It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

originally posted by: ScepticScot

a reply to: Semicollegiate

It makes no difference if money is linked to a physical asset ir not it is still an IOU it just happens to be an exchangeable one. Saying I owe you five pounds/dollars is in no way different from saying I owe you five pounds/dollars worth of gold/silver/sea shells or shiny buttons. What is a surplus to you has inevitably be a debt else where. What is wrong with his column is that he tries to extrapolate up from this to government finances. This would only hold true if all assets and production were fixed. As this is obviously not the case his analysis is so over simplified as to be meaningless.

There is huge difference between a receipt for real material property and an IOU.

An IOU is a promise, without an exchange of collateral.

A receipt for an ounce of gold is easier to carry and transfer than an actual piece of metal. The receipt represents real surplus wealth in a one to one correspondence. Labor and investments increase the amount of stuff in the world. The extra stuff, be it rice or nails or gold, that no one wants to consume today, has value and can be represented as money.

Fiat money, as in the OP, is Ponzi Scheme money. It has value by law. It can be printed with nothing backing it. It is legal counterfeit money. It is not really debt because more money can printed than all the man hours of labor and all of the material on the planet are worth.

Debt is owing real money, i.e. some amount of material property, or a receipt for that specific property.

Fiat money debt is a command to pay, like slavery.

a reply to: Semicollegiate

The value of gold doesn't come from any intrinsic value or utility in its use but from the fact that for centuries it has been used as a currency. Gold value is every bit as faith based as fiat currency.

The value of gold doesn't come from any intrinsic value or utility in its use but from the fact that for centuries it has been used as a currency. Gold value is every bit as faith based as fiat currency.

edit on 29-10-2015 by ScepticScot because: (no reason given)

If everyone has a million dollars, no one has anything.

That's why those that understand this, hoard wealth -- in order to keep the cycle going. Like in any process, something must be expended in order to allow the system to continue to function. In a capitalist system, this 'expenditure' is delegated to the poor. Thus you have the proletariat and the elite and an economic system which maintains this schism by symbiotically feeding off of itself.

That's why those that understand this, hoard wealth -- in order to keep the cycle going. Like in any process, something must be expended in order to allow the system to continue to function. In a capitalist system, this 'expenditure' is delegated to the poor. Thus you have the proletariat and the elite and an economic system which maintains this schism by symbiotically feeding off of itself.

a reply to: CB328

I don't know why people blame population expandsion for these problems, because in reality, with increases in efficiency in food production and manufacturing and so on, everyone could be employed part time and lead fuller and freer lives.

Really!!!.

So, in reality, what sector of the economy benefits from war and/or adopting something more resembling sustainable?, where does potential for more profit lie?.

It's the banking/financial sector, it always has been everywhere else in the world and has only been like that here since the federal reserve gained control of the financial system here in the U.S..

Every year there must be enough debt created out of thin air to service the principal and interest of every loan written the year before.

Ya know?, the revolutionary war was a result of this same old crap way back when.

It's the banking system, not population.

I don't know why people blame population expandsion for these problems, because in reality, with increases in efficiency in food production and manufacturing and so on, everyone could be employed part time and lead fuller and freer lives.

Really!!!.

So, in reality, what sector of the economy benefits from war and/or adopting something more resembling sustainable?, where does potential for more profit lie?.

It's the banking/financial sector, it always has been everywhere else in the world and has only been like that here since the federal reserve gained control of the financial system here in the U.S..

Every year there must be enough debt created out of thin air to service the principal and interest of every loan written the year before.

Ya know?, the revolutionary war was a result of this same old crap way back when.

It's the banking system, not population.

a reply to: Marlborough Red

Uhm I'm not so sure about that.

IMO I think people don't really expect that they can count on their gov't to take care of them and they have a fairly low outlook on gov't.

However, what I do see is that the majority of people feel hopeless to do anything about it and they just continue blindly hoping for the best.

They all think government etc will look after them.

Uhm I'm not so sure about that.

IMO I think people don't really expect that they can count on their gov't to take care of them and they have a fairly low outlook on gov't.

However, what I do see is that the majority of people feel hopeless to do anything about it and they just continue blindly hoping for the best.

originally posted by: ScepticScot

a reply to: Semicollegiate

The value of gold doesn't come from any intrinsic value or utility in its use but from the fact that for centuries it has been used as a currency. Gold value is every bit as faith based as fiat currency.

Gold does have intrinsic value. The gold price is the market value of the commodity.

Fiat money has value because it must be accepted, by law, for all debts, public and private.

a reply to: liteonit6969

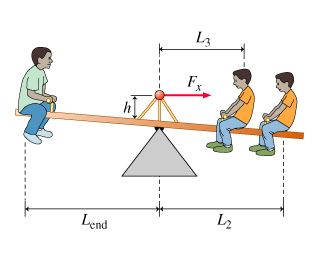

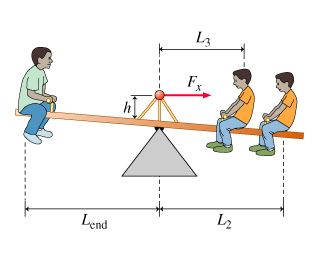

He he! Ya, its like a see saw, only you got one fat kid on one end, and a skinny one at the other end. Or something like this, two skinny kids to every one fat kid at the other end, can anybody say balance, or how about the ratio of Chinese factory workers to American consumers nor how about the mass amount of Chinese factory worker to support one big fat chairmen of boards and ceo's and what not?

Unless off course you all think you have created all the things around you by hand using hammer and nails.

Balance is a funny thing, also quite funny, as it technically just a word.

This money concept is outdated, or actually its more like were humans are now both on a mental and physical spectrum are just not advanced enough to put it into any sufficient practice. To tell the truth going by that most humans should still be in villages and tribes, then trying to play hocus pocus with such things.

But anyways! I dont think an economic collapse is what you should worry about, in fact the concept is just silly, as it does not matter if it collapse or not. Besides pretty much anything works if you want it to work, you all could be trading and making a world wide network that takes dept cheese for all you all and it will still work, and over the centuries people have been trading in plenty of way or using plenty of other mediums. After all paper money or credit or gold or silver or whatever you choose to make it based on is just a fulcrum to anchor peoples collective minds to and thereby place value on things.

After all this current system works and its corrupt as hell and held together by chewing gum and duckt tape, so if this can work, anything else can also work if put half the effort into.

And in our slowly digital age. If there actually were a economic financial collapse people would just start making pockets of such systems in there areas, be those areas towns, or cities or even corner block or neck of the woods. So no, there is no reason what so ever to fear an economic collapse, not when you got all the tools and necessities all around you to just wade through it. And most of the developed world does have that, and so does the undeveloped world.

But it will shake things a little. Kind of like shaking a prune tree, things will fall to the ground, but somebody will pick up those prunes and make some jam or prune juice. But people being so invested in the whole thing and process and machine, will off-course lose, the rich will have more to lose then the poor even but all of that is just minuscule nonsense as like I said before all the infrastructures are already in place, so even if the economy falls things will still run on.

You and humanity have much more to fear from things cementing themslefs into a concrete one way seesaw and a ride which you would not get of in a few short thousands or so years then you would have from the whole seesaw cracking breaking and crashing down, as things can always be rebuilt. But once your stuck to a thing a pattern a machine a system and you are all condition to, well that is another story. Countless civilizations before this have gone through the same patterns.

Its a none issue. Not because the system was meant to last, nothing lasts forever, but because its designed to be and ebb and flow. What the ebb and flow stops, or is blocked, which if you look at current history or even past or even ancient history...The ebb and flow usually stops when its concentrated on one end, in the past it was about class and royals and such. Now its about economics, which is just a prelude to that on a larger scale.

So you can take from Paul to pay Peter, or take from Peter to pay Paul. Only because that is the advanced evolved form of not robbing Peter to pay Paul, which was what we had and still to a degree have now only its not quite as pronounced as it was designed to balance itself out a bit longer.

Or you can all play some other game, or not, or whatever you know, there are so many other systems and ways out there that its hard to pick and choose one ya know. So ya! Do whatever.

Phrase meaning

He he! Ya, its like a see saw, only you got one fat kid on one end, and a skinny one at the other end. Or something like this, two skinny kids to every one fat kid at the other end, can anybody say balance, or how about the ratio of Chinese factory workers to American consumers nor how about the mass amount of Chinese factory worker to support one big fat chairmen of boards and ceo's and what not?

Unless off course you all think you have created all the things around you by hand using hammer and nails.

Balance is a funny thing, also quite funny, as it technically just a word.

This money concept is outdated, or actually its more like were humans are now both on a mental and physical spectrum are just not advanced enough to put it into any sufficient practice. To tell the truth going by that most humans should still be in villages and tribes, then trying to play hocus pocus with such things.

But anyways! I dont think an economic collapse is what you should worry about, in fact the concept is just silly, as it does not matter if it collapse or not. Besides pretty much anything works if you want it to work, you all could be trading and making a world wide network that takes dept cheese for all you all and it will still work, and over the centuries people have been trading in plenty of way or using plenty of other mediums. After all paper money or credit or gold or silver or whatever you choose to make it based on is just a fulcrum to anchor peoples collective minds to and thereby place value on things.

After all this current system works and its corrupt as hell and held together by chewing gum and duckt tape, so if this can work, anything else can also work if put half the effort into.

And in our slowly digital age. If there actually were a economic financial collapse people would just start making pockets of such systems in there areas, be those areas towns, or cities or even corner block or neck of the woods. So no, there is no reason what so ever to fear an economic collapse, not when you got all the tools and necessities all around you to just wade through it. And most of the developed world does have that, and so does the undeveloped world.

But it will shake things a little. Kind of like shaking a prune tree, things will fall to the ground, but somebody will pick up those prunes and make some jam or prune juice. But people being so invested in the whole thing and process and machine, will off-course lose, the rich will have more to lose then the poor even but all of that is just minuscule nonsense as like I said before all the infrastructures are already in place, so even if the economy falls things will still run on.

You and humanity have much more to fear from things cementing themslefs into a concrete one way seesaw and a ride which you would not get of in a few short thousands or so years then you would have from the whole seesaw cracking breaking and crashing down, as things can always be rebuilt. But once your stuck to a thing a pattern a machine a system and you are all condition to, well that is another story. Countless civilizations before this have gone through the same patterns.

Its a none issue. Not because the system was meant to last, nothing lasts forever, but because its designed to be and ebb and flow. What the ebb and flow stops, or is blocked, which if you look at current history or even past or even ancient history...The ebb and flow usually stops when its concentrated on one end, in the past it was about class and royals and such. Now its about economics, which is just a prelude to that on a larger scale.

So you can take from Paul to pay Peter, or take from Peter to pay Paul. Only because that is the advanced evolved form of not robbing Peter to pay Paul, which was what we had and still to a degree have now only its not quite as pronounced as it was designed to balance itself out a bit longer.

Or you can all play some other game, or not, or whatever you know, there are so many other systems and ways out there that its hard to pick and choose one ya know. So ya! Do whatever.

Phrase meaning

a reply to: liteonit6969

Ha! Been done son.

Besides dont ya know that to has an expiration date on it. Yup like the produce in your supermarket world schemes and systems also have there expiration date. That is they work for a time, after there time is up they dont.

But the war economy has worked for some time now, and plenty of other civilization before ours. But only up to a point. Besides even these fake wars people end up dead. In a fake WW3 there will be at least a few million dead. And also when the gloves are off. Well the best strategy is to take out things. You know, nuke things.

So ya! When its all said and done, you dont blow up giant sea going battle ships with hundreds of fighter jets on them, you blow up the factories were there made and the places were they come from and you eliminate the areas, burn them to the ground if you have to. And with nukes, well basically you dont waste time shooting down your enemy's battleship like in the battleship game. What you do is you pick a spot, oh like say New York, or Seattle, or Moscow or beijing and you nuke the funk out of it. After all when there are no people to make guns and bullets or any of it, the enemy cant put up much of a fight then now can it?

Its basically direct tactics, or like the onset of WW1 were they found out that a single soldier operating a machine gun can gun down hundreds of enemy soldiers charging your line. Basically its highly likely that the first nation or people who use such tactics and nuking places is a super awesome great tactic in wining a world war, and not only winning, but survive WW3. And well you know the rest, or most likely wont, depending on which side your on. As history is written by the winners, then it can be re-written again after the nuclear fallout and we see who is left standing.

So I suppose you all should count your lucky stars that all you got is these proxy wars and constant nonsense. But thats like being thankful for not being completely brain dead. So ya! That whole war economy fueling the economy for another few years, may not work out so well if it moves out of the whole cold war stages that it has been in for the past 70 years or so. But we shall see I suppose.

Ha! Been done son.

Besides dont ya know that to has an expiration date on it. Yup like the produce in your supermarket world schemes and systems also have there expiration date. That is they work for a time, after there time is up they dont.

But the war economy has worked for some time now, and plenty of other civilization before ours. But only up to a point. Besides even these fake wars people end up dead. In a fake WW3 there will be at least a few million dead. And also when the gloves are off. Well the best strategy is to take out things. You know, nuke things.

So ya! When its all said and done, you dont blow up giant sea going battle ships with hundreds of fighter jets on them, you blow up the factories were there made and the places were they come from and you eliminate the areas, burn them to the ground if you have to. And with nukes, well basically you dont waste time shooting down your enemy's battleship like in the battleship game. What you do is you pick a spot, oh like say New York, or Seattle, or Moscow or beijing and you nuke the funk out of it. After all when there are no people to make guns and bullets or any of it, the enemy cant put up much of a fight then now can it?

Its basically direct tactics, or like the onset of WW1 were they found out that a single soldier operating a machine gun can gun down hundreds of enemy soldiers charging your line. Basically its highly likely that the first nation or people who use such tactics and nuking places is a super awesome great tactic in wining a world war, and not only winning, but survive WW3. And well you know the rest, or most likely wont, depending on which side your on. As history is written by the winners, then it can be re-written again after the nuclear fallout and we see who is left standing.

So I suppose you all should count your lucky stars that all you got is these proxy wars and constant nonsense. But thats like being thankful for not being completely brain dead. So ya! That whole war economy fueling the economy for another few years, may not work out so well if it moves out of the whole cold war stages that it has been in for the past 70 years or so. But we shall see I suppose.

a reply to: Semicollegiate

Gold has an intrinsic value because it can be used to make things, and is used in things.

Paper not so much or its value by itself is not ranked high on the totempole, both can however be fiat based. Paper being the more fiat neutral as its more abundant then gold. Both however are given a value based on economic factors and fiat factors. However our current world would not be possible without such an arbitrary concept as fiat currency, if we were still trading in gold. We would still be nations locked behind borders and hording that resource and commodity buying oil with gold, and even apples with gold.

Even imaginary numbers in computers such as credit have value on a world wide scale and can even be more important then actual resources even though they dont technically exist but on a screen, as they are a representation of actual items and such or technically its supposed to represent that. In all its just another seesaw one were fiat currency is concerned is not only determined by actual supply and demand, but by believe in that supply and demand that its supposed to represent in our current system which itself is based on believe.

Pretty much anything you want to have value and people believe has value will have value to those people who believe that they have value. They set themselves up and arrange themselves and create themselves around those believes which then become a system which then become the sum total of there world and universe.

However any and all believes can be circumvented or flipped upside down and rightside up. So ya chicken and egg? Cant have one without the other. Gold has more of intrinsic value then paper but good luck carrying it all around with you when you want to buy something. Basically what I am saying is that our whole system is set up on not only believe but also faith which is what those paper IOU's are, there faith even a religion to some, yes its all magical and may even be classified as a religion in many ways.

So if you want to order that new spiffy i-phone the store you dont go there and trade in 2 pounds of gold for it which you carry in your wallet, you use paper money or most likely plastic ie something even more imaginary then paper money value. Gold you see has a very poor value in the every day trade goings on, basically it makes a lousy fiat currency simply because of what it is. So while it may have a much higher value in certain markets, then paper would, it has a lower value as a daily functioning fiat trade item.

So ya! Its all IOU's. And so as you see its all about just making concepts and placing value on it. All while in a changing market or markets and all depending on the situation and quite literally a bunch of other factors. Besides like some have said when things change drastically the whole system will change, basically supply and demand.

Lets say the sun ouputs more then it has these past few million years. Most water will dry up, making water more important, and most foods will be much harder to grow, making that more important, if we lived in a desert world or a water world, gold would be quite meaningless and we would be fighting wars for water or lakes, and people may even kill you for an apple, and paper would be a great commodity as trees would be a whole lot less and likely worth more then gold. That right there to is supply and demand.

All of that can happen with a simple atmosphere change and sun output change. Its all basically just a mix of supply and demand and quite literally believe and faith based fiat trading concepts. So ya! Even today golds value though it does have some uses is based simply on believe and age old factors which have been ingrained into us. And even that only in its market and circumstances...Just like everything else it all has an element of actual use in current environment, but it also has and element of perceived use, even believe, and yes even faith, and there by it has a worth set in the current environment, perceived or otherwise.

You and others would call that current environment supply and demand, the sum total of your whole world both physical and mental, in relation to the sum total of others physical and mental world, all tied and linked through a believe and faith based system called fiat currency ie money, ie IOU's.

As you can see its all magical and stuff.

Gold has an intrinsic value because it can be used to make things, and is used in things.

Paper not so much or its value by itself is not ranked high on the totempole, both can however be fiat based. Paper being the more fiat neutral as its more abundant then gold. Both however are given a value based on economic factors and fiat factors. However our current world would not be possible without such an arbitrary concept as fiat currency, if we were still trading in gold. We would still be nations locked behind borders and hording that resource and commodity buying oil with gold, and even apples with gold.

Even imaginary numbers in computers such as credit have value on a world wide scale and can even be more important then actual resources even though they dont technically exist but on a screen, as they are a representation of actual items and such or technically its supposed to represent that. In all its just another seesaw one were fiat currency is concerned is not only determined by actual supply and demand, but by believe in that supply and demand that its supposed to represent in our current system which itself is based on believe.

Pretty much anything you want to have value and people believe has value will have value to those people who believe that they have value. They set themselves up and arrange themselves and create themselves around those believes which then become a system which then become the sum total of there world and universe.

However any and all believes can be circumvented or flipped upside down and rightside up. So ya chicken and egg? Cant have one without the other. Gold has more of intrinsic value then paper but good luck carrying it all around with you when you want to buy something. Basically what I am saying is that our whole system is set up on not only believe but also faith which is what those paper IOU's are, there faith even a religion to some, yes its all magical and may even be classified as a religion in many ways.

So if you want to order that new spiffy i-phone the store you dont go there and trade in 2 pounds of gold for it which you carry in your wallet, you use paper money or most likely plastic ie something even more imaginary then paper money value. Gold you see has a very poor value in the every day trade goings on, basically it makes a lousy fiat currency simply because of what it is. So while it may have a much higher value in certain markets, then paper would, it has a lower value as a daily functioning fiat trade item.

So ya! Its all IOU's. And so as you see its all about just making concepts and placing value on it. All while in a changing market or markets and all depending on the situation and quite literally a bunch of other factors. Besides like some have said when things change drastically the whole system will change, basically supply and demand.

Lets say the sun ouputs more then it has these past few million years. Most water will dry up, making water more important, and most foods will be much harder to grow, making that more important, if we lived in a desert world or a water world, gold would be quite meaningless and we would be fighting wars for water or lakes, and people may even kill you for an apple, and paper would be a great commodity as trees would be a whole lot less and likely worth more then gold. That right there to is supply and demand.

All of that can happen with a simple atmosphere change and sun output change. Its all basically just a mix of supply and demand and quite literally believe and faith based fiat trading concepts. So ya! Even today golds value though it does have some uses is based simply on believe and age old factors which have been ingrained into us. And even that only in its market and circumstances...Just like everything else it all has an element of actual use in current environment, but it also has and element of perceived use, even believe, and yes even faith, and there by it has a worth set in the current environment, perceived or otherwise.

You and others would call that current environment supply and demand, the sum total of your whole world both physical and mental, in relation to the sum total of others physical and mental world, all tied and linked through a believe and faith based system called fiat currency ie money, ie IOU's.

As you can see its all magical and stuff.

originally posted by: Semicollegiate

Gold does have intrinsic value. The gold price is the market value of the commodity.

Fiat money has value because it must be accepted, by law, for all debts, public and private.

Incorrect. Gold is almost entirely speculation that because it's worth something now, and has been worth something in the past, that it will continue to be worth something in the future. There is very little intrinsic value in gold, it has use in some industrial processes due to it's great electrical conductivity but that's all, and that has really only mattered for the last 70 years or so.

Gold is pretty much the very definition of faith based currency. Then again, when you get down to it all currency is faith based currency.

edit on 31-10-2015 by Aazadan because: (no reason given)

a reply to: Aazadan

a reply to: galadofwarthethird

Fiat money is inflationary.

Commodity money is not. In 1964 a silver quarter would by one gallon of gasoline at 25 cents per gallon with full service.

Today that same silver quarter will buy one gallon of gasoline at $2.50 per gallon ( silver value alone).

Fiat money is a vehicle for inflation. The USDollar has lost 95% of its buying power since 1913.

We should be down to one or two work days per week by now.

a reply to: galadofwarthethird

Fiat money is inflationary.

Commodity money is not. In 1964 a silver quarter would by one gallon of gasoline at 25 cents per gallon with full service.

Today that same silver quarter will buy one gallon of gasoline at $2.50 per gallon ( silver value alone).

Fiat money is a vehicle for inflation. The USDollar has lost 95% of its buying power since 1913.

We should be down to one or two work days per week by now.

a reply to: Semicollegiate

Yes and none of that has anything to do with the intrinsic of the system itself or which immaterial object you wish to put what value on. And it has everything to do with people and human nature and certain facts, one being that they are to stupid to see beyond fancy symbology, and well at least a few hundred if not thousand more.

So what your saying is we should be down to two work days by now if you look at all the stats on paper. But you look away from the paper and out there in the real world and add up ity bitty factors one being what I said above about human nature. And well you do that math and the world you see around you is pretty much were it should be and could be once you add up all those factors.

Like I said. We should technically still be in villages and towns, our mind and brain still has not progressed far from herd or tribal mentalities. And in fact it would not be a good thing if we did. Because when we do, things will become a lot more bot and mechanical out here on planet earth.

And yes money is a commodity. Who knows why they dont teach it as not. Most likely so they can get a heads up on this game over you all. But ya! something is only worth what people think its worth. And when you can control what people think its worth? Well you get the picture. In essence its all fiat currency in a supply and demand society.

But in our case its more or less in a fake scarcity supply and demand society based on a fiat currency which is held up by edicts and mass smoke and mirrors. Basically Paul and Peter both got robed by John so he can pay back Steve who borrowed half from Peter and half from Paul. And round and round we go.

What did you call it? Oh ya> "Fiat money is a vehicle for inflation. The USDollar has lost 95% of its buying power since 1913"

And what you think that if we started using silver or gold it would have been immune to inflation?

Economics like power is based on believe and faith. People believe there IOU's greenback are worth something, and with pomp and much circumvention it is, but only as long as the show is running. And people believe there gold or silver penny is worth something and depending on the pomp and circumstance it is, but only as long as the show is running.

And even that believe itself is suspect and very prone to change hence the whole constant game of politics and such, you know wealth distributions by different names. Some even have fancy names, for instance this one..Trickle down economics. Hilarious!...or how about...Bailouts? Such is the power of rhetoric over masses.

I have seen more concrete economics 101 in this one clip from game of thrones series, then I did in hundreds of pages of school textbooks. After all even now people believe that power and money are synonymous, and as such presto..It is. Like magic you all have brought it into your world and existence simply using the power of believe on a mass scale, and much pomp and gloss.

Yes and none of that has anything to do with the intrinsic of the system itself or which immaterial object you wish to put what value on. And it has everything to do with people and human nature and certain facts, one being that they are to stupid to see beyond fancy symbology, and well at least a few hundred if not thousand more.

So what your saying is we should be down to two work days by now if you look at all the stats on paper. But you look away from the paper and out there in the real world and add up ity bitty factors one being what I said above about human nature. And well you do that math and the world you see around you is pretty much were it should be and could be once you add up all those factors.

Like I said. We should technically still be in villages and towns, our mind and brain still has not progressed far from herd or tribal mentalities. And in fact it would not be a good thing if we did. Because when we do, things will become a lot more bot and mechanical out here on planet earth.

And yes money is a commodity. Who knows why they dont teach it as not. Most likely so they can get a heads up on this game over you all. But ya! something is only worth what people think its worth. And when you can control what people think its worth? Well you get the picture. In essence its all fiat currency in a supply and demand society.

But in our case its more or less in a fake scarcity supply and demand society based on a fiat currency which is held up by edicts and mass smoke and mirrors. Basically Paul and Peter both got robed by John so he can pay back Steve who borrowed half from Peter and half from Paul. And round and round we go.

What did you call it? Oh ya> "Fiat money is a vehicle for inflation. The USDollar has lost 95% of its buying power since 1913"

And what you think that if we started using silver or gold it would have been immune to inflation?

Economics like power is based on believe and faith. People believe there IOU's greenback are worth something, and with pomp and much circumvention it is, but only as long as the show is running. And people believe there gold or silver penny is worth something and depending on the pomp and circumstance it is, but only as long as the show is running.

And even that believe itself is suspect and very prone to change hence the whole constant game of politics and such, you know wealth distributions by different names. Some even have fancy names, for instance this one..Trickle down economics. Hilarious!...or how about...Bailouts? Such is the power of rhetoric over masses.

I have seen more concrete economics 101 in this one clip from game of thrones series, then I did in hundreds of pages of school textbooks. After all even now people believe that power and money are synonymous, and as such presto..It is. Like magic you all have brought it into your world and existence simply using the power of believe on a mass scale, and much pomp and gloss.

originally posted by: galadofwarthethird

a reply to: Semicollegiate

Yes and none of that has anything to do with the intrinsic of the system itself or which immaterial object you wish to put what value on. And it has everything to do with people and human nature and certain facts, one being that they are to stupid to see beyond fancy symbology, and well at least a few hundred if not thousand more.

So what your saying is we should be down to two work days by now if you look at all the stats on paper. But you look away from the paper and out there in the real world and add up ity bitty factors one being what I said above about human nature. And well you do that math and the world you see around you is pretty much were it should be and could be once you add up all those factors.

Like I said. We should technically still be in villages and towns, our mind and brain still has not progressed far from herd or tribal mentalities. And in fact it would not be a good thing if we did. Because when we do, things will become a lot more bot and mechanical out here on planet earth.

And yes money is a commodity. Who knows why they dont teach it as not. Most likely so they can get a heads up on this game over you all. But ya! something is only worth what people think its worth. And when you can control what people think its worth? Well you get the picture. In essence its all fiat currency in a supply and demand society.

But in our case its more or less in a fake scarcity supply and demand society based on a fiat currency which is held up by edicts and mass smoke and mirrors. Basically Paul and Peter both got robed by John so he can pay back Steve who borrowed half from Peter and half from Paul. And round and round we go.

What did you call it? Oh ya> "Fiat money is a vehicle for inflation. The USDollar has lost 95% of its buying power since 1913"

And what you think that if we started using silver or gold it would have been immune to inflation?

The gold backed dollar kept the same value, 0% (zero) inflation from 1789 until 1917. The price of everything decreased over the 19th century.

Inflation means more dollars for the same amount of property and labor.

It is possible to have smaller denominations of gold backed currency, but gold is impossible to inflate, because the amount of gold is fixed with a small percentage increase as new gold is mined.

Gold backed money keeps its value. No inflation is possible.

The international economy went off the gold standard to pay fro WW1. If all countries had stayed on the gold standard, there wouldn't have been enough money to pay for WW1 past the first year.

WW1 cost more than all of the wealth in the world, hence the 95% devaluation of the dollar.

Wealth is real, fiat currency is confiscation. 95% of the average person's wealth has been consumed by inflation.

Such is progressivism.

a reply to: Semicollegiate

On paper it did, outside of that it fluctuated all over the place, but mostly it stayed static is because it was traded for in paper, if it was traded for itself this whole time inflation would still exist and we would still be fighting wars over other resources like oil and everything else.

Which is bizarre considering you have not had a gold standard as in ever on this global scale you somehow seem to think that it will somehow do the same as it did hundreds of years ago on much much smaller scales and not lead up to the same problem we have today.

Don't know if the whole cash for gold craze is still going on or not, but I take it that semi phase within a phase passed as well, or at least till next time around, the gold rush was even in the foundation days of this country. And also the cost of ww1 had again had more to do with human nature then any material object and the values placed on it.

None of it is real, its just as real as you believe it to be. Which is why we fight wars to back up the petro dollar or why if we were under any under medium we would fight wars to protect that standard.

But hey if you believe it so then change it to gold and come back in 70 years and when inflation is still going on then we shall see.

Here in this vid they say its cost prohibited for mass production, but I doubt it.

All your whole gold does not cause inflation is based on the fact that its rare on earth, remove that it becomes just another material. Basically those who trade in gold and for gold have more of an interest in keeping it rare and a commodity and not a standard for commodities. As then it would be subject to the bubbles of supply and demand as its in the forefront of things.

Changing one standard material item for another does nothing in the scope of things. But maybe it will run with it for a few years or even generations if even that.

Just because you label something which has not been in process and practice of our society as "progressivism" does not mean that when it is put into practice it will be that or all that different. It just means you believe it will, but your believe and others believes will carry it only so far. If you were to start back when paper fiat currency was becoming global, then by now we would have reached the same place with gold as we have with fiat paper all the ups and downs busts and bursts.

Magic no? When one war which is meaningless by now can cost more then the sum total of its parts for all of history. Thats like buying a apple thats worth 1$ for one billion dollars. I do believe that is what is called as swindling and nothing else. But hey if you believe it then it must be so...Should you not get on paying back what all those dead people owe?

Or how about this, why dont we just print a one gazzillion dollar bill and pay everything then when everything is payed we can go back to our regular life's right? Or wait is there more to this, like the fact that everybody does not want to admit that we are all living on others sweet in many ways in a system that is for the most part ebb and flow and made up pie cutting contest.

It would be cool you know, especially among religious people, heard they like others paying for there whatever so they can go on doing what it is they are doing. The bank of God and the creditor of Jesus, worked wonders for them, why not adapt it as a financial system as well.

Quite obvious that inflation is sin right? Or is gold somehow magically supposed to solve world hunger and poverty and war and all those things? Were exactly are you going with this. But probably I dont even want to know.

On paper it did, outside of that it fluctuated all over the place, but mostly it stayed static is because it was traded for in paper, if it was traded for itself this whole time inflation would still exist and we would still be fighting wars over other resources like oil and everything else.

Which is bizarre considering you have not had a gold standard as in ever on this global scale you somehow seem to think that it will somehow do the same as it did hundreds of years ago on much much smaller scales and not lead up to the same problem we have today.

Don't know if the whole cash for gold craze is still going on or not, but I take it that semi phase within a phase passed as well, or at least till next time around, the gold rush was even in the foundation days of this country. And also the cost of ww1 had again had more to do with human nature then any material object and the values placed on it.

None of it is real, its just as real as you believe it to be. Which is why we fight wars to back up the petro dollar or why if we were under any under medium we would fight wars to protect that standard.

But hey if you believe it so then change it to gold and come back in 70 years and when inflation is still going on then we shall see.

Here in this vid they say its cost prohibited for mass production, but I doubt it.

All your whole gold does not cause inflation is based on the fact that its rare on earth, remove that it becomes just another material. Basically those who trade in gold and for gold have more of an interest in keeping it rare and a commodity and not a standard for commodities. As then it would be subject to the bubbles of supply and demand as its in the forefront of things.

Changing one standard material item for another does nothing in the scope of things. But maybe it will run with it for a few years or even generations if even that.

Just because you label something which has not been in process and practice of our society as "progressivism" does not mean that when it is put into practice it will be that or all that different. It just means you believe it will, but your believe and others believes will carry it only so far. If you were to start back when paper fiat currency was becoming global, then by now we would have reached the same place with gold as we have with fiat paper all the ups and downs busts and bursts.

WW1 cost more than all of the wealth in the world, hence the 95% devaluation of the dollar.

Magic no? When one war which is meaningless by now can cost more then the sum total of its parts for all of history. Thats like buying a apple thats worth 1$ for one billion dollars. I do believe that is what is called as swindling and nothing else. But hey if you believe it then it must be so...Should you not get on paying back what all those dead people owe?

Or how about this, why dont we just print a one gazzillion dollar bill and pay everything then when everything is payed we can go back to our regular life's right? Or wait is there more to this, like the fact that everybody does not want to admit that we are all living on others sweet in many ways in a system that is for the most part ebb and flow and made up pie cutting contest.

It would be cool you know, especially among religious people, heard they like others paying for there whatever so they can go on doing what it is they are doing. The bank of God and the creditor of Jesus, worked wonders for them, why not adapt it as a financial system as well.

Quite obvious that inflation is sin right? Or is gold somehow magically supposed to solve world hunger and poverty and war and all those things? Were exactly are you going with this. But probably I dont even want to know.

originally posted by: galadofwarthethird

a reply to: Semicollegiate

On paper it did, outside of that it fluctuated all over the place, but mostly it stayed static is because it was traded for in paper, if it was traded for itself this whole time inflation would still exist and we would still be fighting wars over other resources like oil and everything else.

"on paper" is where the fractional reserve banking practice made more money that there was gold to back it. All fluctuations in the supply and value of money are caused by banks lending money that they don't have. The gold standard itself was not the reason for the fluctuations and bank failures and bank panics. Deviation from the gold standard caused all of the bank failures and panics.

Don't know if the whole cash for gold craze is still going on or not, but I take it that semi phase within a phase passed as well, or at least till next time around, the gold rush was even in the foundation days of this country. And also the cost of ww1 had again had more to do with human nature then any material object and the values placed on it.

The war would have stopped when there was no more money to pay for it. About spring or summer 1915.

None of it is real, its just as real as you believe it to be. Which is why we fight wars to back up the petro dollar or why if we were under any under medium we would fight wars to protect that standard.

Fiat currency needs wars because fiat's value comes from governmental power.

Gold has value by the voluntary action of every person producing and trading real goods and services. No government needed.

But hey if you believe it so then change it to gold and come back in 70 years and when inflation is still going on then we shall see.

Gold will be worth a lot more then, at the current rate of inflation every material good will at least double in price.

Here in this vid they say its cost prohibited for mass production, but I doubt it.

Refining is not "creation". The amount of gold on Earth is fixed. That is what makes gold a good basis for sound, non-inflationary money.

All your whole gold does not cause inflation is based on the fact that its rare on earth, remove that it becomes just another material. Basically those who trade in gold and for gold have more of an interest in keeping it rare and a commodity and not a standard for commodities. As then it would be subject to the bubbles of supply and demand as its in the forefront of things.

Money is for trade. Sound money has value because it directly represents, in a one to one, if and only if way, the goods and services that money is traded for.

Sound money is a receipt and a yardstick. Gold is easily distinguished from silvery metals, is indestructible and non reactive, and can be subdivided down to the atomic level if need be.

The business cycle is caused by fictitious money being mixed in with real money until the economy can no longer determine what anything is worth. Then comes the bust. The bust results from confusion as to the amount and scarcity of every good and service. Sound money prevents the confusion.

Changing one standard material item for another does nothing in the scope of things. But maybe it will run with it for a few years or even generations if even that.

Gold worked well and was derived from evolution as to the best kind of money. Mostly gold was good money because it did not inflate.

Over time the amount of stuff in the world increases and gold will buy more stuff, because there is the same amount of gold but more stuff available to buy. That is the natural rate of interest on savings.

Everyone could have been a millionaire by now simply by virtue of saving money in an expanding economy.

Real money and freedom for the common man began to disappear during the Progressive Era. The Progressive Era sold redistribution as prosperity. Or theft and restriction is the same as production and management -- according to the progressive mind.

Just because you label something which has not been in process and practice of our society as "progressivism" does not mean that when it is put into practice it will be that or all that different. It just means you believe it will, but your believe and others believes will carry it only so far. If you were to start back when paper fiat currency was becoming global, then by now we would have reached the same place with gold as we have with fiat paper all the ups and downs busts and bursts.

Gold backed money financed the evolution out of feudalism and the Industrial Revolution.

Prog is the magical novelty.

WW1 cost more than all of the wealth in the world, hence the 95% devaluation of the dollar.

Magic no? When one war which is meaningless by now can cost more then the sum total of its parts for all of history. Thats like buying a apple thats worth 1$ for one billion dollars. I do believe that is what is called as swindling and nothing else. But hey if you believe it then it must be so...Should you not get on paying back what all those dead people owe?

The magic of fiat money. Watch your future vanish into government debts and handouts.

Or how about this, why dont we just print a one gazzillion dollar bill and pay everything then when everything is payed we can go back to our regular life's right? Or wait is there more to this, like the fact that everybody does not want to admit that we are all living on others sweet in many ways in a system that is for the most part ebb and flow and made up pie cutting contest.

Progs freeze the size of the pie. The pie grows in a normal economy. Fiat money takes out all of the growth through inflation.

It would be cool you know, especially among religious people, heard they like others paying for there whatever so they can go on doing what it is they are doing. The bank of God and the creditor of Jesus, worked wonders for them, why not adapt it as a financial system as well.

Quite obvious that inflation is sin right? Or is gold somehow magically supposed to solve world hunger and poverty and war and all those things? Were exactly are you going with this. But probably I dont even want to know.

Typing zeros on a computer will feed the starving?

Capitalism has fed the billions born since the Industrial Revolution.

The gold standard allowed planning by individuals and the result was exponential economic growth and a standard of living beyond the wildest expectations of the common folks through out history.

Fiat money will take away all of the gains to the individual made by modernization through the hidden tax of inflation.

edit on 1-11-2015 by Semicollegiate because: (no reason given)

originally posted by: galadofwarthethird

a reply to: Semicollegiate

Winter is coming.

I enjoyed the clip

The situation is real but not necessary.

Power is people working full time to keep power whilst the rest are trying to live their lives and deal with that power from time to time.

Power is a criminal class.

The doom and gloom economists have been saying this since the bailout in '08. The likes of Gerald Celente, Peter Schiff, Doug Casey, etc. have been

warning every quarter for the past seven years that the crash is inevitable. It's not a case of "if" but "when". But John Q. Public is weary of

this "boy crying wolf" syndrome. It's going to happen when we least expect it, and when everyone in the middle class have their 401k dried up, then

it will be total chaos.

originally posted by: Semicollegiate

The gold backed dollar kept the same value, 0% (zero) inflation from 1789 until 1917. The price of everything decreased over the 19th century.

Incorrect. The gold backed dollar suffered from quite a bit of inflation. At first there was the continental which ended up not being worth anything. Then there was the USD which saw it's value destroyed in the Civil War. Then there was the Greenback which was entirely fiat and the most successful currency we've had as a nation. Then the Greenback was outlawed and the USD lost almost all value in the 1880's and 90's banking collapse. During that time period value was given to existing money by sucking excess dollars out of the system and instituting mass deflation in order to make existing money be worth something. It ended in absolute failure because artificial scarcity and limiting a money supply doesn't work.

originally posted by: Semicollegiate

"on paper" is where the fractional reserve banking practice made more money that there was gold to back it. All fluctuations in the supply and value of money are caused by banks lending money that they don't have. The gold standard itself was not the reason for the fluctuations and bank failures and bank panics. Deviation from the gold standard caused all of the bank failures and panics.

The gold standard and fractional reserve banking are not mutually exclusive concepts. They are actually usually tied together. Additionally, fractional reserve banking has been in use since the 1650's.

Refining is not "creation". The amount of gold on Earth is fixed. That is what makes gold a good basis for sound, non-inflationary money.

The amount of land on Earth is fixed, that's what makes it such a good investment.

Said everyone for the decade preceding the housing collapse. Let me give you some free advice, whenever someone uses the above reasoning you know for 100% certainty that the commodity in question is in a pricing bubble.

Over time the amount of stuff in the world increases and gold will buy more stuff, because there is the same amount of gold but more stuff available to buy. That is the natural rate of interest on savings.

Until of course, the population begins to expand at a rate less than that of gold production. At which time the amount of gold available per capita will begin to rise and it will lose any value it possessed due to scarcity. Gold being indestructible can't be taken out of the economy, there is an ever increasing supply of the metal and that will remain true for as long as it continues to be mined. There is however a cap to it's demand, a cap on demand and an ever increasing supply is a recipe for a failed investment given enough time.

a reply to: Semicollegiate

OK then. Hey! Listen just read the other poster Azadan he said pretty much some things which I would have said and he seems to speak more your language and understanding. No time to read about fairy tales today..Srry.

OK then. Hey! Listen just read the other poster Azadan he said pretty much some things which I would have said and he seems to speak more your language and understanding. No time to read about fairy tales today..Srry.

new topics

-

Happy St George's day you bigots!

Breaking Alternative News: 10 minutes ago -

TLDR post about ATS and why I love it and hope we all stay together somewhere

General Chit Chat: 1 hours ago -

Hate makes for strange bedfellows

US Political Madness: 3 hours ago -

Who guards the guards

US Political Madness: 5 hours ago -

Has Tesla manipulated data logs to cover up auto pilot crash?

Automotive Discussion: 7 hours ago

top topics

-

Hate makes for strange bedfellows

US Political Madness: 3 hours ago, 12 flags -

CIA botched its handling of sexual assault allegations, House intel report says

Breaking Alternative News: 17 hours ago, 11 flags -

whistleblower Captain Bill Uhouse on the Kingman UFO recovery

Aliens and UFOs: 12 hours ago, 10 flags -

Who guards the guards

US Political Madness: 5 hours ago, 10 flags -

1980s Arcade

General Chit Chat: 14 hours ago, 6 flags -

Teenager makes chess history becoming the youngest challenger for the world championship crown

Other Current Events: 16 hours ago, 5 flags -

Deadpool and Wolverine

Movies: 15 hours ago, 4 flags -

TLDR post about ATS and why I love it and hope we all stay together somewhere

General Chit Chat: 1 hours ago, 3 flags -

Has Tesla manipulated data logs to cover up auto pilot crash?

Automotive Discussion: 7 hours ago, 2 flags -

Happy St George's day you bigots!

Breaking Alternative News: 10 minutes ago, 1 flags

active topics

-

Happy St George's day you bigots!

Breaking Alternative News • 4 • : Oldcarpy2 -

Scientists Say Even Insects May Be Sentient

Science & Technology • 56 • : Naftalin -

UN warns Assange may be tortured if extradited to US

Whistle Blowers and Leaked Documents • 14 • : burritocat -

Hate makes for strange bedfellows

US Political Madness • 24 • : FlyersFan -

MULTIPLE SKYMASTER MESSAGES GOING OUT

World War Three • 97 • : Oldcarpy2 -

"We're All Hamas" Heard at Columbia University Protests

Social Issues and Civil Unrest • 239 • : network dude -

Mandela Effect - It Happened to Me!

The Gray Area • 113 • : chris_stibrany -

TLDR post about ATS and why I love it and hope we all stay together somewhere

General Chit Chat • 4 • : theatreboy -

Candidate TRUMP Now Has Crazy Judge JUAN MERCHAN After Him - The Stormy Daniels Hush-Money Case.

Political Conspiracies • 693 • : matafuchs -

1980s Arcade

General Chit Chat • 19 • : theatreboy