It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

They wanted the "Rich" to pay their fair share !

They wanted society to be just and fair for all !

A new formula for fairness they said.

So they they taxed the rich.

Too bad it's illegal !!

Judge Rules Seattle’s Income Tax On Wealthy Is Illegal

They wanted society to be just and fair for all !

A new formula for fairness they said.

So they they taxed the rich.

Too bad it's illegal !!

Judge Rules Seattle’s Income Tax On Wealthy Is Illegal

A Seattle King County Superior Court ruled that a controversial piece of legislation meant to tax wealthy households is illegal, Seattle Times reported.

In a judgment, Judge John R. Ruhl said the city ordinance adopted in July is not authorized under state law.

“ … the City’s tax, which is labeled ‘Income Tax,’ is exactly that,” he wrote. “It cannot be restyled as an ‘excise tax’ on the … ‘privileges’ of receiving revenue in Seattle or choosing to live in Seattle.”

Seattle City Attorney Pete Holmes and Seattle Mayor Tim Burgess said in a joint statement that their goal is to eliminate the state’s “over-reliance on regressive sales taxes” and ensure the wealthy pay their fair share and the ruling was “disappointing,” but they would continue their efforts and appeal the decision.

The wealthy actually pay well more than their fair share. They work hard, become successful, earn more because of it and then have to give more away

because of it.

Want taxes to go farther then cut down on government and hold them accountable. Government is basically the DMV. All they do is waste everyone's time and money. Would you give the DMV more money?

Want taxes to go farther then cut down on government and hold them accountable. Government is basically the DMV. All they do is waste everyone's time and money. Would you give the DMV more money?

Not surprising... I am not familiar with any state that allows a sub-entity to enact an income tax. Sub entities rely mainly on sales tax /

specialized taxes to fund their operations (road improvement / public safety / schools / etc).

I would imagine all that would be needed is either a change in law specifically allowing it or the removal of a state preemption law to allow it.

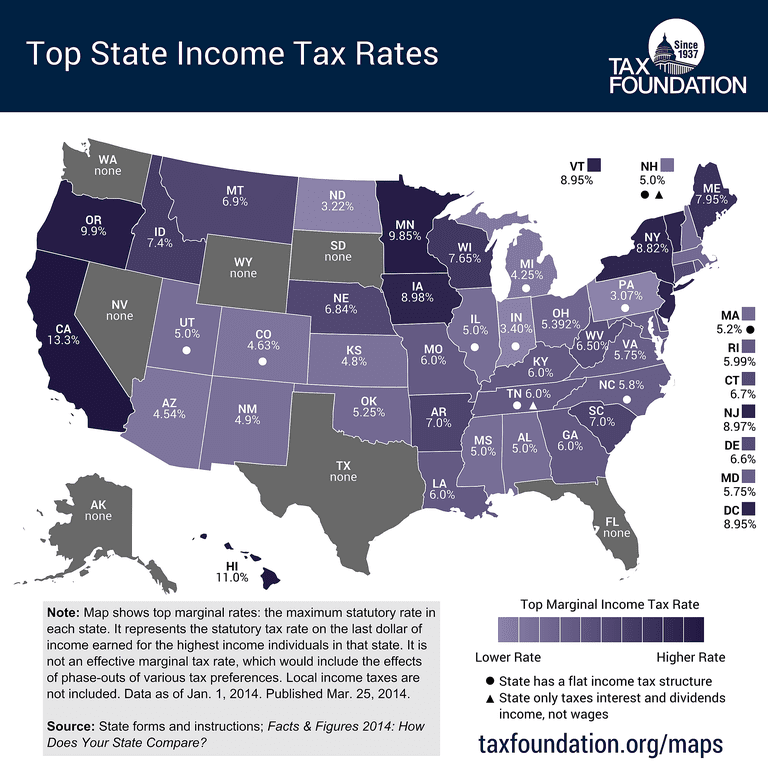

We need to establish set tax brackets and only allow deductions for needed items like clothes / food / school costs etc. The deductions and loopholes need to be removed / closed.

I would imagine all that would be needed is either a change in law specifically allowing it or the removal of a state preemption law to allow it.

We need to establish set tax brackets and only allow deductions for needed items like clothes / food / school costs etc. The deductions and loopholes need to be removed / closed.

Maybe if the decision makers in government had to pay the legal fees of failed initiatives like this, we wouldn’t see this kind of crap.

And that begs the question, who the hell did they get their legal advice from..?

Stoopid is as stoopid does...

And that begs the question, who the hell did they get their legal advice from..?

Stoopid is as stoopid does...

a reply to: BestinShow

Someone who told them it was worth challenging to see if they could make the argument that income was not property like hard goods are.

Someone who told them it was worth challenging to see if they could make the argument that income was not property like hard goods are.

They get their pound of flesh other ways.

B&O Taxes

Sales Taxes in Cities and Counties

B&O classification Rate

Retailing .00471

Wholesaling .00484

Manufacturing .00484

Service & other activities .015

Seattle, WA Sales Tax Rate 10.100%

King County, WA Sales Tax Rate 10.000%

Property Taxes

The average effective property tax rate in King County is 1.01%, 15th highest of the state’s 39 counties. However, the county’s median annual property tax payment is highest in the state, at $3,824. In Seattle, the total 2015 rate was $9.27 per $1,000 in assessed value, a 10% increase from 2014.

Property taxes also hit the poor hard since tenants pay the property tax regardless of the myth the owners pay it.

Rent Prices

The Average Rent in Seattle

While renting is often better than buying in the Seattle area, it isn't necessarily cheap. According to myapartmentmap.com the average rent for a two bedroom apartment in Seattle is $2,109. That is nearly 80% higher than the national average.

In some Seattle neighborhoods, rent is even more expensive than the rates listed above. According to rental listings site Zumper.com, rent for a one bedroom apartment in Seattle's South Lake Union neighborhood (in which Amazon.com has its world headquarters) is $1,900.

originally posted by: MysticPearl

The wealthy actually pay well more than their fair share. They work hard, become successful, earn more because of it and then have to give more away because of it.

This idea of "fair share" is just double speak.

There's no such thing.

The society can run quite well without any taxes a all.

You pay for what you need. Need to use the road? Pay a toll.

Need security to protect your wealth, hire a security guard.

No need for cops.

If there were no governments, no nations would invade other nations, so you don't need to maintain an army.

If there were no governments, there really would be no borders, so no need for immigration services.

The only reason we need taxes, is to maintain a system that only works with taxes.

Get rid of the system, and there the need for taxes vanishes.

originally posted by: AMPTAH

originally posted by: MysticPearl

The wealthy actually pay well more than their fair share. They work hard, become successful, earn more because of it and then have to give more away because of it.

This idea of "fair share" is just double speak.

There's no such thing.

The society can run quite well without any taxes a all.

You pay for what you need. Need to use the road? Pay a toll.

Need security to protect your wealth, hire a security guard.

No need for cops.

If there were no governments, no nations would invade other nations, so you don't need to maintain an army.

If there were no governments, there really would be no borders, so no need for immigration services.

The only reason we need taxes, is to maintain a system that only works with taxes.

Get rid of the system, and there the need for taxes vanishes.

pablo escobar worked in that sort of manner. not sure thats how i want the world being run, essentially whoever has the biggest stick rules then whether its a bully on the block or a multinational criminal entity

edit on 24-11-2017 by TheScale because: (no reason given)

originally posted by: MysticPearl

The wealthy actually pay well more than their fair share. They work hard, become successful, earn more because of it and then have to give more away because of it.

Want taxes to go farther then cut down on government and hold them accountable. Government is basically the DMV. All they do is waste everyone's time and money. Would you give the DMV more money?

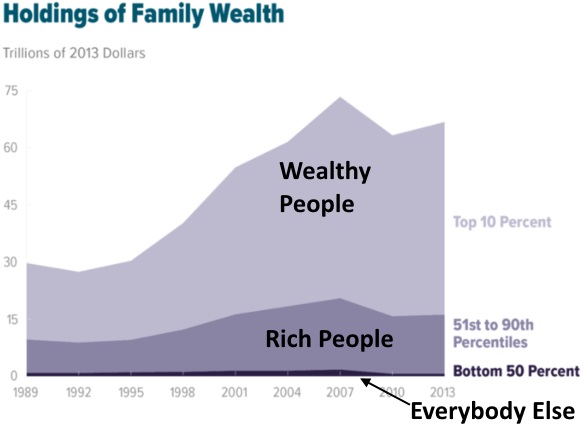

You're describing rich people. WEALTHY people 95% of them are born into it. Then there's the handful of celbrity tech giant founder types that score big and get all the attention.

[Currently, the richest 1% hold about 38% of all privately held wealth in the United States. while the bottom 90% held 73% of all debt. According to The New York Times, the richest 1 percent in the United States now own more wealth than the bottom 90 percent.]

en.wikipedia.org...

edit on 24-11-2017 by IgnoranceIsntBlisss because: (no reason

given)

originally posted by: TheScale

pablo escobar worked in that sort of manner. not sure thats how i want the world being run, essentially whoever has the biggest stick rules then whether its a bully on the block or a multinational criminal entity

Pal, they rule anyway. They simply hide behind the governments and use the system to keep their position of wealth and power behind the scenes, without revealing themselves.

At least, in a taxless society, we'd all know who they are.

But, in the current system, the government is the clouds and the smokescreen, hiding the puppet masters behind the scenes.

a reply to: IgnoranceIsntBlisss

This tax would not have even hit them though.

It was strictly a tax on high paycheck income. Most of the wealthy in the sense you are talking about do not derive that wealth from paycheck income.

So basically what Seattle was really doing was saying that the paychecks people who live paycheck to paycheck depend on are not their personal property but a form of asset that could be readily preyed upon as the city felt the need through targeted taxation. Sure, they might not have been hitting those income levels today, but if Seattle won the right to consider paychecks outside property and thus able to hit narrow brackets at will with taxation, then no one's income level would be safe again.

This tax would not have even hit them though.

It was strictly a tax on high paycheck income. Most of the wealthy in the sense you are talking about do not derive that wealth from paycheck income.

So basically what Seattle was really doing was saying that the paychecks people who live paycheck to paycheck depend on are not their personal property but a form of asset that could be readily preyed upon as the city felt the need through targeted taxation. Sure, they might not have been hitting those income levels today, but if Seattle won the right to consider paychecks outside property and thus able to hit narrow brackets at will with taxation, then no one's income level would be safe again.

a reply to: MysticPearl

So Kim Kardashian works hard?, or any of the Kardashians? Paris Hilton?

I don't understand the demonizing of the wealthy by some, but I also don't understand the ass kissing by others.

They work hard

So Kim Kardashian works hard?, or any of the Kardashians? Paris Hilton?

I don't understand the demonizing of the wealthy by some, but I also don't understand the ass kissing by others.

(post by Oldtimer2 removed for political trolling and baiting)

originally posted by: BestinShow

Maybe if the decision makers in government had to pay the legal fees of failed initiatives like this, we wouldn’t see this kind of crap.

And that begs the question, who the hell did they get their legal advice from..?

Stoopid is as stoopid does...

I'm betting these decision makers could care less if the bill passed and was made policy. They just didn't want to be seen as voting against it so no one could call them out in the next election.

Dumbasses dont realize that the wealthy are smarter. Raise tax to 75% and it still wont be paid.

Super, more judicial activism from the west coast...

I hate judicial activism regardless of whether they get one right once every thousand decisions....

The judicial branch(on every level) should have zero say in taxation..

-Chris

I hate judicial activism regardless of whether they get one right once every thousand decisions....

The judicial branch(on every level) should have zero say in taxation..

-Chris

a reply to: Christosterone

The COTUS protects our private property, and in this case, income is private property. This ruling attempted to strip income of that status as private property in order to do what it did.

For a court to allow it to stand would be to set a dangerous precedent.

I get what you are saying, but at this point, the only way to keep courts out of taxation would be to remove taxation from the laws entirely. After all, taxes must be done through legal means and it is the court's function to rule on a law's constitutional legality.

The COTUS protects our private property, and in this case, income is private property. This ruling attempted to strip income of that status as private property in order to do what it did.

For a court to allow it to stand would be to set a dangerous precedent.

I get what you are saying, but at this point, the only way to keep courts out of taxation would be to remove taxation from the laws entirely. After all, taxes must be done through legal means and it is the court's function to rule on a law's constitutional legality.

a reply to: ketsuko

Fair enough....

I just can’t my head around the courts and their seemingly endless power to stay both legislative and executive powers from a single bench...

Judicial activism amounts to nothing more than tiny fiefdoms ruled by the judicial autocrats which then extend to the rest of the society as a whole...

It’s frustrating and not what Madison had in mind in his federalist arguments...never

-Chris

Fair enough....

I just can’t my head around the courts and their seemingly endless power to stay both legislative and executive powers from a single bench...

Judicial activism amounts to nothing more than tiny fiefdoms ruled by the judicial autocrats which then extend to the rest of the society as a whole...

It’s frustrating and not what Madison had in mind in his federalist arguments...never

-Chris

originally posted by: Christosterone

I just can’t my head around the courts and their seemingly endless power to stay both legislative and executive powers from a single bench...

So how do you propose handling a scenario such as this where a local government violates the state constitution?

new topics

-

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics: 36 minutes ago -

Krystalnacht on today's most elite Universities?

Social Issues and Civil Unrest: 45 minutes ago -

Chris Christie Wishes Death Upon Trump and Ramaswamy

Politicians & People: 1 hours ago -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media: 3 hours ago -

Any one suspicious of fever promotions events, major investor Goldman Sachs card only.

The Gray Area: 5 hours ago -

God's Righteousness is Greater than Our Wrath

Religion, Faith, And Theology: 9 hours ago

top topics

-

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News: 14 hours ago, 11 flags -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues: 15 hours ago, 5 flags -

Sunak spinning the sickness figures

Other Current Events: 15 hours ago, 5 flags -

Electrical tricks for saving money

Education and Media: 13 hours ago, 4 flags -

Late Night with the Devil - a really good unusual modern horror film.

Movies: 17 hours ago, 3 flags -

Krystalnacht on today's most elite Universities?

Social Issues and Civil Unrest: 45 minutes ago, 3 flags -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media: 3 hours ago, 2 flags -

Any one suspicious of fever promotions events, major investor Goldman Sachs card only.

The Gray Area: 5 hours ago, 2 flags -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics: 36 minutes ago, 2 flags -

Chris Christie Wishes Death Upon Trump and Ramaswamy

Politicians & People: 1 hours ago, 0 flags

active topics

-

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media • 59 • : theatreboy -

The Reality of the Laser

Military Projects • 48 • : 5thHead -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues • 69 • : SchrodingersRat -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics • 1 • : network dude -

Candidate TRUMP Now Has Crazy Judge JUAN MERCHAN After Him - The Stormy Daniels Hush-Money Case.

Political Conspiracies • 744 • : Threadbarer -

Truth Social goes public, be careful not to lose your money

Mainstream News • 129 • : matafuchs -

Krystalnacht on today's most elite Universities?

Social Issues and Civil Unrest • 2 • : marg6043 -

Remember These Attacks When President Trump 2.0 Retribution-Justice Commences.

2024 Elections • 56 • : WeMustCare -

British TV Presenter Refuses To Use Guest's Preferred Pronouns

Education and Media • 148 • : Consvoli -

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News • 44 • : ByeByeAmericanPie