It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

The American economy is slowing, dragged down by trade tensions and weak growth overseas. But there are few signs that the decade-long expansion is on the verge of stalling out.

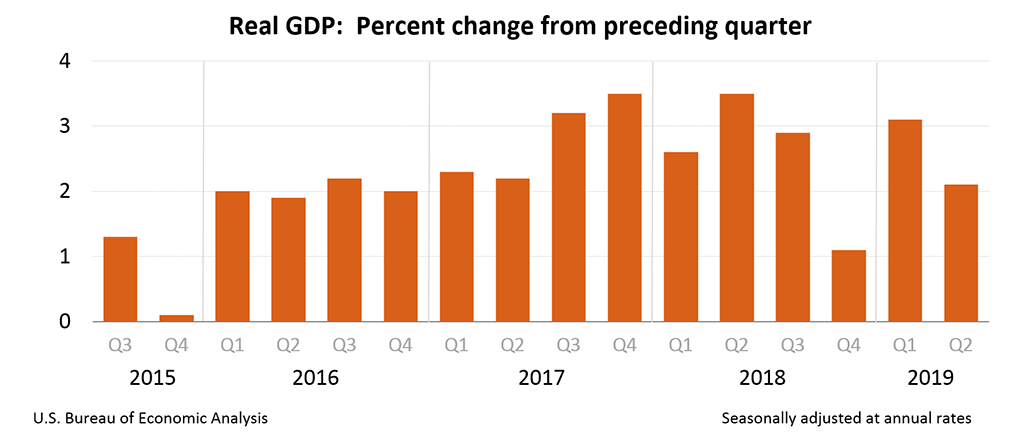

Gross domestic product, the broadest measure of goods and services produced in the economy, rose at a 2.1 percent annual rate in the second quarter, according to preliminary data released by the Commerce Department on Friday.

That is significantly lower than the 3.1 percent growth rate in the first quarter. And it falls far short of the 3 percent target that President Trump has repeatedly promised. Data revisions released Friday wiped away what had been a prized talking point for the White House: G.D.P. grew 2.5 percent for all of 2018, down from the 3 percent previously reported.

Government Link

NY Times Link

It's not the end of the world, 2.1% is not that terrible and it's just a bit lower than the average for last year, which was a 2.5% through 2018... dragged down by an abysmal fourth quarter that barely broke 1% growth.

Still, we are far from the promised 4% and 5% growth, but on par with the GDP of Obama's years. However, the Obama/Trump economy is starting to show weakness and the tariff wars could push us into a recession that we have been warned about, more so recently. We're currently still riding the economy wave that has now started over 10 years ago, the longest expansion in history, but this next quarter will probably tell us what is to come.

In my area especially, things are not looking good for the next few years. A big government DoE contract that creates a lot of jobs here, tens of thousands, is being downsized at the expense of nature and cleanup and safety. Additionally, the largest home builder in the area just went bankrupt and left dozens of other contractors and vendors tens of millions of Dollars in debt. And this is the fastest growing area in the State.

Next quarter will tell us everything: unless we bounce back up to 3% or better next quarter, this year will be lower than the last year's 2.5% growth and could be a sign of worse times to come. What is everyone else seeing? Are ATS readers immune to what is happening elsewhere around us?

edit on 27-7-2019 by Duderino because: (no reason given)

a reply to: Duderino

Crickets.....

When a country (USA) is losing many billions of dollars on trade with virtually every country it does business with, trade wars are good, and easy to win. Example, when we are down $100 billion with a certain country and they get cute, don’t trade anymore-we win big. It’s easy!

Peace

Crickets.....

When a country (USA) is losing many billions of dollars on trade with virtually every country it does business with, trade wars are good, and easy to win. Example, when we are down $100 billion with a certain country and they get cute, don’t trade anymore-we win big. It’s easy!

Peace

Here in Tennessee we are doing well. My business in running strong. Staffing is our biggest problem. I could use 10 more good men Monday.

originally posted by: lakenheath24

a reply to: Duderino

Thats okay then...lets go to 5-6 percent. Then inflation goes up along with interest rates. The global ecomony aint for workin peeps. Op

We're not going to see a GDP that high, that is just something politicians promise the more gullible among us. The last time we had GDP anywhere near that was in 2014, under Obama. He had one quarter at 5.1% growth, and the ONLY reason that happened is because we were digging out of a recession and the previous quarter was in the red. If the previous quarters were stable, the growth would have been normal at 2-3%.

TPTB are setting-up a recession for next year !!!

It's gunna be a whooper !!!

😧

It's gunna be a whooper !!!

😧

Trumps economy is doing this well while the feds implement quantitative tightening, which I’m ok with. But if the fed was implementing

quantitative easing like they did during Obama’s entire presidency the GDP would be a lot higher.

Quantitative tightening is a contractionary monetary policy applied by a central bank to decrease the amount of liquidity within the economy. The policy is the reverse of quantitative easing aimed to increase money supply in order to "stimulate" the economy.

Quantitative tightening is a contractionary monetary policy applied by a central bank to decrease the amount of liquidity within the economy. The policy is the reverse of quantitative easing aimed to increase money supply in order to "stimulate" the economy.

edit on 27-7-2019 by

Middleoftheroad because: (no reason given)

originally posted by: Middleoftheroad

Trumps economy is doing this well while the feds implement quantitative tightening, which I’m ok with. But if the fed was implementing quantitative easing like they did during Obama’s entire presidency the GDP would be a lot higher.

Quantitative tightening is a contractionary monetary policy applied by a central bank to decrease the amount of liquidity within the economy. The policy is the reverse of quantitative easing aimed to increase money supply in order to "stimulate" the economy.

Yes, the Fed rate is higher than it was 2 years ago, but let's be real, it's a difference of less than 2% on the Fed rate. Presidents in the past have had stronger economic policies that got us through 15% to 20% Fed rates. That's a thousand percent higher than they are now.

We are at a 2.5% Fed rate currently. Most of Reagan's years had the rate at double digits, with 1980 and 1981 seeing a mind blowing 20% rate. 20%!

I think it's time to be realistic and stop trying to shift blame. We should just brush right past a 2.5% rate with a strong economy.

a reply to: Duderino

I think that too much of the American economy relies on ''bubbles'' . People with more than month to month money want to invest it because this is the way we do things here in this capitalist worlds. Those people look for whatever is showing returns and they then invest in those opportunities.

If they have invested in a bubble then when that bubble pops they pull out their money and go on to the next bubble. I call it skimming off the wealth from whatever might be a productive venture. Bubble to bubble. It was that huge bubble that popped under Bush 2 and which much of the Obama administration sought to restore. Questionably I might add.

But once things had gotten back on some kind of growth track, the bubble people began to look around for places to invest again. Trump took advantage of this cycle claiming it was all his leadership that brought about this latest economic upswing.

I see it differently. The short term profit bubble people are getting ready to pull their money once more and that crash, that short term profit bubble is going to go flat.

I think that too much of the American economy relies on ''bubbles'' . People with more than month to month money want to invest it because this is the way we do things here in this capitalist worlds. Those people look for whatever is showing returns and they then invest in those opportunities.

If they have invested in a bubble then when that bubble pops they pull out their money and go on to the next bubble. I call it skimming off the wealth from whatever might be a productive venture. Bubble to bubble. It was that huge bubble that popped under Bush 2 and which much of the Obama administration sought to restore. Questionably I might add.

But once things had gotten back on some kind of growth track, the bubble people began to look around for places to invest again. Trump took advantage of this cycle claiming it was all his leadership that brought about this latest economic upswing.

I see it differently. The short term profit bubble people are getting ready to pull their money once more and that crash, that short term profit bubble is going to go flat.

originally posted by: lakenheath24

a reply to: Duderino

Thats okay then...lets go to 5-6 percent. Then inflation goes up along with interest rates. The global ecomony aint for workin peeps. Op

If your a business owner or a financial investor that makes most their money off the global markets, you are doing good.

If you are of the working class, times are only going to get tougher as we head into the future and no politician is going to stop it since the greed for money is stronger than the love of country.

In order for people to accept the NWO, which the ground floor has already been laid, you only need to control them with their pursuit for money and they will follow.

edit on 27-7-2019 by jacobe001 because: (no reason given)

originally posted by: Middleoftheroad

Trumps economy is doing this well while the feds implement quantitative tightening, which I’m ok with. But if the fed was implementing quantitative easing like they did during Obama’s entire presidency the GDP would be a lot higher.

Quantitative tightening is a contractionary monetary policy applied by a central bank to decrease the amount of liquidity within the economy. The policy is the reverse of quantitative easing aimed to increase money supply in order to "stimulate" the economy.

In a free market, neither would be happening.

So we are a controlled economy, and by extension wages are controlled.

originally posted by: TerryMcGuire

a reply to: Duderino

I think that too much of the American economy relies on ''bubbles'' . People with more than month to month money want to invest it because this is the way we do things here in this capitalist worlds. Those people look for whatever is showing returns and they then invest in those opportunities.

If they have invested in a bubble then when that bubble pops they pull out their money and go on to the next bubble. I call it skimming off the wealth from whatever might be a productive venture. Bubble to bubble. It was that huge bubble that popped under Bush 2 and which much of the Obama administration sought to restore. Questionably I might add.

But once things had gotten back on some kind of growth track, the bubble people began to look around for places to invest again. Trump took advantage of this cycle claiming it was all his leadership that brought about this latest economic upswing.

I see it differently. The short term profit bubble people are getting ready to pull their money once more and that crash, that short term profit bubble is going to go flat.

Yep

And even worse, the government policies help fuel and collapse the bubbles so those corporate politicians and all extended people in the know cash in on it ahead of time before the bubble starts to collapse and everyone else is punished for it.

It is immoral and unethical.

a reply to: Duderino

Here's is what is likely to happen and it has in the past.

A Republican administration rides high on 'the economy' that was a result of the earlier administrations policies and actions. They then destroy any gains made, get voted out of office, then blame the 'bad economy' on the newly elected administration. Happens all the time - and people in general don't have the attention span or education to understand that "results lag in time from the adjustments that (maybe) caused them.

Here's is what is likely to happen and it has in the past.

A Republican administration rides high on 'the economy' that was a result of the earlier administrations policies and actions. They then destroy any gains made, get voted out of office, then blame the 'bad economy' on the newly elected administration. Happens all the time - and people in general don't have the attention span or education to understand that "results lag in time from the adjustments that (maybe) caused them.

a reply to: xuenchen

Alan Greenspan lowered interest rates like a Gypsy back in 1999 when employment was near 4.5%.

Ended up backtracking and raising rates in 2000 and 2001 which put the US into recession.

Not something you would want as an incumbent in an election year.

Alan Greenspan lowered interest rates like a Gypsy back in 1999 when employment was near 4.5%.

Ended up backtracking and raising rates in 2000 and 2001 which put the US into recession.

Not something you would want as an incumbent in an election year.

a reply to: jacobe001

Back in the early 80s I got my first real lesson in economics. One of those three week wonder pyramid schemes blew threw our area and many of the people I worked with as well as close friends got swept up in it. I didn't and despite my dire warnings to those around me most of them lost the thousand buck buy ins they had to pony up first for the big payoff.

I studied the whole boondoggle closely and as the next few years began to pass by I began noticing here and there how so much of the rest of our economic structure seemed to have a lot of similarities to that pyramid. First in and first out and everyone else sucking hind tit scrabbling for crumbs.

Back in the early 80s I got my first real lesson in economics. One of those three week wonder pyramid schemes blew threw our area and many of the people I worked with as well as close friends got swept up in it. I didn't and despite my dire warnings to those around me most of them lost the thousand buck buy ins they had to pony up first for the big payoff.

I studied the whole boondoggle closely and as the next few years began to pass by I began noticing here and there how so much of the rest of our economic structure seemed to have a lot of similarities to that pyramid. First in and first out and everyone else sucking hind tit scrabbling for crumbs.

new topics

-

Has Tesla paid towards cover up auto pilot crash?

Automotive Discussion: 2 minutes ago -

whistleblower Captain Bill Uhouse on the Kingman UFO recovery

Aliens and UFOs: 5 hours ago -

1980s Arcade

General Chit Chat: 7 hours ago -

Deadpool and Wolverine

Movies: 7 hours ago -

Teenager makes chess history becoming the youngest challenger for the world championship crown

Other Current Events: 9 hours ago -

CIA botched its handling of sexual assault allegations, House intel report says

Breaking Alternative News: 10 hours ago

top topics

-

Lawsuit Seeks to ‘Ban the Jab’ in Florida

Diseases and Pandemics: 12 hours ago, 20 flags -

Starburst galaxy M82 - Webb Vs Hubble

Space Exploration: 14 hours ago, 13 flags -

The Superstition of Full Moons Filling Hospitals Turns Out To Be True!

Medical Issues & Conspiracies: 16 hours ago, 8 flags -

CIA botched its handling of sexual assault allegations, House intel report says

Breaking Alternative News: 10 hours ago, 8 flags -

15 Unhealthiest Sodas On The Market

Health & Wellness: 14 hours ago, 6 flags -

whistleblower Captain Bill Uhouse on the Kingman UFO recovery

Aliens and UFOs: 5 hours ago, 6 flags -

1980s Arcade

General Chit Chat: 7 hours ago, 4 flags -

Deadpool and Wolverine

Movies: 7 hours ago, 3 flags -

Teenager makes chess history becoming the youngest challenger for the world championship crown

Other Current Events: 9 hours ago, 3 flags -

Has Tesla paid towards cover up auto pilot crash?

Automotive Discussion: 2 minutes ago, 0 flags

active topics

-

They Killed Dr. Who for Good

Rant • 62 • : FlyersFan -

Has Tesla paid towards cover up auto pilot crash?

Automotive Discussion • 0 • : Cavemannick -

Lawsuit Seeks to ‘Ban the Jab’ in Florida

Diseases and Pandemics • 22 • : Disgusted123 -

Definitive 9.11 Pentagon EVIDENCE.

9/11 Conspiracies • 421 • : Lazy88 -

1980s Arcade

General Chit Chat • 8 • : F2d5thCavv2 -

What is a dream

The Gray Area • 27 • : wrayth -

Europe declares war on Russia?

World War Three • 61 • : F2d5thCavv2 -

The Acronym Game .. Pt.3

General Chit Chat • 7741 • : F2d5thCavv2 -

Russia Ukraine Update Thread - part 3

World War Three • 5713 • : F2d5thCavv2 -

IDF Intel Chief Resigns Over Hamas attack

Middle East Issues • 32 • : Terpene