It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

5

share:

www.illinoispolicy.org...

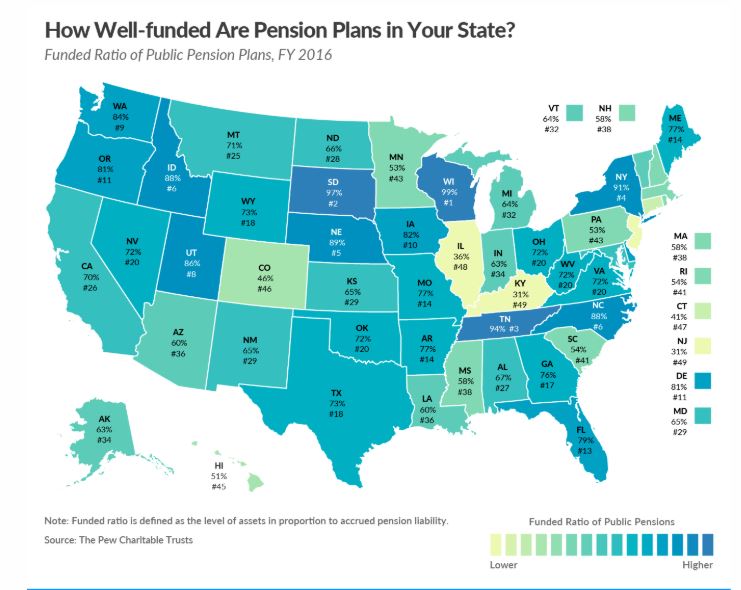

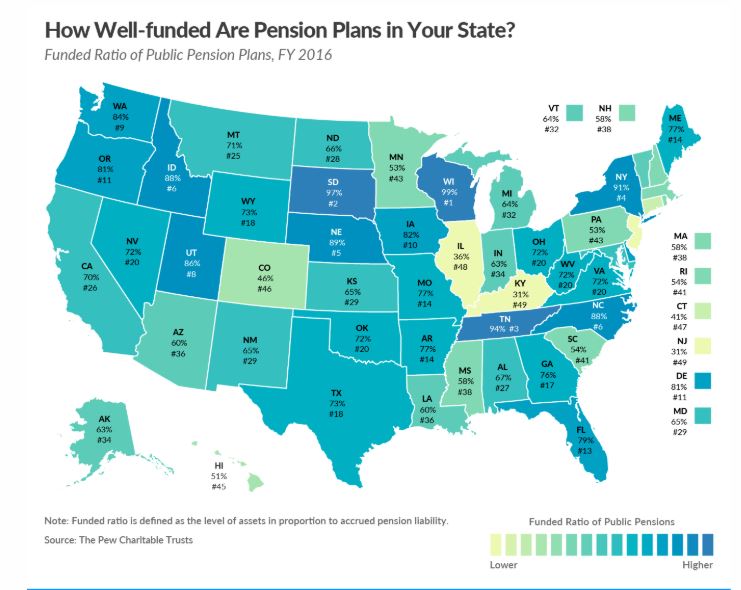

Look at those numbers! If I were to give a young person one bit of advice early in their career, it would be that. Don't move to these states.

I don't think we've even seen the tip of the iceberg. It is coming, it's going to be ugly. I am not in a pension debt state, but I'm next to one, and even that concerns me.

I belong to some Old House groups on social media. Without fail, people see these gorgeous, huge, amazing, very very low priced houses in places like Illinois, Pennsylvania, New York. They are literally salivating at the thought of the "low cost". They don't realize these areas are ticking time bombs. The taxes alone will out cost the mortgage. It is already happening in Illinois. Time and time again, people warn them, do not move here. They do not take heed.

I've read a lot on Buffet, and watched his documentary. He is really an incredible guy with the cutest giggle I've ever heard.

His advice is so simple, listen to him.

Cembalest calculated that spending on pensions, retiree health care, and interest on debt would need to consume 51% of all state revenue in Illinois to fully pay off current obligations over 30 years, assuming a 6% return on pension fund investments.

Look at those numbers! If I were to give a young person one bit of advice early in their career, it would be that. Don't move to these states.

I don't think we've even seen the tip of the iceberg. It is coming, it's going to be ugly. I am not in a pension debt state, but I'm next to one, and even that concerns me.

I belong to some Old House groups on social media. Without fail, people see these gorgeous, huge, amazing, very very low priced houses in places like Illinois, Pennsylvania, New York. They are literally salivating at the thought of the "low cost". They don't realize these areas are ticking time bombs. The taxes alone will out cost the mortgage. It is already happening in Illinois. Time and time again, people warn them, do not move here. They do not take heed.

I've read a lot on Buffet, and watched his documentary. He is really an incredible guy with the cutest giggle I've ever heard.

His advice is so simple, listen to him.

a reply to: JAGStorm

How does your state fare? This is data from 2016 and some info might have changed but it is the most recent available.

taxfoundation.org...

How does your state fare? This is data from 2016 and some info might have changed but it is the most recent available.

taxfoundation.org...

edit on 30-4-2019 by JAGStorm because: (no reason given)

I don't know how these states are going to dig themselves out of this mess. My guess is that eventually, the Feds are going to have to step in as the

systematic risks are huge much like when the housing bubble imploded.

There need to be some laws passed so that public unions are illegal and that politicians can't underfund the pensions.

I'm in IL and our property taxes are insane and it is because it is primarily paying the retirement pensions. I live in a house that on a good day might sell for $525,000... about what it cost me 15 years ago! Yet, my tax bill has more than doubled in that time. My current tax bill is about $15k/yr. In other states, I've seen $1.5 million houses with lower tax bills.

It isn't uncommon in my community for property tax bills to exceed people's mortgages. People almost always move out my community once their kids are out of school. We have excellent public schools, so people stay but once junior is about to graduate, they pack up and leave for cheaper pastures because of the property taxes.

There need to be some laws passed so that public unions are illegal and that politicians can't underfund the pensions.

I'm in IL and our property taxes are insane and it is because it is primarily paying the retirement pensions. I live in a house that on a good day might sell for $525,000... about what it cost me 15 years ago! Yet, my tax bill has more than doubled in that time. My current tax bill is about $15k/yr. In other states, I've seen $1.5 million houses with lower tax bills.

It isn't uncommon in my community for property tax bills to exceed people's mortgages. People almost always move out my community once their kids are out of school. We have excellent public schools, so people stay but once junior is about to graduate, they pack up and leave for cheaper pastures because of the property taxes.

edit on 30-4-2019 by Edumakated because: (no reason given)

a reply to: Edumakated

Your property tax is atrocious!

That sucks! My house price has gone up while my property taxes have gone down.

I do not feel like the Feds should step in. I know they probably will, but I feel it is due to the irresponsibility of the individual state. Why should we all get the burden?

Interesting article on Illinois Unions. Looks like it is already starting to crumble.

www.illinoispolicy.org...

Your property tax is atrocious!

That sucks! My house price has gone up while my property taxes have gone down.

I do not feel like the Feds should step in. I know they probably will, but I feel it is due to the irresponsibility of the individual state. Why should we all get the burden?

Interesting article on Illinois Unions. Looks like it is already starting to crumble.

www.illinoispolicy.org...

originally posted by: dantanna

a reply to: JAGStorm

buffet is a scumbag billionaire internati0nalist.

he is not cute by any means.

he is one of them, and he brags advice to the working man, brags about his small house, yet he never worries about money at all, except stealing more of it.

His advice is as solid as it gets. He doesn't worry about money because he has used his own advice.

originally posted by: JAGStorm

a reply to: Edumakated

Your property tax is atrocious!

That sucks! My house price has gone up while my property taxes have gone down.

I do not feel like the Feds should step in. I know they probably will, but I feel it is due to the irresponsibility of the individual state. Why should we all get the burden?

Interesting article on Illinois Unions. Looks like it is already starting to crumble.

www.illinoispolicy.org...

I don't want the feds to step in, but they will because politically, they don't want to deal with the financial fallout much like when the housing bubble crashed.

Only thing that keeps me in IL is I like my town / schools for kids. I kind of want to move, but my wife (boss) isn't having it.

originally posted by: dantanna

a reply to: JAGStorm

buffet is a scumbag billionaire internati0nalist.

he is not cute by any means.

he is one of them, and he brags advice to the working man, brags about his small house, yet he never worries about money at all, except stealing more of it.

I have no regard for Buffet as a person but I think this time he's right

just don't tell the Illinois Democrat Party. this might upset them.

I can easily see a future (democrat) administration (coughBerniecough) adding (democrat) state pensions to the national debt pile.

a reply to: dantanna

He is a self made man and very intelligent when it comes to financial decisions. On top of that, he loves to share his knowledge and wisdom.

He's actually quite humble. But when you get to his level of financial superiority he is battling with the big dogs, not the puppies. He needs to act a little scumbaggish once in a while.

In comparison to guys like Steve jobs, and Trump, or other billionaires he is a saint.

He is a self made man and very intelligent when it comes to financial decisions. On top of that, he loves to share his knowledge and wisdom.

He's actually quite humble. But when you get to his level of financial superiority he is battling with the big dogs, not the puppies. He needs to act a little scumbaggish once in a while.

In comparison to guys like Steve jobs, and Trump, or other billionaires he is a saint.

a reply to: JAGStorm

Truer words were never spoken. High pension obligation states are a developing disastrous time bomb waiting explode into ever higher taxes until one day........bond default and bankruptcy followed by homelessness and starvation as the pensioners livliehood is cut off. Ultimately this is how the next "Great Recession" becomes the next "Great Depression".

Truer words were never spoken. High pension obligation states are a developing disastrous time bomb waiting explode into ever higher taxes until one day........bond default and bankruptcy followed by homelessness and starvation as the pensioners livliehood is cut off. Ultimately this is how the next "Great Recession" becomes the next "Great Depression".

originally posted by: TonyS

a reply to: JAGStorm

Truer words were never spoken. High pension obligation states are a developing disastrous time bomb waiting explode into ever higher taxes until one day........bond default and bankruptcy followed by homelessness and starvation as the pensioners livliehood is cut off. Ultimately this is how the next "Great Recession" becomes the next "Great Depression".

The only bright side is that some of those states will be ripe for the picking, for smart people that have good timing.

originally posted by: Edumakated

I don't know how these states are going to dig themselves out of this mess. My guess is that eventually, the Feds are going to have to step in as the systematic risks are huge much like when the housing bubble imploded.

There need to be some laws passed so that public unions are illegal and that politicians can't underfund the pensions.

I'm in IL and our property taxes are insane and it is because it is primarily paying the retirement pensions. I live in a house that on a good day might sell for $525,000... about what it cost me 15 years ago! Yet, my tax bill has more than doubled in that time. My current tax bill is about $15k/yr. In other states, I've seen $1.5 million houses with lower tax bills.

It isn't uncommon in my community for property tax bills to exceed people's mortgages. People almost always move out my community once their kids are out of school. We have excellent public schools, so people stay but once junior is about to graduate, they pack up and leave for cheaper pastures because of the property taxes.

I'm in Illinois too, and am in the exact same situation. My property taxes on a 375k house are over 9k per year, and I'm in one of the better towns in our area for taxes. We do have good schools where I live, but my youngest is only in 1st grade. We're already counting down the years...11 more until the kiddos graduate high school and then we outta here! Can't come fast enough!

a reply to: JAGStorm

Only for years after the total default and even then, the lack of infrastructure will make profit difficult... Today, you can buy a 5,000 square foot two story mansion in Detroit, but there's no gas, electric or even street lights. And you might have to drive 45 miles or more to buy groceries. Kinda like livng in a ghost town.

After default, you will have Ghost States.

Only for years after the total default and even then, the lack of infrastructure will make profit difficult... Today, you can buy a 5,000 square foot two story mansion in Detroit, but there's no gas, electric or even street lights. And you might have to drive 45 miles or more to buy groceries. Kinda like livng in a ghost town.

After default, you will have Ghost States.

originally posted by: TonyS

a reply to: JAGStorm

Only for years after the total default and even then, the lack of infrastructure will make profit difficult... Today, you can buy a 5,000 square foot two story mansion in Detroit, but there's no gas, electric or even street lights. And you might have to drive 45 miles or more to buy groceries. Kinda like livng in a ghost town.

After default, you will have Ghost States.

Location location location. It all depends. Some places have a knack for always bouncing back. Florida comes to mind.

I think about the Tampa area. After the recession and then the BP spill things were looking pretty bad for that region. It didn't take long, it bounced back and now is even growing.

Detroit is a sad story. I think they could have survived one or two events but they had too many happen in such a short span. Post war issues, race wars, and of course economic and tax issues. I look at some of those old houses in Detroit, what a shame, some beautiful old painted ladies left to ruin there.

originally posted by: JAGStorm

a reply to: JAGStorm

How does your state fare? This is data from 2016 and some info might have changed but it is the most recent available.

taxfoundation.org...

I'm not sure how to read this. Take OR, they have a very lucrative PERS program that is about 20 billion in the red. They don't have enough civil workers such as police etc and their student to teacher ratio is horrid while their retirement plan keeps growing and growing eating up more and more of their state taxes. They are even talking of charging all teachers with monthly payments into the program, carbon taxes and anything else they can dream up of to get more money to feed this monster.

I then look at your chart and their 81% is looking good...lol

a reply to: Xtrozero

This is the correct step, and if they do it everyone in the state will be better off.

Illinois talked about doing this 20-25 years ago and if they did they would not be in the yellow.

The chart doesn't mean your state is great, it just means it is not as bad as Illinois, Kentucky etc.

This article explains it a lot better. Looks like Oregon is at least trying to do something. Good for your state!

www.pionline.com...

They are even talking of charging all teachers with monthly payments into the program,

This is the correct step, and if they do it everyone in the state will be better off.

Illinois talked about doing this 20-25 years ago and if they did they would not be in the yellow.

The chart doesn't mean your state is great, it just means it is not as bad as Illinois, Kentucky etc.

This article explains it a lot better. Looks like Oregon is at least trying to do something. Good for your state!

www.pionline.com...

new topics

-

More Bad News for Labour and Rachel Reeves Stole Christmas from Working Families

Regional Politics: 8 minutes ago -

Light from Space Might Be Travelling Instantaneously

Space Exploration: 1 hours ago -

The MSM has the United Healthcare assassin all wrong.

Mainstream News: 2 hours ago -

2025 Bingo Card

General Conspiracies: 2 hours ago -

The Mystery Drones and Government Lies

Other Current Events: 4 hours ago -

Pelosi injured in Luxembourg

Other Current Events: 11 hours ago

top topics

-

Pelosi injured in Luxembourg

Other Current Events: 11 hours ago, 16 flags -

The Mystery Drones and Government Lies

Other Current Events: 4 hours ago, 8 flags -

Nov 2024 - Former President Barack Hussein Obama Has Lost His Aura.

US Political Madness: 12 hours ago, 7 flags -

2025 Bingo Card

General Conspiracies: 2 hours ago, 4 flags -

The MSM has the United Healthcare assassin all wrong.

Mainstream News: 2 hours ago, 4 flags -

Light from Space Might Be Travelling Instantaneously

Space Exploration: 1 hours ago, 2 flags -

More Bad News for Labour and Rachel Reeves Stole Christmas from Working Families

Regional Politics: 8 minutes ago, 0 flags

active topics

-

The MSM has the United Healthcare assassin all wrong.

Mainstream News • 3 • : xuenchen -

Top Sci Fi/Horror Crossover Movies

Movies • 15 • : LocutusofBorg001 -

Light from Space Might Be Travelling Instantaneously

Space Exploration • 8 • : cooperton -

More Bad News for Labour and Rachel Reeves Stole Christmas from Working Families

Regional Politics • 0 • : gortex -

2025 Bingo Card

General Conspiracies • 5 • : MauiWaui -

Pelosi injured in Luxembourg

Other Current Events • 22 • : xuenchen -

The Mystery Drones and Government Lies

Other Current Events • 14 • : Xtrozero -

A Bunch of Maybe Drones Just Flew Across Hillsborough County

Aircraft Projects • 81 • : Zaphod58 -

I See a Different Attitude This Time Around with Congress

US Political Madness • 27 • : interupt42 -

Drones everywhere in New Jersey

Aliens and UFOs • 115 • : xuenchen

5