It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

a reply to: tothetenthpower

You could go micro brewer stile and sell you own specialized variety to compete with the big boys

ETA:

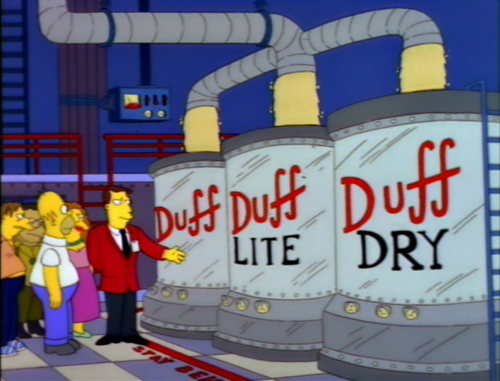

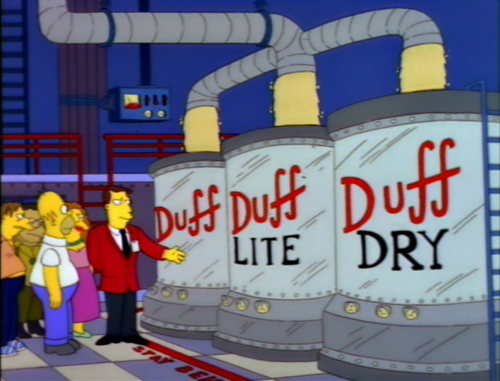

You don't even need a real specialized variety, just make it like duff

You could go micro brewer stile and sell you own specialized variety to compete with the big boys

ETA:

You don't even need a real specialized variety, just make it like duff

edit on 15-4-2015 by Indigent because: (no reason given)

a reply to: tothetenthpower

I disagree. Look at the microbrewery market. That is a market that was largely non-existent up until the early 2000's. Alcohol production and sales were all done through large brewing companies like Budweiser or Miller. Now, in any region in the US you can find local breweries galore catered to that specific region of the country. Local breweries have become so popular that now even the larger breweries are trying to imitate the microbrewery taste (usually the IPA or lager).

Marijuana is even easier to grow than it is to brew beer. Marijuana is a weed and will grow pretty much anywhere there is dirt. Just keep pests and animals away from eating your crop and you are pretty much set. I find it unlikely that big business will ever be able to edge out smaller marijuana businesses. It's just too easy to grow.

I disagree. Look at the microbrewery market. That is a market that was largely non-existent up until the early 2000's. Alcohol production and sales were all done through large brewing companies like Budweiser or Miller. Now, in any region in the US you can find local breweries galore catered to that specific region of the country. Local breweries have become so popular that now even the larger breweries are trying to imitate the microbrewery taste (usually the IPA or lager).

Marijuana is even easier to grow than it is to brew beer. Marijuana is a weed and will grow pretty much anywhere there is dirt. Just keep pests and animals away from eating your crop and you are pretty much set. I find it unlikely that big business will ever be able to edge out smaller marijuana businesses. It's just too easy to grow.

originally posted by: MysterX

a reply to: ignorant_ape

I was thinking much the same thing IA.

Don't claim tax expenses on the Pot per se, but claim on all the other connected, but easily 'unconnected' things required to run a Pot business instead...claim it as incidentals for your 'horticultural' business or somesuch.

I don't understand this either. So, does this mean that people leasing space to Pot Shops can't claim any deductions either? What about the people that sold them growing supplies and storage equipment? What about the contractor that did the permitting and Tenant Improvement for the layout of the store, can they not make any deductions either, because they most certainly know its a pot shop, due to the local permit requirement to be open in the first place? What about the Security System Service they use ADT, etc? What about the people that worked for the Pot Shop, can they not pay their taxes either?

Think of it this way, say I was to open a "Property Management Company" that specializes in leasing space exclusively to Pot Shops. I own the building, I own the equipment, the staff are my employees, that I contract out to the owner, whom has the growing/distribution license. Every month he pays me a fee, in cash, for "Property Management" and none of my staff are allowed to handle sales and cannot do pick ups or deliveries of any kind. So putting aside the whole "payment in cash/FBI" issue and deposits at my bank, why wouldn't I be allowed to take business deductions for my "Property Management Company"? I don't own the pot business, I don't have the state license and I don't work in the shop. Also, what if Pot Shops started paying their bills in bartered items, Bitcoins, Gold, Silver or rare coins? As I understand, the tax code does allow for this.

Somebody needs to hurry up and take this to tax court. Also, if these Pot Shops have any business sense, they would pool their money, to get proper representation for the first case to makes it to trial, maybe even form a PAC to get more lobbying done in their favor.

edit on 15-4-2015 by

boohoo because: (no reason given)

originally posted by: network dude

a reply to: tothetenthpower

Wouldn't the IRS accepting a tax payment for Pot related business be a felony as well? These idiots have been talking out of both sides of their mouths for so long, they don't even listen to themselves.

That's what I was thinking.

It's no different than the IRS auditing a pimp and ordering him to pay back taxes.

"We don't condone your illegal activity but, by god, you owe us taxes on the profits you've made!"

edit on 4/15/2015 by Answer because: (no

reason given)

originally posted by: generik

originally posted by: network dude

a reply to: tothetenthpower

Wouldn't the IRS accepting a tax payment for Pot related business be a felony as well? These idiots have been talking out of both sides of their mouths for so long, they don't even listen to themselves.

actually as silly as it sounds, you DO in fact have to pay taxes on gains from illegal activity. Al Capone was not in jail for his crimes, but because he didn't pay taxes on it.

That's a bit of a misinterpretation. Capone was guilty of tax evasion on his legal activity and that's what the FBI got him on.

Not everything Capone did, business-wise, was totally illegal. Like most good mobsters, he had legitimate businesses that helped hide his illegal activity. When he went to trial, he was worth about $30 million but had NEVER filed an income tax return. The prosecutors had to prove that Capone was making profits from his businesses and it wasn't easy because he was so careful. In the end, they found enough evidence that he was making money from his empire and not paying Uncle Sam. Realistically, his legitimate business dealings brought him down because they were easier to investigate.

originally posted by: doompornjunkie

Again. Quit offering to pay in order to exercise your rights.

Bro, you're paying the government to exercise all your rights including just living in this country.

Income tax, sales tax, property tax, etc. etc. etc.

Unless you're homeless and digging your food out of other people's trash, you're paying Uncle Sam in order to exercise your rights.

originally posted by: Indigent

a reply to: tothetenthpower

You could go micro brewer stile and sell you own specialized variety to compete with the big boys

ETA:

You don't even need a real specialized variety, just make it like duff

That reminds me of the Japanese restaurant. They have two different Soy sauce bottles. One with a red lid, and one with a green lid. They say the green lid is less sodium. But I watched them fill all the bottles out of one Giant container. I suppose as long as you feel like you are eating health, then you are.

originally posted by: Krazysh0t

a reply to: tothetenthpower

I disagree. Look at the microbrewery market. That is a market that was largely non-existent up until the early 2000's. Alcohol production and sales were all done through large brewing companies like Budweiser or Miller. Now, in any region in the US you can find local breweries galore catered to that specific region of the country. Local breweries have become so popular that now even the larger breweries are trying to imitate the microbrewery taste (usually the IPA or lager).

Marijuana is even easier to grow than it is to brew beer. Marijuana is a weed and will grow pretty much anywhere there is dirt. Just keep pests and animals away from eating your crop and you are pretty much set. I find it unlikely that big business will ever be able to edge out smaller marijuana businesses. It's just too easy to grow.

Your analogy regarding microbrews is spot-on, as it relates to tastes and preferences (although you didn't make that claim with respect to tastes/preferences - you did say "local breweries galore catered to that specific region of the country", which to me implies a delineation based on tastes/preferences not achievable from large breweries) . I believe tastes and preferences will be a mitigating factor in big business's attempt to edge out smaller marijuana businesses.

Production costs aren't so low that a barrier of entry has been created, though. Big business hasn't been deterred based on the assertion that "it's just too easy to grow". It may be, but that's not in any way, shape, or form a barrier to entry.

a reply to: tothetenthpower

Makes it even more despicable when companies like Apple haven't payed taxes in years. The amount of regulation is an absolute joke. Doesn't make a lot of sense when you can walk into a liquor store and buy enough alcohol to drink yourself to death 100 times over with little to no issue. But it would be impossible to purchase enough cannabis to kill yourself. EVER!!

Makes it even more despicable when companies like Apple haven't payed taxes in years. The amount of regulation is an absolute joke. Doesn't make a lot of sense when you can walk into a liquor store and buy enough alcohol to drink yourself to death 100 times over with little to no issue. But it would be impossible to purchase enough cannabis to kill yourself. EVER!!

originally posted by: network dude

a reply to: tothetenthpower

Wouldn't the IRS accepting a tax payment for Pot related business be a felony as well? These idiots have been talking out of both sides of their mouths for so long, they don't even listen to themselves.

The IRS isn't getting tax money from it, the States are.

a reply to: chuck258

They still have to file federal tax forms which is where the problem arises.

You see they can't deduct anything that they used for their business which isn't noticed by the federal government as a legal business, although they are in those states the decriminalized it.

Federal gov't. still has the last word on this until we get it decriminalized throughout the country.

And the fact that I live in Georgia I really don't think we will have problems such as this anytime soon.

The IRS isn't getting tax money from it, the States are.

They still have to file federal tax forms which is where the problem arises.

You see they can't deduct anything that they used for their business which isn't noticed by the federal government as a legal business, although they are in those states the decriminalized it.

Federal gov't. still has the last word on this until we get it decriminalized throughout the country.

And the fact that I live in Georgia I really don't think we will have problems such as this anytime soon.

edit on 19-4-2015 by tsurfer2000h

because: (no reason given)

new topics

-

Elites disapearing

Political Conspiracies: 1 hours ago -

A Personal Cigar UFO/UAP Video footage I have held onto and will release it here and now.

Aliens and UFOs: 1 hours ago -

Go Woke, Go Broke--Forbes Confirms Disney Has Lost Money On Star Wars

Movies: 3 hours ago -

Freddie Mercury

Paranormal Studies: 4 hours ago -

Nirvana - Immigrant Song

Music: 8 hours ago -

British TV Presenter Refuses To Use Guest's Preferred Pronouns

Education and Media: 9 hours ago -

Tucker Carlson interviews Christian pastor from Bethlehem.

Middle East Issues: 11 hours ago

top topics

-

British TV Presenter Refuses To Use Guest's Preferred Pronouns

Education and Media: 9 hours ago, 16 flags -

Go Woke, Go Broke--Forbes Confirms Disney Has Lost Money On Star Wars

Movies: 3 hours ago, 11 flags -

Trump To Hold Dinner with President of Poland At Trump Tower Tonight

2024 Elections: 12 hours ago, 8 flags -

Tucker Carlson interviews Christian pastor from Bethlehem.

Middle East Issues: 11 hours ago, 7 flags -

Revolution in advertising: the Russians launched a unique satellite

Science & Technology: 17 hours ago, 5 flags -

A family from Kansas with six children moved to the Moscow region

Other Current Events: 15 hours ago, 5 flags -

Freddie Mercury

Paranormal Studies: 4 hours ago, 5 flags -

A Personal Cigar UFO/UAP Video footage I have held onto and will release it here and now.

Aliens and UFOs: 1 hours ago, 4 flags -

Nirvana - Immigrant Song

Music: 8 hours ago, 4 flags -

Elites disapearing

Political Conspiracies: 1 hours ago, 4 flags

active topics

-

Elites disapearing

Political Conspiracies • 5 • : VariedcodeSole -

The Truth About Jesus

Conspiracies in Religions • 269 • : lilzazz -

Trump To Hold Dinner with President of Poland At Trump Tower Tonight

2024 Elections • 24 • : ImagoDei -

A Personal Cigar UFO/UAP Video footage I have held onto and will release it here and now.

Aliens and UFOs • 6 • : CataclysmicRockets -

Are the 'Abrahamic Religions' all Really the Worshipping the Same Abrahamic God?

Conspiracies in Religions • 189 • : ToneD -

A family from Kansas with six children moved to the Moscow region

Other Current Events • 71 • : Freeborn -

New Photo's reveal Railway System underneathe the Pyramids

Breaking Alternative News • 28 • : Skinnerbot -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 509 • : RealityDestroyer -

Tucker Carlson interviews Christian pastor from Bethlehem.

Middle East Issues • 16 • : Degradation33 -

Go Woke, Go Broke--Forbes Confirms Disney Has Lost Money On Star Wars

Movies • 11 • : Bluntone22