It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

In the United Sates of America, do they wealthy really get all of these tax breaks I heave heard about? Are they free skating while people like me are

shouldering the burden? The war on the wealthy seems to be a popular sentiment. Who really is paying the taxes that keep our Federal Government

governing federally?

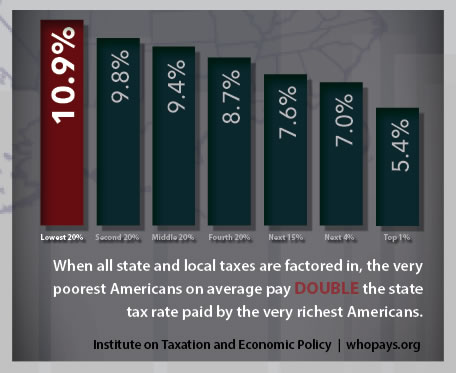

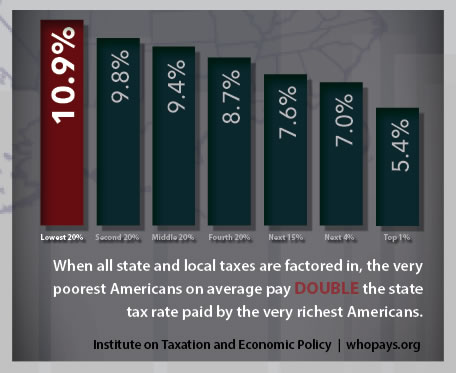

Sometimes you may come across a graph like this:

ITEP Link

The intention is to say that the poorest 20% of Americans pay double the rate as the wealthiest 1%. This is of course only true when only factoring in State and Local taxes. What is not told, is that these poor Americans can write it off when filing their Federal taxes.

CNBC Article

So, what are the Federal Government's sources of revenue? Let me tell you, they are MAINLY Individual Income Tax and Payroll Taxes. Payroll taxes can be construed as another form of income tax because it is an employment tax. Your employer has to pay a certain amount that he/she cannot put back into the business for expansion or higher wages. A full 82% of Federal Revenue, comes from Income Tax and Payroll Tax.

TCP Link

Who is paying this 42% of Federal Income tax that keeps our Government going, knowing 40% is already coming from Employers/Employees in the form of Payroll Tax? Well in 2011, the latest stats I've found, the top 1% of wealthiest Americans paid 35.1% of the Income Taxes. Add to that the 1-5% wealthiest and they pay a full 56.5%. That is 5% paying over half of the Income Taxes in this country. How much more shall we attempt to squeeze them?

As a matter of FACT, the top 50% of this country pay 97.1% of the Income Taxes to the Federal Government. The bottom 50% of Americans pay 2.89% of their Income to the Federal Government.

Tax Foundation Link

I see a problem with society think that money grows on trees. If that is the case, I question how much you can squeeze before the fruit no longer produces her juice?

There is some graphs and charts in the links I provided. I was unable to upload them, If anyone has the means, then by ALL means upload them here. It would probably help the discussion.

Sometimes you may come across a graph like this:

ITEP Link

The intention is to say that the poorest 20% of Americans pay double the rate as the wealthiest 1%. This is of course only true when only factoring in State and Local taxes. What is not told, is that these poor Americans can write it off when filing their Federal taxes.

The second problem with looking purely at state and local taxes is that taxpayers can deduct state and local taxes from their federal taxes. So some of that tax burden shifted to the middle and lower class at the state level is given back by the federal government. The federal tax system, in other words, rebalances or cancels out some of the regressive structure of the state and local taxes.

In other words, saying the tax system is upside down based on state and local taxes is like studying the estate tax or mansion tax and saying millionaires pay all the taxes in America.

CNBC Article

So, what are the Federal Government's sources of revenue? Let me tell you, they are MAINLY Individual Income Tax and Payroll Taxes. Payroll taxes can be construed as another form of income tax because it is an employment tax. Your employer has to pay a certain amount that he/she cannot put back into the business for expansion or higher wages. A full 82% of Federal Revenue, comes from Income Tax and Payroll Tax.

TCP Link

Who is paying this 42% of Federal Income tax that keeps our Government going, knowing 40% is already coming from Employers/Employees in the form of Payroll Tax? Well in 2011, the latest stats I've found, the top 1% of wealthiest Americans paid 35.1% of the Income Taxes. Add to that the 1-5% wealthiest and they pay a full 56.5%. That is 5% paying over half of the Income Taxes in this country. How much more shall we attempt to squeeze them?

As a matter of FACT, the top 50% of this country pay 97.1% of the Income Taxes to the Federal Government. The bottom 50% of Americans pay 2.89% of their Income to the Federal Government.

Tax Foundation Link

I see a problem with society think that money grows on trees. If that is the case, I question how much you can squeeze before the fruit no longer produces her juice?

There is some graphs and charts in the links I provided. I was unable to upload them, If anyone has the means, then by ALL means upload them here. It would probably help the discussion.

a reply to: harvestdog

Another factor to consider is the fact that a lot of wealthy people make their fortunes off of capital gains, which in states like California have a tax rate of 13.3% www.nerdwallet.com...

The fact of the matter is that for those who are economically disadvantaged, they are having trouble finding a way to get by week-to-week on their earnings. Meanwhile, the wealthy find ways of dodging taxes, using off-shore banks and other avenues not feasible for Joe Shmoe working a 9-5.

The disparity between the rich and the poor continues to grow and people earning minimum wage cannot survive - if our representatives are living lavish lifestyles and getting all of these benefits, there should be some way of lifting up the poorest communities so they aren't struggling for crumbs everyday. It's just so wrong. That's how I feel.

As for myself, I pay my fair share of taxes and am not on any type of social services, but I see people who are everyday in my job. Year after year there are more people struggling and more people relying on the state for services, while services continue to get slashed and budgets are cut, those on Capitol Hill haven't made the same sacrifices and are still enjoying 1st-class flying and other percs unimaginable to the bourgeoisie/blue collars.

That's my 2 cents

Another factor to consider is the fact that a lot of wealthy people make their fortunes off of capital gains, which in states like California have a tax rate of 13.3% www.nerdwallet.com...

The fact of the matter is that for those who are economically disadvantaged, they are having trouble finding a way to get by week-to-week on their earnings. Meanwhile, the wealthy find ways of dodging taxes, using off-shore banks and other avenues not feasible for Joe Shmoe working a 9-5.

The disparity between the rich and the poor continues to grow and people earning minimum wage cannot survive - if our representatives are living lavish lifestyles and getting all of these benefits, there should be some way of lifting up the poorest communities so they aren't struggling for crumbs everyday. It's just so wrong. That's how I feel.

As for myself, I pay my fair share of taxes and am not on any type of social services, but I see people who are everyday in my job. Year after year there are more people struggling and more people relying on the state for services, while services continue to get slashed and budgets are cut, those on Capitol Hill haven't made the same sacrifices and are still enjoying 1st-class flying and other percs unimaginable to the bourgeoisie/blue collars.

That's my 2 cents

a reply to: harvestdog

I have some friends who make very little money therefor are not subject to income tax. They do get an earned income credit which in some cases is a lot of money.

It is all very confusing to me as they are not subject to an income tax then what exactly is the credit for?

So, I would venture a guess to say that they certainly DO get a lot of breaks.

I do not agree with the first chart that shows the poorest of us paying the majority of taxes.

THAT would just be impossible IMO...

I don't know anything though...

I have some friends who make very little money therefor are not subject to income tax. They do get an earned income credit which in some cases is a lot of money.

It is all very confusing to me as they are not subject to an income tax then what exactly is the credit for?

So, I would venture a guess to say that they certainly DO get a lot of breaks.

I do not agree with the first chart that shows the poorest of us paying the majority of taxes.

THAT would just be impossible IMO...

I don't know anything though...

Here's a story from last year ...

Taxpayers earning $100,000 or more a year pay 71.6% of the nation’s share in individual federal income taxes, according to the latest data from the Internal Revenue Service (IRS) from 2011.

These data do not include corporate income taxes, or taxes on capital gains or dividends, or payroll taxes for Social Security and other programs.

$100K-Plus Earners Pay 72% of Federal Income Taxes

a reply to: harvestdog

Some of the rich over privileged twats probably dont pay any taxes if they can help it!

Some of the rich over privileged twats probably dont pay any taxes if they can help it!

edit on 28-9-2015 by andy06shake because: (no

reason given)

I think that this is a matter of language.

The rich pay a lower tax rate on capitol gains. But the rich pay most of the taxes.

I think that I read somewhere that the bottom 50% of American earners don't pay any income tax. However if you include sales tax, they may indeed be paying a higher tax rate than the tax rate on capital gains.

The rich pay a lower tax rate on capitol gains. But the rich pay most of the taxes.

I think that I read somewhere that the bottom 50% of American earners don't pay any income tax. However if you include sales tax, they may indeed be paying a higher tax rate than the tax rate on capital gains.

Rates vary on the type of income you make. Super rich types tend to make Capitol gains and stock options and whatnot. They don't always get a pay

check every week like you and me.

a reply to: harvestdog

Getting Tax Breaks Via Charitable Donations ... To Themselves

It's #ty how the ultra-rich pay virtually no taxes, but at least

when they lower their bill through stuff like charitable donations,

it lessens the blow a bit. Sure, they're doing it knowing full well

it'll save them another billion dollars come next April, but if it

means fewer babies die of cancer, then deduct away, you princes

and princesses of opulence.

The problem comes when the charity forgets to charity and exists to

line the pockets of the Million-Dollar Douche running it. And then

donating to it for the tax breaks. Everyone's favorite philanthropists,

the Waltons of Walmart, have this scam down to an art form.

Despite being among the richest people in the planet, the Waltons

donate under 0.04 percent of their fortune to one charity: the

Walmart Family Foundation. That's not pennies on the dollar --

that's a microscopic shaving of the corner of one penny to the dollar.

They donated about $58 million over 23 years, but merely having the

charity saves them $3 billion in taxes. Per year.

Walmart1Percent

But that's not all -- the Waltons also utilize something called "Jackie O. Trusts,"

in which they put a bunch of money aside, with a certain amount going to

charity each year. Whatever remains after 20-30 years goes to their

beneficiary (i.e., other Waltons) tax-free. And since the IRS bafflingly

only requires that a charity spend five percent of its money on making

the world a better place, guess where the other 95 percent goes?

But hey, they donate some money, and if it goes to ALS research or

whatever, then at least it's something, right? Yeah, they don't do that.

Instead, they display paintings. Their Crystal Bridges Museum Of

American Art shows off all the artwork Alice Walton has collected

over the years, and ... that's it! A few hundredths of one percent

of more money than Dr. Evil demanded in exchange for not destroying

the world, and their big contribution is a room full of nice pictures.

www.cracked.com...

Getting Tax Breaks Via Charitable Donations ... To Themselves

It's #ty how the ultra-rich pay virtually no taxes, but at least

when they lower their bill through stuff like charitable donations,

it lessens the blow a bit. Sure, they're doing it knowing full well

it'll save them another billion dollars come next April, but if it

means fewer babies die of cancer, then deduct away, you princes

and princesses of opulence.

The problem comes when the charity forgets to charity and exists to

line the pockets of the Million-Dollar Douche running it. And then

donating to it for the tax breaks. Everyone's favorite philanthropists,

the Waltons of Walmart, have this scam down to an art form.

Despite being among the richest people in the planet, the Waltons

donate under 0.04 percent of their fortune to one charity: the

Walmart Family Foundation. That's not pennies on the dollar --

that's a microscopic shaving of the corner of one penny to the dollar.

They donated about $58 million over 23 years, but merely having the

charity saves them $3 billion in taxes. Per year.

Walmart1Percent

But that's not all -- the Waltons also utilize something called "Jackie O. Trusts,"

in which they put a bunch of money aside, with a certain amount going to

charity each year. Whatever remains after 20-30 years goes to their

beneficiary (i.e., other Waltons) tax-free. And since the IRS bafflingly

only requires that a charity spend five percent of its money on making

the world a better place, guess where the other 95 percent goes?

But hey, they donate some money, and if it goes to ALS research or

whatever, then at least it's something, right? Yeah, they don't do that.

Instead, they display paintings. Their Crystal Bridges Museum Of

American Art shows off all the artwork Alice Walton has collected

over the years, and ... that's it! A few hundredths of one percent

of more money than Dr. Evil demanded in exchange for not destroying

the world, and their big contribution is a room full of nice pictures.

www.cracked.com...

edit on 28-9-2015 by radarloveguy because: $$$$$$

edit on 28-9-2015 by radarloveguy because: %%%%%%%

a reply to: TNMockingbird

I like you, being from TN. I was born in Millington, outside of Memphis. Tried to go b back to Murfreesboro, but to much family in So Cal. That first chart, was shown for the shear fact that it is not telling the story. Places that have no income tax hit the poorer harder. But that is mad up in Federal Income Tax Deductions. I live all around gamers of the system, they don't have the audits like the wealthy people dodging taxes do.

I like you, being from TN. I was born in Millington, outside of Memphis. Tried to go b back to Murfreesboro, but to much family in So Cal. That first chart, was shown for the shear fact that it is not telling the story. Places that have no income tax hit the poorer harder. But that is mad up in Federal Income Tax Deductions. I live all around gamers of the system, they don't have the audits like the wealthy people dodging taxes do.

a reply to: andy06shake Not that I disagree with you, but I don't want that to be the excuse to jack up tax rates. The bottom

50% pay 2.89% of Income Tax. How much more are you willing to tax us, over the 50%, when we already pay 97% of it?

99% tax on the 1%?

99% tax on the 1%?

a reply to: harvestdog

I guess I don't know enough to say whether I am "for" or "against" capital gains, but I'm leaning towards the idea that it is too low if anything.

I was just explaining that this was another factor to be considered when looking at various economic classes and the taxes they pay.

I guess I don't know enough to say whether I am "for" or "against" capital gains, but I'm leaning towards the idea that it is too low if anything.

I was just explaining that this was another factor to be considered when looking at various economic classes and the taxes they pay.

edit on

28-9-2015 by FamCore because: (no reason given)

a reply to: Wildbob77

This is about taxes to the Federal Government. We have established Capital Gains are not a big funder of Federal Government. Plus that could be a big hit on me. Am I so rich as to pay your way? The bottom 50% pay only 2.9%. Don't touch my good life decisions.

This is about taxes to the Federal Government. We have established Capital Gains are not a big funder of Federal Government. Plus that could be a big hit on me. Am I so rich as to pay your way? The bottom 50% pay only 2.9%. Don't touch my good life decisions.

a reply to: harvestdog

You don't want taxes to go up, that's touching. But the truth is that taxes generally go it that direction.

How else are "They" supposed to squeeze the blood from the metaphorical stone?

You don't want taxes to go up, that's touching. But the truth is that taxes generally go it that direction.

How else are "They" supposed to squeeze the blood from the metaphorical stone?

a reply to: harvestdog

Uhm interesting, so why don't the super rich want a flat tax?

If true why wouldn't the top earners in this country want to pay the same income tax ratio as everyone else?

What is the income to tax ratio for the super rich versus say the middle class and who is paying more?

Sure they super rich pay more but who is really getting screwed?

Without taking deductions and oversea account or dividend into account lets assume that:

Billionaire Joe pays 10% of his 1 Billion dollar income, hence he paid 100,000,000 in taxes.

Then you have Joe Smoe middle class guy who for what ever reason paid say 100% of his 100K income so he paid 100k in taxes.

So sure , Billionaire Joe paid more (100M) than Joe Smoe Middle class guy ( 100K) but in reality he still paid less when it comes to the income to tax ratio. Billionaire Joe only felt 10% of his money dwindle but Joe Smoe Middle class guy felt 100% of his money dwindle.

So why shouldn't we all be paying the same income tax ratio to feel it the same?

More importantly why aren't the super rich fighting for a flat tax?

As a matter of FACT, the top 50% of this country pay 97.1% of the Income Taxes to the Federal Government.

Uhm interesting, so why don't the super rich want a flat tax?

If true why wouldn't the top earners in this country want to pay the same income tax ratio as everyone else?

What is the income to tax ratio for the super rich versus say the middle class and who is paying more?

Sure they super rich pay more but who is really getting screwed?

Without taking deductions and oversea account or dividend into account lets assume that:

Billionaire Joe pays 10% of his 1 Billion dollar income, hence he paid 100,000,000 in taxes.

Then you have Joe Smoe middle class guy who for what ever reason paid say 100% of his 100K income so he paid 100k in taxes.

So sure , Billionaire Joe paid more (100M) than Joe Smoe Middle class guy ( 100K) but in reality he still paid less when it comes to the income to tax ratio. Billionaire Joe only felt 10% of his money dwindle but Joe Smoe Middle class guy felt 100% of his money dwindle.

So why shouldn't we all be paying the same income tax ratio to feel it the same?

More importantly why aren't the super rich fighting for a flat tax?

edit on 21930America/ChicagoMon, 28 Sep 2015 15:21:04

-0500000000p3042 by interupt42 because: (no reason given)

originally posted by: Wildbob77

I think that this is a matter of language.

The rich pay a lower tax rate on capitol gains. But the rich pay most of the taxes.

I think that I read somewhere that the bottom 50% of American earners don't pay any income tax. However if you include sales tax, they may indeed be paying a higher tax rate than the tax rate on capital gains.

The more income you make the higher the capital gains get taxed. Many lower income and middle income taxpayers pay nothing on captial gains.

If you're in the 10% or 15% tax bracket for ordinary income, then your long-term capital gains rate is 0%. If you're in the 25%, 28%, 33%, or 35% tax bracket, then your long-term capital gains rate is 15%. If you're in the 39.6% tax bracket, then your long-term capital gains rate is 20%.Aug 16, 2015

What you probably meant to say is that the capital gains rate is less than the income tax rate for those making high incomes. But it's been that way for a long time. You hold a stock for 3 years and it doubles from $10,000 to 20,000. Is it fair or right that it should be taxed at 20% or even 39%? your growth would go from 33% a year to only 20% .

a reply to: andy06shake

Shoot their hand while they are grabbing it?

Taxes go up, true, shall we not try to save the Republic?

Shoot their hand while they are grabbing it?

Taxes go up, true, shall we not try to save the Republic?

a reply to: harvestdog

Depends on how corrupt said republic has become i suppose.

A return to your original constitutional ideologies would be a step in the right direction. And shall we say less involvement in foreign matters that are really none of your concern(My own nation is no better) could possibly aid in the salvation of the republic.

Depends on how corrupt said republic has become i suppose.

A return to your original constitutional ideologies would be a step in the right direction. And shall we say less involvement in foreign matters that are really none of your concern(My own nation is no better) could possibly aid in the salvation of the republic.

a reply to: pavil

Thanks for some clarity in the issue. I add the link that I think you got it from for some clarity.

www.bankrate.com...

But the finer point must be made, who has the discretion to tell me why my investments are yours? Can you tell me why you are entitled to my profits when I hold all of the risk?

Thanks for some clarity in the issue. I add the link that I think you got it from for some clarity.

www.bankrate.com...

But the finer point must be made, who has the discretion to tell me why my investments are yours? Can you tell me why you are entitled to my profits when I hold all of the risk?

new topics

-

Electrical tricks for saving money

Education and Media: 35 minutes ago -

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News: 1 hours ago -

Sunak spinning the sickness figures

Other Current Events: 2 hours ago -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues: 2 hours ago -

Late Night with the Devil - a really good unusual modern horror film.

Movies: 4 hours ago -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest: 5 hours ago -

The Good News According to Jesus - Episode 1

Religion, Faith, And Theology: 7 hours ago -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three: 9 hours ago

top topics

-

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs: 16 hours ago, 8 flags -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest: 5 hours ago, 8 flags -

Florida man's trip overseas ends in shock over $143,000 T-Mobile phone bill

Social Issues and Civil Unrest: 12 hours ago, 8 flags -

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News: 1 hours ago, 6 flags -

Former Labour minister Frank Field dies aged 81

People: 15 hours ago, 4 flags -

Bobiverse

Fantasy & Science Fiction: 12 hours ago, 3 flags -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three: 9 hours ago, 3 flags -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues: 2 hours ago, 3 flags -

Sunak spinning the sickness figures

Other Current Events: 2 hours ago, 3 flags -

Late Night with the Devil - a really good unusual modern horror film.

Movies: 4 hours ago, 2 flags

active topics

-

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three • 28 • : budzprime69 -

Huge ancient city found in the Amazon.

Ancient & Lost Civilizations • 61 • : Therealbeverage -

The Reality of the Laser

Military Projects • 43 • : 5thHead -

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News • 16 • : matafuchs -

Should Biden Replace Harris With AOC On the 2024 Democrat Ticket?

2024 Elections • 49 • : Therealbeverage -

WF Killer Patents & Secret Science Vol. 1 | Free Energy & Anti-Gravity Cover-Ups

General Conspiracies • 32 • : Arbitrageur -

Is there a hole at the North Pole?

ATS Skunk Works • 38 • : Therealbeverage -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest • 11 • : charlyv -

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs • 41 • : TheMisguidedAngel -

Naked Eye Supernova Erupting in the T Coronae Borealis

Space Exploration • 13 • : Therealbeverage