It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

originally posted by: Lab4Us

originally posted by: toysforadults

there are several bubbles forming due to the fact that the average income for my entire generation is less than 25k a year nationwide and everyone has tons of student loan debt

you brought the crash on now you are going to suffer

good luck Gen X and Baby Boomers

So if that’s the “average”, that would mean about 50% of “your generation” are making at least $50k a year and I suspect they are actually making much much more when you factor out the unemployed peeps.

I’m pretty sure that in any branch of the military you can start at 18 with about $40k annually with benefits...but then again you have to actually work in those jobs...

What?? In what universe? Try around $18 grand just starting out.

originally posted by: toysforadults

a reply to: Bluntone22

technically the market is being hyperinflate by banks buying up stock and companies buying massive amounts of their own stock back it's not being generate by actual market activity

Thats a dumb statement banks buying stocks for 401k or companies purchasing their stocks because they are investing their Capitol is what market activity is. Your funny it's like saying well ocean water has salt in it so it's not actually water

a reply to: FamCore

I want to give you credit for such a humble statement

With this attitude its is people like yourself, I believe, who will actually learn something

Thanks for the OP I will be glad to give it some serious thought.

I do recall the last fed chair saying she was against the tax cut.

There is this big "tax cut" at a time when the economy is not doing all that terrible, which isn't a good situation because if we do hit a recession the administration will be less likely to want to raise taxes. I personally think the timing of this was not good, but I'm not an expert at politics or economics (although I am a student of both).

I want to give you credit for such a humble statement

With this attitude its is people like yourself, I believe, who will actually learn something

Thanks for the OP I will be glad to give it some serious thought.

I do recall the last fed chair saying she was against the tax cut.

The stock marker remember is like a roller coaster, its goes up and goes down.

You have to look at real world events to gauge the economy, for better or worse, not the fickle stock market

I can recall one of our IT engineers going to Bear Stearns the day it went down and describing the horrible gloom there.

Events like that, and thank God there not happening now, will give us an indication of the economy’s condition.

You have to look at real world events to gauge the economy, for better or worse, not the fickle stock market

I can recall one of our IT engineers going to Bear Stearns the day it went down and describing the horrible gloom there.

Events like that, and thank God there not happening now, will give us an indication of the economy’s condition.

originally posted by: intrptr

a reply to: FamCore

Stocks up, big tax cut, great for big business. The tax cuts went mostly to the wealthy, the hi stocks benefit mostly the wealthy, the inequality of wealth in this country remains the same.

How are things improving for whom?

Please explain in detail just what "the inequality of wealth in this country..." means? Do you idiot liberals or socialists or communists (or what ever you all call yourselves, now) really believe someone in this country, hell, this world, is really going to give you something for nothing? Didn't you get an education? Do you have a Job? Do you sit on your ass and watch Oprah all day?

I apologize for my passion, but I worked hard for my living since I was 10 years old. I was injured when I was 58 and cannot hold a job any more (really sucks!) but I have never complained about someone having more than myself or my family. I trained myself and went to school to do what I love which was electrical and electronics. I worked hard and made plenty of money, saved a lot and paid into Social Security which for the last 8 years when I was an electrical supervisor topped out at the maximum you could pay.

I tell you what, you can take your liberal opinion and stick it where the sun never shines. As for myself, I have the utmost respect for people who work AND work to better themselves despite the odds and idiot people like yourself! I'll get banned for this, but I hope you choke on your EBT steak!!!!!

originally posted by: Nyiah

originally posted by: Lab4Us

originally posted by: toysforadults

there are several bubbles forming due to the fact that the average income for my entire generation is less than 25k a year nationwide and everyone has tons of student loan debt

you brought the crash on now you are going to suffer

good luck Gen X and Baby Boomers

So if that’s the “average”, that would mean about 50% of “your generation” are making at least $50k a year and I suspect they are actually making much much more when you factor out the unemployed peeps.

I’m pretty sure that in any branch of the military you can start at 18 with about $40k annually with benefits...but then again you have to actually work in those jobs...

What?? In what universe? Try around $18 grand just starting out.

18k pay, it's the benefits that are the icing on the cake. I worked on an army base in their hospital. Active duty soldiers get a lot of perks.

a reply to: NightFlight

It means 1 percent of the wealthiest people control 99 percent of the countries assets.

You been around since 2007 and don't know this?

Please explain in detail just what "the inequality of wealth in this country..." means?

It means 1 percent of the wealthiest people control 99 percent of the countries assets.

You been around since 2007 and don't know this?

originally posted by: Nickn3

I moved my 401K into a safe haven over a month ago, I am to old to take another loss like in 2008 & 2009. The stock market is to volatile for my comfort.

Which type of "safe haven" was that? bonds, cash, corporate bonds, real-estate?

originally posted by: toysforadults

originally posted by: Nickn3

I moved my 401K into a safe haven over a month ago, I am to old to take another loss like in 2008 & 2009. The stock market is to volatile for my comfort.

many investors are moving into secure positions

if you play it right and go long you'll actually be positioned fantastically for the next rise

also if your in the british pound or yen right now I'm thinking you'll be in a better position soon as the dollar continues to lose value

did you just draw a connection between the USD, the Yen and the Pound? Hmm

originally posted by: anonentity

a reply to: FamCore

It's getting a bit too obvious as to what they are up to, which means if you understand this, the market is predictable , and your chances of loosing on investments is greatly reduced. Which means the Fed and Central Banks are giving money to canny investors. They can also do this only for a limited time, although they can print any amount of money they want, it will end with Hyperinflation, to avoid this, they would have to recall billions of dollars, crashing the market destroys lots of unwanted dollars in a day. They do this just by selling their stocks and bonds at the top. The timing of when this event happens will be reflected in the run for the lifeboats which has to be the Precious metals.

So basically in your opinion, precious metals, food and guns is our best option at this point then? or is that another 10 days down the road in terms of the system here in the West?

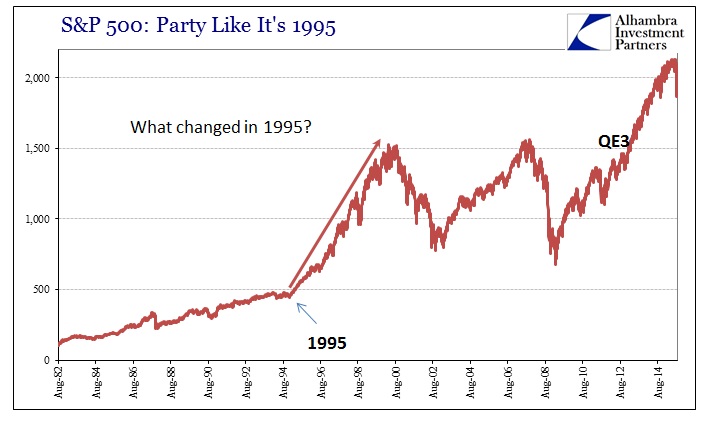

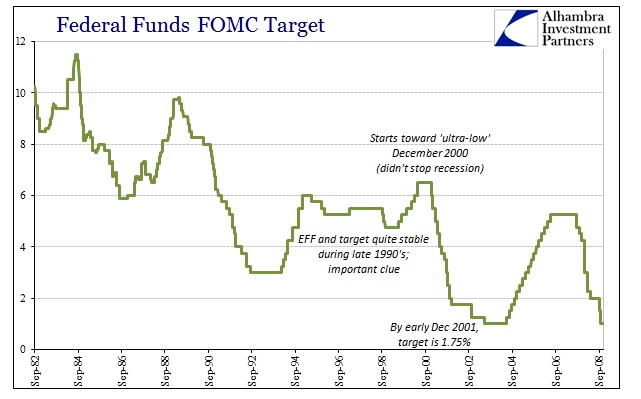

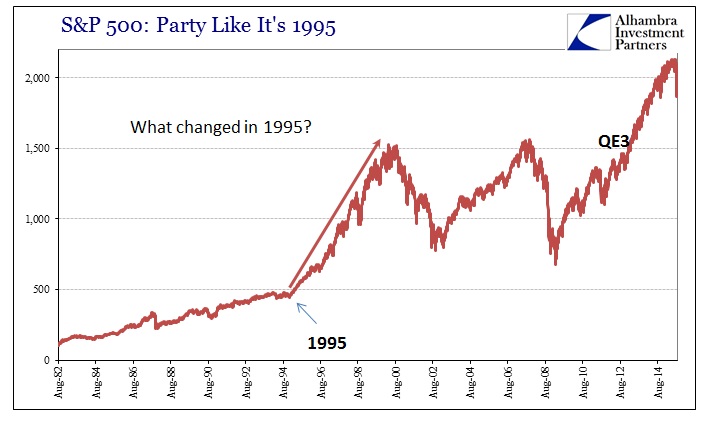

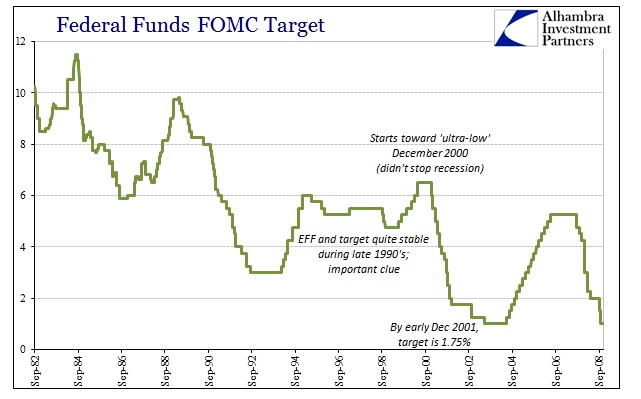

The financial markets have been completely distorted since the mid 1990s. But in general since Nixon closed the gold window in 1971, allowing the

United States government to naked short the economy by deficit spending.

Then the markets changed fundamentally again in the mid 1990s.

Since then it's been a series of policy errors that create higher and higher bubbles that end with a crash, 2000, 2008 and another coming soon. Primarily it's the fed, every time they lower the prime lending rate it spurs lending and the economy takes off. Then after about 7-8 years it becomes obvious that the debt wasn't used for productive purposes but was instead used for speculation in the markets so they crash because there's no real productivity to service the debt.

From 2001-2008 the obvious mal-investments was housing, that ended with the subprime housing crisis. This time it's an everything bubble as bonds, stocks and real estate are all mis-priced in terms of our economic productivity.

Trump's tax cuts help the publicly traded corporations but they'll just use the increased money for more financial games like stock buybacks or mergers.

You put it best on the 1st page OP when you said that savings rates dropping to 2.9% are lowest in a long time, that's the real indicator there that people loaded up on debt once again to buy things that have no use to the real economy, in generating actual productivity.

So the markets will crash again, I don't know by how much or when but John Hussman said recently he expects them to fall 2/3rd, but if the rest of the world drops the dollar in trade we might go back to the long term mean for the DOW of around 3,000. That would be like an 85% drop and take out most of the debt used to blow this mega super cycle in the markets since 1995.

Then the markets changed fundamentally again in the mid 1990s.

www.zerohedge.com...

We don’t even have to search very hard for the commonality of 1995, either. It was at that time, developed throughout the late 1980’s and early 1990’s, the JP Morgan “sold” its RiskMetrics platform widely to Wall Street and London. The torrent of dark leverage and wholesale “banking” that would be unleashed through the mathematical effects on balance sheet leverage, extended and received, was simply obvious. That counted, too, for the global effects upon the eurodollar stage, as the surge of the “dollar” coincided with the end stage of pure economic financialization. Greenspan believed, as did almost everyone else, he was controlling the economy through minute fine-tuning of the federal funds rate, a quarter point here, quarter point there, as if those made any true difference. Instead, the “dollar” was surging everywhere but especially Europe (this is Bernanke/Greenspan’s mysterious “global savings glut”; not “savings” at all but balance sheet expansion across multiple dimensions).

Since then it's been a series of policy errors that create higher and higher bubbles that end with a crash, 2000, 2008 and another coming soon. Primarily it's the fed, every time they lower the prime lending rate it spurs lending and the economy takes off. Then after about 7-8 years it becomes obvious that the debt wasn't used for productive purposes but was instead used for speculation in the markets so they crash because there's no real productivity to service the debt.

From 2001-2008 the obvious mal-investments was housing, that ended with the subprime housing crisis. This time it's an everything bubble as bonds, stocks and real estate are all mis-priced in terms of our economic productivity.

Trump's tax cuts help the publicly traded corporations but they'll just use the increased money for more financial games like stock buybacks or mergers.

You put it best on the 1st page OP when you said that savings rates dropping to 2.9% are lowest in a long time, that's the real indicator there that people loaded up on debt once again to buy things that have no use to the real economy, in generating actual productivity.

So the markets will crash again, I don't know by how much or when but John Hussman said recently he expects them to fall 2/3rd, but if the rest of the world drops the dollar in trade we might go back to the long term mean for the DOW of around 3,000. That would be like an 85% drop and take out most of the debt used to blow this mega super cycle in the markets since 1995.

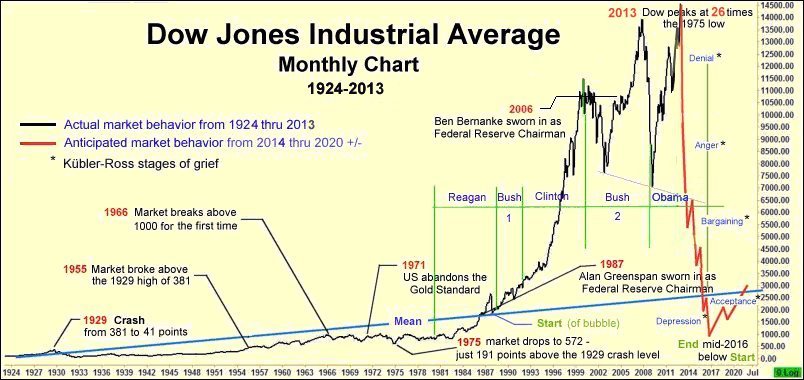

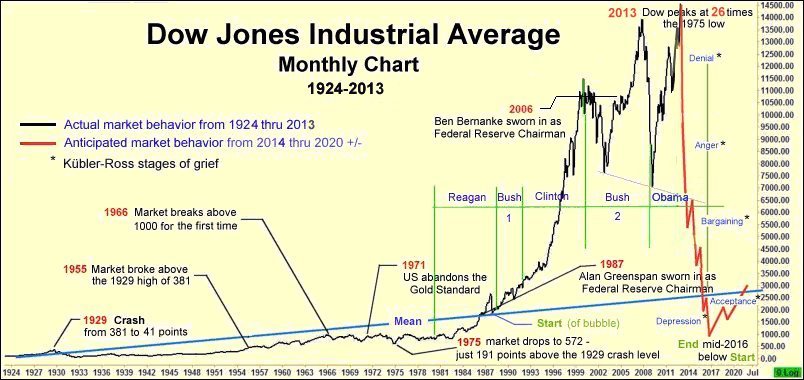

edit on 30-1-2018 by SkeptiSchism because: added chart

This is like my favorite chart, it was done about 4 years ago but it's still valid IMO. That little blurb way off to the left was the 1929 stock

market crash. That is how far distorted our financial markets have become with all this non-secured lending.

a reply to: SkeptiSchism

well the banks and corporations are already picking up the tab in the market and dumping billions of dollars worth of gold into the market at a clip so, who knows where we are really at

well the banks and corporations are already picking up the tab in the market and dumping billions of dollars worth of gold into the market at a clip so, who knows where we are really at

a reply to: SkeptiSchism

the chart you posted looks like it only goes to something like 14,000, when we are currently at over 26,000.

this is Not good...

the chart you posted looks like it only goes to something like 14,000, when we are currently at over 26,000.

this is Not good...

a reply to: FamCore

Yah it came from an obscure website I found 5 years ago, the guy took his website down because he was convinced the markets were going to tank. Then they didn't.

It's really a matter of confidence. As long as sheeple keep piling their retirement money into the markets they can keep leveraging up but eventually they abuse even that to the point it no longer works.

Pension funds are hosed, most of them are already 50% undercapitalized and that is with this current monster bubble in stocks.

They knew about that 8 years ago too, Obama and his pals wanted to start up MyRA and take everyone's 401k and create a new 'retirement plan' by stealing their current wealth and replacing it with treasury bonds (IOUs).

I like Trump but he owns this one, on his campaign he said we were in a big fat bubble, then once he got in we were no longer in a bubble right? Because he was president I guess. He owns this one and the real culprits, ie. Greenscam, Bernanke, Yellen, JPMc and the rest of the too big too fail crew will escape notice once again.

Yah it came from an obscure website I found 5 years ago, the guy took his website down because he was convinced the markets were going to tank. Then they didn't.

It's really a matter of confidence. As long as sheeple keep piling their retirement money into the markets they can keep leveraging up but eventually they abuse even that to the point it no longer works.

Pension funds are hosed, most of them are already 50% undercapitalized and that is with this current monster bubble in stocks.

They knew about that 8 years ago too, Obama and his pals wanted to start up MyRA and take everyone's 401k and create a new 'retirement plan' by stealing their current wealth and replacing it with treasury bonds (IOUs).

I like Trump but he owns this one, on his campaign he said we were in a big fat bubble, then once he got in we were no longer in a bubble right? Because he was president I guess. He owns this one and the real culprits, ie. Greenscam, Bernanke, Yellen, JPMc and the rest of the too big too fail crew will escape notice once again.

originally posted by: FamCore

originally posted by: Nickn3

I moved my 401K into a safe haven over a month ago, I am to old to take another loss like in 2008 & 2009. The stock market is to volatile for my comfort.

Which type of "safe haven" was that? bonds, cash, corporate bonds, real-estate?

420 green investments. It's the new thing. fortune.com...

and Pandas...

originally posted by: intrptr

a reply to: NightFlight

Please explain in detail just what "the inequality of wealth in this country..." means?

It means 1 percent of the wealthiest people control 99 percent of the countries assets.

You been around since 2007 and don't know this?

You certainly have been indoctrinated very well, Luke. I'm taking the lie you espouse as to mean that 1% of Americans OWN 99% of America. B.S. Because they sure as hell don't own it nor control the country. As much as you would like this to be true, it ain't. I can't remember the actual percentages, some where around 47% or 48% IIRC, which mostly are corporations and LLC's, which is a far cry from 99% but still high IMO.

P.S. You need to get out more and see our wonderful country and most of all, turn off the CNN and the TV! It will make you fat... between the ears especially.

a reply to: NightFlight

well you have to admit that the average american wage has been stagnant since the 70's all while worker productivity has gone up. meanwhile ceo's and upper managements salaries continue to rise. trickle down or trickle up?

well you have to admit that the average american wage has been stagnant since the 70's all while worker productivity has gone up. meanwhile ceo's and upper managements salaries continue to rise. trickle down or trickle up?

originally posted by: NightFlight

originally posted by: intrptr

a reply to: NightFlight

Please explain in detail just what "the inequality of wealth in this country..." means?

It means 1 percent of the wealthiest people control 99 percent of the countries assets.

You been around since 2007 and don't know this?

You certainly have been indoctrinated very well, Luke. I'm taking the lie you espouse as to mean that 1% of Americans OWN 99% of America. B.S. Because they sure as hell don't own it nor control the country. As much as you would like this to be true, it ain't. I can't remember the actual percentages, some where around 47% or 48% IIRC, which mostly are corporations and LLC's, which is a far cry from 99% but still high IMO.

P.S. You need to get out more and see our wonderful country and most of all, turn off the CNN and the TV! It will make you fat... between the ears especially.

Can you provide evidence? surely you can find a link that backs up those numbers ....

new topics

-

The functionality of boldening and italics is clunky and no post char limit warning?

ATS Freshman's Forum: 28 minutes ago -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News: 1 hours ago -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest: 1 hours ago -

Weinstein's conviction overturned

Mainstream News: 2 hours ago -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics: 4 hours ago -

Krystalnacht on today's most elite Universities?

Social Issues and Civil Unrest: 4 hours ago -

Chris Christie Wishes Death Upon Trump and Ramaswamy

Politicians & People: 4 hours ago -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media: 6 hours ago -

Any one suspicious of fever promotions events, major investor Goldman Sachs card only.

The Gray Area: 9 hours ago

top topics

-

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News: 17 hours ago, 11 flags -

Krystalnacht on today's most elite Universities?

Social Issues and Civil Unrest: 4 hours ago, 8 flags -

Weinstein's conviction overturned

Mainstream News: 2 hours ago, 6 flags -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics: 4 hours ago, 5 flags -

Electrical tricks for saving money

Education and Media: 16 hours ago, 5 flags -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media: 6 hours ago, 4 flags -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News: 1 hours ago, 3 flags -

Any one suspicious of fever promotions events, major investor Goldman Sachs card only.

The Gray Area: 9 hours ago, 2 flags -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest: 1 hours ago, 2 flags -

God's Righteousness is Greater than Our Wrath

Religion, Faith, And Theology: 13 hours ago, 1 flags

active topics

-

Weinstein's conviction overturned

Mainstream News • 18 • : nugget1 -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media • 158 • : Threadbarer -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 675 • : Thoughtful3 -

Candidate TRUMP Now Has Crazy Judge JUAN MERCHAN After Him - The Stormy Daniels Hush-Money Case.

Political Conspiracies • 760 • : matafuchs -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News • 3 • : network dude -

Any one suspicious of fever promotions events, major investor Goldman Sachs card only.

The Gray Area • 9 • : xuenchen -

President BIDEN Vows to Make Americans Pay More Federal Taxes in 2025 - Political Suicide.

2024 Elections • 145 • : ImagoDei -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest • 7 • : nugget1 -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues • 86 • : Consvoli -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics • 51 • : Threadbarer