It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

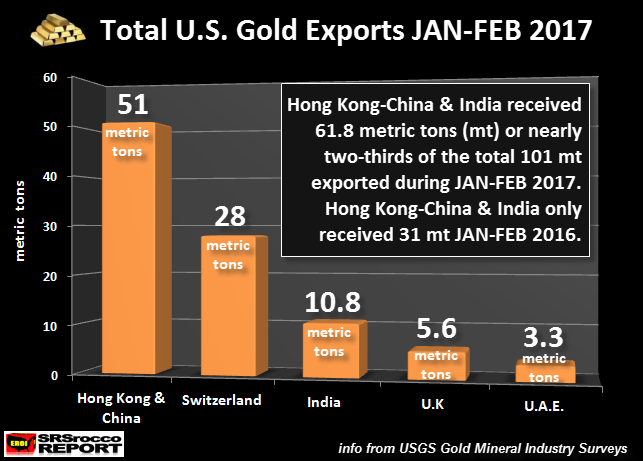

Where is all our gold going?? In 2016 the US exported 56.5 metric tons of gold for the January to February timeline. The same two months of 2017 saw

this number jump to 101 tons!! Not only that though, there was a deficit from mine supply, so gold in vaults had to be tapped to make the

difference.

Well, a good buying opportunity was about a week ago for the bottom of this small dip. There may be more dips to buy into though. Im not letting go of a single gram of gold now after reading this. Its almost like if its a run up to something, something major...

Keep an eye on what Goldman Sachs says in their press releases and investor relations, there will be clues.

Soren K. Group

Most Americans didn’t realize it, but something BIG changed in the U.S. gold market in the beginning of 2017. While precious metals sentiment and buying in the U.S. has dropped off considerably in the first quarter of 2017, the East continues to acquire gold, HAND OVER FIST.

Total U.S. gold exports JAN-FEB 2017 surged to 101 metric tons (mt), compared to 56.5 mt last year. This is quite interesting because total U.S. gold mine supply plus gold imports for JAN-FEB 2017 only equaled 80 mt. Thus, the U.S. suffered a 21 mt gold supply deficit in the first two months of the year. Which means, someone had to liquidate an additional 21 mt of gold from their vaults to export to the East….. where they still understand the vital role of gold as REAL MONEY.

And where did the majority of U.S. gold exports head to? You got it….. Hong Kong-China & India:

Well, a good buying opportunity was about a week ago for the bottom of this small dip. There may be more dips to buy into though. Im not letting go of a single gram of gold now after reading this. Its almost like if its a run up to something, something major...

Keep an eye on what Goldman Sachs says in their press releases and investor relations, there will be clues.

edit on 5-15-2017 by

worldstarcountry because: (no reason given)

a reply to: worldstarcountry

In the last year or two I read a Paul Craig Roberts article he explained in detail why the price of Gold has been deliberately suppressed and how they do it on the comex.

He said the Comex (I think thats waht is called) was in danger of running out of gold. At that time Russia was selling oil and using the money to by gold at the artifically low prices. The comex could not permit this to continue as they would round out of bullion to deliver to the Russians and so shortly after the Urkrane thig happened.

In addition to that he said the Asians were buying more and more gold all the time and he speculated that the Comex via the fed would rehypothcate gold from the vaults of Americian's "friend." (vassal states)

Since then I've not seen anything else on the subject by PCR but what you have alluded to is significient. I have read there is a world wide shortage to scrap steel, which seems to indicate war is on the way.

I've also read silver has increased within a short time and now as you indicate, gold has jumped out of the control of the Comex. These signs do not auger well.

Only in recent weeks I've read that the US govt is passing a bill that ensures/permits them to guard UKraine ports (I think it was) by blockading Russian ports. The Russians have responded by saying that if this bill gets past it is, the same thing as a declaration of war.

Something is going on out there.

In the last year or two I read a Paul Craig Roberts article he explained in detail why the price of Gold has been deliberately suppressed and how they do it on the comex.

He said the Comex (I think thats waht is called) was in danger of running out of gold. At that time Russia was selling oil and using the money to by gold at the artifically low prices. The comex could not permit this to continue as they would round out of bullion to deliver to the Russians and so shortly after the Urkrane thig happened.

In addition to that he said the Asians were buying more and more gold all the time and he speculated that the Comex via the fed would rehypothcate gold from the vaults of Americian's "friend." (vassal states)

Since then I've not seen anything else on the subject by PCR but what you have alluded to is significient. I have read there is a world wide shortage to scrap steel, which seems to indicate war is on the way.

I've also read silver has increased within a short time and now as you indicate, gold has jumped out of the control of the Comex. These signs do not auger well.

Only in recent weeks I've read that the US govt is passing a bill that ensures/permits them to guard UKraine ports (I think it was) by blockading Russian ports. The Russians have responded by saying that if this bill gets past it is, the same thing as a declaration of war.

Something is going on out there.

a reply to: worldstarcountry\

Yes the Shanghai gold exchange just deals with China, but the new Hong Kong one is a new one that deals with the world. The Guys that were running the London one threw in their contract with a couple of years to go on it. The paper price on the Comex isn't a true representative price of the precious metals, basically the big banks short the price, to make the western fiat currencies look good, with government approval. So what's been happening is that the price of Gold and Silver is so cheap the East has been stocking up on never to be repeated prices. JP Morgan have been using the shorts to stockpile 550 million ounces of silver in their vaults. Seems their game is almost up, because if they cant do the short they have to make up the difference. Demand isn't keeping the price down. I think very soon it will change ,because their is no where else for the money to go as the SHTF has hit the housing bubble, their are foreclosures just about going stellar, but are not being reported.

Yes the Shanghai gold exchange just deals with China, but the new Hong Kong one is a new one that deals with the world. The Guys that were running the London one threw in their contract with a couple of years to go on it. The paper price on the Comex isn't a true representative price of the precious metals, basically the big banks short the price, to make the western fiat currencies look good, with government approval. So what's been happening is that the price of Gold and Silver is so cheap the East has been stocking up on never to be repeated prices. JP Morgan have been using the shorts to stockpile 550 million ounces of silver in their vaults. Seems their game is almost up, because if they cant do the short they have to make up the difference. Demand isn't keeping the price down. I think very soon it will change ,because their is no where else for the money to go as the SHTF has hit the housing bubble, their are foreclosures just about going stellar, but are not being reported.

a reply to: worldstarcountry

Meanwhile India, China and Russia are hoarding it like there's no tomorrow

Meanwhile India, China and Russia are hoarding it like there's no tomorrow

The U.S. doesn`t need gold because the dollar isn`t backed by gold,

maybe the U.S. is stockpiling something more valuable than gold, after all gold is just a shiny yellow rock you can`t really do anything with it.you can`t eat it, you can`t refine it and use it as fuel.

about the only thing you can do with it is make jewelry and gold coins with it, but the world can survive just fine without gold coins and jewelry.

maybe the U.S. is stockpiling something more valuable than gold, after all gold is just a shiny yellow rock you can`t really do anything with it.you can`t eat it, you can`t refine it and use it as fuel.

about the only thing you can do with it is make jewelry and gold coins with it, but the world can survive just fine without gold coins and jewelry.

originally posted by: Tardacus

The U.S. doesn`t need gold because the dollar isn`t backed by gold,

maybe the U.S. is stockpiling something more valuable than gold, after all gold is just a shiny yellow rock you can`t really do anything with it.you can`t eat it, you can`t refine it and use it as fuel.

about the only thing you can do with it is make jewelry and gold coins with it, but the world can survive just fine without gold coins and jewelry.

Yeah because no one uses gold! I'm sure they no longer use it as a superconductor, not do they put it in any number of pieces of technology, most likely in the very device you are using right now. It's all useless!!

edit on 15-5-2017 by boneoracle because: (no reason given)

a reply to: boneoracle

it doesn`t take much gold to make those things and since the U.S. doesn`t make much of anything anymore they don`t need much gold for manufacturing purposes.

it doesn`t take much gold to make those things and since the U.S. doesn`t make much of anything anymore they don`t need much gold for manufacturing purposes.

the USA exports of gold & silver are a losing proposition...

the USA must find a way to recover those lost hoards of Gold... that's why the present nation of Syria is in the cross-hairs...(just as Libya and Iraq each had a fairly big stash of gold bullion which were then lost without trace to any USA bullion vault)

so, the lost assets are recovered from other sovereign vaults, it seems

if bit-coin is now worth $1800. per crypto coin, because of world-wide confidence that the bit-coin is always worth something... don't paint yourself in the "Gold-is-Worthless" corner... the other 6.7 Billion people and their leaders on Earth think Gold is worth way more than the $1250. per ounce rate in terms of USD's...

In fact the Gold bullion premium in the USA is only about $40 per oz... but in other places around the world the premium for Gold ounces range from $62 -to- $150 per ounce especially for big transactions gold can only be had for around $1500.00 per ounce at todays rate of ~ $1250.00

the USD is surly getting beaten up, the tactical nuke card is about to be played sooner-than-later

U say:

then explain why Treasury refuses to AUDIT the bullion Vaults, (filled by IOUs of rehypothicated gold, or vast troves of unmined gold in places like Alaska or the fabled Grand-Canyon/Hoover Dam, Gold Caverns...)

the USA must find a way to recover those lost hoards of Gold... that's why the present nation of Syria is in the cross-hairs...(just as Libya and Iraq each had a fairly big stash of gold bullion which were then lost without trace to any USA bullion vault)

so, the lost assets are recovered from other sovereign vaults, it seems

if bit-coin is now worth $1800. per crypto coin, because of world-wide confidence that the bit-coin is always worth something... don't paint yourself in the "Gold-is-Worthless" corner... the other 6.7 Billion people and their leaders on Earth think Gold is worth way more than the $1250. per ounce rate in terms of USD's...

In fact the Gold bullion premium in the USA is only about $40 per oz... but in other places around the world the premium for Gold ounces range from $62 -to- $150 per ounce especially for big transactions gold can only be had for around $1500.00 per ounce at todays rate of ~ $1250.00

the USD is surly getting beaten up, the tactical nuke card is about to be played sooner-than-later

U say:

"The US still has by far the world's largest reserve of gold. "

then explain why Treasury refuses to AUDIT the bullion Vaults, (filled by IOUs of rehypothicated gold, or vast troves of unmined gold in places like Alaska or the fabled Grand-Canyon/Hoover Dam, Gold Caverns...)

edit on th31149487073515522017 by St Udio because: (no reason given)

a reply to: Tardacus

The dollar which is backed by little to nothing is under attack. The BRICS nations have effectively complete their creation of full alternatives to our entire financial system. SWIFT, the IMF, World Bank are now irrelevant to the economic future of much of Asia or BRICS. The Petro/dollar loses more of its clout every year. Also coming near this fall, possibly October would the collective of the BRICS reaching a 15% stake in voting rights at the IMF. That means someone other than the USA will have veto power on policy decisions for what seems like the first time.

The lie that rich people have made us peasants believe is that gold is irrelevant. And yet, every central bank, government, hedge fund, and pretty much anybody in power makes certain to maintain a healthy stock of it while demanding we all switch to imaginary numbers on a digital screen. There should be immediate cause to question that.

It could be possible though that our government is discreetly settling our foreign debt obligations with these increased exports.

You cannot eat dollars either, but you continue to chase that worthless paper. I suppose it does function well as toilet paper or fire kindling though.

The dollar which is backed by little to nothing is under attack. The BRICS nations have effectively complete their creation of full alternatives to our entire financial system. SWIFT, the IMF, World Bank are now irrelevant to the economic future of much of Asia or BRICS. The Petro/dollar loses more of its clout every year. Also coming near this fall, possibly October would the collective of the BRICS reaching a 15% stake in voting rights at the IMF. That means someone other than the USA will have veto power on policy decisions for what seems like the first time.

The lie that rich people have made us peasants believe is that gold is irrelevant. And yet, every central bank, government, hedge fund, and pretty much anybody in power makes certain to maintain a healthy stock of it while demanding we all switch to imaginary numbers on a digital screen. There should be immediate cause to question that.

It could be possible though that our government is discreetly settling our foreign debt obligations with these increased exports.

You cannot eat dollars either, but you continue to chase that worthless paper. I suppose it does function well as toilet paper or fire kindling though.

edit on 5-15-2017 by worldstarcountry because: (no reason given)

I can't understand why people value gold so much, I would much rather have copper than gold. I kind of like silver too, but I just can't get into the

color of gold. If people want to go nuts over it, go ahead, I think they live a life of delusion myself. I don't mind Yukon gold potatoes, but that

is about the only gold I like. Oh yeah, they used to have those two cent square gold nugget chocolates on the counters at the gas stations and candy

stores, those I liked. I forgot about them. The ice cubes mint chocolate candies used to be good too.

a reply to: St Udio

I went back to some recent resource articles

see: kingworldnews.com...

the best-of-the-best gold bullion producers are the Swiss, they have a few high priced mints that make gold bar kilos & other sized weights...

but the article says that their gold only carries a 'Premium' over spot-price of between $1-2 dollars per oz

that's one way the gold providers get around the manipulated paper-gold prices (but I sure don't see how a $1 or $2 markup per ounce can make up for a $50 per ounce under-valuation brought about by the Bankers who create 500-1 more naked short contracts tha gold available at a thieves market sale price some $50 under the real mined cost of gold production..

just putting the article out there for you all to review

I can only nickel & dime my position on silver...no way to even afford those 1/10 ounce gold coins I see at sale for some $250.oo plus

I went back to some recent resource articles

see: kingworldnews.com...

the best-of-the-best gold bullion producers are the Swiss, they have a few high priced mints that make gold bar kilos & other sized weights...

but the article says that their gold only carries a 'Premium' over spot-price of between $1-2 dollars per oz

that's one way the gold providers get around the manipulated paper-gold prices (but I sure don't see how a $1 or $2 markup per ounce can make up for a $50 per ounce under-valuation brought about by the Bankers who create 500-1 more naked short contracts tha gold available at a thieves market sale price some $50 under the real mined cost of gold production..

just putting the article out there for you all to review

I can only nickel & dime my position on silver...no way to even afford those 1/10 ounce gold coins I see at sale for some $250.oo plus

a reply to: boneoracle

Actually all the high tech devices we use need silver and gold, or they wouldn't work. Theirs about an ounce of silver and gold plated connectors in every flat screen TV. About 50 cents worth of silver in a cell phone. Its actually more valuable than money.

Actually all the high tech devices we use need silver and gold, or they wouldn't work. Theirs about an ounce of silver and gold plated connectors in every flat screen TV. About 50 cents worth of silver in a cell phone. Its actually more valuable than money.

blog.gainesvillecoins.com...

it seems that the London Bullion Exchange has a need to reassure the populace that the $18 Billion in daily gold transfers they undertake is fully accounted and audited... the proof will be printed later this SUMMER of 2017

LBMA is going down even as the Eastern bullion exchanges in physical ONLY metals takes the lead position--- recall that Shanghai bought a position in LBMA a year or two back from today..(for appearances only... the Illegal operators in London got rescued by the China gold holders for what reason I cannot even guess

it seems that the London Bullion Exchange has a need to reassure the populace that the $18 Billion in daily gold transfers they undertake is fully accounted and audited... the proof will be printed later this SUMMER of 2017

LBMA is going down even as the Eastern bullion exchanges in physical ONLY metals takes the lead position--- recall that Shanghai bought a position in LBMA a year or two back from today..(for appearances only... the Illegal operators in London got rescued by the China gold holders for what reason I cannot even guess

a reply to: anonentity

... and if memory serves me right,,,

the Drones that blasted Syria.. all 59 of them ... use nearly 50 ounces of silver in each cruise-missile

that silver is lost to the world, there just ain't any molecules of silver or gold left to retrieve

which opens the Pandora's box on silver value... it might well be declared a strategic metal and be turned in to the government in the future so as to protect our way-of-life...

because there isn't much being mined any more, especially after the Jihadists and Leftists seek to destroy the working government of the USA that has too many Christian & white privilege & favoritism ingrained into the system

... and if memory serves me right,,,

the Drones that blasted Syria.. all 59 of them ... use nearly 50 ounces of silver in each cruise-missile

that silver is lost to the world, there just ain't any molecules of silver or gold left to retrieve

which opens the Pandora's box on silver value... it might well be declared a strategic metal and be turned in to the government in the future so as to protect our way-of-life...

because there isn't much being mined any more, especially after the Jihadists and Leftists seek to destroy the working government of the USA that has too many Christian & white privilege & favoritism ingrained into the system

edit on th31149488846215472017 by St Udio because: (no reason given)

a reply to: St Udio

Ahh, I did not realize my local bullion dealer had their own blog, I should pay more attention. I have bought hundreds of ounces of silver from them and some gold. Lowest premiums I can find if I drive for 100 miles that I know of for sure. Even better than most online dealers I have come across.

I remember a recent article on some shenanigans coming out of Switzerland recently, buying up an atypical stake and volume of equities.

Would such a stake temporarily depress bullion prices in order to facilitate low price acquisitions???

Ahh, I did not realize my local bullion dealer had their own blog, I should pay more attention. I have bought hundreds of ounces of silver from them and some gold. Lowest premiums I can find if I drive for 100 miles that I know of for sure. Even better than most online dealers I have come across.

I remember a recent article on some shenanigans coming out of Switzerland recently, buying up an atypical stake and volume of equities.

"Mystery" Central Bank Buyer Revealed, Goes On Q1 Buying Spree

What it showed is that, as rumored, the Swiss National Bank had gone on a record buying spree in the first quarter, boosting its total equity holdings to an all time high $80.4 billion, up $17 billion from the $63.4 billion at the end of 2016, the biggest quarterly increase in "AUM" in history.

Would such a stake temporarily depress bullion prices in order to facilitate low price acquisitions???

a reply to: St Udio

They got rescued because they didn't have enough physical to pay for the shorts. When China decides its got payback for the opium wars, like got all the gold and silver that they were drained of back aways. The PM's will take a shot to the moon. They also have a say on the spot price because they are stocking up. We might think JP Morgan is holding a lot of western silver, but looking at all the Chinese names on the board I doubt it. Currencies exist because of peoples confidence in it.The Yuan, and Rouble might be the best bet in the future.

They got rescued because they didn't have enough physical to pay for the shorts. When China decides its got payback for the opium wars, like got all the gold and silver that they were drained of back aways. The PM's will take a shot to the moon. They also have a say on the spot price because they are stocking up. We might think JP Morgan is holding a lot of western silver, but looking at all the Chinese names on the board I doubt it. Currencies exist because of peoples confidence in it.The Yuan, and Rouble might be the best bet in the future.

a reply to: worldstarcountry

the dollar isn`t backed by gold, but what does back the dollar is worth more than gold.

so, what does back the dollar?

the U.S. is the number 1 food exporter in the world

food, weapons, refined petroleum, technology, all back the dollar.

if gold means little or nothing to the U.S. and other countries have a lot of gold what are they going to buy our food exports with? and our technology,weapons,refined fuel with? they will buy those things with the U.S. dollar.

when you are buying something it doesn`t matter what you think it`s worth, all that matters is what the seller thinks it`s worth and when it comes to something like food which you need to survive the seller will always get what they want.

when you are hungry you can`t eat gold, and if the person with all the food thinks 10 pounds of gold is as worthless as 10 pounds of dog crap what are you going to give them to buy food if all you have to trade with is gold?

The only things that have real value are the things which you need to survive, the lie that the rich have been telling and that the peasants have been believing is that gold and money are the most valuable things and that they should spend their lives chasing and trying to accumulate it.

when the SHTF gold is just going to be a shiny heavy anchor that nobody wants not even the rich.

the rich invest in food, weapons, medicines,technology, refined fuels, the ONLY reason the rich invest in gold is as a safety net because they have convinced the peasants that gold has value.if worse comes to worse the rich know that the peasants will hand over everything that they have to obtain gold because they have been brainwashed into believing that gold has value.

the rich won`t be selling or trading food for gold or weapons for gold or technology or medicine or refined fuels for gold, it will be the other way around. the peasants will be giving away food for gold, giving away weapons, medicine,technology, refined fuels for gold and paper money.

That`s how the rich have always gotten richer and will continue to get richer.gold and money are worthless the rich know that, the only thing that gives gold and money any worth is the belief by the peasants that gold and money has worth.

if you could convince or brainwash your friends into believing that your dogs crap is the most valuable thing on earth your friends would give you everything they have in exchange for piles of your dogs crap,but that doesn`t make your dogs crap worth anything.

the dollar isn`t backed by gold, but what does back the dollar is worth more than gold.

so, what does back the dollar?

the U.S. is the number 1 food exporter in the world

food, weapons, refined petroleum, technology, all back the dollar.

if gold means little or nothing to the U.S. and other countries have a lot of gold what are they going to buy our food exports with? and our technology,weapons,refined fuel with? they will buy those things with the U.S. dollar.

when you are buying something it doesn`t matter what you think it`s worth, all that matters is what the seller thinks it`s worth and when it comes to something like food which you need to survive the seller will always get what they want.

when you are hungry you can`t eat gold, and if the person with all the food thinks 10 pounds of gold is as worthless as 10 pounds of dog crap what are you going to give them to buy food if all you have to trade with is gold?

The only things that have real value are the things which you need to survive, the lie that the rich have been telling and that the peasants have been believing is that gold and money are the most valuable things and that they should spend their lives chasing and trying to accumulate it.

when the SHTF gold is just going to be a shiny heavy anchor that nobody wants not even the rich.

the rich invest in food, weapons, medicines,technology, refined fuels, the ONLY reason the rich invest in gold is as a safety net because they have convinced the peasants that gold has value.if worse comes to worse the rich know that the peasants will hand over everything that they have to obtain gold because they have been brainwashed into believing that gold has value.

the rich won`t be selling or trading food for gold or weapons for gold or technology or medicine or refined fuels for gold, it will be the other way around. the peasants will be giving away food for gold, giving away weapons, medicine,technology, refined fuels for gold and paper money.

That`s how the rich have always gotten richer and will continue to get richer.gold and money are worthless the rich know that, the only thing that gives gold and money any worth is the belief by the peasants that gold and money has worth.

if you could convince or brainwash your friends into believing that your dogs crap is the most valuable thing on earth your friends would give you everything they have in exchange for piles of your dogs crap,but that doesn`t make your dogs crap worth anything.

edit on 15-5-2017 by Tardacus because: (no reason given)

edit on 15-5-2017 by Tardacus because: (no reason

given)

edit on 15-5-2017 by Tardacus because: (no reason given)

new topics

-

Intro once again

Introductions: 19 minutes ago -

University student disciplined after saying veganism is wrong and gender fluidity is stupid

Education and Media: 1 hours ago -

Geddy Lee in Conversation with Alex Lifeson - My Effin’ Life

People: 2 hours ago -

God lived as a Devil Dog.

Short Stories: 2 hours ago -

Police clash with St George’s Day protesters at central London rally

Social Issues and Civil Unrest: 4 hours ago -

TLDR post about ATS and why I love it and hope we all stay together somewhere

General Chit Chat: 5 hours ago -

Hate makes for strange bedfellows

US Political Madness: 7 hours ago -

Who guards the guards

US Political Madness: 10 hours ago -

Has Tesla manipulated data logs to cover up auto pilot crash?

Automotive Discussion: 11 hours ago

top topics

-

Hate makes for strange bedfellows

US Political Madness: 7 hours ago, 15 flags -

Who guards the guards

US Political Madness: 10 hours ago, 13 flags -

whistleblower Captain Bill Uhouse on the Kingman UFO recovery

Aliens and UFOs: 16 hours ago, 11 flags -

Police clash with St George’s Day protesters at central London rally

Social Issues and Civil Unrest: 4 hours ago, 7 flags -

TLDR post about ATS and why I love it and hope we all stay together somewhere

General Chit Chat: 5 hours ago, 5 flags -

University student disciplined after saying veganism is wrong and gender fluidity is stupid

Education and Media: 1 hours ago, 3 flags -

Has Tesla manipulated data logs to cover up auto pilot crash?

Automotive Discussion: 11 hours ago, 2 flags -

God lived as a Devil Dog.

Short Stories: 2 hours ago, 2 flags -

Geddy Lee in Conversation with Alex Lifeson - My Effin’ Life

People: 2 hours ago, 2 flags -

Intro once again

Introductions: 19 minutes ago, 1 flags

active topics

-

University student disciplined after saying veganism is wrong and gender fluidity is stupid

Education and Media • 7 • : theatreboy -

My wife just had a very powerful prophetic dream - massive war in Israel...

The Gray Area • 13 • : BukkaWukka -

Terrifying Encounters With The Black Eyed Kids

Paranormal Studies • 59 • : Consvoli -

Mandela Effect - It Happened to Me!

The Gray Area • 114 • : ArMaP -

Silent Moments --In Memory of Beloved Member TDDA

Short Stories • 69 • : Naftalin -

Hate makes for strange bedfellows

US Political Madness • 32 • : theatreboy -

Police clash with St George’s Day protesters at central London rally

Social Issues and Civil Unrest • 36 • : FlyersFan -

"We're All Hamas" Heard at Columbia University Protests

Social Issues and Civil Unrest • 249 • : marg6043 -

Europe declares war on Russia?

World War Three • 66 • : Consvoli -

Candidate TRUMP Now Has Crazy Judge JUAN MERCHAN After Him - The Stormy Daniels Hush-Money Case.

Political Conspiracies • 732 • : matafuchs