It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

Recessions And Yield-Curve Inversion: What Does It Mean?.

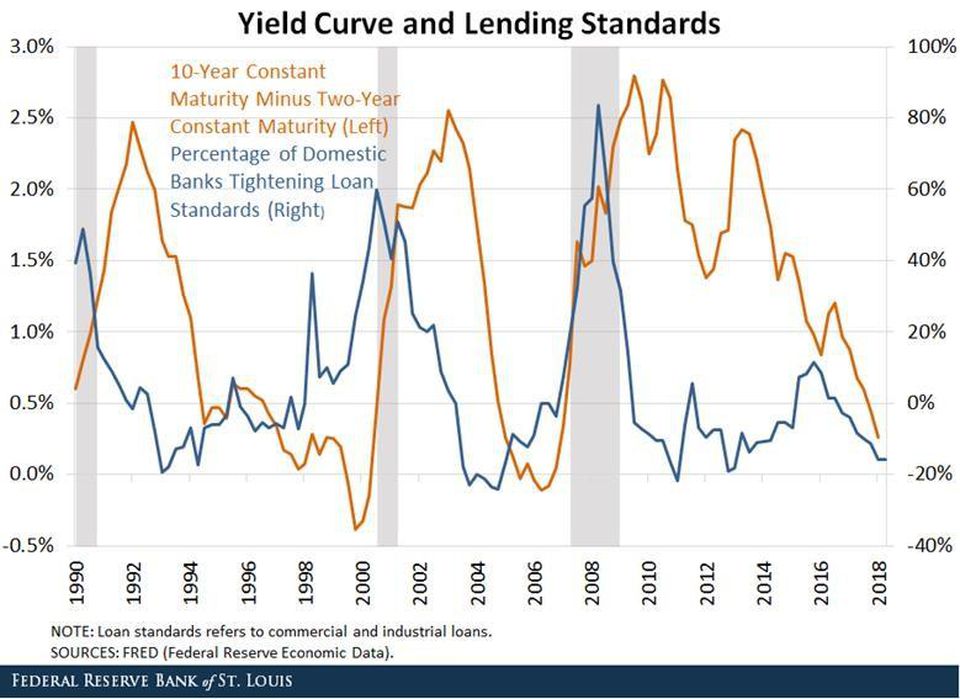

There’s a lot of chatter about the inversion of the yield curve and how it’s an indicator of an impending recession.

An inversion is when the short-term rates are higher than the long-term rates.

Is an inversion a predictor of a recession? In general, an inversion is a good predictor of lower growth and a subsequent recession.

The problem is that the doom and gloomers are ALWAYS predicting an economic collapse.

And because of the debt based monetary system, the Fed has trained us to think that "booms" and "busts" are normal... theyre not.

Well they are normal in a debt based system but otherwise they would be much less common and would quickly resolve themselves if we had an actual free market economy.

According to this article, a yield curve inversion had preceded the past 11 recessions...

Authors like this never want to cause a panic, they just want to "inform".

How bad would it really be? Are we in some kind of a bubble?

As always, be prepared as best you can.

edit on 1-4-2019 by gladtobehere because: typo

Interesting. I have been waiting for the student loan bubble to go boom, but it may not be a boom as much as an "anchor" on Millennials and younger

peeps.

www.forbes.com...

Right now, Millennials can't afford a new home in like 78% of counties in the US. A lot of that has a lot to do with School debt. I read a stat that they only have a net worth of $10K.

Also, if you watch the movie The Big Short...nothing changed policy-wise. So there could easily be a housing bubble 2.0.

20somethingfinance.com...

Retail just slowed as well, which is peeps cutting back on non-essential things.

And food bank usage is increasing.

www.forbes.com...

Right now, Millennials can't afford a new home in like 78% of counties in the US. A lot of that has a lot to do with School debt. I read a stat that they only have a net worth of $10K.

Also, if you watch the movie The Big Short...nothing changed policy-wise. So there could easily be a housing bubble 2.0.

20somethingfinance.com...

Retail just slowed as well, which is peeps cutting back on non-essential things.

And food bank usage is increasing.

I HIGHLY recommend my fellow Millenials get the hell out of debt. Let's not make the same mistakes as our parents. Living from one loan to the next,

"following your dreams" in college to the tune of hundreds of thousands, not saving a freakin dime for anything, and spending nearly all of your money

on daily outings is not how we forge prosperity for ourselves or our posterity.

Right now, most of my dollar-denominated assets have been converted to Bitcoin-denominated assets, with the exception of my mortgage, I pay my bills in crypto.

Because of this my car is getting paid off VERY early.

Right now, most of my dollar-denominated assets have been converted to Bitcoin-denominated assets, with the exception of my mortgage, I pay my bills in crypto.

Because of this my car is getting paid off VERY early.

a reply to: projectvxn

What will the banks do take everyone's cars and kick people out of their homes, and take away their diploma or whatever?

Government wouldn't allow this to happen. This is why banks allow ot to happen on smaller scale to make it look like it's the consumers fault for seeking education, buying a car and house.

What will the banks do take everyone's cars and kick people out of their homes, and take away their diploma or whatever?

Government wouldn't allow this to happen. This is why banks allow ot to happen on smaller scale to make it look like it's the consumers fault for seeking education, buying a car and house.

a reply to: strongfp

Ummm, you might want to educate yourself on federal school loans. They are given by the government and CANNOT be defaulted on.

That is over $1.5 trillion dollars of debt that has to be repaid no matter what. AS a matter of fact, one of the biggest debts by older people is them taking out loans for their grandkids.

Ummm, you might want to educate yourself on federal school loans. They are given by the government and CANNOT be defaulted on.

That is over $1.5 trillion dollars of debt that has to be repaid no matter what. AS a matter of fact, one of the biggest debts by older people is them taking out loans for their grandkids.

a reply to: lakenheath24

If there was a economic collapse in a massive scale what would happen? How will recalling student debt solve anything? Oh no, put me into more debt and kick me out of school and watch the economy crash.

A total collapse is almost impossible. Hence why I suggested it's almost like banks and feds, are letting off on a pressure valve once in a while.

I got my student loans from my province, guess its different in the states.

If there was a economic collapse in a massive scale what would happen? How will recalling student debt solve anything? Oh no, put me into more debt and kick me out of school and watch the economy crash.

A total collapse is almost impossible. Hence why I suggested it's almost like banks and feds, are letting off on a pressure valve once in a while.

I got my student loans from my province, guess its different in the states.

a reply to: gladtobehere

The economy, has already collapsed. They will just kick the can down the road by lowering interest rates, and by controlling the price of PM's, which leaves the share market the only place for money to go. Until one day theirs a panic and everyone wants to get into cash. When they do the dollar will loose value. At that time their wont be any Gold available because the banks will have it all, ready to issue a new gold/silver backed dollar, because their wont be any alternative.

The economy, has already collapsed. They will just kick the can down the road by lowering interest rates, and by controlling the price of PM's, which leaves the share market the only place for money to go. Until one day theirs a panic and everyone wants to get into cash. When they do the dollar will loose value. At that time their wont be any Gold available because the banks will have it all, ready to issue a new gold/silver backed dollar, because their wont be any alternative.

a reply to: strongfp

Well 7 million peeps lost their homes in 2008. So while it was not total economic collapse, it sure as hell was painful AND its entirely possible another housing bubble could be out there. And this time there are no interest rates to lower.

Its called poor regulation of an industry. Peeps in the SEC get promised cushy jobs in the industry to look the other way for a while.

Well 7 million peeps lost their homes in 2008. So while it was not total economic collapse, it sure as hell was painful AND its entirely possible another housing bubble could be out there. And this time there are no interest rates to lower.

Its called poor regulation of an industry. Peeps in the SEC get promised cushy jobs in the industry to look the other way for a while.

The economy does not depend on college grads with useless degrees - which most of them are. Of course there are some jobs that absolutely require a

degree. But many high paying jobs do not. Revamping the education system will help the economy to a small degree but only after a significant period

of adjustment.

The more immediate threat to the economy is grounded in COGS - which is about to go haywire for quite a few industries. The first to feel the heat will be food and food service industries. Everything from the farms to the grocery stores including the people in between like the shipping companies and distributors. Restaurants are going to suffer and will fall on their own blade as recreational spending decreases dramatically.

Luxury, convenience, and entertainment industries will fall shortly thereafter.

The last great affliction will be the tax burden placed on the average citizen when the realized tax revenue from the aforementioned industries diminishes.

Its not all doom and gloom though. There is a way out, but it will take some stern resolve to adjust to lean times until the real crunch is over.

The more immediate threat to the economy is grounded in COGS - which is about to go haywire for quite a few industries. The first to feel the heat will be food and food service industries. Everything from the farms to the grocery stores including the people in between like the shipping companies and distributors. Restaurants are going to suffer and will fall on their own blade as recreational spending decreases dramatically.

Luxury, convenience, and entertainment industries will fall shortly thereafter.

The last great affliction will be the tax burden placed on the average citizen when the realized tax revenue from the aforementioned industries diminishes.

Its not all doom and gloom though. There is a way out, but it will take some stern resolve to adjust to lean times until the real crunch is over.

the non-desire to borrow sums for long terms

causes the creditor to use only short term loans with a close horizon to pay-off (while still employed)

which results in the rate inversion.... its a result of people having enough money for the then & there bills only ---> but long term horizons are only for the affluent that don't have their backs against the wall...it only indicates 'stress' not recessions

ETA

the 10 yr & 2 yr are getting close

www.sprottmoney.com...

causes the creditor to use only short term loans with a close horizon to pay-off (while still employed)

which results in the rate inversion.... its a result of people having enough money for the then & there bills only ---> but long term horizons are only for the affluent that don't have their backs against the wall...it only indicates 'stress' not recessions

the 10 yr & 2 yr are getting close

www.sprottmoney.com...

edit on st30155416338901032019 by St Udio because: (no reason given)

a reply to: lakenheath24

Yep. Luckily I have a stupid low locked in rate on a house I could comfortably afford even if I were making half of what I am now.

Planned ahead and everything.

Weird right?

Yep. Luckily I have a stupid low locked in rate on a house I could comfortably afford even if I were making half of what I am now.

Planned ahead and everything.

Weird right?

a reply to: Vroomfondel

The thing is most jobs if you want to make any kind of decent money, require a college degree at least to get you into a higher pay bracket. The HR see it as a sign of stick-with-it-ness and intelligence. Whether that's true or not, I don't think so in all cases, but the degree does mean a lot in regards to which jobs you get and how much you make.

The thing is most jobs if you want to make any kind of decent money, require a college degree at least to get you into a higher pay bracket. The HR see it as a sign of stick-with-it-ness and intelligence. Whether that's true or not, I don't think so in all cases, but the degree does mean a lot in regards to which jobs you get and how much you make.

a reply to: projectvxn

From your posts I like you, and I think you are a fellow veteran right? The perks we get for housing with the loan etc do not translate to the average person. Especially if you get the package of paying off your student loans via enlistement either. It's easy to say 'it's easy' but for a lot of people they don't have the where-with-all to get the easy pass after all the work of the military.

That said, common sense spending and saving every month is the most important thing, along with some kind of retirement plan, whether it be 401k or whatever. I always keep at least 5 to 6 months in saving for living if both the wife and I get unemployed. That's a basic.

Don't trust crypto as far as I can't throw it however.

From your posts I like you, and I think you are a fellow veteran right? The perks we get for housing with the loan etc do not translate to the average person. Especially if you get the package of paying off your student loans via enlistement either. It's easy to say 'it's easy' but for a lot of people they don't have the where-with-all to get the easy pass after all the work of the military.

That said, common sense spending and saving every month is the most important thing, along with some kind of retirement plan, whether it be 401k or whatever. I always keep at least 5 to 6 months in saving for living if both the wife and I get unemployed. That's a basic.

Don't trust crypto as far as I can't throw it however.

a reply to: chris_stibrany

The only perk I ever got for using the VA loan guarantee was a no down loan.

My credit rating did the rest. This was built with discipline and wise investment. With deferred gratification and personal sacrifice. Things people don't believe in anymore.

Then the wall is still up. Look over some time. You might be surprised at what you find.

The perks we get for housing with the loan etc do not translate to the average person.

The only perk I ever got for using the VA loan guarantee was a no down loan.

My credit rating did the rest. This was built with discipline and wise investment. With deferred gratification and personal sacrifice. Things people don't believe in anymore.

Don't trust crypto as far as I can't throw it however.

Then the wall is still up. Look over some time. You might be surprised at what you find.

edit on 1 4 19 by projectvxn because: (no reason

given)

a reply to: gladtobehere

Low mortgage rates combined with pent up demand tend to keep the country out of deep recession.

When someone borrows to build a new house.

The mortgage underwriter gets paid.

The roofer gets paid.

The shingle manufacturer gets paid by the roofer.

The carpenters get paid by the building contractor.

The Home depot or Lowes who stock the lumber and building supplies gets paid by the building contractor.

The lumber yard that cuts the lumber gets paid by Lowes or Home Depot.

The lumber jack gets paid by the lumber yard.

The chainsaw manufacturers get paid by the lumber jack.

And this goes on and on for every dollar borrowed for a new house the money recirculates 5 to 7 times benefiting everybody!

On the other hand if an unsecured bond is floated at 3% a short term rate for the purpose of buying stock on the hopes that the stock price will appreciate at 6% then only the stock holder can get a quick 3% profit at the expense of the bond holder.

The Trump administration gave the US a great jump start last year so I doubt we will see a severe recession.

Theoretically loan underwriting could be reformed so that nobody could borrow with a blatant greed motive.

We are still a long way from communism.

Low mortgage rates combined with pent up demand tend to keep the country out of deep recession.

When someone borrows to build a new house.

The mortgage underwriter gets paid.

The roofer gets paid.

The shingle manufacturer gets paid by the roofer.

The carpenters get paid by the building contractor.

The Home depot or Lowes who stock the lumber and building supplies gets paid by the building contractor.

The lumber yard that cuts the lumber gets paid by Lowes or Home Depot.

The lumber jack gets paid by the lumber yard.

The chainsaw manufacturers get paid by the lumber jack.

And this goes on and on for every dollar borrowed for a new house the money recirculates 5 to 7 times benefiting everybody!

On the other hand if an unsecured bond is floated at 3% a short term rate for the purpose of buying stock on the hopes that the stock price will appreciate at 6% then only the stock holder can get a quick 3% profit at the expense of the bond holder.

The Trump administration gave the US a great jump start last year so I doubt we will see a severe recession.

Theoretically loan underwriting could be reformed so that nobody could borrow with a blatant greed motive.

We are still a long way from communism.

originally posted by: lakenheath24

a reply to: strongfp

Ummm, you might want to educate yourself on federal school loans. They are given by the government and CANNOT be defaulted on.

That is over $1.5 trillion dollars of debt that has to be repaid no matter what. AS a matter of fact, one of the biggest debts by older people is them taking out loans for their grandkids.

The student loan scam was a gift to the banksters.

They are almost risk free high interest rate non dis-chargeable loans for them to make bank.

That is why the costs have risen so high, smart money chasing after risk free money.

My theory is as long as people continue to copulate and have babies the economy will continue to hum along.

a reply to: gladtobehere

Jason Burack of Wall St for Main St claims "economists at the Fed" are openly talking about negative interest rates and even debt jubilee (that 2nd thing will never happen as far as I can see though)

I do believe we are going to see a recession and increased prices for all sorts of necessities and luxuries - central banks and the gov do NOT want to allow deflation (bankers cannot exploit the masses as easily and gov cannot tax as effectively when prices go down)

Jason Burack of Wall St for Main St claims "economists at the Fed" are openly talking about negative interest rates and even debt jubilee (that 2nd thing will never happen as far as I can see though)

I do believe we are going to see a recession and increased prices for all sorts of necessities and luxuries - central banks and the gov do NOT want to allow deflation (bankers cannot exploit the masses as easily and gov cannot tax as effectively when prices go down)

a reply to: gladtobehere

If it was going to collapse then there would have been NO financial handout when the banks overextended their lending practices!

But they did, so it didn’t. Not saying it might dive and suck your 401K down the hole but the collapse has “safety breaks” so doubt that it will happen.

A major “readjustment” is coming... has been since I have been alive... but it is always delayed? Hum? Trillions in debt and still we pile on. Like money ain’t worth the hemp it is printed on!!

It won’t be a collapse but freedom!

If it was going to collapse then there would have been NO financial handout when the banks overextended their lending practices!

But they did, so it didn’t. Not saying it might dive and suck your 401K down the hole but the collapse has “safety breaks” so doubt that it will happen.

A major “readjustment” is coming... has been since I have been alive... but it is always delayed? Hum? Trillions in debt and still we pile on. Like money ain’t worth the hemp it is printed on!!

It won’t be a collapse but freedom!

a reply to: FamCore

Jubilee debt relief for the poorest countries sounds like a trap, remember what happened to Greece?

Here in the States, Fed chairman Powell indicated we will probably leave $3.5 trillion worth of US debt from the 2008 mortgage crisis on the books for now.

The countries that default will likely lose their currency value but would not have to float a lot of high interest yield bonds.

Less competition for bond yields means lower interest rate required to attract buyers to the US bonds when the Fed finally does decide to unwind.

Jubilee debt relief for the poorest countries sounds like a trap, remember what happened to Greece?

Here in the States, Fed chairman Powell indicated we will probably leave $3.5 trillion worth of US debt from the 2008 mortgage crisis on the books for now.

The countries that default will likely lose their currency value but would not have to float a lot of high interest yield bonds.

Less competition for bond yields means lower interest rate required to attract buyers to the US bonds when the Fed finally does decide to unwind.

new topics

-

God's Righteousness is Greater than Our Wrath

Religion, Faith, And Theology: 1 hours ago -

Electrical tricks for saving money

Education and Media: 5 hours ago -

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News: 6 hours ago -

Sunak spinning the sickness figures

Other Current Events: 7 hours ago -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues: 7 hours ago -

Late Night with the Devil - a really good unusual modern horror film.

Movies: 9 hours ago -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest: 10 hours ago

top topics

-

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News: 6 hours ago, 9 flags -

Florida man's trip overseas ends in shock over $143,000 T-Mobile phone bill

Social Issues and Civil Unrest: 17 hours ago, 8 flags -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest: 10 hours ago, 8 flags -

Electrical tricks for saving money

Education and Media: 5 hours ago, 4 flags -

Bobiverse

Fantasy & Science Fiction: 17 hours ago, 3 flags -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three: 14 hours ago, 3 flags -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues: 7 hours ago, 3 flags -

Sunak spinning the sickness figures

Other Current Events: 7 hours ago, 3 flags -

Late Night with the Devil - a really good unusual modern horror film.

Movies: 9 hours ago, 2 flags -

The Good News According to Jesus - Episode 1

Religion, Faith, And Theology: 12 hours ago, 1 flags

active topics

-

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News • 39 • : Asher47 -

Electrical tricks for saving money

Education and Media • 4 • : Lumenari -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest • 19 • : WeMustCare -

New whistleblower Jason Sands speaks on Twitter Spaces last night.

Aliens and UFOs • 54 • : Ophiuchus1 -

DONALD J. TRUMP - 2024 Candidate for President - His Communications to Americans and the World.

2024 Elections • 514 • : WeMustCare -

The Acronym Game .. Pt.3

General Chit Chat • 7744 • : bally001 -

Truth Social goes public, be careful not to lose your money

Mainstream News • 128 • : Astyanax -

Sunak spinning the sickness figures

Other Current Events • 5 • : glen200376 -

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs • 44 • : MikeDeGrasseTyson -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three • 31 • : budzprime69