It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

6

share:

No, that was not a catchy title to draw you in to a thread explaining what short selling is in the finance world - I literally don't understand

it and I'm asking.

I'm asking because, as many people know, George Soros is one of the richest people on the planet, and after reading his Wiki page, I found that he made something to the tune of $1 billion off of a short sale back in the early 90's, during the "Black Wednesday UK Crisis":

en.wikipedia.org...

I wanted to try to figure out what a short is, remember that movie 'The Big Short" about the '08 financial crisis? Were the bailouts a "short sale" for someone as well? Wiki on Short Selling: Wiki

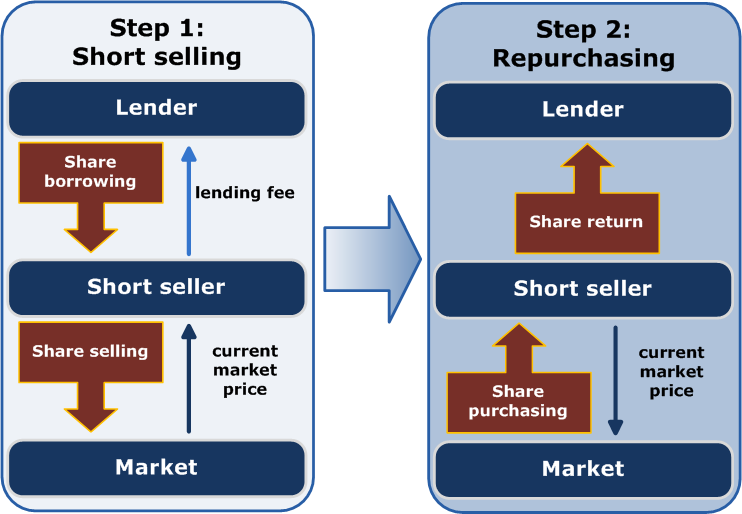

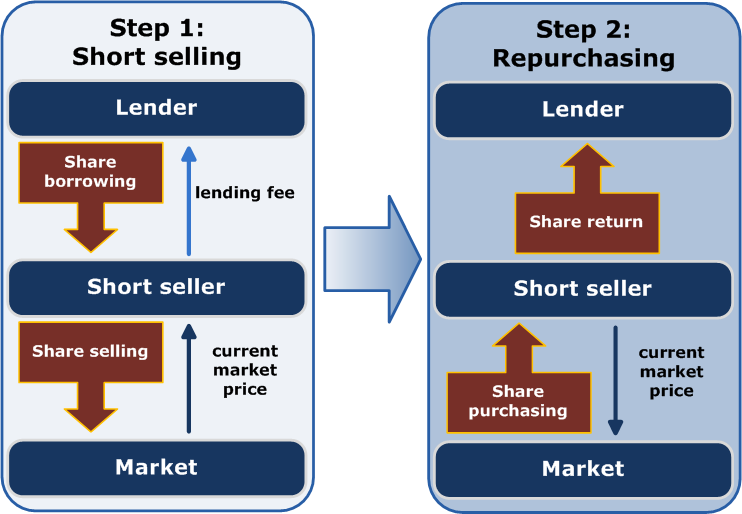

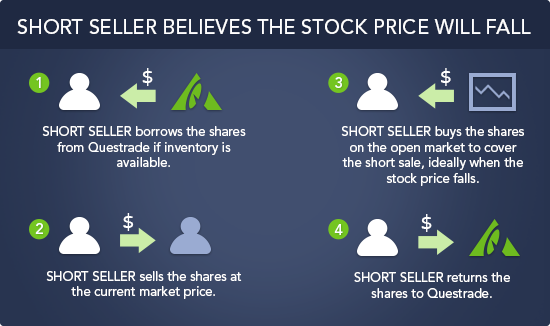

Even with this handy-dandy diagram I can't quite envision how this works.

I feel like I can almost grasp what this concept is - like you are making a deal before you have the money to cover it, then once the transaction goes through you can take money from your profits to pay for the initial deal (which you technically already made, but didn't have the money to cover it at the time). Or am I totally mistaken?

Can anyone help? Thanks everyone in advance, looking forward to learning something new and talking about these tricky little money games

P.S. I also need to do some more reading on Black Wednesday. If any of our members from UK can provide any personal comments about that event that too would be a great addition to the thread.

I'm asking because, as many people know, George Soros is one of the richest people on the planet, and after reading his Wiki page, I found that he made something to the tune of $1 billion off of a short sale back in the early 90's, during the "Black Wednesday UK Crisis":

He is known as "The Man Who Broke the Bank of England" because of his short sale of US$10 billion worth of pounds, making him a profit of $1 billion during the 1992 Black Wednesday UK currency crisis.[8][9][10] Soros is one of the 30 richest people in the world.[11]

en.wikipedia.org...

I wanted to try to figure out what a short is, remember that movie 'The Big Short" about the '08 financial crisis? Were the bailouts a "short sale" for someone as well? Wiki on Short Selling: Wiki

Even with this handy-dandy diagram I can't quite envision how this works.

I feel like I can almost grasp what this concept is - like you are making a deal before you have the money to cover it, then once the transaction goes through you can take money from your profits to pay for the initial deal (which you technically already made, but didn't have the money to cover it at the time). Or am I totally mistaken?

Can anyone help? Thanks everyone in advance, looking forward to learning something new and talking about these tricky little money games

P.S. I also need to do some more reading on Black Wednesday. If any of our members from UK can provide any personal comments about that event that too would be a great addition to the thread.

edit on 11-2-2016 by FamCore because: (no reason given)

a reply to: FamCore

That is a terrible diagram. Let me see if I can find a better one.

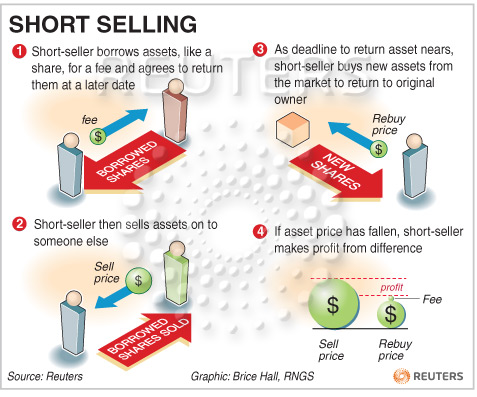

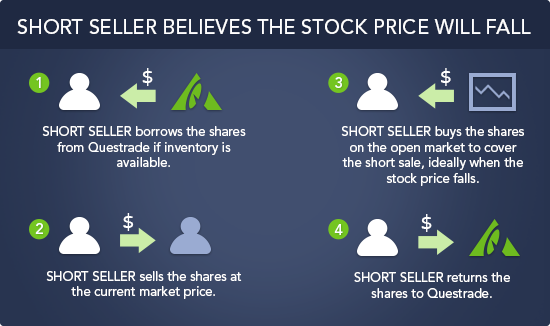

Edit: Here you go, this one explains it nicely:

The trick is that you only do this when you feel certain that the price of the particular stock will fall.

Essentially it is a bet the the price will drop - if it rises, you are screwed (or at least then you loose money),

That is a terrible diagram. Let me see if I can find a better one.

Edit: Here you go, this one explains it nicely:

The trick is that you only do this when you feel certain that the price of the particular stock will fall.

Essentially it is a bet the the price will drop - if it rises, you are screwed (or at least then you loose money),

edit on 11-2-2016 by DupontDeux because: (no reason given)

a reply to: DupontDeux

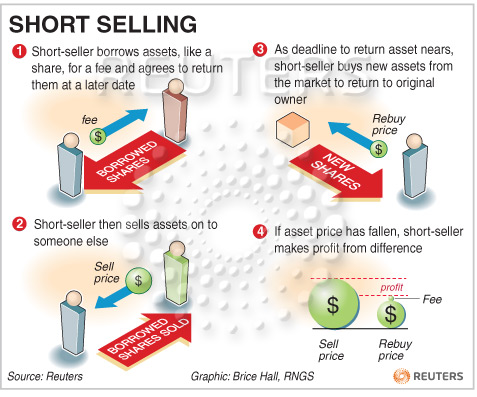

Great diagram - I actually just found that same one and another version of it (below)

That makes a lot more sense.

I wonder how Soros was SO certain the price was going to drop hmm

Great diagram - I actually just found that same one and another version of it (below)

That makes a lot more sense.

I wonder how Soros was SO certain the price was going to drop hmm

a reply to: FamCore

You are quiet there.

The short seller borrows shares for a short time span. He sells it and pays the lender a fee. Then he re-buys the shares on the market and can give back the shares to the lender.

Visual example: Little Billy knows somebody who pays 10 $ for 50 sweets. So he asks Little Bobby, who always has tons of sweets. Bobby lends Billy the sweets, but asks 50 Cent for the deal, when Billy has sold the sweets. Also Bobby wants back his sweets next week.

Billy is lucky. The guy who bought the sweets from him tried to sell them to his classmates, but could not sell one at all. Billy offers him 8 $ and he agrees. So Billy can give back the sweets to Bobby and made 1.50 $.

Of course, Sorro can buy many more sweets... And Billy also could have had bad luck, when the prices would have gone up instead of down.

You are quiet there.

The short seller borrows shares for a short time span. He sells it and pays the lender a fee. Then he re-buys the shares on the market and can give back the shares to the lender.

Visual example: Little Billy knows somebody who pays 10 $ for 50 sweets. So he asks Little Bobby, who always has tons of sweets. Bobby lends Billy the sweets, but asks 50 Cent for the deal, when Billy has sold the sweets. Also Bobby wants back his sweets next week.

Billy is lucky. The guy who bought the sweets from him tried to sell them to his classmates, but could not sell one at all. Billy offers him 8 $ and he agrees. So Billy can give back the sweets to Bobby and made 1.50 $.

Of course, Sorro can buy many more sweets... And Billy also could have had bad luck, when the prices would have gone up instead of down.

When I first read it about him

To me he made money of falling market currency

I ll catch on

To me he made money of falling market currency

I ll catch on

edit on 11-2-2016 by Sessionexpired because: (no reason given)

If I could make one regulatory change to the financial world, it would be to ban short selling across all global markets.

In laymen's terms, you are betting the price of the asset will fall. You are long when you are betting the price will increase.

This is why traders make a ton of money. You are playing with a lot of money trying to read the tea leaves as to which way the markets will move. Only the best seem to be able to do it with any degree of longevity and investors are willing to pay for the outsized returns above the broader market.

This is why traders make a ton of money. You are playing with a lot of money trying to read the tea leaves as to which way the markets will move. Only the best seem to be able to do it with any degree of longevity and investors are willing to pay for the outsized returns above the broader market.

a reply to: Painterz

Why is that?

I think a more dangerous concern is the derivatives market. Even back in 2010 it was estimated to be worth a whopping $1.2 quadrillion. entirely based on "betting" on the performance of an underlying entity.

In my head I picture a giant house of cards, but maybe I'm not well-enough versed in economics/finance for this concern to be legitimized.

Investopia on Derivatives

Why is that?

I think a more dangerous concern is the derivatives market. Even back in 2010 it was estimated to be worth a whopping $1.2 quadrillion. entirely based on "betting" on the performance of an underlying entity.

In my head I picture a giant house of cards, but maybe I'm not well-enough versed in economics/finance for this concern to be legitimized.

Investopia on Derivatives

edit on 11-2-2016 by FamCore because: (no reason

given)

In simple term, a short is when you borrow someone's stock and sell it. Later when the stock drops in prices, you get that money since the owner never

sold it?

All this financial stuff befuddles me. It seems to me this is just a multi-quadrillion dollar casino, played with Monopoly money. Let me see if I

understand this.

So the general refrain in the stock market is:

- Buy Low

- Sell High

But with Shorts, it's:

- Borrow High

- Sell High

- Buy Low

- Repay Low

And the way these Traders make money on this is by predicting which way the stock market moves.

Now I've heard that, these days, the stock market is moving in a manner that is not only completely contrary to the fundamentals, but contrary to common sense as well.

So, in order to be successful the Trader has to be able to successfully read the Tea Leaves, Tarot Cards, Runes, Crystal Ball, Chicken Bones, and Goat Entrails.

Ok. Doesn't sound like it would be a good line of work for me.

-dex

So the general refrain in the stock market is:

- Buy Low

- Sell High

But with Shorts, it's:

- Borrow High

- Sell High

- Buy Low

- Repay Low

And the way these Traders make money on this is by predicting which way the stock market moves.

Now I've heard that, these days, the stock market is moving in a manner that is not only completely contrary to the fundamentals, but contrary to common sense as well.

So, in order to be successful the Trader has to be able to successfully read the Tea Leaves, Tarot Cards, Runes, Crystal Ball, Chicken Bones, and Goat Entrails.

Ok. Doesn't sound like it would be a good line of work for me.

-dex

a reply to: DexterRiley

Actually the big money isn't made with prediction, that's for suckers. It's made with manipulation and inside info. But don't tell anybody, the world's economy depends on it.

Actually the big money isn't made with prediction, that's for suckers. It's made with manipulation and inside info. But don't tell anybody, the world's economy depends on it.

I don't understand how stock can be a borrowed asset. That just seems shady, but then...

originally posted by: DupontDeux

The trick is that you only do this when you feel certain that the price of the particular stock will fall.

Such as when you have the ability to make the stock fall with your selling of it.

a reply to: FamCore

Yeahright seems to have a damn good grasp of the commodities market. It's not a simple thing to get and I commend either the diligence in researching or the teacher for getting it across. I'd say that while manipulation has become the order of the day with the rise of the super-rich, there is still room to be made in making reasonable decisions based on market history. Of course the more manipulation gets involved the less honest traders can get dependable results from market history. Before long all history will be moot as volatility is driven by the decision-makers and their friends. It's become a dark and dangerous time for any honest commodities investor.

I think it's important to know for those that see it as a big scam though, that originally the commodity market did have a legitimate purpose. When you produce a commodity like pork bellies or heads of cattle or corn there was never certainty that you could get current market value for the finished product at a later date. Commodities markets allowed producers to hedge their production on current market value. So, farmer John could lock in a price in December for his corn that would be harvested at a later date. It's a hedge. Hedging your product for current price because the market allowed somebody to promise that price at a later date.

If you want to get into the dynamics of how short sales are necessary to keep this system afloat you would have to take a course or study it. It can't be explained in a post. Ultimately it's about people assuming the risk that farmer John wanted to avoid and betting on either an increase or decrease in market value over time. Sadly it's becoming a rigged game.

Yeahright seems to have a damn good grasp of the commodities market. It's not a simple thing to get and I commend either the diligence in researching or the teacher for getting it across. I'd say that while manipulation has become the order of the day with the rise of the super-rich, there is still room to be made in making reasonable decisions based on market history. Of course the more manipulation gets involved the less honest traders can get dependable results from market history. Before long all history will be moot as volatility is driven by the decision-makers and their friends. It's become a dark and dangerous time for any honest commodities investor.

I think it's important to know for those that see it as a big scam though, that originally the commodity market did have a legitimate purpose. When you produce a commodity like pork bellies or heads of cattle or corn there was never certainty that you could get current market value for the finished product at a later date. Commodities markets allowed producers to hedge their production on current market value. So, farmer John could lock in a price in December for his corn that would be harvested at a later date. It's a hedge. Hedging your product for current price because the market allowed somebody to promise that price at a later date.

If you want to get into the dynamics of how short sales are necessary to keep this system afloat you would have to take a course or study it. It can't be explained in a post. Ultimately it's about people assuming the risk that farmer John wanted to avoid and betting on either an increase or decrease in market value over time. Sadly it's becoming a rigged game.

new topics

-

whistleblower Captain Bill Uhouse on the Kingman UFO recovery

Aliens and UFOs: 3 hours ago -

1980s Arcade

General Chit Chat: 5 hours ago -

Deadpool and Wolverine

Movies: 6 hours ago -

Teenager makes chess history becoming the youngest challenger for the world championship crown

Other Current Events: 7 hours ago -

CIA botched its handling of sexual assault allegations, House intel report says

Breaking Alternative News: 8 hours ago -

Lawsuit Seeks to ‘Ban the Jab’ in Florida

Diseases and Pandemics: 11 hours ago

top topics

-

Lawsuit Seeks to ‘Ban the Jab’ in Florida

Diseases and Pandemics: 11 hours ago, 20 flags -

Starburst galaxy M82 - Webb Vs Hubble

Space Exploration: 13 hours ago, 12 flags -

The Superstition of Full Moons Filling Hospitals Turns Out To Be True!

Medical Issues & Conspiracies: 14 hours ago, 8 flags -

CIA botched its handling of sexual assault allegations, House intel report says

Breaking Alternative News: 8 hours ago, 8 flags -

whistleblower Captain Bill Uhouse on the Kingman UFO recovery

Aliens and UFOs: 3 hours ago, 6 flags -

15 Unhealthiest Sodas On The Market

Health & Wellness: 13 hours ago, 5 flags -

Teenager makes chess history becoming the youngest challenger for the world championship crown

Other Current Events: 7 hours ago, 3 flags -

Deadpool and Wolverine

Movies: 6 hours ago, 3 flags -

1980s Arcade

General Chit Chat: 5 hours ago, 3 flags

active topics

-

Fast Moving Disc Shaped UFO Captured on Camera During Flight from Florida to New York City

Aliens and UFOs • 18 • : inflaymes69 -

Definitive 9.11 Pentagon EVIDENCE.

9/11 Conspiracies • 419 • : SchrodingersRat -

They Killed Dr. Who for Good

Rant • 61 • : Cymru -

How ageing is" immune deficiency"

Medical Issues & Conspiracies • 26 • : RookQueen2 -

The Democrats Take Control the House - Look what happened while you were sleeping

US Political Madness • 105 • : SchrodingersRat -

Starburst galaxy M82 - Webb Vs Hubble

Space Exploration • 4 • : SchrodingersRat -

Non-Human Operate Within The Visual Spectrum 'We Cannot See' - ULTRATERRESTRIALS EXIST!

Paranormal Studies • 136 • : burritocat -

New whistleblower Jason Sands speaks on Twitter Spaces last night.

Aliens and UFOs • 39 • : RookQueen2 -

23,000 Dead People Registered Within a Two Week Period In One State

US Political Madness • 39 • : Audreagassulke -

1980s Arcade

General Chit Chat • 7 • : Freeborn

6