It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

I think they will bounce back in time, by next year if this thread is still going I will expect something may be serious. The reason I say this is

because China is the manufacturing hub of the world, thats not going to be changing any time within the next century unless there is some kind of

major world economic shift. I cant imagine anything other than nanotech 3d printing to destablise such an economy. I dont see that happening any time

soon from any country enough to effect the global economy.

originally posted by: St Udio

ADD: I also have a notion that the China Stock Market 30% crash was engineered by bad people (who were not Chinese... but part of the western financial juggernaught in control of world markets

Correct.

In fact, all stock market crashes are arranged. I'll try and explain this in layman terms.

Mr. A buys 1 million in stock options. He doesn't really provide the money, it's only an option. The stock of his option is at 100 when he buys it, and at some later point it is at 200. At this time, the option taker uses his "exit stragedy" ... this is when you read on Bloomberg, how great an option this is. They'll tell you that it's a major buy. Why? Because Mr. A wants to sell and he needs a buyer. You and me, the little people ... buy this option, with our pension and long earned silver dollars. After we buy it, the stock will drop and even crash below the 100 marker ( like in China ). At which point, Mr. A has made his million without spending a cent and you and me are the losers.

What you need to know, is that the stock will NEVER RISE AGAIN. Because that it rose in the first place, is a scheme ... often referred to as a bubble ... because it contains nothing but air. And is used to turn empty non-value options, into real money.

It's legalized theft.

So, the Chinese have taken action. GOOD! The greeks voted, NO ... even better. Now lets see what can be done with all this ... let's hope the Chinese have the "firepower" to back up their decision. And make it "stick".

China will transition to service industry same as US. Africa will produce cheap goods and Chinese will oversee this. Parts of Africa will be

satellites of China same as soviet Russia.

edit on 6-7-2015 by pl3bscheese because: (no reason given)

originally posted by: FormOfTheLord

The reason I say this is because China is the manufacturing hub of the world, thats not going to be changing any time within the next century unless there is some kind of major world economic shift.

It is already changing as Southeast Asian countries like Vietnam produce goods even cheaper than the Chinese can. The Chinese have a burgeoning middle class and as the poster above mentioned, their purchasing will drive manufacturing to other developing nations in Africa and the Indian sub-continent as it becomes too expensive to keep manufacturing in China.

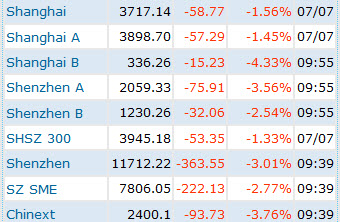

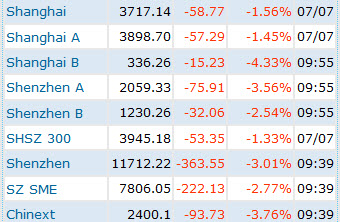

So all eyes are on China this morning.

After giving bucket loads of cash to investment agencies to give to investors to prop up the market, todays a pretty important indicator of how its going

..and its dropping like a stone.

After giving bucket loads of cash to investment agencies to give to investors to prop up the market, todays a pretty important indicator of how its going

..and its dropping like a stone.

a reply to: Agit8dChop

I was reading an article about the Chinese government actions to try and stabilize whats going on (Ill find and post it). Basically they were saying that the actions being taken by the Chinese government are along the same lines the Us government took when the great depression hit.

I was reading an article about the Chinese government actions to try and stabilize whats going on (Ill find and post it). Basically they were saying that the actions being taken by the Chinese government are along the same lines the Us government took when the great depression hit.

a reply to: Xcathdra

I read this morning that the government was giving cash to the investment banks, to give to investors to invest.

I cant find the article now but that was the gist.

After days of losses and a somewhat up and down day yesterday, for it to drop so significantly again today spells great problems ahead i think

Its still dropping after government intervention

I read this morning that the government was giving cash to the investment banks, to give to investors to invest.

I cant find the article now but that was the gist.

After days of losses and a somewhat up and down day yesterday, for it to drop so significantly again today spells great problems ahead i think

Its still dropping after government intervention

a reply to: Agit8dChop

Found it -

China's stock market is crashing, and the Chinese are trying to do the exact same thing America did in 1929

Click link for last few paragraphs of article.

Found it -

China's stock market is crashing, and the Chinese are trying to do the exact same thing America did in 1929

(AP Images) Four members of the House of Morgan stand on a balcony outside the Senate Banking Committee room just before the committee resumed its investigation into the banking institution's practices, May 31, 1933, in Washington.

While attention is focused on Greece, China is having a serious market meltdown.

After exploding earlier in the year because of deregulation, China's benchmark Shanghai Composite has collapsed a crazy 29% since the highs of early June. China's other stock markets have had similarly steep falls.

Bloomberg notes that the crisis is closely mirroring the 1929 Wall Street crash, which led to the Great Depression in the US in the 1930s.

China's government is now also using the same tactics as Wall Street did back then to try to prop up the markets.

Over the weekend China's top stock brokerages pledged that they would collectively buy at least 120 billion yuan (£12.3 billion, $19.3 billion) of shares to help steady the market, with backing from the People's Bank of China.

The central bank is effectively becoming the buyer of last resort, printing money to buy up shares and prop up prices.

Click link for last few paragraphs of article.

a reply to: OccamsRazor04

They don't have to continue being an export economy. The USA transformed into an importer economy in the 2nd half of the 20th century, why can't they? If the yuan is trusted and and worth more than whatever the peg is they need to let it rise.

They can't and shouldn't be exporters forever.

They don't have to continue being an export economy. The USA transformed into an importer economy in the 2nd half of the 20th century, why can't they? If the yuan is trusted and and worth more than whatever the peg is they need to let it rise.

They can't and shouldn't be exporters forever.

originally posted by: asmall89

a reply to: OccamsRazor04

They don't have to continue being an export economy. The USA transformed into an importer economy in the 2nd half of the 20th century, why can't they? If the yuan is trusted and and worth more than whatever the peg is they need to let it rise.

They can't and shouldn't be exporters forever.

They don't have the middle class for an import company (yet) and the world is not the same place as when the US did it.

a reply to: OccamsRazor04

Of course they do.

Link

Of course they do.

Link

edit on 7-7-2015 by pl3bscheese because: (no reason given)

edit on 7-7-2015 by pl3bscheese because: (no reason given)

originally posted by: pl3bscheese

a reply to: OccamsRazor04

Of course they do.

Which has nothing to do with the fact that the US middle class could be better off and is 50%. The Chinese middle class is about 38%, and if you remove all the manufacturing jobs and wipe 30% off the stock market how many do you think are left?

a reply to: OccamsRazor04

I'm just showing that you were wrong, that's all.

Nothing more to say, except, "a lot".

I'm just showing that you were wrong, that's all.

Nothing more to say, except, "a lot".

originally posted by: pl3bscheese

a reply to: OccamsRazor04

I'm just showing that you were wrong, that's all.

Nothing more to say, except, "a lot".

How are you showing me I am wrong when they do not have the middle class, nothing you said supported it, and this recent market crash has hurt that middle class even more?

Your graph shows what, 7% of middle class consumption come from China versus 17% from the US, while having a 430% higher population? That means to be "equal" to the US they need to consume 68%. So they are basically at 10% of where the US is.

Wow, impressive.

new topics

-

Bobiverse

Fantasy & Science Fiction: 8 minutes ago -

Florida man's trip overseas ends in shock over $143,000 T-Mobile phone bill

Social Issues and Civil Unrest: 13 minutes ago -

Former Labour minister Frank Field dies aged 81

People: 2 hours ago -

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs: 4 hours ago -

This is our Story

General Entertainment: 6 hours ago -

President BIDEN Vows to Make Americans Pay More Federal Taxes in 2025 - Political Suicide.

2024 Elections: 9 hours ago -

Ode to Artemis

General Chit Chat: 9 hours ago

top topics

-

University student disciplined after saying veganism is wrong and gender fluidity is stupid

Education and Media: 17 hours ago, 14 flags -

President BIDEN Vows to Make Americans Pay More Federal Taxes in 2025 - Political Suicide.

2024 Elections: 9 hours ago, 12 flags -

Should Biden Replace Harris With AOC On the 2024 Democrat Ticket?

2024 Elections: 15 hours ago, 6 flags -

One Flame Throwing Robot Dog for Christmas Please!

Weaponry: 13 hours ago, 6 flags -

Don't take advantage of people just because it seems easy it will backfire

Rant: 13 hours ago, 4 flags -

Ditching physical money

History: 13 hours ago, 4 flags -

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs: 4 hours ago, 4 flags -

Former Labour minister Frank Field dies aged 81

People: 2 hours ago, 3 flags -

Ode to Artemis

General Chit Chat: 9 hours ago, 3 flags -

This is our Story

General Entertainment: 6 hours ago, 2 flags

active topics

-

So this is what Hamas considers 'freedom fighting' ...

War On Terrorism • 247 • : HopeForTheFuture -

President BIDEN Vows to Make Americans Pay More Federal Taxes in 2025 - Political Suicide.

2024 Elections • 24 • : network dude -

University student disciplined after saying veganism is wrong and gender fluidity is stupid

Education and Media • 44 • : confuzedcitizen -

Who guards the guards

US Political Madness • 6 • : covent -

Remember These Attacks When President Trump 2.0 Retribution-Justice Commences.

2024 Elections • 53 • : Justoneman -

Russia Ukraine Update Thread - part 3

World War Three • 5723 • : BernnieJGato -

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs • 20 • : Consvoli -

Bobiverse

Fantasy & Science Fiction • 0 • : DAVID64 -

Lawsuit Seeks to ‘Ban the Jab’ in Florida

Diseases and Pandemics • 30 • : 320MPH -

Florida man's trip overseas ends in shock over $143,000 T-Mobile phone bill

Social Issues and Civil Unrest • 0 • : Consvoli