It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

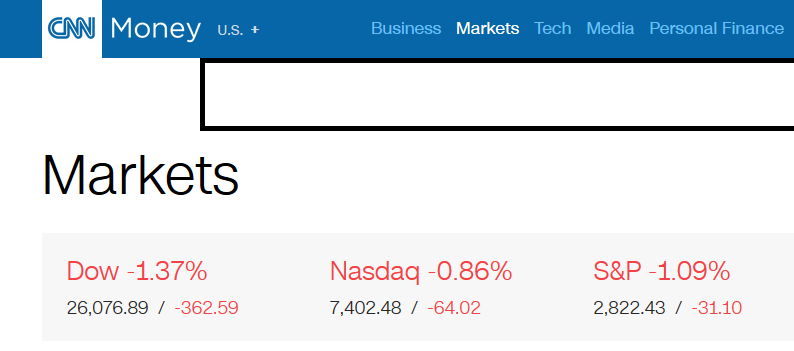

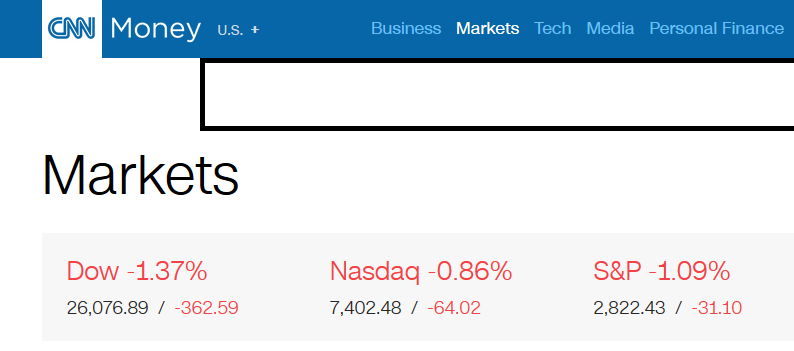

As many of you probably know, the teflon US equities market finally had a small correction today, with the DOW down more than 360 points:

Ironically, I saw a newsflash pop up on MarketWatch that said this was the biggest drop in 8 months, when I created this thread (DOW was down 350 points on that single day): US Stock Market Takes a Beating Today - DOW Down 350... FamCore's Analysis of the Larger Situation

The US 10-year yield is rising (selloff in the bond market). The yield curve continues to flatten... link

The legendary Jeffrey Gundlach said if the US 10-year hit 2.63 it would not be a good sign (it is currently at 2.73 and on a trajectory to keep rising) link

There is this big "tax cut" at a time when the economy is not doing all that terrible, which isn't a good situation because if we do hit a recession the administration will be less likely to want to raise taxes. I personally think the timing of this was not good, but I'm not an expert at politics or economics (although I am a student of both).

The overvaluation in the markets, including the housing market in many areas is unsustainable, as is the debt problem. Personal debt especially - the US Savings Rate has fallen to a 12-year low to 2.9%: link

I had the impression this bull market would continue, at least for awhile. But looking at the economy aside from stocks altogether, I am concerned in terms of monetary policy, the Federal Reserve's seeming incompetence, and lack of options we seem to have here in the US (but we're not alone, either).

Precious metals sold off today, as did bonds, commodities, AND US equities... the money needs to find a place to go, and it will likely go back into the stock market. At least for now...

I am curious to hear what my friends here on ATS think about the current situation with US Equities, the economy in general, and whether or not that bumpy ride is coming down the pike sooner or later. What says, ATS?

Ironically, I saw a newsflash pop up on MarketWatch that said this was the biggest drop in 8 months, when I created this thread (DOW was down 350 points on that single day): US Stock Market Takes a Beating Today - DOW Down 350... FamCore's Analysis of the Larger Situation

The US 10-year yield is rising (selloff in the bond market). The yield curve continues to flatten... link

The legendary Jeffrey Gundlach said if the US 10-year hit 2.63 it would not be a good sign (it is currently at 2.73 and on a trajectory to keep rising) link

There is this big "tax cut" at a time when the economy is not doing all that terrible, which isn't a good situation because if we do hit a recession the administration will be less likely to want to raise taxes. I personally think the timing of this was not good, but I'm not an expert at politics or economics (although I am a student of both).

The overvaluation in the markets, including the housing market in many areas is unsustainable, as is the debt problem. Personal debt especially - the US Savings Rate has fallen to a 12-year low to 2.9%: link

I had the impression this bull market would continue, at least for awhile. But looking at the economy aside from stocks altogether, I am concerned in terms of monetary policy, the Federal Reserve's seeming incompetence, and lack of options we seem to have here in the US (but we're not alone, either).

Precious metals sold off today, as did bonds, commodities, AND US equities... the money needs to find a place to go, and it will likely go back into the stock market. At least for now...

I am curious to hear what my friends here on ATS think about the current situation with US Equities, the economy in general, and whether or not that bumpy ride is coming down the pike sooner or later. What says, ATS?

edit on 30-1-2018 by FamCore because: (no reason given)

I'm shocked but not surprised. I've had a feeling that this would happen under Trump.

I guess Trump lives rent free in your heads.

Dow down 1 percent from ATH and its the end? Do you people think that markets are supposed to go up forever?

Do you think there aren't corrections, short term bear trends, and even criminal activities that need to be cleared or that are cleared?

Get a grip on your anti-Trump hysteria already.

Hell this could be driven by what's going on in the cryptoworld today. Lots of companies invested in Bitcoin are sweating right now.

Dow down 1 percent from ATH and its the end? Do you people think that markets are supposed to go up forever?

Do you think there aren't corrections, short term bear trends, and even criminal activities that need to be cleared or that are cleared?

Get a grip on your anti-Trump hysteria already.

Hell this could be driven by what's going on in the cryptoworld today. Lots of companies invested in Bitcoin are sweating right now.

a reply to: FamCore

This is a 'market correction,' and nothing more. I think that, overall, the economy will continue to climb, but only after it gets an overdue correction (which this may not be--this could be fear of the SOTU address, or concern over "the memo" and all of the turmoil in Washington, concern that all of the raises/bonuses were premature, etc, etc.).

I predict that this will be temporary, and that we will continue on a slow climb upward once again.

But we'll see...historically speaking, the stock market gained 1.47% after Trump's first speech in March of 2017, so if I wanted to put my conspiracy hat on, maybe this is a concerted effort to lower the market the day of so that it can appear to rise even more the following day. There have been a lot of negative reactions the day after SOTU addresses, also, so maybe there is a conspiracy to give him all positive reactions during his first term?

Here is a list of gains/losses the day after the SOTU from Kennedy on, if you want to check them out at Market Watch.

Just a couple of thoughts, but I don't think that this will be a prolonged bumpy road at all.

This is a 'market correction,' and nothing more. I think that, overall, the economy will continue to climb, but only after it gets an overdue correction (which this may not be--this could be fear of the SOTU address, or concern over "the memo" and all of the turmoil in Washington, concern that all of the raises/bonuses were premature, etc, etc.).

I predict that this will be temporary, and that we will continue on a slow climb upward once again.

But we'll see...historically speaking, the stock market gained 1.47% after Trump's first speech in March of 2017, so if I wanted to put my conspiracy hat on, maybe this is a concerted effort to lower the market the day of so that it can appear to rise even more the following day. There have been a lot of negative reactions the day after SOTU addresses, also, so maybe there is a conspiracy to give him all positive reactions during his first term?

Here is a list of gains/losses the day after the SOTU from Kennedy on, if you want to check them out at Market Watch.

Just a couple of thoughts, but I don't think that this will be a prolonged bumpy road at all.

there are several bubbles forming due to the fact that the average income for my entire generation is less than 25k a year nationwide and everyone has

tons of student loan debt

you brought the crash on now you are going to suffer

good luck Gen X and Baby Boomers

you brought the crash on now you are going to suffer

good luck Gen X and Baby Boomers

originally posted by: intrptr

a reply to: FamCore

Stocks up, big tax cut, great for big business. The tax cuts went mostly to the wealthy, the hi stocks benefit mostly the wealthy, the inequality of wealth in this country remains the same.

How are things improving for whom?

Gee, my investments are up over 40% since Trump came into office, I can promise that "improved things" for me. Can definitely say I am not sweating a one day drop of 1.36%.

The only ting happening under Trump... is the act of righting-the-ship-of-state, by that I mean the equities did a fractional tumble today after

learning of Higher Interest Rates on bonds/treasuries...

this is not a 12 hour Correction...IT is only a 16 hour hiccup by the speculators in the Stocks/Equities part of the DOW market...

after tonight's SOTU which will sound reasonable to the voters, tomorrow We will see a Trump 'SOTU Speech' Bounce...

its a dead give-away when stocks-bonds-commodities all join in the down-draft hiccup at the same time...

perhaps the voters see the major shake-up @ FBI & DOJ & the top eschelon of the potus #44 Administration all getting the deserved handcuffing & being swiftly prosecuted for Anti-Constitution activities/plots/election sabotage, et al

naw, I think that the markets (including BTC) were all down...just in anticipation of Trump being not Presidential tonight...and pre-positioning themselves for action or non-action tomorrow when the DOW opens for Trading all sorts of stocks-bonds-metals-etc.

this is not a 12 hour Correction...IT is only a 16 hour hiccup by the speculators in the Stocks/Equities part of the DOW market...

after tonight's SOTU which will sound reasonable to the voters, tomorrow We will see a Trump 'SOTU Speech' Bounce...

its a dead give-away when stocks-bonds-commodities all join in the down-draft hiccup at the same time...

perhaps the voters see the major shake-up @ FBI & DOJ & the top eschelon of the potus #44 Administration all getting the deserved handcuffing & being swiftly prosecuted for Anti-Constitution activities/plots/election sabotage, et al

naw, I think that the markets (including BTC) were all down...just in anticipation of Trump being not Presidential tonight...and pre-positioning themselves for action or non-action tomorrow when the DOW opens for Trading all sorts of stocks-bonds-metals-etc.

edit on

th31151735317230592018 by St Udio because: (no reason given)

originally posted by: Ameilia

originally posted by: intrptr

a reply to: FamCore

Stocks up, big tax cut, great for big business. The tax cuts went mostly to the wealthy, the hi stocks benefit mostly the wealthy, the inequality of wealth in this country remains the same.

How are things improving for whom?

Gee, my investments are up over 40% since Trump came into office, I can promise that "improved things" for me. Can definitely say I am not sweating a one day drop of 1.36%.

Your 'investments' are Intangible. IOW, they could go up a thousand percent tomorrow and unless you cash out, you aren't holding the money, someone else is. The same someones that needed bailing out back in 2008. Those idiots are still in charge.

originally posted by: St Udio

The only ting happening under Trump... is the act of righting-the-ship-of-state, by that I mean the equities did a fractional tumble today after learning of Higher Interest Rates on bonds/treasuries...

this was not a 12 hour correction... it is only a hiccup by the speculators in the Stocks/Equities part of the DOW market...

after tonight's SOTU which will sound reasonable to the voters, tomorrow will see a Trump 'SOTU Speech' Bounce...

its a dead give-away when stocks-bonds-commodities all join in the down-draft hiccup at the same time...

perhaps the voters see the major shake-up @ FBI & DOJ & the top eschelon of the potus #44 Administration all getting the deserved handcuffing & being swiftly prosecuted for Anti-Constitution activities/plots/election sabotage, et al

naw, I think that the markets (including BTC) were all down...just in anticipation of Trump being not Presidential tonight...and pre-positioning themselves for action or non-action tomorrow when the DOW opens for Trading all sorts of stocks-bonds-metals-etc.

It looks like the Bezos, Buffet, Dimon alliance hit healthcare and kind of dragged the market down. Definitely not time to panic over one day's news.

originally posted by: toysforadults

there are several bubbles forming due to the fact that the average income for my entire generation is less than 25k a year nationwide and everyone has tons of student loan debt

you brought the crash on now you are going to suffer

good luck Gen X and Baby Boomers

Whaaaa.... You are unhappy that you have to settle for a wage that meets your skills and not your expectation. More whining form you is falling upon deaf ears.

This is merely a small correction, and unless we get a asteroid strike or freak hurricane, it will amount to nothing over time. It is still up more than it was last week....even after the minor fall today.

Time for folks to stop looking at the immediate satisfaction and begin looking at long term gains.

a reply to: St Udio

You're wrong on BTC. There's a huge scandal with BTC right now with regard to a large exchange called Bitfinex and a crypto they own called USDT:

www.abovetopsecret.com...

naw, I think that the markets (including BTC) were all down...just in anticipation of Trump being not Presidential tonight...and pre-positioning themselves for action or non-action tomorrow when the DOW opens for Trading all sorts of stocks-bonds-metals-etc.

You're wrong on BTC. There's a huge scandal with BTC right now with regard to a large exchange called Bitfinex and a crypto they own called USDT:

www.abovetopsecret.com...

edit on 30 1 18 by projectvxn because: (no reason given)

a reply to: Bluntone22

technically the market is being hyperinflate by banks buying up stock and companies buying massive amounts of their own stock back it's not being generate by actual market activity

technically the market is being hyperinflate by banks buying up stock and companies buying massive amounts of their own stock back it's not being generate by actual market activity

a reply to: projectvxn

pretty much every single crypto went down today as well, which is fairly suspicious to me, but cryptos especially seem to "flock" together.

Precious metals went down, oil went down... now there is a lot of money waiting to find "somewhere to go".

I anticipate we will see a lot of cryptos and the US equities rise in the short term. Fairly bullish still to be honest but economically I'm not optimistic (Fed rate is low, less ammunition for them to combat inflation as it begins to rear its ugly head)

pretty much every single crypto went down today as well, which is fairly suspicious to me, but cryptos especially seem to "flock" together.

Precious metals went down, oil went down... now there is a lot of money waiting to find "somewhere to go".

I anticipate we will see a lot of cryptos and the US equities rise in the short term. Fairly bullish still to be honest but economically I'm not optimistic (Fed rate is low, less ammunition for them to combat inflation as it begins to rear its ugly head)

edit on 30-1-2018 by FamCore

because: (no reason given)

a reply to: Bluntone22

I'm looking at the Stock Market separately from the US economy, although both are somewhat connected (as other posters have pointed out though, stock buybacks and central bank intervention allow for a manipulated and overvalued market).

I'm more concerned about the economy than stocks, as should anyone who doesn't have a lot of their money invested in the market..

I'm looking at the Stock Market separately from the US economy, although both are somewhat connected (as other posters have pointed out though, stock buybacks and central bank intervention allow for a manipulated and overvalued market).

I'm more concerned about the economy than stocks, as should anyone who doesn't have a lot of their money invested in the market..

a reply to: FamCore

USDT is a seriously widespread problem.

Enough for subpoenas to go out.

You also have to remember that what happens to Bitcoin tends to affect the alt-coin market. I believe there's a limit to how far that will go if BTC is the target.

What is happening to BTC right now is not dependent on what is happening politically in the US at all. it is an unregulated market with most of its weight located in Korea, China, Europe, and Russia. It is insulated from the overall economy for the most part.

That said, there are companies that are invested in BTC BIG TIME. Large companies too. Those companies might suffer quite a loss as a result of the phantom demand created by the Tether/Bitfinex counterfeiting operation.

USDT is a seriously widespread problem.

Enough for subpoenas to go out.

You also have to remember that what happens to Bitcoin tends to affect the alt-coin market. I believe there's a limit to how far that will go if BTC is the target.

What is happening to BTC right now is not dependent on what is happening politically in the US at all. it is an unregulated market with most of its weight located in Korea, China, Europe, and Russia. It is insulated from the overall economy for the most part.

That said, there are companies that are invested in BTC BIG TIME. Large companies too. Those companies might suffer quite a loss as a result of the phantom demand created by the Tether/Bitfinex counterfeiting operation.

edit on 30 1 18 by projectvxn because: (no reason given)

new topics

-

This is our Story

General Entertainment: 2 hours ago -

President BIDEN Vows to Make Americans Pay More Federal Taxes in 2025 - Political Suicide.

2024 Elections: 4 hours ago -

Ode to Artemis

General Chit Chat: 5 hours ago -

Ditching physical money

History: 8 hours ago -

One Flame Throwing Robot Dog for Christmas Please!

Weaponry: 8 hours ago -

Don't take advantage of people just because it seems easy it will backfire

Rant: 9 hours ago -

VirginOfGrand says hello

Introductions: 9 hours ago -

Should Biden Replace Harris With AOC On the 2024 Democrat Ticket?

2024 Elections: 10 hours ago

top topics

-

University student disciplined after saying veganism is wrong and gender fluidity is stupid

Education and Media: 12 hours ago, 12 flags -

Police clash with St George’s Day protesters at central London rally

Social Issues and Civil Unrest: 15 hours ago, 9 flags -

President BIDEN Vows to Make Americans Pay More Federal Taxes in 2025 - Political Suicide.

2024 Elections: 4 hours ago, 9 flags -

TLDR post about ATS and why I love it and hope we all stay together somewhere

General Chit Chat: 16 hours ago, 7 flags -

Should Biden Replace Harris With AOC On the 2024 Democrat Ticket?

2024 Elections: 10 hours ago, 6 flags -

Don't take advantage of people just because it seems easy it will backfire

Rant: 9 hours ago, 4 flags -

One Flame Throwing Robot Dog for Christmas Please!

Weaponry: 8 hours ago, 4 flags -

God lived as a Devil Dog.

Short Stories: 14 hours ago, 3 flags -

Ditching physical money

History: 8 hours ago, 3 flags -

VirginOfGrand says hello

Introductions: 9 hours ago, 2 flags

active topics

-

President BIDEN Vows to Make Americans Pay More Federal Taxes in 2025 - Political Suicide.

2024 Elections • 4 • : 727Sky -

University student disciplined after saying veganism is wrong and gender fluidity is stupid

Education and Media • 25 • : Consvoli -

British TV Presenter Refuses To Use Guest's Preferred Pronouns

Education and Media • 128 • : Consvoli -

Terrifying Encounters With The Black Eyed Kids

Paranormal Studies • 70 • : burritocat -

Tucker Carlson UFOs are piloted by spiritual entities with bases under the ocean and the ground

Aliens and UFOs • 42 • : Jukiodone -

The Fight for Election Integrity Continues -- Audits, Criminal Investigations, Legislative Reform

2024 Elections • 4143 • : Station27 -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 636 • : F2d5thCavv2 -

Russia Ukraine Update Thread - part 3

World War Three • 5719 • : F2d5thCavv2 -

Who guards the guards

US Political Madness • 5 • : 19Bones79 -

One Flame Throwing Robot Dog for Christmas Please!

Weaponry • 6 • : BeTheGoddess2