It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

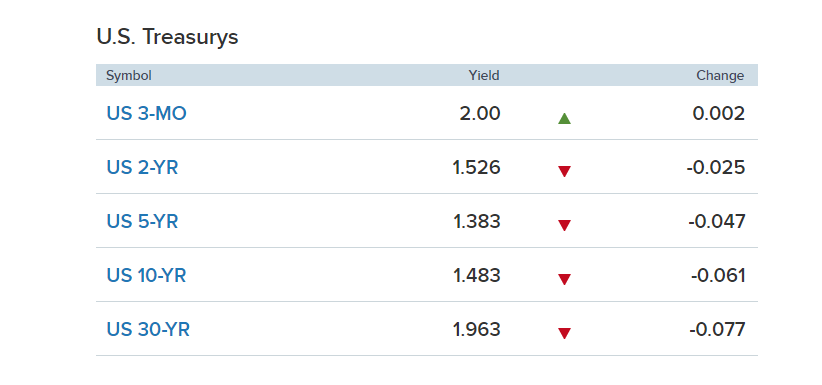

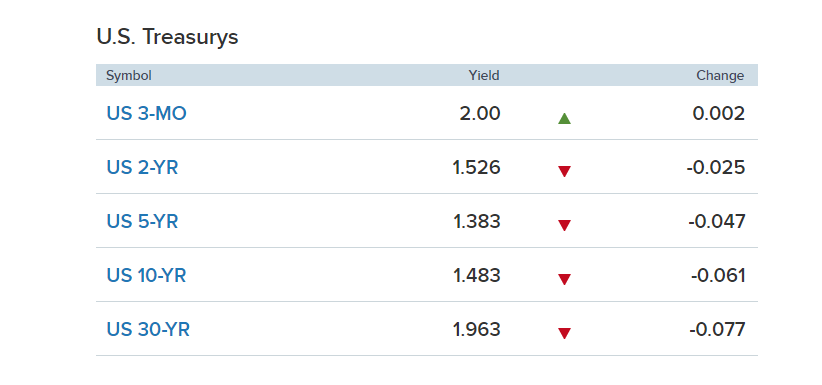

Pic of the current treasury rates...

Traders what are you thinking?

I just took all of my stock yesterday and sold ALL OF IT and dumped my money into a junior miner that just signed an investment deal for Aug 30th where the investor bought in at 1.50 price point and it's currently at 1.20.

I will be dumping more into that junior miner this week. Current bond yields are crazy and Trump is about to pay for destroying investor confidence with his Tweets.

Traders what are you thinking?

I just took all of my stock yesterday and sold ALL OF IT and dumped my money into a junior miner that just signed an investment deal for Aug 30th where the investor bought in at 1.50 price point and it's currently at 1.20.

I will be dumping more into that junior miner this week. Current bond yields are crazy and Trump is about to pay for destroying investor confidence with his Tweets.

a reply to: toysforadults

Nah, f$ck that. If you can’t corner the orange juice concentrate commodities market, call these guys:

Diversify your bonds, 'n-word'!

And get that money. Killer Bs swarming on that Wall Street a$$! Remember dat

Nah, f$ck that. If you can’t corner the orange juice concentrate commodities market, call these guys:

Diversify your bonds, 'n-word'!

And get that money. Killer Bs swarming on that Wall Street a$$! Remember dat

edit on Tue Aug 27 2019 by DontTreadOnMe because:

Do Not Evade the Automatic Censors

a reply to: toysforadults

SELL SELL, I have no idea what I am talking about when it comes to investing but orange juice worked back then, lol

SELL SELL, I have no idea what I am talking about when it comes to investing but orange juice worked back then, lol

edit on 27-8-2019 by UpIsNowDown because: typo

a reply to: toysforadults

Ha. Nice. I’m sure GZA and his fiduciary cohorts would agree: you’re catching a falling knife. We tapped out in March of ‘18, actually turning a lil bit on US Steel, too.

What I’m curious about concerns gambling and institutional investors ability to ‘experiment’ in those markets. It’s (gambling) been legal in the U.K. for the longest time, so I’m sure I’ll eventually google it and they’ll be an instant answer... the same econometrics are used and the data is cheap and asymmetric info is almost guaranteed, so it seems a no-brainer. Such a no-brainer it’s likely prohibited and this is just spit-balling.

Ha. Nice. I’m sure GZA and his fiduciary cohorts would agree: you’re catching a falling knife. We tapped out in March of ‘18, actually turning a lil bit on US Steel, too.

What I’m curious about concerns gambling and institutional investors ability to ‘experiment’ in those markets. It’s (gambling) been legal in the U.K. for the longest time, so I’m sure I’ll eventually google it and they’ll be an instant answer... the same econometrics are used and the data is cheap and asymmetric info is almost guaranteed, so it seems a no-brainer. Such a no-brainer it’s likely prohibited and this is just spit-balling.

How will this correlate with the average near and long term housing markets?

a reply to: toysforadults

Gotcha. What do they mine? I’m fairly confident we’ll still be digging holes here on earth for a good while and just having leasing rights pays in perpetuity...or at least until they actually pull it off in space (in betting parlance those are long odds). Best of luck.

Gotcha. What do they mine? I’m fairly confident we’ll still be digging holes here on earth for a good while and just having leasing rights pays in perpetuity...or at least until they actually pull it off in space (in betting parlance those are long odds). Best of luck.

originally posted by: 38181

How will this correlate with the average near and long term housing markets?

Mortgage rates are falling. They are highly correlated with the 10 year treasury. People are still buying, but I do think we are at the top of the housing market right now.

In my market here in Chicago, any gains are being eroded by property taxes that keep going up which is the elephant in the room. Some areas have seen no gains in property values in like 15 years...

I live in a highly desirable wealthy suburb in Chicago area. I'd be lucky to get what I paid for my house 15 years ago. However, my property tax bill has more than doubled in that time frame.

edit on 27-8-2019 by Edumakated because: (no reason given)

originally posted by: toysforadults

a reply to: 38181

housing markets will get propped up by lower interest rates and higher inflation

your major concern should be debt when it comes to housing, lower rates and higher inflation are good for housing unless no one is buying

In some markets, no one is buying... top end markets like NYC and west coast are seeing fairly significant slow downs.

a reply to: Edumakated

I just read both your post, thanks for the info I'm not up on my housing market game

I just read both your post, thanks for the info I'm not up on my housing market game

a reply to: toysforadults

Don’t worry, brother. I imagine the person who moves on ‘market advice’ from random internet posters, probably shares the same profile as the person those PSAs for scammers calling parents for jail money are intended for, but not me.

Like I said, get that money. Just full disclosure in letting you know I tapped out in March of 2018. Also true the old lady’s account held a significant position in US Steel (I wanna say she had it since 2014, well before there was cohabitation, so that wasn’t me) and she unloaded all of it, making out fairly well given how poorly it had performed.

Don’t worry, brother. I imagine the person who moves on ‘market advice’ from random internet posters, probably shares the same profile as the person those PSAs for scammers calling parents for jail money are intended for, but not me.

Like I said, get that money. Just full disclosure in letting you know I tapped out in March of 2018. Also true the old lady’s account held a significant position in US Steel (I wanna say she had it since 2014, well before there was cohabitation, so that wasn’t me) and she unloaded all of it, making out fairly well given how poorly it had performed.

a reply to: Edumakated

Yah, chicago is a joke. Hows that Netflix tax? You want to move out of Chicago? Pay the exit tax. I figure you are probably in Barrington, maybe on the lake if you are lucky. My sister lives in a nice place in Wicker Park. Value of her place dropped 130k in the last year. Best of luck!

Yah, chicago is a joke. Hows that Netflix tax? You want to move out of Chicago? Pay the exit tax. I figure you are probably in Barrington, maybe on the lake if you are lucky. My sister lives in a nice place in Wicker Park. Value of her place dropped 130k in the last year. Best of luck!

a reply to: toysforadults

When the stock markets finally crash for good. The world will be a better place.

When the stock markets finally crash for good. The world will be a better place.

a reply to: Cravens

I totally understand and I'm playing a speculative game right now. I know a lot of people who have been out of the market for a while.

Lot of people moving into gold and bonds it looks like to me based on the yield curve we aren't alone on our assumptions.

I totally understand and I'm playing a speculative game right now. I know a lot of people who have been out of the market for a while.

Lot of people moving into gold and bonds it looks like to me based on the yield curve we aren't alone on our assumptions.

originally posted by: Edumakated

originally posted by: toysforadults

a reply to: 38181

housing markets will get propped up by lower interest rates and higher inflation

your major concern should be debt when it comes to housing, lower rates and higher inflation are good for housing unless no one is buying

In some markets, no one is buying... top end markets like NYC and west coast are seeing fairly significant slow downs.

Iowa (Des Moines) market is stable. In 2009 i think we only saw a 5% drop in prices and it recovered pretty quick, but new construction was stagnant, driving up the price of materials. And that has never gone back down.

a reply to: drewlander

hmmm interesting I would think that less demand for construction materials would drive prices down due to suppliers needing to dump inventory

maybe it's the inflation rate increasing?

hmmm interesting I would think that less demand for construction materials would drive prices down due to suppliers needing to dump inventory

maybe it's the inflation rate increasing?

new topics

-

Russia Flooding

Other Current Events: 1 hours ago -

MULTIPLE SKYMASTER MESSAGES GOING OUT

World War Three: 1 hours ago -

Two Serious Crimes Committed by President JOE BIDEN that are Easy to Impeach Him For.

US Political Madness: 2 hours ago -

911 emergency lines are DOWN across multiple states

Breaking Alternative News: 2 hours ago -

Former NYT Reporter Attacks Scientists For Misleading Him Over COVID Lab-Leak Theory

Education and Media: 4 hours ago -

Why did Phizer team with nanobot maker

Medical Issues & Conspiracies: 4 hours ago -

Pro Hamas protesters at Columbia claim hit with chemical spray

World War Three: 5 hours ago -

Elites disapearing

Political Conspiracies: 7 hours ago -

A Personal Cigar UFO/UAP Video footage I have held onto and will release it here and now.

Aliens and UFOs: 7 hours ago -

Go Woke, Go Broke--Forbes Confirms Disney Has Lost Money On Star Wars

Movies: 9 hours ago

top topics

-

British TV Presenter Refuses To Use Guest's Preferred Pronouns

Education and Media: 15 hours ago, 17 flags -

Go Woke, Go Broke--Forbes Confirms Disney Has Lost Money On Star Wars

Movies: 9 hours ago, 13 flags -

Pro Hamas protesters at Columbia claim hit with chemical spray

World War Three: 5 hours ago, 11 flags -

Trump To Hold Dinner with President of Poland At Trump Tower Tonight

2024 Elections: 17 hours ago, 8 flags -

Tucker Carlson interviews Christian pastor from Bethlehem.

Middle East Issues: 17 hours ago, 8 flags -

Elites disapearing

Political Conspiracies: 7 hours ago, 7 flags -

Freddie Mercury

Paranormal Studies: 9 hours ago, 7 flags -

A Personal Cigar UFO/UAP Video footage I have held onto and will release it here and now.

Aliens and UFOs: 7 hours ago, 5 flags -

Nirvana - Immigrant Song

Music: 14 hours ago, 5 flags -

Why did Phizer team with nanobot maker

Medical Issues & Conspiracies: 4 hours ago, 4 flags

active topics

-

Echo & The Bunnymen - The Killing Moon!

Music • 11 • : Freeborn -

MULTIPLE SKYMASTER MESSAGES GOING OUT

World War Three • 8 • : Zaphod58 -

Mood Music Part VI

Music • 3049 • : boozo -

Are the 'Abrahamic Religions' all Really the Worshipping the Same Abrahamic God?

Conspiracies in Religions • 191 • : ToneD -

Go Woke, Go Broke--Forbes Confirms Disney Has Lost Money On Star Wars

Movies • 16 • : GotterDameron23 -

Pro Hamas protesters at Columbia claim hit with chemical spray

World War Three • 12 • : GENERAL EYES -

Elites disapearing

Political Conspiracies • 17 • : AwakeNotWoke -

A family from Kansas with six children moved to the Moscow region

Other Current Events • 74 • : Freeborn -

The US Supreme Court Appears to Side With the January 6th 2021 Capitol Protestors.

Political Conspiracies • 43 • : GotterDameron23 -

Why did Phizer team with nanobot maker

Medical Issues & Conspiracies • 4 • : AwakeNotWoke