It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

I'm mostly talking about public pensions, and why they are still being offered at all.

Everyone else, no way. 401K style or something similar should be used for everyone, government workers, teachers etc.

We've known that pensions don't work, we've know this for at least 20 years. Why are we ignoring the problem?

States like Illinois use the lame excuse that it is in their states constitution, so what, do a constitutional amendment!!

I know why, and this is part of the reason:

www.chicagobusiness.com...

So basically all hope is lost, and nothing should be changed? I think this is a massive error in thinking.

I think there are two different issues that intersect. The past and the future.

Of course everyone that has worked for a pension feels rightly entitled to that.

Everyone going forward feels they should get more of their hard earned money.

They are both right and wrong, and in the end everyone is going to lose if something isn't done.

It is amazing how neither side is willing to give a little... We are going to see some serious stuff within the next 5 to 10 years, just watch.

Everyone else, no way. 401K style or something similar should be used for everyone, government workers, teachers etc.

We've known that pensions don't work, we've know this for at least 20 years. Why are we ignoring the problem?

States like Illinois use the lame excuse that it is in their states constitution, so what, do a constitutional amendment!!

I know why, and this is part of the reason:

www.chicagobusiness.com...

Keep this overarching reality in mind: Illinois and many of its municipalities have no way to end their fiscal crises without reducing unfunded pension liabilities. If you doubt that, ask why nobody has ever laid out even a rough outline of a plan to do so. Nobody will. Nobody can. The math is insurmountable.

So basically all hope is lost, and nothing should be changed? I think this is a massive error in thinking.

I think there are two different issues that intersect. The past and the future.

Of course everyone that has worked for a pension feels rightly entitled to that.

Everyone going forward feels they should get more of their hard earned money.

They are both right and wrong, and in the end everyone is going to lose if something isn't done.

It is amazing how neither side is willing to give a little... We are going to see some serious stuff within the next 5 to 10 years, just watch.

a reply to: JAGStorm

www.illinoispolicy.org...

www.illinoispolicy.org...

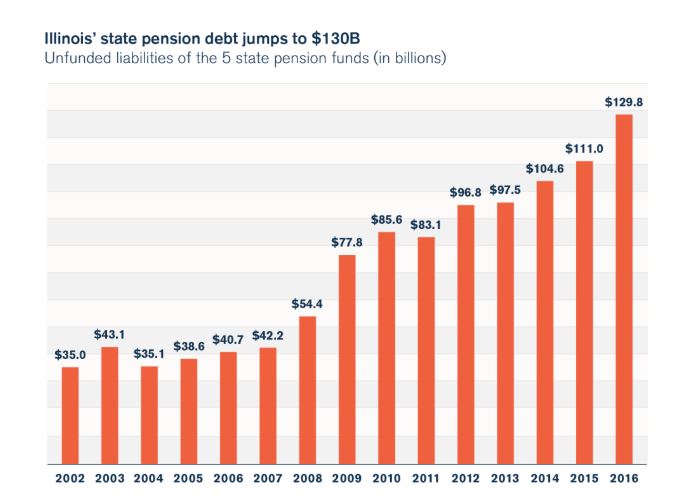

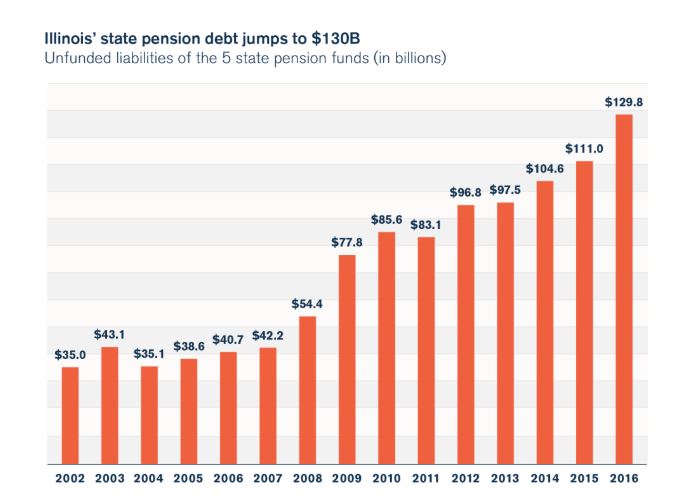

Households in Illinois now owe more than $27,000 each in state pension debt, an increase of over $4,000, or 17 percent, from 2015. Illinois’ pension debt has more than tripled since 2002, when Illinoisans owed $7,600 per household.

All I know is my wife worked in a private school that has a pension for retirees...which she paid into it for over thirty years, so she better get

what's coming to her...but of course will be taxed on money already taxed before

I on the other hand have had to pay the 401-k

I on the other hand have had to pay the 401-k

originally posted by: Zrtst

All I know is my wife worked in a private school that has a pension for retirees...which she paid into it for over thirty years, so she better get what's coming to her...but of course will be taxed on money already taxed before

I on the other hand have had to pay the 401-k

I feel for your wife and good luck to you guys, but look what happened to Detroit.

www.detroitnews.com...

The city had promised lifetime health care benefits to its retirees. An obligation Rhodes said was not sustainable. At the time of Detroit's bankruptcy, pension and health care obligations made up about 40 percent of the city's annual budget, and it was projected to climb to 60-70 percent within a few years, he said.

My only advice for you is to be prepared, hope for the best but expect the worst. If you are Illinois, it will happen, they are already there.

Pensions are unsustainable because they are based on faulty assumptions. When they were initially setup, people didn't live as long. So you could

have a guy who puts in 25 or 30 year and retires at 55 years old. They were usually dead by say 65 or so. Now what is happening is that same person

retires at 55, but they may live to 85... the math can't support it.

In addition, the pension benefits relative to the employee contributions are too lucrative.

We haven't even gotten into the gaming the pension where bureaucrats get promotions their last year before retirement to increase their pension payout.

The pension crisis is what happens when politicians and unions are negotiating but the interest of the public are not represented at the table. The politicians are supported politically by unions so there is a huge conflict of interest.

The big problem with 401ks is that they depend on people to be responsible. There is a huge issue of people not contributing to them and general financial ignorance. Trump has made some changes so that 401ks can be more easily transferred.

What needs to happen is that 401ks need to be decoupled entirely from an employer. Govt also needs to significantly increase tax benefits of saving for your own retirement.

In addition, the pension benefits relative to the employee contributions are too lucrative.

We haven't even gotten into the gaming the pension where bureaucrats get promotions their last year before retirement to increase their pension payout.

The pension crisis is what happens when politicians and unions are negotiating but the interest of the public are not represented at the table. The politicians are supported politically by unions so there is a huge conflict of interest.

The big problem with 401ks is that they depend on people to be responsible. There is a huge issue of people not contributing to them and general financial ignorance. Trump has made some changes so that 401ks can be more easily transferred.

What needs to happen is that 401ks need to be decoupled entirely from an employer. Govt also needs to significantly increase tax benefits of saving for your own retirement.

a reply to: Edumakated

The biggest employer in Wisconsin is the UW schools. So pretty much exactly what you are saying, self interest.

The pension crisis is what happens when politicians and unions are negotiating but the interest of the public are not represented at the table. The politicians are supported politically by unions so there is a huge conflict of interest.

The biggest employer in Wisconsin is the UW schools. So pretty much exactly what you are saying, self interest.

a reply to: JAGStorm

When the government- either federal, state or local- has a hand in your pension plan there always exists the chance of corruption and or mishandling so that your pension is always at risk of being depleted or even completely lost. Same goes with some company funded pensions- company goes under, pension is liquidated as a company asset. Even people with union pensions or individual pensions (like 401Ks) are at the mercy of the stock market. There are no guarantees. but it is better to take a risk and have some sort of plan for your future than none at all. Even Social Security was operating at a surplus until our own government plundered it in the 90s, now it may not even exist by the time I get old enough to get it. Will the government give me back all of the money I paid into it? No! Will the government asshats who stole it still get a retirement? Yes!

When the government- either federal, state or local- has a hand in your pension plan there always exists the chance of corruption and or mishandling so that your pension is always at risk of being depleted or even completely lost. Same goes with some company funded pensions- company goes under, pension is liquidated as a company asset. Even people with union pensions or individual pensions (like 401Ks) are at the mercy of the stock market. There are no guarantees. but it is better to take a risk and have some sort of plan for your future than none at all. Even Social Security was operating at a surplus until our own government plundered it in the 90s, now it may not even exist by the time I get old enough to get it. Will the government give me back all of the money I paid into it? No! Will the government asshats who stole it still get a retirement? Yes!

It sounds like a great idea until you're the elderly guy whose 401k is running out and you're too old to work.

Everyone should have a pension. IMO pensions are more deserving to be a right than healthcare is, which I consider to be a luxury.

I and many others are paying into pensions and expect those pensions to be there when we retire. Taking them away throws us all under the bus.

There's no way I could fund my retirement with a 401k. It would run out and I know it would run out. Without a pension my retirement plan might as well be a pistol and bullet for my skull.

Everyone should have a pension. IMO pensions are more deserving to be a right than healthcare is, which I consider to be a luxury.

I and many others are paying into pensions and expect those pensions to be there when we retire. Taking them away throws us all under the bus.

There's no way I could fund my retirement with a 401k. It would run out and I know it would run out. Without a pension my retirement plan might as well be a pistol and bullet for my skull.

a reply to: Edumakated

No. The problem is the pension companies themselves. Investing YOUR money in the stock exchange and other risky investments can and will lead to bad financial returns. They've been doing it for decades.

Another thing you might want to examine is how much the pension companies profit each year, much of which goes back to the shareholders of the pension companies.

No. The problem is the pension companies themselves. Investing YOUR money in the stock exchange and other risky investments can and will lead to bad financial returns. They've been doing it for decades.

Another thing you might want to examine is how much the pension companies profit each year, much of which goes back to the shareholders of the pension companies.

originally posted by: GeauxHomeYoureDrunk

a reply to: JAGStorm

When the government- either federal, state or local- has a hand in your pension plan there always exists the chance of corruption and or mishandling so that your pension is always at risk of being depleted or even completely lost. Same goes with some company funded pensions- company goes under, pension is liquidated as a company asset. Even people with union pensions or individual pensions (like 401Ks) are at the mercy of the stock market. There are no guarantees. but it is better to take a risk and have some sort of plan for your future than none at all. Even Social Security was operating at a surplus until our own government plundered it in the 90s, now it may not even exist by the time I get old enough to get it. Will the government give me back all of the money I paid into it? No! Will the government asshats who stole it still get a retirement? Yes!

I have no problem with private pensions. The issue is that govt employee pensions are backstopped by the tax payer so there is no incentive to properly manage or to stop asking for more largess.

There is always investment risk. However, the equity markets over time have always been a winner. Social security is just redistribution of wealth. The vast majority of people would be far better off if they could invest and keep their social security contributions.

The problem though is that we have far too many people who are irresponsible financially and do not make any efforts at funding their own retirement. They get of retirement age and are broke and then need the government or other services to support them.

originally posted by: LightSpeedDriver

a reply to: Edumakated

No. The problem is the pension companies themselves. Investing YOUR money in the stock exchange and other risky investments can and will lead to bad financial returns. They've been doing it for decades.

Another thing you might want to examine is how much the pension companies profit each year, much of which goes back to the shareholders of the pension companies.

Pensions need to seek higher returns or else they cannot pay out all the obligations. That is how it works. Investing involves risk. Risk free investment will not yield high enough returns. The greater the risk, the higher the return. Fund managers make a lot because they are good at beating the market for returns.

You don't seriously think a pension with billions under management is going to keep all the money in a checking account do you?

The other problem is liberals start trying to use political activism in choosing investments. For example, instead of investing for the best returns, they come up with bullsh*t like trying to force the pension to only invest in green companies. Companies with certain levels of diversity. None of which has sh*t to do with getting godo return on the money or is a sound investment.

originally posted by: peskyhumans

It sounds like a great idea until you're the elderly guy whose 401k is running out and you're too old to work.

Everyone should have a pension. IMO pensions are more deserving to be a right than healthcare is, which I consider to be a luxury.

I and many others are paying into pensions and expect those pensions to be there when we retire. Taking them away throws us all under the bus.

There's no way I could fund my retirement with a 401k. It would run out and I know it would run out. Without a pension my retirement plan might as well be a pistol and bullet for my skull.

You do realize that in order to fund your pension that other are suffering. That is exactly what my OP is about.

You are sacrificing one for the other, instead of spreading the pain/wealth to both.

a reply to: JAGStorm

As always, the devil is in the details. Pensions are not a problem in and of themselves. The problem is the many loopholes and built-in privileges for the lucky few that ruin it for everyone else. Things like "double-dipping," and unreasonable "overtime" hours padding their pension payouts, etc. And that's over and above the absolutely outrageous salaries so many government employees already receive.

When implemented properly, a pension plan based on real savings will ALWAYS be preferable to a 401k plan based on gambling and speculation. A pension plan is far more practical and effective.

The real problem is the wholesale corruption of our banking institutions, which now punish savers and "reward" the gamblers and debtors. And, of course, those who cheer them on despite the chaos and poverty and misery it has caused... even to the point that they would FORCE others into the same debauched economic prison (and servitude) of gambling and debt.

I'm mostly talking about public pensions, and why they are still being offered at all. Everyone else, no way.

As always, the devil is in the details. Pensions are not a problem in and of themselves. The problem is the many loopholes and built-in privileges for the lucky few that ruin it for everyone else. Things like "double-dipping," and unreasonable "overtime" hours padding their pension payouts, etc. And that's over and above the absolutely outrageous salaries so many government employees already receive.

...401K style or something similar should be used for everyone, government workers, teachers etc.

When implemented properly, a pension plan based on real savings will ALWAYS be preferable to a 401k plan based on gambling and speculation. A pension plan is far more practical and effective.

The real problem is the wholesale corruption of our banking institutions, which now punish savers and "reward" the gamblers and debtors. And, of course, those who cheer them on despite the chaos and poverty and misery it has caused... even to the point that they would FORCE others into the same debauched economic prison (and servitude) of gambling and debt.

originally posted by: peskyhumans

It sounds like a great idea until you're the elderly guy whose 401k is running out and you're too old to work.

Everyone should have a pension. IMO pensions are more deserving to be a right than healthcare is, which I consider to be a luxury.

I and many others are paying into pensions and expect those pensions to be there when we retire. Taking them away throws us all under the bus.

There's no way I could fund my retirement with a 401k. It would run out and I know it would run out. Without a pension my retirement plan might as well be a pistol and bullet for my skull.

The retirement for your guy is social security.... however, everyone should be proactively investing for their retirement. Unfortunately, people do not. You have to start saving early and often.

Also, as you get older, you should be deleveraging and cutting expenses. No reason anyone should have a mortgage when they are nearing retirement. Car payments. Credit card debt.

Most people simply don't understand this... we need significant financial literacy in this country.

Instead of buying an iphone, they should buy Apple stock.

still getting Pensions (to some degree or at some unfunded rate)…

it might be because of Contracts & Contract Law Rules at least that's my guess

City or State Pensions are different animals than Social Security retirement/disability Accounts as are 401k or ROTH accounts or Military Pensions for Retirement or Pension for Disability (@ 100% rating)

too many diverse 'pensions' are being addressed here... the Union wrestled 'Pensions' are high falutin' promises made to beguile the State Government Employees with the Free Lunch Syndrome...

the damage was long ago done and has become ingrained into the System...so payouts will be the burden of the tax payers for their lifetimes

it might be because of Contracts & Contract Law Rules at least that's my guess

City or State Pensions are different animals than Social Security retirement/disability Accounts as are 401k or ROTH accounts or Military Pensions for Retirement or Pension for Disability (@ 100% rating)

too many diverse 'pensions' are being addressed here... the Union wrestled 'Pensions' are high falutin' promises made to beguile the State Government Employees with the Free Lunch Syndrome...

the damage was long ago done and has become ingrained into the System...so payouts will be the burden of the tax payers for their lifetimes

edit on th31155206941408232019 by St Udio because: (no reason given)

originally posted by: peskyhumans

It sounds like a great idea until you're the elderly guy whose 401k is running out and you're too old to work.

Everyone should have a pension. IMO pensions are more deserving to be a right than healthcare is, which I consider to be a luxury.

I and many others are paying into pensions and expect those pensions to be there when we retire. Taking them away throws us all under the bus.

There's no way I could fund my retirement with a 401k. It would run out and I know it would run out. Without a pension my retirement plan might as well be a pistol and bullet for my skull.

No wonder the country is screwed up if people have this believe.

a reply to: Edumakated

That's what they wanted to convince you of. It has nothing to do with a checking account. It's about sound investments and not frittering other peoples money away on a chance investment. They could have invested the money in government bonds or a savings account, for example. Sure the return might be lower but the guarantee that your money is still there at the end of your pension payments is guaranteed.

But good luck with what you believe. In my native England many years ago, pensions were devalued by 60% or more in one fell swoop due to very questionable investments.

That's what they wanted to convince you of. It has nothing to do with a checking account. It's about sound investments and not frittering other peoples money away on a chance investment. They could have invested the money in government bonds or a savings account, for example. Sure the return might be lower but the guarantee that your money is still there at the end of your pension payments is guaranteed.

But good luck with what you believe. In my native England many years ago, pensions were devalued by 60% or more in one fell swoop due to very questionable investments.

Pensions work it's just the people running them are stealing from them left and right. kind of like other things that people control.

Our strike fund that give you $100 a week while on strike had over a billion dollars in it. We went on strike about 10,000 of us. 2 Weeks into the strike they said it was running low and they were going to reduce our weekly pay to $50 ??????????????????????????????????????????? Somebody was really bad at math or lying but probably both.

Our strike fund that give you $100 a week while on strike had over a billion dollars in it. We went on strike about 10,000 of us. 2 Weeks into the strike they said it was running low and they were going to reduce our weekly pay to $50 ??????????????????????????????????????????? Somebody was really bad at math or lying but probably both.

Pensions are stupid and always have been.

You should never be paying someone that doesnt work for you.

Most of the pensions I've encountered are not properly funded by the employer.

A 401k is funded by both parties immediately and are always up to date.

It won't be long before some of these funds collapse and everyone will be screaming bailout..

You should never be paying someone that doesnt work for you.

Most of the pensions I've encountered are not properly funded by the employer.

A 401k is funded by both parties immediately and are always up to date.

It won't be long before some of these funds collapse and everyone will be screaming bailout..

a reply to: Bluntone22

No bailout, if they didn't want to compromise let them all fail.

It won't be long before some of these funds collapse and everyone will be screaming bailout..

No bailout, if they didn't want to compromise let them all fail.

new topics

-

In an Historic First, In N Out Burger Permanently Closes a Location

Mainstream News: 32 minutes ago -

MH370 Again....

Disaster Conspiracies: 1 hours ago -

Are you ready for the return of Jesus Christ? Have you been cleansed by His blood?

Religion, Faith, And Theology: 3 hours ago -

Chronological time line of open source information

History: 4 hours ago -

A man of the people

Diseases and Pandemics: 5 hours ago -

Ramblings on DNA, blood, and Spirit.

Philosophy and Metaphysics: 6 hours ago -

4 plans of US elites to defeat Russia

New World Order: 7 hours ago -

Thousands Of Young Ukrainian Men Trying To Flee The Country To Avoid Conscription And The War

Other Current Events: 11 hours ago

top topics

-

Israeli Missile Strikes in Iran, Explosions in Syria + Iraq

World War Three: 14 hours ago, 17 flags -

Thousands Of Young Ukrainian Men Trying To Flee The Country To Avoid Conscription And The War

Other Current Events: 11 hours ago, 7 flags -

In an Historic First, In N Out Burger Permanently Closes a Location

Mainstream News: 32 minutes ago, 6 flags -

Iran launches Retalliation Strike 4.18.24

World War Three: 14 hours ago, 6 flags -

12 jurors selected in Trump criminal trial

US Political Madness: 13 hours ago, 4 flags -

4 plans of US elites to defeat Russia

New World Order: 7 hours ago, 4 flags -

A man of the people

Diseases and Pandemics: 5 hours ago, 3 flags -

Chronological time line of open source information

History: 4 hours ago, 2 flags -

Are you ready for the return of Jesus Christ? Have you been cleansed by His blood?

Religion, Faith, And Theology: 3 hours ago, 1 flags -

MH370 Again....

Disaster Conspiracies: 1 hours ago, 1 flags

active topics

-

12 jurors selected in Trump criminal trial

US Political Madness • 42 • : Vermilion -

Post A Funny (T&C Friendly) Pic Part IV: The LOL awakens!

General Chit Chat • 7125 • : imitator -

I Guess Cloud Seeding Works

Fragile Earth • 28 • : Degradation33 -

MH370 Again....

Disaster Conspiracies • 1 • : AlexandrosOMegas -

AARO/Dr Kirkpatrick-Caught Lying in UAP report.

Aliens and UFOs • 26 • : baablacksheep1 -

Are you ready for the return of Jesus Christ? Have you been cleansed by His blood?

Religion, Faith, And Theology • 11 • : Sookiechacha -

Thousands Of Young Ukrainian Men Trying To Flee The Country To Avoid Conscription And The War

Other Current Events • 21 • : Consvoli -

Not Aliens but a Nazi Occult Inspired and then Science Rendered Design.

Aliens and UFOs • 15 • : anthelion -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 540 • : IndieA -

Scarface does Tiny Desk Concert

Music • 8 • : zosimov