It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

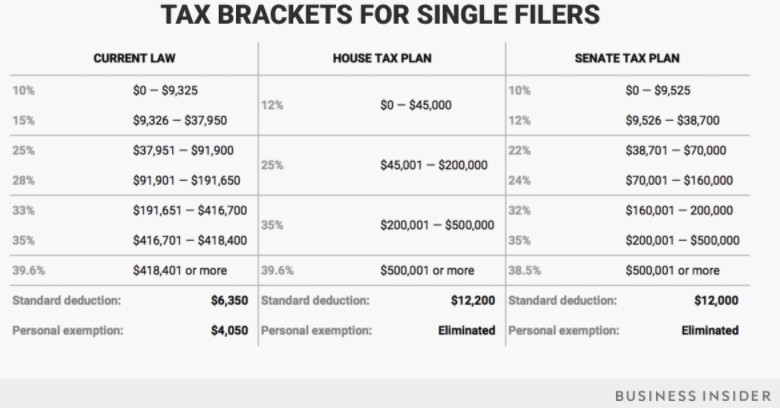

New tax plan... Awesome... I'll get just a little more back from my tax returns. Not so awesome when I realized what actually took place.

Here are the facts:

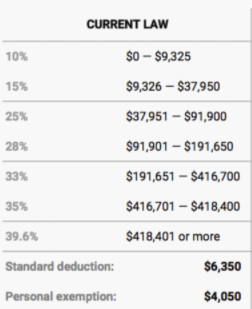

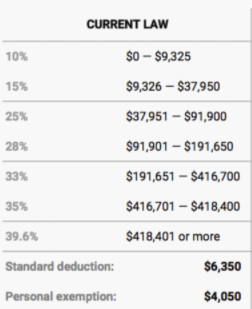

Current 2016 Taxes (Paid this year):

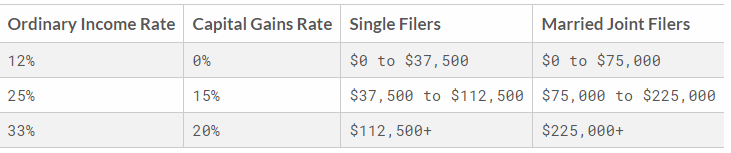

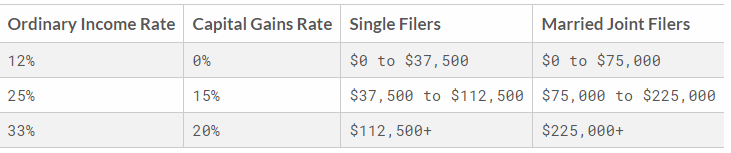

Trump Plan:

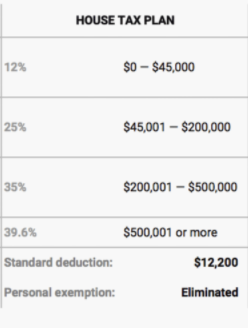

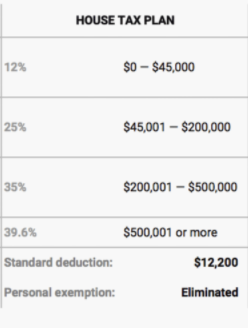

This is what happened when the HOUSE made THEIR changes:

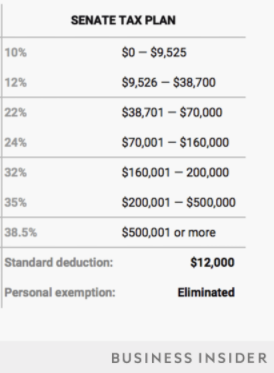

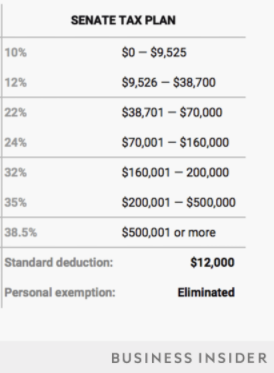

Annnnd finally, this is what happened when the SENATE got their grubby little hands on it.

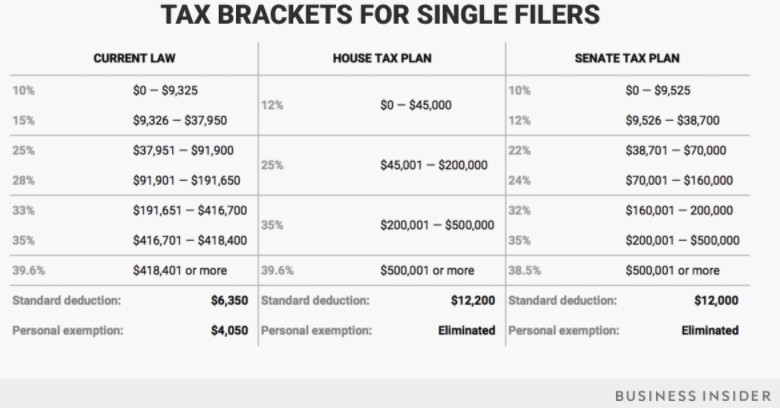

Lets compare them side by side so you can see what has me a bit pissed:

So you see... Trump threw some numbers out there that had me excited. Then the HOUSE made a few changes and I thought "hmm.. ok, not bad". Then those bas-tards in the SENATE got a hold of it and, well... You can see for yourself.

Look... I'm happy that I have to pay less taxes this year coming but it just tans my butt to no end on how this was done. This is the way "EYE" see it.

Trump throws us a bone. The House takes that bone and adds a little meat to it. Then the Senate takes it all away and gives us leftovers. Table scraps!!

And now the conspiracy side of me says.... It was all a sham and it was done exactly THIS way to make sure we would only get our scraps. It was done at the last minute to fool the regular folk into thinking we were getting more than what we had... much more. But, they bickered back and forth and waited till the last days of December where they KNEW something had to pass, so they passed CRAP!

I tallied some of the numbers for single payer tax deductions. This is how much extra you're going to save:

9525 @ 10% = 0

38700 @ 12% = 1161

82500 @ 22% = 2475

157500 @ 24% = 6300

200000 @ 32% = 2000

500000 @ 35% = 0?

1000000 @ 37% = 24000

- So why is it that the little guy (zero to 9.5K) gets nadda? So the guy on food stamps get's squat.

- The lower middle class get 1k.

- The middle class (myself) get's 2.4k.

- The upper middle gets OVER DOUBLE!!! Who the hell... why the hell?!?

- Then the lower upper gets 2k. Who cares. Like they need 2k?

- Then the upper gets squat. See previous statement.

- But..... the millionares get 24000 back! Ok, so they earned it but I SURE IN HELL can make better use of that money than they can. I can stimulate the economy far greater than they can/will with the same amount. Why? Because I'LL actually SPEND IT and I'll do it locally.

Fair is fair. I'll show the same numbers with the actual % changes. The numbers will make more sense.

9525 @ 10% = +0% change

38700 @ 12% = +3% change

82500 @ 22% = +3% change

157500 @ 24% = +4% change (WTF!! Why are these guys so important???)

200000 @ 32% = 1% change (They must have taken the extra 1% from this guy and tossed it to the guys below them)

500000 @ 35% = 0% ? (This lil piggy didn't get none?)

1000000 @ 37% = 2.4% change (This lil piggy cried we we we we we... all the way to the bank!)

So yeah... we've been duped. Looks like someone in the Senate (all of them) can't count and have no idea how to divy up the cookies. I know the US isn't known for the greatest mathematicians but CMON MAN!

Here are the facts:

Current 2016 Taxes (Paid this year):

Trump Plan:

This is what happened when the HOUSE made THEIR changes:

Annnnd finally, this is what happened when the SENATE got their grubby little hands on it.

Lets compare them side by side so you can see what has me a bit pissed:

So you see... Trump threw some numbers out there that had me excited. Then the HOUSE made a few changes and I thought "hmm.. ok, not bad". Then those bas-tards in the SENATE got a hold of it and, well... You can see for yourself.

Look... I'm happy that I have to pay less taxes this year coming but it just tans my butt to no end on how this was done. This is the way "EYE" see it.

Trump throws us a bone. The House takes that bone and adds a little meat to it. Then the Senate takes it all away and gives us leftovers. Table scraps!!

And now the conspiracy side of me says.... It was all a sham and it was done exactly THIS way to make sure we would only get our scraps. It was done at the last minute to fool the regular folk into thinking we were getting more than what we had... much more. But, they bickered back and forth and waited till the last days of December where they KNEW something had to pass, so they passed CRAP!

I tallied some of the numbers for single payer tax deductions. This is how much extra you're going to save:

9525 @ 10% = 0

38700 @ 12% = 1161

82500 @ 22% = 2475

157500 @ 24% = 6300

200000 @ 32% = 2000

500000 @ 35% = 0?

1000000 @ 37% = 24000

- So why is it that the little guy (zero to 9.5K) gets nadda? So the guy on food stamps get's squat.

- The lower middle class get 1k.

- The middle class (myself) get's 2.4k.

- The upper middle gets OVER DOUBLE!!! Who the hell... why the hell?!?

- Then the lower upper gets 2k. Who cares. Like they need 2k?

- Then the upper gets squat. See previous statement.

- But..... the millionares get 24000 back! Ok, so they earned it but I SURE IN HELL can make better use of that money than they can. I can stimulate the economy far greater than they can/will with the same amount. Why? Because I'LL actually SPEND IT and I'll do it locally.

Fair is fair. I'll show the same numbers with the actual % changes. The numbers will make more sense.

9525 @ 10% = +0% change

38700 @ 12% = +3% change

82500 @ 22% = +3% change

157500 @ 24% = +4% change (WTF!! Why are these guys so important???)

200000 @ 32% = 1% change (They must have taken the extra 1% from this guy and tossed it to the guys below them)

500000 @ 35% = 0% ? (This lil piggy didn't get none?)

1000000 @ 37% = 2.4% change (This lil piggy cried we we we we we... all the way to the bank!)

So yeah... we've been duped. Looks like someone in the Senate (all of them) can't count and have no idea how to divy up the cookies. I know the US isn't known for the greatest mathematicians but CMON MAN!

edit on 20-12-2017 by StallionDuck because: Does anyone read these?

a reply to: StallionDuck

Because the guy on food stamps was already basically paying zero income taxes.

Because the guy on food stamps was already basically paying zero income taxes.

edit on 20-12-2017 by Grambler because: (no reason given)

a reply to: StallionDuck

We are in a perpetual mess that us adults do not want to talk about. The almost $21,000,000,000,000 dollar credit card bill that our elected officials used while we stood by and smiled. But hell as long as we get a little crumb back in form of a $3000 check we will ride this mother into the ground.

Our elected officials are the result of us, the citizens. We will solve this problem of debt, and I often wonder if we are willing to expend the cannon fodder it will require to clear the ledger (again).

We are in a perpetual mess that us adults do not want to talk about. The almost $21,000,000,000,000 dollar credit card bill that our elected officials used while we stood by and smiled. But hell as long as we get a little crumb back in form of a $3000 check we will ride this mother into the ground.

Our elected officials are the result of us, the citizens. We will solve this problem of debt, and I often wonder if we are willing to expend the cannon fodder it will require to clear the ledger (again).

edit on 20-12-2017 by seasonal because: .

a reply to: StallionDuck

It is so strange how people with lower income already paid no taxes and subsequently see less savings. Seriously, people like me need this tax cut. Don't begrudge your fellow tax paying Americans their good fortune.

It is so strange how people with lower income already paid no taxes and subsequently see less savings. Seriously, people like me need this tax cut. Don't begrudge your fellow tax paying Americans their good fortune.

originally posted by: theruthlessone

Only the little people pay taxes

2nd

Very true, and many many very profitable corps pay nothing. In fact many very profitable corps get public assistance.

a reply to: seasonal

The problem is we need spending cuts.

And no one wants to be the one that bites that bullet.

Look at how many dems are saying a tax cut will be the end of the world.

Can you imagine the hysterics if someone actually tried to restructure Medicare or social security?

But until then, our future generations will c9ntinue to be saddled for our over spending.

The problem is we need spending cuts.

And no one wants to be the one that bites that bullet.

Look at how many dems are saying a tax cut will be the end of the world.

Can you imagine the hysterics if someone actually tried to restructure Medicare or social security?

But until then, our future generations will c9ntinue to be saddled for our over spending.

originally posted by: Grambler

a reply to: StallionDuck

Because the guy on food stamps was already basically paying zero income taxes.

Maybe but not always. Those people making 9k a year surely aren't getting the foodstamps they need to continue living in anything other than DIRT POOR conditions. It's not always black and white and this is one of the few exceptions. It's like killing the good cells while trying to kill the bad cancer cells. I certainly don't want to be the guy who denies food to the poor because jack-holes are abusing it.

a reply to: StallionDuck

Just use this... My savings are going to help me out a lot if this is accurate.

taxplancalculator.com...

Just use this... My savings are going to help me out a lot if this is accurate.

taxplancalculator.com...

a reply to: Grambler

No, we need spending cuts and tax increases to clear out the debt. And we need a leader who can explain why we need a little bit of pain.

I guess people think the banks getting all that $ was free. Or the flash bang shock an awe was free or the 16 years in Afghanistan is super cheap.

It is going to come to a head, and I have a feeling to get the US back in the black is going to require rivers of red.

No, we need spending cuts and tax increases to clear out the debt. And we need a leader who can explain why we need a little bit of pain.

I guess people think the banks getting all that $ was free. Or the flash bang shock an awe was free or the 16 years in Afghanistan is super cheap.

It is going to come to a head, and I have a feeling to get the US back in the black is going to require rivers of red.

a reply to: StallionDuck

Your surprised?!?!

Everyone has known the gop ONLY CARES about those who are upper middle class and upward , for decades...

That is who votes for them, so that is all that matters..

How people EVER bought trickle down economics, I will never know..

Your surprised?!?!

Everyone has known the gop ONLY CARES about those who are upper middle class and upward , for decades...

That is who votes for them, so that is all that matters..

How people EVER bought trickle down economics, I will never know..

originally posted by: theruthlessone

Only the little people pay taxes

2nd

Not true.

An estimated 45.3 percent of American households — roughly 77.5 million — will pay no federal individual income tax, according to data for the 2015 tax year from the Tax Policy Center, a nonpartisan Washington-based research group. (Note that this does not necessarily mean they won’t owe their states income tax.)

Roughly half pay no federal income tax because they have no taxable income, and the other roughly half get enough tax breaks to erase their tax liability, explains Roberton Williams, a senior fellow at the Tax Policy Center.

Despite the fact that rich people paying little in the way of income taxes makes plenty of headlines, this is the exception to the rule: The top 1 percent of taxpayers pay a higher effective income tax rate than any other group (around 23 percent, according to a report released by the Tax Policy Center in 2014) — nearly seven times higher than those in the bottom 50 percent.

nypost.com...

Almost half of Americans pay no income tax.

So clearly they would not benefit directly from this tax cut.

However, they will benefit if the economy grows.

a reply to: Metallicus

I'm not disputing that one bit. I need this tax break too especially after a few hard hit years in the Oil Field. I get how the trend is supposed to work. Focus more on the questionable tactics used here and how certain classes receive more than they should. The numbers dont trickle either way. It's a change before and after. Just look at the % of each and you'll see what I'm mad about. Still, I will ALWAYS look at the lil guy. If you want to stimulate the economy, look at the guy who's going to spend that money on goods that are needed rather than overseas trips. The work I do is no less important and probably more so than the guy a tax bracket two steps above me is doing. He just happens to get a bigger break than I do... the guys that's busting his balls to make a living who wasn't born with a silver spoon. Sure, I know not everyone was born with it... I just don't see the numbers playing out fair. The original plan was what sold me. What we received is NOT that plan.

I'm not disputing that one bit. I need this tax break too especially after a few hard hit years in the Oil Field. I get how the trend is supposed to work. Focus more on the questionable tactics used here and how certain classes receive more than they should. The numbers dont trickle either way. It's a change before and after. Just look at the % of each and you'll see what I'm mad about. Still, I will ALWAYS look at the lil guy. If you want to stimulate the economy, look at the guy who's going to spend that money on goods that are needed rather than overseas trips. The work I do is no less important and probably more so than the guy a tax bracket two steps above me is doing. He just happens to get a bigger break than I do... the guys that's busting his balls to make a living who wasn't born with a silver spoon. Sure, I know not everyone was born with it... I just don't see the numbers playing out fair. The original plan was what sold me. What we received is NOT that plan.

Hmm, seems wealthy individuals on wall st are saying this will cost them more.

www.bloomberg.com...

Not the narrative that is being spun that the rich all benefit and the poor are screwed.

www.bloomberg.com...

Not the narrative that is being spun that the rich all benefit and the poor are screwed.

a reply to: StallionDuck

I see your point, but really, I'm not crying over the guy on food stamps getting squat. Seems like folks who live on $10K a year or less, rely on LOTS of public assistance/benefits they get from people who work their butts off every year. Maybe that's why that most are lazy and refuse to find employment, or they hook up with someone with a good job and keep collecting the benefits. I am a little confused with some of your figures though. In 2016, people making $418,401 or more, are taxed at a 39.5% rate and the current Senate plan shows people in the $200,001-$500,000 group getting taxed at a 35% rate. Wouldn't a person making $500,000/yr see their taxes go down with a larger standard deduction? Why list it at 0%?

I see your point, but really, I'm not crying over the guy on food stamps getting squat. Seems like folks who live on $10K a year or less, rely on LOTS of public assistance/benefits they get from people who work their butts off every year. Maybe that's why that most are lazy and refuse to find employment, or they hook up with someone with a good job and keep collecting the benefits. I am a little confused with some of your figures though. In 2016, people making $418,401 or more, are taxed at a 39.5% rate and the current Senate plan shows people in the $200,001-$500,000 group getting taxed at a 35% rate. Wouldn't a person making $500,000/yr see their taxes go down with a larger standard deduction? Why list it at 0%?

originally posted by: LSU0408

a reply to: StallionDuck

Just use this... My savings are going to help me out a lot if this is accurate.

taxplancalculator.com...

Thank you LSU. No one wants to look at what they will be getting. It looks too good to bitch about. Go figure.

edit on 12/20/2017 by

Martin75 because: Damn spell check... hmpft

originally posted by: Grambler

a reply to: seasonal

We do not need tax increases.

We need smaller government.

Increases in taxes will lead only to increases in spending and excuses to not curb it.

I tend to agree with you here. Spending cuts, cuts in our outrageous military budget (we spend roughly three times as much as the next largest military. And of course less tax breaks to our overseas investors. As well as making some of our biggest corporations pay their fair share of taxes.

But I'm dreaming...of course.

a reply to: Grambler

and then...

So 7 times higher than the lowest 50%... which your source will pay nothing, or almost nothing... So seven times higher than nothing is how much exactly???

An estimated 45.3 percent of American households — roughly 77.5 million — will pay no federal individual income tax,

and then...

The top 1 percent of taxpayers pay a higher effective income tax rate than any other group (around 23 percent, according to a report released by the Tax Policy Center in 2014) — nearly seven times higher than those in the bottom 50 percent.

So 7 times higher than the lowest 50%... which your source will pay nothing, or almost nothing... So seven times higher than nothing is how much exactly???

new topics

-

Maestro Benedetto

Literature: 18 minutes ago -

Is AI Better Than the Hollywood Elite?

Movies: 27 minutes ago -

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs: 3 hours ago -

2024 Pigeon Forge Rod Run - On the Strip (Video made for you)

Automotive Discussion: 4 hours ago -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues: 5 hours ago -

The functionality of boldening and italics is clunky and no post char limit warning?

ATS Freshman's Forum: 6 hours ago -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News: 6 hours ago -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest: 7 hours ago -

Weinstein's conviction overturned

Mainstream News: 8 hours ago -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics: 9 hours ago

top topics

-

Krystalnacht on today's most elite Universities?

Social Issues and Civil Unrest: 10 hours ago, 9 flags -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics: 9 hours ago, 8 flags -

Weinstein's conviction overturned

Mainstream News: 8 hours ago, 7 flags -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues: 5 hours ago, 7 flags -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media: 12 hours ago, 6 flags -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest: 7 hours ago, 6 flags -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News: 6 hours ago, 5 flags -

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs: 3 hours ago, 3 flags -

2024 Pigeon Forge Rod Run - On the Strip (Video made for you)

Automotive Discussion: 4 hours ago, 2 flags -

Any one suspicious of fever promotions events, major investor Goldman Sachs card only.

The Gray Area: 14 hours ago, 2 flags

active topics

-

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media • 216 • : KrustyKrab -

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News • 57 • : Guyfriday -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues • 24 • : DBCowboy -

Mood Music Part VI

Music • 3102 • : Hellmutt -

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs • 9 • : Ophiuchus1 -

Is AI Better Than the Hollywood Elite?

Movies • 1 • : 5thHead -

British TV Presenter Refuses To Use Guest's Preferred Pronouns

Education and Media • 164 • : Annee -

Maestro Benedetto

Literature • 0 • : BrotherKinsMan -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest • 11 • : marg6043 -

Electrical tricks for saving money

Education and Media • 7 • : chr0naut