It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

a reply to: toysforadults

People have been saying this for decades now.

Saying it's all going to collapse come October or right after the new year or in the summer.

Yet it doesn't happen.

It's become like Yellowstone doom porn.

People have been saying this for decades now.

Saying it's all going to collapse come October or right after the new year or in the summer.

Yet it doesn't happen.

It's become like Yellowstone doom porn.

If only Obama hadn't added MORE to the national debt than every other administration combined.

a reply to: toysforadults

Yes and no.

What is really behind the swings in the market is politics. Leftist fund managers on the coasts are selling high, re-buying back in low to panic the public. This to shake confidence in Trump to assist in defeating hime in 2020.

The real economic prooblems wont start until after the election of Bloomber,g, Kamala Harris or Cory Booker to POTUS. They have aready signaled what they would do and they start by bsting up Googe, Amazon and Facebook incenerating trillions in wealth.

Yes and no.

What is really behind the swings in the market is politics. Leftist fund managers on the coasts are selling high, re-buying back in low to panic the public. This to shake confidence in Trump to assist in defeating hime in 2020.

The real economic prooblems wont start until after the election of Bloomber,g, Kamala Harris or Cory Booker to POTUS. They have aready signaled what they would do and they start by bsting up Googe, Amazon and Facebook incenerating trillions in wealth.

It has to come eventually. There are natural market cycles and bust is part of it. We've gone without a real market correction for far too long

because people are pain averse -- too big to fail and all that.

It sucks that we have no debt ,other than the debt from credit cards we accumulate during the month and pay off, yet the consumer debt of the other

people in the country will strongly negatively effect our lives if things crash. Money in the bank does no good if the banks are closed down for a

while. We do not keep much money in the house either, a couple hundred at most because if you do have money in the house and some wrong people find

out about it, they break in.

I remember when the majority of people had money in the bank and no credit card debt. But some idiots managing our countries economy figured it would look better if everyone got credit to buy things they want at their fingertips. So they allowed more risky credit to be given, actually promoting it.

I remember when the majority of people had money in the bank and no credit card debt. But some idiots managing our countries economy figured it would look better if everyone got credit to buy things they want at their fingertips. So they allowed more risky credit to be given, actually promoting it.

We've been in a debt crisis since the Federal Reserve was established with a 100 year contract in 1913. That's when our governmemt unconstitutionally

stopped regulating the weights and measures of money (gold/silver). From 1913 to 1971 the Federal Resrve began to debase the U.S. dollar. In 1971

Nixon took us off the gold standard with a promise we'd return to it. Since the creation of the Federal Resrve every dollar one makes today is worth

less tomorrow. The U.S. dollar has lost @ 90% of its value since 1971. It now takes 2 people's incomes to raise a family instead of just 1.

We are now in a catch 22 situation. If interest rates continue to rise, the economy will slow down & real estate/stock market values will collapse & if we lower interest rates, we'll need more quantatative easing. Fyi, inflation & quantatative easing are the same thing. Quantatative Easing = inflation of the money supply. The more dollars out there, the less they are worth. The next round of QE will have to be exponentially larger then previous rounds of QE to jump start the economy, this will be hyperinflation of the money supply, which will lead to higher prices of almost everything, including gold/silver/stock market prices. I would say it would lead to higher real estate prices too but people can't afford real estate at current prices. I guess the banks could offer 50 or 100 year mortgages to continue the charade.

We are now in a catch 22 situation. If interest rates continue to rise, the economy will slow down & real estate/stock market values will collapse & if we lower interest rates, we'll need more quantatative easing. Fyi, inflation & quantatative easing are the same thing. Quantatative Easing = inflation of the money supply. The more dollars out there, the less they are worth. The next round of QE will have to be exponentially larger then previous rounds of QE to jump start the economy, this will be hyperinflation of the money supply, which will lead to higher prices of almost everything, including gold/silver/stock market prices. I would say it would lead to higher real estate prices too but people can't afford real estate at current prices. I guess the banks could offer 50 or 100 year mortgages to continue the charade.

edit on 8-12-2018 by JBIZZ because: (no

reason given)

originally posted by: ketsuko

It has to come eventually. There are natural market cycles and bust is part of it. We've gone without a real market correction for far too long because people are pain averse -- too big to fail and all that.

I agree, but there has been a fundamental change to the natural flow of business boom and bust cycles. it's going from being a business cycle to a debt bubble cycle

originally posted by: 83Liberty

On the other hand, the Bank of England have recently increased interest rates, which they just wouldn't do if there was a crash incoming. Unless that's part of their plan so they can blame it on Brexit or Trump.

Something something nail on head. Remember Bill Maher saying he'd love to see a recession just so they could blame it on Trump? You think he's the only progressive that thinks that? They'd be perfectly fine seeing a bunch of people lose their jobs and homes, as long as it hurts Trump.

originally posted by: JBIZZ

It now takes 2 people's incomes to raise a family instead of just 1.

And I suppose this has nothing to do with the fact that people need a new phone every year, every new gadget and gizmo they see on tv, are buying homes and cars that are well above their income range, I can go on and on. The reason you could live off 1 income back then is because you weren't buying junk left and right.

a reply to: face23785

oh yeah, show us the data that proves it. see your platitudes sound good, they make sense but the data doesn't support your position. just ask Apple

nypost.com...

but ya, go ahead and keep repeating that platitude even though the economic data suggest that people are spending all of their money on basic necessities and inflation is what is the main driver behind the debt increase

oh yeah, show us the data that proves it. see your platitudes sound good, they make sense but the data doesn't support your position. just ask Apple

nypost.com...

It seems global consumers are wising up when it comes to upgrading their smartphones. Smartphone makers saw the first quarterly decline in the last three months of 2017, compared with year-earlier figures.

but ya, go ahead and keep repeating that platitude even though the economic data suggest that people are spending all of their money on basic necessities and inflation is what is the main driver behind the debt increase

originally posted by: toysforadults

a reply to: face23785

oh yeah, show us the data that proves it. see your platitudes sound good, they make sense but the data doesn't support your position. just ask Apple

nypost.com...

It seems global consumers are wising up when it comes to upgrading their smartphones. Smartphone makers saw the first quarterly decline in the last three months of 2017, compared with year-earlier figures.

but ya, go ahead and keep repeating that platitude even though the economic data suggest that people are spending all of their money on basic necessities and inflation is what is the main driver behind the debt increase

You're actually claiming that the average American doesn't have a ton of # they don't need? Okay, you go with that.

originally posted by: toysforadults

a reply to: face23785

oh yeah, show us the data that proves it. see your platitudes sound good, they make sense but the data doesn't support your position. just ask Apple

nypost.com...

It seems global consumers are wising up when it comes to upgrading their smartphones. Smartphone makers saw the first quarterly decline in the last three months of 2017, compared with year-earlier figures.

but ya, go ahead and keep repeating that platitude even though the economic data suggest that people are spending all of their money on basic necessities and inflation is what is the main driver behind the debt increase

I love how you dishonestly expanded that to the global market. We're talking about America here.

In 2017, Americans spent $240 billion—twice as much as they’d spent in 2002—on goods like jewelry, watches, books, luggage, and telephones and related communication equipment, according to the Bureau of Economic Analysis, which adjusted those numbers for inflation. Over that time, the population grew just 13 percent. Spending on personal care products also doubled over that time period. Americans spent, on average, $971.87 on clothes last year, buying nearly 66 garments, according to the American Apparel and Footwear Association. That’s 20 percent more money than they spent in 2000. The average American bought 7.4 pairs of shoes last year, up from 6.6 pairs in 2000.

Read. We're a consumerist society.

originally posted by: toysforadults

a reply to: rickymouse

the issue is that people are using this credit to cover basic necessities

As long as the economy appears to flourish and people are spending money, it doesn't make any difference to the ones running the economy. Yes, you are right, people are surviving off of credit too. But that kind of data is not separated from overall data that shows our economy is doing better than it is. After we recovered from the 08 crash national consumer debt seemed to be declining but it is back up there again. Student debt is jumping higher steadily too. The student debt is not included in the consumer debt, realistic numbers are hard to find.

a reply to: face23785

I'm not making claims. Year over year people spend less and less money on things like entertainment. You have no idea though because you are making an assumption based on a platitude and not actually looking at the data.

Look I can show you data all day but you will ignore to defend your narrative.

Narrative buster

BUSTER ALERT

Apple correction due to low iPhone sales

ALERT ALERT, Your narrative is false.

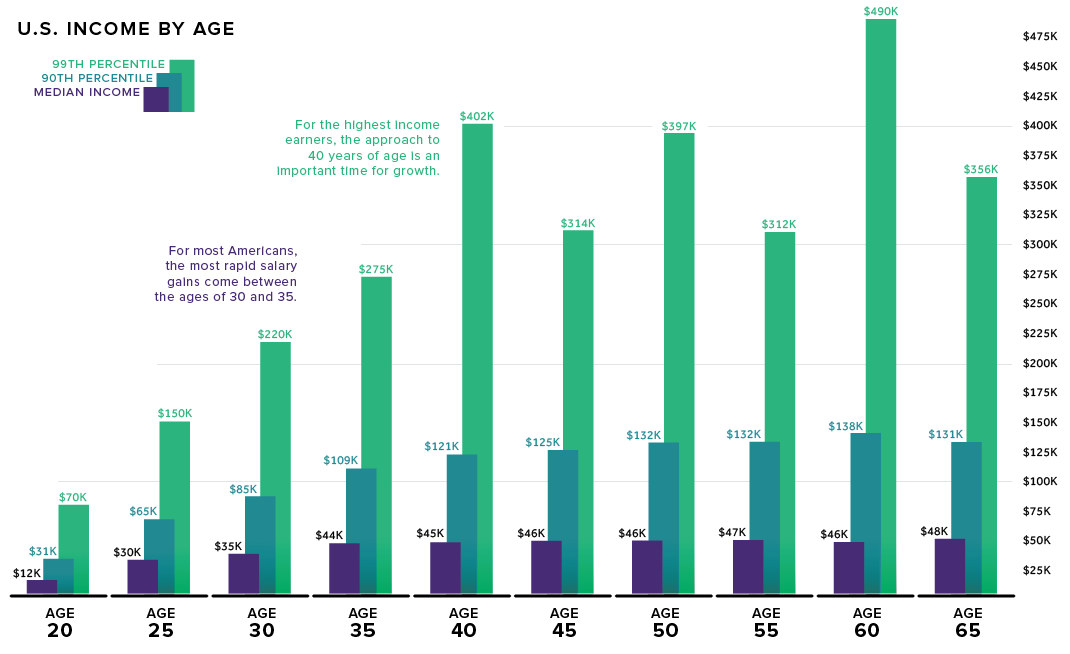

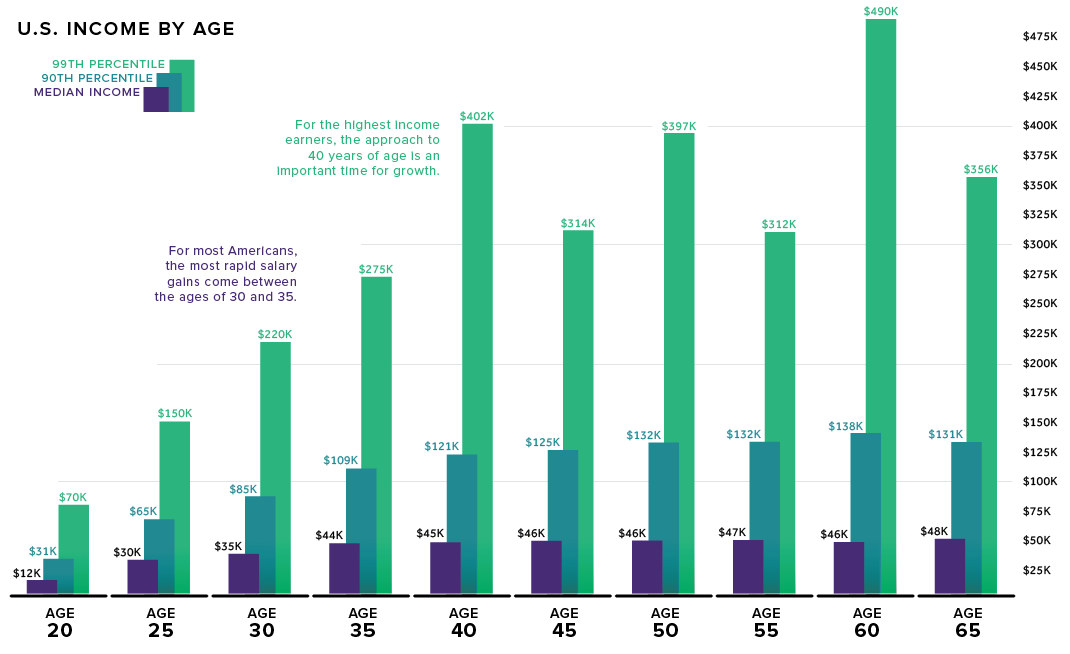

Will you look at that. It's the older generations doing all of the duplicitous spending. probably because the majority of my ages groups adult life has been spent during a massive economic downturn. I know, it's all our fault right?

Visual Capitalist

See, we're not the ones making all of the money AND taking on all of the debt. but you won't care, because the TV told you it's the Millennial's that are the problem. not the economy and the failed institutions of our nation

visual capitalist, one of my favorite sites

you see that, look at where they get their data, look at the inverse relationships where the debt is coming from and why

then, leave your narrative/ platitudes behind because they are wrong. unless you like being wrong. do you like being wrong or misinformed?

I'm not making claims. Year over year people spend less and less money on things like entertainment. You have no idea though because you are making an assumption based on a platitude and not actually looking at the data.

Look I can show you data all day but you will ignore to defend your narrative.

Narrative buster

When you sign that restaurant tab, it may not feel as if you're saving big bucks. But according to a newly released spending index, while millennials aren't afraid to wine and dine—and shop, for that matter—we are spending less money than other generations.

BUSTER ALERT

Apple correction due to low iPhone sales

Apple burdened by weak iPhone sales, not trade, says expert

ALERT ALERT, Your narrative is false.

Overall, the typical Gen-Xer or baby boomer spends about $1,000 on discretionary items—think: dining, retail, entertainment, apparel, and travel—plus about $1,600 a month on bills, according to TD Bank's Consumer Spending Index. That's about $32,000 annually—before factoring in extras such as car payments, loan repayments, or healthcare. On the other hand, millennials spend an average of about $26,000 total each year—about 27 percent less than Gen Xers and 23 percent less than Baby Boomers, according to the index.

Will you look at that. It's the older generations doing all of the duplicitous spending. probably because the majority of my ages groups adult life has been spent during a massive economic downturn. I know, it's all our fault right?

Visual Capitalist

See, we're not the ones making all of the money AND taking on all of the debt. but you won't care, because the TV told you it's the Millennial's that are the problem. not the economy and the failed institutions of our nation

visual capitalist, one of my favorite sites

you see that, look at where they get their data, look at the inverse relationships where the debt is coming from and why

then, leave your narrative/ platitudes behind because they are wrong. unless you like being wrong. do you like being wrong or misinformed?

originally posted by: rickymouse

originally posted by: toysforadults

a reply to: rickymouse

the issue is that people are using this credit to cover basic necessities

As long as the economy appears to flourish and people are spending money, it doesn't make any difference to the ones running the economy. Yes, you are right, people are surviving off of credit too. But that kind of data is not separated from overall data that shows our economy is doing better than it is. After we recovered from the 08 crash national consumer debt seemed to be declining but it is back up there again. Student debt is jumping higher steadily too. The student debt is not included in the consumer debt, realistic numbers are hard to find.

and you nailed it. the politicians and talking heads on TV are just using whatever data they can to support their analysis without adding context. they rely on the ignorance of the masses to do this

a reply to: face23785

People were buying stuff which they could not afford back then too. Debt & loans have been around for thousands of years. A smartphone is a radio, TV, alarm clock, encyclopedia, cookbook, map, camera, video camera, diagnostic tool, etc. & $1000 for a smartphone is a deal so is $500 for a 50' flat screen TV. Lets say your went back in time before 1971. Did you have a camera, video camera, encyclopedia, cookbooks, TV, radio, etc? How much did those things combined cost you before 1971? I'm pretty sure they're way more affordable today, yet people still don't have enough money to buy them. This is because of the Federal Reserves debasement of our currency. A dollar is a U.S. debt note. Even if one has enough debt notes to buy something, they are still using debt to buy it.

People were buying stuff which they could not afford back then too. Debt & loans have been around for thousands of years. A smartphone is a radio, TV, alarm clock, encyclopedia, cookbook, map, camera, video camera, diagnostic tool, etc. & $1000 for a smartphone is a deal so is $500 for a 50' flat screen TV. Lets say your went back in time before 1971. Did you have a camera, video camera, encyclopedia, cookbooks, TV, radio, etc? How much did those things combined cost you before 1971? I'm pretty sure they're way more affordable today, yet people still don't have enough money to buy them. This is because of the Federal Reserves debasement of our currency. A dollar is a U.S. debt note. Even if one has enough debt notes to buy something, they are still using debt to buy it.

edit on 8-12-2018 by JBIZZ because: (no reason given)

new topics

-

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs: 2 hours ago -

2024 Pigeon Forge Rod Run - On the Strip (Video made for you)

Automotive Discussion: 3 hours ago -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues: 3 hours ago -

The functionality of boldening and italics is clunky and no post char limit warning?

ATS Freshman's Forum: 4 hours ago -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News: 5 hours ago -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest: 5 hours ago -

Weinstein's conviction overturned

Mainstream News: 7 hours ago -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics: 8 hours ago -

Krystalnacht on today's most elite Universities?

Social Issues and Civil Unrest: 8 hours ago -

Chris Christie Wishes Death Upon Trump and Ramaswamy

Politicians & People: 9 hours ago

top topics

-

Krystalnacht on today's most elite Universities?

Social Issues and Civil Unrest: 8 hours ago, 9 flags -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics: 8 hours ago, 8 flags -

Weinstein's conviction overturned

Mainstream News: 7 hours ago, 7 flags -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media: 11 hours ago, 6 flags -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News: 5 hours ago, 5 flags -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues: 3 hours ago, 4 flags -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest: 5 hours ago, 4 flags -

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs: 2 hours ago, 3 flags -

Chris Christie Wishes Death Upon Trump and Ramaswamy

Politicians & People: 9 hours ago, 2 flags -

Any one suspicious of fever promotions events, major investor Goldman Sachs card only.

The Gray Area: 13 hours ago, 2 flags

active topics

-

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News • 10 • : chr0naut -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics • 75 • : Vermilion -

University student disciplined after saying veganism is wrong and gender fluidity is stupid

Education and Media • 50 • : watchitburn -

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News • 55 • : CarlLaFong -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest • 23 • : Ravenwatcher -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 680 • : 777Vader -

Is there a hole at the North Pole?

ATS Skunk Works • 40 • : Oldcarpy2 -

Fossils in Greece Suggest Human Ancestors Evolved in Europe, Not Africa

Origins and Creationism • 89 • : whereislogic -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media • 197 • : NorthOS -

Candidate TRUMP Now Has Crazy Judge JUAN MERCHAN After Him - The Stormy Daniels Hush-Money Case.

Political Conspiracies • 790 • : Oldcarpy2