It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

Chinese Physical Gold Investment Demand Surges While Americans Pile Into Stock & Crypto Bubbles

page: 1share:

This gives me a bit of a chill, as it somewhat supports my suspicions on a thread I did last month:

Is Crypto-currency Value Being Manipulated as a Means to Taking Physical Gold Out of Private Hands?

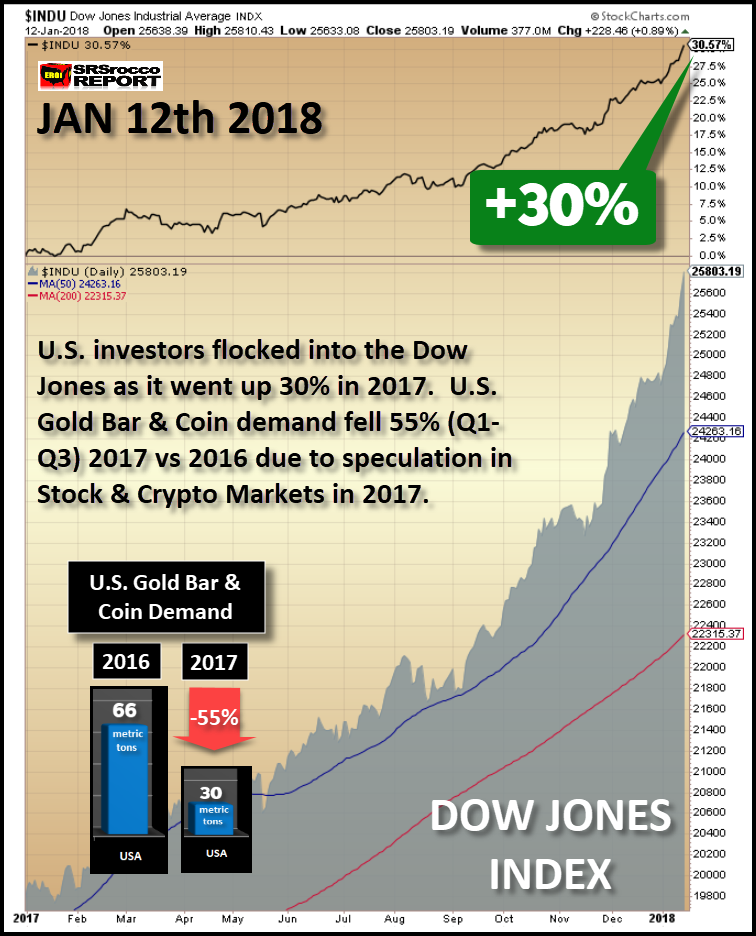

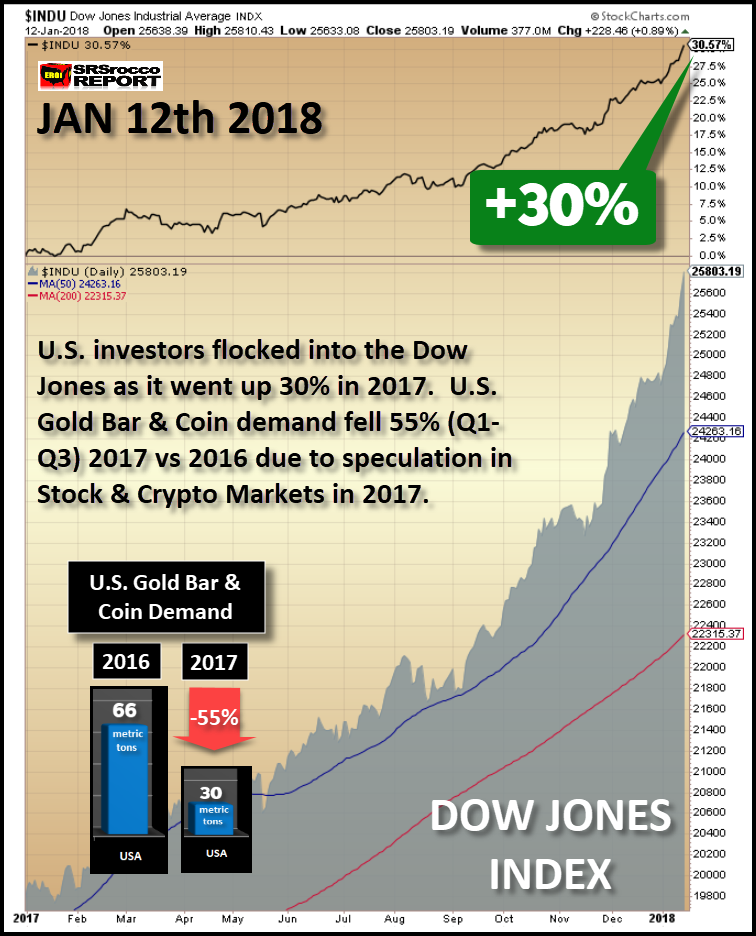

American gold demand was just extremely low last year during a time when it would have been good buy opportunity and the Dow was churning out hella gains. Of course the Chinese took advantage of this to buy record amounts as their own index surpassed the Dow Jones. The fact that their government had shutdown bitcoin mining and banned trading it on exchanges for me seems a bit suspicious. Well, I have been suspicious from the get go though and have not held back in that opinion. It's like a lure baiting people into undermining their own economy is how I feel about it.

Other countries made a smart play and increased their bullion holdings. Switzerland stayed neutral (typical). We practically abandoned it. Not a good sign my friends, not a good sign at all.

Is Crypto-currency Value Being Manipulated as a Means to Taking Physical Gold Out of Private Hands?

American gold demand was just extremely low last year during a time when it would have been good buy opportunity and the Dow was churning out hella gains. Of course the Chinese took advantage of this to buy record amounts as their own index surpassed the Dow Jones. The fact that their government had shutdown bitcoin mining and banned trading it on exchanges for me seems a bit suspicious. Well, I have been suspicious from the get go though and have not held back in that opinion. It's like a lure baiting people into undermining their own economy is how I feel about it.

Marketslant

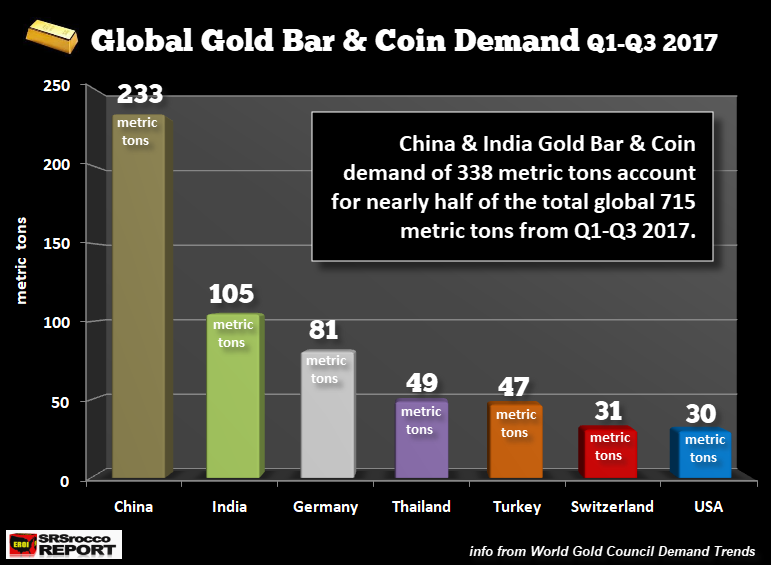

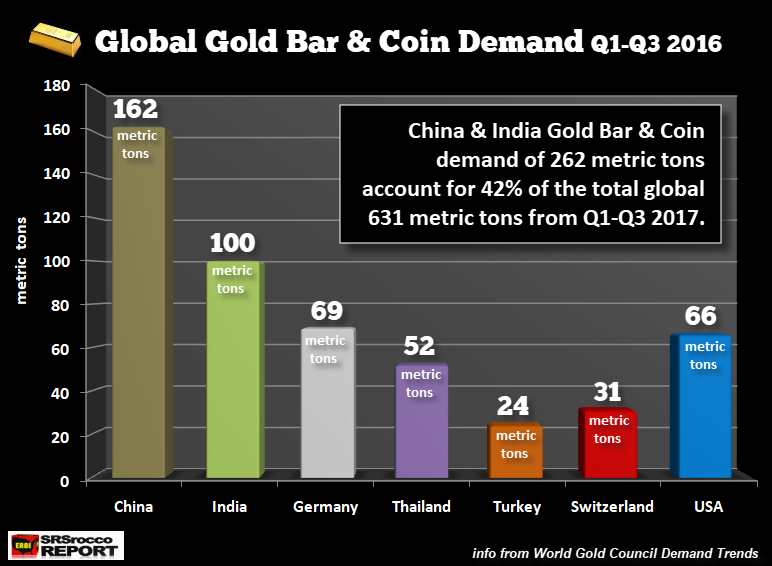

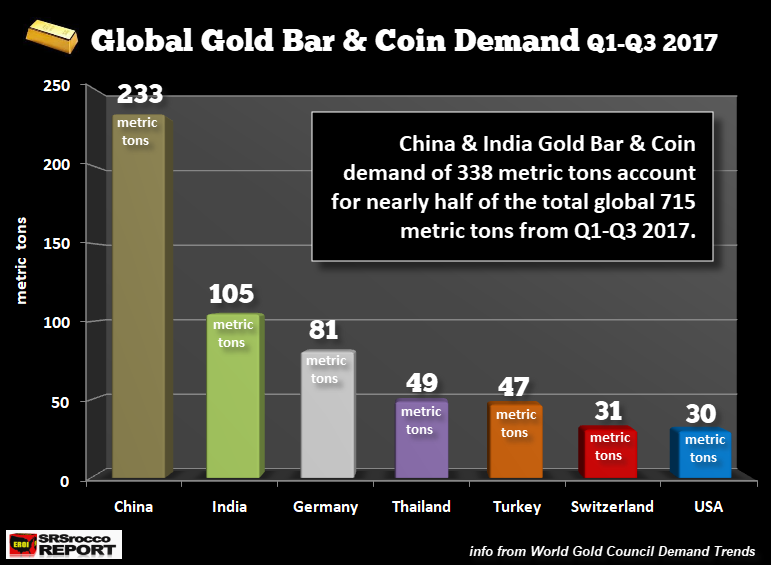

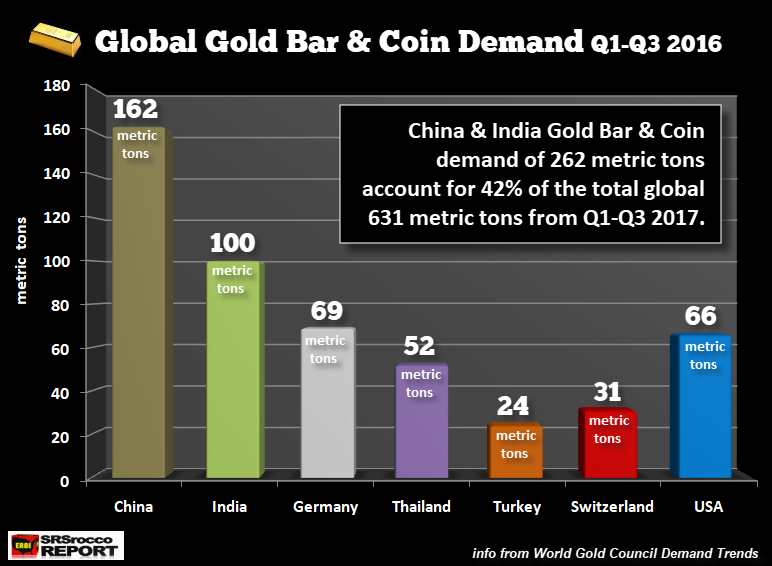

Chinese demand for physical gold investment surged in the first three-quarters of 2017 while Americans ditched the shiny yellow metal for increased bets in the crypto mania and stock market bubble market. Even though China’s Hang Seng Stock Market outperformed the Dow Jones Index last year, Chinese citizens purchased the most gold bar and coin products Q1-Q3 2017 since the same period in 2013, when they took advantage of huge gold market price selloff.

According to the World Gold Council, Chinese gold bar and coin demand increased to 233 metric tons (mt) in the first three-quarters of 2017 compared to 162 mt in the same period last year. Furthermore, if we include Indian gold bar and coin demand, China and India consumed nearly half of the world’s total:

... it doesn’t help that some precious metals investors, now turned crypto specialists and aficionados, are only happy discussing assets that make 10-20 baggers. Forget about old fashion work and taking the time and money to build something real, we have now moved into a new investment strategy that to be successful, one must make 6-7 figure returns by clicking on a mouse.

For whatever reason, Chinese physical gold investment demand increased significantly Q1-Q3 2017 while U.S. demand dropped like a rock. It will be interesting to see how 2018 unfolds and if the extreme leverage in the stock and crypto markets finally unravels. You see, it’s not a matter of if, it’s only a matter of time. And, while many believe the Dow Jones will continue higher forever, all markets have to correct. However, the next correction may turn out to be one heck of a crash.

Other countries made a smart play and increased their bullion holdings. Switzerland stayed neutral (typical). We practically abandoned it. Not a good sign my friends, not a good sign at all.

Nice I like Steve De'angelo great analyst. And yes gold has been flowing from west to east in mega tonnage.

a reply to: worldstarcountry

This has been going on for quite a while, I'd say at least 10-15 years.

Not just gold. I had a patio poured last year, it was a small fortune, I was shocked at the price. I guess the Chinese are buying up a lot of our concrete /cement supplies too which is raising the price of concrete like crazy!

China used morecement between 2011 and 2013 than the U.S. used in the entire 20th Century.

www.washingtonpost.com... 5ae6f76702

This has been going on for quite a while, I'd say at least 10-15 years.

Not just gold. I had a patio poured last year, it was a small fortune, I was shocked at the price. I guess the Chinese are buying up a lot of our concrete /cement supplies too which is raising the price of concrete like crazy!

China used morecement between 2011 and 2013 than the U.S. used in the entire 20th Century.

www.washingtonpost.com... 5ae6f76702

How could your thread not be covered in Flaggs idk

hey, their govt told them 4 years ago to everybody in the nation.....buy all the gold you can....4 years ago told every household to hold it

but for advice on investment in Gold...hail no....get Silver....it'll be all about how many ounces you have...not the price you paid....just how muchya got bub

hey, their govt told them 4 years ago to everybody in the nation.....buy all the gold you can....4 years ago told every household to hold it

but for advice on investment in Gold...hail no....get Silver....it'll be all about how many ounces you have...not the price you paid....just how muchya got bub

edit on 17-1-2018 by GBP/JPY because: (no reason given)

edit on 17-1-2018 by GBP/JPY because: (no reason

given)

originally posted by: JAGStorm

a reply to: worldstarcountry

This has been going on for quite a while, I'd say at least 10-15 years.

Not just gold. I had a patio poured last year, it was a small fortune, I was shocked at the price. I guess the Chinese are buying up a lot of our concrete /cement supplies too which is raising the price of concrete like crazy!

China used morecement between 2011 and 2013 than the U.S. used in the entire 20th Century.

www.washingtonpost.com... 5ae6f76702

is that why i had to pay 150 a yard this summer?

a reply to: GBP/JPY

Yes, they are using up concrete at an unbelievably pace, steel too!

China Used More Concrete In 3 Years Than The U.S. Used In The Entire 20th Century [Infographic]

www.forbes.com... 5223a74131

www.scmp.com...

Yes, they are using up concrete at an unbelievably pace, steel too!

China Used More Concrete In 3 Years Than The U.S. Used In The Entire 20th Century [Infographic]

www.forbes.com... 5223a74131

www.scmp.com...

Most Eastern cultures understand ancestral heritage, so they focus on long term goals and are patient. Americans more often focus on immediate

gratifications and do not consider the future beyond their own individuals selfishness.

I would be a hypocrit if I did not include myself into this selfishness. I am a mutt from my ancestors and it is difficult to focus on the end goal for me and my immediate family...let alone for an more encompassing future generation beyond my own life. Americans really do not have an established culture...it is too mishmashed for such thoughts.

As a side, this is not all bad. Americans generationally have an easier time to quickly assess, innovate, and change without cultural influence in necessary times of strife. So, don't simply base your ideas of conspiracy without understanding the culture and histories of all involved.

Is it possible that bit coins will be a big bust? Certainly at some point. When it comes to money and investments, it is all gambling. Gold may not make a big comeback in the near future or your lifetime...it is your gamble. Just realize that some eastern countries gamble based on longer term goals that the individual purchaser will never realize.

I would be a hypocrit if I did not include myself into this selfishness. I am a mutt from my ancestors and it is difficult to focus on the end goal for me and my immediate family...let alone for an more encompassing future generation beyond my own life. Americans really do not have an established culture...it is too mishmashed for such thoughts.

As a side, this is not all bad. Americans generationally have an easier time to quickly assess, innovate, and change without cultural influence in necessary times of strife. So, don't simply base your ideas of conspiracy without understanding the culture and histories of all involved.

Is it possible that bit coins will be a big bust? Certainly at some point. When it comes to money and investments, it is all gambling. Gold may not make a big comeback in the near future or your lifetime...it is your gamble. Just realize that some eastern countries gamble based on longer term goals that the individual purchaser will never realize.

Gold is not in demand it's the fact that someone keeps dumping billions of dollars of precious metals into the market to keep the price down. I'm

talking 4 billion drops at a clip.

conspiracynutters.com

conspiracynutters.com

a reply to: JAGStorm

Yeah... I can't believe their concrete/steel usage either. I could understand it if people were occupying these massive cities, but these are bone empty. How the hell are cities the size of Manhattan built and kept empty???

My take from it... the Chinese are far worse at their money management than even the U.S. is. That's saying a lot.

I feel China is purposely causing fiat to tank by wasting as much as possible. There will be no other option in the not so distant future to adapt to the AI takeover the best we can or fail as a species.

5G networking will make goods and services so cheap for all humans soon enough, that the gold will be used for the high end microchips as they approach the many of billions... to hold gold will be nothing more than a novelty item and will fall with fiat. People are already glued to their robots... I mean mobile phones. It will be turning from a dog eat dog world to a bot eat bot world... humans will have to adapt of suffer.

Fiat means 'trust'. That's why our banking system uses the word trust... people set up trusts to manage their funds. All those managers of funds are getting put on early retirement within 10 years max. I don't trust a fiat... never have and never will.

Yeah... I can't believe their concrete/steel usage either. I could understand it if people were occupying these massive cities, but these are bone empty. How the hell are cities the size of Manhattan built and kept empty???

My take from it... the Chinese are far worse at their money management than even the U.S. is. That's saying a lot.

I feel China is purposely causing fiat to tank by wasting as much as possible. There will be no other option in the not so distant future to adapt to the AI takeover the best we can or fail as a species.

5G networking will make goods and services so cheap for all humans soon enough, that the gold will be used for the high end microchips as they approach the many of billions... to hold gold will be nothing more than a novelty item and will fall with fiat. People are already glued to their robots... I mean mobile phones. It will be turning from a dog eat dog world to a bot eat bot world... humans will have to adapt of suffer.

Fiat means 'trust'. That's why our banking system uses the word trust... people set up trusts to manage their funds. All those managers of funds are getting put on early retirement within 10 years max. I don't trust a fiat... never have and never will.

a reply to: CynConcepts

Totally agree with ancestral heritage. Europe was that way for quite a while too. The houses were built to last hundreds of years, not like in the US. I am American, and I love America but we sure do build some crap houses (in general).

Totally agree with ancestral heritage. Europe was that way for quite a while too. The houses were built to last hundreds of years, not like in the US. I am American, and I love America but we sure do build some crap houses (in general).

a reply to: worldstarcountry

Good luck going to your local Denver Nuggets basketball game... trying to weasel your way into a seat or two with some gold teeth and bracelets hoarded in a box in the bedroom closet. Hell, the Denver Nuggets are named after the beloved currency of gold... isn't it quite a contradiction that they won't let gold teeth by a seat for the game???

Everybody already converted to crypto... everyone has a chip in their wallet and a personal robot they carry with them everywhere. Take the personal phones/robots away and most people will off themselves out of panic alone. We already are at the point of no return... its a matter of when, not if.

If AI wants your gold, AI will have your gold...

Good luck going to your local Denver Nuggets basketball game... trying to weasel your way into a seat or two with some gold teeth and bracelets hoarded in a box in the bedroom closet. Hell, the Denver Nuggets are named after the beloved currency of gold... isn't it quite a contradiction that they won't let gold teeth by a seat for the game???

Everybody already converted to crypto... everyone has a chip in their wallet and a personal robot they carry with them everywhere. Take the personal phones/robots away and most people will off themselves out of panic alone. We already are at the point of no return... its a matter of when, not if.

If AI wants your gold, AI will have your gold...

a reply to: vonclod

Their next building boom will be better planned out IMO, they are planning on building a conduit across the old silks roads into Turkey. The area of development will be roughly equal to the entire continental united states, and it will bring many nations into their new economic/monetary system of the petro-yuan.

So the new development will include roads, railways and other infrastructure to develop nations currently in '3rd world' status like Azerbaijan, Turkmenistan, Uzbekistan and Armenia.

Their next building boom will be better planned out IMO, they are planning on building a conduit across the old silks roads into Turkey. The area of development will be roughly equal to the entire continental united states, and it will bring many nations into their new economic/monetary system of the petro-yuan.

So the new development will include roads, railways and other infrastructure to develop nations currently in '3rd world' status like Azerbaijan, Turkmenistan, Uzbekistan and Armenia.

a reply to: toysforadults

Sure paper, naked shorts. You realize that there are 500 times more paper claims on gold than available in warehousing for delivery?

Sure paper, naked shorts. You realize that there are 500 times more paper claims on gold than available in warehousing for delivery?

amazing the reply's on this post .

China has been working on Independence ( yep you read that right )

Simple Build the country have massive amounts of industry build the biggest hydro power dam ever .

Now the world relies on you for all the stuff they need the last key is becoming the Main money used now one way that has worked for ooo 7,000 years is have LOTS OF gold .

Guess what it still works all the wile you invest in PIXELS LOL

A fool and his money soon part ways must be a Chinese saying .

Millions of imangery money trillions of colored paper not worth the ink used to print it backed by imagination .

Lets see just how much people respond when they can get nothing without paying china and have nothing to pay with .

Set game match .

Lord I knew this 20 years agaio . I say the end game will be soon as china is now shifting more towards self sustenance .The reason they have been doing a gold buying spree more each year soon they will be the only ones left who have it .

Soon enough they will no longer even need our store shelfs Walmart will be a big empty building .

China has been working on Independence ( yep you read that right )

Simple Build the country have massive amounts of industry build the biggest hydro power dam ever .

Now the world relies on you for all the stuff they need the last key is becoming the Main money used now one way that has worked for ooo 7,000 years is have LOTS OF gold .

Guess what it still works all the wile you invest in PIXELS LOL

A fool and his money soon part ways must be a Chinese saying .

Millions of imangery money trillions of colored paper not worth the ink used to print it backed by imagination .

Lets see just how much people respond when they can get nothing without paying china and have nothing to pay with .

Set game match .

Lord I knew this 20 years agaio . I say the end game will be soon as china is now shifting more towards self sustenance .The reason they have been doing a gold buying spree more each year soon they will be the only ones left who have it .

Soon enough they will no longer even need our store shelfs Walmart will be a big empty building .

a reply to: SkeptiSchism

Definitely a strategy then, makes some sense. Maybe not well executed, but like you say, they will plan it out better in future.

Definitely a strategy then, makes some sense. Maybe not well executed, but like you say, they will plan it out better in future.

a reply to: vonclod

You can read about the project here: english.gov.cn...

So in the west we'll be bailing out failing banks and pension funds while they are building infrastructure and improving entire nations.

I'm by no means a communist but I see the value in their aspirations.

You can read about the project here: english.gov.cn...

So in the west we'll be bailing out failing banks and pension funds while they are building infrastructure and improving entire nations.

I'm by no means a communist but I see the value in their aspirations.

a reply to: SkeptiSchism

My employer worked in China setting up production of a spray gun he designed in the late 90s so I know exactly what your talking about..he would agree with you.

My employer worked in China setting up production of a spray gun he designed in the late 90s so I know exactly what your talking about..he would agree with you.

new topics

-

More Bad News for Labour and Rachel Reeves Stole Christmas from Working Families

Regional Politics: 3 hours ago -

Light from Space Might Be Travelling Instantaneously

Space Exploration: 4 hours ago -

The MSM has the United Healthcare assassin all wrong.

General Conspiracies: 5 hours ago -

2025 Bingo Card

The Gray Area: 5 hours ago -

The Mystery Drones and Government Lies

Political Conspiracies: 7 hours ago

top topics

-

Pelosi injured in Luxembourg

Other Current Events: 14 hours ago, 18 flags -

The Mystery Drones and Government Lies

Political Conspiracies: 7 hours ago, 9 flags -

Nov 2024 - Former President Barack Hussein Obama Has Lost His Aura.

US Political Madness: 15 hours ago, 7 flags -

The MSM has the United Healthcare assassin all wrong.

General Conspiracies: 5 hours ago, 6 flags -

More Bad News for Labour and Rachel Reeves Stole Christmas from Working Families

Regional Politics: 3 hours ago, 6 flags -

2025 Bingo Card

The Gray Area: 5 hours ago, 5 flags -

Light from Space Might Be Travelling Instantaneously

Space Exploration: 4 hours ago, 4 flags

active topics

-

Pelosi injured in Luxembourg

Other Current Events • 28 • : WeMustCare -

The Mystery Drones and Government Lies

Political Conspiracies • 46 • : WeMustCare -

Airplane Crashed and Airplane Disabled Near Ohare Airport - Could be UFO Related.

Aliens and UFOs • 69 • : WeMustCare -

Drones everywhere in New Jersey

Aliens and UFOs • 119 • : matafuchs -

2025 Bingo Card

The Gray Area • 12 • : Oldcarpy2 -

Light from Space Might Be Travelling Instantaneously

Space Exploration • 15 • : cooperton -

Something better

Dissecting Disinformation • 22 • : Astrocometus -

They Know

Aliens and UFOs • 78 • : sendhelp -

The MSM has the United Healthcare assassin all wrong.

General Conspiracies • 9 • : Solvedit -

I See a Different Attitude This Time Around with Congress

US Political Madness • 32 • : interupt42