It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

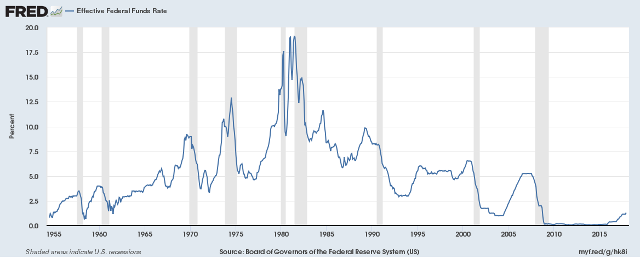

This chart here is probably the best to describe what happened

So essentially what happened is Nixon ended the gold window, gold began finding it's true price in about 1973, gold spiked and interest rates on the 10 year treasury bond rose to around 17%. Then Volker started lowering the interest rate.

That is essentially the engine because corporations can then borrow cheaper in the future so they 'roll' their debt instead of servicing it through profits (productivity). Over 40 years everybody did that, so instead of servicing debt they just borrow more because they can always borrow cheaper in the future.

If corporations had to service that debt, instead of borrowing to roll it over their stock prices would plummet. And they should crash, it's all mal-investments.

I live down the road a Dodge Ram Crystler plant. Since the 80's I could tell when a slow down is coming because the storage lots fill with trucks.

They build until they have no room to put anything. Starting in 2005 when gas hit $4.50 a gallon I started to see the lots fill. At the same time the

price of food exploded. When the auto industry came to a halt the smaller suppliers started closing up. I watched entire industrial complexes

disappear. In 2007 people started losing their homes and the banks lost their ass. I was at ground zero I watched it all unfold.

The price of gas has been climbing the past couple months. If it hits above $4 I could see another crash possibly happening. People lose their disposable income when they have to put it in the gas tank. I don't trust having the CEO of Exon as our secretary of state.

The price of gas has been climbing the past couple months. If it hits above $4 I could see another crash possibly happening. People lose their disposable income when they have to put it in the gas tank. I don't trust having the CEO of Exon as our secretary of state.

originally posted by: DBCowboy

a reply to: toysforadults

I'm still waiting for the stock market to "correct".

It's not going to be pretty.

But I'm old-school and am buying gold and silver bullion, just in case.

Why bother with gold or silver...no sentiment or value is left in that either.

One can feel it in the skies...bullion will never help out those who hold it...it never really did.

(with sad bunny face)

a reply to: toysforadults

As long as we play nice with banks, they will be heartless bastards with OUR wealth.

I say next collapse we eat some bankers, raw.

As long as we play nice with banks, they will be heartless bastards with OUR wealth.

I say next collapse we eat some bankers, raw.

a reply to: wantsome

I am anticipating the future, my next project which I have been putting off for years , (Just waiting for the technology to catch up) is converting my old mountain bike into an E Bike. , and you can set the pedal assist all the way up to not having to pedal at all. It should save a few bucks, and give me some exercise. Their are some nice options out there now which can get you up to a hundred miles on a charge, so I guess it wont be long before they charge you for it. (Pun intended.)

I am anticipating the future, my next project which I have been putting off for years , (Just waiting for the technology to catch up) is converting my old mountain bike into an E Bike. , and you can set the pedal assist all the way up to not having to pedal at all. It should save a few bucks, and give me some exercise. Their are some nice options out there now which can get you up to a hundred miles on a charge, so I guess it wont be long before they charge you for it. (Pun intended.)

a reply to: wantsome

Yah that ties in with the idea of peak oil. So when oil/gas gets too expensive it cuts into disposable income and people cut back on spending. Then the economy goes down. We had a big buildup of oil from 2010 after fracking went nuts, all financed with debt btw, but I guess inventories are now drawing down.

So once inventories get low enough the price of oil goes back up. It's a really fine line and I think right now we are at that point where it looks like everything is going to go gangbusters, then the price of gas gets too high and crash.

Yah that ties in with the idea of peak oil. So when oil/gas gets too expensive it cuts into disposable income and people cut back on spending. Then the economy goes down. We had a big buildup of oil from 2010 after fracking went nuts, all financed with debt btw, but I guess inventories are now drawing down.

So once inventories get low enough the price of oil goes back up. It's a really fine line and I think right now we are at that point where it looks like everything is going to go gangbusters, then the price of gas gets too high and crash.

I wouldn't forget about the other events in the world and how they can possibly tie in with this all to further make matters worse...

We have the Saudi Prince Handling a shake up... ( seems much more is being done while at the same time, saving face with a progressive stance )

We have the Brexit butthurt fallout ( corps / Govs )

We have The North and South Korean talks pick up again with a possible united women's hockey team...

We have an African tech boom taking shape

Then underneath it all, we have cryptocurrencies, and the possible demise of bitcoin, yes demise, because as a crypto insider for years, bitcoin and many altcoins just are not being built with future sense, because they are built by garageband heros mostly and not real thinktanks. Bitcoin blockchain is so congested, that miner fees, once they were under a dollar USD a transaction are now 40 USD a transaction... Sorry but, other altcoins can work much faster, but also have their own issues. And lets face it, the blockchain is slow, you only use it when you NEED decentralization. Ironically, most decentralized altcoins have changed into centralized communities owned by the few and manipulating the many.

To have a truly decentralized altcoin, you need EVERYONE able to mine and EVERYONE able to transact without issue, no matter the size of the blockchain, no one should wait hours for a blockchain download.

Then there is the energy issue!

We have here the makings of the NWO, on levels you just won't grasp until it's 98% shaped.

Ask yourself this lil questions, whos been the in the middle with the hands in the cookie jars of all nations?

Who will be forced out as a 3rd class " #hole " nation in the future of a 3rd worlds turned 1st?

We have the Saudi Prince Handling a shake up... ( seems much more is being done while at the same time, saving face with a progressive stance )

We have the Brexit butthurt fallout ( corps / Govs )

We have The North and South Korean talks pick up again with a possible united women's hockey team...

We have an African tech boom taking shape

Then underneath it all, we have cryptocurrencies, and the possible demise of bitcoin, yes demise, because as a crypto insider for years, bitcoin and many altcoins just are not being built with future sense, because they are built by garageband heros mostly and not real thinktanks. Bitcoin blockchain is so congested, that miner fees, once they were under a dollar USD a transaction are now 40 USD a transaction... Sorry but, other altcoins can work much faster, but also have their own issues. And lets face it, the blockchain is slow, you only use it when you NEED decentralization. Ironically, most decentralized altcoins have changed into centralized communities owned by the few and manipulating the many.

To have a truly decentralized altcoin, you need EVERYONE able to mine and EVERYONE able to transact without issue, no matter the size of the blockchain, no one should wait hours for a blockchain download.

Then there is the energy issue!

We have here the makings of the NWO, on levels you just won't grasp until it's 98% shaped.

Ask yourself this lil questions, whos been the in the middle with the hands in the cookie jars of all nations?

Who will be forced out as a 3rd class " #hole " nation in the future of a 3rd worlds turned 1st?

edit on 14-1-2018 by Tranceopticalinclined

because: (no reason given)

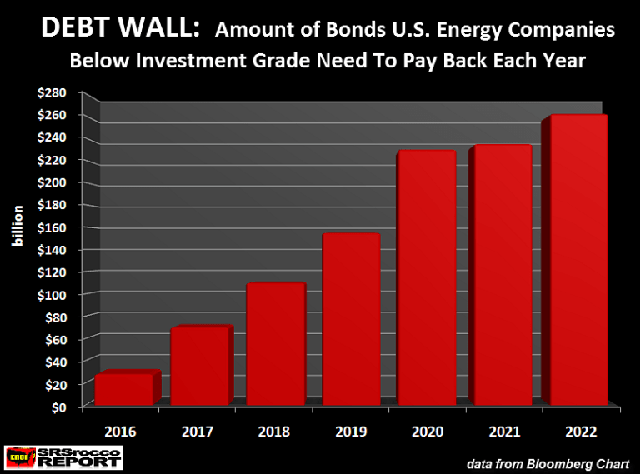

This is probably the best graphic I've seen in a long time, US energy companies have almost $200 billion in bonds to roll in the next 4 years.

Basically our energy companies have been existing on bond sales, enabled by the low rates pushed out by the fed. They cannot exist without this artificial subsidy and it can't go on forever. Especially if the petrodollar dies a slow death.

srsroccoreport.com...

According to the data by Bloomberg, the amount of bonds below investment grade the U.S. energy companies need to pay back each year will surge to approximately $70 billion in 2017, up from $30 billion in 2016. That’s just the beginning…. it gets even worse each passing year.

As we can see, the outstanding debt (in bonds) will jump to $110 billion in 2018, $155 billion in 2019, and then skyrocket to $230 billion in 2020. This is extremely bad news because it takes oil profits to pay down debt

Basically our energy companies have been existing on bond sales, enabled by the low rates pushed out by the fed. They cannot exist without this artificial subsidy and it can't go on forever. Especially if the petrodollar dies a slow death.

edit on 14-1-2018 by SkeptiSchism because:

text

a reply to: toysforadults

lol the market will not crash anytime soon especially with Trump as president. These things will take a while to occur. Because it is so slow to occur, the market will not crash. Crashes only happen in a major event at a short period of time. Getting a mortgage today is not easy as this guy makes you think. I'm in mortgage and it is difficult as hell to qualify.

lol the market will not crash anytime soon especially with Trump as president. These things will take a while to occur. Because it is so slow to occur, the market will not crash. Crashes only happen in a major event at a short period of time. Getting a mortgage today is not easy as this guy makes you think. I'm in mortgage and it is difficult as hell to qualify.

originally posted by: DBCowboy

a reply to: toysforadults

I'm still waiting for the stock market to "correct".

It's not going to be pretty.

But I'm old-school and am buying gold and silver bullion, just in case.

Gold is a much more dangerous investment than stocks. All of these stock market warnings exist only because the stock market is inherently safe. It has things like performance indicators, earnings reports, business expectations, and so on. Gold has none of that (and neither does crypto). You can get out of stocks with massive profit when things are overvalued. What leading indicators do you have that gold is or isn't overvalued?

originally posted by: toysforadults

a reply to: DBCowboy

Real estate isnt looking to good either demand just isn't there

The subprime auto loan market is going to take down real estate the moment no one has a car to get to work.

originally posted by: InTheLight

My advice to everyone is to co-own with friends or family and share the load. He's my brother, he ain't heavy.

Until you want to sell and he doesn't.

My friend has been watching this and a few other people and he's convinced that the dollar will collapse by the end of February. Still waiting. I

don't think it's going to happen.

a reply to: amazing

It won't collapse but Thursday China begins issuing oil futures contracts convertible to gold bullion, so slowly over time the dollar will become less and less of a world reserve currency.

If it's not a dominant reserve currency then China, Japan, Saudi Arabia and other nations that hold US treasury bonds will sell them, at a time when the fed says they want to reduce their balance sheets by selling the treasuries they own.

That means interest rates are likely to rise faster than the fed wants, or they do want that but don't say so publicly. Trump said he wants a weaker dollar, I'm sure he'll get it but maybe weaker than he expects.

I think the support for the dollar is around 71 that hit on April 22, 2008

It won't collapse but Thursday China begins issuing oil futures contracts convertible to gold bullion, so slowly over time the dollar will become less and less of a world reserve currency.

If it's not a dominant reserve currency then China, Japan, Saudi Arabia and other nations that hold US treasury bonds will sell them, at a time when the fed says they want to reduce their balance sheets by selling the treasuries they own.

That means interest rates are likely to rise faster than the fed wants, or they do want that but don't say so publicly. Trump said he wants a weaker dollar, I'm sure he'll get it but maybe weaker than he expects.

I think the support for the dollar is around 71 that hit on April 22, 2008

Economy is good here in Southwest Michigan . Job fairs offering $25 an hour for skilled production workers. Machinist , welders and such can name

their price.

Home sales anything under $300k has less than 3 week sale time under $750 is a couple of months.

Good times

Home sales anything under $300k has less than 3 week sale time under $750 is a couple of months.

Good times

new topics

-

President BIDEN Vows to Make Americans Pay More Federal Taxes in 2025 - Political Suicide.

2024 Elections: 1 hours ago -

Ode to Artemis

General Chit Chat: 2 hours ago -

Ditching physical money

History: 6 hours ago -

One Flame Throwing Robot Dog for Christmas Please!

Weaponry: 6 hours ago -

Don't take advantage of people just because it seems easy it will backfire

Rant: 6 hours ago -

VirginOfGrand says hello

Introductions: 7 hours ago -

Should Biden Replace Harris With AOC On the 2024 Democrat Ticket?

2024 Elections: 7 hours ago -

University student disciplined after saying veganism is wrong and gender fluidity is stupid

Education and Media: 10 hours ago -

Geddy Lee in Conversation with Alex Lifeson - My Effin’ Life

People: 11 hours ago -

God lived as a Devil Dog.

Short Stories: 11 hours ago

top topics

-

Hate makes for strange bedfellows

US Political Madness: 16 hours ago, 20 flags -

University student disciplined after saying veganism is wrong and gender fluidity is stupid

Education and Media: 10 hours ago, 12 flags -

Police clash with St George’s Day protesters at central London rally

Social Issues and Civil Unrest: 13 hours ago, 9 flags -

President BIDEN Vows to Make Americans Pay More Federal Taxes in 2025 - Political Suicide.

2024 Elections: 1 hours ago, 7 flags -

TLDR post about ATS and why I love it and hope we all stay together somewhere

General Chit Chat: 14 hours ago, 7 flags -

Should Biden Replace Harris With AOC On the 2024 Democrat Ticket?

2024 Elections: 7 hours ago, 6 flags -

Don't take advantage of people just because it seems easy it will backfire

Rant: 6 hours ago, 4 flags -

One Flame Throwing Robot Dog for Christmas Please!

Weaponry: 6 hours ago, 4 flags -

God lived as a Devil Dog.

Short Stories: 11 hours ago, 3 flags -

Ditching physical money

History: 6 hours ago, 3 flags

active topics

-

Why to avoid TikTok

Education and Media • 17 • : mooncake -

The Superstition of Full Moons Filling Hospitals Turns Out To Be True!

Medical Issues & Conspiracies • 22 • : mooncake -

University student disciplined after saying veganism is wrong and gender fluidity is stupid

Education and Media • 23 • : BigDuckEnergy -

President BIDEN Vows to Make Americans Pay More Federal Taxes in 2025 - Political Suicide.

2024 Elections • 3 • : BingoMcGoof -

Russia Ukraine Update Thread - part 3

World War Three • 5717 • : Arbitrageur -

Should Biden Replace Harris With AOC On the 2024 Democrat Ticket?

2024 Elections • 44 • : budzprime69 -

Hundreds of teenagers flood into downtown Chicago, smashing car windows

Other Current Events • 111 • : 777Vader -

British TV Presenter Refuses To Use Guest's Preferred Pronouns

Education and Media • 125 • : Annee -

Who guards the guards

US Political Madness • 4 • : kwaka -

New whistleblower Jason Sands speaks on Twitter Spaces last night.

Aliens and UFOs • 44 • : pianopraze