as demand increases we could be looking as massive inflation in the new year at least under this scenario.

Everything is expressed in US dollars, many countries are buying in because their countries fiat is weaker so its a perceived flight to safety. So America has to hold Euros and issue dollars. The only place for these dollars to hang out is in the stock market because everything else cant cut the mustard. Hence the stock market reaching new highs. This has the effect of keeping the price of Gold and Silver suppressed because it keeps demand down. This allows central banks to buy at suppressed prices.

Every economy on Earth exists because of stable food supply, if the supply shows any sign of instability the effect on the stock market will be the same as oil interruptions. According to the MSM the poor harvest is nothing to worry about, even though the price of a box of Kellogg's has gone up thirty per cent in Australia. This inflation in food prices should suppress the retail sector over the Christmas period, with the penny dropping after Xmas, when a flight to safety should begin. Many asset managers are putting a per cent age of gold into clients portfolios. But if the Central Banks have bought all the cheap precious metals, and demand goes up for what's left in the event of a rush, that would put a strong competitor against the Fiat dollar. Since the American dollar is the only game in town, and has to chase Gold/Silver as demand increases we could be looking as massive inflation in the new year at least under this scenario.

a reply to: anonentity

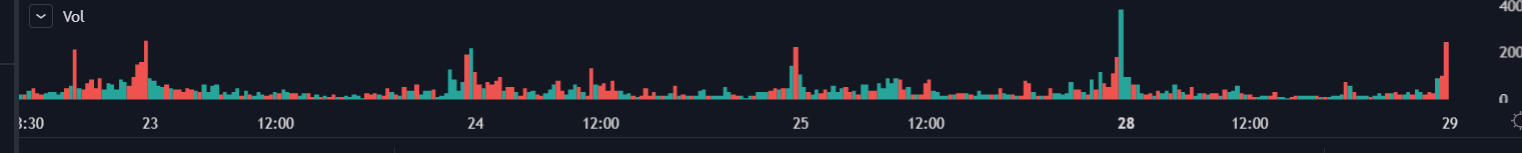

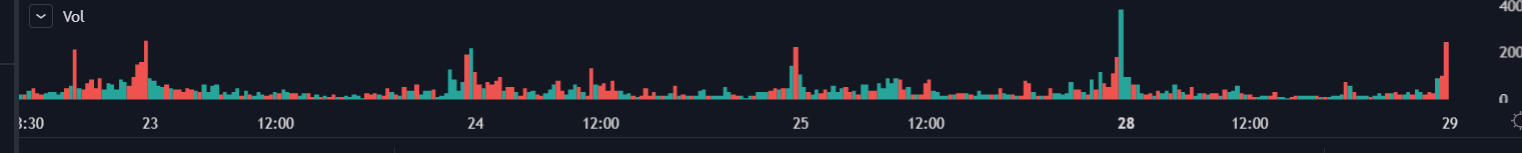

once the Fed drops rates on Wednesday, there might be a massive move into bonds and eventually PMs, the volume has been dead waiting for the Fed meeting and we gap up in the morning with zero follow through day after day

I'm expecting a solid sell off and move into bonds and PMs Wednesday-Friday in that time frame

once the Fed drops rates on Wednesday, there might be a massive move into bonds and eventually PMs, the volume has been dead waiting for the Fed meeting and we gap up in the morning with zero follow through day after day

I'm expecting a solid sell off and move into bonds and PMs Wednesday-Friday in that time frame

a reply to: toysforadults

I wonder... simply because if they move to bonds, the Fed just pumps up the share market again, its not like they have to print notes, the money is just created on a screen. None of this new money does anything for the real economy, in fact it cant because theirs nothing to invest in outside the Stock market without getting into deep water. This illusion could go on for a long time. Since theirs a lack of cash in the real economy, demand is falling as Hooverville accelerates.

I wonder... simply because if they move to bonds, the Fed just pumps up the share market again, its not like they have to print notes, the money is just created on a screen. None of this new money does anything for the real economy, in fact it cant because theirs nothing to invest in outside the Stock market without getting into deep water. This illusion could go on for a long time. Since theirs a lack of cash in the real economy, demand is falling as Hooverville accelerates.

a reply to: anonentity

look at the S&P the last few days, gap up, no follow through flat day, this is basically the last 2 weeks (which can be somewhat normal going into FOMC)

Look at the volume, today it was 2 million in the first hour then dead for the rest of the day, I could take 30-40 minute breaks from watching the market and come back to the same exact candlesticks, but you see how it's everyday there's a gap up then flat/ dead market for the rest of the day with super low volume

it's like there's no institutional investing happening right now

look at the S&P the last few days, gap up, no follow through flat day, this is basically the last 2 weeks (which can be somewhat normal going into FOMC)

Look at the volume, today it was 2 million in the first hour then dead for the rest of the day, I could take 30-40 minute breaks from watching the market and come back to the same exact candlesticks, but you see how it's everyday there's a gap up then flat/ dead market for the rest of the day with super low volume

it's like there's no institutional investing happening right now

edit on 28-10-2019 by toysforadults because: (no reason given)

a reply to: anonentity

Look at the channel the SPY is in...

it gaps up over to ATH today (all time high) and then literally rides right along the trendline I've had sitting there for about 2 weeks and then closes right below it, that's a very weak break up/ out.. no institutional commitment to ATH's

now look at the SPY (S&P ETF), you see how it has been forming this larger pattern of reaching highs then correcting down, another high, correction, another high, correction?

With the Fed dropping rates for the 3rd time in a row, repo market chaos, and POMO... something is up.. one or more of the big banks is failing.

www.investopedia.com...

www.zacks.com...

This is Germany and the EU's banking crisis bleeding into the US stock markets and banking system.

www.theguardian.com...

markets.businessinsider.com...

Look at the channel the SPY is in...

it gaps up over to ATH today (all time high) and then literally rides right along the trendline I've had sitting there for about 2 weeks and then closes right below it, that's a very weak break up/ out.. no institutional commitment to ATH's

now look at the SPY (S&P ETF), you see how it has been forming this larger pattern of reaching highs then correcting down, another high, correction, another high, correction?

With the Fed dropping rates for the 3rd time in a row, repo market chaos, and POMO... something is up.. one or more of the big banks is failing.

www.investopedia.com...

Repo 105 was a type of loophole in accounting for repurchase (repo) transactions that the now-extinguished Lehman Brothers exploited in an attempt to hide true amounts of leverage during its times of trouble in 2007-2008. In this repurchase agreement, since updated to close the loophole, a company could classify a short-term loan as a sale and subsequently use the cash proceeds from the "sale" to reduce its liabilities.

www.zacks.com...

Per the source, the first loan worth $340 million, backing the leveraged buyout of Smart & Final grocery chain by Apollo Global Management, was priced at a discount of 90 cents on the dollar by a group of banks led by Deutsche Bank, on the one hand. Moreover, such deal eroded the fees to be earned by the bank on the transaction. Though the amount of loss was not known, it was incurred as investors refrained from buying the debt under the prior terms offered.

This is Germany and the EU's banking crisis bleeding into the US stock markets and banking system.

www.theguardian.com...

markets.businessinsider.com...

Germany's economy may have already slumped into recession, its central bank says

a reply to: toysforadults

I came across this discourse in a Gold orientated thread posted way back in 97'. Basically it states that if you were a middle eastern oil producing nation, you were never going to sell the only thing your country had of real value for American dollars which may end up worthless in a hundred years time. , but you would sell it at least a proportion of it as long as some of the deal was done in real money i.e.. Gold. So a deal was set up to facilitate this and keep all parties happy. The whole discourse maintains that the price of gold has to be kept controlled because the moment it doesn't a bull market develops and Gold goes into lockdown. It goes on to claim, that because the Western society is oil dependent, the control of the Gold price remains essential. So a form of stealth purchasing is used so as not to upset the apple cart. When this discourse was produced Gold was about 350 US dollars an ounce. Twenty years later its around 1500us per ounce. The LMBA which fixes the price opened its books around the time this discourse was produced, it literally shocked the world as to how much gold was being used as a real money source to settle transactions around the world. Now that the US dollar is being used to bail out Banks and institutions with regards to QE. The spot price of Gold with regards to partial settling on oil deals would have a lot of pressure on it to go up. But the price of oil would also go up, which would drive the West into a deeper recession. Until as the article states controls on the price of Gold would cease to exist and it would skyrocket until it would have to be withdrawn from sale, when this point will happen cant be pinpointed with any accuracy but it will coincide with the rise of the US Dollar and the rise in the price of Gold at the same time. Guess what it happened the other day.www.usagold.com...

I came across this discourse in a Gold orientated thread posted way back in 97'. Basically it states that if you were a middle eastern oil producing nation, you were never going to sell the only thing your country had of real value for American dollars which may end up worthless in a hundred years time. , but you would sell it at least a proportion of it as long as some of the deal was done in real money i.e.. Gold. So a deal was set up to facilitate this and keep all parties happy. The whole discourse maintains that the price of gold has to be kept controlled because the moment it doesn't a bull market develops and Gold goes into lockdown. It goes on to claim, that because the Western society is oil dependent, the control of the Gold price remains essential. So a form of stealth purchasing is used so as not to upset the apple cart. When this discourse was produced Gold was about 350 US dollars an ounce. Twenty years later its around 1500us per ounce. The LMBA which fixes the price opened its books around the time this discourse was produced, it literally shocked the world as to how much gold was being used as a real money source to settle transactions around the world. Now that the US dollar is being used to bail out Banks and institutions with regards to QE. The spot price of Gold with regards to partial settling on oil deals would have a lot of pressure on it to go up. But the price of oil would also go up, which would drive the West into a deeper recession. Until as the article states controls on the price of Gold would cease to exist and it would skyrocket until it would have to be withdrawn from sale, when this point will happen cant be pinpointed with any accuracy but it will coincide with the rise of the US Dollar and the rise in the price of Gold at the same time. Guess what it happened the other day.www.usagold.com...

the event will be China announcing their Gold Hoard and the releasing their Gold Backed, Crypto Yuan---

All near the USA 's 2020 elections and before New Year 2021

here's a few of my inputs over the past few weeks:

just a mini-data dump.... sift through the sandbox

sept-oct 2020 the financial paradigm will be overthrown by China

the USA & reserve dollar go defunct, the proxy armies of the CIA lose all ability to sustain itselves as the dollar is unstable & due to hyper-inflate as a result of the China financial system replacing the London-NY- BIS … bowl-of-du$t

All near the USA 's 2020 elections and before New Year 2021

here's a few of my inputs over the past few weeks:

kingworldnews.com...

Greyerz – This Will Be Spectacular And Frightening, Plus China Has More Than 20,000 Tonnes Of Gold

www.zerohedge.com...

(( As I have outlined in past articles, cryptocurrency and blockchain tech have no anonymity whatsoever despite claims originally circulated by proponents and crypto-activists.

It is also clear that central banks intend to introduce their own highly managed currencies and most other coins will be buried in the process.((3/4th down page)) *****

> as opposed to Fed Reserve issued cyber coins

[[[the 12 or 13 banks that comprise the federal reserve central bank here in USA... might just be permitted to issue their brand-name crypto coin under the central banker rules ]]]

www.prophecynewswatch.com...

www.zerohedge.com...

neural thread: concerning the illusion of decentralized crypto coins...the money changers would replace the dope cartels, among other underground activities in the swapping of assets/valued cryptos

~~~~~~~~~~~~~~~~~

CHINA ROAD AND BELT, DIGITAL CURRENCY W/GOLD BACKING (ASSETS)-> rare earths/pm/quantum-cyber technology to manage crypto currency unlike present bitcoin era technology

www.zerohedge.com...

2nd video has Celente, both vids around 12 minutes each, china 20 tonns gold & planning gold backed CRYPTO by sept 2020

just a mini-data dump.... sift through the sandbox

sept-oct 2020 the financial paradigm will be overthrown by China

the USA & reserve dollar go defunct, the proxy armies of the CIA lose all ability to sustain itselves as the dollar is unstable & due to hyper-inflate as a result of the China financial system replacing the London-NY- BIS … bowl-of-du$t

I reread my post of last DEC.

completely missed the novel-coronavirus outbreak in China or perhaps 'by' China

the deep-state/Globalists are the likely Perps of releasing the bio-weapon

the entire trade and tariff system is in chaos... the supply- delivery models are kaput... concentrated factories & workforces in concentrated locations are the nightmare of the Globlisation Planners...

all China got left is tonnes of PMs like gold and a busted economy with the serfs quieted down for now or until the killer virus passes then the protests resume with more intensity and Anarchy

completely missed the novel-coronavirus outbreak in China or perhaps 'by' China

the deep-state/Globalists are the likely Perps of releasing the bio-weapon

the entire trade and tariff system is in chaos... the supply- delivery models are kaput... concentrated factories & workforces in concentrated locations are the nightmare of the Globlisation Planners...

all China got left is tonnes of PMs like gold and a busted economy with the serfs quieted down for now or until the killer virus passes then the protests resume with more intensity and Anarchy

new topics

-

Geddy Lee in Conversation with Alex Lifeson - My Effin’ Life

People: 49 minutes ago -

God lived as a Devil Dog.

Short Stories: 1 hours ago -

Happy St George's day you bigots!

Breaking Alternative News: 2 hours ago -

TLDR post about ATS and why I love it and hope we all stay together somewhere

General Chit Chat: 3 hours ago -

Hate makes for strange bedfellows

US Political Madness: 5 hours ago -

Who guards the guards

US Political Madness: 8 hours ago -

Has Tesla manipulated data logs to cover up auto pilot crash?

Automotive Discussion: 10 hours ago

top topics

-

Hate makes for strange bedfellows

US Political Madness: 5 hours ago, 14 flags -

whistleblower Captain Bill Uhouse on the Kingman UFO recovery

Aliens and UFOs: 15 hours ago, 11 flags -

Who guards the guards

US Political Madness: 8 hours ago, 10 flags -

1980s Arcade

General Chit Chat: 17 hours ago, 7 flags -

TLDR post about ATS and why I love it and hope we all stay together somewhere

General Chit Chat: 3 hours ago, 4 flags -

Happy St George's day you bigots!

Breaking Alternative News: 2 hours ago, 3 flags -

Has Tesla manipulated data logs to cover up auto pilot crash?

Automotive Discussion: 10 hours ago, 2 flags -

God lived as a Devil Dog.

Short Stories: 1 hours ago, 1 flags -

Geddy Lee in Conversation with Alex Lifeson - My Effin’ Life

People: 49 minutes ago, 1 flags

active topics

-

Happy St George's day you bigots!

Breaking Alternative News • 19 • : BedevereTheWise -

Geddy Lee in Conversation with Alex Lifeson - My Effin’ Life

People • 1 • : WakeofPoseidon -

British TV Presenter Refuses To Use Guest's Preferred Pronouns

Education and Media • 116 • : Consvoli -

Michael Avenatti Says He Will Testify FOR Trump

US Political Madness • 62 • : WeMustCare -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 621 • : Justoneman -

SC Jack Smith is Using Subterfuge Tricks with Donald Trumps Upcoming Documents Trial.

Dissecting Disinformation • 109 • : WeMustCare -

"We're All Hamas" Heard at Columbia University Protests

Social Issues and Civil Unrest • 245 • : RazorV66 -

Candidate TRUMP Now Has Crazy Judge JUAN MERCHAN After Him - The Stormy Daniels Hush-Money Case.

Political Conspiracies • 728 • : Justoneman -

New whistleblower Jason Sands speaks on Twitter Spaces last night.

Aliens and UFOs • 43 • : Ophiuchus1 -

Republican Voters Against Trump

2024 Elections • 287 • : some_stupid_name